NOTICE: This post references card features that have changed, expired, or are not currently available

Back in August, the internet was abuzz with news of a rumored shakeup in Marriott’s credit card portfolio. We guessed then that September 22nd would be the date of a big announcement, when the details of the new (and newly-refreshed) cards would be made public. But, until then, we just had to guess ’bout the beautiful bounty that Bonvoy would bestow. Well, the wait is over and the changes are live today.

Amex and Chase have each introduced new $250 annual fee Marriott cards: the Bonvoy Bountiful card from Chase and the Bonvoy Bevy card from Amex. At the same time, and as was expected, Amex has also announced that the Marriott Bonvoy Brilliant card has an increased annual fee of $650 (up from $450) with some improved features to go along with the blingy price tag.

So are these new cards breakdancing bangups that have us doing backflips? Or are they befuddling backsliders? Let’s take a look. Greg the Frequent Miler wrote a great post last month where he speculated on what the details of the new cards would be. So, we’ll look at his predictions and then compare them to what we’ve found out about the cards today.

Greg’s Predictions vs Reality

First off, Greg predicted that the current $95 annual fee cards wouldn’t change and he was right on. Chase’s Bonvoy Boundless card and Amex’s Bonvoy card share a $95 fee and many of the same benefits, including:

- $95 annual fee

- 35K free night certificate each year upon renewal

- Automatic Silver Elite status

- 15 elite qualifying nights per year towards elite status

- Earn Gold Elite status with $35K annual spend

- Earn 6x points at Marriott hotels and 2x for most other spend (the Chase card also throws in 3X at gas stations, grocery stores, and dining on up to $6K in combined purchases each year)

These two cards are unchanged, with the same annual fees and benefits. But now there is a new tier of $250 cards and, given the extra $155 in annual fee, they must carry a ton of additional value and a bountiful bevy of new features, right? Um, right…?!?

Unveiling the Bevy and Bountiful

| Card Offer and Details |

|---|

ⓘ $317 1st Yr Value EstimateClick to learn about first year value estimates 85K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 85K points after $5k in eligible purchases within your first 6 months of card membership. Terms apply. Rates & Fees $250 Annual Fee Recent better offer: 155K points after $5k spend in the first 6 months (expired 9/25/25) Earning rate: 6X Marriott.✦ 4X restaurants & U.S. Supermarkets on up to $15K in eligible purchases per year ✦ 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: One 50K Free Night Award after $15K calendar year spend on eligible purchases. Noteworthy perks: 15 night credit towards elite status every year upon account anniversary ✦ 1,000 bonus points with each qualifying stay ✦ Gold elite status See also: Marriott Bonvoy Complete Guide |

| Card Offer and Details |

|---|

ⓘ $333 1st Yr Value EstimateClick to learn about first year value estimates 85K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 85K points after $4K total spend in first 3 months$250 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 6X Marriott.✦ 4X restaurants & grocery on up to $15K spend per year ✦ 2X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: One 50K Free Night Award after $15K calendar year spend. Noteworthy perks: 15 night credit towards elite status every year upon account anniversary ✦ 1,000 bonus points with each qualifying stay ✦ Gold elite status ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit See also: Marriott Bonvoy Complete Guide |

Here’s what Greg predicted the details of the news cards would be, including the features that he thought would warrant the additional annual fee, compared to the actual details about the cards that we’ve learned today:

| Greg’s Guesses | The Bountiful Truth | |

|---|---|---|

| Annual Fee | $250 | $250 |

| Statement Credits | $120 @ $10/month | none |

| Free Night Award | 50K Certificate | none |

| Free Night w/ Spend | N/A | 50K cert after $15k spend |

| Automatic Elite Status | Gold Elite | Gold Elite |

| Elite Status w/ $75K Spend | Platinum Elite | None |

| Automatic Elite Credits | 15 Elite Nights | 15 Elite Nights |

| Free Priority Pass | No | No |

| Earnings from Spend | 6x points at Marriott hotels and 2x for most other spend with 3x or 4x categories as well. | 6X Marriott; 4X US restaurants and grocery (up to $15k/year), 2X on all other eligible purchases |

