Since Samuel L. Jackson and Jennifer Garner won’t stop asking, this week we discuss what’s in OUR wallets (and why). Will the answer make Mr. Jackson proud? (Spoiler alert: Neither of us carries a Quicksilver card :-D).

Since Samuel L. Jackson and Jennifer Garner won’t stop asking, this week we discuss what’s in OUR wallets (and why). Will the answer make Mr. Jackson proud? (Spoiler alert: Neither of us carries a Quicksilver card :-D).

Elsewhere on the blog this week, we share easy ways to use up “coupon book” benefits and we look at the rumored changes to the “coupons” on one of the most valuable cards on the market. See also posts about the easy way to Star Alliance Gold status and a super-simple $200 bonus that just requires paying a business bill. Watch, listen, or read on for more from this week at Frequent Miler.

00:40 Giant Mailbag

03:02 Card Talk: Hilton Aspire

12:55 Award Talk

13:04 Alaska Devalues JAL awards

17:00 Southwest Wanna Get Away Plus for the win

20:05 Nick’s quick hit Award Talk triple header

20:15 LifeMiles Manual Booking success

22:41 Hotel Nyack

23:38 MGM “Free” stay

25:22 Main Event: What’s in our wallets?

27:38 Greg’s Travel spend card

28:40 Greg’s dinning card

29:50 Greg’s grocery card

31:06 Greg’s gas card

32:10 Greg’s Office Supply card

32:50 Greg’s Apple Pay card

34:52 Greg’s Everywhere Else card

40:33 Nick’s Travel card

43:07 Nick’s dining card

44:04 Nick’s gas card

45:15 Nick’s Office Supply card

46:21 Nick’s Google Pay card

47:08 Nick’s Pharmacy card

48:20 Nick’s Everywhere else card

49:48 Greg’s Debit card

53:14 Question of the Week: What’s the best program for suite upgrades — and what can you do to increase your chances of an upgrade?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Would rumored changes kill the Aspire card?

A recent survey has us thinking that changes are likely coming the Hilton Honors Aspire card, which is arguably the best long-term value card on the market in its current form. We don’t know for sure that these changes will happen or when they may happen, but they seem very, very plausible. When they do hit, they will certainly represent a decrease in value for the card, though these changes might make the benefits more appealing to some. The Aspire card might stay in my (spare) wallet (full of cards I rarely use), but it still won’t move to the daily use wallet any time soon.

Credit card coupon book cheat sheet

A common joke about many of the premium credit cards on the market is that they have slowly turned into “coupon books”, with many different monthly, quarterly, semi-annual, or annual benefits that may not seem intuitive to use. This post covers the most valuable of these “coupons” and explains how to best leverage the benefits — sometimes for things beyond the scope you might otherwise imagine.

