NOTICE: This post references card features that have changed, expired, or are not currently available

This past weekend, I was invited to speak about miles and points at a conference for accountants. I fielded some of the typical questions both during and after, including which is the single best credit card. Long-time readers know that there isn’t a great answer to that question since the single best way to amass maximum credit card rewards is through new credit card welcome bonuses (i.e. opening new cards) and the second-best way is by leveraging the best category bonuses (and doing that well requires considering credit card combos). All that is to say that a single-credit-card strategy isn’t a good one if your goal is to maximize rewards (and if you really insist on a single card right now, it is hard to ignore the Resy Platinum card offer — though also hard to convince a newcomber that it is worth paying $695 for it). That said, I find the topic of a single card interesting from an analytical standpoint and because I know that some people will indeed carry a single credit card. So which is best?

A question with no perfect answer

Greg has previously tackled this question. In his analysis a couple of years ago, the Capital One Venture card surprisingly came out on top — and that was before Capital One moved most of its transfer partners to 1:1 transfers. However, recent developments have me questioning whether the Venture card is still a great answer (and I don’t just mean social distancing).

What really got me thinking about this topic even before the accounting conference was our recent experience on Moskito Island with Bilt CEO Ankur Jain. It became clear that Bilt viewed its card as being in direct competition with just a couple of competitors cards for the single slot in someone’s wallet. Could rewards on rent make it the single best card for a renter? What about the Amex Gold card? Then came Greg’s post about the X1 card yesterday adding a new contender.

The single best credit card is highly situational, but I wanted to consider an imaginary spend profile to see which card would earn the most points.

An imperfect methodology

There is no perfect way to determine the single best credit card. Everyone’s expenses are different, so the number of points earned on spend (both within bonus categories and unbonused spend) is going to vary wildly.

Still, since we all eat, I thought it worthwhile to consider average spending on groceries and dining. I’m putting all other expenses into an “everywhere else” category.

The USDA publishes monthly “Food plan” estimated costs. This document estimates cost per person on a weekly or monthly basis (as of September 2021) for a low-cost, medium-cost, or liberal cost food plan. These estimates are meant to be for a nutritious food plan for at-home preparation (i.e. groceries, not dining out).

That document notes that the cost estimates are based on a 4-person household and that a single-person household should add 20%, a two-person household should add 10%, and a three-person household should add 5% per person (with further adjustments for larger households).

I decided to assume that the average person considering maximum credit card rewards has the means for a “moderate” food plan. Rather than trying to decide how many people should be in a theoretical household, I decided to keep things conservative by estimating based on a single household member. Since the food plan for a single 19-50yr old male was a bit more expensive than for a female, I went with the male estimate and added 20% (figuring that this compensates somewhat for the fact that many households will have more than 1 person).

That meant monthly at-home food cost came to $392.40 per month. Let’s round that up to $400 per month recognizing that there are other monthly grocery expenses incurred beyond food (like dish soap, laundry detergent, etc).

According to various websites, it seems like the average household spends about $250 per month eating out. That seemed like a reasonable enough number to me — I imagine that plenty of single people spend more than that on dining out, particularly in major cities, so even though the numbers I saw were all based on a “household”, that didn’t seem like an unreasonable number whether a single-person or multi-person household.

Other expenses will obviously vary wildly: gas vs public transit, insurances, utilities, clothing, and so on are so highly variable that they are hard to estimate. However, I’ll assume that the vast majority of those “other” expenses go unbonused and that the two main bonus categories for most households are grocery and dining.

Grocery and dining accounts for $650 per month. I’ll assume a further $650 per month in “other” purchases that can be paid with a credit card — gas, public transit, insurances, utilities including phone and Internet, etc. Again, this number is intentionally conservative. In total, this assumes $15,600 per year in credit card spend between groceries, dining, and “other”.

So how do things stack up? Let’s consider how many points you would earn with each of a few cards.

