NOTICE: This post references card features that have changed, expired, or are not currently available

The points bonanza of the past two years has been absolutely bonkers. Credit card issuers have long offered welcome bonuses and spending category bonuses to entice us to get and use their cards, but nothing that I recall like these past two years.

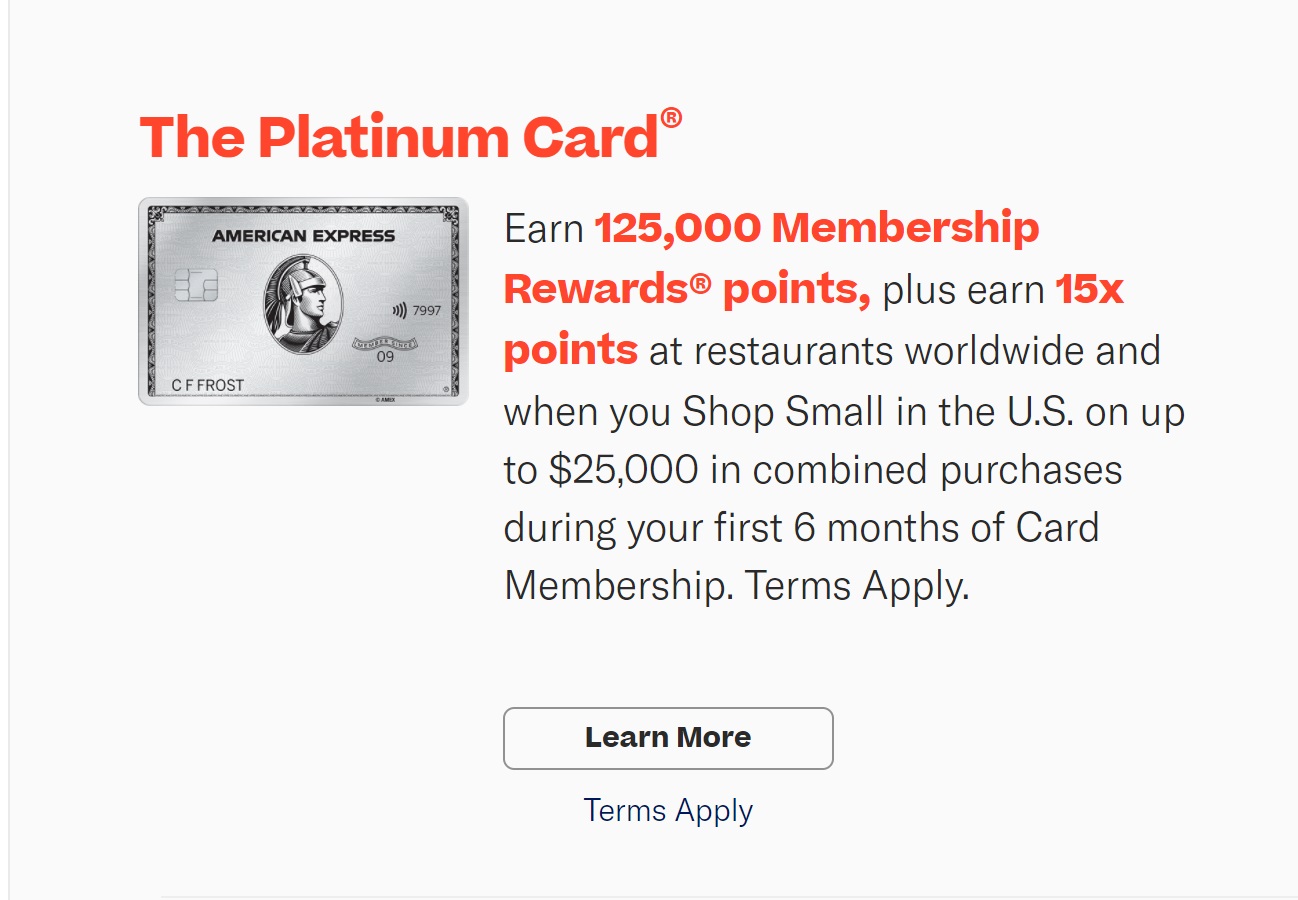

From 75K offers on cards with no annual fee to a 100K offer on a $95 card to , easy monthly rebates last year and this year, and so much more, it has been an amazing time to be a player in this game. You could trip over a new unheard-of offer almost monthly. But the unprecedented King among Kings has been the offer to get 125,000 transferable points after $6K in purchases and 15x (yes, fifteen points per dollar!) on up to $25K in purchases at restaurants and when you Shop Small in the US. I finally grabbed what I anticipate will likely be the best new credit card offer I’ll ever see — and in the best of points-earning times, my timing was almost the worst it could have been.

