Over the past couple of years, we have seen incredible welcome offers on many different credit cards. The crème de la crème has surely been the Amex Platinum card. Last year in particular, we saw amazing welcome offers all year long that made the card a no-brainer to get despite its humongous $695 annual fee (which might make it hard to keep). Many people who got the card are newcomers to the Amex ecosystem and as such we have had a lot of questions about what to do as the second-year annual fee posts. I imagine there are more than a few people who got the card who won’t be excited about the idea of renewing at $695, but before you run off to call and cancel, consider your strategy.

If you need help with the calculation as to whether you should keep or cancel, see: Which Ultra-premium cards are keepers? for a handy worksheet

Step 1: Ask for a retention offer

The Amex Platinum has been a terrific value in year one between huge welcome bonus offers, big intro spending offers, and its many ultra-premium card credits and benefits. It isn’t hard to come out well ahead of the fee in the first year.

In subsequent years, some people find the card worth keeping for its benefits, but it is no surprise that the number of people willing to pay nearly-seven-hundred-bucks to renew a card is much thinner than the number of folks who opened the card in the first place.

However, before you hang it up and cancel, it is absolutely worth checking on the possibility of a retention offer. For those unfamiliar, a retention offer is an offer extended by a credit card issuer to entice you to keep a card that you were otherwise going to cancel.

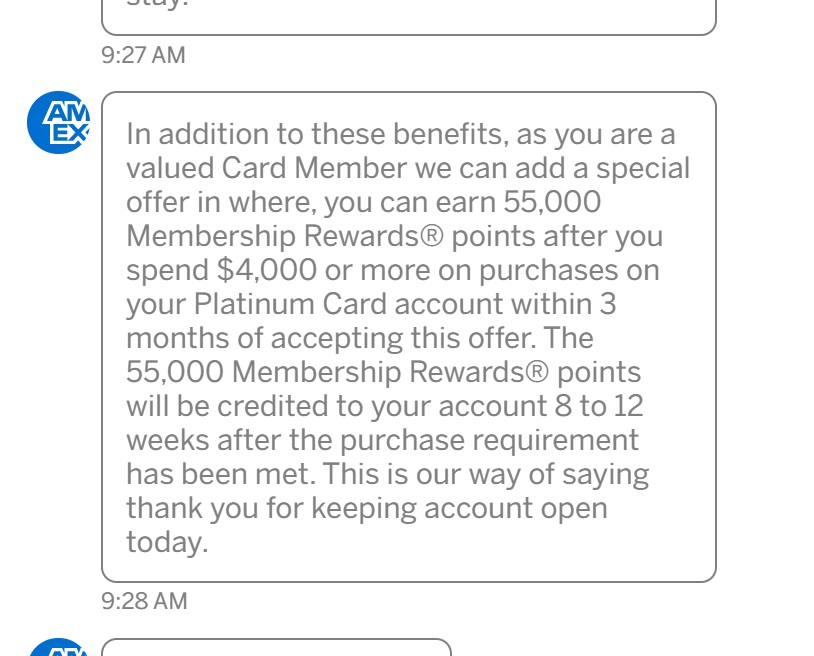

Amex has been particularly generous with Platinum card retention offers over the past year. Asking is easy. You can call the number on the back of your card and navigate the menu to a human and then tell that human that you are leaning toward cancelling because of the high annual fee unless there is an offer to entice you to keep it. I recommend getting to a human before saying that you want to cancel since the automated system may hear “cancel” and process a cancellation automatically, so be sure to get to a person first. That human will transfer you to a retention specialist.

Alternatively, you can initiate the same conversation via the chat function while logged in to your account. Note that the retention team is only available via chat Monday through Friday from 9am to 5:30pm (retention specialists continue to be available until late in the evening over the phone).

