NOTICE: This post references card features that have changed, expired, or are not currently available

While blogs have long pumped a specific card that earns 2x travel and dining as the “best starter card”, that one didn’t even make it into this week’s Frequent Miler on the Air discussion on the best starter card for a student or young professional just starting out on life’s journey and beginning to collect rewards for spend. Greg and I discussed a number of great options for you to recommend for those young professionals in your life, whether they are kids leaving your nest or newbies in the next cubicle. With most in that crowd unlikely to cram their wallet full of cards from the start, what would you recommend?

While blogs have long pumped a specific card that earns 2x travel and dining as the “best starter card”, that one didn’t even make it into this week’s Frequent Miler on the Air discussion on the best starter card for a student or young professional just starting out on life’s journey and beginning to collect rewards for spend. Greg and I discussed a number of great options for you to recommend for those young professionals in your life, whether they are kids leaving your nest or newbies in the next cubicle. With most in that crowd unlikely to cram their wallet full of cards from the start, what would you recommend?

Elsewhere on the blog this week, we wrote about Marriott points being more valuable than expected, which hotel free night certificates are best, a sweet spot for intra-European travel, and more. If you are a baseball fan, skip directly down to the post called “Baseball fans: Capital One has great seats for 5,000 miles each”, because you can score a spot a few rows from the field for a pittance of miles if you act fast. Watch, listen, or read on for more of this week at Frequent Miler.

1:09 Giant Mailbag double feature. A cool trick for Caesars and Wyndham and a reader thank-you.

5:10 What crazy thing . . . did Greg the Frequent Miler do this week?

12:14 Mattress running the numbers — err, lounge running the numbers with the Royal Air Maroc status match.

19:35 Main Event: The single best starter card

21:10 Discover It Student card

26:24 Freedom cards

32:37 Citi Double Cash

37:53 Citi Custom Cash

41:15 Bilt Mastercard

1:01:12 Question of the Week: Looking for flexibility in United award tickets

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week at Frequent Miler

In credit cards

Is the Bilt card worth it? Who should consider it? Is it the ultimate starter rewards card? (On Nick’s mind)

The impetus for this week’s discussion was certainly the public launch of the Bilt card, now issued by Wells Fargo and available without a waitlist. In this post, I compared the Bilt card against cards like the Sapphire Preferred and Capital One Venture card, though on this week’s show we have a far more complete discussion about which card would be best for a young person starting out with a rewards credit card. There’s a lot going for the Bilt card: points in what is likely the most significant spending category for most, decent return on dining and travel, ability to transfer to a unique and highly useful collection of partners, primary rental car coverage, and phone insurance all in a card with no annual fee clearly puts the Bilt card in the discussion, but is it the one?

Bilt now available for all: refer friends & get points

![]()

Bilt launched to the masses this week and now anyone can earn points for paying rent — even if their landlord doesn’t accept a credit card (Bilt even has a mechanism for paying by ACH). The truth is that this card isn’t a great fit for many of us who are willing to juggle a dozen different cards and a number of annual fees, but I think many of us know a few people for whom it would be a good fit. The nice thing is that you can be rewarded for that even if you don’t have the Bilt card. You’ll get 25K points — which you can transfer to Hyatt, AA, Turkish, etc — for every 5 successful referrals to the card. That’s a pretty sweet deal.

