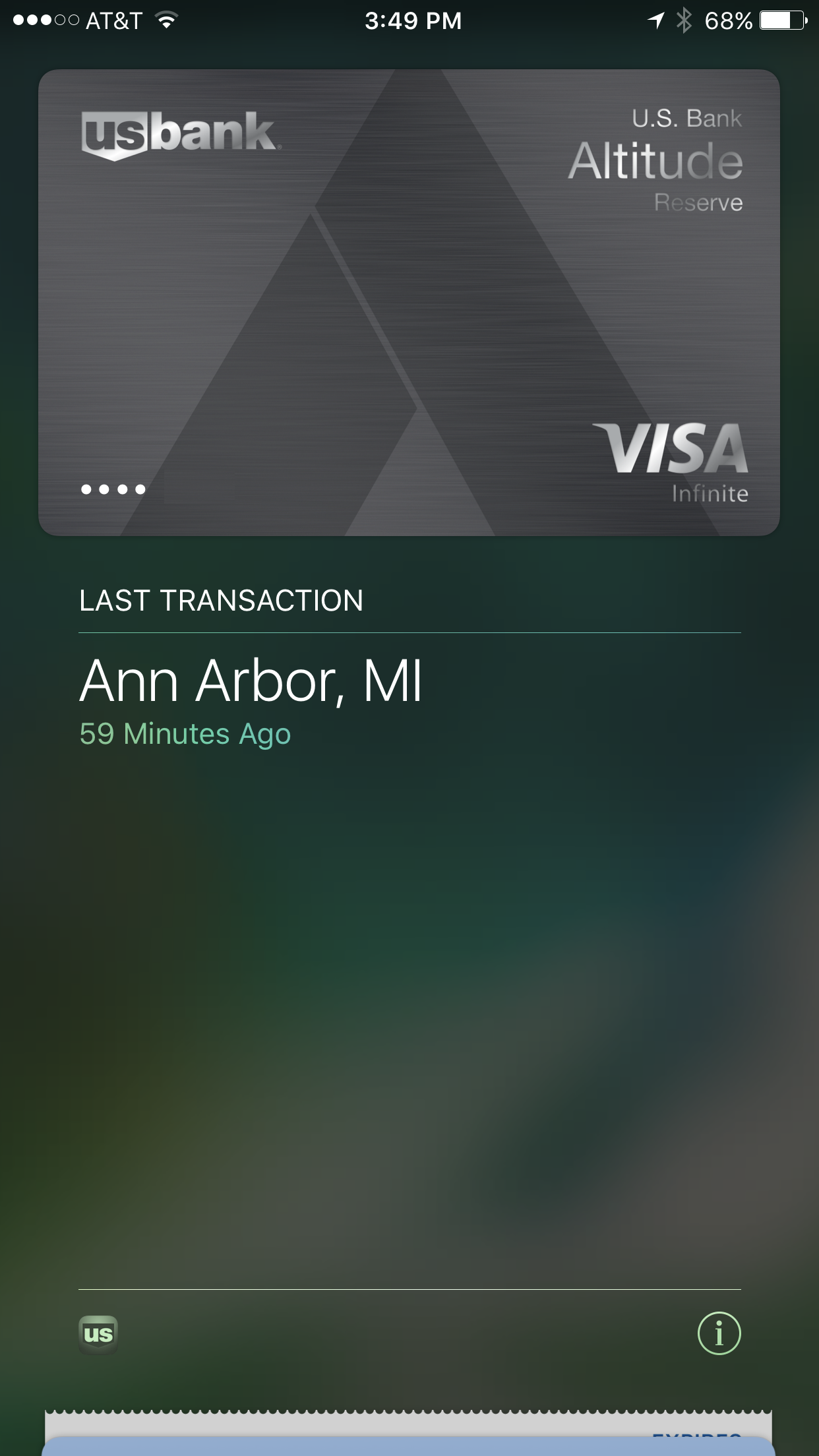

Recently, Greg republished our complete guide to the US Bank Altitude Reserve card. The Altitude Reserve Visa Infinite card is special: given its 3x points on mobile wallet payments — like using Apple Pay, Google Pay, or Samsung Pay at checkout in-store – the guide notes that it is “like getting a 4.5% rebate nearly everywhere”. That’s a great rebate and one that had me very excited before the card launched a few years ago. Yet here we are a couple of years later and while Greg has had the Altitude Reserve in his (mobile) wallet almost since the card launch, it still isn’t in my wallet. Should it be?

