With eight million miles and points available via new credit card welcome offers, the rewards card game can be very rewarding indeed. This week, we tackle the basics of getting started on the path to becoming a points millionaire and some of the key strategy that can bump up your bottom line even more.

With eight million miles and points available via new credit card welcome offers, the rewards card game can be very rewarding indeed. This week, we tackle the basics of getting started on the path to becoming a points millionaire and some of the key strategy that can bump up your bottom line even more.

Elsewhere on the blog this week, I share the results of my recent application spree, Greg covers your strategy for cancelling Business Platinum cards, we’ve updated the best uses of Virgin points and our World of Hyatt Complete Guide, and a lot more. Watch or listen to the podcast or scroll on for more from this week at Frequent Miler.

00:00 Intro

01:45 Giant Mailbag

09:05 Card Talk: JetBlue Plus and JetBlue Business Cards

15:37 What crazy thing . . . happened to Greg the Frequent Miler this week?

21:10 Mattress Running the Numbers: 50% transfer bonus from Chase to Marriott

23:57 Award Talk

24:09 Nairobi to Cape Town….via Doha

27:15 Main Event: How to earn millions of points from credit card welcome offers?

28:59 Won’t this ruin my credit score?

32:53 High-level summary

|36:56 How do you choose which card?

39:30 Start with 5/24 strategy

42:05 How do you find the best offers?

50:08 Family referrals

58:35 If you get denied, it’s not over

1:01:54 Meeting minimum spending requirements

1:02:40 Call for a retention offer

1:08:57 Downgrade options

1:17:12 Question of the Week: Why aren’t we using Altitude Reserve points to pay for our car rentals?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Making cents from Nick’s nonsensical application spree

I recently went on an unexpected and mostly unplanned credit card application spree and added several new cards to my portfolio that will be long-term keepers and one for a good quick hit bonus. Out of the bunch, I think I’m most excited about the Altitude Reserve card. I’ve been in Europe this week and Google Pay seems to work almost everywhere, which could easily make this a great keeper card to use for just about everything while traveling. My only adjustment is that I’m going to have to start wearing my Pixel Watch on my right hand because the tap-to-pay panel on all of the credit card machines in Europe have been on the left side of the machine, which is awkward to tap with the watch on my left wrist. Still, it’s been working splendidly well overall.

First steps towards rebuilding my point fortune: Bilt and AA

Greg’s approach to rebuilding his points and miles fortune is quite a bit different, and in this post he explains recent applications for a big bonus on the AA Executive card and what finally pushed him to get a Bilt Rewards card. Personally, I wasn’t even tempted by the Executive card since Admirals Club lounge access isn’t useful for me and I don’t find the bonus exciting in comparison to the annual fee. Nonetheless, I find it fun that Greg and I have very different approaches to recent applications — it just goes to show that we all play the game a little differently and have different needs at different times.

