NOTICE: This post references card features that have changed, expired, or are not currently available

Many ultra premium cards come with keeper features — those killer benefits that make the cards worth having and holding. But there is often an argument to be made against keeping those cards forever and ever, so this week on Frequent Miler on the Air we take turns playing matchmaker or the anti-cupid: we pick a card, one of us talks about one or two keeper features and the other rebuts with the reason that card isn’t a keeper.

Many ultra premium cards come with keeper features — those killer benefits that make the cards worth having and holding. But there is often an argument to be made against keeping those cards forever and ever, so this week on Frequent Miler on the Air we take turns playing matchmaker or the anti-cupid: we pick a card, one of us talks about one or two keeper features and the other rebuts with the reason that card isn’t a keeper.

Elsewhere on the blog this week, read our beginner’s guide for booking partner awards, find out how Greg’s Global Upgrade to Premium Select went, learn how you can still see the Virgin Atlantic monthly calendar view and more.

00:50 Giant Mailbag

5:13 What crazy thing…..double feature! First up: Virgin Atlantic takes away calendar view (but we’ve got ya covered)

8:03 What crazy thing…did Germany do this week?

11:22 Mattress running the numbers: Is the 50% transfer bonus from Chase to Marriott a good deal?

18:20 Main Event: Keeper features of ultra premium cards

39:01 Question of the Week: Is it worth spending toward Delta elite status to get my family upgraded?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week at Frequent Miler

A beginner’s guide to searching for partner award flights

New to the game and not sure how to use your United miles to fly on LOT Polish or your American Airlines miles to fly on Cathay Pacific? This post explains what you need to know to get started on the path to booking partner awards like a pro.

The InterContinental Ambassador Experiment

Greg recently got creative and tried for a multi-tiered stack at an InterContinental abroad. Despite how things worked out with his “presidential” suite upgrade, I’d say that this worked out to be a nice win in terms of lessons learned. I’m still not convinced that I’d ever sign up for InterContinental Ambassador for the BOGO “free” night coupon, but I could certainly see why it might make sense when booking a special stay.

(Still live via referral) Sapphire Preferred 80K Q&A: Everything you need to know

I’m including this post this weekend just to alert readers to the fact that the elevated offer is still available via friend referral. If you were interested and thought you missed out, you may be in luck — but you’ll want to move on that sooner rather than later as it probably won’t last much longer.