The retention specialist may reiterate the benefits of the card to try to convince you to keep it, but if there is an offer available for your account they will share the details with you. Some people have received statement credits worth hundreds (I’ve heard of as much as $500) without any spending requirement. In our case, my wife got an offer to earn 55,000 points with $4,000 in purchases in 3 months. That’s almost like getting a second welcome bonus! She was happy to take that offer since the points alone are worth about as much as the annual fee and so if we get even half of face value out of the $200 airline incidental credit, $200 in Uber credits, and $200 Fine Hotels & Resorts credit, we should be in great shape.

Others have reported offers of 30K or 50K points with no spending requirement at all while some people receive no retention offer at all. You don’t know what you’ll get unless you ask, so the first step is to ask. If you get offered a $500 statement credit or enough points for a redemption that you value highly, it certainly might make sense to keep the card.

Whether or not you get a good offer, you should move on to Step 2.

Step 2: Get yourself the Amex Everyday or Blue Business Plus card

Unfortunately, there is no fee-free downgrade path for the Platinum card. Your only downgrade options are the Amex Gold card or Amex Green card and both have annual fees. Furthermore, if you downgrade to a card which you’ve never had before, you’ll lose your chance to earn a future welcome bonus on that card.

An so regardless of the outcome of Step 1, you want to build a long-term Amex strategy that doesn’t rely on retention offers. That means having a no-annual-fee Amex card that offers transfers to partners so that you can freely add or eliminate other Amex cards without any fear of losing your points.

If your only Amex card is the Platinum card and you cancel your Platinum card, you will lose your Membership Rewards points. Don’t do that. First, you want to protect your points by getting them pooled with a card you will keep long-term.

Amex automatically pools points by social security number, so if you currently have the Amex Platinum card and you open an Amex Everyday card or Blue Business Plus card, your points will automatically be combined in a pool. Once that happens, your Membership Rewards points are safe. Having a second Membership Rewards-earning card means that you will be able to cancel your Platinum card without losing any points.

To be clear, the same is true if you have any other Membership Rewards-earning card. If in addition to your Platinum card you currently have an Everyday Preferred or an Amex Gold card, your points are pooled and you can cancel your Platinum card without fear of losing any points.

Keep in mind that the points are tied to the social security number of the primary cardholder. If you are the primary cardholder on your Platinum card and, for example, your “other” Amex card is an employee card on your spouse’s Business Gold card (again, just an example), this will not keep your points alive. You will need a second card in the name of the same primary cardholder to keep points alive.

This is why it makes sense to have a Blue Business Plus or an Everyday card long-term. Those cards earn Membership Rewards points and have no annual fee. Furthermore, even if one of those cards is your only Amex card, you can still transfer your Membership Rewards points to partners. There is no disadvantage to having the Everyday card or the Blue Business Plus — only an upside in keeping your points alive and making it possible to cancel other cards when you like.

If you are applying new, keep in mind that the Blue Business Plus card will not add to your 5/24 status with Chase since it is a business card. Of course, you’ll need a business to apply — but Amex has historically been pretty welcoming to those with new and/or small businesses (YMMV).

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

Step 3: Use those annual credits NOW

The Platinum card comes packed with perks. Some of those perks are calendar year perks and you’ll want to be sure you use those before you cancel.

For example, if you opened your Platinum card last year, you should have used your $200 in annual airline incidental credits before December 31st. Starting on January 1, 2022, you picked up a fresh new $200 in airline incidental credits. Be sure to use those airline incidental credits again before you cancel the card.

The same is true for both the $200 Fine Hotels & Resorts credit and the twice-annual $50 credit with Saks 5th Avenue (you get up to $50 in credits between January and June and $50 between July and December).

Hopefully you used the $179 CLEAR reimbursement when United was offering 15,000 miles for singing up last week as that was a shot at some easy free miles for those who took advantage. On the other hand, if you didn’t do that but you do value CLEAR, be sure to use your credit while you can.

There are also plenty of monthly credits to use, so if you can use those for the month before you cancel, that’s great.

