NOTICE: This post references card features that have changed, expired, or are not currently available

I don’t know if I coined the phrase (maybe?), but I often refer to couples working together to collect points & miles as “two player mode”. For example, when talking about a hotel card that offers an annual free night, I often advise couples to sign up individually and at the same time. This way, both will earn welcome bonuses, and the expiration dates on those free nights will match. The latter is important because it will then be much easier to plan free weekend getaways every year.

With most couples, one person is often more into this hobby. That person is referred to as “player 1” and the other is “player 2”. You shouldn’t be surprised then to learn that in my marriage, when it comes to points, miles, and credit cards, I’m player 1 and my wife is player 2. She has given me permission to make decisions regarding earning and spending points & miles in her name. As a result, she has recently (in June & July) signed up for several new credit cards. In this post I thought readers might find it interesting to learn which cards she signed up for and why…

Chase Sapphire Preferred 100K after $4K Spend

When Chase unveiled their 100K Sapphire Preferred offer, I was excited to find that it had been more than 48 months since my wife had earned a welcome bonus for a Sapphire card (since that’s a requirement to getting a new bonus). She had signed up for the awesome 100K Sapphire Reserve offer when that card was first introduced in 2016, but had long since downgraded it to a Freedom card. Best of all, I signed into her Travel Freely account and saw at a glance that she was under 5/24! She applied and was instantly approved.