A theoretical comparison

Amex Gold Card

Key Card Details

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card offers an awesome return on US supermarket and worldwide dining spend, putting it at or near the top-of-class in both categories. Dining credits and Uber / Uber Eats credits go a long way towards reducing the sting of this card's annual fee. $325 Annual Fee Earning rate: 3X points for flights booked with airlines or on amextravel.com ✦ 4x points at US Supermarkets (up to $25K in purchases, then 1x) ✦ 4x at restaurants worldwide (up to $50k in purchases, then 1x) ✦ 1X points on other purchases. Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $10 in statement credits monthly with participating dining partners (Goldbelly, Wine.com, Five Guys, Seamless/Grubhub, The Cheesecake Factory) ✦ $10 monthly Uber or Uber Eats credit (use it or lose it each month - must select Amex card as payment method to redeem) ✦ Up to $7 monthly Dunkin' credit - enrollment required ✦ Up to $50 twice-annual Resy credit ✦ $100 hotel credit on qualifying charges on stays of 2 nights or longer, plus a room upgrade upon arrival, if available with The Hotel Collection at americanexpress.com/hc ✦ Enrollment required for select benefits. |

Since this card offers 4x at US Supermarkets (on up to $25K per year then 1x) and 4x dining, you would earn 4x on these two main categories of spend. That’s $650 per month x 4 = 2,600 points per month. Over the course of a year, that’s 31,200 points on groceries and dining alone.

Assuming a further $7800 in expenses per year at 1x, that is a total 1-year earnings of 39,000 points.

Amex Membership Rewards has many great transfer partners that make for fantastic sweet spots. Our Reasonable Redemption Value for Amex points is 1.55c per point, making these points worth around $600 without too much effort at maximization assuming that you value flight and hotel awards (note that the points could be worth much more depending on how you use them — as an example, 34,000 points could get you a one-way flat bed business class ticket from New York or Boston to Madrid during off-peak season). If you prefer cash, the Gold card is a poor choice since points are only worth about 0.6c per point to cover charges — meaning the points would only cover $234.