Reasons why the US Bank Altitude Reserve isn’t in my wallet

There are a number of reasons why the Altitude Reserve hasn’t yet made its way into my wallet.

I just don’t spend that much in person and when I do I have equal or better options

First (and most importantly), and this is especially true since the pandemic began, I’ve realized that I just don’t spend that much in person (which is a necessity for taking advantage of the mobile payments category bonus). Update: Grant’s comment lead me to realize that I left out something important here: One of the big reasons that I don’t spend much in person is because I hate feeling like I’ve left points on the table. Shopping in-store comes at the cost of missing out on shopping portal rewards and promos. How can I miss the chance to earn 124x Wyndham points at Things Remembered )(caution: read the post before buying). Even before the pandemic, I realized that I just don’t often spend money in person for items that could be bought online while stacking coupons / portal rewards / card-linked offers / etc. That has of course only amplified with the pandemic. I look forward to walking around the mall again at some point (and wouldn’t mine if it were a Simon Mall when I finally get out again), but I just don’t frequently spend a lot in physical stores apart from grocery and gift card purchases.

Early reports were that US Bank was gift card sensitive on the Altitude Reserve (and Simon Malls hadn’t been taking mobile payment for gift card purchases before I stopped going last year anyway). The one category in which we do spend a good deal in person is groceries. Getting an effective 4.5% back on grocery store spend would ordinarily be excellent, but over the past 6-10 months, we’ve had a lot of better options available:

- 10x Membership Rewards points via the Platinum card offer

- 3x Ultimate Rewards points on up to $1,000 per month on the Sapphire Reserve

- 5x spending offers on Chase cards (many of which were tied to grocery spend in past quarters but are more general this quarter)

And more generally, we could do as well or better with our other ordinary options:

- 4x Membership Rewards points per dollar with the Amex Gold Card (on up to $25K per year, then 1x). Cashed out via the Schwab Platinum, that’s worth 5% back. Note that this also works for our online curbside pickup orders, which wouldn’t have an option for mobile payment.

- 5x Chase Ultimate Rewards points per dollar on gift card purchased at Office Supply stores which could be used to buy groceries for an effective 5x if the cards are purchased during a fee-free sale. This is worth at least 5% back (or 7.5% back toward travel booked through Chase if you have the Sapphire Reserve card).

While the 5x Ultimate Rewards strategy is theoretically applicable to almost all purchases, it is easier to implement on grocery purchases because the cards auto-drain at many supermarket chains, so you don’t really need to worry about knowing which card still has $48.26 and asking the cashier to split tender. Just swipe a card, let the payment terminal drain it, and on to the next one.

A related problem when it comes to the thought of using the Altitude Reserve for grocery spend: my wife does most of the grocery shopping. Try as hard as I may, I just can’t get her to embrace mobile payment technology. It doesn’t help that since the pandemic began, we’re rarely ever in a store together for me to walk her through the steps. The fact of the matter is that there would be resistance to a mobile-payment-only conversion in my household.

