NOTICE: This post references card features that have changed, expired, or are not currently available

Is Extreme Stacking dead? We’ve recently seen a number of seemingly easy stacking deals go wrong, leaving us to ask ourselves how the game has changed and where there are still opportunities to stack huge savings. The good news is that despite the mishaps, extreme stacking isn’t over. Those who pay attention to the details continue to find new ways to leverage card-linked offers, shopping portals, and credit card benefits — just be sure to keep plenty of screenshots. On this week’s Frequent Miler on the Air, we also touch on why those Southwest Companion Pass offers aren’t worth a second thought, how our hobby is the rare place where when it looks too good to be true it probably is indeed true, and more. Watch, listen, or read on for more of this week at Frequent Miler.

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen here in the browser:

This week at Frequent Miler

In maximizing available offers

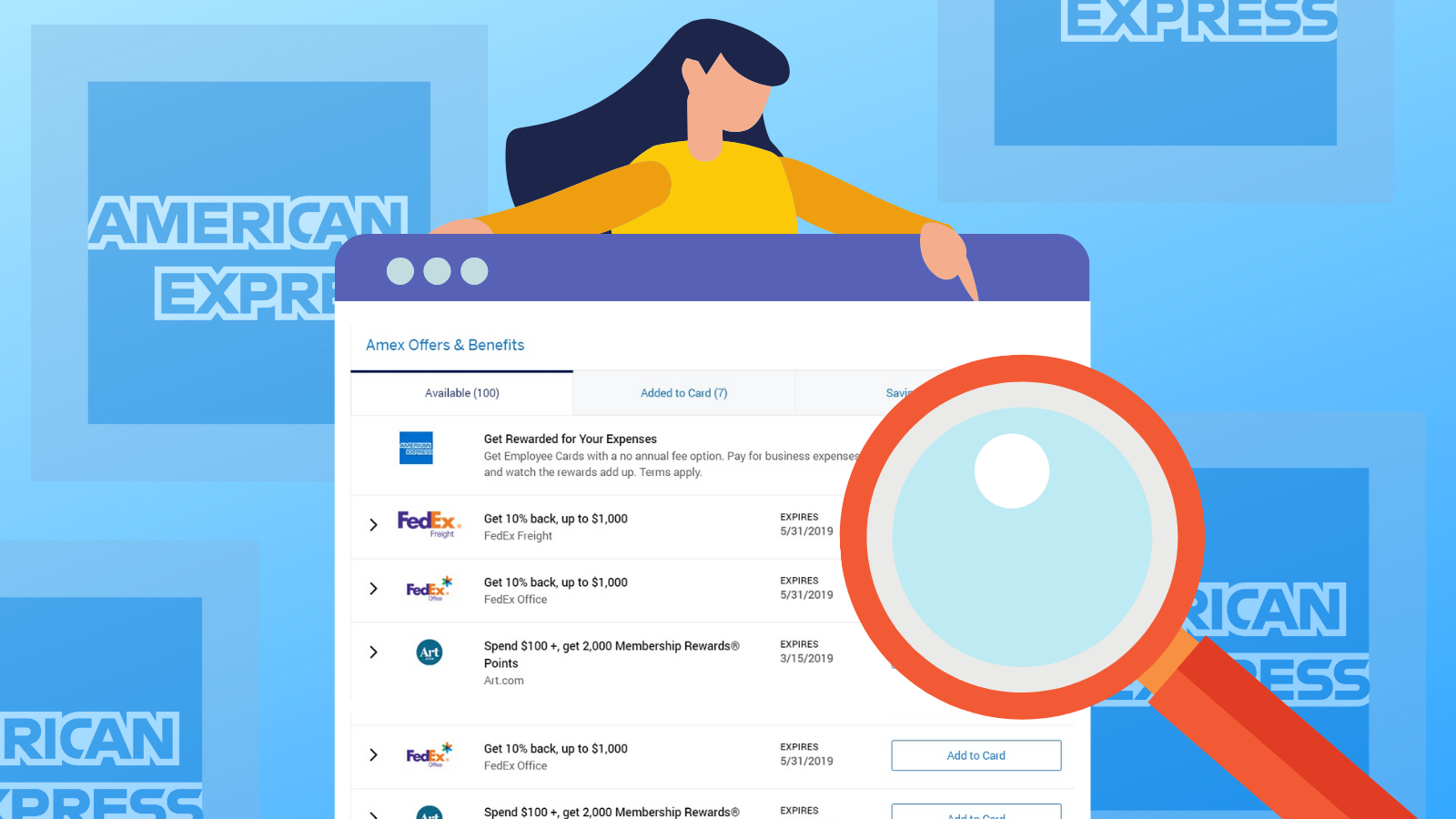

Amex Offer Cheat Sheet

Can you buy a gift card to earn credit X? Can you stack A, B, and C to maximize return when using credit Y? Is there an easy way to use up my monthly benefit so that I don’t need to think about it too hard each month? If you’ve asked those types of questions, this post has the answers. The most popular Amex Offers and benefits can sometimes be stacked for enhanced deals or the savings can be reserved for later use. See this post for the non-obvious ways to get the most out of the most popular offers.

How to find the best Amex Gold bonus (75K, 60K + $250, 60K + 30K)