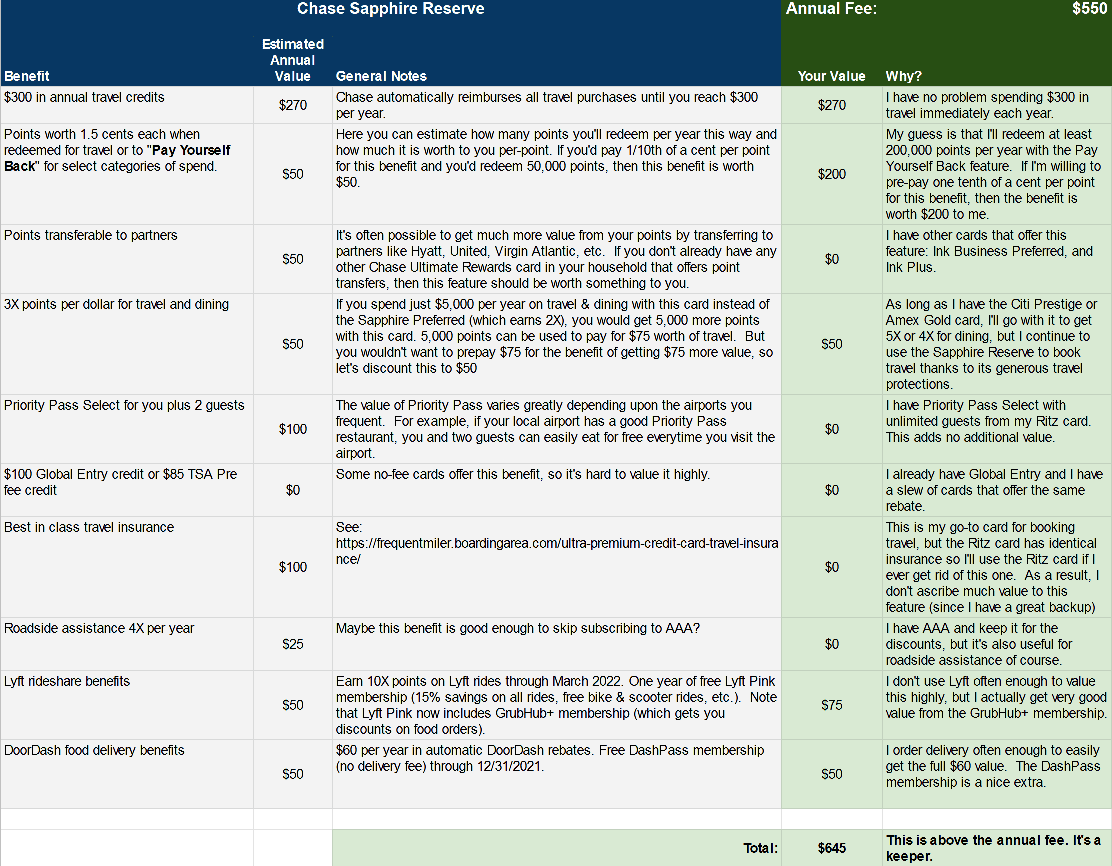

Which Premium Cards are Keepers?

High-end credit cards come with high-end perks. Unfortunately, they also come with increasingly high-end annual fees. This updated post and accompanying spreadsheet can help you decide which cards are keepers in your book.

Canceling Business Platinum cards

Greg wrote this week about a topic near and dear to my heart (or at least near the top of my mind!): cancelling Business Platinum cards. We have a couple more Business Platinum cards than we need to keep in my household also. Unlike Greg, I didn’t time things out quite as well: I had to pay an annual fee in late May. My January to June Dell credit took a while to post, so the fee was due and paid before the 30-day window to cancel without penalty. At that point, it seemed to make more sense to wait to use the July-to-December Dell credit and then downgrade to a Business Green card for a pro-rated fee refund. I actually haven’t done that yet, but that’s on my to-do list this week,

World of Hyatt Complete Guide

We have Complete Guides to many of the most popular programs that you can find by clicking “Resources” in the top menu on any page at Frequent Miler. We work to keep these guides up-to-date, including the recent changes to the MGM partnership as that winds down between MGM and World of Hyatt. Unfortunately, the MGM Gold / Hyatt Explorist merry-go-round ended last month and the partnership will be over for good at the end of September 2023. Hopefully we’ll see interesting things come of the partnership with Marriott that’s set to begin in October.

Best uses for Virgin Points across Virgin Atlantic & Virgin Red (Sweet Spot Spotlight)

If you’re amassing millions of points through new card welcome offers, you probably have very easy access to points in the Virgin ecosystem since Virgin Atlantic and/or Virgin Red partner with almost all of the major transferable currencies and they have some particularly interesting sweet spots. Greg updated and republished this guide this week now that ITA Airways is bookable and he adjusted information about Necker Island and all of the other Virgin Limited properties.

A points and miles pivot: Our trip to the original Legoland in Billund, Denmark

My family made a close-in change in plans on our current trip to Europe and decided to travel to Billund, Denmark to visit the original Legoland. We spent a couple of nights “on-property” using Hotels.com gift cards which we earned through Capital One Shopping portal rates. On the way, we had our first Lindner Hotel stay (a relatively recent addition to Hyatt) and we got to enjoy a really nice business class ride across the pond. Read more about all of the above in this post.

A Wyndham (yep, Wyndham) luxury resort in Greece

Frankly, I’m too interested in Wyndham’s Vacasa partnership to get too interested in any hotel properties that cost 30,000 points per night (that could get me a really nice two bedroom vacation rental in the right destination!). That’s especially true in Greece, where there are so many interesting award stay options and luxury hotels can be pretty affordable in some areas. All that said, the location is what caught my interest the most here as this property is in a part of Greece, south of Thessaloniki, that has never really been on my radar. Maybe I’d consider this if I were planning to hop around Greece and I found that I wanted to see that area, but it’s not high on my list at this point.

Dream Miami South Beach: Bottom Line Review

The short story is that Dream Miami South Beach doesn’t sound so dreamy to me, particularly at the award price point. With a good cash rate, I could see staying here, but Tim’s review makes me question even that. He gave it one thumb up and one thumb down, but his description put both of my thumbs down.

Can you drive to Masai Mara? Navigating Kenya’s roads with a Toyota Rav 4

And this is why I didn’t even try to book the JW Marriott Masai Mara: Greg mentioned that it required a bush plane and then in our private work Slack said something about it maybe being drivable and Carrie mentioned that she had driven it and the bush plane was probably preferable. I was out even before reading her full story, though reading the story gave me a lot of chuckles and memories of our own misadventures in our 20s traveling on a shoestring budget. We didn’t make it to quite as many places as Carrie and Drew, but we definitely had a similar travel style for quite a while and it’s fun remembering those days (as I sit in a very comfortable Marriott :-D). Any time I read Carrie’s travel stories, I miss those days a bit while also being thankful for the ways things have changed with the convenience of always being connected and the comforts provided by award travel.