| Additional benefits | Same as current | 1,000 bonus Bonvoy points per stay. |

As you can see, Greg was right on the money with most of his predictions, with one glaring exception: he was crazy enough to believe the new $250 cards would be better than the current $95 cards! I gotta say, I’m blown away by how exceptionally average the benefits are on these new cards, despite the increased fee. No annual free night cert, unlike the $95 cards? No additional statement credits or Priority Pass or path to spend to elite status (as far as we know right now)?

The only difference between the new $250 cards and their humbler $95 brethren is that they have 4x at up to $15K at restaurants and supermarkets, complimentary Gold status (which is of extremely marginal value) and that cardholders earn an extra 1,000pts per stay. But, given that the $95 cards come with a 35K cert, you’d need to stay 30+ times before that extra 1K per stay approximates what you are gauranteed from the cards that leave $155 in your pocket.

If you showed me these new cards’ benefits compared to the Boundless and Bonvoy cards and told me that they all had the same annual fee, I would probably take the Boundless and Bonvoy, simply because the 35K cert would be more valuable to me than the combination of benefits that the Bevy and Bountiful have. At 2.5x the annual cost of the $95 cards, I just don’t get the reasoning here, unless Marriott/Chase/Amex feel that Gold Elite is way more valuable than it actually is.

These new cards are bit of a…buzzkill. How about the new and improved Bonvoy Brilliant? Will that make up for the snooziness of the new $250 cards?

The new $650 Brilliant

Here are the details of the new, $650 Bonvoy Brilliant, again compared with Greg’s predictions:

| Greg’s Guesses | “New” Bonvoy Brilliant | |

|---|---|---|

| Annual Fee | $650 | $650 |

| Statement Credits | $300 Dining ($25 / Month) | $300 Dining ($25 / Month) |

| Free Night Award | 85K Certificate | 85K Certificate |

| Free Night w/ Spend | 85K Cert after $50K Spend | 85K Cert after $60K Spend (as a choice benefit) |

| Annual Choice Award | After $50K Spend: Choose 50K points, 40% bedding discount, gift set, gift Gold status, or 15% off Ritz Yacht Collection | After $60K Spend: Choose 85k Free Night Award, Five Suite Night Awards or $750 off a bed on Marriott Bonvoy Boutiques |

| Automatic Elite Status | Platinum Elite | Platinum Elite |

| Elite Status w/ $75K Spend | Titanium Elite | None |

| Automatic Elite Credits | 25 Elite Nights | 25 Elite Nights |

| Earnings from Spend | 3X airfare charged by airline; 3X US restaurants, 6X Marriott; 2X on all other eligible purchases | 3X airfare charged by airline; 3X US restaurants, 6X Marriott; 2X on all other eligible purchases |

| Travel benefits | Priority Pass Select with 2 free guests + Global Entry fee credit | Priority Pass Select with 2 free guests + Global Entry fee credit |

*** There is also a $100 property credit for qualifying charges at The Ritz-Carlton or St. Regis brands when you book direct using a special rate for a 2+ night stay. My assumption is that the “special rate” won’t be terribly competitive.