The Gold card has had a string of very strong offers and in this post Greg shows you how to get the best of them. The interesting thing is that it isn’t immediately clear which of the best offers is best for everyone, though my guess is that many readers playing in two-player mode would benefit the most from combining a 30K referral with the 60K offer. Without that, the 60K + $250 offer seems like the no-brainer to me, though a couple of readers chimed in to say that they’d prefer the 75K offer. Any way you slice it, the offer most sites will show you is not the best you can do.

My experience setting up a new LLC

On a recent Frequent Miler on the Air podcast, I roasted Greg for writing about the big Brex Cash bonus and not telling us how to set up an LLC. That conversation ended with me saying that I’d set one up to see what the process is like. It turned out to be a great decision because the LLC will be beneficial for me and I learned that it was easier than I expected to set up a new business. That said, it isn’t necessarily cheap and I don’t recommend setting up an LLC just for the Brex bonus. Those 110,000 points / $1100 are very tempting, but the costs you’ll incur will make it less exciting. That said, if an LLC is a good fit for you or you already have one, it just doesn’t make sense to miss out on Brex.

1-800 Flowers Extreme Stacking: Amex Offers, Bonus Miles, Portals, Gift Cards & More

Greg long ago established himself as the master of slicing and dicing at 1-800-Flowers to stack six ways from Sunday and end up with a gourmet meal, a Companion Pass, and a lifetime supply of caramel corn while somehow getting more back than he’d spent. Things have changed significantly at 1-800-Flowers as promo codes became unstackable with portals and they stopped selling gift cards and eventually dropped off of Shoprunner shipping while we were sleeping. But that doesn’t mean you can’t still save big, and in this post Stephen Pepper shows you how. It may be too late to save your Valentine’s Day, but read this post and you can at least say you’re sorry you forgot.