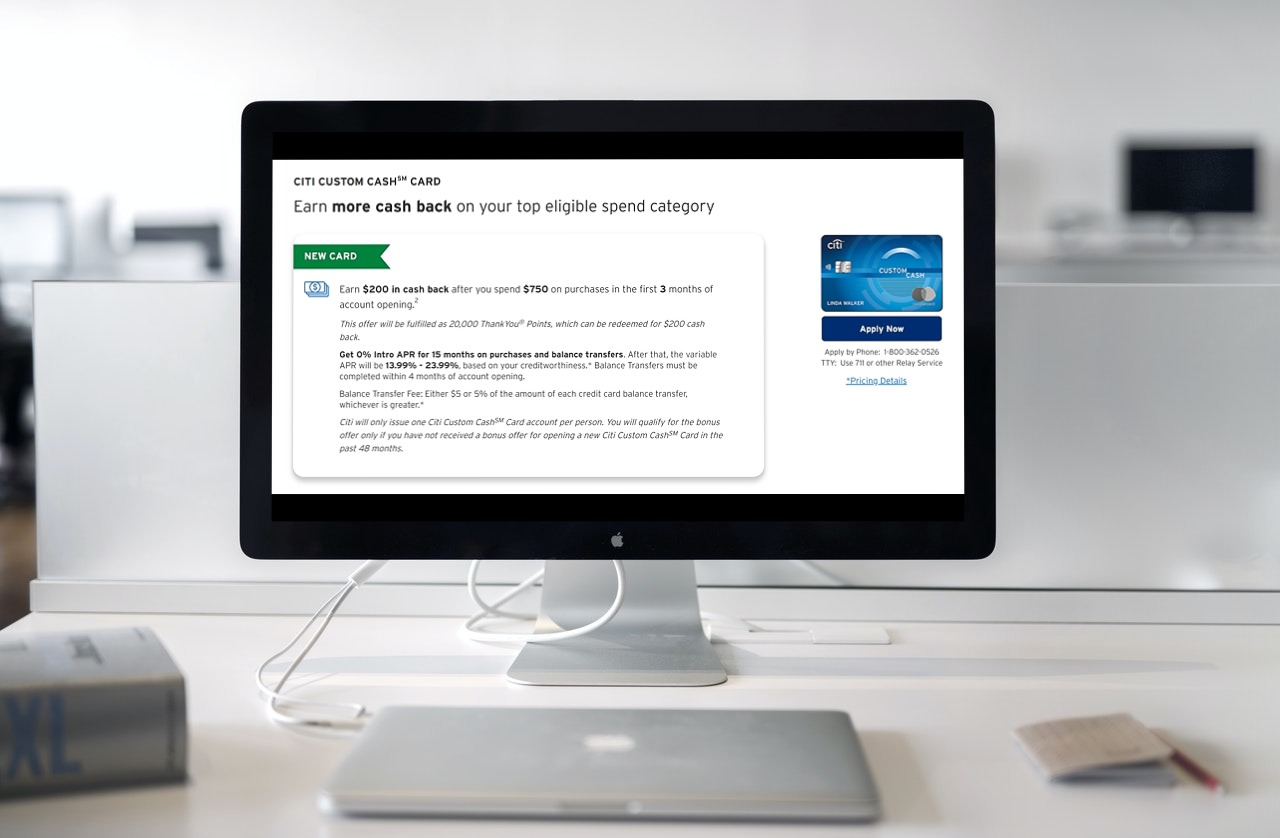

Citi Custom Cash

Key Card Details

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This is a great card to have and hold for a single category where you spend no more than $500 per month as it represents an excellent return without rotating categories to track. No Annual Fee Earning rate: 5x on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1x thereafter. Eligible categories: Restaurants, Gas Stations, Grocery Stores, Select Travel, Select Transit, Select Streaming Services, Drugstores, Home Improvement Stores, Fitness Clubs and Live Entertainment. ✦ 1x on all other purchases Base: 1X (1.5%) Travel: 5X (7.5%) Flights: 5X (7.5%) Hotels: 5X (7.5%) Grocery: 5X (7.5%) Dine: 5X (7.5%) Gas: 5X (7.5%) Card Info: Mastercard issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: Transfer points to airline and hotel partners (at reduced ratios and no AA) ✦ 24 month extended warranty See also: Citi ThankYou Rewards Complete Guide |

This card offers 5x in the category in which you spend the most each billing cycle out of several eligible categories and 1 everywhere else. Assuming that groceries are your top category at $400 in spend per month, you would be looking at 2,000 points per month in groceries and a further 250 points per month on dining for a total of 2,250 points per month. Over the course of a year, that’s 27,000 points on grocery and dining

Assuming a further $7800 in expenses per year at 1x, that is a total 1-year earnings of 34,800 points.

However, with minimal effort you could do a bit better. By purchasing an additional $100 per month in gift cards at the grocery store that help cover other expenses (reducing your “other” expenses from $7800 to $6,600 by spending that extra $100 per month on gift cards for Amazon, Lowe’s or other places where you do your spending on other needs), you would be looking at earning 2,500 points per month on groceries. That makes for an annual total of 33,000 points on groceries and dining.

With the further $6,600 in annual expenses, you’re looking at 39,600 total points earned. Unfortunately, if you only have the Citi Custom Cash, your redemption options will be pretty limited. You’ll be able to redeem for $396 or transfers to very limited partners.

