The newly revamped AAdvantage Loyalty Points program seems to be designed with an eye toward gamification. Gone are the days when George Clooney’s character from Up in the Air was the ideal of an airline’s best customer because this new program values those of us who earn miles without flying. Listen in to hear us discuss our takeaways form this week’s AAdvantage announcement — and a lot more.

Elsewhere on the blog this week, scroll on to read about why you should be applying for cards with calendar-based benefits right now, how Capital One is caring for Greg’s mental health by simplifying his wallet, and a lot more.

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Sweeping changes at American Airlines: Is the program more AAdvantageous than before?

American Airlines has announced some big changes coming when the new loyalty year begins on March 1, 2023. Choice benefits will no longer be tied to status but rather Loyalty Points and the big trade here is that you’ll no longer need to fly any segments on American Airlines to receive a choice benefit like 2 systemwide upgrades, but you will need to earn an additional 50,000 Loyalty Points beyond the Platinum Pro status threshold. Personally, I find it far easier to go after an additional 50K Loyalty Points than 30 segments, so I’m excited to see this change — but I note in the post that I can certainly understand the frustration of folks like George Clooney’s character in Up in the Air. Frankly though, this makes sense: American’s most profitable customers are the ones helping it sell the most miles to banks and shopping portals and other entities, so it makes sense that they want to reward and encourage more of that behavior.

Remember, December is a great time for cards with calendar year benefits

There’s no doubt about it: December is the time to apply for cards with calendar year benefits thanks to a triple dip. The short story is this: open a card in December that has a calendar year benefit like an airline fee credit and use that fee credit for 2022 before the end of this month, again in 2023, and likely a third time in January 2024 before your second annual fee is due (at which point you can downgrade or cancel if you don’t want to keep the card). That move can add significant value to a new card application this month — like the Business Platinum cards my wife and I recently opened. We’ll each get an extra $200 Dell credit, $200 airline incidental credit, and $10 in wireless credit beyond the max we could get opening in any other month of the year. That’s on top of the great targeted bonus for a lot of points.

PSA: Remember to enroll in Platinum card benefits

If like me you recently opened a Platinum card for that triple dip described above (whether business or personal), don’t forget to enroll before using benefits. Many of the credits require enrollment, so before you go putting your wireless bill or making a Dell purchase on that shiny new Business Platinum card or spending money at Saks with your personal Platinum (etc), make sure you enroll to be eligible for the credits. Also, be sure to choose your airline now — we sometimes hear data points from people who selected their airline only an hour before making a charge who don’t end up getting the credit, so you’ll want to make sure you choose your airline a day before making associated charges if possible. And don’t leave it to the last minute — one year, a 12/31 charge I made at United posted with a purchase date of 1/1 and not only did I miss out on the $200 airline fee credit for the previous year, but I used up the new year credit on day 1.