Finally picking up the huge Resy Amex Platinum offer (but with awful timing)

After months of talking about the most amazing credit card bonus offer that we’ve ever seen, I finally took the plunge and did it: I applied for the Amex Platinum card via the insane Resy offer for 125,000 points after $6K in purchases in the first 6 months and 15x on up to $25K at small businesses and restaurants (which is the offer you’ll see on our Best Offers page and listed on our Amex Platinum page here). We have written about this offer repeatedly because it is the hands-down best offer for a new Platinum card and the best offer we have ever seen on any credit card. I really can’t believe that it has lasted as long as it has.

Greg even wrote recently about how to turn the offer into a 600,000 or 620,000-point offer. I may just get that 600K if I’m lucky. Unfortunately, my timing wasn’t quite perfect.

I hadn’t said this out loud (mostly to not jinx myself), but I had been planning to wait until December to apply if possible. While I initially didn’t think the Resy offer would last, it has become apparent that it will probably be around as long as the current public offer lasts. Probably. I have no idea how long that will be, but I’ve been hopeful that there will at least be a rumor that tips me off before the current bonus ends.

The reason I intended to wait for December is for the classic “triple dip”. By applying in December, it would be possible to triple dip some of the card’s credits. Someone applying in December should be able to get the following before their renewal date in 2022:

- $200 airline fee credit in 2021 (before the end of December)

- $200 Fine Hotels & Resorts credit in 2021 (before the end of December)

- $50 Saks Credit in 2021 (before the end of December)

- $35 Uber credit in December 2021

- $200 airline fee credit in 2022

- $200 Fine Hotels & Resorts credit in 2022

- $100 Saks Credits in 2022

- $200 Uber credits in 2022

If one’s renewal date is in December 2022, the annual fee payment likely wouldn’t be due until sometime in January 2023. It should then therefore be possible to additionally get and use the following credits before the fee is due in January 2023:

- $200 airline fee credit in January 2023

- $200 Fine Hotels & Resorts credit in January 2023

- $15 Uber credit in January 2023

- $50 Saks credit

Actually, you could get even more than that if you count credits like the monthly Walmart+ credit, digital entertainment credit, CLEAR credit, etc. Even if you don’t value any of it at face value (and you shouldn’t), it is still very easy to surpass $695 in value in the first 13 months before the second annual fee is due and that’s what I intended to do before I am forced to decide whether to pay the fee and keep the Platinum card or drop it.

Unfortunately though, circumstances pushed me in to an early Platinum card application. I was looking to make use of a specific Amex Offer and the short version of the story is that I needed to get the Platinum card right away. More about why that is to come in another post about a different topic.

Since I had to apply this week, my first statement is scheduled to cut this month and therefore I expect my annual fee to bill after my November 2022 statement cuts. That means my second annual fee will likely be due in December 2022. I won’t probably get a chance to use the January 2023 credits unless I put up another $695. That’s a decision I’ll put off until next December.

Sadly, I will miss out on more than $400 in credits thanks to applying early. That’s part of the reason I call this the worst of timing — just a few more weeks would have netted me a few hundred dollars more.

The other thing that makes my timing awful is the mountain of spend we are suddenly facing in my household.

At the moment, we have to meet the following spending requirements:

- $10K in the next 6 months for the Capital One Venture X

- $10K left to go on the World of Hyatt card to finish the welcome bonus and get the Category 1-4 free night award for $15K spend this year (the current offer on this card is awful but my wife wanted to get it before going over 5/24; I wish we had focused on getting the spend done sooner)

- Potentially $23K on the Business Green Rewards card (more on this below).

- The Resy Platinum card offer which would require $25K to max out

That’s got to be the most required spend I’ve ever faced at one time.

Wait, the Business Green card — why?

For those raising an eyebrow at the Business Green bullet point, here’s the deal.