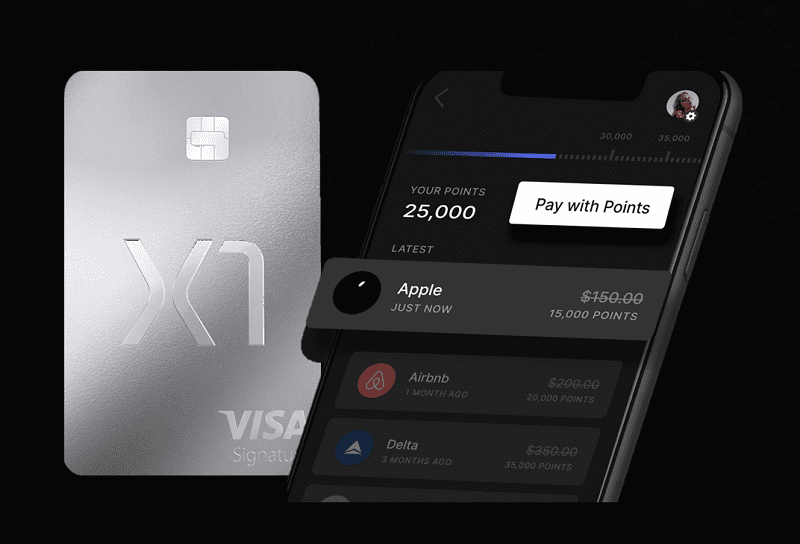

X1 Card

Key Card Details

- $0 annual fee

- Earn 2x everywhere

- Earn 3x on all purchases if you spend $15K per calendar year

- Earn 4x for 30 days when referring a new customer

The X1 card offers a flat 2x everywhere, but with our assumptions ($7800 per year on grocery and dining and $7800 per year on everything else that can be paid with a credit card), you’d meet the $15,000 threshold necessary to earn 3x on all expenses.

That means you would earn 46,800 points annually with the X1 card.

Keep in mind that these points are not transferable. At best, the points can be redeemed for $468 worth of travel with partners like American Airlines, Delta, Southwest, JetBlue, United, Alaska, Airbnb, Hotels.com, and Vrbo or merchandise with partners like Apple, Wayfair, Nike, Sephora, Etsy, REI, and more. If you prefer cash, the return would only be $327.60 based on the 0.7c per point reported by one cardholder (which may not be available to everyone).

Note that the X1 card isn’t publicly-available yet – there is a waiting list to apply for the card. See Greg’s post for more info.

Capital One Venture Card

Key Card Details

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card earns 2 miles per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their miles to airline miles & hotel points. Click here for our complete card review $95 Annual Fee Earning rate: 2X miles everywhere ✦ 5X miles on hotels, vacations rentals and rental cars booked via Capital One Travel ✦ 5X miles on Capital One Entertainment Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Receive up to $120 application fee credit for Global Entry or TSA PreCheck® ✦ Redeem miles for travel at value of 1 cent per mile ✦ Transfer Miles to airline miles & hotel points |

The winner of Greg’s previous analysis, the Capital One Venture card would offer an easy 2x everywhere. Based on our theoretical $15,800 per year in expenses, that’s 31,600 points per year. Those points could reimburse $316 in travel or transfer to Capital One’s many transfer partners to take advantage of Capital One sweet spots. While not as many points earned as with the other previous options, the fact that this card allows both travel erasure at $0.01 per point and transfers to partners on a single card with a $95 annual fee makes it remain competitive — though keep in mind that Capital One cards are hard to get (and possibly hard to keep).

US Bank Altitude Go

Key Card Details

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card offers solid return on dining - including takeout & delivery - and no annual or foreign transaction fees. That makes it a great option for those who prefer cash back. No Annual Fee Earning rate: 4X take out, food delivery ($2k/qtr max), and dining ✦ 2X grocery (including meal kit delivery), gas stations, and streaming services Base: 1% Grocery: 2% Dine: 4% Gas: 2% Card Info: Visa issued by USB. This card imposes foreign transaction fees. Noteworthy perks: $15 credit for annual streaming services ( after 11 months of consecutive streaming service charges, the 12th month will get the $15 credit) |

While the US Bank Altitude Go may not have been at the top of mind for a single-card solution, the fact that it offers 4% on dining and 2% on groceries, gas, and streaming services (in cold, hard cash back) might make it appealing for some.

Consider our theoretical $400 per month in groceries at 2%, $250 per month dining at 4%, and everything else at 1% and you’ll get a total of $294 per year in cash back with no annual fee. If you spend much on gas and streaming (or much more in dining), figure a few bucks more and the Altitude Go may not be a bad single-card solution, albeit with no transfers to partners or other valuable benefits.