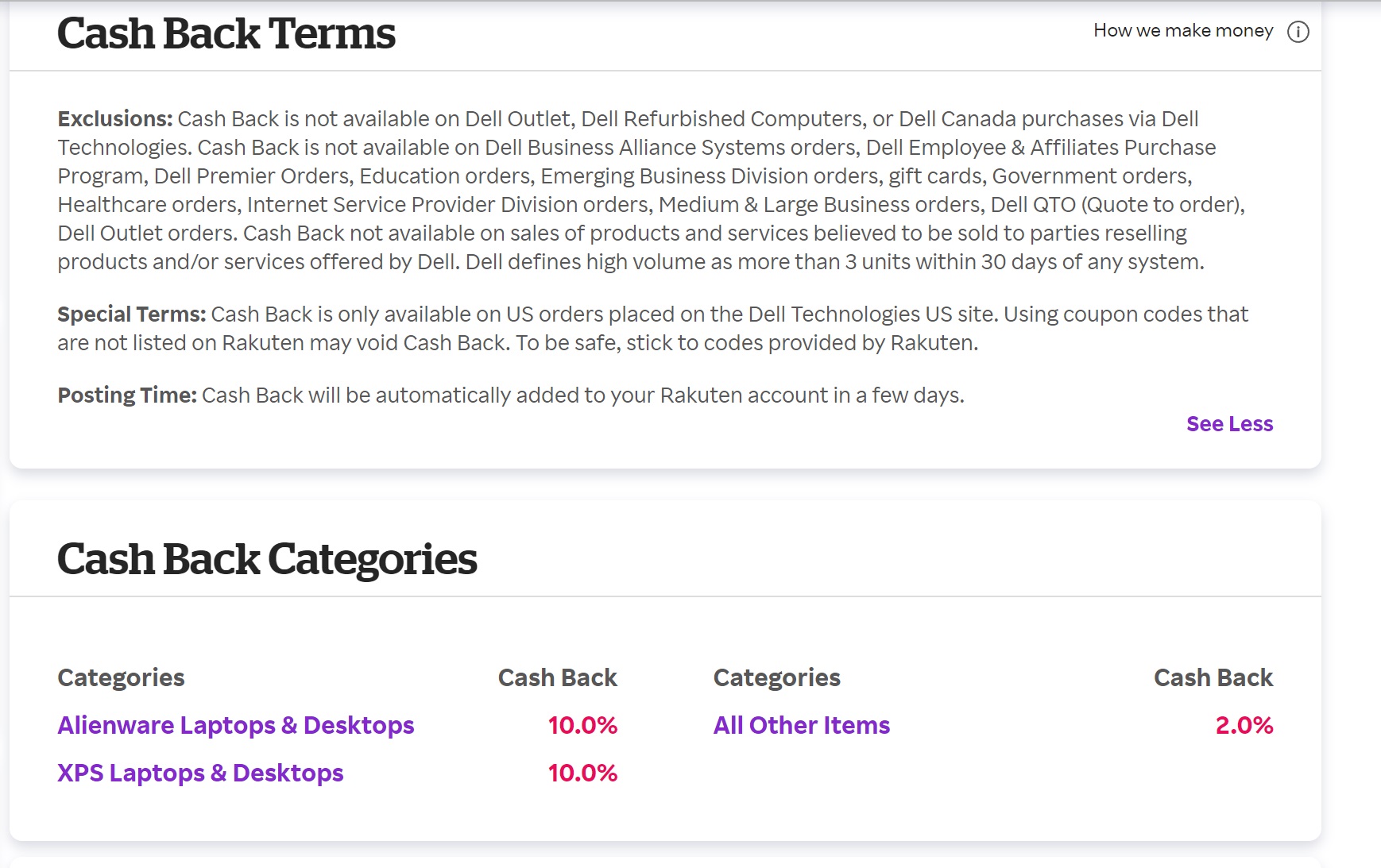

Caution: Dell portal payouts now split (high payouts only for computers)

Now that you’ve enrolled in the Dell benefit on the Business Platinum card, don’t go rush-clicking through any old shopping portal en route to order something like those Bose headphones we wrote about: some portals are now showing a split payout where the headline rate is only for Alienware and XPS computers and all other purchases will earn a lower return. Readers tell me this started mid-November and then around Black Friday / Cyber Monday Dell was showing a single payout for all items before splitting into separate payout levels again shortly thereafter. In other words, you may just end up stuck with a lower payout this time around, but in the future keep your eye out for major sales periods (like Black Friday / Cyber Monday and maybe things like President’s Day sales, Memorial Day sales, etc, to see if Dell goes back to a unified and increased payout as that’ll be the time to use up your credits).

