Pop quiz: when was the last time we talked about ways to increase credit card spend and get most of it back on our podcast? You’ll have to listen to this week’s Frequent Miler on the Air to find out, but the short story is that it was nice to discuss ways to turbocharge your earnings by increasing your spend without incurring much cost. That makes it possible to earn big new credit card bonuses and to leverage category bonuses to maximum benefit.

Pop quiz: when was the last time we talked about ways to increase credit card spend and get most of it back on our podcast? You’ll have to listen to this week’s Frequent Miler on the Air to find out, but the short story is that it was nice to discuss ways to turbocharge your earnings by increasing your spend without incurring much cost. That makes it possible to earn big new credit card bonuses and to leverage category bonuses to maximum benefit.

Elsewhere on the blog this week, we cover Marriott’s bird bath, the portal that’s pricing Rakuten out of my rotation, and a lot more. Watch, listen, or read on for more of this week at Frequent Miler.

1:41 Announcements. Tim Goes Full Time

3:10 Monthly Ask Us Anything 5:42 See Nick live at FTU Washington DC

13:02 Card Talk: Amex Bonvoy Brilliant Card

23:36 Award Talk -Marriott now allows online point transfers

25:38 Helping Maisie book a last-minute business class award to Europe

29:03 Using a soon-expiring IHG Free Night Certificate

32:49 Spirit Status Challenge Update

41:23: Main Event: 13 Ways to increase credit card spend (and get most of it back)

41:41 #1: Don’t take “No credit cards” at face value

43:50 #2 Pay your taxes

45:42 #3 Pay bills that don’t ordinarily accept a credit card with services like Plastiq and Melio

48:05 #4 Fund college savings or pay student loans

50:14 #5 Make loans through Kiva

55:08 #6 Coordinate events with friends 55:54 #7 Pay bills for friends or family

57:06 #8 Fund new bank accounts

1:00:28 #9 Buy and sell merchandise

1:03:53 #10 Buy and sell gift cards

1:07:27 #11 Buy Visa and Mastercard Gift Cards

1:13:07 #12 Reload reloadable cards

1:16:32 #13 Gambling on riskier business

1:23:31 Question of the Week: How can I use the Hilton Aspire $250 resort credit without staying at a resort?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Greg’s Top Picks for April

Wondering about the latest and greatest offers? Our Best Offers page lists all the best offers as objectively as possible, but in Greg’s Top Picks, he offers his subjective analysis of what’s hot and why.

Shifting shopping portal habits (On Nick’s Mind)

I love a big shopping portal payout as much as anyone and for most of the past few years, Rakuten was my go-to portal for increased payouts thanks to the ability to earn the rewards in the form of Membership Rewards points. However, choosing to earn Membership Rewards points comes at the cost of the opportunity to instead earn cash back — and with the amazing rates we’ve seen lately from a competitor, the cost of earning Membership Rewards points has priced me out of earning with Rakuten for now.

Marriott’s 2023 “Devaluation”: Much Better Than Expected

If you were preparing for the worst with Marriott’s change to all-dynamic pricing, you may have prepared prematurely. Stephen collected a whole bunch of data weeks before the devaluation so that he could compare the before and after and it turns out that the changes weren’t as bad as you may have expected. It’s not all rainbows and sunshine, but there is probably more sunshine than you expected (so far).

What are Marriott Bonvoy points worth?

Stephen’s post about the devaluation mostly centered on the changes in points costs, but how do those “devalued” amounts compare to cash costs? Greg found that not much has changed at all in terms of the value of each point. That’s pretty good news when you consider the fact that many hotels have decreased in points cost. Personally, I’ll keep my aim of using Marriott points for at least 1 cent per point and it sounds like that should be pretty doable.

Shortcuts to Marriott Elite status

Now that we’ve found that the Marriott devaluation isn’t as bad as we’d feared (so far), you may be tempted to hop back on the elite status hamster wheel. However, you don’t really want to spend 50 or 75 nights in Marriott hotels, do you? If you’re looking for shortcuts to get status with head in fewer beds, this post has you covered.

