| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

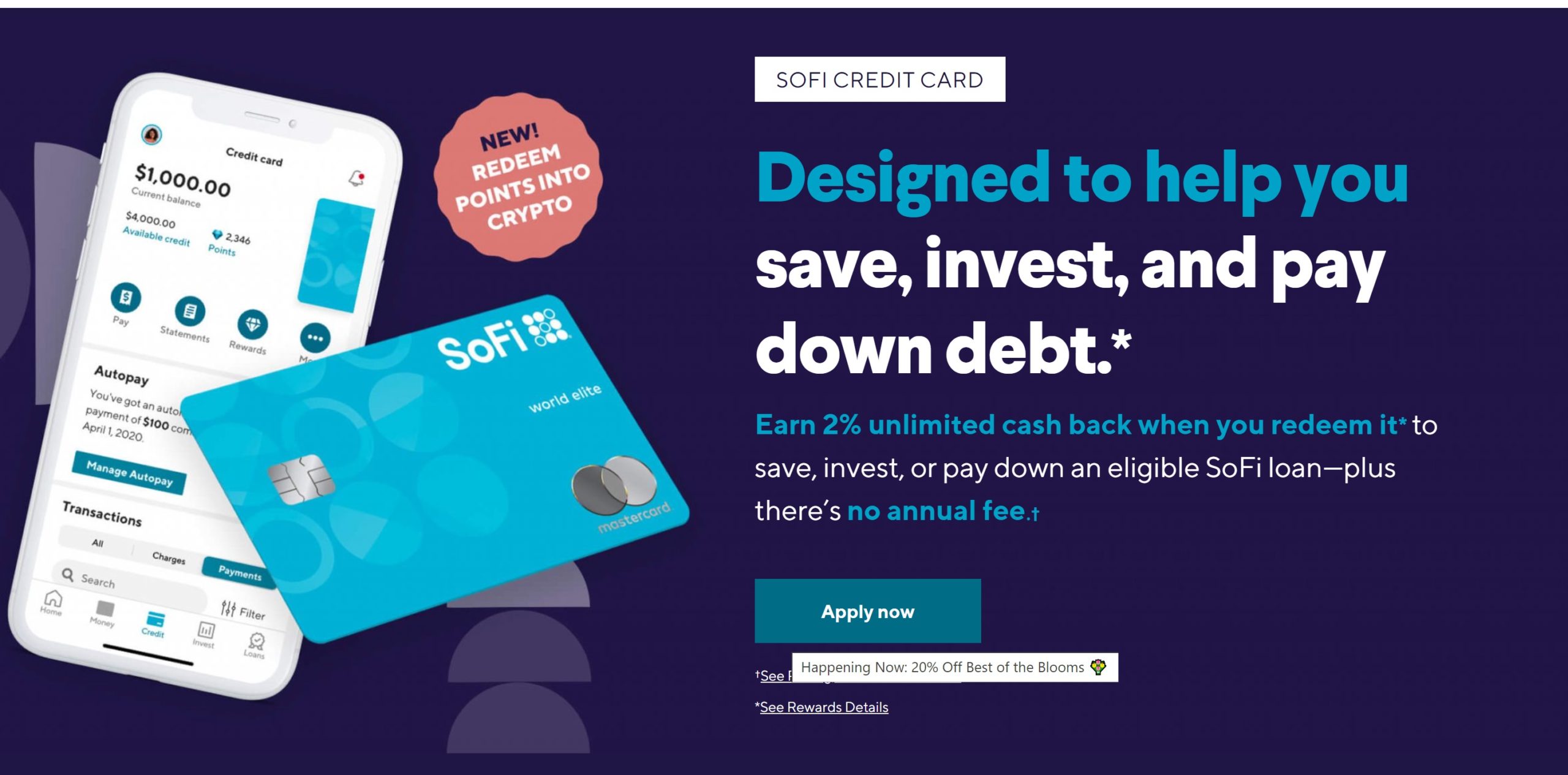

The SoFi Credit Card is offering a $100 bonus in rewards points after you are approved and make your first purchase. While that’s a relatively small new cardmember credit card bonus, it could be worth it if you’re after a 2% cash back card and you also want a welcome bonus. The Citi Double Cash is arguably a better choice long-term, that card features no welcome bonus at all which might make the SoFi card a hundred bucks more attractive to some.

The Offer & Key Card Details

Click the card name below for more information and to find a link to apply.

| Card Offer and Details |

|---|

None ⓘ Non-Affiliate There is currently no welcome bonus offered.No Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card could be a good option for someone looking for a 2% cash back Mastercard, though keep in mind that the Citi DoubleCash is a competitor that earns at the same rate while offering points which could become transferable to airline partners, whereas the SoFi credit card only earns cash back rewards. Earning rate: 2X everywhere Base: 2% Card Info: Mastercard World Elite issued by SoFi. This card has no foreign currency conversion fees. Noteworthy perks: 2% cash back on all purchases (3% for first year on up to $12k with direct deposit) ✦ no foreign transaction fees ✦ cell phone insurance |

Quick Thoughts

This welcome bonus came out this month and is only on until 2/28/22, so there is a limited amount of time to take advantage of it.

While the SoFi credit card is just a run-of-the-mill 2% cash back card, it can be worth having one of those in your wallet for otherwise unbonused spend. If you’re into transferable points for travel, I would sooner recommend the Citi Double Cash card since that card earns Thank You points that can be redeemed for cash (making it effectively a 2% cash back card) with the added flexibility of combining those points with those earned on a Citi Premier or Prestige card to make the points transferable to airline and hotel partners. If you have a sizable amount of investments (including IRAs), the Bank of America Premium Rewards or Cash Unlimited cards could be an even better option since it could earn 2.625% back everywhere with Preferred Rewards Platinum Honors status. In other words, there are clearly options on the market that could be better.

However, if you aren’t looking to collect transferable points and you don’t have the investments to have high-level status with Bank of America, getting an extra hundred bucks on first purchase on a card with no annual fee that you can keep as a backup “everywhere else” card could be enough to put this one over the edge. It is a World Elite Mastercard and has cell phone insurance up to $1,000 per claim, which are nice additions for someone who doesn’t have other cards with similar benefits. The SoFi card is issued by The Bank of Missouri and that makes it a bit of an outlier in the sense that you likely don’t have other cards from the same issuer for whatever that’s worth.

[…] 2/19/22: Deal is back through 2/28/22. Hat tip to FM (Original post below is from […]

[…] 2/19/22: Deal is back through 2/28/22. Hat tip to FM (Original post below is from […]