NOTICE: This post references card features that have changed, expired, or are not currently available

Several months ago, I signed up for the Bank of America Premium Rewards card. The reason? It is the perfect “everywhere else” card… for me… in my particular situation. An “everywhere else” card is the card you use when you’re making a purchase that doesn’t qualify for 5X rewards with this card or 3X rewards with that card. It is a card that offers great rewards for all spend, regardless of what you’re buying and where.

For those just getting started with miles and points, the Capital One® Venture® Rewards Credit Card (and its business twin: Capital One® Spark® Miles for Business) is a great “everywhere else” option. If you have the Chase Sapphire Reserve card, though, you might be happier using the Chase Freedom Unlimited or Ink Business Unlimited as your everywhere else card. And, if you have a business, it’s hard to beat the Amex Blue Business Plus.

All of the cards I just mentioned share a common trait: they earn transferable points. Transferable points are points that can be used directly to purchase travel or can be transferred to various frequent flyer programs towards even better value (assuming you know how to capitalize on airline miles).

In my experience, having a stash of transferable points ready to go is a great thing. When booking travel, it’s hard to predict in advance which airlines will have award availability. With transferable points in-hand, when you find award space on any airline, chances are good that you can book that award, most likely with a partner airline’s miles. And when doing so, it’s often possible to get huge value from your points. When this happens, transferable points can be far more valuable than cash.

Diminishing Returns

What if you reach a point where you have enough transferable points for almost any trip you can think of, and you find that you’re earning points faster than you’re spending them?

At that point, I’d argue that it’s time to consider earning cash back instead. When points sit idle, they risk devaluation. Award charts change over time (usually for the worse). And the best sweet spot awards often get taken away. Meanwhile, extra cash back does not have to sit idle. Cash back can be invested so that it increases value with time.

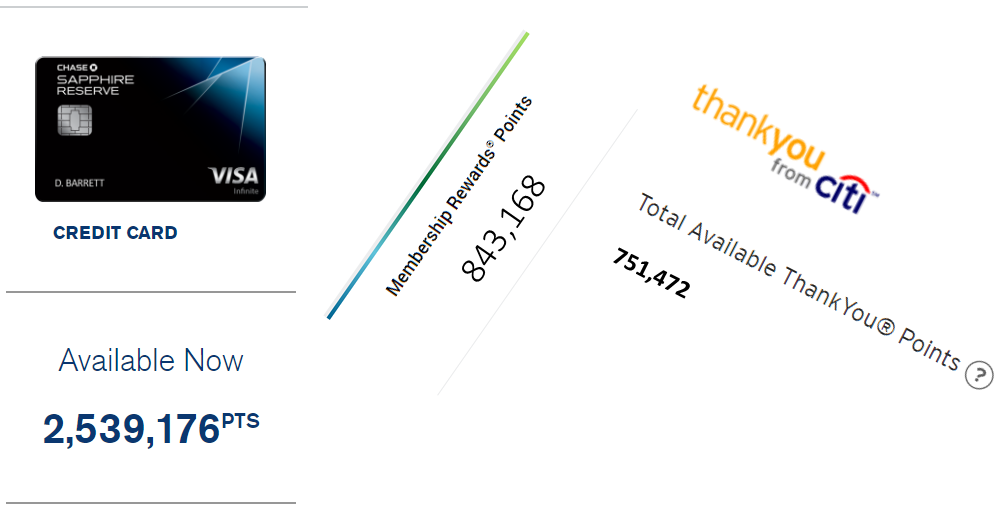

This is essentially the situation where I’ve found myself. I have a healthy stash of transferable points, and I’m earning them faster than I’m using them. So, I turned my eye to cash back…

Blue Business Plus + Schwab Platinum Card

In many ways, the Amex combination of the Blue Business Plus card and the Schwab Platinum card is the perfect duo because you don’t have to decide between transferable points or cash back.

The Blue Business Plus card earns 2X Membership Rewards everywhere on up to $50K spend per year. And the Schwab card makes it possible to cash out those points at a favorable value: 1.25 cents per point. This card combo, then, means that you can decide between best-in-class points earnings (2X everywhere) or best-in-class cash back earning (2.5% everywhere) at any time after earning the points.

So, it’s an absolutely perfect combination, right?

Well, not really. Ignoring the high annual fee for the Schwab card, there are problems with using the Blue Business Plus as your everywhere else card:

- The Blue Business Plus caps 2X earnings at $50K per year.

- The Blue Business Plus charges foreign transaction fees.

- Both cards are Amex cards, which means they are often not accepted.

- Amex has bigger restrictions than other options when it comes to making credit card payments via Plastiq. This last point is especially important to me because, as a blogger, I’ve earned a very large amount of Fee Free Dollars from Plastiq (which means that I can pay bills by credit card without paying Plastiq’s 2.5% fee).