Last week, I opened an Amex Business Green Rewards card. Yes, I applied for what is possibly the worst Amex business card available. At the time, I did so just to trigger the +4 referral bonus on my wife’s Amex Gold card so that she would get 8x restaurants and 8x at US Supermarkets (4x at US Supermarkets on up to $25K per cardmember year, then 1x, plus 4x on up to $25K in purchases within 3 months from the referral). The holidays are a popular time for supermarket deals and I wanted to make sure we had that multiplier before visiting family in Krogerland in the coming weeks.

Since the Business Green offer had a waived annual fee in the first year, it wouldn’t add anything to my growing list of annual fees until a year from now and since I’d never had the card before, I would qualify for the welcome bonus. Yes, I’d be adding another $3K in spend, but that still didn’t seem out of reach last week.

In fact, it seemed like a pretty good deal because if I could get someone else to apply for a card with my Amex Green referral link before starting my spending on the card, I could get +4 points per dollar on the $3K required spend (a total of 5x with the card’s base rate of 1x included). That means that I’d be looking at 40K total points after $3K spend. Not a bad deal!

And then Amex offered to throw more points at me.

Within a couple of days of approval, I found the offer shown above in my Business Green Rewards card account: I could add up to 5 employee cards and get $20K points after $4K in purchases on each one. As if that isn’t already a great deal on a Business Green, stacking that with a +4 from a referral would mean getting a total of 10x on $4K in purchases on each employee card:

- 1x base earning

- 4x from the refer-a-friend offer (on up to $25K in purchases over the next 3 months)

- 20K after $4K spend, which works out to an additional 5x if spending exactly $4K

In other words, for my 5 employee cards, I’d get 40K for each of them that spends $4K. On up to 5 cards. Wow!

Stacked with the 40K I stand to earn from the welcome bonus on the primary card, that would mean getting a total of 240K points with my Business Green Rewards card in the first 3 months. I’d love to say that that I planned that when applying for the card, but I sometimes it is better to be lucky than smart. The trouble is that maxing this out would require $23K in purchases.

For those who would say that I could alternatively earn X number of welcome bonuses with that spend, you are absolutely right, but earning the equivalent of 3 or 4 good welcome bonuses while only opening a single business card has its benefits.

At the time when I applied for the Business Green Rewards card, I was literally looking at it as a simple $3K spend and thinking that I had a month to stagger it with my planned timing for a new Platinum card application. Then things changed and I got the Platinum card also. I will probably meet the Green card spending requirements by buying and reselling products during the holiday season. That’s some of what I would have done with the Platinum card, so I needed a new plan for maxing out my Platinum card earnings.

A hopeful plan for the Platinum card spend

While I’ll hope to figure out the Business Green card spend by reselling, the spend on the Platinum card is a different situation given the opportunity to earn as much as 19x at restaurants and small businesses.

While the welcome bonus on the Platinum card via the Resy offer is good for both the big 125K points after minimum purchases and 15x at restaurants worldwide and when you Shop Small in the US, it can get even better. (Note that the 125K + 15x offer is only available through Resy, you can’t refer someone to this offer which is why the Resy offer is the link you’ll find on our Best Offers page).

A couple of weeks ago, Greg wrote about how you could turn the Resy offer into 600K or 620K points with a single card (see this section of his post). The key is the current +4x Amex referral promotion. If I use my new Platinum card to generate a referral link and I refer a friend who successfully opens an Amex card (keeping in mind that your friend can open almost any Amex card with your link), I can get 4 additional points per dollar on all purchases on up to $25K in spend over the next 3 months. That means that I would actually earn 19x at restaurants and qualifying US small businesses for the next few months on up to $25K in purchases! That is absolutely bananas.

Many people have asked how one would spend so much at small businesses. While I can concede that $25K is a lot to spend, small businesses are everywhere you look. I have previously written that anyone planning a wedding or who can pay for an office party rental space and be reimbursed or who is paying a contractor to do a home improvement project could probably hit the spend pretty easily. I wouldn’t probably hit $25K with stuff like dry cleaning, holiday shopping, and purchases at my small local home improvement store, but I could hit a not-insignificant piece of it with minor effort.