Don’t try to cut your steak with a butter knife

Some credit card benefits are very straightforward and easy to use and others have more limited scope than you might like them to have, but success often relies on identifying the right tool for the job — or perhaps which jobs best suit the tools you have in your kit. This post has my tips about the best ways to use a bunch of different key credit card benefits.

No joke: Tim goes full time at Frequent Miler

After a little over a year writing part time at Frequent Miler, Tim started full time this past week and I am excited about it. As Greg mentions in the post, the entire team was in enthusiastic agreement with the decision to bring Tim on board and none of us have regretted the decision for a second. Personally, I am very excited for readers to get to know Tim’s personality. I can’t lie, he’s a funny guy — and I look forward to readers getting to know his sense of humor — and getting to more about miles and points in the process.

Marriott Bonvoy Brilliant Guide and Review

The Bonvoy Brilliant card doesn’t particularly interest me. The $650 price tag and monthly dining credit just don’t excite me much. The automatic Platinum elite status could certainly make the card worthwhile for someone who has high-end Marriott stays planned and won’t otherwise make the cut for Platinum status, though I’m otherwise pretty lukewarm on this card.

Platinum Card Now Available With Physical Coupon Book + New Benefits

Tim isn’t the only member of the team with a great sense of humor. Stephen’s April Fool’s Day post about the Amex Platinum card had many readers laughing out loud. If you want to mentally turn the clock back to April 1st for a moment, enjoy this post.