Bilt card

Key Card Details

- $0 annual fee

- 3x dining

- 2x travel

- 1x rent and everywhere else

The Bilt card offers a very unique value proposition for those who rent. The card has no annual fee and offers 1x on rent as long as you have at least 5 transactions per month (note that your landlord does not need to be affiliated with Bilt to use the card and service as they will send a check if your landlord is not part of their alliance). See this post for more detail.

The Bilt card offers 3x on dining, 2x on travel, and 1x on everything else. That means that $400 per month in groceries (at 1x) and $250 per month in dining (at 3x) will earn a total of 1,150 points per month or 9,000 points per year.

Added together with the 7,800 points per year on “other” expenses, that is only 16,800 points per year. That number is considerably lower than the other cards on this list. However, it doesn’t take an enormous amount of rent to make up the difference.

Consider that the highest publicly-available earner on the list thus far (I’m excluding X1 since it is waitlist-only right now whereas you can skip the waitlist with Bilt) is the Citi Custom Cash at 39,600 points per year — 22,800 more points than one would earn on the Bilt card paying the same expenses.

However, that means that a tenant paying more than $1,900 per month in rent would come out ahead of the Custom Cash card thanks to earning 1,900+ points per month on rent (22,800+ points per year). Note that more dining spend may also lead to a greater Bilt advantage (though you’d also have to consider where that additional dining spend would bring your totals with the other cards on the list since X1 would be earning 3x on all additional spending, the Amex Gold card would offer 4x on dining, etc).

While $1900 per month is higher than the average US rent, it isn’t particularly high in many major or mid-major US cities. If you spend significantly more on rent and you don’t want to rotate multiple cards for the best return in various categories and you value Bilt’s transfer partners (I think the list is solid), the Bilt card can be a good option. Keep in mind that Bilt offers up to 50,000 points per year on the rent, so if your rent is higher than $4166 per month, you will cap that out.

What about annual fees and benefits?

The only card on the list above with an annual fee is the Amex Gold card. At $250 per year, it isn’t cheap. On the other hand, it comes with a monthly $10 Uber credit (which can also be used for Uber Eats) and a monthly $10 credit that works at GrubHub, Seamless, Boxed.com, Cheesecake Factory, and a few other options. It also comes with access to Amex Offers. While I don’t generally place huge value on Amex Offers since they are also available on fee-free Amex cards like the Everyday or Blue Business Plus cards, those considering only one card have to consider the value of money-saving offers that appear regularly on Amex cards. It wouldn’t be hard to cover the cost of the fee between Amex Offers and monthly benefits.

On the other hand, the Bilt card offers some protections that you won’t get on the Gold card like cell phone insurance, trip cancellation insurance, and rental car insurance. It also offers $5 off your first two DoorDash orders per month and a Lyft benefit when taking at least 3 Lyft rides per month.

While the Citi Custom Cash has no annual fee, it doesn’t come with much along the lines of benefits as Citi dashed most travel and purchase benefits years ago.

The Venture Card probably doesn’t offer enough by way of benefits to beat out the Bilt card for those with high enough rent expenses to earn a comparable number of Bilt points. While the Venture Card does have some travel coverages and a TSA PreCheck / Global Entry credit, those benefits likely don’t beat out Bilt benefits (particularly not with the Venture card charging a $95 annual fee versus no fee for Bilt). On the other hand, if you don’t rent, the Venture card might make more sense than the Custom Cash because of transferability to partners and the Amex Gold if you don’t value the Gold card’s monthly credits and instead prefer the lower annual fee.

The X1 card is a Visa Signature card, but it doesn’t list any of the common ancillary Visa benefits like rental car coverage and trip cancellation / protection, so I’m not sure which (if any) additional benefits it carries.

Which combination of features matters most to you is once again situational. I think the Bilt card does offer compelling benefits for those who rent and the Amex Gold card offers benefits that mitigate its fee (but it is missing things like cell phone and rental car insurance). It is difficult to put a one-size-fits-all value on those things. YMMV.