BOA Premium Rewards Card with Platinum Honors

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: With Platinum Honors status with Bank of America's Preferred Rewards program, earn: 3.5X travel and dining ✦ 2.625X everywhere else Base: 2.625% Travel: 3.5% Flights: 3.5% Hotels: 3.5% Dine: 3.5% |

Bank of America’s Premium Rewards Card is a gem… if you have $100K or more in investments with Bank of America and Merrill Edge. The $100K in investments (401K savings, in my case) gives you Platinum Honors status, which means you get a 75% bonus on card rewards for select BOA cards, including this one.

Yes the card has a $95 annual fee, but its annual $100 airline incidentals fee reimbursement makes up for it. Plus, with Platinum Honors status, this card offers unlimited 3.5% for travel and dining and 2.62% everywhere else. That’s an outstanding cash back rate. And this is a Visa card, so it is accepted nearly everywhere. And there are no foreign transaction fees.

The only thing missing here is the ability to transfer points to airline miles. If they ever add that feature (like I predicted they would), this card and Platinum Honors combination would be unbeatable.

Double Cash may be a good in-between

The Citi Double Cash Mastercard will soon gain the ability to convert rewards to Citi ThankYou points which will presumably be transferable to airline miles as long as you have either the Citi Premier or Prestige card. The latest rumor is that the conversion rate will be one to one (see: Citi is poised to rock our wallets again). If that happens, the Double Cash will be a strong contender for everyone’s “everywhere else” card.

Even with one to one transfers, the Double Cash isn’t a perfect “everywhere else” card. It does charge foreign transaction fees. And it may or may not have any purchase protections. And if cash back is your primary goal, you can do better with the other options discussed above (or with the 2.5% everywhere Alliant Visa card).

Still, the Double Cash is a Mastercard and is therefore accepted in far more places than Amex. And for Plastiq bill payments, Mastercard is more lenient even than Visa. And, of course, you don’t need to have $100K in investments with Citi to get a good rate of return.

Circling back to the point

I seem to have wandered off from the main point of this post. The main point is that if you have already earned a huge pile of points, you may do better earning cash back going forward — at least until your point balance dwindles a bit. That’s my current situation and it’s the reason I’m currently happy using a card that offers me at least 2.62% back on all spend.

On the other hand, if you haven’t yet built up a huge pile of transferable points, and if you want to spend your rewards on travel, I’d still recommend you focus your efforts on earning points rather than cash back.

Does Amex send you a 1099 for the schwab cash out.

Because I got a 1099 for the referral bonuses, if Amex sends out a 1099 for the Schwab Plat cash out, that would be double dipping fro Amex side

Thanks

Raghu

No, they won’t send a 1099 (they better not!)

[…] diversify your balances. But what if you already have enough miles for the trips you want to take? Greg from Frequent Miler writes about this situation and why he’s looking to cashback cards (but maybe you […]

A great use the B of A premium rewards card is paying federal income taxes. You can use the card on pay1040.com to pay your taxes or estimated payments – at a cost of 1.87% and get back 2.62% – giving you .75% cash for paying your taxes and delaying your due date by your credit cards billing cycle.

[…] Why I’m suddenly choosing cash over points, and why you shouldn’t […]

I think you should get Altitude Reserve into the picture. That’s 4.5% on everything in person. Add BofA Cash Rewards, and you’ll get 5.25% for online, albeit it’s limited to $2500 per quarter. Well, you may get a few of those.

Add another 2% cashback card for backup just in case.

I do use the Altitude Reserve for mobile wallet payments. Cash Rewards is a good add-on suggestion.

How is this better than 3% (or 4.5%) on almost everything with Samsung Pay and the Altitude Reserve?

I own a travel agency, put all airfare on amex plat with 5x and can redeem through schwab at 1.25cpm=6% or higher, giving me a much higher ROI. I also bank with BOFA and can probably earn 2.62% on all non-airfare/hotesl expenditures (excluding citi prestige 3x on airfare/dining). Would you recommend this?

Yes, that would be a winning combo

Most of my spend is online where I can’t get 3X with Altitude Reserve. I do use Altitude Reserve for most in-person spend (except when I have other cards that offer better than 4.5% back for certain categories of spend)

In this case you better off with BOA Cash Rewards Card, which gives 3% for online purchases with no relationship at all with BOA, and with your kind of relationship with them you’ll get a whopping 5.25% on online purchases

That’s a really great point. Do you know if things like Plastiq and fed taxes count as “online”?

They do exclude certain classes of “merchants” from the online shopping category, one of which is taxes. you can see the entire list of exclusions here:

https://www.bankofamerica.com/credit-cards/products/cash-back-credit-card/cash-back-category-choices/

Very smart. Risk of devaluation+ opportunity cost of money that would have been invested all pushes me to maintain a rather modest balance.

