NOTICE: This post references card features that have changed, expired, or are not currently available

Last week, Greg, Stephen, and I shared the contents of our everyday wallets. Quite a few readers seemed surprised that none of us carry the Chase Freedom Unlimited. Greg and I talked about why we don’t on last week’s Frequent Miler on the Air podcast / vlog around the 1hr 14min mark. After declaring that I thought nobody should apply for the CFU on the podcast, I thought more about it over the past few days in an attempt to answer: Who should carry the Chase Freedom Unlimited? Is there any group that should consider applying for it? I realized that my podcast statements might need amending as there are some who belong in either group.

Quick Recap: Why the CFU didn’t make it in my wallet

Many readers questioned why the CFU wasn’t in our wallets. To be clear, we weren’t recommending our wallets as ideal but rather sharing what’s in them. However, quite a few people were intrigued by what wasn’t in our wallets. If you want to hear more about why it hasn’t been in my wallet, listen to last week’s podcast. In a nutshell, I said that I earn a decent number of Ultimate Rewards each year at 5x. Furthermore, once you get to a point where you have a healthy stash of Ultimate Rewards points, cash back makes more sense (as do better category bonuses on other cards).

That said, I recognized that the Freedom Unlimited can be a solid choice for those who do not have all of the URs they need (and in fact I admitted that my UR balance is weak; I product changed to a CFU a few days after my wallet post and will be rotating it into my wallet for a few months as I build back URs).

However, I maintained on the podcast that this isn’t a great card to apply for or carry for “everywhere else” spend. But that isn’t universally true: there are many people who should consider it. This post covers who should consider applying, who shouldn’t, and which groups should or should not consider using it for everyday spend.

Who should apply for the Chase Freedom Unlimited?

In the podcast, I explained that I thought that the CFU is a poor choice for a new card sign up. One reason I said that is because Chase allows product changing within a card family. Those ultimately interested in a Freedom Unlimited may be better off first applying for a different Ultimate Rewards-earning card like the Chase Sapphire Preferred (or Sapphire Reserve) and then product changing / downgrading later on. That provides the opportunity to earn a much more valuable initial welcome bonus.

Keep in mind that to get approved for any of the Chase cards, you’ll need to be below 5/24.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

That said, there is (at least) one group of people who might want to consider applying for a Freedom Unlimited:

Those just starting a credit history (students or others with no credit history). / Those who have applied for better Chase cards but not been approved might consider it.

The Freedom Unlimited could possibly be a good starter card for a student dipping their toes in the rewards credit card pool. Part of the reason this card could be a good choice is because it does not have a large minimum credit line to be approved. Whereas most of Chase’s Visa Signature cards require an opening credit line of $5,000 to be approved (and a Visa Infinite card like the Sapphire Reserve requires an opening credit line of $10,000), I’ve seen reports of Freedom Unlimited approvals with credit lines in the realm of $1,000. For someone with no credit history and limited income, this card might make for an easier approval.

Still, it might be worth trying for a Chase card with a higher bonus if you think you can qualify. If you’ve tried a Sapphire application or Ink Business application and been denied, the Freedom Unlimited might be a good place to start when you try again in a few months. That said….

Who shouldn’t apply for the CFU?

Those who can qualify for the Ink Business Unlimited

The Chase Ink Business Unlimited offers the same 1.5x-everywhere earning structure as the Chase Freedom Unlimited. However, it generally offers a much better welcome bonus (about 2.5x the size of the bonus on the Freedom Unlimited at the time of writing). The Ink Business Unlimited is a business card, so you’ll need some type of a business to apply.

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

If you can qualify for a business credit card, the Ink Business Unlimited is a better choice than a Freedom Unlimited card. In fact, that’s exactly the conclusion that Greg determined when planning out a credit card path for his son.

Those looking for a balance transfer should probably look elsewhere

I’m not an expert on balance transfers, but I know they can be a tool that can be helpful from a number of different standpoints. The Chase Freedom Unlimited often comes with an introductory balance transfer offer.

However, Chase usually adds a fee of 3% of the balance transfer even on the introductory offer (which is typically good for transfers made within 60 days of account opening, after that the fee increases). You can alternatively often score an introductory balance transfer offer with no balance transfer fee from other issuers (like some Amex cards), so I don’t think the Freedom Unlimited is particularly compelling for this use.

Who should consider using the Freedom Unlimited as an everywhere else card?