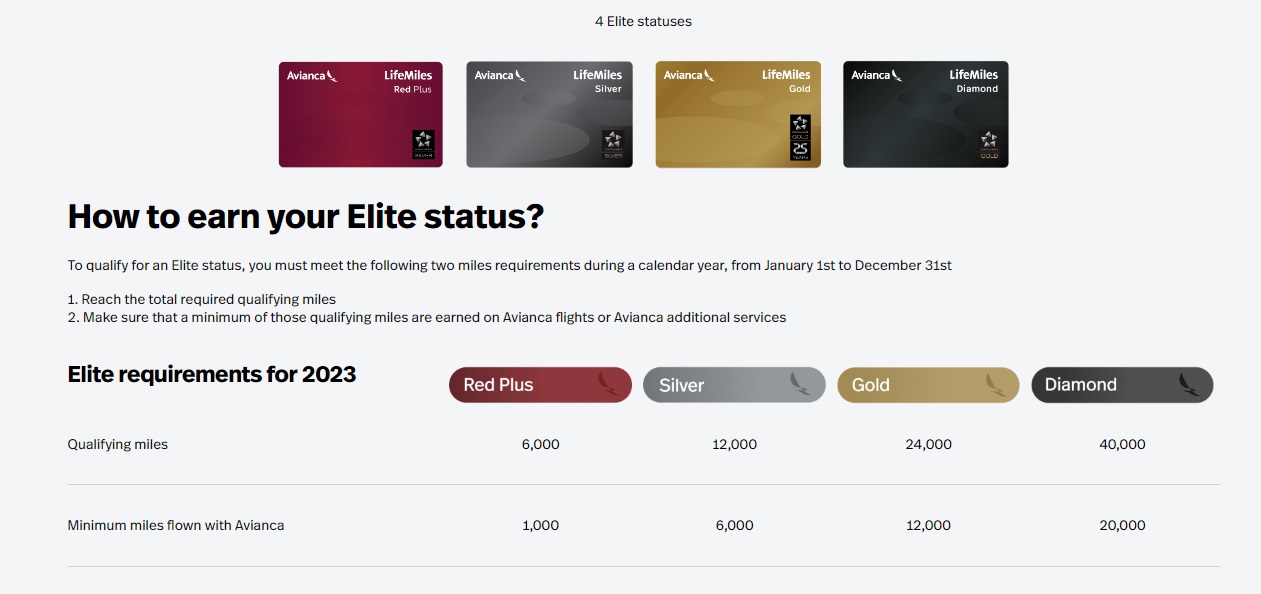

The easyish route to Star Alliance Gold status: Avianca LifeMiles

If you’re after Star Alliance Gold status, Avianca LifeMiles could be the ticket. That said, it won’t be a cheap ticket, just an easier path than most other airlines given the fact that you can earn half the points necessary for elite status by transferring from a credit card program or buying miles (like in the current sale). The hard part is that you do still need to fly on Avianca, but in this post I demonstrate how you could reach status with just one paid flight and miles transferred in.

8 ways to get CLEAR for less

CLEAR finally got me around the holidays this year when we had plans to fly on the Saturday after Thanksgiving and we were staying at the Hyatt Regency Orlando Airport, so the enrollment line was literally at the bottom of the escalator from the hotel. And since it costs me nothing thanks to my American Express Platinum Card®, how can I complain? The good news is that even if you don’t have a Platinum Card®, this post covers ways you can get CLEAR for less.