Capital One shut me down… Again

I know that Greg has mentioned now and then that he doesn’t go after checking account bonuses because he wants to simplify his financial life and that it just isn’t worth the mental energy trying to juggle different requirements. Maybe Capital One is just looking out for Greg’s mental health, because they sure do seem to want to simplify what’s in his wallet by making it extra clear that their card(s) aren’t welcome there. I could almost hear Samuel L. Jackson reading the letter they sent his wife and then looking at Greg with intensity and slowly enunciating, “What’s not in your wallet?”. I think the message got through, but it sure is crazy that Capital One has no mechanism to review decisions that could be costing them a shot at a good customer.

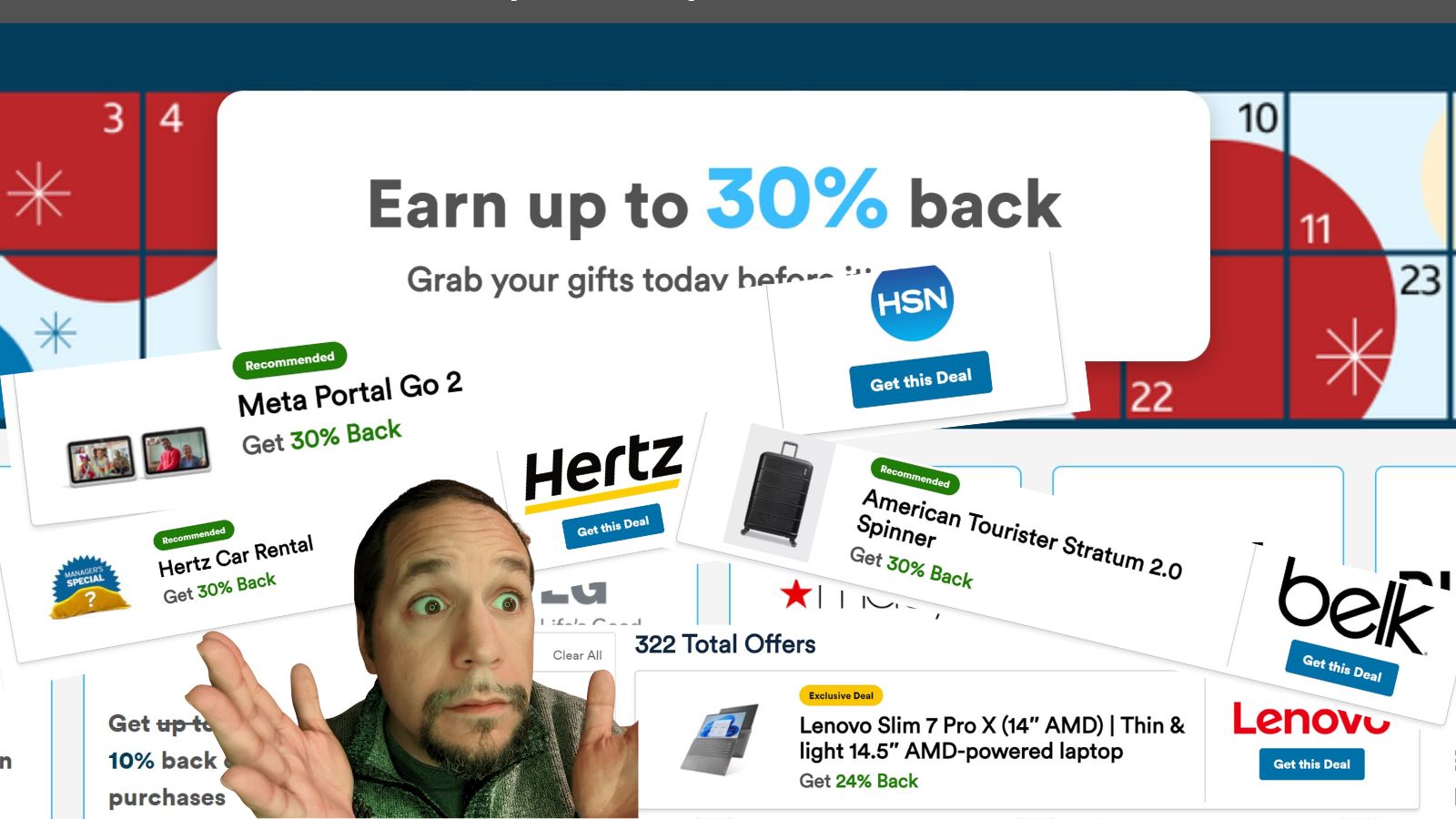

Excellent Capital One Shopping offers: 30% back at Hertz, Belk, HSN, and more (maybe targeted, but maybe not?)

