NOTICE: This post references card features that have changed, expired, or are not currently available

The points & miles game is more rewarding when playing as a couple or a family. Why get only one new welcome bonus when you can get two or more? Nick expanded on this idea here: Playing in multi-player mode to earn more valuable rewards. And, more recently, I wrote about how my wife (“player 2” in our points-relationship) was pursuing over 500,000 points thanks to recent credit card signups. What we didn’t previously cover was how best to manage these rewards. How do you keep track of passwords, loyalty account numbers, and credit cards? Can you move player 2’s points to your account? If not, what happens to player 2’s points when they cancel their cards? How do you keep track of things like free nights that expire each year? In this post, I’ll give tips for addressing each of these questions…

In this post I make the assumption that your player 2 (and player 3, player 4, etc.) are truly hands-off. They don’t want to be involved in the rewards process at all, but (and this is important!) they have explicitly authorized you to handle this stuff for them.

Multi-Player Email & Phone

In order to properly manage multiple rewards accounts, it’s necessary to have access to unique contact info for each player.

Email address

I like to set up a unique email address for each player that is separate from their primary email addresses. For example, you could create a free Gmail account for each player and use a common email name format that’s easy for you to remember. For example, if Player 2’s initials are “ABC”, you could create an email address such as “rewards_uniquetext_ABC”. Then setup Gmail to automatically forward all email in this account to your own rewards account.

When your player 2 signs up for loyalty accounts, credit cards, etc., use this email address so that you have access to all of the emailed info, including promotions that require registration.

Phone number

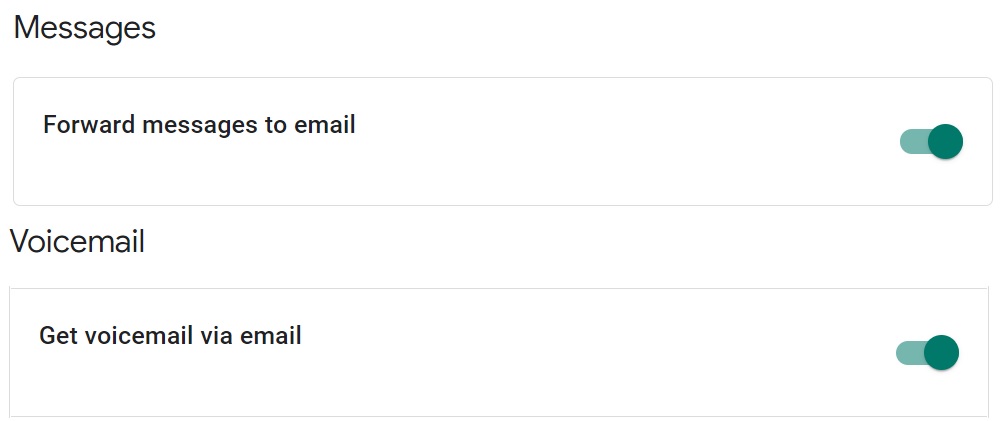

After setting up each player’s Gmail email address, you can also get a free phone number for each person by signing them up for Google Voice. It’s then simple to configure Google Voice to send text messages and voice mail to email so that you’ll be alerted to any messages:

Some accounts won’t accept Google Voice as a valid phone number for text messages. In that case you’ll have to either use your own mobile number or your family member’s number (understanding that you may have to ask them regularly for two-factor codes that are texted to their phone).