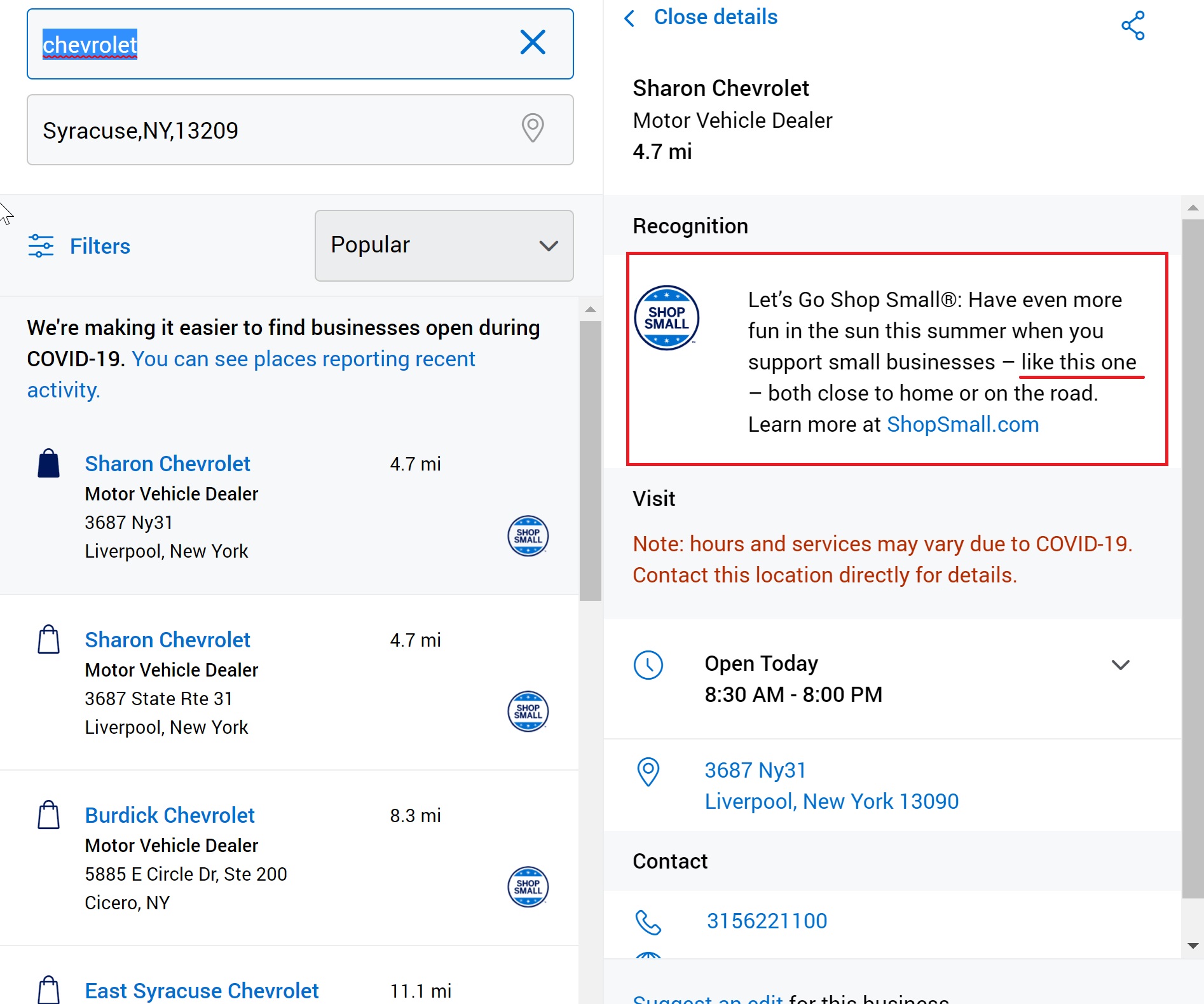

Of key importance: the Amex small business map (found here) is not a complete listing. Many people seem to think that only businesses labeled as “Shop Small” on that map qualify as small businesses. That isn’t true. The map can be useful for finding some qualifying small businesses, but there are many qualifying small businesses that are not listed on the Amex map. My wife has a card that has been earning +4x at small businesses from a previous referral offer and we have been pleasantly surprised at how many places code as small businesses (and it makes sense since many things are locally-owned even when they don’t appear to be downright small). Do keep in mind that some small businesses don’t code correctly for one reason or another. Sometimes you need to experiment with a smaller charge.