Luckily for Greg, he doesn’t need a Capital One account to take advantage of the insane Capital One Shopping offers. I don’t usually include Quick Deal posts in our week in review, but I included this one hoping you’d read at least that first sentence and stop missing out. Almost every day I find a new reader who didn’t know that you don’t need a Capital One account to get these crazy cash back rates and I know there must be many others scrolling past the headlines. Stop sleeping on Capital One Shopping. Greg doesn’t have a Capital One account and he uses Capital One Shopping. You should, too. In my household, this week’s offers have saved Santa a lot of money.

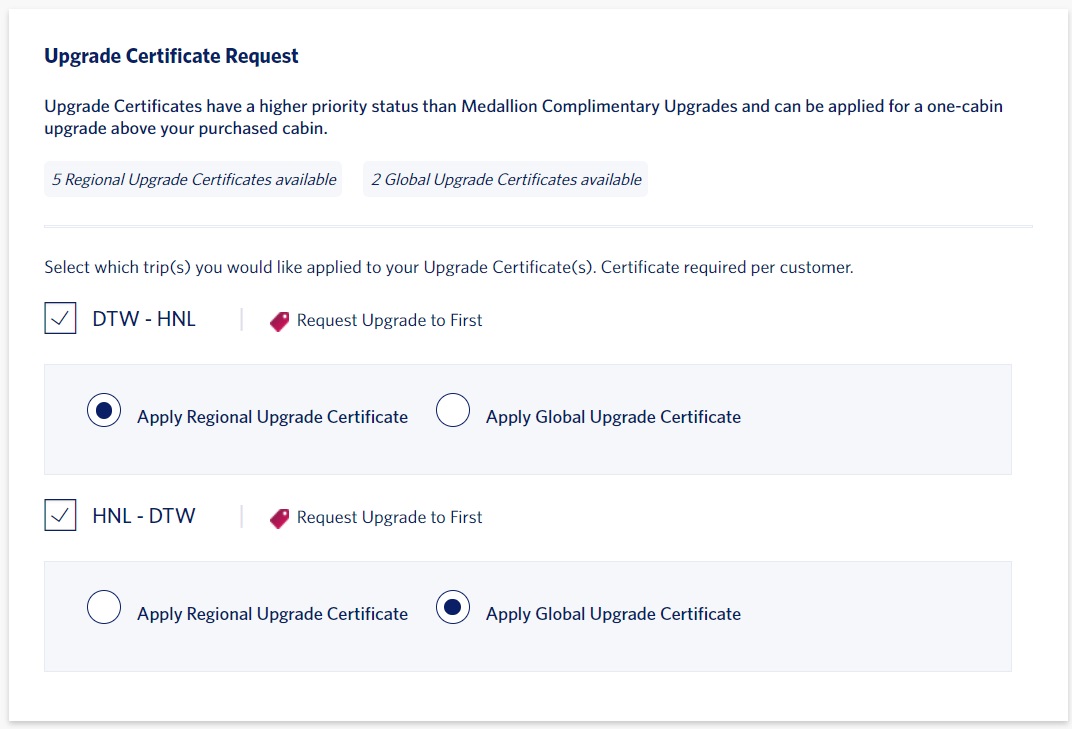

Apply Delta Upgrade Certificates Online

Delta sure has improved the process for applying upgrade certificates in the relatively short time since we ran our GUC Challenge. Unfortunately, they’ve also devalued them pretty significantly. ‘m glad to see a customer-friendly change in the ability to (at least potentially) avoid an hour or more on the phone (and potentially multiple times), but overall my enthusiasm for Delta GUCs is weak.