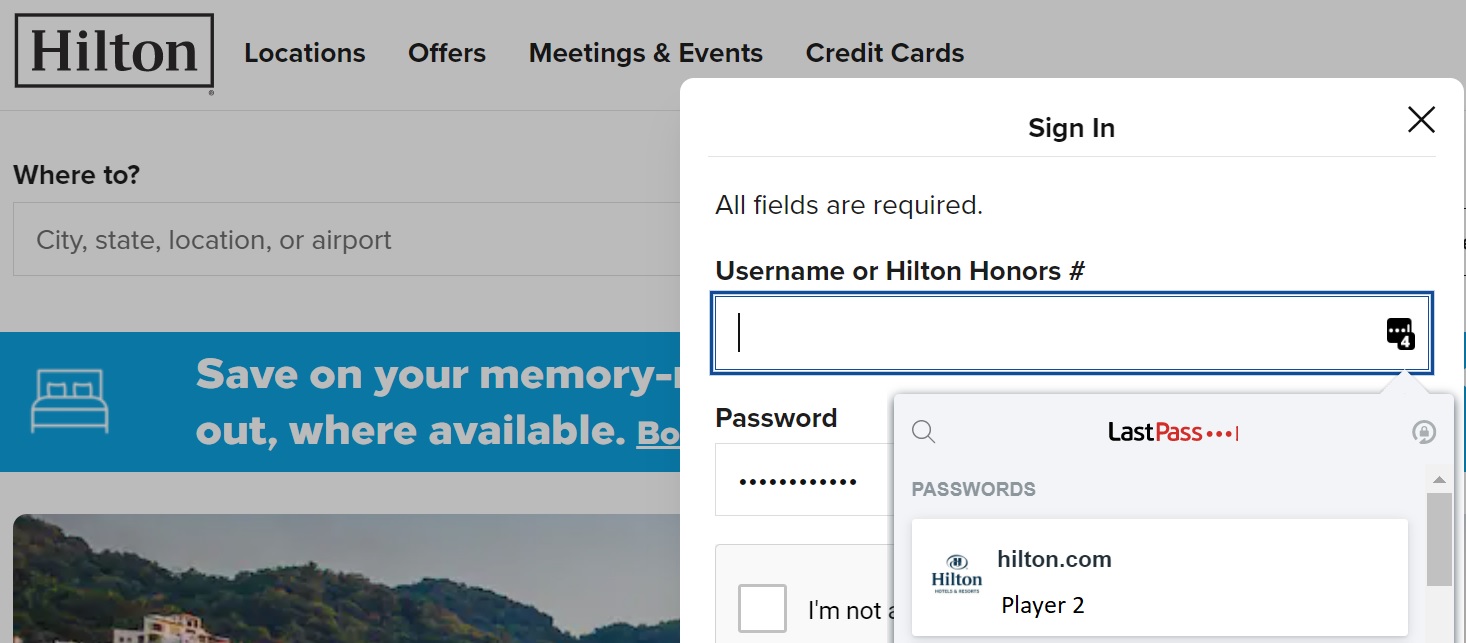

Password manager

I use LastPass to manage passwords, but I have no doubt that other services work well too. The great thing about using a password manager is that you can use it to generate and remember strong passwords for every log-in. You only have to remember one strong password: for the password manager itself. One thing I love about LastPass is the ability to give people emergency access. If something were to happen to me, then my wife and/or son could get emergency access to my LastPass account and therefore to all of our online accounts.