Bottom line

So which card is “best” for someone who only wants a single card? As noted at the top, there isn’t one good answer. If pressed, I think I’d probably give the nod to the Amex Gold for most people. While the fee is high and benefits are light, the points are highly valuable thanks to great transfer partners. One factor not mentioned in the post is referrals: if you can refer just one person a year to an Amex card (keeping in mind that you can generate a referral to almost any Amex card), your earnings with the Gold card will increase substantially. Referral offers on my wife’s Gold Card have ranged from 15,000 points to 30,000 points for a single referral (or the current +4x offer). Even referring one person every other year could bring the card out substantially ahead of the rest of the field if you’re able to get one of the higher referral offers. While you may not have a huge network of people to refer, picking up one referral every couple of years probably isn’t completely unrealistic and when combined with the increased point earnings and value of Amex Offers, I think I’d give it the nod for most people. On the other hand, cell phone insurance has been very important for me this past year and I book enough travel that travel insurance also matters to me. If I rented, I’d probably personally pick the Bilt card. That said, I’d much rather have some of the best credit card combos and I really want that X1 card as my new “everywhere else” card. I’m glad that I don’t have to pick since I’m open to maximizing rewards by having multiple cards in my wallet. What would be in your wallet if you could only have one card?

[…] One Card Wallet: Most of us in this hobby know that to accumulate a lot of points fast you have to take advantage of sign up bonuses and credit card combos. But what if you don’t want the hassle of multiple cards? What would be the best one card option? […]

Don’t show the Amex Blue Cash Everyday card in your picture then not mention it in the article….click baiting jerk.

I don’t think you can do much better than the 3% AOD card if you want one card for everything. But Bilt is also decent with the various premium-esque protections and coverages + rent points. Agree with the other comments that anyone wanting one card probably wouldn’t want to bother with transfer systems anyhow (except for the diehard Amex Platinum one-card-wallet crew). But who are we kidding? Even a free two/three-card setup including one or two 5% revolvers would be vastly superior to any of these options and the added effort would be minimal.

Or Altitude Reserve for the good earn/redemption ratio via contactless payments + premium benefits/protections.

US Bank Altitude Reserve. Net $75 fee (the credit is more easy than CSR, it works on dining), 3x returns almost everywhere (if anything, the pandemic was good getting NFC terminals to most places), 1x elsewhere, and 1.5 cpp with real time rewards for travel. Let’s say super conservatively half of all charges get the bonus, that’s a $393 net return, already more than the ones in the article. Plus it’s perks.

But in practice, I find >80% of my payments are either travel or works with Google Pay (not working is dining where the server takes away my card to pay, plus a VERY few vendors like Walmart and Michaels). With that ratio, the net return is $533.40 a year, beating the cr*p out of all listed and previously mentioned cards.

Don’t understand how you missed the AMEX EDP.

3x grocery, 2x gas and 50% extra points with 30 transactions. Oh and return protection (which Amex Gold doesn’t have).

The Sapphire preferred is a contender if you grocery shopping is online.

3% on groceries 3% on dining out, primary rental car coverage, $50 per year hotels through Chase, and 0.1% extra bonus per year and the ability to get 1.25 cents per point back through Chase travel portal. Also no foreign transaction fee.

A pretty nice suite of benefits for $95 a year.

In addition there are 4 transfer partners that are straightforward, JetBlue, United, South West, and Hyatt.

Is it the best for everyone? Definitely not. Is the best for some? I think so.

In MHA In real life with the real expenses a person looking for a single card should get a two point on all purchases card.

Amex blue business plus

Venture

Citi double cash

Or one of the sparks

Isn’t 2.5%>2.0%?

Alex Blue Business Plus hands down. 2X MR points per dollar and no Annual Fee.

Just don’t ever leave the U.S.

Agreed. And not planning on it till the gov’ts allow us to not wear masks on planes any more.

If you’re limited to one card, I feel like Chase’s Freedom Flex could be a contender.

It has a consistent 3X for dining. Based on your assumptions, that’s 9000 points.

Now of course there’s no way to predict what the revolving bonus categories will be each year, but I can’t remember a single year that Chase hasn’t had “Groceries” in the 5X rotation. I don’t think it’s unreasonable to count another 6000 points for 3 months of grocery spending.