Still, we wouldn’t ordinarily spend $25K at small businesses in the next 6 months (or the next 3 from whenever we trigger the Platinum card’s current +4x referral offer). However, this offer is going to kick forward our timing on buying a new car.

A few years ago, I wrote about buying a car “with a credit card” to earn points. In that post, I explained how we bought the car that we currently drive and how we leveraged it into earning a bunch of points. A lot has changed since I wrote that post, but we are about to finish paying that car off. Now we are finally succumbing to the hard truth that a minivan just makes sense and we have kicked around the idea of buying one. Just a few days ago, I told my wife that we shouldn’t buy a car right now given the high price of cars. Then, yesterday, I was telling her why we need to buy right now. Crazy how quickly things can change in this game…

The value to be had here is so big that I won’t mind if we overpay a bit for the car.

That’s because many car dealerships should code as small businesses. For me, that was intuitive from the start: most car dealerships are franchise businesses owned by a local company, group, or person. Maybe it’s because I grew up in a small town where I actually knew the faces of the people who owned the dealerships because they were constantly in the community and their kids were in school with me, but I pictured a car purchase as a great way to meet the small business spending requirement from the start when this offer came out.

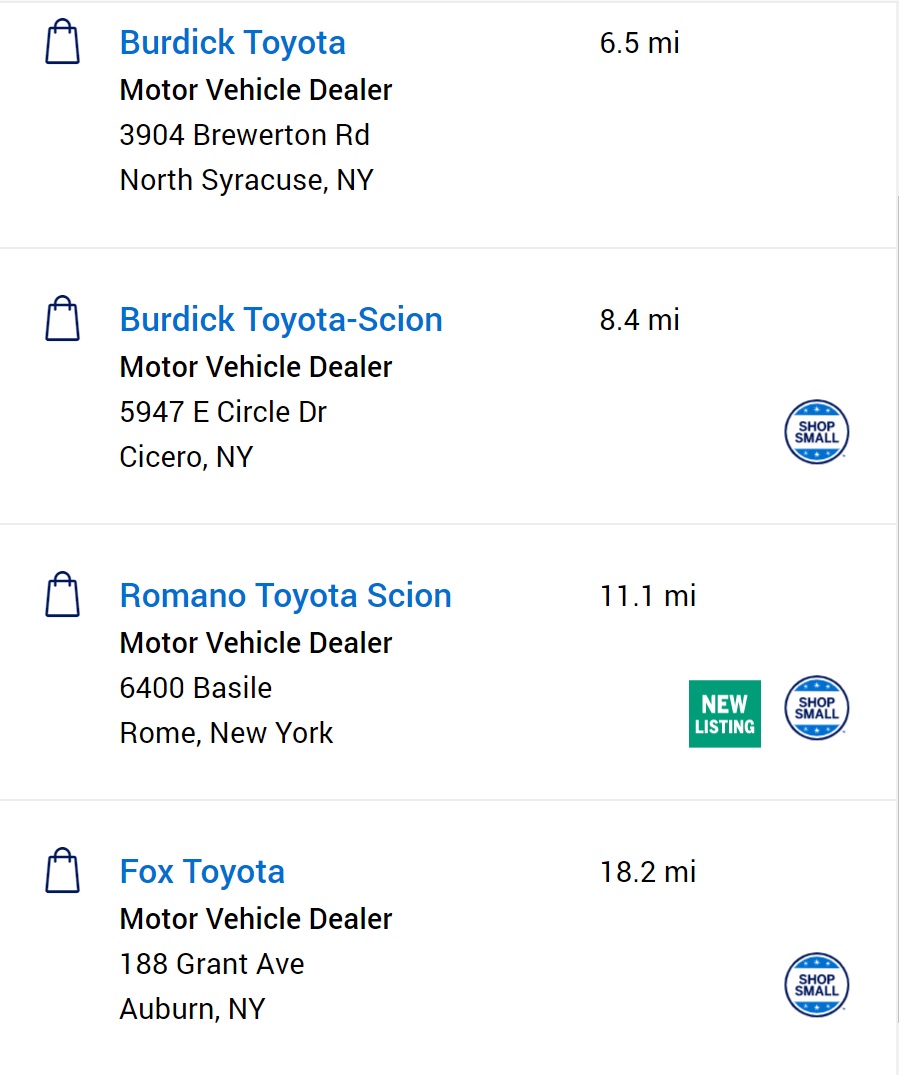

Sure enough, Amex’s small business map shows plenty of car dealerships with the ShopSmall logo (though not all of them as you can see here).