Step 4: Check the Checklist

We have a post that is A checklist for cancelling credit cards. It’s worth checking the checklist for stuff like making sure to switch cards on any recurring payments that were charged to your Platinum card (like if you plan to keep that NYT subscription or Walmart+), and updating your tracking spreadsheet (or your Travel Freely account).

The most important tip included in that checklist that is not yet addressed in this post is to stop spending on the card if you’re planning to cancel it. If you spend a bunch of money but haven’t yet received the rewards when you cancel, you may lose the value of pending rewards. Therefore, apart from any spending for annual credits, move purchases to another card as soon as you can.

Step 5: Remember the deadline

Keep in mind that you don’t need to cancel as soon as you see the annual fee appear. Amex will refund the annual fee if you cancel within 30 days after the statement in which the annual fee hits. In other words, you should have 30 days from the statement cut date for the statement on which your annual fee appears. That gives you a little wiggle room if you’ve just be slapped with Will Smith’s right hand that heavy annual fee.

If you downgrade (like to the Gold or Green card), Amex will prorate the annual fee (i.e. refund whatever part of the year is left on your Platinum card’s annual fee and charge you a corresponding percentage of the annual fee on the card to which you downgrade). That can be done at any time during the year. However, keep in mind the notes above about not downgrading to a card that you’ve never had before (which would cost you a future opportunity to get a welcome bonus on said card).

While opening a new Everyday or Blue Business Plus (or other Membership Rewards-earning card) theoretically protects your Membership Rewards points balance as soon as you are approved, I’d not wait until the very last day of the cancellation deadline to open your new Everyday or Blue Business Plus card. If you’re opening one of those cards to preserve your points, give yourself a day or two between opening your new card and cancelling your existing Platinum card. It may not actually be necessary to have that buffer zone, but I’d not gamble a large pile of points on it.

Bottom line

Many readers likely took advantage of terrific welcome bonuses on the Platinum card over the past year, but the time is here to decide whether or not to pay for a second year. If you need help with the calculation as to whether you should keep or cancel, see: Which Ultra-premium cards are keepers? for a handy worksheet. I imagine that many readers who have cards with overlapping benefits may decide to cancel. However, before you cancel, make sure you have a strategy set in place. You do not want to lose your points or transfer them speculatively, locking them up in a specific airline program rather than keeping them fully flexible for no annual cost.

I think the average cardholder should make sure they have a long-term Amex strategy in place with the Blue Business Plus or Everyday card regardless of whether they intend to keep or cancel the Platinum card. A retention offer combined with the annual credits certainly could make the Platinum card worth keeping — though keep in mind that you can use the annual credits whether or not you receive a retention offer, so the real question becomes whether a retention offer combined with all of those monthly credits moves the needle enough to keep the card. Beauty is in the eye of the beholder there, so be sure to check out the worksheet to decide how much you value those credits and benefits.

I cxld a Platinum card in January after charging the $200 travel charge, $50 saks charge & $8k FHR charge. But I cancelled before seeing the benefit credits and points. To let everyone know, I got all the $450 credits and annual fee refunded. I do not see the points for my charges in January (including the 5x points for the FHR charge).

Do I still earn the points for the charges in the month I cancel the card?

I can come back and let people know but hoping someone knows now. the 5x on the FHR is worth more than the $200 credit. I only have a few days left to cxl itinerary, thinking to be safe I should cxl and book on player 2 card.

Just an update – Stmt closed and no clawbacks on any credits including $200 FHR credit for reservayion that I cxld after acct closed. Full refund and no $200 chargeback.

I was just denied a 2nd retention offer request on the verge of my 2nd anniversary of my Personal Platinum Card. I already have the AMEX Everyday card, so I am not concerned about losing my points if I cancel the platinum card. Is the following a valid strategy over the next few months:

Thanks for the input.

Wow. Just finished chatting with Amex CS and they are being aggressive and also tricky if you decide you need more time to assess if you’re keeping the card. They’ll try to get you to answer this question:

“I want to confirm that after our conversation today about the benefits of your card, you are keeping your Schwab Platinum Card account open. If you have any questions in the future, you can reach our Customer Service Department by calling the number on the back of your card.

