NOTICE: This post references card features that have changed, expired, or are not currently available

Six months ago, I applied for the Capital One Venture Rewards card. Denied. 18 months before that, I applied for the Spark Miles Business card. Denied. Other family members tried either or both cards. They too were denied.

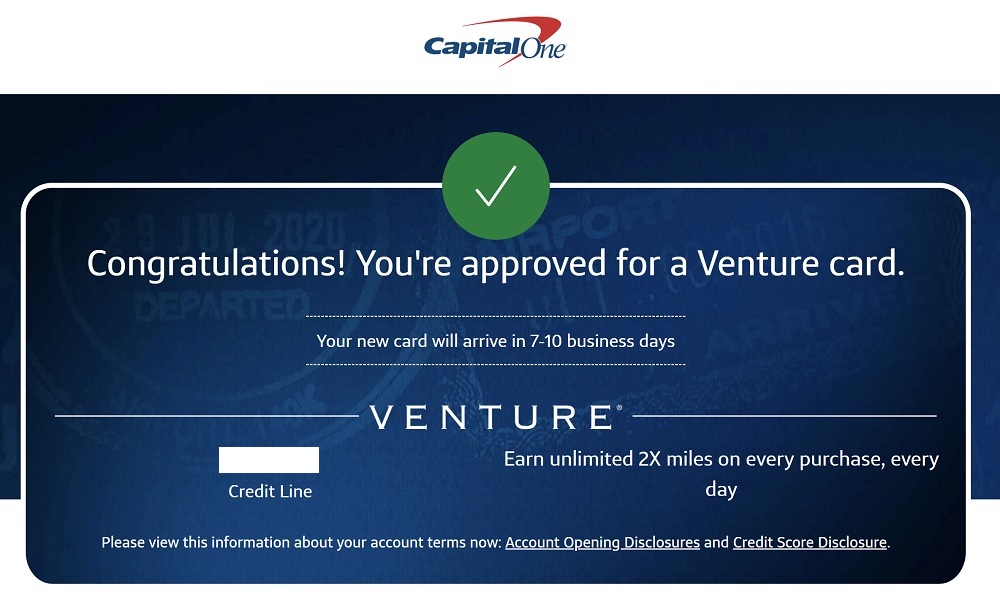

Today, though, I figured I’d have another go at kicking that football and… bam! Instantly approved for the Venture Rewards 100K offer! [Note that the 100K offer has since expired]

For the record, my interest in Capital One increased recently after I learned what great value is possible with Wyndham points for booking Vacasa vacation rentals (see: Wyndham Vacasa: Great Value is Real!). Capitol One offers the only transferable points that transfer to Wyndham (transfer ratio: 2 to 1.5 1 to 1 as of April 20, 2021!). And even though I’ll soon earn 45K points from my new Wyndham Earner Business Card, it will be great to have an easy way to top off my Wyndham account as needed. Plus, of course, as a blogger who writes about this stuff, having a Capital One card is useful for knowing first-hand the things I write about.

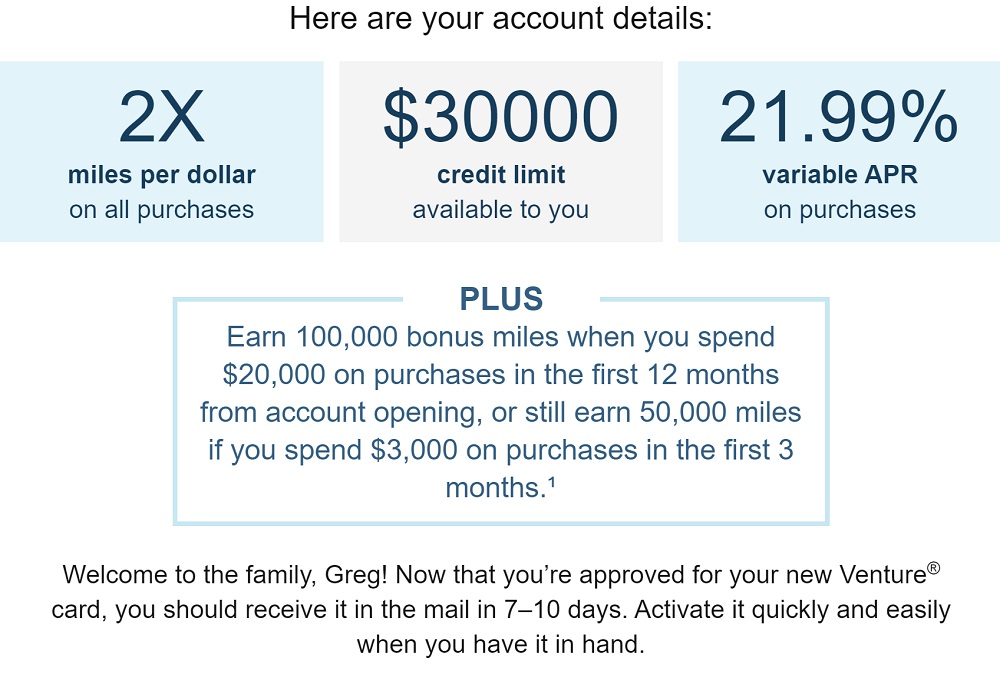

With the current offer, I’ll get 100,000 “miles” after $20K spend in a year [Note that the 100K offer has since expired]. Plus, of course, all spend earns 2X “miles” per dollar, so I’ll have at least 140,000 “miles” once I complete the spend. Not bad at all!