And let’s be clear, it isn’t just the Shop Small icon on the search page, but when you click through on a dealership that has the icon, Amex’s map makes it clear that many dealerships are qualifying small businesses.

With used car prices (and values) high, I had anticipated trading in our current vehicle, but now I’ll look to sell it privately and use the funds toward paying off the new car. I expect our current car to fetch something in the low to mid $20K’s and we’ll probably buy a used (er, “pre-owned”) minivan in the $25K-$30K price range. We’ll cover the difference out of pocket (at least initially). That’s because I want to pay the full price of the new vehicle on my Amex Platinum card.

Will it be possible to buy a car entirely on a credit card? Many will say it isn’t. And I expect it to be very difficult, but I’m not convinced that it will be impossible to do. Heck, Richard Kerr did it years ago and wrote about it in a TPG post that I can no longer find. Jason Steele did it this year (also written about at TPG). I won’t let them show me up. Game on, gentlemen.

Most dealerships will not take the full purchase price of a car on a credit card, so I expect this to be “not easy”, but I intend to make it my mission for the next 3 months to find a minivan we want at a qualifying dealership that will take the entire purchase price (or at least the $25K) on a credit card. That might mean having to settle on less important things like the color of the car or the exact options package we want. It may also mean paying an extra 2 or 3% to cover the dealer’s swipe fees. I won’t mind.

That’s because the return here is incredible. If I am able to successfully charge a $25K car to the card at a qualifying “Shop Small” dealership, I’ll end up with:

- 375,000 points from $25K spend at 15x

- 100,000 points from the +4 referral offer

- 125,000 points from the welcome bonus

- 600,000 Membership Rewards points

If I later open the Schwab Platinum card, I could redeem those points for $6,600 — a rebate of 26.4% on a $25K purchase. That’ll more than cover whatever upcharge the dealer wants to add for paying with a credit card. Alternatively I could use the points for a more valuable redemption of course — like maybe 4 round-the-world business class tickets with stops in 8 cities. That’s not a bad side dish to get with a new car.

How will I find a dealership willing to take the full purchase price on a car?

I guess my first step will be reaching out to Jason Steele to get a lead on the dealership he used :-).

After that, my next step is the Amex Auto Purchasing program. I wrote about this in my previous post about buying a car with a credit card. In short, the Amex Auto Purchasing program is an Amex-branded version of TrueCar, the site/service that links customers with pre-negotiated deals on vehicles through local dealerships. The Amex version only lists dealers that take an Amex card for at least part of the purchase price.

I’m not sure if they still do, but in the past the initial email you got from a dealer used to show how much of the car purchase price could be put on an Amex card like this one that says the dealer accepts any American Express card for up to $5,000.

In the past, I found that some dealerships explicitly said that they would accept the entire purchase price on a card. See here:

The prices I’ve seen via the Amex Auto Purchasing program are usually decent but rarely great. Still, if I can use this to identify the dealerships that will take an Amex card for the full purchase price, that will be great. At the very least I can quickly identify the ones that won’t balk at taking an Amex card.

It is worth noting that if you pursue the Amex Auto Purchasing program (or probably anything similar), you should create a new junk email address to use and probably also create a free Google Voice number. Otherwise, you will be absolutely inundated with a deluge of emails, phone calls, and texts from dealers for years. Ask me how I know.

I think it is equally possible that I’ll find a dealership through that program or that I’ll find an even smaller truly “local” used car dealer looking to make a sale. Or maybe I won’t — I can’t unequivocally predict success, but I have six hundred thousand reasons to put in some effort and plenty of miles to fly wherever I need to in the US to pick it up. Game on.

A crazy idea to leverage the purchase a bit more

Let me be clear that this post is not financial advice. I’m not a financial advisor and I could be off my rocker here, but I have a kind of wacky idea about what I might do after buying a minivan and selling my current car.

After buying the minivan and selling my current car, I’ll obviously pay off the Platinum card immediately. Then I’ll have a paid-off car on my hands.

I haven’t dug deeply into this, but I think it should be possible to take out some kind of auto equity loan / refinance loan to then take cash value out of the car.

