NOTICE: This post references card features that have changed, expired, or are not currently available

Citi has sent out an email and created a landing page confirming the previously-rumored changes to the Citi Prestige card. You can find Citi’s page detailing the changes here. They have mostly confirmed what we already knew, with two big zingers: 1) many of us who have been enjoying a grandfathered $350 annual fee will see an increase to the new $495 fee in 2019/2020 and 2) Beginning on September 1, 2019 4th night free bookings must be made through thankyou.com. While I initially planned to keep the card long-term, that second point might be the nail in my Prestige card’s coffin for a number of reasons detailed below.

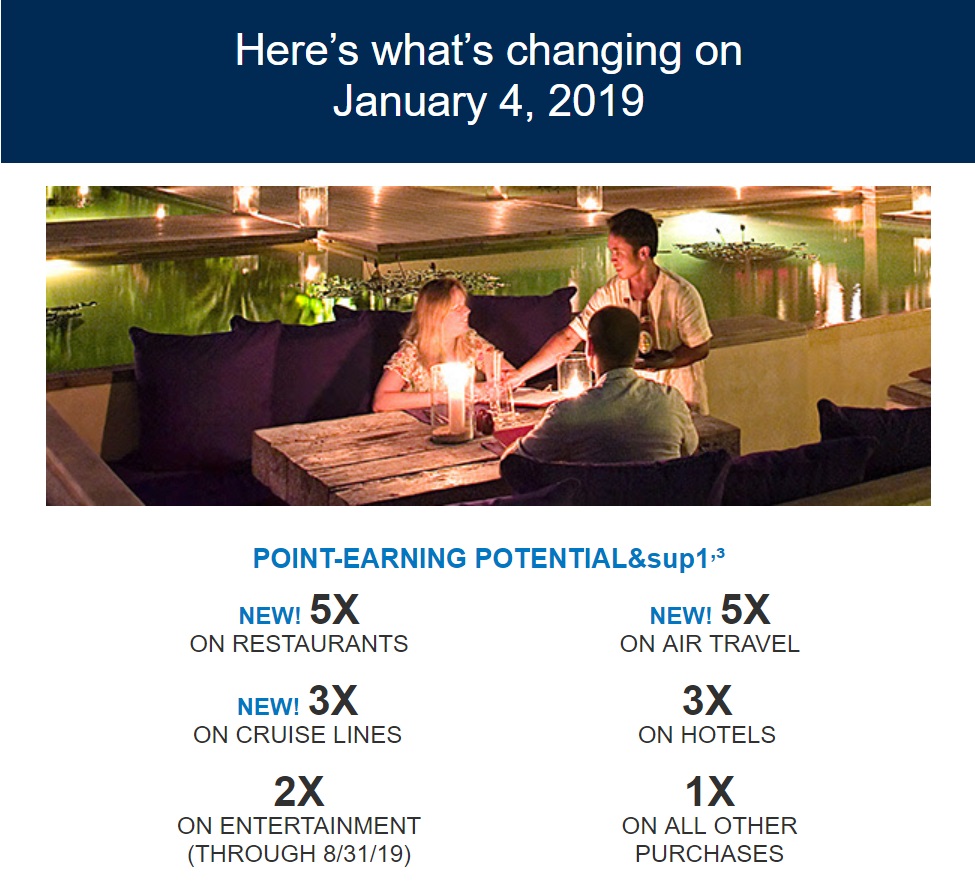

It’s official: 5x dining & 5x airfare

As you can see above, beginning on January 4, 2019, you will earn:

- 5x on restaurants & air travel & travel agencies (listed in the fine print)

- 3x on cruise lines and hotels

- 2x on entertainment through 8/31/19 [*Note: This bonus category is being pulled 9/19]

- 1x on all other purchases.

Another key change comes to the annual travel credit:

- $250 annual travel credit will be available for all travel purchases (previously only air travel triggered this)

Additionally, as of May 1, 2019 the card will come with Cell Phone Protection, but we don’t have any details about how that will work.

However, it’s not all rainbows and sunshine….