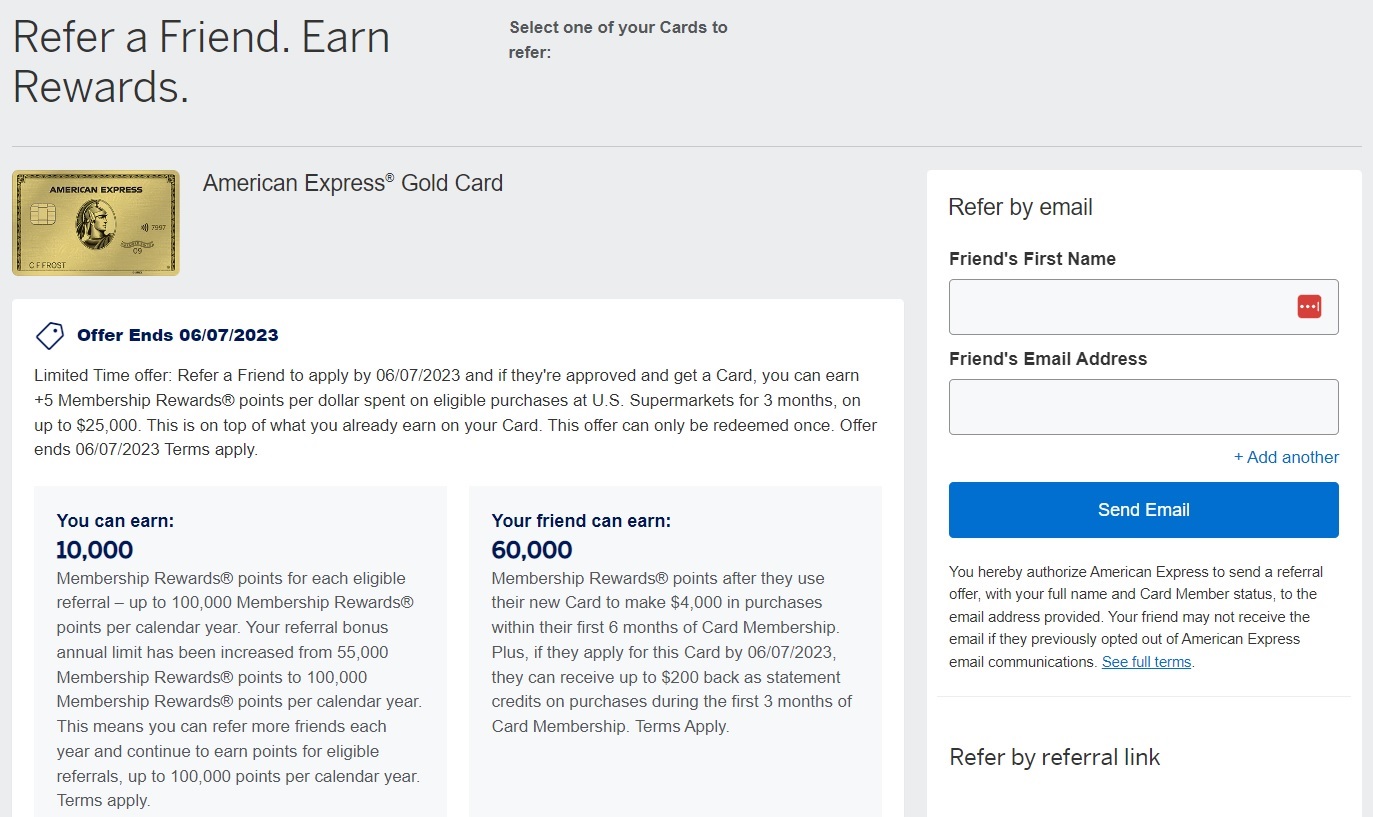

Unable To Refer From An Amex Card? You Need To Lose It.

Stephen covers a tip for how to get your referral link back if you’ve lost it. For some reason, some cardholders get locked out of Amex referrals. It isn’t always clear why this happens, but apparently you can get your link back…temporarily. According to Miles Earn and Burn, the links only come back for a month or two.