With interest rates as low as they are, my thought is to take a loan for $20K against the car after purchase. Then, my wife and I will look to put the $20K into I-Bonds at Treasury Direct (each of us could buy up to $10K per year). The current rate for the first 6 months on I Bonds is 7.12% interest. We won’t know the rate for the second half of the first year until May, but even if the rate is 0%, the money should earn a risk-free 3.55% over the first year. Note that you can’t cash out I Bonds for a year and then if you cash out sooner than 5 years you forfeit the last 3 months of interest. Still, like I said, even if I earned zero interest for the second six months, I’d come out decently ahead of current low car loan rates. Note that I’ve only done cursory research on this, so do your own homework.

If I am correct, I expect that the interest earned from the I bonds in year 1 should nearly negate the interest owed over the entire term of the $20K loan (there are a lot of unknown factors here: if I am even able to take a loan against the car, I obviously don’t know exactly what the rate and terms will be, I’m just making guesses based on current used and refinance rates at the most competitive institutions).

Then, if I’m lucky, I may be able to pay off the loan with a credit card and earn more points from this purchase.

Will that really happen? I don’t know, but it’s fun to think about how much juice I can squeeze out of this purchase. Thanks be to Amex for putting me on the road to points riches.

Bottom line

I finally opened the Amex Platinum under the insane offer from Resy that could yield me 600,000 points. With a lot of spend to do over these next few months, I think my best bet for the spend will be to trade out my current car for a replacement if I’m able to find a qualifying small business dealer to take the full purchase price of the car on my new Platinum card. While my application timing is imperfect both from the standpoint of missing out on some extra credits and because of the mountain of spend I am currently facing, the rewards I stand to earn should make up for whatever I lose in extra credits or time. I certainly hope so. At the very least, I am excited about the challenge to put this amazing new card offer to work for me.

Damn that’s crazy and i fckn love it!! Go for it sir

Hi Nick! Nice ambitious plans with purchasing a car on a credit card. I don’t think you’ll have much problem with it if you’re really willing to throw the dealer extra 2-3%. And yes, if you pay it off, you should be able to turn around and refinance around 2.5%.

Question for you if you don’t mind. I had my wife apply for Business Platinum card since both of us already have vanilla Platinum, making us ineligible for Resy offer. Then my wife referred me to Business Green to open up 4x. I chose it because it has no AF and doesn’t add to 5/24. Then I got the same banner that you did.

I can refer my wife back from Business Green probably to Hilton Aspire since I don’t see many attractive offers for her and she has fifth Amex credit card slot open and never had Aspire. But my problem is where to take 5 employees to open the cards for. Both wife and I have real businesses but both are self-employed with no employees. How do you solve this problem? Are you using F&F or is there a better way?

Nick, you said Business Green was luckiest mistake. I made a mistake too. I wanted to trigger my husband’s AMEX PLAT (vis Resy link) for 4+, so I got my family member applied for AMEX gold. Now I think back I ‘m not sure 250 annual fee could be well covered. (ugh!) I wish I made your lucky mistake.

1]My BBP doesn’t have any Referral Link. Can anyone help?

I have referrals links from my green, gold, plat, plat business, etc.

2] My P2 open 125K Plat via Resy. He could generate referral links immediately. I wanted to use his Plat to apply for Gold. However the gold has 60K only thru his “Plat” referral page. The strange thing is if he generated the referral link from his Gold, he could see gold offered 75K.

Any tips/ help to get 75K via Plat referral link?

Thanks!

For the referral link generated from BBP, I was finally able to generate the BBP referral link via Incognito window. I used that to refer my P2.

Just the system of AMEX this afternoon was very strange, when I am asked to answer security question to get temporary card number, the page got lost. No I have to wait until Dec 9. And because of this, I can’t generate the referral link from my P2’s new BBP link.

Again, wanted to share the experience. All in sudden I got the welcome email from AMEX and there was “get your number” button. I did that on my mobile (Nick and Greg mentioned to try different browser/ devices), and I was successful to get the temp. number which means I am now able to generate the referral 4+ link.