I got approved today after applying a few time over the past 10 years and getting denied. I did recently open a C1 checking account for the bonus and also had slowed my churning way down over the last 2 years (I think I’m 1 or 2/24).

Applied a couple of years ago on a very fancy private invitation and pre-approved letter with 60K points for $3K spent (at the time the regular offer was 50K points on $4K spend) and was approved on the spot (phone call). Been using the card ever since, heavily! Dropped spend on Amex Bonvoy (SPG used to be my major spend) in favor of Venture. I use the points for transfer to Avianca for Star Alliance flights. The No FTF is the best reason for the heavy use as I spent many days overseas, especially with the COVID/work remotely… Don’t have “premium” cards (not gotten into them yet, Maybe some day. Never say never, right?) but a number of transferable point ones. Domestically i use the no fee Amex biz blue for the 2pt/$1 on everything, but it is a no-go for outside the US (has FTF). Got DH on a referral Venture 100K/$20K in Nov – so we are looking for at least160K total combined (his 140K plus 20K for the referral on mine).

Truth be told, after the big disappointments with the SPG fold and all the not-worth iterations of the Bonvoy from Aug 2018 on, it was the Venture private offer that got me on the card-wagon again. Enjoy the Venture!

Based on the pod, I was feeling optimistic and applied. Denied once again! Disappointed, but moving on.

I got approved as well! I’ve been trying to get a new card approved with C1 for the last 3 years. I referred myself from P2’s Venture, any idea if she’ll get the referral bonus, even though I’m an existing customer? I see the terms exclude existing customers, just wondering if it’s a hard and fast rule with C1. Thanks

You’re correct that the terms suggest no, but I’m not sure how it works in practice. I’ll be curious to hear how it works out for you. In my experience, the referral points post within a couple of days just like miles from transactions — you’d probably see them in 2-3 days. If you don’t see anything after a week, I’d assume you’re likely not getting the referral bonus. Keep us updated as I’d like to know that also!

As we suspected, no referral bonus. Was able to use that 50% off Simon promo code though, small consolation prize there I guess. Thanks for the reply!

Capital One approved you _with a $30k credit line_ after having denied you 6 months ago? That is really weird. Capital One must have really fallen off the cliff during the Clampdown.

Been wanting the Savor. Applied and denied Nov. Had gotten a different card the month before. Despite great credit score still denied said too many accounts. Moved on and got another in Jan. May try the Savor again in a few months. At least by then a couple from a few years ago will drop off. What are my chances…

Hmmm. I have never been approved for a CapOne card either. Denied twice. Now I will have to think about it again.

Based on your post I gave it another shot as I too have been chronically denied. I wasn’t instant denied but I wasn’t approved either…just received a “application is submitted look for a letter in the mail” message.

Maybe?

Called and sat on hold for 45 minutes to find out I wasn’t approved. Oh well!

Shocker…

Not surprising for Capital One.

nice update. Last time applying here on a pre-approved letter…was denied.

Did they pull from all 3 agencies?

Yes

Will be really interested in seeing how much you ultimately use it. I’ve had it for three years (got it for 1.5x airline miles when traveling abroad with no foreign transaction fee), and it is now getting minimal-to-no spend due to multiple excellent bonus offers from AMEX and Chase (with some bonus activity from Citi and even from my Fidelity credit card). Haven’t received a decent bonus offer from Barclays in years, even after calling them to ask why (and as a result have now downgraded all Barclays cards to no fee), and Capital One hasn’t offered me anything either. I am loyal to those who are nice to me. I know the sign-up bonus is excellent, but hoping Cap One will up its game if they want actual spend on their cards!

I also did for the Accor ALL points to top off while still have some status for Canadian Fairmonts. Accor has let me down easy on status since absorbing Fairmont & 21c – still have Gold & some nice perks!

I was denied also, despite being +800. The fact they pull 3x makes me wary of applying again.

Has anything changed for you since last time?

Did you open a C1 checking a/c for the recent $400 SUB?

Nothing has changed that I can think of except that many issuers were tougher on approvals earlier in the pandemic

How many cards have you applied for in the past 12 or 24 months?

I applied for 9 in the past 24 months, not counting this one. 2 were denials (and one of those denials was from Cap One)

How many total CC accounts do you have open? I’ve tried Cap1 each of the last 3 years, only to be denied for somewhat cryptic. Their last letter seemed to suggest total accounts as a reason – I’ve been 6-8/24 for a while now, with 15 CC’s open. But it was definitely cryptic and I can’t access it now as it was electronic and the link expired.

Not counting business cards that don’t show up on the credit reports, I had 34 accounts open at the time I was approved for the Venture.

Congratulations @Greg The Frequent Miler!

As an aside, the Wyndham Earner+ doesn’t look so bad either now, with its uncapped 4x grocery.

True!