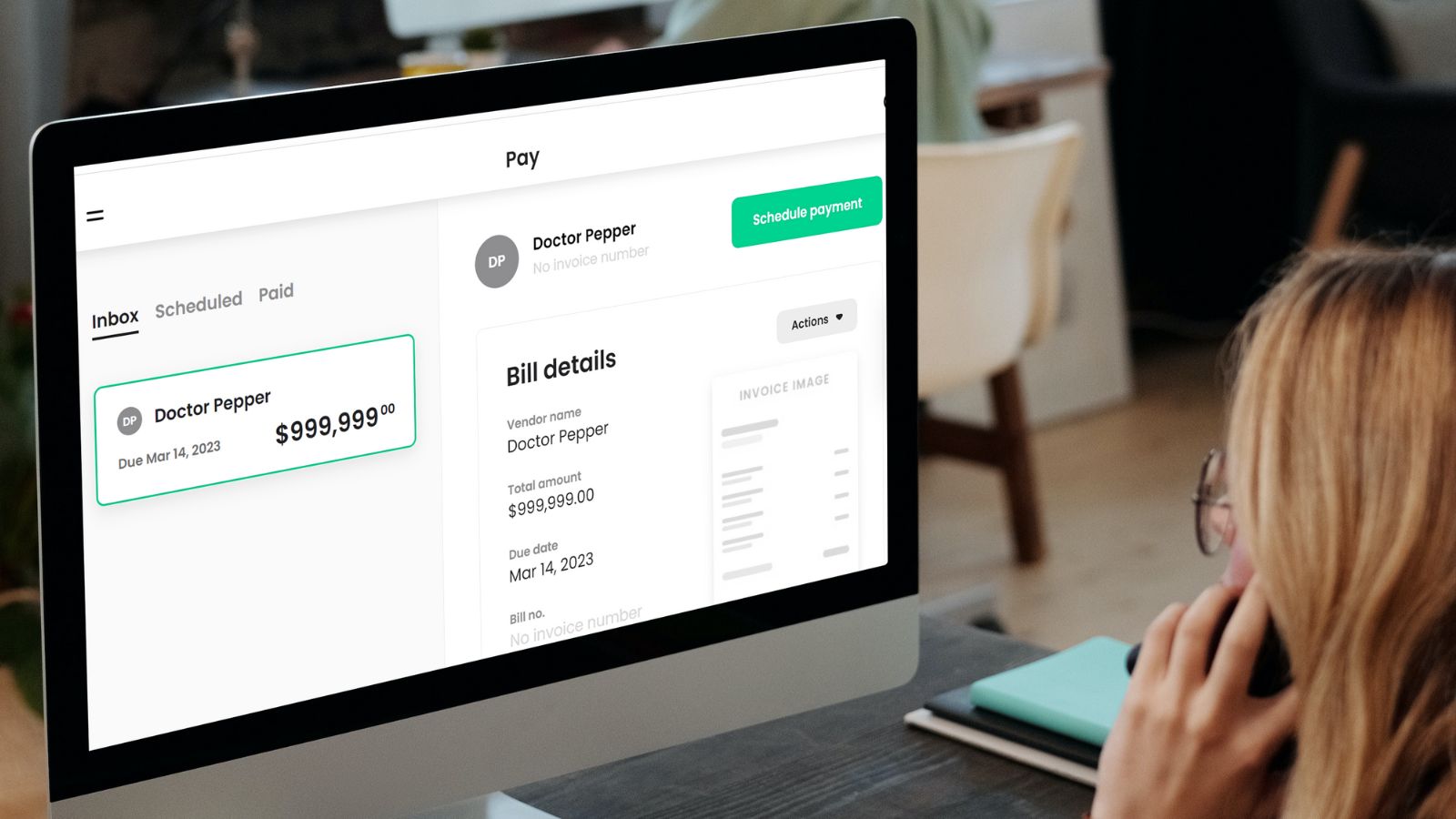

Melio: Pay business bills by credit card

Melio is a service that has been around for a while to pay business bills with a credit card. I hadn’t ever thought hard about using it because I’ve used Plastiq for years. However, with a $200 bonus to be had, taxes to be paid, and Business Platinum pre-approval mailers continuing to come in, I think it’s time that Melio and I got acquainted.

Plastiq Guide: Pay Bills via Credit Card (Payments to US Vendors Back to Normal)

Just a quick update here, but it made sense to include this in our week in review following Melio: Plastiq payments are back up and running.

Marriott Bonvoy Complete Guide

This guide has seen a number of updates this week and serves as a total reference guide for all of the key aspects of the Marriott Bonvoy program.

That’s it for this week at Frequent Miler. Keep your eye on this week’s last chance deals to be sure you grab them before they’re gone.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

I for one happen to really enjoy these “what’s in your wallet” updates every year or so, so even though it’s familiar territory I like when you guys do it.

Regarding the question of the week, I’m like Greg in that I travel with my wife, so the extra space of a suite upgrade doesn’t mean a whole lot to me. I also mostly stay in city hotels. For me, one thing that I really enjoy, that seems to be under-appreciated, is the choose-your-own-room feature that Hilton’s app provides upon check-in.

Of course sometimes you get reassigned anyway, but when it works (which for me is the majority of the time) I often find that with 2-3 minutes’ scrutiny of the hotel layout, I can find a room that suits my preferences (high floor, end of the hall, corner if possible or at least not an adjoining room) as well or better than what someone behind a desk might throw at me as an “upgrade.”

how do you get mgm free nights? As a mgm gold member, I don’t think I’ve ever seen one. Where do you find them and what do they look like?

I’m surprised you have enough spend that isn’t going to meeting the minimum spend requirement on a new card to warrant a wallet full of other cards. You clearly need to up your churning game 😉

Any update on the team challenge?

I’ll post an update very soon.

For Greg in particular re ATM cards. I’m also Chase Private Client. I have tested using the Chase Private Client, the Fidelity, and the Schwab ATM cards overseas at the same time. Fidelity and Schwab gave me the same FX rate and fee rebate (although Schwab rebates at month end as Nick mentioned).

Chase gave the same rebate but exactly a 1% worse FX rate. There was no FX fee itemized by Chase, but again the rate was 1% worse. I’ve done this test twice and received the same result. I was a bit bummed out to discover this because I also bank a lot with Chase.

If you believe this is not the case any more, let me know. I’m in SE Asia now and could make a withdrawal with all 3 cards in the next day or so.

You are correct. What most people don’t know is that Chase levies a hidden 1% exchange rate spread on all foreign transactions on all cards (even those with no FTFs). There’s a way to check. Complete a purchase in a foreign currency and request an immediate refund from the vendor. Your refund will be 1% less than your purchase.

Not that I don’t believe you because I’ve experienced this immediate refund thing as well, but is this spread documented anywhere?

A hidden 1% exchange rate on the CSR too?

I don’t have a CSR to test, but there was no such hidden charge on a Chase Hyatt card that I used today….

Ouch, good to know! Question: is the difference really based on the issuing bank or the network? e.g. my Chase debit card is Visa. Are the Schwab and Fidelity debit cards Mastercards?

My Fidelity and Schwab ATM cards are also Visa.

Here is the good news. Chase is not putting this hidden charge on their credit cards. I just tested out 3 credit cards with no FX fees. The Chase Hyatt (Visa), the Venture X (Visa), and the Citi AA Plat (Mastercard). The first two were identical, and the MC was just rounded slightly differently…

And I should have added….the FX rate on all 3 cards was very near the mid-market rate….so all 3 were great rates.

@Greg. Perhaps a mea culpa. I recently tried the Chase, Schwab, and Fidelity ATM cards all within a minute of each other at an ATM in Thailand. I did receive exactly the same rates on all 3. I’m not sure why I vividly remember the other data point from some time ago. Perhaps more time had passed than I remembered between the withdrawals from the different cards, perhaps it was a different ATM machine if that mattered somehow, maybe my account wasn’t reflecting my Private Client status then, or perhaps I’m just an idiot. Regardless, I just wanted to clear up the DP I mentioned above.