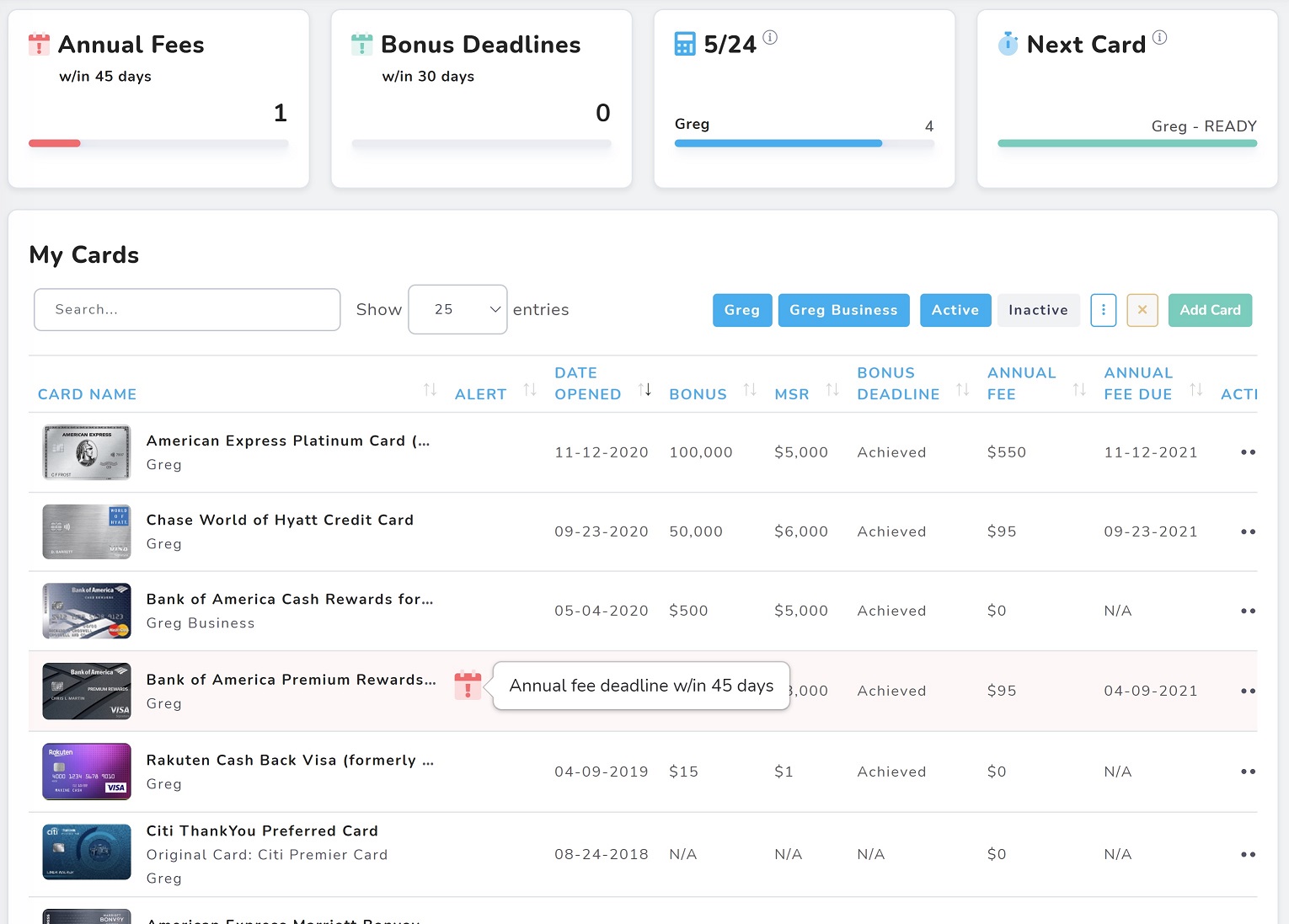

Credit card manager

If you’re in charge of deciding which cards your family members should sign up for, and when they should do so, you’ll have to keep track of every card they have, when they signed up for it, and more. Plus, you’ll presumably be the one to make sure that they spend enough to earn welcome bonuses and that they downgrade or cancel cards when annual fees come due.

I use Travel Freely to help me track almost everything having to do with the credit card signup bonus process. For details, see: Take the stress out of credit card bonus hunting: Travel Freely. Within Travel Freely, you can manage two people from a single account. In my case, though, since I manage 3 separate accounts, I set up Travel Freely separately for each “player”.

Travel Freely emails me when signup bonus deadlines are nearing so that I can make sure we meet minimum spend requirements. It also emails me when annual fees are coming due so that I can decide whether to keep, cancel, or downgrade those cards before paying for another year. And, at a glance, I can easily see which cards each player has, whether they’re under “5/24” (Chase will only approve you for new cards if you’ve opened fewer than 5 cards in the past 24 months), and more. If you’re interested in signing up for Travel Freely, consider using our referral link (we’ll earn a commission if you sign up for new cards through Travel Freely):

Here’s the link to sign up: Travel Freely. It’s free.

Rewards manager

I don’t know what I’d do without AwardWallet. Even if I was only managing my own rewards programs it would be difficult to keep track of all of the loyalty programs I’ve signed up for, but AwardWallet makes it easy. Importantly, it also tracks point balances and rewards certificates, alerts you when points or certificates (such as hotel free nights) are nearing expiration, and more.

Full details plus a free upgrade to AwardWallet Plus (for those who haven’t tried it before), can be found here: AwardWallet.