My husband has 4/24. Is it worth using the last one applying for AMEX Plat Resy? The points potentially generated is more tempting than CIC/ CIP he supposed to apply next two months. Thank you

If this isn’t worth a slot, what is? 75K Ultimate Rewards points with a max of $125K more if you max out office supply on the CIC in the first year is a total of 200K. You’d only have to spend $5K on the Resy Platinum at restaurants and US Small businesses to earn 200K points. If you can spend any more than that, you’ll do better than you would with $25K office supply stores in the first hear in the CIC. If you can do $10K at restaurants and small businesses, you’re looking at 275K points. If you can hit the whole $25K, it’s 500,000 points — two and a half times more than you could earn in a year with the same amount of spend on the CIC. And if you refer someone before you start spending, that’s another 100K (if you do all $25K with that +4 referral offer).

I just can’t even imagine the offer that would be worth missing this one for personally.

THANK YOU SO MUCH!!!!!!!

One more question – If he gets the Amex Plat. now, can he use the FHR $200 credit for calendar year 2021 immediately? We want to book sth. in Napa at the end of Jan 2022.

Yes, absolutely. Also be sure to use the 2021 $200 airline fee incidental credit and the $50 Saks credit that’s valid until the end of December.

Hi Nick, how are you getting to 40k here?

In fact, it seemed like a pretty good deal because if I could get someone else to apply for a card with my Amex Green referral link before starting my spending on the card, I could get +4 points per dollar on the $3K required spend (a total of 5x with the card’s base rate of 1x included). That means that I’d be looking at 40K total points after $3K spend. Not a bad deal!

5x on 3k spend is only 15k points. What am I missing?

The Amex Business Green card has a welcome bonus of 25K points after $3K spend. Since you also earn 1x on the $3K in purchases, you’ll have 28K total points.

If I first refer someone by 12/1 before spending on the card, I can earn +4 points per dollar on all spend for 3 months on up to $25K spend (the current Amex referral offer). So if I refer someone before spending on my Business Green Rewards, I’ll earn an additional +4 points per dollar on that $3K spend that I need to do to earn the welcome bonus (an additional 12K points) for a total of 40k with the welcome bonus (25K welcome bonus + 3K points from $3K spend at 1x + 12K points based on $3K spend at 4 additional points per dollar for referring someone).

The way I explained it in the post was 1x + 4x = 5x times $3K = 15x on the spend plus the 25K welcome bonus (which gets to the same 40K).

I then further lucked out with an offer to add up to 5 employee cards and get 20K after $4K on each of them, but I don’t think you were asking about that part.

Does that make more sense?

Ah I forgot about the welcome bonus. Thanks

Wow, that is a lot of spend! That is an amazing amount of MR points you can get by buying a car. Good luck getting the dealer to take the whole thing with your Amex. Like you said, it is well worth it if you have to pay the swipe fees.

omgg. Life is too short to even read this post, let alone partake of this scheme. Good luck though, I’ll be thinking of you while biking, hiking, traveling, eating, and doing all that stuff I get to do b/c I’m not doing what you’re doing.

Did this process a couple months ago, it was very stressful but after 5-6 weeks found a decent-ish price on the desired car, dealership agreed to take a 20k down payment on amex w/no swipe fee.

Out of 4 other dealerships -one would have accepted the full 20k but with a 5% fee, and the others all had 3k hard limits on CC’s.

I was thinking to app plat (69th time’s a charm? dang pop up for eternity) and was hoping to do in the next week or so for triple dip/ be able to use on a thanksgiving trip. Now i’m worried/confused I won’t get the triple dip (also see @kevin’s response below). Altho amex may hate me in the end anyway so it could be moot.

What date did you app @Nick Reyes?

Not sure why your first statement date is so soon. I just got the Amex Biz Plat on Nov 16th and statement closes December 16th, leaving me plenty of time to triple dip the credits. Annual fee will post December 16th, and then I’ll have until mid-January to triple dip.

Yeah, others commented about the same. I don’t know, either. I mentioned in response to someone else that by Business Green Rewards card first statement date was scheduled for a month after approval (i.e. in December), but my Platinum card’s first statement cut date was less than two weeks from approval.

You misquoted. It’s, “It was the best of times, it was the blurst of times.”

I am having issues accessing the application page on Resy. Getting a 404 error. Is there another link besides the one in your Best CC Offers page?

It’s working for me. Maybe try clearing your cookies or another browser.

Great post! Thanks. Any thoughts/experience on whether paying college tuition to a small, private liberal arts college would qualify as small business and get the 15x?

Great post but good luck with buying the car on a CC.

Good luck buying the car at all.

There’s never been a worse time to buy a minivan