So when you add in all the unbonused spend, that gives you 3600 points of 1X grocery spending and 7800 points everywhere else. However if you wanted to buy $100 in gift cards at the grocery for 3 of those months, you could include another 1200 points.

But I think you could do a little better on your groceries.

Chase has historically included categories like ” Wholesale Clubs” and “Wal-Mart” and “Chase Pay”in its 5X rotation. I think you could include another 3 months worth of 5X grocery spending for this reason. This gives you another 4800 points.

Total: 32,400 points that are $324 cash equivalent.

That total isn’t quite as compelling as the Citi Custom Cash example, but it’s not too shabby either. And if Chase throws in a 5X “Gas” (don’t forget those gift cards) and some other random categories, you could do significantly better.

Sorry, 1 card wallets are about simplicity. For most simplicity means not worrying about buying gift cards (Citi), maxing categories, or likely even transfer partners. Cash is king in this world.

I know there is one hoop to jump through for PR, but BOA has to be on the list. Unlimited Cash: 1.5%+1.125% w/ Pref Rewards is $410/yr. Or Custom Cash (w/PR): 5.25% on $3k in restaurant ($157) + 3% on $4800 groceries ($144) + 1% on $7800 ($78) is $379.

This is two cards from one issuer w/ $0AF that both give more cash back than any of the other options listed w/o trying to buy gift cards.

The Custom Cash with Platinum Honors is actually better than that: 5.25% on restaurants, 3.5% on groceries, 1.75% on others.

For $3000 restaurants, $4800 groceries, and $7800 other, that’s $462 cash back with no AF, which is quite probably the best single option for this spending.

You’re right. Bad math on +75% on grocery & regular. Should have slowed down. Thanks for the catch. Should be $168 for grocery & $137 on other. Totals at $462 like you said. Cash is king for simplicity.

Did your accountant audience indicate that their clients are more and more charging fees to use credit cards? Within the last 6 months I have had to choose whether to use a debit card on large purchases or pay the surcharge. I spend a lot of unnecessary time debating this. Anyone else running into this.

AOD FCU Visa Signature — 3% everywhere, no annual fee — if you qualify.

Lots of good ones depending on what they want. Citi Premier, Hilton Surpass, Cap One Venture. Definately Bilt if they have high rent. If they can get biz cards then BBP or CIC or even Marriott Biz.

Marriott Biz or Hilton Surpass as the only card? In what scenario?

If they value hotel points and low AF

This just highlights how terrible a 1 card strategy is imo. Better to just get 1 SUB/yr and change your 1 card every year. Shouldn’t make any banks too mad and just make card application based on your plans/expenses for that year. Y’all could do a write up on card of the year in January for us to refer casuals to. Good for business.

It’s just a bad question. It tells you the person is either not very financially literate, or at least hasn’t done any legwork on the subject.

Nobody has a one card restriction based on any tangible constraint except in their mind. Limiting yourself to one CC is the primary factor in your reduced earnings, not which one it is. So the answer to the question should be “it doesn’t matter”, because you should probably get #1, #2 and #3 at some point anyway.

One card is also a dangerous line to draw, as it could get rejected, you could lose it, or you could be abroad where maybe acceptance is limited by visa/mc/Amex, or maybe your one card has FTFs. It’s really dumb to be traveling at all with just one CC. So indulging this phobia of more than one CC is probably not helping. Better to explain instead why they shouldn’t rely on one card.

Your points are all good ones. Some people will still only carry one card though. My parents are a great example — one card for the vast majority of my life. When it’s been rejected, they’ve had to stand there at the register and call the bank to get it sorted out (eventually enough annoyance there did encourage them to get a second card, but they went decades with only one). They haven’t yet lost it or traveled abroad, so it hasn’t been an issue.

Obviously I haven’t adopted the same strategy and I would advise them differently if they cared to hear it, but not everybody does. If you’re only going to have one, better to have a good one.

Agree. For many, it’s one card, plus a back-up (esp if AMEX or a Costco shopper).