Using multi-player points

For the purpose of booking award travel, it’s great if you have the opportunity to combine points. This is helpful because you might otherwise not have enough points in one account to book the full trip. Plus, in some cases it is better to book an award from an elite member’s account because you may then get better award availability, more flexible cancellations, etc. That said, combining points usually isn’t necessary. You can use one person’s airline miles to book a flight for another person. Sometimes you can do the same with hotel points. And when using bank points to pay for travel, you can always book travel in someone else’s name.

Here’s a summary of the options available for dealing with multi-player points with some popular rewards programs:

Transferrable Points

- Amex Membership Rewards: Amex doesn’t allow members to move points from one person’s account to another. However, it is possible to transfer one person’s points to another person’s loyalty program account. The key is that the person who receives the points must be an authorized user or employee on the other person’s account. For example, my wife can transfer Membership Rewards points to my Virgin Atlantic account as long as I’m an authorized user (or employee) on any of her Membership Rewards cards. The authorized user card must be active for 90 days before it will unlock the ability to transfer your points to the authorized user’s loyalty program account.

- Capital One “Miles”: Freely move points to any other person’s Capital One account

- Chase Ultimate Rewards: Freely move points to another household member’s account.

- Citi ThankYou Rewards: Freely move up to 100K points per year to any other person’s Citi ThankYou account. Points moved this way expire after 90 days, so be sure to use them quickly (by transferring to an airline program, for example).

Airline miles

Unfortunately, in almost all cases airline programs charge you a steep fee to move miles from one account to another. For example, Delta charges 1 cent per mile plus a $30 processing fee. That should be a last resort and done only if you have an opportunity to get much better value from those miles. A better option, if possible, is to use your Delta miles to book flights for another person. Some airlines, though, offer family pooling where you can freely pool together points from multiple people. That’s ideal.

- Air Canada: Air Canada offers free family sharing: pool points together for free.

- American Airlines: No family pooling. Transferring miles costs 1.5 cents per mile (don’t do it). Best bet is to book from account that has miles. That person doesn’t have to be a traveler.

- British Airways: British Airways offers a free family pooling option called a Household Account.

- Delta Airlines: No family pooling. Transferring miles costs 1 cent per mile plus a $30 processing fee (don’t do it). Best bet is to book from account that has miles. That person doesn’t have to be a traveler.

- JetBlue: JetBlue offers a free family pooling option called Points Pooling.

- Southwest Airlines: No family pooling. Transferring points costs 1 cent per point (don’t do it). Best bet is to book from account that has points. That person doesn’t have to be a traveler.

- United Airlines: No family pooling. Transferring miles costs 1.5 cents per mile plus a $30 processing fee (don’t do it). Best bet is to book from account that has miles. That person doesn’t have to be a traveler.

Hotel points & free night certificates

Unlike airline programs which allow you to use miles to book flights for other people, hotel programs often require that you use your points and free night certificates for your own stays. They’ll let you book multiple rooms, but your account number will be on the reservation. This is a problem when one player has (or is seeking) hotel elite status but the other player has the points or free night certificates. For example, my Marriott status gives us free breakfast at most Marriott hotels, but if we book a stay with my wife’s free night certificate, we won’t be eligible for free breakfast since it will be her loyalty number, not mine, on the reservation.

- Choice Privileges: You cannot transfer your points to another person. You can book award nights for a spouse, partner, children, parents, in-laws, brother or sister, even if you are not occupying the room.

- Hilton Honors: Hilton allows points pooling with up to 10 other members in a pool free of charge. Each member can transfer up to 500,000 points per calendar year into a pool and a member can receive up to 2 million points. Hilton also allows free night award certificates to be redeemed for someone else, but once the certificate becomes “issued” to a person (presumably through making a reservation), it is non-transferable.

- IHG Rewards Club: IHG charges half a cent per point to transfer points. Don’t do that! You can often buy points outright for that amount during sales! Instead of paying to transfer points, IHG provides the ability to add up to 3 additional guest names on a reservation when you’re booking online. I recommend also contacting the hotel to add the elite member’s reward number to the reservation if applicable. Free night certificates are not transferable. Instead, contact IHG to make a reservation for someone else using your free night certificate.