That’s it for this week at Frequent Miler. Keep an eye out for this week’s last chance deals.

Not sure if you guys know but ur credit card offers page is a mess now. Can you please bring back the old page. The links are broken, cant see any cards.

Thanks for commenting. Fixed!

Glad to have you join team Altitude Reserve Nick! It has been a great card for rental car use and cool to see other readers highlight it as well.

The cash back offers on the card have some overlap with Chase offers but I’ve noticed that it seems to get more offers overall. The Carnival Cruise offers on it lately have been more generous for sure ($35 back on $100 instead of 10% back).

@Nick Reyes Reyes Hey guys slight error on the B6 Plus/Biz cards. ONLY the biz has group A boarding. While ONLY the personal plus can offset certain charges for .75 cents/point in SC. For me group A is huge, comparable to group 1 on UA or like group 3ish on delta.

Great Scott, that’s a great catch.

How bizarre that they have different boarding group benefits depending on whether you have the consumer or biz card! Does the consumer card not have any preferred boarding at all?

I don’t believe the personal plus card(99 af) has any priority boarding privileges at all. It was my understanding that they added 1 feature to each of the cards with annual fees. The 99 af personal got the points payback for statement credits, with poor value plus caps etc. The 99 biz got group A boarding. The only people who board ahead of group A are IIRC mosaic, elderly/disabled, and active duty. Maybe young children as well, not 100% sure. It’s important to remember that these were solely improvements, nothing was taken away or reduced. Since blue basic cash fares have no carry on, I think the biz card may be a bit of a trick since like united, they base carry on bag off of boarding group.

You mentioned a post on the resources tab that has all the reconsideration line phone numbers but I cannot find it.

Also, how do I get my hands on some of those 8 million points when I am 9/24 and in pop-up jail with Amex?

If you go to Best Credit Card Offers, the reconsideration phone numbers should be in the application tips for each issuer.

As AlexL said, the recon numbers are on our Best Offers page under each issuing bank. https://frequentmiler.com/best-credit-card-sign-up-offers/

9/24: Concentrate on non-Chase business cards until you get under 5/24

Pop-up prison:

Nick is spot on about the opportunity cost regarding the $50k of spending on the Jet Blue card. The same opportunity cost (plus execution costs) applies to MSing Delta cards for Diamond Medallion — depending, somewhere between $4k to $6k. Save the money and buy upgrades . . . or, simply buy a couple of J tickets to Europe each year.

One great move for Jetblue is spending on Citi Double card and transferring to Jetblue through the Premier.

The Altitude Reserve works well for me for a variety of reasons. I normally use it for all car rentals (I no longer have a Sapphire Reserve and have never had a Ritz) because I value it more than 2x UR on CSP or 2x on Venture X. Occasionally I will get a pseudo double- or triple-dip: if it is early in my annual cycle, I will get credit for the travel toward the annual $325 and I will also get real-time-rewards. And often the amount of RTR will be based on the amount temporarily held on the card for the rental including the extra $100-$300 at the point of rental, so the $150 minimum is almost always met and helps to draw down the RTR faster. And since they are never worth more than the 1.5 cpp you get in this case, there is no point in hanging on to them for a better option.

My P2 is not super-excited to play the game, but is willing to use whatever card I am working on a SUB for everyday spend … but she always knows the in-store backup that will never be a bad choice is to use Samsung Pay with Altitude Reserve for effective 4.5% back. Although that sort of leaves her stuck with a Galaxy S7 until most of our local stores start using NFC-enabled terminals, but that works for her.

I’m surprised that most of your local stores aren’t using NFC-enabled terminals. I live in a very rural town (population about 1,000 — and my town is *big* compared to several of the surrounding towns) and almost everywhere has NFC-enabled terminals now (grocery store, gas stations, pharmacy, etc). I’m sure there must be some places that don’t have them, but I haven’t found myself in any of them in quite a while.

sorry, don’t know how to delete.

Opened/Approved for JetBlue card Sept 2022. Received bonus points 3 months later. Want to close the card before the Annual fee hits. But I have a flight with these points September as well. And with this card I get Free checked bag and carryon. Will closing the card before the flight affect my free check and carryon luggage… Thanks

I don’t know how soon after closing the card you lose the checked baggage benefit

Barclays will refund annual fee for 60 days after fee posts for the personal card, assume either the same or 30 for biz. I’d wait as you can wait for 5k points to post at anniversary and then get fee back.

I canceled the card and still got the checked bag earlier this year.

It’s 4 days so I may see if we can do All carryon. There’s 3 of us. And maybe just one checked if we have to. But either way I want to cancel the card. Thanks everyone.