| Card Offer and Details |

|---|

ⓘ $285 1st Yr Value Estimate$300 dining credit ($25 per month) valued at $270 Click to learn about first year value estimates 100K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 100K points after $6k in eligible purchases within your first 6 months of card membership. Terms apply. Rates & Fees $650 Annual Fee Recent better offer: 185K points after $6k spend in the first 6 months (expired 9/25/25) FM Mini Review: Decent ultra-premium option for Marriott fans, especially those aiming for lifetime status tiers Earning rate: 3X airfare -on flights booked directly with airlines; 3X restaurants worldwide, 6X Marriott; 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Annual Choice Award with $60K calendar year eligible spend, choose one of: 50k points, 5 Nightly Upgrade Awards, 85k free night certificate, or $1K off a Marriott Bonvoy brand bed Noteworthy perks: ✦ 85K Free Night Award each year upon renewal ✦ $300 dining credit per calendar year ($25/mo) ✦ Platinum Elite status ✦ 25 elite nights credit ✦ Priority Pass™ membership (Lounges only) with 2 guests ✦ Global Entry fee credit ✦ Free premium internet at Marriott properties ✦ Note: Enrollment required for some benefits. See also: Marriott Bonvoy Complete Guide |

Greg was cooking with gas here and his predictions are eerily prescient. Effectively, for $200 extra in annual fee, cardholders get an 85K cert instead of a 50K cert, 25 elite nights credit instead of 15, automatic Platinum Elite Status (that sometimes gets you breakfast at some properties) and the ability to get a 85K cert instead of a 50K cert as an Annual Choice Award…admittedly after spending an additional $10,000 on the card compared to the version that Greg had hoped for.

To me, this seems like a fair-ish upgrade, if not a home run. Having automatic Platinum status is a big upgrade from the near-useless Gold and the 85k cert opens up far more redemption possibilities than a 50k. That said, you only get one 85k cert, which can be a pain to redeem by itself, ie, you end up looking for places to burn it as opposed to burning it at places you’re looking for. If you want to spend more than one night in that high end hotel, the second night will cost you dearly.

I like the 25 nights of elite night credit. Combined with a $125 business card, you’ll get 40 elite nights annually, just 10 nights below the 50 night choice award and 35 nights away from Titanium and another 40K cert (because of the Choice Award at 75 nights).

Titanium itself could end up becoming more valuable as a result of these changes, given that the ranks of Platinum elites will undoubtedly swell due to the the Brilliant card awarding the status as a cardholder perk. This could make meaningful upgrades much harder to come by and increase the likelihood that Titaniums will find themselves in a better spot for suites (assuming individual properties care to differentiate).

I do wish that there was more incentive for big spend. I’d love to see there be a path to spending to Titanium as well as getting an additional cert or points. Greg was hoping that $50k spend would earn 50K points as an Annual Card Choice Award as well as the ability get another free night cert and Titanium status by hitting $75k spend. Instead, there’s a better Choice Award at $60k and…nothing else.

What happened to the Ritz-Carlton Card?

And then there’s the Ritz card. If there’s a clear winner out of this shakeup, this is it. The card hasn’t been available for new sign-ups for many years, but it’s still possible to get it by starting with a Chase Marriott Boundless card, and upgrading to the Ritz.

| Card Offer and Details |

|---|

ⓘ $-450 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available$450 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: While the card is pricey, the annual free night, plus $300 in airline fee credits, plus other perks make this card a keeper. Earning rate: ✦ 6X Ritz & Marriott.✦ 3X airline tickets purchased directly with the airline, at car rental agencies and at restaurants ✦ 2X everywhere else Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: $75K spend per calendar year for Platinum elite status Noteworthy perks: ✦ Annual 85K hotel certificate upon renewal ✦ 3 club level upgrades. $100 hotel credit for each 2 night or longer stay ✦ Priority Pass Select with unlimited guests ✦ Access Sapphire Lounges for yourself and unlimited guests for free ✦ $300 annual credit for airline incidentals ✦ Automatic Gold Status See also: Marriott Bonvoy Complete Guide |

Greg predicted that the Ritz card would stay as is, and he was almost right. For an extra $200/year above the $250 Bonvoy Bountiful and Bevy cards, the Ritz card offers a much better rebate ($300 in airline incidental fees vs. nothing), Priority Pass that includes restaurants and best in-class travel protections.