- Marriott Bonvoy: Marriott allows any member to transfer up to 100,000 points per year to other members and an individual member can receive up to 500,000 points per year from such transfers. Marriott does not allow using a free night certificate to book for someone else.

- World of Hyatt: Hyatt allows the transfer of points from one member to any other member, up to once per 30 days. Additionally, Hyatt free night certificates can be gifted to any other Hyatt member.

More information about sharing hotel points and certificates can be found here: Gift hotel points, free night certificates, and award nights booked with points: Rules by program.

Keeping points alive when cancelling cards

Despite what phone agents often erroneously tell people, you can freely cancel almost any airline or hotel credit card without fear of losing the associated miles or points. The reason is that the miles and points are held with the airline or hotel loyalty program, not with the bank. For example, as long as you don’t close your Delta loyalty account, you can freely cancel your American Express Delta card without fear of losing Delta miles that you’ve previously earned.

Bank rewards points are different. With points offered directly by a bank, cancelling your cards with that bank will forfeit your points. In most cases, an easy work around is to simply downgrade to a fee free card rather than cancelling.

- Amex Membership Rewards: With Amex, you can freely cancel your Membership Rewards cards as long as you keep at least one open. This is true even if you earned all of your current points on a card that you cancel. For example, suppose you earned 200,000 points with an Amex Platinum card and 10,000 points with a fee-free Blue Business Plus card. You can freely cancel the Platinum card and you’ll keep all 210,000 points thanks to keeping the Blue Business Plus card open.

- Capital One “Miles”: Capital One might not always offer an option to product change to a fee free card. If that’s not an option for you, then a better bet is to open a fee free card and move your “Miles” to that card before canceling.

- Chase Ultimate Rewards: You can always downgrade to a fee free card. However, if you want to cancel rather than downgrade, make sure to first move points to another Ultimate Rewards card account that you own or that another household member owns. Note that you’ll need at least one premium Ultimate Rewards card (Sapphire Preferred, Sapphire Reserve, Ink Business Preferred) in your household in order to transfer to hotel & airline partners because fee-free cards don’t have that capability.

- Citi ThankYou Rewards: Downgrading is the only good option other than spending down your points before cancelling. See this post for details: Cancelling your Prestige or Premier card? Here’s how to keep ThankYou points alive. Note that you’ll need a Premier or Prestige card in order to preserve the ability to transfer points to airline partners.

Chase UR question: If my husband has the Chase Sapphire Reserve, and I have a Chase Flex or Freedom (with him as an authorized user) – can he transfer UR points to my frequent flier accounts? Or are we just allowed to share the UR points (we are in the same household). Thanks!

Yes he can transfer to your frequent flyer accounts

I did not find anything about transfer Wyndham points between 2 accounts. Is this possible without fee? Or any other option to use points from other account?

I’m not aware of any way to do that. Instead, we will book some nights from my wife’s account and other nights from mine. Since we both have the Wyndham Business Earner card, we both have Diamond status. And we’ll both continue to follow these steps to try to keep our unused points alive long term: https://frequentmiler.com/how-i-saved-my-wyndham-points-from-expiry/

[…] We in this hobby have all struggled to get our spouses/partners more involved. Most normal people do not think like us lol. This is a good post about the unique challenges and tips on Managing Rewards in Multi-Player Mode. […]

When finding availability for 2 award tickets, Virgin Atlantic [for ANA] told me “no problem, why don’t I just combine your accounts so that I can book you on the same itinerary” while AA told me “we will not combine” and thus we had to book 2 separate itineraries. Pooling is always nice.

That’s awesome. I thought that Virgin required Gold status before they would combine points.

A list of banks that are able to use Google Voice numbers for SMS verification etc. Would be super helpful

nice photo. Monkey see, monkey do.

Interested to hear how you use Hilton FNC for someone else. When ever I’m using P2’s they only put P2 on the reservation – meaning my status doesn’t carry over. It’s created some headaches on upgrades/late checkout/etc…

Alaska allows transfers for $10 per thousand plus service fee

Question, I know that if I am added as an authorized user on a personal account it adds to my 5/24 total. Is the same true if I become an authorized user on a business card? I ask this question here because I would like to become an authorized user on Player 2’s AMEX business card so that Player 2 can transfer points to my frequent flyer accounts. However, if the cost is adding to 5/24 it would not be worth it.