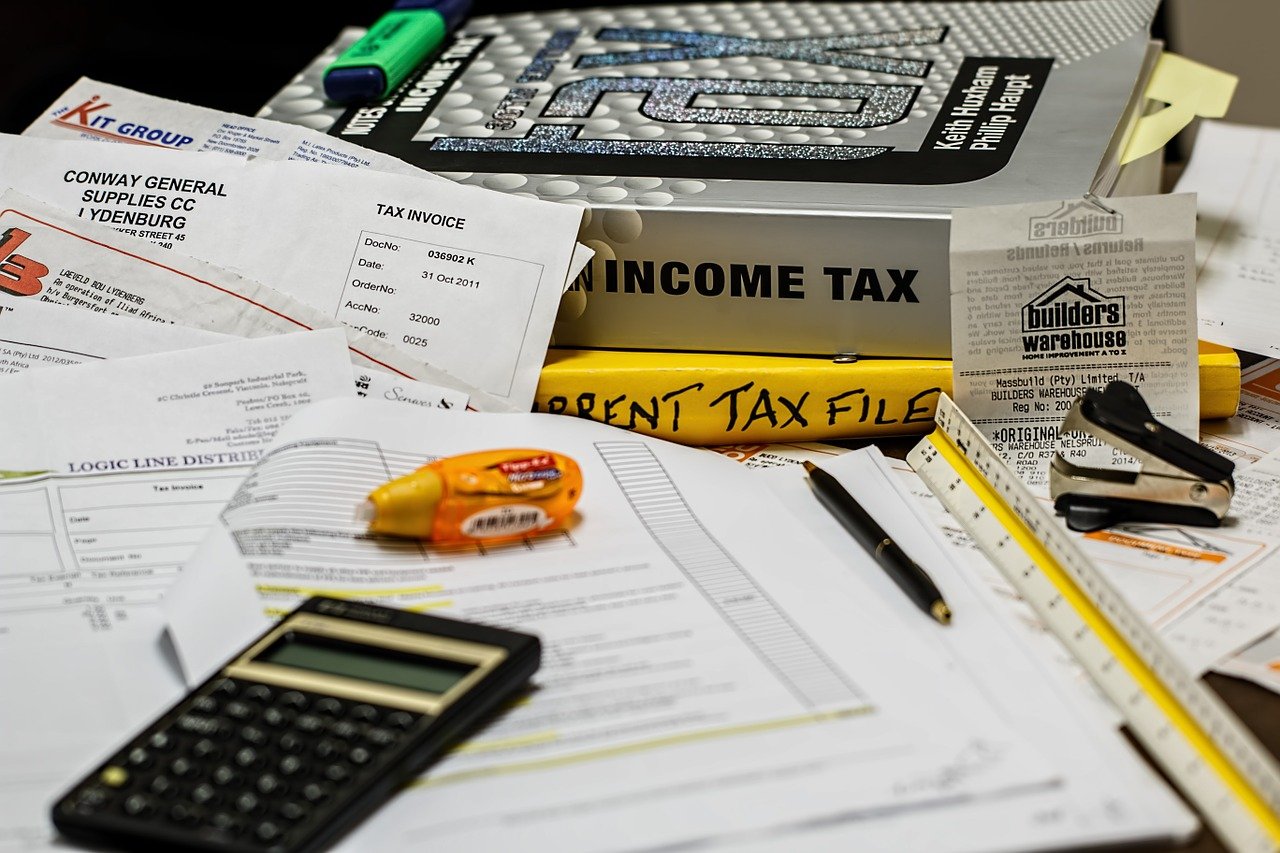

Tax To The Max: Stacking Deals On Tax Prep Software

We have long maintained a resource for how to pay your taxes via credit card, but in this post Stephen looks at how to pay for your tax preparation with a credit card and save as much as possible. This much is for sure: you shouldn’t be paying full price if you’re using services like TurboTax, TaxAct, or H&R Block. I have personally used TaxAct for years and that is where I started my taxes again this year with the intention to use the Amex Offer. Next year, I will likely switch over to an accountant with my new LLC, but I think I’ll partly miss TaxAct after having used it for more than decade — certainly in no small part because of the low price.