Zinger #1: No more grandfathered fee

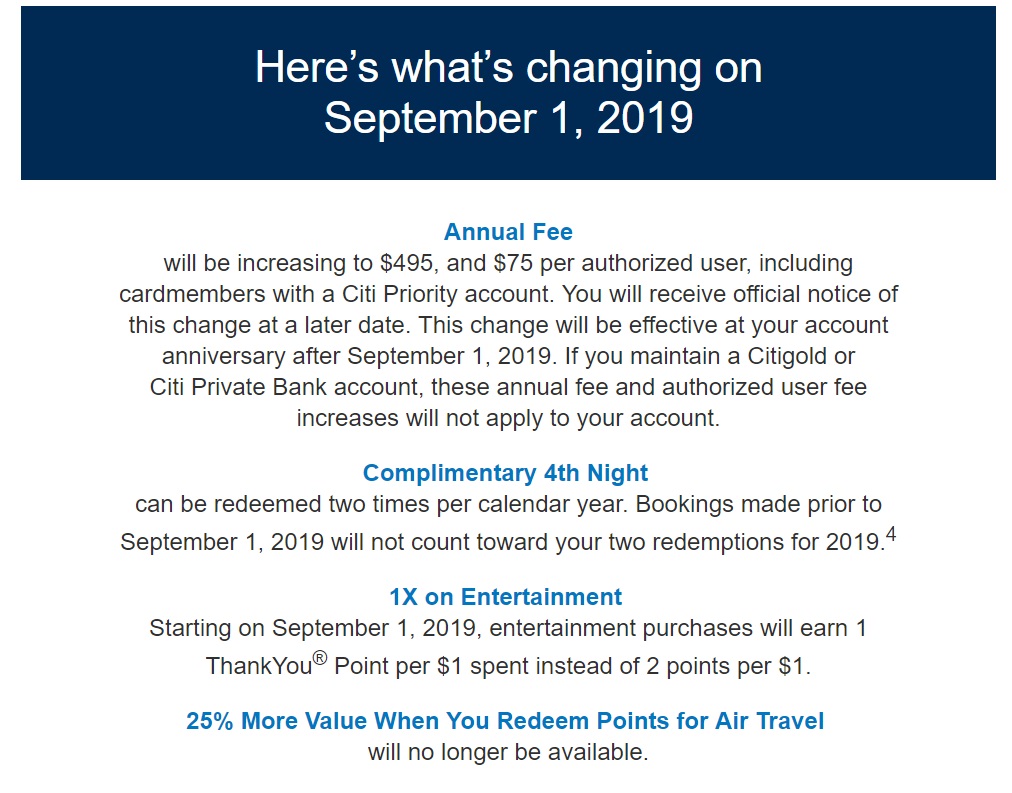

Citi also popped in a few negative changes, some of which were expected. The first comes in the annual fee, and there is some unexpected news here:

As you can see above, the fee will be increasing to $495 per year plus $75 per authorized user (up from $450 / $50). What’s more, it says that Citi Priority members (many of whom have enjoyed a $350 annual fee for years) will also see the fee increase to $495 at next anniversary after September 1, 2019. That’s a bummer. Truth be told, I’m neither surprised nor all that upset. Many of us who have enjoyed the $350 annual fee did not expect to continue to do so for years after opening (and in many cases closing) a Citi Priority account. I know that I’ve been surprised the past couple of years when my card has renewed and I was only charged $350. It’s been a pleasant surprise, but not something I expected. While I might have previously disagreed with Greg’s 6 reasons the Citi Prestige is not a Sapphire Reserve killer, the increase in fee might be a game changer for some.

Thankfully, they are giving quite a bit of notice on the change. If your anniversary date is before September 1st, you’re getting quite a bit of advance notice indeed. My anniversary comes around mid-year, so I won’t see a fee increase until summer 2020. I can’t complain about more than a year and a half of notice.

Those with a Citigold account, which requires $200K on deposit / invested, or with Citi Private Bank, will not see a change in the annual fee.

Unfortunately, the card will no longer earn 2x on entertainment as of 9/1/19 and you will no longer get 1.25 cents in value when you redeem points towards air travel from that day on.

A small positive….but….

Of course, the other big change sure to disappoint many Prestige enthusiasts is the limitation of the Citi Prestige 4th Night Free benefit. While we have previously been able to take advantage of this benefit an unlimited number of times, the benefit will be limited to two uses per year in the future. However, the good news is that bookings made before September 1, 2019 will not count against the cap. This means you have almost another year to book, and you should be able to book through the end of the schedule, so you could enjoy nearly two years of 4th night free bookings if you know where your travels will take you in 2020 and can book before September 1st.

While those who frequently use this benefit will no doubt lament its demise (and it is indeed a massive devaluation for those using this benefit even once a month, no less those using it more often), but I think this is about as good as it could get in terms of advance notice and the ability to get another year of value out of a fantastic benefit.