Those who have a specific high-value use in mind for the points

Chase Ultimate Rewards points can be leveraged to high value with Chase transfer partners. If you’re collecting Ultimate Rewards points, you hopefully intend to use them with those transfer partners when possible in order to maximize value.

If you’re working toward a specific high-value use, it could certainly be well worth making the Freedom Unlimited your “everywhere else” card. For example, if you’re saving up to fly ANA First Class from the US to Tokyo using Chase transfer partner Virgin Atlantic (110K round trip from the Western US or 120K from the Eastern US) or you need to travel during a peak period when rates are high but you can reliably find Hyatt award availability, it can make a lot of sense to earn Ultimate Rewards points on everyday purchases at the 1.5x rate. Chase partners in general offer many oppprunities to get great value out of your points.

If you know with reasonably certainty that you’ll use the points for experiences you highly value, I think this can be a great everyday card for otherwise unbonused spend.

Those who don’t yet have more points than they can reasonably use

If you are building or re-building a Chase Ultimate Rewards balance and don’t yet have a comfortable cushion of points, it can make sense to use the CFU to pad your stash. In many instances, I’d say that it would be faster and more efficient to pad your stash with the Ink Business Cash card at office supply stores (perhaps buying 3rd party gift cards for the stores you frequent), but the Freedom Unlimited could be part of a great one-two punch.

On the other hand, if you have more points than you can reasonably use any time soon, I would argue that choosing Ultimate Rewards points over cash back is a questionable choice. For example, if you could qualify for the Bank of America Premium Rewards card with Platinum Honors, you could be earning 2.625% back everywhere. By choosing to instead use the Freedom Unlimited, you’re giving up 2.625c for every 1.5 Ultimate Rewards points — an opportunity cost of about 1.75c per UR point. As your UR balance grows, that price is likely to seem fairly high.

Those who can make strong use of Hyatt

Many people love Ultimate Rewards specifically for Hyatt. With Hyatt hotels ranging from 5,000 points per night at Category 1 to 30,000 points for top-tier Hyatt hotels (or 40K from some of the SLH properties), there are opportunities to leverage Hyatt for great value.

A couple of years ago, as a Hyatt Globalist, I used a suite upgrade at the Park Hyatt Mallorca to book a confirmed suite for the standard room award price 20,000 points per night. This suite was going for about $2,000 per night at the time I booked. Hyatt definitely yields many similar opportunities for outsized value.

Who shouldn’t use it as an everywhere else card?

Those who will primarily book chain hotels through Chase Travel℠.

Many people justify the use of the Chase Freedom Unlimited because they say they will get a “minimum” of 2.25% in value when they combine points with a Chase Sapphire Reserve card.

Here’s the math on that: If you earn 1.5 Ultimate Rewards points per dollar spent using the CFU and then you combine those points with a Chase Sapphire Reserve card to book travel through Chase Travel, you can get 1.5c in value for each point. Multiplying 1.5 points per dollar earned with 1.5c in value for each point redeemed, you arrive at a value of 2.25c per dollar spent on the CFU.

While that’s true if you’re booking travel through Chase at the same price at which you’d have booked it elsewhere, I think it’s overly optimistic to view the CFU as yielding 2.25c in value per dollar spent.

That’s because booking through Chase Travel eliminates your ability to shop around and stack other discounts / opportunities.