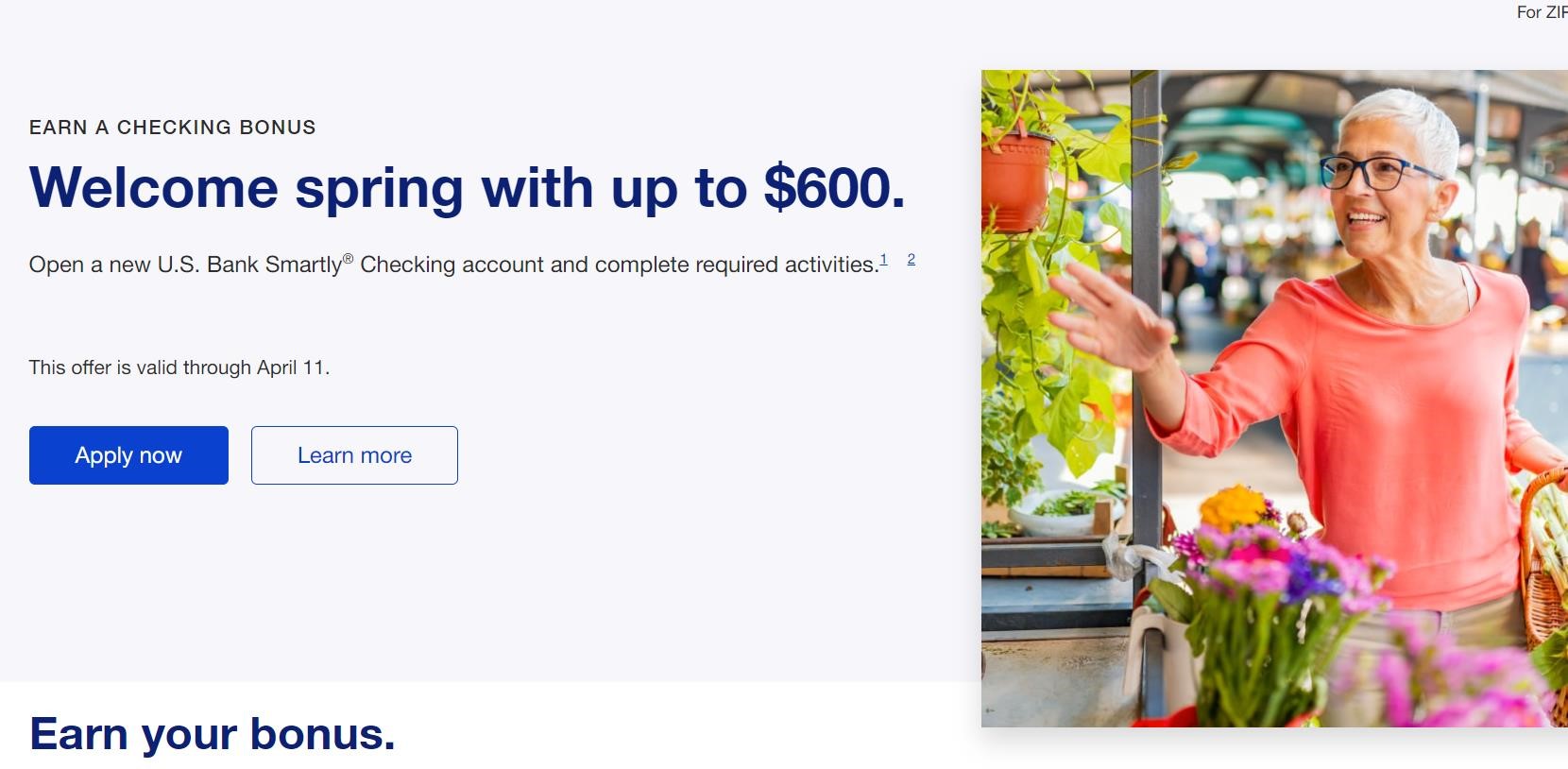

US Bank: Up to a $600 Bonus When Opening a New Checking Account (Can Fund with Credit Card)

I’m including this Quick Deal post in this week-in-review specifically because we called it out in the main event on the podcast in our discussion about ways to to generate spend and get most of it back. This account could potentially be a good way to knock out a new card welcome bonus in your pajamas — and add an extra six hundred bucks on top.

Come see Nick at FTU Signature Washington DC on 5/6/23

Calling all points and miles enthusiasts! Frequent Traveler University is back in Washington, DC next month and I’ll be speaking (That’s Nick — Greg won’t be able to make it unfortunately). If you’re interested in attending, get your ticket now and please do come up and say hi as I love to meet readers.

Keep your eyes out for this week’s last chance deals so you can get them while they’re still here.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

Nick, do you tend to do multiple swipes at a location for one MO (probably using $200 vgcs from staples)? If so, do they know you’re using gift cards? I can never get myself to ask about doing multiple swipes because I feel like it will be such a red flag. As it is, my heart is already racing and my palms are all sweaty, so I rarely get a MO these days since I’m just converting $200 at a time. I’m curious how you got to a place where you comfortably walk into an establishment and do lots of swipes. Do you try to get to know the employees, etc? Any thoughts appreciated. Thanks!

Greg touched on this for a moment, but my wife keeps the Brilliant card because we now think of it as getting an 85k and a 40k cert (for the choice benefit at titanium status). Nick mentioned that keeping the Ritz/Boundless card and the Business card gets someone to 30 nights, so if you just stay 20 nights you get platinum status. However, if you stay 25 nights you could get to titanium status if you have the Brilliant card and business card (and apply the 50 night benefit of 5 elite nights), which would give a 40k certificate as a choice benefit. I think a lot of people should consider this. If you were going to stay for 20 nights to get to platinum status, it’s pretty likely you’d get to 25 nights too (which is generally the case for my wife). Matching to United silver status has also come in handy from time to time.

I’m bad at math. You would need to stay 30 nights, not 25. Still, the point stands that anyone who thinks they will get to 30 nights could have extra incentive to own the Brilliant card.

Feel like I’m watching an old timey episode with Darius.

Another idea regarding Gift of College:

You can buy gcs worth up to $200 on their website for a 3% fee. You can also make a direct contribution with a credit card for up to $500. The fee is 5%, with a max of $15 (so if you contribute $500, it’s a 3% effective fee). Clearly a $500 in-store GoC gift card with a $5.95 fee is superior, but they’re not sold within 1,000 of me in Sothern CA, so not an option.