Personally, I only pay for hotels a few times a year and then rarely stay 4 nights on a paid rate, but over the past few years I’ve used the benefit once each year to good value (I’ll use it twice this year). If I can continue to average one use a year at a hundred bucks or so in value (my real-world uses have been more valuable), I’d say the net annual fee (after travel credit) is still worth it for 5x dining (which should also work abroad) and 5x air travel on a card with decent travel insurance protections.

However, after September 1, 2019, I’ll probably never use the 4th night free again due to….

Zinger #2: 4th Night Free Bookings must be made through Thankyou.com from 9/1/19 on

This is the one I not only didn’t see coming, but didn’t see at all on my first read-through of the changes (H/T to Lucky at One Mile at a Time for reporting on this): beginning on September 1, 2019, fourth night free bookings must be made through thankyou.com. Here is the relevant very fine print from the website:

Beginning 09/01/19, Citi Prestige Concierge will no longer be available for Fourth Night bookings and bookings must be made either online at ThankYou.com or by phone at 1-800-ThankYou in order to be eligible for the Fourth Night benefit

Up until then, bookings can still be made through the Prestige Concierge (presumably over the phone or via email), but after that you’ll only be able to book these through thankyou.com. That’s a big time bummer for a number of reasons:

- Bookings through Thankyou.com count as 3rd party bookings, which means that they do not earn elite credit, points, or receive elite benefits in most cases.

- You can not book special rates through Thankyou.com, like AAA rates or hotel rates that require a promotion code. That’s a huge bummer because it means your 4th night free will not be based on the best available rate to you and thus will not really be worth the full face value. Additionally, many hotels run promo codes when booking direct that have worked through the Prestige concierge, like for a 3rd or 5th night free that have stacked with the Prestige benefit.

- One Mile at a Time reports that you won’t have access to the same number of hotels. I’ve never compared Thankyou.com to what you can book over the phone since I’ve never considered booking through the site, but this sounds like a third kill point for those who prefer more unique properties.

While I figured I’d likely keep my Prestige card thanks to using the 4th night free once a year, I imagine I like will not continue to use it once a year, particularly since that means I will not be able to stack with best rate guarantees as I did in these situations:

- Stacking 4th night free + BRG for big savings

- Hilton’s new price match guarantee & stacking it with 4th night free

At least I’ll continue to be able to do so until September 1st of next year….

Bottom line

These changes were mostly expected, but I’d say that Citi slaughtered the 4th night free by limiting it to ThankYou.com as any of us who care about points, loyalty benefits, or, ya know, finding the best deal probably won’t book through Thankyou.com in most instances. The increase in annual fee will be a surprise to many previously grandfathered in with a $350 fee, but I think I’m more surprised that the grandfathered fee has persisted than I am that it will finally end. As someone who did not use the 4th night free prolifically, I was happy to trade unlimited uses for 5x dining and air travel, but I’m not sure I’m willing to trade it altogether in exchange for those things (and surely those who did use it prolifically will hate this change). At least we get a good bit of heads up…

[…] In November 2018, Citi announced a raft of changes to the Prestige card (See: Prestige ups fee, slaughters 4th night free for most of us). […]

[…] the slew of negative changes coming to the Citi Prestige (in addition to a higher annual fee), I opted to downgrade my card to the Premier. While it […]

That last point, the thankyou.com is my killer. I am a top level elite with a hotel chain, and the 4th night free, at rack rates, does not even begin to offset the elite benefits and rate difference. One more trip this year and it is goodbye Citi Prestige.

I’m wondering if Citi’s plan is to “encourage” people to hold both the Prestige and Premier,by dropping the increased redemption rate of TYP for tickets. From what I can see, the Premier still gets 1.25 cents per point when used for airfare, so the only way to keep the 1.25 cents per point value and still keep the higher earnings of the Prestige would be to have the Premier and then move points over whenever you plan on buying tickets.

If that’s Citi’s plan, I would read their annual fee increase from $450 to $590, which is -very- disappointing. Certainly not competitive.

That’s a good point. You do need the Premier to get full value for paying with points yet you need the Prestige to get 5X rewards

Citi’s appeal is becoming more selective.

Email message is different from the online summary

Email:

Cardmembers will enjoy a complimentary fourth night with no black-out dates (“Fourth Night”), when booking at least four consecutive nights at any hotel only through thankyou.com or by phone at 1-800-THANKYOU (powered by Connexions) or the Citi Prestige Concierge (the “Citi Prestige Concierge” is Aspire Lifestyles) and subject to additional requirements stated below. The amount due to you for the Fourth Night benefit will be based on the average nightly rate of your stay (excluding taxes and fees). When booked through the Citi Prestige Concierge, you will receive a statement credit for this amount within two billing cycles. When booked through thankyou.com or 1‑800‑THANKYOU, the complimentary night savings will be provided at the time of booking.