Real-time mobile rewards is great, but not really for me

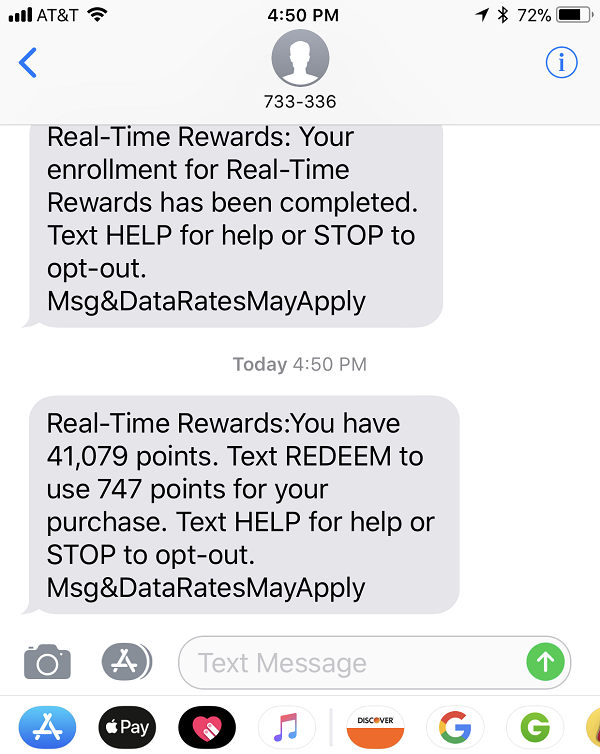

US Bank’s Real-time mobile rewards system is fantastic. I get excited thinking about how you can book travel however you want (through a shopping portal, directly with the provider for benefits and credit, etc), get a text message, and then redeem your points without being forced to book through a bank portal that makes you forgo loyalty points, elite credit, or other benefits. US Bank has an awesome setup there that I wish they’d market a bit harder so that it would encourage others to compete with them.

However, real-time mobile rewards would be of more limited value to me personally. Earning 4.5% back that I can use toward hotel stays or other travel is appealing.

The problem here is that while US Bank does not have onerous minimum redemptions for most travel purchases, they require a minimum redemption of $500 for a hotel stay. Unfortunately, at least until I burn through my current pile of hotel points, I just don’t often spend more than $500 on a hotel stay. My multi-night hotel stays are more typically high-end redemptions where I’m using hotel points or free night certificates for outsized value to stay at a place where I wouldn’t want to pay the cash rate. My paid nights tend to be less expensive one or two night stays like on a road trip or near an airport. I’d love to be able to use real-time mobile rewards for a $150 road trip hotel that would otherwise cost 30,000 Marriott or Hilton or IHG points per night — but the $500 minimum makes this less convenient.

US Bank also has a minimum on car rental redemptions ($250). Given the rising cost of rentals, that may not be much of a barrier. However, I’ve seen Stephen Pepper put the Sapphire Reserve’s car rental protection to use, so I feel confident putting a rental on the Sapphire Reserve. The Altitude Reserve should theoretically offer similar coverage, but I’d be at least a bit more hesitant using it for rentals. That said, if rental costs do continue to be significant, the Altitude Reserve may earn reconsideration.

My other paid travel just likely wouldn’t fit real-time mobile rewards. I don’t book that many paid flights and when I do they are more likely to be something like an intra-European fare on a non-qualifying foreign carrier. If I lived in a place served by Uber Eats, I’d almost certainly be excited to redeem Altitude Reserve points for Uber cash purchases. However, I do not have Uber Eats at home and Chase has extended Pay Yourself Back, so I can currently use Ultimate Rewards points to pay myself back for dining purchases if I so choose. The Altitude Reserve would be adding anything for me on that front right now.

While I think real-time mobile rewards is an awesome feature, the truth is that I don’t think I’d make great use of it right now.

Reasons why I may eventually consider the US Bank Altitude Reserve card

I noted Uber above. I know that Uber charges work for real-time mobile rewards, so I assume that Uber Eats charges would work but Uber Eats charges don’t according to our page highlighting what works. Still, Uber Cash should trigger reimbursement which could then be used for Uber Eats – so you could indirectly use points to buy food. I like to eat. As noted above, this isn’t convenient for me at home, but it would be if and when I travel again and that may well happen at some time after Chase ends Pay Yourself Back. At that time, the Altitude Reserve card may be more appealing.

And that same sentiment more broadly applies to the other strengths and features of the Altitude Reserve card. Eventually, I expect to be spending more money in-person again. Someday when I am doing a remodel or reselling more (whether merchandise or gift cards) that requires in-store spend, the Altitude Reserve would once again gain a lot of appeal. And I think I could get my wife on the mobile payments bandwagon with some chances to walk her through the steps, which would help make the Altitude Reserve more appealing.