Sounds good, but what makes it the clear winner here?

While the annual fee on the Ritz card is staying the same at $450, the annual free night certificate is moving from the old 50K cert to an 85K cert. So, for no difference in annual fee, you’re getting a much better free night cert with no reduction in the other benefits that made the Ritz card so desireable to begin with. Factor in the Priority Pass, travel protections and $300 in credits and this card seems to be a no-brainer as a first-year product change from the Bevy or Bountiful after receiving the welcome offer.

I’ve been dragging my feet on product-changing my old Boundless card to the Ritz, and the improved annual certificate is the kick in the pants that I need to finally do it.

Quick Thoughts

In the end, this much-anticipated reveal is underwhelming. The most appealing cards, by far, are the previously existing Ritz, Bonvoy Brilliant and the unchanged Bonvoy Boundless. On the other hand, the new $250 mid-tier cards are snoozers, in my opinion. I’d have a hard time figuring out a reason to recommend them as keepers to anyone.

Looking for status, perks and a valuable free night certificate? Go for the Ritz or the Brilliant. Looking for elite nights in the Marriott ecosphere and a (semi-)decent free night award? Take a look at the $95 Boundless. These new cards end up in a no man’s land of too much cost and not enough benefits, with better options available by going up or down in annual fee.

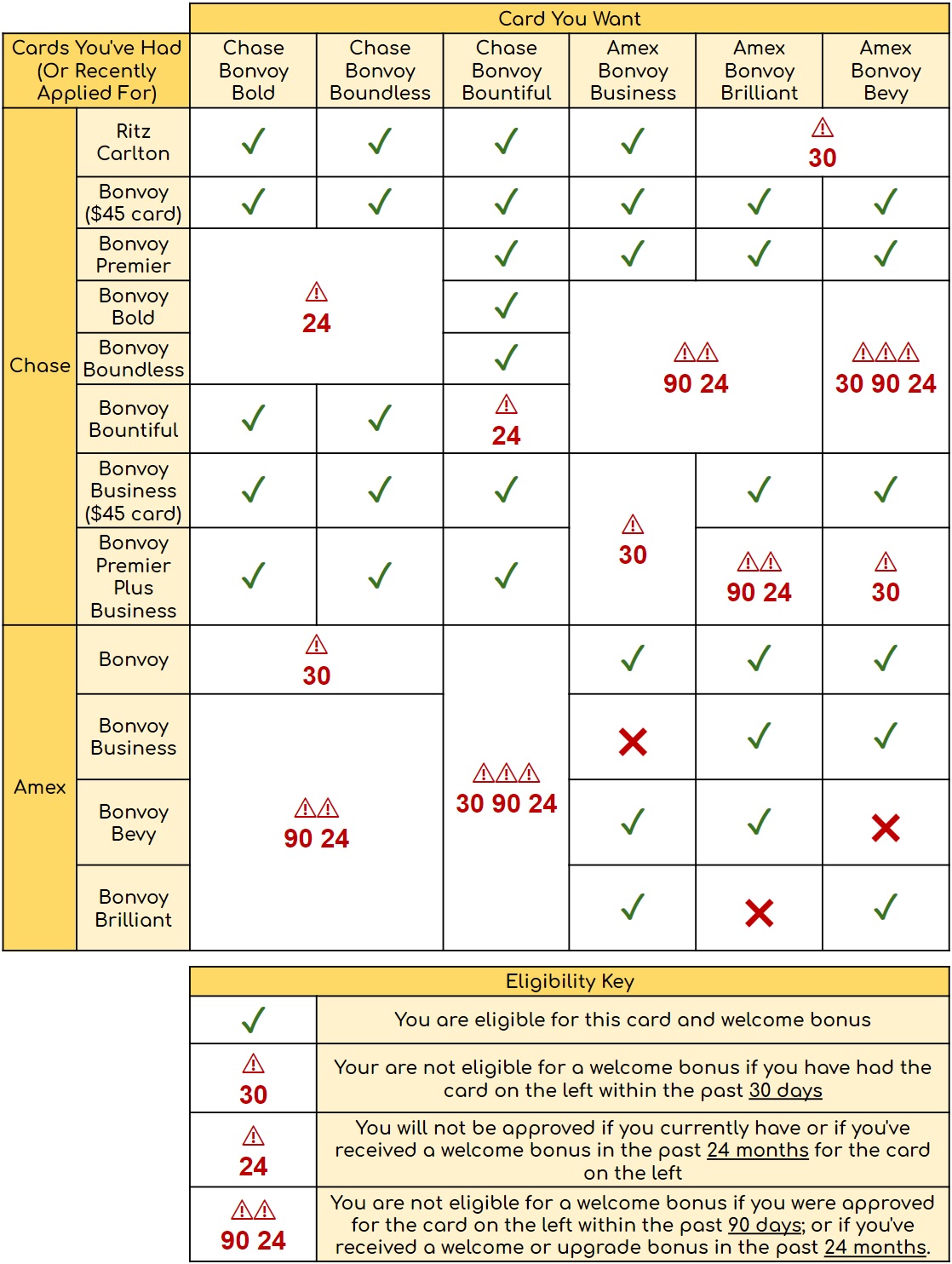

All three of these cards have good, limited-time welcome offers that last until early-January. Each offer is worth $1000+ according to our reasonable redemption values and are worth a look for the welcome bonus alone, if not as a long-term keeper. Whether or not you’re eligible for them is always a fun parlor game to work through:

|

The Bevy and Bountiful are woven into this fine tapestry of approval odds in exactly the same way as the Bonvoy and Boundless, with the same 30 day, 90 day and 24 month rules (as opposed to the Brilliant which is more restrictive). But, one last thing to take note of: if you’d like to hold both the Brilliant and Ritz cards, make sure you get approved for the Brilliant before product-changing to the Ritz, as simply holding the Ritz card will make you ineligible for the Brilliant.