Online:

Cardmembers will enjoy a complimentary fourth night with no black-out dates (“Fourth Night”), when booking at least four consecutive nights at any hotel only through Thankyou.com or by phone at 1-800-ThankYou (powered by Connexions) or the Citi Prestige Concierge (the “Citi Prestige Concierge” is Aspire Lifestyles) and subject to additional requirements stated below. Beginning 09/01/19, Citi Prestige Concierge will no longer be available for Fourth Night bookings and bookings must be made either online at ThankYou.com or by phone at 1-800-ThankYou in order to be eligible for the Fourth Night benefit. The amount due to you for the Fourth Night benefit will be based on the average nightly rate of your stay (excluding taxes and fees). When booked through the Citi Prestige Concierge, you will receive a statement credit for this amount within two billing cycles. When booked through Thankyou.com or 1-800-ThankYou, the complimentary night savings will be provided at the time of booking.

U know around 8/29/2019 take a LOOK and see if u can book ur trip online Fine do it then or @ a later Date .If not book it then by email or ph and get the 4th free the old way. ..

CHEERs

I received an email from Citi today indicating that bookings can still be made after 9/19 through Citi Concierge.

The card holder may still be able to book through Citi Concierge after September 2019, but will fourth night free still work with Citi Concierge? Based on the T&C, it does not seem so.

Update: Saw Yuri’s post, and conflicting messages from Citi.

Thanks Michael it will come out what a person can DO ..Unreal with the card using Restaurants HAD 4 in SYD I could hit and their in the Main Area not like a 20 min walk ..

CHEERs

I received an email today from Citi indicating that bookings can still be made through Citi Concierge after 9/19.

If you timed this correctly you could take 4th night free all the way into the summer of 2020 and still get a lot of value from this card! 5X restaurants so I won’t be tempted by AMEX Gold!

For #3, hotel choice, I would also add room choice even if a hotel is listed. They often don’t have the full range of rooms available that I would find on either the hotel itself or even another portal like hotels.com; things like plus parking, plus breakfast, etc. This part is not so bad, at least for me. But along with this, the room rates are sometimes only competitive for the prepaid rates, at least in my experience. The refundable rates can be inflated enough to basically wipe out the advantage to the 20% redemption bonus when redeeming points.

As Rob says, w/o taxes it’s 15-20% on 4N bookings and falling >4N. Can replicate that via something like Hotels.com for any stay length, plus you get hotels.com program benefit if desired. Plus without leveraging an underlying platform like Chase did with Expedia, you have much more limited selection. Last place I used the benefit in Africa — Citi = 13 selections / Hotels.com = 135. Unless the contract with Aspire no longer will permit that service, it’s an odd decision. Perhaps the work-load of being proxy travel agents on these bookings and crediting process was too heavy, but 2x annual per user max would have minimized. Unless seeking status/stay credit, CapOne Venture seems better now.

ThankYou.com booking is the deal breaker for me.

Citi sent me an email on the matter ..Unlimited 4th nite Free if booked by 9/1/2019 then just two more.. So i will book trips till 2/2020 by then and then after 9/1 use the 2 on my 5/2020 trip ..P lounges still the same and I just did 2 restaurants @ A$36 in SYD thanks for the post on that as in $$$$.. .My renewal is 7/10/19 so $450 then will Cancel 7/10/2020 if no new deal. .I’ll cancel my Premier card $95 don’t need it .Of course I’ll take the $250 rebate @ 1/2019 then 1/1/2020 too and @ renewal IF we can’t agree on a Deal who cares. If I get a new Iphone the ins could b very good but on a $225 G7 worthless .

Sounds good still for me just like the deal I had this time ..

CHEERs

Yep the portal instead of the concierge is the straw that breaks this camel’s back. Since the last round of changes where Citi excluded taxes from the 4th night free reimbursement I’ve found the benefit really only saves 15-20% which is a savings rate that is not hard to replicate if you forego elite credit. First they cut AA lounge, then AA 1.6 cents per point, then golf, then the taxes on 4NF, then switched to average nightly rate from 4th night actual cost, now limited to 2 times and no elite credit. Talk about jerking your customers around, this card looks nothing like the card they sold me.

a definite account close for me once the $495 hits, but interested to see what the cell phone protection is