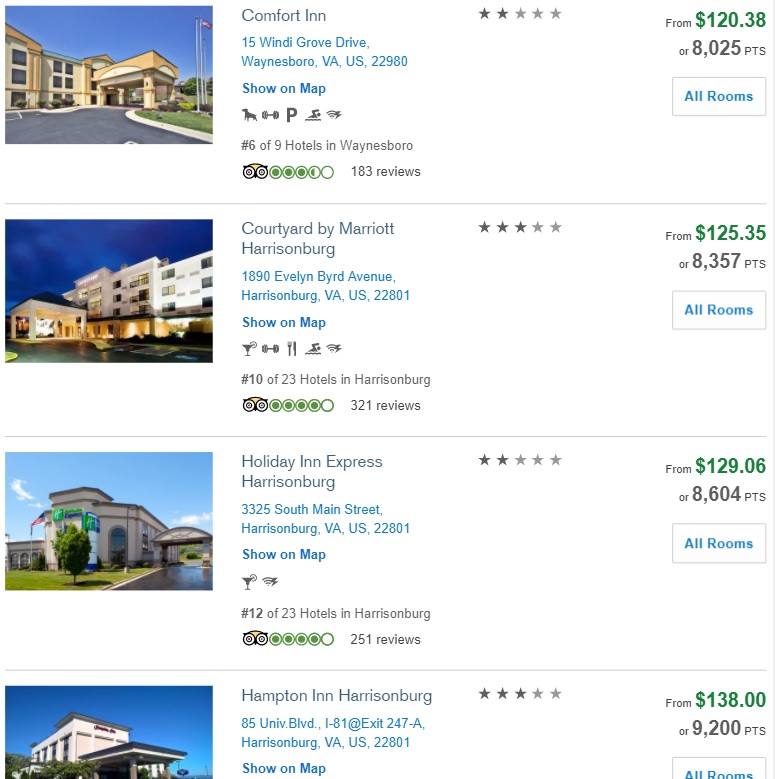

For example, let’s say that you want to book a Marriott hotel with a standard rate of $200. If you book through Chase, you’ll pay 13,333 points if you have the CSR.

However, if you book through Marriott.com, you can first click through a shopping portal. At the time of writing, the best rate for stays in the US is 3%. That’s $6 you could earn back. Then you’ll additionally earn Marriott points — 10x base points for a member with no status means 2,000 points earned. Even if we conservatively value Marriott points at half a cent each, that’s at least $10 worth of points. The $200 stay has a net cost of $184.

$184 / 13,333 points = 1.38c per point

If you earn 1.5x on the CFU and use it for a real-world value of 1.38c per point, you’re getting a real-world return of about 2.07c per point used.

If you were able to have originally booked a AAA rate for 10% off, your net cost could be even lower and using the CFU starts to compare poorly to a 2% cash back card.

If you’re going to book chain hotels where you could be earning hotel points and elite credit and/or using discounts like AAA or other hotel promo codes, I think you’d probably be better off long-term with a cash back strategy.

That brings me to the last group who shouldn’t consider the CFU as an everywhere else card:

Those who can do BOA Premium Rewards with Platinum Honors

The BOA Premium Rewards card with Platinum Honors offers those who can deposit, invest, or move retirement savings to BOA/Merrill the chance to earn 2.625% back everywhere. That’s a great ongoing return on unbonused spend.

As I mentioned earlier in this post, if you have the ability to move money and/or investments to take advantage of this card, it makes the opportunity cost of using the Freedom Unlimited seem pretty high.

Let’s say you have both cards — the CFU and the BOA Premium Rewards with Platinum Honors. Each time you spend $1, you have a choice between earning 2.625 cents or 1.5 Ultimate Rewards points.

Put another way, when you choose to earn Ultimate Rewards points in that scenario, each point is costing you the chance to earn about 1.75 cents.

2.625c / 1.5 Ultimate Rewards points = 1.75c per UR point

In pennies, the choice to take UR points might not seem like a big deal. Let’s imagine you were planning to eventually spend a total of $100,000 on one of these two cards. You could either have:

$2,625 with the BOA Premium Rewards card w/ Platinum Honors

or

150,000 Ultimate Rewards points

While I think we can all agree that it is certainly possible to get far more than $2600 in value for UR points, imagine two envelopes in front of you. If you take the points, you give up the cash. It’s not necessarily a bad trade — but would you continue to make that trade over and over in perpetuity? If you have 0 Ultimate Rewards points, it’s easier to consider taking the points. If you already have a million URs, the cash likely starts to look more and more appealing — or at the least the choice to take the points becomes suspect when you could have cash in your pocket to save / invest / use. If you get to the point where you have enough UR points to meet your transfer partner needs, the flexibility of taking the cash (which could be used for travel or pizza or anything in between) becomes more and more appealing. Likewise, the cost of choosing to earn URs over such a high rate of cash back likely seems high.

Bottom line

Last week, readers found out that none of us on #TeamFM are carrying a Freedom Unlimited in our wallets and many asked why. In our podcast, I asserted that it doesn’t make sense to apply for the card and that the opportunity cost of using it for everyday spend is high. When I thought about it more, I came up with some scenarios where it could make sense to pick the card up and/or to use it, though I think that most readers could do better with other methods / combinations.

Nick

I was just @ Uncle Clay’s House of Pure Aloha But No Uncle Clay !!

Bronson was in-charge and it’s Hard to find and Tough to beat !

CHEERs

Great post. One other reason to consider cashback to fixed-value portal redemptions is instant/near-instant redemption. Cash can be instantly redeemed and moved to an investment account where it can then grow. In a good year like this last one, that could mean the 2% back redeemed from say a DC card might be worth 2.5+% one year later. Obviously there is risk involved, but even in a HYS account, the money should at least mostly keep up with inflation. In comparison it seems like many people hold onto points for a long time, waiting for that perfect redemption and thereby incurring a slow deval (somewhat offset by inflationary averaging on the accrual side, it’s true, but cash back also benefits from this).

