NOTICE: This post references card features that have changed, expired, or are not currently available

Is your favorite bank about to start charging cash advance fees for your favorite types of purchases? You probably got an email this week alerting you to transaction types that will incur a cash advance fee in the future. This week on Frequent Miler on the Air, Greg talked about which techniques are likely to be affected and what we found particularly telling when reading between the lines. We also talk that Motley Fool deal you shouldn’t have missed, Brex Cash, United Excursionist, and more. Watch or listen below or read on for more from this week at Frequent Miler.

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen here in the browser:

This week at Frequent Miler

Updated Chase Card Cash-Like Transaction Terms: What It Might & Might Not Mean

We talk about this topic in our Main Event on the Frequent Miler on the Air episode above, but Stephen Pepper provides an excellent break down in this post explaining what that email likely means and what you don’t need to panic about. The bottom line is that what was omitted means more to me than what they included. While I’m somewhat disappointed, I am in some ways glad that this wasn’t worse news than it is.

Which is the best Amex Platinum card in 2021?

In the comments of this post that Greg updated with the most current details, a reader noted the obvious: the best Amex Platinum card is the one for which you can qualify for a welcome bonus. But with several that carry similar offers, which is better than another — or more importantly for some, which is the one to have and hold long term? The answer isn’t one-size-fits-all, so see the post for more.

Free Spirit: Surprisingly good, but still suspicious

Look, I get it: you don’t think Spirit Airlines is worth a minute of your time. But with point values consistently in the 1.2-1.9c per point range and a revamped Savers Club that could easily save you a couple hundred bucks for a family round trip, it is worth a look. That said, as I note in the post, I remain suspicious as to whether it will still be any good five or six months from now. I like competition, so I hope that Spirit maintains this — because they now have a loyalty program worth joining even if it won’t become your primary option.

How to max out your monthly $30 in free PayPal spend

Are you looking for an easy way to use up your monthly Amex Platinum PayPal credit? Did you forget that this month’s credit is about to expire? This post has you covered. Personally, I used mine this month to order meal delivery from EveryPlate (my wife found a deal advertised on Facebook so that after the Platinum credit we paid $18.79 for 5 meals that feed 4 people each!). However, I’ve set a monthly reminder for a couple of days before the end of the month to buy a gift card through Fluz if I haven’t organically used the credit on something like meal delivery.

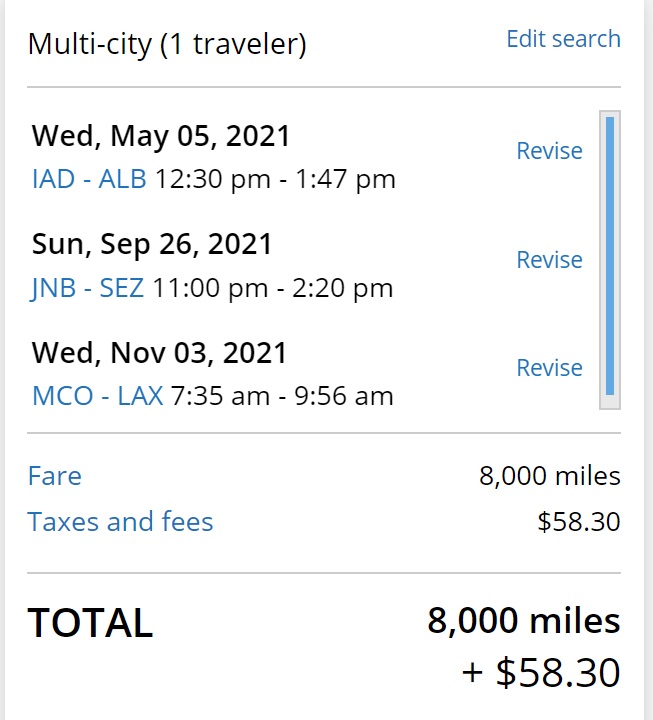

United flights now from 3K miles each way, making for cheaper Excursionist Perks

Unfortunately, the flights costing 3K miles were a one-day promotion upon which I accidentally stumbled, but the meat of this post is a reminder that the United Excursionist Perk is alive and well and can save you a bundle of miles. It is much easier now than before to find cheap 5K awards and those can be leveraged in the right situations — and if we see the 3K promotional awards return, that will be a great time to take advantage once again. Later this year, I have a speculative (and unlikely to actually happen) trip booked to the Seychelles. I followed this post up with an example showing how I could enhance my trip to the Seychelles by also visiting someplace else in Africa and save 23,000 miles on that side trip with the Excursionist trick. See that follow-up post here.

Where Marriott Suite Night Awards don’t work

Where Hyatt Suite Upgrade Awards don’t work

Are you hunting for elite status with Hyatt or Marriott via the incredible promotions they are running to fast-track you to top-tier status? Before you drop a bundle on a mattress run, think about how you’ll leverage that status. If you’re looking forward to the luxury of a suite, you’ll want to know which properties are excluded from using suite upgrade instruments in either program. Greg highlights the exceptions for both in those two posts above.

The Deal of the Week

Brex Bonus: 110K transferable points without a credit inquiry

If you have an LLC or S-corp or something of that sort (i.e. not a sole proprietorship), drop what you are doing and read this post. Some readers have said that we have an early candidate for Deal of the Year: 110K transferable points for opening a cash management account (read: this isn’t even a credit card! it won’t count against 5/24!). Read more in the post above.

That’s it for this week at Frequent Miler. Don’t miss this week’s last chance deals.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

You guys mentioned you haven’t gotten something wrong in 2021 but then continue to roast each other on what you got wrong lol. On the Staples gift card, you forget they share L3 data.

Did Greg select the GUC?

See our Instagram story.

There is a instagram story about Greg picking GUC? I saw you used Amex paypal credit on food delivery service though.

I’ve now added the video to Youtube: https://youtu.be/4bt3cXAjMl0

Thanks. Now hopefully Nick can put a nice trip together.

Perhaps an article on the card linked programs? Thanks again!

Can you please clarify how you did the Choice points promo as well?

I personally think its ironic that they were “fooled” when its a publication dedicated to finding loopholes in the stock market.

It was a card-linked offer. Stephen included a link to card-linked offers at Cashbackmonitor in his original post:

https://www.cashbackmonitor.com/cashback-store/the-motley-fool-card-linked/

I just had to link the card number that I was going to use at checkout to Choice Privileges. Again, no points there yet, but I’m not surprised. Sometimes these things take a little time.

You just taught me a whole new way to earn points. Wow, how did I not know this? Thank you!