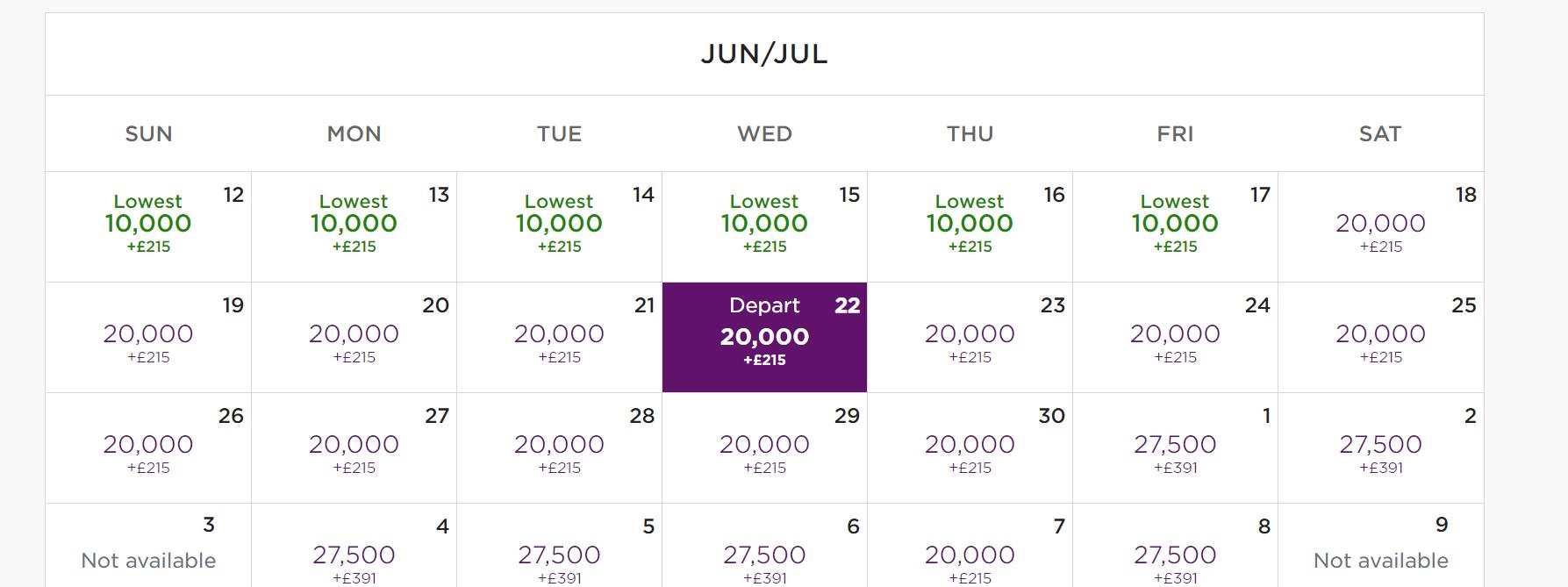

The Virgin Atlantic monthly award calendar still exists. Here’s how to find it.

Did Virgin Atlantic hire away the Turkish Miles & Smiles IT team? You may recall that Turkish took away its checkout button for booking online Star Alliance awards, then brought it back but made it non-functional for a while (some had found the code in the page script to force the button to work, but now it is finally working again for everyone). Taking a page from that book, Virgin Atlantic has taken away the button to see monthly availability. Fortunately, they haven’t taken away the data, just the button to make it visible. Don’t worry, Greg has you covered with an easy solution to get that monthly calendar back.

Avoiding phantom award space basics

There’s nothing worse than finding availability, getting excited, and starting through the booking process only to find that it was phantom availability that didn’t actually exist. Double or quadruple that disappointment if you’ve transferred points to miles to book what turned out to be phantom space. This post gives you some of the double-check and triple-check steps to try before transferring in the hopes that it helps you avoid that headache/heartache.

Your old friend: the dummy booking

We always maintain links to the best publicly-available offers on our Best Offers page. However, if you’re looking for a co-branded card, you can sometimes do a little better by starting the booking process with that airline or hotel’s website. Just beware — not all dummy booking offers are a good deal. This post shows some current examples, both good and bad.

Five free Marriott 50K free night certificates returns (and yes, you can top off the certs)

One credit card offer that increased substantially this week is the offer on the Marriott Bonvoy Boundless card. Now with five free night certificates once again, this offer could be highly valuable. I’m including this “Quick Deal” post in our week in review because there was some initial confusion about whether or not you’ll be able to use points to top off the certificates from the offer. We were able to confirm that you can.

Delta Premium Select Bottom Line Review

Now that I’ll be traveling with a family of four, I expect that there will be more premium economy in our future over the next decade and a half, so I was glad to read Greg’s review of the experience on a long-haul international Delta flight in Premium Select. I was less glad to see the lack of space for these seats. Legroom is nice, but the lack of elbow room and storage space is what I find most annoying about economy class (which is fresh in my mind having flown Southwest with the family just yesterday). I’ll be curious to see how this stacks up with other airlines, but my next few trips will still be in premium cabins so I won’t find out until at least next year.

Best card for free access to Delta Sky Clubs®

This post could be highly valuable to you if you frequently fly from or through an airport with a Delta Sky Club. I’ve not previously put much thought into this as I’ve had a Platinum card more often than not for reasons unrelated to SkyClub access. As it turns out, I haven’t had much use for the benefit myself since I don’t typically fly Delta — which is a good reminder to value benefits like this one based on how often you’re likely to actually use them.

Palacio de Villapanes Sevilla, Mr. and Mrs. Smith: Bottom Line Review

Tim reviews a lovely-looking Mr. and Mrs. Smith property. I’ve gone on record on the podcast a few times noting that the brand name — Mr. and Mrs. Smith — just doesn’t speak to me (or at least, it doesn’t say “luxury” to me despite the fact that I know it’s a luxury brand). However, Tim shows why you shouldn’t listen to what speaks to me — this place looks quite nice if being in this area is on your agenda (and I do highly recommend Seville!).