Technically this an issue with all flexible points, but especially relevant when comparing cash to fixed redemption options. Transferring to partners at least allows for higher cpp.

Great article as usual, Nick. I’m not sure that B of A with platinum is really the yardstick though. First, getting to platinum is not easy and even for people with an IRA that they can transfer or have $100k sitting around that can’t get a better return, it takes 3 months and another 5/24 slot. Second, many of us value citi and amex points as worth more than 1.3125 cents per point. Accordingly, double cash and blue business (at least for 50k per year) present a better comparison because of the 2x possibilities. At least for some of us.

Anyway, once you put those two cards in the equation it brings in the entire discussion of citi v. chase v. amex (and I guess secondarily the concern about Amex’s acceptance rate for those who prefer simplicity or thin wallets). You guys have the best resources on the web for the three main flexible currency programs. But the existence of 2x cards out there for nonbonus spend I think brings all of that discussion into play when considering whether to use a 1.5x card — or even whether to use a capital one card which I guess if you think about it is essentially a 1.5x everywhere card when used for transferring airline miles.

tl;dr — I think the whether to use chase at 1.5x for nonbonus spend question really requires a detailed consideration of the differences — both in programs available and in frequency of transfer bonuses — for citi, chase, cap one, and amex. You’ve covered the Hyatt issue, which may well be the most significant, but there are definitely others.

BB+ is superior for everything else spend. I was more curious why you didn’t have CF, not CFU.

Here’s my take: anyone who knows how to leverage UR, MR and TYP should collect them all and value them fairly equally. I need all 3. Here’s what I carry (outside of new card spending bonuses): Citi Prestige for 5x restaurant, airfare and OTA’s. AMEX Blue for Business for all non-category spend (and that covers a lot). Chase Ink Plus (no loner available) for 5x phone, TV and Internet paired with Freedom Unlimited for 1.5x at Costco and places that don’t accept AMEX. Pair with shopping portals, MileagePlusX, etc. and earn points in gobs. My #1 category is dining – and I would argue with anyone that 5x TYP beats 4x UR or 3x MR any day, unless you have specific needs.

Had the card for some time, but never used it, since I had other options (Amex BBP, Priceline 2x, Altitude Reserve).

Converted the card to Freedom, now I have 6 Freedoms. I don’t know why should anybody use this card, since there are Amex BBP, Citi Double Cash cards available.

I do not tend to aggregate large piles of Ultimate Rewards organically, but having the pairing of the Chase Sapphire Reserve and the Chase Freedom Unlimited, it has been my go-to method for booking discounted car rentals using some manufactured spending.

Using the Chase Freedom Unlimited for Simon Mall Gift cards and liquidating them, it costs me about $6 to produce 1500 Ultimate Reward points. At a redemption that values about $22.50 per gift card, I net about $16.50 per gift card (so about a 73% savings on car rentals for me). It takes me about 15 minutes to obtain and liquidate each gift card, and when netting about $16.50 per card, this translates to me saving an equivalent of $66/hr (definitely more than I make from my job’s take-home pay). If someone wants to factor in a Chase Sapphire Reserve fee of $250 ($550 – $300 travel credit), it drops my savings rate closer to $38/hr (I can rotate about 36 Simon gift cards a year for my Chase Freedom Unlimited, full math not provided), but I’m still fine with that. Also noteworthy for those that care, using the Chase Portal to rent cars paired with the Chase Sapphire Reserve maintains primary rental car insurance, which is a boon for me and my neurotic travel companion.

I know there are other paths I could take, but most are not avenues I can use right now, such as Chase Ink Business Unlimited (I’m not willing to get a business card yet), Citi Double Cash Back paired with Citi Premium for x2.5 Car Rental redemption (I do not have the Double Cash Back card yet; lacks primary car rental insurance), use a plain 2% back card (I had a Fidelity card, but it was cancelled on me), etc. This is just the best path I’ve found with the tools at my disposal.

I am sure I could get some other reasonable redemptions for Ultimate Rewards, but there are plenty of other good ways for me to accrue airfare and hotel points. Car rentals on the other hand have been a sore spot for me.