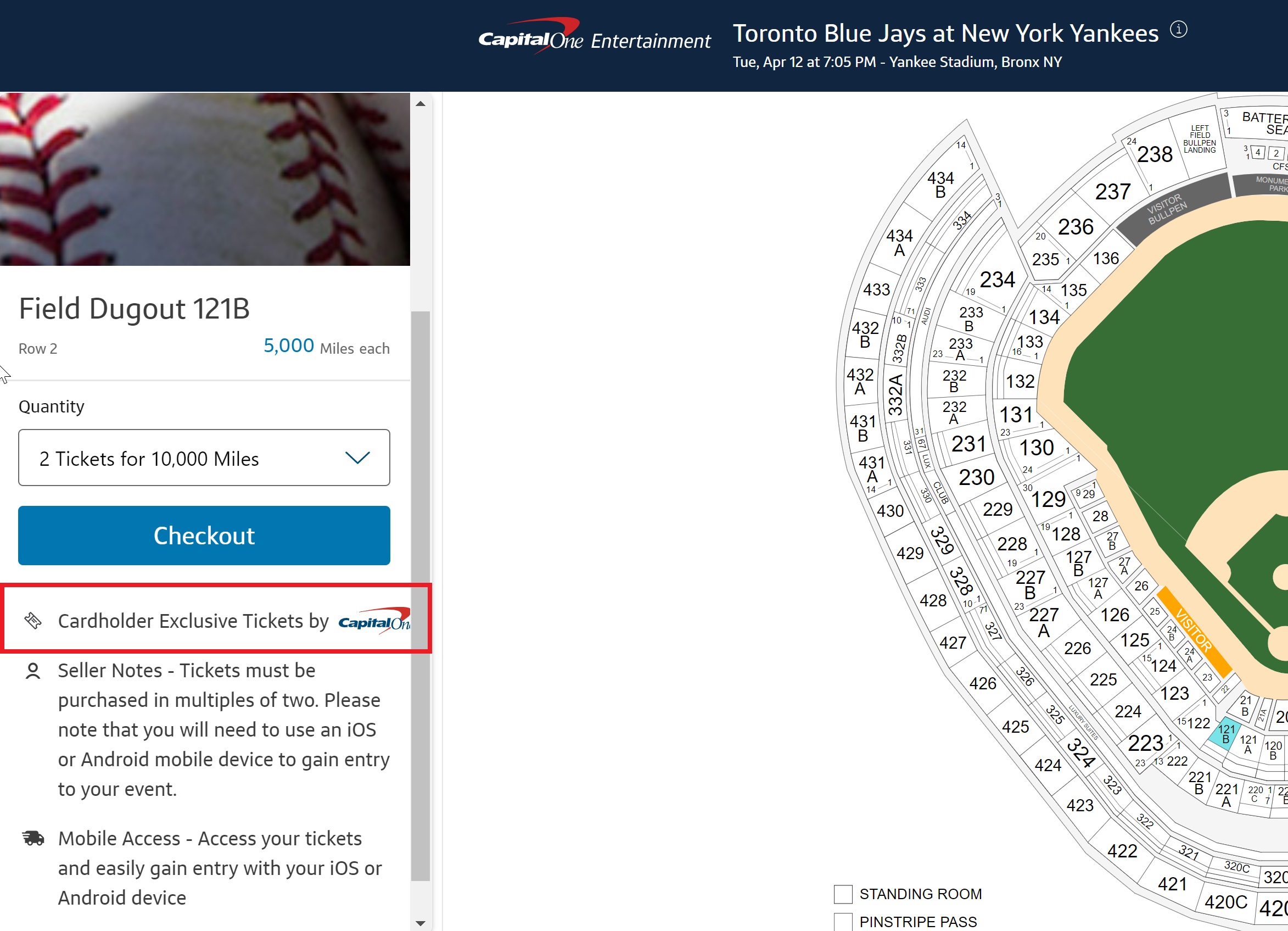

Baseball fans: Capital One has great seats for 5,000 miles each

If you like baseball, you need to check this out: Capital One has cardholder exclusive tickets to baseball games that cost just 5,000 miles per ticket and they are awesome seats (in many cases they are seats that ordinarily go for $200-$300 per seat. Think just a couple rows off of the field for 5K miles flat. The confusing thing is that they only have 4 seats per game and when the special cardholder exclusive seats are gone, they sell a wide array of normal seats for awful prices. I added screen shots to the post after publication to make it easier to identify the good stuff.

Which credit card offers the best free night certificates?

With so many programs changing to dynamic pricing, what are the free night certificates worth? Who has the best ones? I think Greg was at least tipping his rocker here if not crashing completely off of it: clearly the Hilton certs are by far the best, right? Well, that’s true as long as you’re willing to travel to a Hilton where they can be maximized. The truth is that there is a lot of “beauty in the eye of the beholder” here. The best free night certificates are the ones you’ll use to good value before they expire. Now excuse me while I try to clear out this collection of Marriott certs scheduled to expire at the end of June . . . .

Pay taxes via credit card 2022 edition

The tax man cometh, so it’s time for you to collect as many points as you can. Greg has updated the guide to paying your taxes by card because the end is near. I had a goal in mind to have my taxes done as soon as I had all the forms in February, but now I’m just shooting for having them done in time to mail a check via Plastiq. Here’s hoping….

In loyalty and awards

Air France & KLM across Europe for less [Sweet-Spot Spotlight]

Greg highlights a fantastic sweet spot that I’d certainly missed: Virgin Atlantic’s excellent pricing for intra-European flights on Air France and KLM, particularly in business class. Like Greg, I was hit with some sticker shock on the cost of intra-European travel the last time I was in Europe (what do you mean there are no $5 flights on Ryanair on the day and route when I need them?!?) and like Greg I wasn’t impressed with award pricing via most partners. This is a great one to keep in mind and since I have two potential trips to Europe on the docket for this year it is one that may just come in handy for me.

Permanent change: Earn elite credit with Delta award tickets

This is awesome: Delta is going to indefinitely continue awarding elite credit on Delta-operated SkyMiles award tickets. Originally scheduled to be a temporary program change, it just makes sense to me for an airline to reward customers for remaining loyal and for redeeming miles in a way that is fairly advantageous for the airline. While I don’t have any extra love for the dynamically priced programs the major US airlines have created, I think that Delta and American are hitting the nail on the head in rewarding loyalty in a broader sense than has been traditionally recognized. Kudos to Delta on this — hopefully others will follow suit.