The new cardmember offer on the Altitude Reserve card is excellent and the effective annual fee is entirely reasonable after using the annual travel credit (which isn’t difficult in a normal year in my household). Given the low ongoing cost, it probably will make sense to add this card to our arsenal at some point. The time just hasn’t been right so far.

But I recognize that times will change (and like everyone else right now, I look forward to the coming change) and when it does the Altitude Reserve may come in handy as our car rental / Uber Eats eraser.

Bottom line

The US Bank Altitude Reserve card looks fantastic on paper. It has a great welcome bonus, a low effective annual fee if you value the easy-to-use travel credit, and one of the most interesting bonus categories on the market in 3x mobile payments. But despite all of those strengths, it just hasn’t been for me because I just don’t spend that much on face-to-face transactions for the 4.5% to be as appealing as I thought it would be. Furthermore, I don’t see redemptions being as much of a slam dunk for me as they are for some folks. It’s interesting to me that a card I consider to be one of the most exciting / interesting on the market has been available for years without being a fit for me. Someday I expect that will change — but for the time being, the Altitude Reserve still isn’t in my (digital) wallet and likely won’t be in 2021.

“I just don’t spend that much in person”

You say that, but there’s a ton of times when I’ve ended up spending hundreds to thousands:

>Vet bills

>Dentist bills

>Car repair bills

>Getting a suit

>Watches

These aren’t incredibly frequent, but as an absolute amount of money they’re relatively hefty. I appreciate having the 4.5% back.

Looked at my last year’s spending, and I actually end up spending a lot on these other categories. Add furniture store, Home Depot/Lowe’s, pharmacy, Costco, gas. On-line mobile pay is increasingly common. If one spends 10-20k on these, it becomes $450-900. IF you are a traveler, there are hotel stays or flights that can overcome the threshold for redemption. I think this card is for those who can get fixed 4.5% for a lot of their spend without a lot of work trying to chase deals with points. Agree that if you put in the effort, you can likely make more with trifectas, difectas, transfer of points, etc. That game is not for all.

I was tempted when it was rumored to disappear, but thankfully it came back. I’m pretty close to being under 5/24. I’ve had similar bonus spending to you, so new card bonuses have taken a backseat. The Venture 100k looks really tempting tho. Richard Kerr had been trying for years like me and just got approved recently. I have an old crappy C1 card and not sure whether I should cancel it first or not.

Data point on Altitude Reserve CDW protection: It’s every bit as good (same company, actually) as the CSR. Having made claims with both, the service is identical.

Great to hear!

Regarding cashing out the rewards, SW works.

Where do you shop for your kids things?

Basically anything having to do with kids, for us are better bought in person. We’ve got 3, and their clothes, toys, and supplies are a good chunk of our monthly spend.

Buying clothes online for the kids just doesn’t work for us, for various reasons. The sizes are always off (i.e. sizes running different between different manufacturers I suppose), and if you need to return something it’s a pain in the butt. Sometimes shipping is delayed, which isn’t cool when your kids shoes are too small, or falling apart, or whatever.

I could go on, but it’s kinda more of the same… with toys and supplies, better bought in person as well.

Since most of these items are sold by stores without obvious category bonuses, the altitude reserve might be a good option to save a little in this department.

My wife has bought shoes in person for my son a couple of times and wandered into Carter’s while I was buying Simon Gift Cards a couple of times, but the vast majority of clothes at this point have been purchased online. Returns are perhaps less of a hassle on the mainland than for you. Same with toys, though truthfully my wife is a master of Facebook marketplace. Less plastic waste and they often end up with really cool toys for a fraction of the cost, so I can’t argue with paying cash. I’m sure there are plenty of poor-condition toys on Facebook marketplace, but my wife never ceases to amaze me with the stuff she finds. That’s obviously slowed considerably in current times, but luckily our 3yr old had plenty to pass down to his little brother and the 3yr old is as happy with the children’s library worth of books that my wife has sourced secondhand to keep him happy for hours as he is playing with his collection of monster trucks every day all day no matter what other toys we get. We’re at the age where that just doesn’t get old.