Not the cheapest route, but as easy as it gets if you’re contributing to a 529 anyway. GoC also takes Amex.

No Lucky in SoCal anymore? If not, Bay Area is less than 1000 miles away. Just FYI.

I stand corrected.

Cheapest round-trip is about $90, and I would save $9 per $500 card. So break-even at $5,000 spend 🙂

Would be a highly productive diversion if I found myself running a United Mile Play promotion, for example.

Yep that makes sense. Also, Kroger sells them online up to $200 and you can earn fuel points when doing so.

https://frequentmiler.com/best-options-buying-gift-college-gift-cards/

Another concern regarding manufactured spending that is relevant for the first time in years: time value of money.

For years savings account interest rates were close to 0%. So it was worth “paying” a 1% default rate on Kiva loans rather than paying a 2.9% fee for Plastiq, even if Kiva took 6 months to payback.

Currently you can get 5% on savings accounts. So Kiva costs about 1% default rate + 2.5% lost interest = 3.5%. Plastiq lets you pay a bill a month later than if you paid from a bank account, so the money can sit in your account longer and the effective fee is slightly lower than 2.9%.

Plus to me the short-term options are much easier — less to think about and keep track of long-term.

I just went through most of the application process for the US Bank Smartly account and there is indeed an option to fund the account using a credit, debit, or PREPAID card. What’s the highest prepaid card I can buy with a credit card and where can I get it? Even 1k would help me greatly to reach the 5k spend.

$1K is the highest I’ve seen, from Simon Mall.

But if you’re going for min spend, why not just use the credit card itself?

Regarding the US Bank Smartly Checking account from your podcast today, I need 5k spend for my recently arrived Chase British Airways Visa to get the 75k points, will it work to use it for the initial deposit of say $2000? I’m worried that it will code as a cash advance. Is there any way to find out before proceeding(other than calling Chase)?

Google “doctor of credit bank accounts that can be funded with a credit card.” Seems like US Bank used to allow CC funding, stopped at some point, and recently resumed with this account. So the data points are old. However there are no data points of Chase cards categorizing US Bank account deposits as cash advance.

I saw a blog post somewhere else that I should just call Chase and lower the cash advance amount to $0 and then if it is classified as a cash advance the transaction would be declined. I was wondering though if it went through would it still could towards the 5k spend I need on the card.

That works. You can also secure message Chase on the website. If it goes through, yes it will count towards the min spend.

I can’t think of ever hearing a report about a specific type of purchase not counting towards minimum spending requirement. I have funded plenty of new bank accounts with Chase cards and never had an issue. Chase may not allow you to set the cash advance limit to zero – they may insist on a cash advance limit of $500. Same effect here – it’ll mean that a $3K cash advance won’t go through. If it goes through, it’s coding as a purchase and will count towards the spending requirement.

I should note that if you call Chase and explain to a rep what you’re doing, they’re going to tell you that it won’t count because they will logically assume that it won’t. That answer will be based on their understanding of the way things are written, not on real world experience. So I wouldn’t recommend asking Chase – their answer is easily predictable (and predictably incorrect in this case).

Nick: I think your comment is specific to Chase? I believe Amex has been known to not count purchases such as gift cards towards signup bonuses?

Yes, I mean specifically with hard to Chase as that’s what you’re asking about. Thanks for asking to clarify.

Nick, You are right about the cash advance limit although the rep I talked to told me it’s a percentage of your total credit(like 5% I think). I did an amount somewhat less than the $3000 max for the US Bank account and it was accepted. Thanks for all the advice.

Regarding the Brilliant, if someone earns a second 85k FNC via spending, can a person use two FNCs on a single stay?

Yes, of course. You can use as many free night certificates as you have.

To be clear, you can’t combine them for a single night (like you can’t put two 85K certs together to cover a room that costs 150K), but you can use them to cover two consecutive nights so long as the nights have availability.

Thanks.

Also, let’s say a standard room goes for 85k and a suite goes for 85k + $X. Can the FNC be used for the suite?

Nope. Only a standard room.

Understood. Thanks.