I think the ideal points balance and points earning rate is one that’s merely sufficient to cover the most expensive, “good” redemption flight or stay you’d intend to take whether or not you had the points, erring downward if uncertain. It’s abstract and hard to pin down exactly, but for me, if I’ve got enough for two business class round trips to Asia, probably worth pushing excess earnings into cash

Yep. I’m at 1 million MR/UR/AA. Working up a Hilton stash but I am shifting to cash.

In my Credit Cards > Cash Back Cards section I list 9 2% cash back cards and 2 3% cards, the later with upper limits. My favorite, the one I use regularly, is the one from State Department Federal Credit Union, as it has no foreign transaction fees. I have used it successfully in England and Iceland.

Obviously the big thing to get are the sign up bonuses, after that some of the points generating cards aren’t worth the annual fee unless you are either a fairly good sized spender and/or manufacture spending. If you have a business you can generate some healthy point totals. I used to talk with a guy who had a couple of businesses and would put all his spend on his Amex card (I never said he was good in the points game) and has something like 30 million points. The rest of us can’t do that.

I have some points but unfortunately not in the places I’d like. I probably have 600,000+ on AA/BA which I wish were in Chase or Amex. Due to my low spending habits (single person doesn’t buy many groceries) I’m moving to some of the cash back cards. If I can get 6% cash back for a $95 annual fee that is much better than spending $200+ on a card that gives me 3% in points.

I keep my CSR card since the travel bonus is easy to use (unlike the Amex airline credit) and the 3% on restaurants is used frequently.

As long as I can get a couple business class tickets to Europe every year or every other year, I’m happy. I don’t wish to spend a lot of time traveling.

Good luck.

When P5 doesn’t travel so much anymore – and can’t keep up as well with getting new cards….

Yup, been doing mostly cashback for years. >8 figure points balance spread across multiple programs. Dabble in specialty programs, mainly for status on a few select programs.

Maybe I should start a blog – would like a large stash of Plastiq fee-free dollars. Watch out Greg, I (might) be coming for ya!

Anybody else having a good time with the Zero card and the carbon status?

The terms seem to specifically call out any and all MS. How are you using?

I don’t MS because there aren’t opportunities that I know of any more. But mortgage payments through Plastiq or income/property taxes are all good uses for the card. With fees up to 2.5%, it’s a no brainer to use Zero and pocket the cb difference.

Also element to factor in when already sitting on large stash of points is the opportunity costs when choosing which balance to accumulate more of. Points devalue generally while that balance sits, while a cashback even put into a super conservative investment like a CD or T-Bills will at least minimally appreciate over inflation. Assuming a miles&points person is at least market-index fund level of risk appetite and that ~2-3% spread of optimal points over cash-back can be covered fairly easily in short order.

Cheese and crackers people! How do you build up such balances (2.5M UR!). I assume Greg hits all his referral bonuses, but the rest of you? I thought I was sitting pretty at 300k UR. Do you all spend that much naturally? And if it’s via MS, that’s a pretty big up front cost associated with generating that many points….is that up front cost really worth it?

Same question here! I’m curious!

I always assumed it was because they were in a position to generate them easily such as a consultant, run their own business, or event planner. Otherwise I’m not sure tbh.

I’m also quite curious about this. For my humble spending habits, there’s no way I generate points faster than I can use them. In fact, I actually have to save enough for quite a while before enjoying a decent redemption.

Simon Malls isn’t the cheapest way to generate points — but even if you’re only earning 1 point per dollar on Simon Mall purchases, that means your points are costing you less than half a cent each after activation and liquidation costs. Every 100K points then costs you $500 to generate. If you’re earning 1.5x on those purchases (like with a Freedom Unlimited), your cost per point is under a third of a penny per point, so that 100K now costs you $330 to generate. If you then redeem those 100K points for a statement credit at $0.01 each, you’ve got a thousand bucks. If you use them towards travel at 1.5c each, you’ve got $1500 in travel. If you strategically transfer them to partners to fly up front and/or for free valuable hotel nights, then yes I would say it is well worth it.

And again, that’s just based on Simon purchases. There are also many cheaper ways to generate those points — fee-free VGC office supply store promos, and grocery store VGCs with the Amex Gold just to name two. Those aren’t the only ones. Opportunities come and go for cheap MS, but they do come around.

I’m not telling you that you should do it — but rather answering your question as to whether or not the up front cost is worth it. Yes.

Ben

Greg and the wife spend $1/2 m on the cards every year read all his posts .So even if something doesn’t work so what . I have about 300k points (modest) left But I can use them all so set for Air travel till like 2/2023 .But Hotels ????

Cheers