In the meantime, may your Bonvoy adventures be a brilliant bevy of bountiful breakthoughs (and forgive me if all this seems like boundless balderdash).

How long do I have to wait in order to upgrade my Boundless to Ritz after applying for the Amex Brilliant?

It has been well over 24 months since I got the sign on bonus for the Boundless. I also have the Bonvoy business, but that doesn’t seem to impact applying for the Brilliant nor upgrading the Boundless to the Ritz

The big loosers here are the Lifetime platinum people that got the status by staying 600 nights and 10 years as platinums. The status just became meaningless with the automatic platinum status one can get with the Brilliant card. Hopefully there will be a path for lifetime titanium, although it will probably become meaningless also.

Just noticed my MR nights increased by 10 since last week without a stay, so it looks like the Brilliant card is upping elite night credits 15-> 25 this year.

Love to hear about existing card holders experience regarding the upgraded Platinum status.

Looks like the $25 restaurant credit started on the 22nd/23rd September for the existing card holders. I used $3 on fast food just to see what happens on 23rd and boom, credit appeared today. $22 to go before the end of the month.

Glad I got in on the five 50K FNC offer for Boundless before these mediocre cards came out. I get they aren’t as flexible as points but I’d have a hard time stomaching the $155 higher AF for “half” the points on these welcome offers.

I see one play where the new Bountiful/Bevy card can make sense and that is if you do a lot of short Marriott stays throughout the year, such as a contractor or consultant with frequent 1 – 2 night trips. If you can funnel all that spend through the new cards for 50+ nights then you could hit $10K+ in organic hotel spend while earning 6X which puts you close to the 50K free night cert, and you’d earn an extra 25K – 50K points for the 1000 point per stay bonus. That would more than compensate for the higher AF and you’d already earn Platinum organically (probably Titanium with the extra nights from the card) so there’s less appeal to get the Brilliant card. It’s a somewhat niche use case as it doesn’t help if you do longer stays for weeks at a time and you need to be able to put that business spend on your personal card. Not a bad way to earn ongoing Marriott points if it fits you though.