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

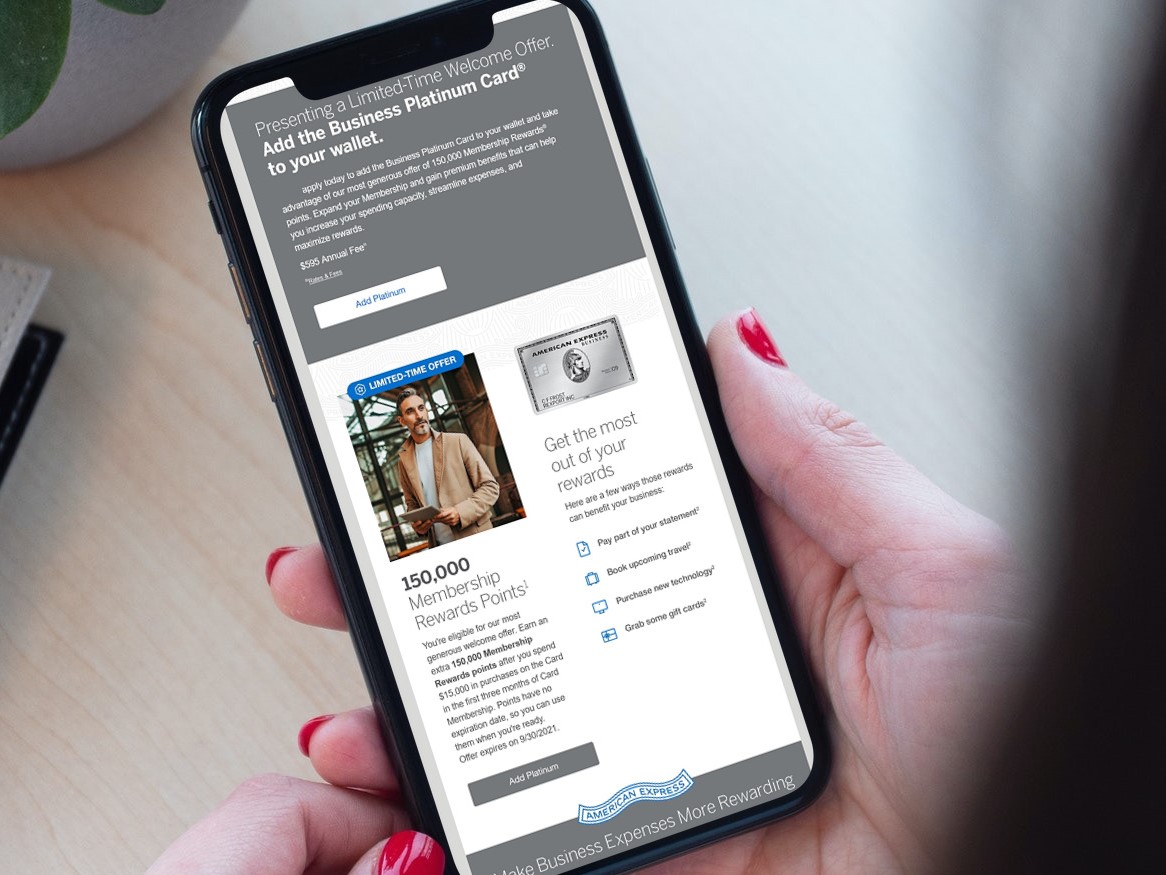

Amex Business Platinum 150K after $15K Spend

Shortly after signing up for the Sapphire Preferred card, my wife signed up for the 150K Business Platinum “expand your membership” offer. She has had the Business Platinum card before, but the expand your membership offers do not have the usual Amex lifetime rule against getting a welcome bonus again. See details here: Bypass Amex’s lifetime rule when you “expand your membership”. Her application was instantly approved.

More:

You must have a business (but you probably do): In order to apply for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort.When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website.

Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so.

Amex Platinum: 100K after $5K Spend + 10X Gas and Grocery

This is the only signup in this roundup that I regret. When Amex came out with the special referral-only Platinum card offer for 100,000 points plus 10x earnings at U.S. gas stations and grocery stores for 6 months, I didn’t believe there would ever be a better offer. I signed up myself back in November. Even though I had had the card before (and Amex’s lifetime rule did apply), Amex eventually sort of forgets about it. I wrote about my success here: Bending Amex’s Lifetime Rule. But when my wife tried to sign up, she got the pop-up indicating that she wasn’t eligible since she had had the card before (ironically, she had cancelled her old Platinum card longer ago than I had). So, about once a month, we tried again and received the pop-up every time. Finally, on June 30th, it was the last day to lock in a year with the old $550 annual fee, and so we tried again. No pop-up. Approved instantly!

Of course, the next day, the offer got better. Way better. The new best offer for the Platinum card (at the time of this writing) is for 125,000 points after $6K spend in 6 months plus earn 15 points per dollar (that’s not a typo!) for spend with small businesses in the U.S. and at restaurants worldwide on up to $25K spend in 6 months. I desperately want to get in on this 15x offer since almost all of my spend qualifies for these categories. If one were to max out this offer with $25K of qualifying spend, you would end up with 500,000 Membership Rewards points! But I’m ineligible due to having signed up for the Platinum card last November and my wife is ineligible due to having signed up in June. My son (player 3!) is technically eligible, but he keeps getting the pop-up that is caused not by having had the card before but because Amex doesn’t currently seem to like him. He’s been too often opening and closing cards and rarely putting spend on them (the latter is now changing).

Schwab Platinum: 100K after $6K Spend + 10X Small Business & Dining

This offer isn’t as good as the generic Platinum offer, but it’s still very good. If we were to max out the 10X spend, my wife would earn a total of 350,000 Membership Rewards points. Not bad! And since my wife has never had the card before, she’s eligible for it. She currently has about a million Membership Rewards points and I was hoping that this card would make it possible for her to cash out some of them at 1.25 cents each before the rate drops down to 1.1 in September (see this post for details). Unfortunately, her application is currently pending and so I don’t know if she’ll get approved in time or at all. I suspect that Amex may have a velocity limit for applying for multiple Platinum cards in a short amount of time. They have known velocity limits for credit cards (max 2 in 90 days) but not (to my knowledge) for charge cards or “pay over time” cards like the Platinum cards.

Wyndham Rewards Earner Business Card: 90K after $2K Spend

Even before Wyndham doubled the welcome bonus for this card (from 45K to 90K), I was a fan. The card offers the following great features:

- 15K annual point bonus: The annual point bonus alone is worth the card’s $95 annual fee.