All of that will surely change someday, but for now most of what we get them is either online or secondhand / cash.

You’re totally right shipping is much more complicated for us lol. On the other hand, with the pandemic going on we just don’t feel comfortable with buying second hand items.

Yeah, luckily we haven’t needed many new toys since the pandemic began (made two exceptions I can think of — one was a fisher price bike that connects to a tablet, which has been great for exercise when it’s cold outside. It hasn’t been available new for a while now (it was like a $300-$400 toy back when it was released and she found it in like-new condition for $40 — between that and a $60 Amazon Fire tablet, the kid’s essentially got a Peloton for $100 lol. It was easy to sanitize). We’re also in the probably rare circumstances of having the only two grandchildren / nephews on either side of our family, so our sons are very lucky in that sense and so we are likely more conservative on toy spend.

Hi Nick, thanks for sharing the reasons why you don’t have a USB AR CC. I assume you have an existing US Bank relationship, since that is a requirement to get this CC. My favorite use for this CC is when I travel / shop with my wife, many stores take ApplePay that don’t fall into a bonus category, so I gladly use this CC to pay. The points rack up pretty quickly. I’ve also had good luck calling for retention offers every year and getting 5k points (worth $75) that offsets the net $75 annual fee, making it annual fee free 🙂

That’s awesome on the retention offers!

Yes, I have a Radisson card and a checking account that I managed to get open despite being out of the footprint years ago. My wife recently opened a self-directed brokerage account and then a checking account, so she also has a US Bank relationship these days.

I guess that before kids we did more in-person shopping than we do now (though even then, we’ve long done 90% of the non-grocery shopping online since before the pandemic).

Your comment makes me realize that I inadvertently left out the most important point: the reason I don’t spend much money in person is that I have a hard time spending much money without going through a shopping portal. It pains me to spend more than like fifty bucks without stacking with an opportunity for more points. Yes, there are card-linked in-store offers, but except in rare instances like mom-and-pop shops, there is usually savings to be stacked.

Of course, someday when all of the stores are gone because everyone shops online, I’ll regret my compulsion for cash back :-D.

I struggle to get less than 5x on my spend. Even my Blue Business Plus is sock-drawered. The occasional non-bonused spend is almost always some kind of online spend.

The card also works for mobile payment purchases online. E.g. when you see an Apple Pay or Google Pay button during checkout. It’s not restricted to in person purchases to earn the 3x on mobile wallet.

Perhaps I don’t shop at the right places online – I haven’t seen a Google Pay button during checkout apart from apps like Uber.

Jay and @Nick Reyes ….Square pay (online invoice payment) offers both Apple pay and Google pay as payment methods.

@Nick Reyes doesn’t purchases using sites that take Apple Pay work too? Like in the Starbucks app. So you don’t necessarily have to be in a physical store?

I don’t think he rocks an iPhone 😀

True story. I do not rock an iPhone. Maybe I’m missing out on a bunch of those opportunities?

Slide app (5%) + TopCashBack (5%) + AR via Apple Pay (4.5%) = 14.5% cashback on gift cards. Take gift card and go back through portal again to boost earnings.

How can you go wrong?

Also checkout DOXO app which is like Plastiq but charges a higher fee of about 3.5%. It accepts Apple Pay.

What do you do to get the topcashback count? I tried using topcashback and it says in app purchases do not count.

I know it says in app purchases don’t count, but they do. I mean, the only to make a purchase with Slide is to use the app. Probably just boilerplate language.

Got it thanks. For me, Slide is 4% and topcashback is 3% not the 5% for each.

TCB rate varies. When I initially posted it was at 5%. The proper order to get the full 5% from Slide is as follows:

Load Slide app with Apple Pay (1% + 3x AR)

Go to TCB, click through to Slide

purchase GC with Slide preloaded balance (4% + current TCB rate)