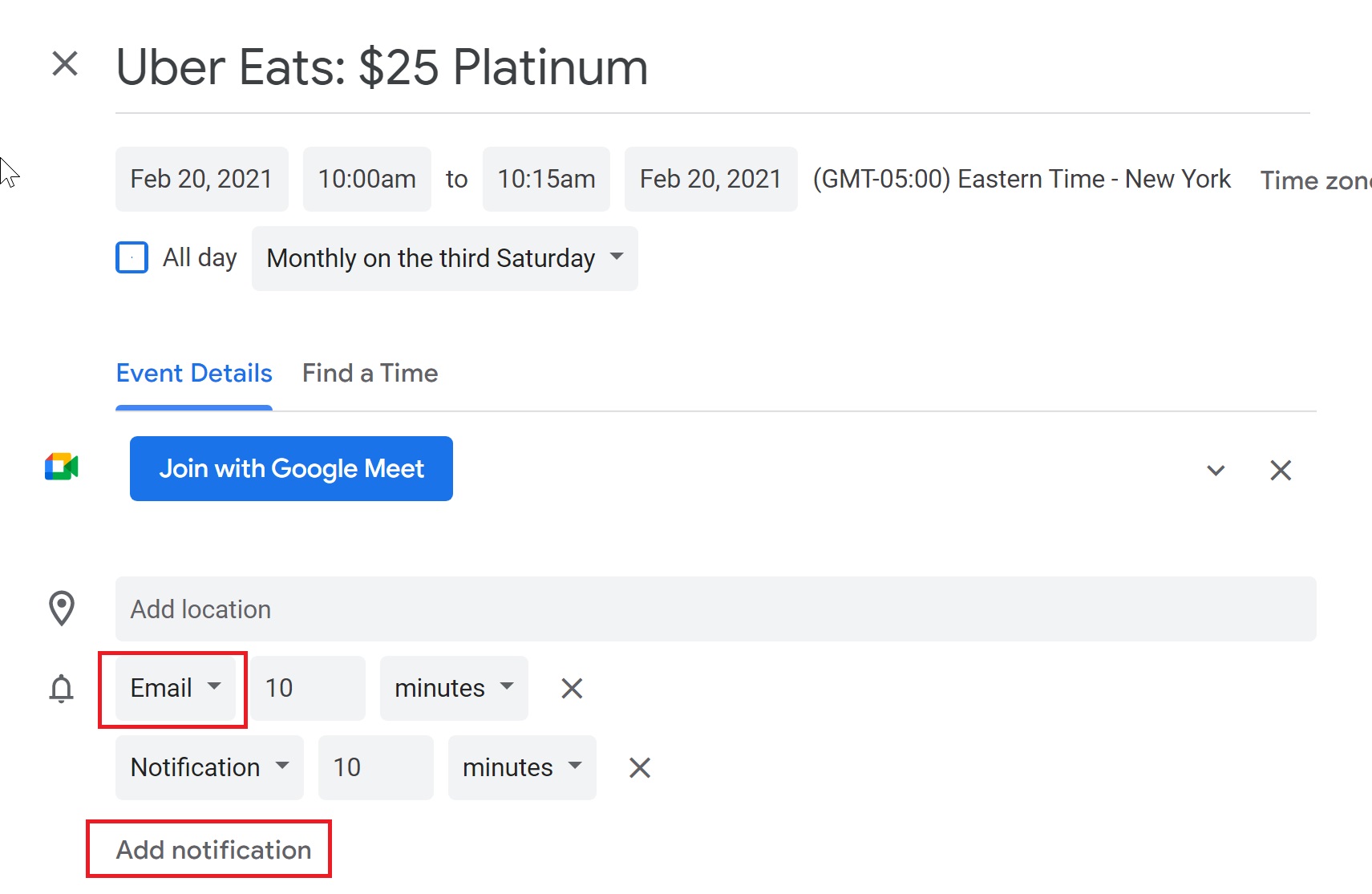

A system for reminding myself to use credits and benefits

With the myriad of temporary spending offers, statement credits, and short-term benefits being offered in response to the pandemic on top of Amex’s newfound love of monthly credits, it’s getting hard to keep track and make sure that I’ve used everything by the end of each month. This post is the system I’ve come up with to stay organized, but see the comments as many readers had helpful suggestions for how to do this even better.

In loyalty & travel

Vacation Rentals at Wild Dunes Resort Review: Like a box of chocolates

When I got up on Friday morning, I looked at my thermometer and it said -11º F. That’s before the wind chill. I immediately thought of Greg and his cushy 3-bedroom oceanfront villa at Wild Dunes resort and was nearly eaten alive by envy. Of course, I took some solace in the fact that he didn’t quite have it all given that I had seen his ironing board desk and bar stool office chair. Still, I really want to spend a week like this and hope to make it happen at some point before the prices at Wild Dunes skyrocket thanks to his positive reviews. I’ll just make sure I bring a folding desk.

Your Platinum card arrived. Here’s what to do next…

While many of us haven’t been traveling much for a quite a while now, I imagine that will change over the coming months as more and more people are vaccinated. Those who opened a Platinum card over the winter may have put off activating some of the travel-related benefits given that, for example, Hilton Gold status won’t cook pancakes for you in your home kitchen. If you left some of these things to do later, there’s no time like the present. Here’s what to do to take full advantage of benefits.

That’s it for this week at Frequent Miler. Don’t forget to check out this week’s last chance deals.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

Motley Fool did something poorly?

Shocking I tell you!

#notreally

I recently signed up for Motley Fool on Chase Rewards shopping site in the hope of getting 15000 UR points and the $99 credit back from Amex. I got the $99 amex credit but not 15000 UR points. Any feedback from folks who tried this earlier?

I believe that when they increased the payout to 15,000, they added the terms I talked about in the podcast that the payout is only valid on 3 specific subscriptions (which cost $999, $1999, and $2999). Did you take a screen shot of the terms? If yes and it doesn’t specifically state which subscriptions are qualifying, you can try filing a claim with Chase. They’ll probably tell you that you need to wait X number of days. Then set a reminder and follow up again.

Most people shouldn’t have to pay for tax prep software at all. If your family’s AGI is less than $72K, the IRS has the free file program: https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free