The only thing worst than making a mistake is not correcting it!

Thanks so much for the update! Luckily for me I’ve been too lazy to switch debit cards 🙂

Regarding Hotel Nyack -P2 and I live in NYC and it’s a nice escape, his parents live near by so we’ve stayed a few times. No surprise it’s going up in category, it’s the only nice hotel around and hosts a ton of weddings (every time we’ve stayed the weekend there’s been 2-3 weddings) and cash prices are really high

– town center is cute and walking distance. They have free bikes included in the resort fee as well that can get you there

– resort fee also includes a free wine or beer or well drink at the bar. Often great quality live music

– we didn’t use the pool but it’s available in warm weather

– the resort fee claims to include local fruit but it’s usually sad bananas and apples

– if you don’t have the thruway view you have a cemetery view conveniently blocked by the blinds. Matches the quirky gothic decor

Overall great redemption and nice hotel

It certainly looked quirky and interesting enough. Unfortunately, my wife didn’t enjoy her stay very much. Pull out sofa was broken (she was advised of this at check-in though). Requested housekeeping at check-in and they never cleaned the room (which was an issue because they had eaten dinner the night before and had the trash from that and a dirty diaper in the room all day and still there when they got back at night). Thermostat didn’t work right (had to get maintenance to fix it). And there must have been some of the live music you cite — because my wife messaged me saying that she could feel the bass from the music in the bar while lying in bed. Breakfast ended up being kind of disappointing, too.

Could have just been a perfect storm, but I don’t think I’ll convince her to ever give it another shot unfortunately.

Sorry to hear that! I can see how it would be not as good with kids and can’t speak to the issues with housekeeping since we never stayed more than one night. More of an escape from parents house for a couple needing a drink. I think we also have gotten lucky that our rooms have always been far enough from the bar and from the ballrooms hosting weddings.

Not seeing this in my Google podcasts feed?

Yep, still not there.

Not sure when it appeared, but it is there now.

Gentlemen, there are some individuals who (for various reasons) seek pure cash back as opposed to transferable points. Nick has occasionally mentioned the concept. Benjy as well. Question: if you were only seeking pure cash back, which three credit cards would be in your wallet? (A transferable points card is okay if the points convert to cash back and it is the winner.) Thanks.

1) Bank of America Premium Rewards or Cash Unlimited with Platinum Honors status for 2.625% back everywhere. $95 AF for Premium Rewards or none for Unlimited Cash. Whether you want Premium Rewards or Unlimited Cash comes down to whether you can easily use the $100 airline incidental credit on the Premium Rewards. You should be able to use that very easily — and then you pick up the benefit of 3.5% back on dining with this card. You *could* get a US Bank Altitude Connect for 4% back on dining, but whether or not it’s worth opening a separate card for that is up to personal circumstances.

2) Chase Ink Cash for 5% back at Office Supply on up to $25K per year (recognizing that you could buy gift cards for purchases at lots of other places and get 5% back).

3) Citi Custom Cash for 5% back on the category in which you spend the most on up to $500 spend per billing cycle. I’d use this as a grocery card for 5% back (and take care of any overage on grocery spend by buying VGCs at Staples with the Ink Cash).

Alternatively, cut out the Custom Cash since you can just get VGCs at Staples to cover groceries and dining at 5% and pick up a Wyndham Earner Business card for 8x on gas. I mentioned on the podcast how you could convert Wyndham points to Caesars and then use those Caesars points on the sportsbook if you’re in a state with online sportsbooks. With some math and a little effort, you could essentially convert that to cash.

Excellent. Thanks.

Would you also use the BofA cards for travel purchases if your objective on those travel purchases was cash back and not transferable points?

Thanks again.

BofA doesn’t have a transferable points program, so you’d only do this for cashback. Also worth noting is that their customized cash rewards card lets you do online shopping at 5.25% (up to 2500/qtr) at the same level that gets you 2.625%, which seems like a pretty good deal.

It’s interesting to hear about the MX Hilton Aspire card being touted as one of the best ongoing values in the credit card market, with benefits that outweigh the annual fee. It’s important to keep in mind that credit card benefits can change over time, so it will be interesting to see if the card is able to maintain its value in the long term. As it stands now, the annual free night certificate is a great perk, and it will be interesting to see what changes are rumored to be coming. Overall, this card seems like a good option for those who can take advantage of its benefits.

One other category: gym membership. A nice feature of the Hyatt card. Maybe a segment on super niche category bonuses would be fun?

Interesting, but only for 3x categories and higher. Several cards will get you 2x at Planet Fitness.

Other options (in addition to Hyatt):