That’s exactly the right strategy. Adding yourself to a business account does not show up on your credit report and so it won’t affect your 5/24 status. Note that while a personal card could add to your 5/24, it only sort-of does so. By that I mean that you can call Chase and have them evaluate your application without the AU cards. Also, I think (but I’m not 100% sure) that if the personal Amex card has been open for more than 24 months, it will be dated the same way on your credit report and so it won’t count towards 5/24 at all.

Despite having starting doing this stuff around the same time you did I am always still learning more from you, thank you. What was key in today’s message was that I needed to add myself as an AU to my wife’s personal Plat Amex (with the free gold card for AU’s) so that I have the option of transferring her MR to one of my linked transfer partner accounts.

Quick tip on sharing a Marriott free night cert – simply do app check-in from the account of the person whose cert you’re using. Have another guests name down as also staying in the room so they can grab key cards, etc. Posted full details of my experience (from last month) in the “Gift hotel points” post you guys linked to in this article.

I love the picture of the monkeys and I love the technology, but I prefer to keep my credit card information on my own spreadsheet. I was burned in the past when these kind of small companies simply disappear taking all my data with them and no way for me to restore it.

I use my own s/s too. Awardwallet is kind of tempting, but alas, no.

if you downgrade out of a MR or UR earning card, you can’t transfer to airlines or hotels anymore.

I think you mean UR or Citi, right? Fee free Amex can still transfer. I updated the Chase and Citi downgrade sections to mention that. Thanks!

Has Chase just recently added the requirement that the transferee must be an AU? I tried to transfer from my Sapphire and got a message that says “you may only transfer points to yourself or one additional household member who is listed as an authorized user on your card account”.

That’s long been true when transferring from Chase to a rewards program, but you can transfer Ultimate Rewards points directly to one other household member even if they are not an authorized user.

I’m not sure Capital One points can be freely moved to any other person’s Capital One account. I recently tried to move my wife’s Capital One points to my Capital One account in order to redeem them using my Wyndham Diamond status and was told by the Capital One account representative that they no longer allow the movement of points.

This is interesting and requires some further investigation.

The short answer to this is to say that my wife just minutes ago called and successfully moved Capital One miles from her Venture card to mine and then moved cash back from her Spark Cash card to miles in my Venture account on the same call. So it’s definitely still possible.

However, you’re not off your rocker. Something is afoot that’s going to require some more investigation. For the past couple of years, when logged in to your Capital One account and going to the “Move Rewards” section it had a drop-down asking if you wanted to move rewards to one of your own accounts or someone else’s. If you selected someone else’s, it gave a message saying that they were working on bringing that functionality online and in the meantime you’d have to call in to do it. That section is now completely gone — it doesn’t say anything about moving to someone else’s account. So that’s sign #1 that something changed.

I briefed my wife on the situation before having her call, so she was aware of your data point and that I thought it was more likely than not that they would tell her no (and in this case, we legitimately had been meaning to call and move points for a redemption, so I was very bummed when I saw your data point and found the “someone else’s account” choice missing). However, my wife told the rep what she wanted to do and the rep said “let me check if you’re eligible to move rewards” and then a moment later she said, “Yes, I see you’re eligible to do that”. Since we actually wanted to move the miles and weren’t just trying for science, my wife didn’t ask what the eligibility criteria were since she didn’t want to step in the way of getting what she wanted. The rep went ahead and moved the Capital One miles to my account. I then transferred from my Venture to my VentureOne online and made the redemption I wanted, so it all went through without a hitch.

But the eligibility comment and everything else above gives me more questions than answers. I’m going to follow up with Capital One and another test, but in the meantime you may want to try calling again to see if you get a different answer.

If you wouldn’t mind sharing some more detail, I’m curious which cards you were trying to combine rewards between and approximately when they were opened (i.e. in 2021 or 2005 or whatever). If you don’t want to comment here with the info, send me an email through the “Contact” link at the top of this page. I’m wondering if it’s something grandfathered at this point and/or restricted by card type.