Marriott’s dynamic pricing is looking surprisingly good (for now)

Whoever said that Marriott points might get more valuable when they go dynamic was a downright genius. That guy who said that they would likely be worth something between 0.7c and 1c per point must have been a flat-out savant. Or maybe Marriott made a calculated move to get themselves some positive press for now while setting themselves up to take advantage of its ability to stealthily devalue now that nobody knows how much a property should cost anyway. One or the other is true — but for now, it doesn’t much matter. Enjoy the party until the music stops.

Marriott Dynamic Pricing: Check Existing Reservations For Cheaper Pricing

Speaking of the music, it’s time to play musical chairs with your Marriott reservations. Point pricing has likely changed for your existing reservations, so it’s worth checking to see if you can save some points. My limited set of reservations was for properties set to increase substantially, but if you had some award stays booked at properties on the margins you might save a bundle by rebooking. Hotel reservations are becoming like Southwest Airlines tickets: you need to set a weekly reminder to check for price drops.

Spirit Airlines extends loyalty to the afterlife

If you want to live happily ever after, I guess you’re going to have to go back to 4/1 and re-live Spirit’s everlasting announcement. Leave it to “Free” Spirit to reach into your grave looking for some way to extract more revenue.

Breaking: American Airlines unveils “You’re Fairly Safe in Our Hands” arrival guarantee

My favorite comment was this one from reader Alex: “By the way, love the guarantee that you arrive no later than 24 hours after the scheduled arrival time. It does not guarantee where you arrive to. Very AAish!”. And yet here we are chasing Platinum Pro via the shopping portal :-).

In hotel reviews

Hyatt Centric Times Square 1 king suite: Bottom Line Review

Hyatt Palm Springs: Bottom Line Review

The Confidante Miami Beach: Bottom Line Review

That’s it for this week at Frequent Miler. Keep your eye out for this week’s last chance deals to make sure you get ’em before they’re gone.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

Towards the beginning, there was a discussion about amazing Hilton properties to use free night certs. While I agree in the United States there are none of the big aspirational properties, Nick went one step further and said probably not in North America either. I would disagree with that!! The Waldorf Astoria Pedregal in Cabo definitely is on that list. For a long while (before the latest devaluation), there were only 2 properties in the entire Hilton portfolio where the standard rate was above 95K points–the Waldorf in the Maldives and the Waldorf Pedregal. Having stayed there last year, I definitely deserves it. Every room has great water views and plunge pools, amazing service. Probably my favorite hotel stay ever.

I felt the discussion of starter cards ignored a major hurdle: the fact that a college student with no history is unlikely to be approved for many of the cards mentioned. Someone with zero credit history is almost certainly going to be denied for a Freedom series card, unless they bank with Chase. DPs are very consistent on that. Citi cards also come with a high likelihood of denial under this circumstance, though Citi is slightly less predictable on this front.

I’d be curious to know more about Bilt on that point, haven’t seen DPs.

I agree- Chase likes a young person to be in their ecosystem for a while. My DD obtained the Chase Freedom for Students her freshman year of college and after 3 semesters of use, successfully applied for the Freedom Flex. After graduation, she’ll then consider the CSP. Her go to credit card is the C1 Student card (which wasn’t mentioned at all iirc), however.

There is no requirement to specifically start with another Chase card prior to getting the CFU/CFF, but you do need 12 months with a card, Chase or otherwise (occasional DPs of people approved at 7-9 months, but many many more of denial. I’d strongly recommend waiting 12), OR a checking/savings account with Chase.

Another issue that should have been considered is income. Many non-student cards are going to be a struggle to be approved for with an income of, say, $3K-$5K a year (which is feasible for a college student). The law prevents those under 21 from using household income, so a student cannot declare their parents’ income, only what they earn/get as an allowance/get in scholarships etc.

I agree about the Cap1 student cards deserving a mention. They used to be uncompetitive, but recently introduced a student version of Savor One, which is interesting. Approval is less easy to predict than with something like the Discover Student, however. Cap1 are all over the place with underwriting. There is also no SUB.

Cap One Savor card for students currently has a $100 SUB for $100 spend. Along with hopefully ease of approval, 3% dining/grocery/streaming, along with some other benefits, seems like a good choice

My child had no problem getting approved for a Freedom — of course, they had been an A/U on a couple of our cards for several years which may have helped.

The thing that I didn’t think about when getting them signed up (I haven’t listened to the podcast yet, so I don’t know if it’s discussed) is just how little spend young, just-starting-out people have. It was touch-and-go to meet the $500 threshold.

Did your child have:

If the answer to both of these is no, and they didn’t apply for the student Freedom, then consider them lucky. We see such DPs occasionally, but they are rare and usually involve begging to recon.

AU history is typically not sufficient to surpass Chase’s strong preference for either an existing history with another card (which can occasionally be swapped with loan history), or a banking relationship.