That’s it for this week at Frequent Miler. Keep an eye out for the latest edition of last chance deals.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

Good morning. You discussed the insurance benefits of the sapphire reserve card in this week’s podcast.When we travel out of country we often travel with my 83 yr old mother. So we always purchase travel insurance out of fear that something could occur and Medicare won’t cover it.Just paid $350 to cover her for two weeks in the UK. (Which did include quarantine coverage if we end up not being able to fly back as scheduled)I’ve been uncertain of free credit card insurance would be adequate.Is this totally unnecessary? Are y’all confident that included insurance is equivalent to what you can purchase?Thanks

The question re getting F domestic seats on DL; best use for $10-20K monthly business spend.

Let me concatenate several things you mentioned, with some additions at the end:

Even before all the SUBs and possible employee bonuses, the 2x return under #4 joined to the 35% MR points back in #2 turns $180,000 annual spend into $5,400 in DL F tickets; depending on how hard one can hit #3, this could easily be doubled, at least for a long first year.

The only keeper feature of ultra premium cards for me is a solid retention offer. Unless you are severely velocity constrained, there is really no reason to keep any high AF card. The benefits across cards are so duplicative that you would almost certainly be better off just getting a new SUB, which yields a much higher ROI on your spend and your AF investment.

Your podcast is my favorite podcast and I listen to it every Saturday so I hope you don’t mind some constructive criticism. I found this weeks podcast pretty frustrating. No depth to any analysis of the cards you discussed. I personally would have preferred splitting this up and deeper discussion or narrowing down the cards discussed to allow for more discussion. Love you guys and appreciate all the knowledge you’ve shared.

It was a good bit shorter than their usual episodes.

You forgot about the Bank of America Premium Rewards Elite Credit Card. Probably because it is indeed forgettable.

Regarding the US Bank Altitude Reserve Card, I do make a lot of purchases in person and it is a great rewards card BUT I’m going to drop it. Nick, you might find this hard to believe but US Bank’s customer service is worse than Citi and Wells Fargo combined.

The fraud freeze algorithm has a hair trigger. So, one calls in. Unlocking the Altitude Reserve (as opposed all other US Bank credit cards) is ONLY done by a “special group.” While customer service reps say they are transferring one to the right department, invariably, the call involves five transfers and two hours. At the end of the two hours, you learn that specific fraud codes are actually segregated into different special groups . . . and unlike the other fraud special groups that work 24/7, this fraud special group for this particular fraud code is only open Monday – Friday from 8am – 6pm CT. All for its top-tier customers.

We just got back from a month in Europe. Three times the fraud freeze kicked in. Back in the US, it kicked in once more for old time’s sake.

Greg, when I commented to another article about the time cost of an award / benefit, I’m calling myself out on the Altitude Reserve. My last purchase on the card will be for a good acetylene torch.

On the 9-euro Germany ticket, there’s a much bigger caveat you guys missed: it doesn’t apply to long-distance ICE (Inter-City Express) or IC trains. If you look at taking a train from say Frankfurt to Berlin (as Nick mentioned), it would almost certainly be on one of these trains. It’s not to say that it’s impossible to get from Frankfurt to Berlin on the 9-euro ticket, but you’d have to piece together a series of regional trains (RB or Regional Bahn, RE or Regional Express), which means numerous stops and changes and a much longer trip.

The real value is that with one 9-euro ticket, you get unlimited travel on all forms of local public transport in whatever city you visit (local and regional trains, buses, trams), so it’s great for exploring whatever city you visit, and its outskirts.

Greg actually mentioned exactly that. He mentioned that it would take forever to get from Frankfurt to Berlin because it would only be on local trains and then he mentioned that it was better for local transit. You’re totally right, but we didn’t miss it (or at least Greg didn’t) on the show.

Ahh my bad. Should’ve reviewed the piece again before writing.

I think a great topic for another podcast would be on utilizing positioning flights. When to use it – who should use it – is it a good idea when traveling with non experienced travelers , etc.

Sometimes there’s no award inventory for one’s preferred departure city. And, there’s no connecting route within award inventory. So, there’s no choice but to have a stand-alone positioning flight. Once one opens the mind to such flights, magic happens. One begins to think “what if?”. One begins to consider Seattle or Vegas or wherever as potential departure points for possible award inventory. Play with it. Be creative.