Do I have your approval to keep your card account open? (Yes or no)”

And if you answer yes, it means you’re going to keep your card. I really don’t like how Amex is doing business these days.

Hi All,

My wife just cancelled her personal platinum. We were not concerned about her MR points because she opened a new business platinum a month or so ago. She cancelled the card after not getting a retention offer. We checked back on her card and now it is saying the MR points that she had on her personal platinum are now gone. They do not show on her account anymore. We called amex and they say that her points are forfeit because her accounts were not linked despite showing up together in the same login. The rep and supervisor refused to re-instate the points. What is the deal? I have never heard of this. Her business card was not applied for directly with her login initially but she called and linked them later on.

Patrick

I am needing help deciding what to do. I’ve had the platinum for one year in January but I don’t want to keep it. Should I apply now for the gold card and will I be able to keep my membership rewards I got from the sign up bonus of the platinum?

Something may have changed with their terms because I’m getting mixed messages at this time: I signed up for the Amex Platinum two months ago, got charged with the annual fee early this month, earned my 100k rewards, now have the Amex Everyday Card, but now the retention specialist said my points would be lost because they won’t pool into the Everday Card, since I haven’t had the Amex Platinum for more than a year… I tried to see if it was a bluff, but he reminded me he’s on a recorded line and was quite intense about it… Or is the move to sign up for the Platinum card right after early August *then* wait the year and cancel after the fee hits?

I’m confused. You opened an Amex Platinum card 2 months ago and were trying to talk to retention about that account today? Why would you be calling about cancelling after only having the card for two months?

Ah, so I had an upcoming large purchase, saw the offer for the Amex Platinum, and I realized I could meet the minimum spend requirements in no time (which I did). A long time ago (I’m getting back into mile collecting only recently) I remember doing the same with another card (Saphire Preferred I vaguely recall) and being charged the yearly fee only a year of having the card, so I went in expecting the same. Perhaps times have changed/I’m now a dinosaur? Either way, I think the lesson learned/to impart is that it’s a *signup* yearly fee (also after talking some more with an agent again)?

Correction: I remember doing the same with another card (Saphire Preferred I vaguely recall) and being charged the yearly fee only a year *after* having the card.

I have a number of these Bus Plat cards and one is up for renewal. I was offered only a measly $100 off the fee (it is already a $100 lower than the current annual fee). I also have a separate offer for the usual 150,000 MR after $15K spend. Unfortunately I have to decide on the old one before I can apply for the new one. Any suggestions

Out of curiosity, how much does it hurt your relationship if you close a Biz Gold and Biz Platinum after 12 months? I spoke to the retention dept and all they offered was $100 loyalty CR or the option to PC Biz Gold→Biz Green or Biz Plat→Biz Gold/Biz Green, none of which seem very appealing.

I am about to find out …

I had the identical offer.

It’s impossible for anyone to predict definitively, but probably not a big deal now and then (particularly if you also have other Amex cards that you’re keeping long-term).

Why bother with opening another rewards credit card if we can simply transfer the miles to a partner airline/hotel. When cancelling the high rewards Amex card the can’t cancel the already transferred airline miles, right?

Correct that once the miles are transferred, they remain in that program. However, there is no sense in transferring until you’re ready to redeem. Both the Blue Business Plus and the Everyday cards have no annual fee and enable the ability to transfer to partners — so rather than picking an airline or hotel partner and transferring without a plan, you can open one of those cards and keep the points flexible until you’re ready to transfer to a program to book a specific award.

how are you transferring to a airline / hotel? which website do you use?

just getting started wit this!

Thank you for the information. I was able to use the strategy, 40K MR for $4k spending.

on another subject, if a card (BP) is cancel after 12 months, the into MR offer bonus offer is lost/retracted?