Well, I doubt I’ll be keeping the Brilliant card. For a $200 increase the added benefits just don’t add up in my book. My anniversary date is in Sept so I’ll have the T status for a full year, maybe I’ll change my mind, but, I doubt it.

Used to get 15 nights from Chase Bonvoy and 15 from Amex Brilliant. Total of 30. Now, you get from 25 from Brilliant and zero from Bonvoy, unless you have a business card. Again, a downgrade.

Totally agree. I have 2 stays coming up early next year and see how I am treated with Platinum status. If no upgrade, no breakfast or lounge access at JW, no renewal next April.

[…] Hat tip to FM […]

Obviously, a lot of work went into this. Thanks!

If everyone didn’t have platinum status before, they will now. And they’ll have 25 nights toward titanium. Meanwhile, Marriott makes ZERO improvements to titanium or ambassador benefits to make customers actually achieve those statuses. Already, some properties are getting 75 guests every night with platinum status. That doesn’t count titanium or ambassador. Commentary aside, the new benefits of the $650 card sound like basically the old Ritz-Carlton card. Before Bonvoy, didn’t the Ritz-Carlton AmEx gave Ritz-Carlton Rewards platinum status?

Kudos on your predictions. Now let’s talk about current card holders and what should they do when the next renewal hits. Brilliant and Hilton Aspire holder.

Yeah, this kind of concerns me what they might do to the Aspire card …

The Bevy and the Bountiful don’t have an annual free night cert upon paying the steep $250 annual fee? Hilarious. Who are they kidding? That’s a card to get for the sign up bonus and then dump after one year.

But is the 25k difference in SUB between the Boundless and the Bevy/Bountiful worth $155 and trading a 35k cert for a $15k spend locked 50k cert?

IMO, not at all. With the goofy Marriott eligibility rules, I don’t even see many people jumping in on the $250 cards for the SUBs.

(ed: forgot to include that I realize that the FNA is after year 1, but it feels like buying Marriott points at .62 cpp isn’t a great deal for a SUB when a better on going option exists)

Is the platinum 4pm still GUARANTEED? Ive had to argue with hotels, big ones like st Regis NYC, who told me I could not get late check out and it was subject to availability. Then I had to reach out to Bonvoy on Twitter, who then called to rectify. That guaranteed late check out means alot to me. Now everyone will have it? How will hotels handle that? In Marriotts email it says subject to availability at resorts and convention but doesn’t mention guaranteed otherwise.

Yes it’s supposed to be guaranteed except at resorts, but getting a hotel to honor guaranteed benefits when they don’t want to can be a challenge. Plus, this isn’t one of the benefits that they guarantee by offering perks if the hotel can’t fulfill it so it’s an empty guarantee.

https://frequentmiler.com/marriott-spg-elite-benefits-guarantee/

True. I’ve had good success reaching out to Bonvoy on Twitter. They actually call the hotel and make them do it.

What was the sign up bonus on the Brilliant before the changes? 75,000? 100,000? Does anyone know?

It was 75,000 points for $3,000 spend … I was debating getting it … By waiting, AF went up $200 and lost out on doing the $300 double dip … but the SUB increased by 75,000 points for $2,000 extra spend … so, kind of a wash depending on what you value Marriott points … especially with the upcoming full dynamic pricing – it’s anyone’s guess if Marriott points will be closer to IHG or Hilton points.

Great review on these new cards and the revised brilliant. I do have the brilliant and I just renewed in July but really think I will cancel with July comes back around. Besides platinum status which I already have thought nights. There is nothing really appealing for an extra 200 and no statement credits. Btelw the business card is 125, not 95.

Fixed, thanks.