- Wyndham Diamond status: With this status you can get suite upgrades (including on free nights), welcome amenity, and ability to gift Gold status to others. Even better, Wyndham Diamond status freely matches to Caesar’s Diamond which offers perks like waived resort fees, free $100 Celebration dinner (read Nick’s Celebration Dinner trip report here), and much more.

- Strong earnings for gas station purchases (8X), Wyndham hotels (8X), and utilities (5X)

- Won’t add to your 5/24 Count: Business cards from most issuers (including Barclays) do not show as accounts on your personal credit reports and therefore do not add to your Chase 5/24 count.

Since I no longer have the option of 1 to 1 transfers from Capital One to Wyndham (thanks to Capital One shutting me down), this excellent offer was all the more appealing. My wife was instantly approved.

Summary

Player 2 (my wife) recently applied for the following offers:

- Chase Sapphire Preferred: 100K after $4K Spend (instantly approved)

- Amex Business Platinum: 150K after $15K Spend (instantly approved)

- Amex Platinum: 100K after $5K Spend + 10X Gas and Grocery (instantly approved)

- Schwab Platinum: 100K after $6K Spend + 10X Small Business & Dining (pending)

- Wyndham Rewards Earner Business Card: 90K after $2K Spend (instantly approved)

My wife has already earned the bonuses on the Sapphire Preferred and Business Platinum cards. Including points earned from spend, she has earned over 104K points with the Sapphire Preferred and approximately 170K points with the Business Platinum card. With the generic Platinum card, we’re hoping to earn the welcome bonus with $6K spend entirely within 10x categories (gas and grocery). If we accomplish that, she’ll earn 160K points with that card. With the Wyndham card (which hasn’t yet arrived), she’ll easily earn at least 92K points with $2k spend.

If my wife is never approved for the Schwab Platinum card, she’ll still end up with over 500,000 points thanks to her latest new card acquisitions! Even better, the vast majority of these points are extremely valuable transferable points. And if she is approved for the Schwab card and if we max out the card’s 10x categories, she’ll end up with nearly 900,000 points altogether!

What has your player 2 done lately? 😉

Excellent post! How do you plan to spend the 500K?

Amex has a 1/90 rule for Plat signups for at least the last few months. There’s a FM Insider post including three data points from the last three months. Basically, if someone has been approved for a Plat in the last 90 days, the system interprets the app for a different Plat flavor as a duplicate. You will soon receive mail indicating that Amex has not processed your Schwab app because you were just approved for a Plat. You’ll either have to sweet talk it through or wait

Great info, thanks! I missed that FM Insider post. Will look for it now.

I should clarify that this seems to affect personal plat co-brand flavors, not the biz plat. I don’t see a good way of generating a link to the post and I certainly don’t want to post the names of those in the FB group thread for privacy reasons… but let me know a good way to DM you if you need help finding it

Great timing on this post! So I was recently targeted for both the Amex Biz Platinum (150K SUB, 15K spend) and Amex Biz Gold (80K SUB, 10K spend). I’m aware that both are charge cards, I’m fully capable of charging 25K (total spend for both cards) within 3 months, and I would like to open both cards for their SUBs in the next week. My question is this — should I apply for both of them on the same day? Or is it better to apply for the Biz Plat first, then wait 5+ days to apply for the Biz Gold? TIA!

Nvm. Rolled the dice today and applied for Biz Plat (instant approval), then Biz Gold (instant approval)!

At least among points blogs and stuff, you’re definitely the first one that I can remember using the expression player 2 to refer to the second less involved points player in the household.

Any tips for maxing out the 15x bonus for small business and restaurant spend? 500,000 points sounds amazing of course, but I don’t see myself getting anywhere close to the $25K max spend within 6 months just on eating out.