I am getting conflicting information, a personal or business, some even speculating a card needs to be in existence for 2 renewals in order not to lose the MR bonus offer. My understanding was after your first renewal you can discontinue your card without any penalties or the lost of the introduction MR offer..

Yes if you cancel before 12 months. So what you need to do is cancel between when the fee hits (not before!) and no more than 30 days after the fee hits.

Peter answered accurately here.

Is it after the fee hits or after the statement on which the fee appears cuts? I am googling this and I see two different answers (just like you stated in this article where you say it’s 30 days after the statement closes yet the comment above talks about 30 days after the fee hits). Looks like I’ll have to search AMEX website to be 100% sure.

OK, I searched AMEX website and you are correct: “If an Annual Membership fee applies, we will refund this fee if you notify us that you are voluntarily closing your Account within 30 days of the Closing Date of the billing statement on which that fee appears.” So Peter is NOT correct.

I think that the annual fee and the statement close date usually (always?) are on the same day

I am normally charge the fee on the last day of a statement cycle, example May 15. So I have 30 days from May 15 which is the last day of statement cycle as well as the fee posting date

Just called and said that I wasn’t comfortable with the increased Platinum fee; like the card, but we aren’t traveling as much as expected, yada yada …

Agent who answered offered to downgrade to gold or green; I said I already have Blue Cash. He then said there were no other options. Going HUCB route, but I see from the notes that I might have better luck through chat.

Is there a particular time of day that works best of a particular phraseology? Or am I SOL now that I’ve called and not received a retention offer?

Sorry, I had missed this question before. Retention is available via chat Monday through Friday I believe from 9am to 5:30pm Eastern.

Hello,

Great blog post! I was hoping you could help me figure out this 30 day grace period timing for canceling my amex platinum. I’m having a hard time with the wording. Maybe best to use my case as an example:

April 25th 2022 695 yearly fee

Statement in which it is included goes from march 26th to April 25th

Payment is due may 20th

Until what calendar date (minus one to be safe 😉 ) do I need to call to get a full refund? Is it June 19th? May 24th?

Thanks!

I tried but they did not connect me to retention specialist and they did not make any offer. Could that because I just renewed my membership couple months ago?

Just took offer for P2 of 40,000 MR for $3K in 3 months (was also offered as $400 credit). Thanks for great post–mine is due next month.

Nick,

this may be off topic, but can you confirm that using your Marriott Boundless card allow you elite points to upgrade status from gold to Platinum. I thought I saw it in one of your pasts and now can’t locate it. Would appreciate your help and even sending me the post with that explanation. Thanks

Yes, this has nothing to do with the Platinum card topic of this post, but happy to answer.

You can get 1 elite night credit for every $5K you spend on the Chase Marriott Bonvoy Boundless card. You need 50 nights to reach Platinum status. Having that card gives you credit for 15 elite nights automatically, so you would need 35 nights to reach Platinum status. Those 35 nights can be a mix of paid / award nights and nights earned from spend.

If you also have a Marriott business credit card, you also get 15 elite nights from the business card, which means you would need to earn a total of 20 nights from a mix of stays and spend on the Boundless card. Having multiple personal cards will not give you extra elite nights — you can only get a total of 15 nights from having one or more Marriott personal cards (whether Chase or Amex) and a total of 15 nights from having one or more business cards (whether from Chase or Amex).

Here’s the post: https://frequentmiler.com/marriott-boundless-card-changes-3x-categories-and-elite-nights-from-spend/

Out of curiosity, I know you said you couldn’t locate that post. I am not at all being snarky here but rather from a site usability standpoint I’m curious what you did to try to find it (if anything)? When I type “Marriott Boundless” in the search box at the top of the site, that post (with the title “Marriott Boundless Card Changes: 3x categories and elite nights from spend”) is the second result, so I’m assuming you searched something else or searched differently in some way. Again, I’m happy to answer the question and not at all trying to send a message otherwise — I’m legitimately asking what you did because what I would have done matters less than what people are actually doing; I want to make info easy for people to find. Appreciate any feedback.