Your argument against 2.25 cents when combined with Reserve and using to book travel alters the facts. Yes, you may find other discounts on hotels by not using the Chase portal, but that’s generally not the case with airfares. If you only use the Chase portal for airfares, you effectively can get a real 2.25 cents every time by charging everyday expenses to CFU then using the portal through the Reserve card. I have the Reserve, which I use for travel and restaurants (3x), and then I use CFU for everyday. And my family members use an additional CFU on my account because there is no fee. That combo works great for me and seems better than alternatives.

Actually, that section specifically says that the CFU isn’t good for people who will primarily book chain hotels through Chase. I didn’t address those who will primarily use their points toward paid flights. You do get 2.25c towards airfare. I made the point in a comment on Greg’s wallet post that it’s absolutely true that you get 2.25c toward paid airfare as long as the fare you want to buy is available via Chase. If that fits, you’re totally right and it can be a decent fit for you. Though if that’s your primary use of UR points, you’d be better off with 3% back with Discover in the first year (churnable) or 2.625% back with the BOA Premium Rewards card if that’s an option for you.

Note that the Chase portal doesn’t have many low cost carriers and now and then we post airfare sales here that aren’t available through Chase. In the majority of cases, certainly for domestic US travel, the Chase portal will be the same price you can find elsewhere.

In my case, that doesn’t appeal to me because I rarely fly paid flights and domestically I typically fly Southwest, so the Chase portal doesn’t work for me. But, again, if it works for you, that’s not a bad use of your points if not the best return for your spend.

The CFU makes sense for me. After years in this hobby, I got tired of juggling so many banks, points pools, cards, etc, and decided to streamline. My husband and I still have 30 accounts open, down from 60. We focus on Amex, Chase & Cap 1 + whatever needs an infusion that can’t be transferred, e.g. AA & Amtrak. The CFU and Cap 1 take turns being our “everything else” cards depending on which needs a balance boost. We’ve been in the game long enough to have CFU, 2 Freedom, 2 Ink Cash, Ink Preferred, Sapphire Preferred between us. So, it isn’t Team Captain, but it does its job.

A few nuances:

1) Chase targets those that have existing cards for Chase Freedom Unlimited accounts even if they are over 5/24. That is how I got mine recently. So the move is to apply for the other Chase cards you want, then respond to the targeted Chase offer for the CFU. At that point there is no reason not to have the card as a UR companion

2) A lot of readers aren’t applying for business cards, using portals, etc. So many of the arguments won’t apply

3) Hyatt is the most valuable UR transfer partner, and you can’t replicate earning Hyatt points via cash back cards

4) Most readers don’t have millions of UR (or any currency)

In short, CFU is a great card to have available for unbonused spend. No reason not to have one if you are invested in UR a tall

I would argue for another group who should use it: Those who prefer to “simplify” their rewards strategy. When I first got into the game many years ago, I regularly was maximizing rewards through multiple issuers. But I found over time most of my redemptions were with Hyatt, United, and Southwest, so UR points were my go-to-currency. Eventually, I decided it made life simpler and easier for my other half to juggle his cards by just having 4 cards going — Sapphire Reserve, Freedom, Freedom Unlimited, and an Ink. Yes, it might not be the absolute best value, but I get great value from this and enjoy always having UR points at the ready.

That’s a great point: it is terrific for simplicity. Chase does offer a decent ecosystem of cards for splicity’s sake and if Hyatt is where you want to be, it’s a good choice over the other options.

I agree w you, Lynn. I like the simplicity not so much for myself, but for my wife. I have her use the Sapphire Reserve for dining, and the Freedom Unlimited for everything else. I use an older Ink card to get 5x when I buy Amazon and WholeFoods gift cards from an office supply store, but am considering getting her the Amazon card just to avoid that hassle. So she would have 3 cards in her wallet, which I feel is the most I can ask her to do. We have other cards like United/Southwest/Alaska/Ink Business Preferred (for cell phone protection), but I don’t have her carry any of those around (unless we’re traveling on one of those airlines). I don’t seem to have any problem finding ways to use Chase points – we travel a lot!

Also, I know this doesn’t make financial sense, but I prefer to have my rewards in Chase Ultimate Rewards than cash back. From a strictly financial sense, it would make more sense to prefer cash which I can spend on anything. But from a psychological perspective, I prefer ‘free’ airfares/hotels/rental cars to cash which just gets applied to bills. It’s a way for me to save card rewards for travel rather than spend it immediately. And a trip to Hawaii feels like even more fun if it feels free. Not logical, I know. But i’m willing to sacrifice a bit of value that I would get from the BofA Premium Rewards card nonetheless.