Thanks to referring a new card signup with my Platinum card, I have the ability to earn an additional 4 points per dollar at small businesses and restaurants for 6 months on up to $25K spend. In other words, my Platinum card has a similar offer activated but for 5x rather than 15x. Anyway, I’ve been amazed by the things that earn the full 5x. It seems like almost everything counts as a small business! It doesn’t have to be in Amex’s small business directory to count. And if you want to shop at big box stores, you can buy gift cards through Fluz (which counts as a small business) in order to earn 15x and then use those gift cards to pay at the big box stores.

I think whether something qualified as a small business for this bonus is really relevant data point. Is there somewhere we can easily look/contribute?

It’s a very relevant data point. My experience now for about 3 weeks on the 15X version is go to Amex Small Business site and there you can find what businesses are approved (by city, category, or online and category…pretty cool). If it’s not, you won’t get the extra points. Example, a small publishing firm parent company is, but an outlet owned by them is not or at least I did not get the points.

I’m hoping to buy a car later this fall (scheduled purchase and not because of Amex 15X) and using a car dealership that is on the Amex list to get the 15X. 500K is a lot of anybody’s points let alone Amex!

I was thrilled to see my local dentist on Amex’s small biz page (less thrilled to be charging several thousand dollars there). Made my chipped tooth feel a little better!

How easy is Barclays with Sole Proprietorships? I still have nightmares from the “verification process” on the one personal card I have from them.

I can’t say in general but for my wife it was super easy.

Pretty easy here, many various cards for me over the years both personal and biz. Good with moving CL around to get approved too.

Amex doesn’t let you pool points together, but from reading it looks like one amex membership rewards member can transfer points to another person’s travel loyalty account / frequent flyer account as long as that person is an authorized user of the card. Do you have to be an authorized user on THAT specific card in which you earned points. Or can you be an authorized user on ANY amex card and it should work. Thanks in advance.

That’s correct. When it’s time to transfer points I’ll transfer from P2’s Amex account to my loyalty account. No, you do not have to be an AU on the same card with which P2 earned points.

I am impressed by the fact that P2 was under 5/24…

What is your take on Barclays (Wyndham)? On a personal card, I always get rejected for too many cards. Any chance on the business card?

What method did you use to get P2’s pop up to go away? More spend? How much spend? And on how many different cards?

I was getting approvals and upgrade offers from Amex this spring, but when I went to get the Schwab platinum the other day I got the pop up. Doh!

There are two kinds of pop-ups. Paraphrasing:

My wife had the first one. The only way out of the first one is to 1) wait until they forget that you had the card before (that’s what happened with her Platinum card); or 2) Apply with an offer that has no lifetime language (as she did with the Business Platinum card).

My son is getting the second type of pop-up. In his case, the only known way to get out of pop-up prison is to start putting regular spend on current Amex cards. There’s no real proof that this works but it seems reasonable to me. I have no idea how much spend or how often or for how long is necessary to make this work. In my son’s case, spending a few thousand dollars on one card in one billing cycle was not enough.

Yea, I’m the latter unfortunately. P2 is also in this situation, but she hasn’t tried in a few months and we will try for the 125k + 15x offer soon if I can’t get the Schwab. The funny thing is that right now I’m putting spend on all my Amex cards. Some more than others, and this includes two that are still working on signup and upgrade bonuses. Does your son only currently have 1 Amex card, or are there others he could put spend on as well?

I’m pretty convinced that Amex has some kind of algorithm to calculate profitability of each individual. If you aren’t profitable, they don’t offer you a signup bonus. Once you become profitable again through spend, they do. It seems like your son still isn’t profitable despite thousands in spend, whereas I’ve heard of some people putting a few hundred spend on a card and getting out of pop up jail.

It’s ironic that it’s easier for me to get credit card SUBs with chase and Barclays than Amex. I wonder if I could even get approved for a Capone card??

The answer is no (if you’re hitting SUBs like you should be), and good riddance to bad rubbish anyway

I should add they didn’t outright decline me…they offered me a garbage card with a $1k limit and no SUB…I declined. 3 hard pulls, huzzah! Better than getting a new card, using a 5/24 slot and then having them close it on you and offer you an insulting value for your points. That never happens though.