Booking a Turkish Miles & Smiles award for a friend

I had heard from readers in the past that they had difficulty booking tickets for friends via the Turkish Miles & Smiles website, so I was excited when I was able to pull off a booking for friends (who are traveling without me) for travel on Turkish-operated flights. I published the process I used to be able to make this work, but a number of readers insisted that they are still unable to do the same thing. I don’t know how or why the system would treat my account differently (before you yell “because you’re a blogger!” at your computer screen, scroll up a few articles and read that post about Greg’s blogger treatment from Capital One), but it seems that maybe this isn’t possible for everyone. Regardless, the fact that it worked for me means the website does have the capability built into it — I’d like to see this become far easier though.

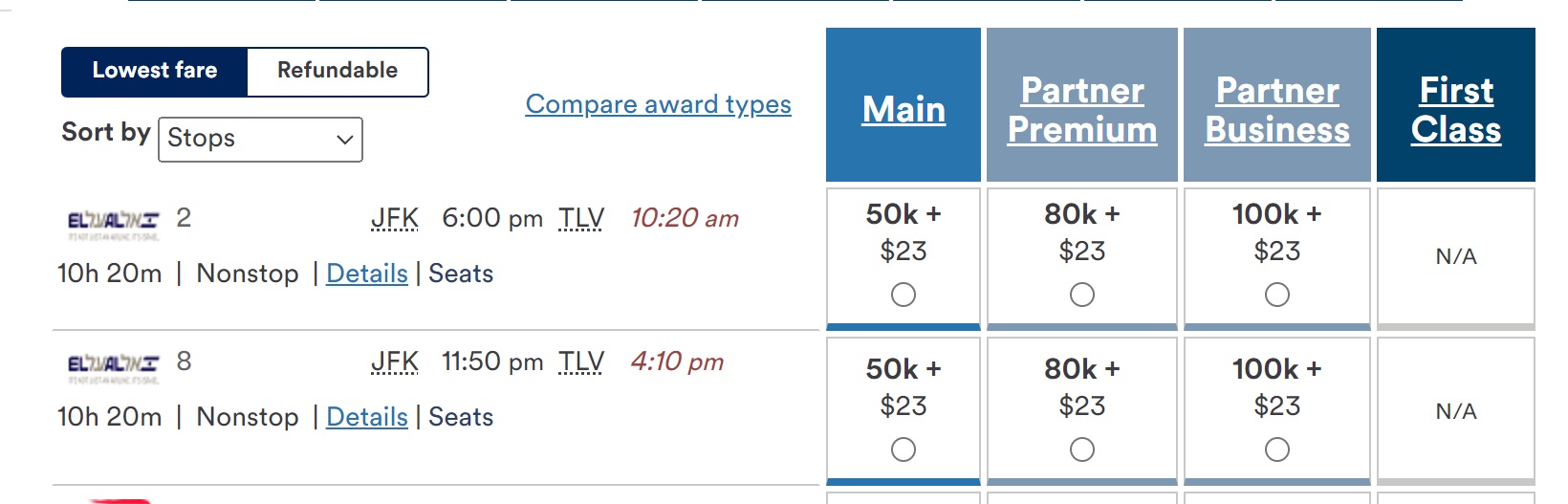

Book El Al with Alaska miles online, access expanded space

You can now book El Al flights with Alaska miles online, which will make it a bit easier for those looking to book awards to/from Israel. Unfortunately, redemption rates for El Al flights via Alaska are nowhere near as good as booking via Qantas. However, Alaska appears to have access to more availability than Qantas, so this may still be a good option during periods of high demand.

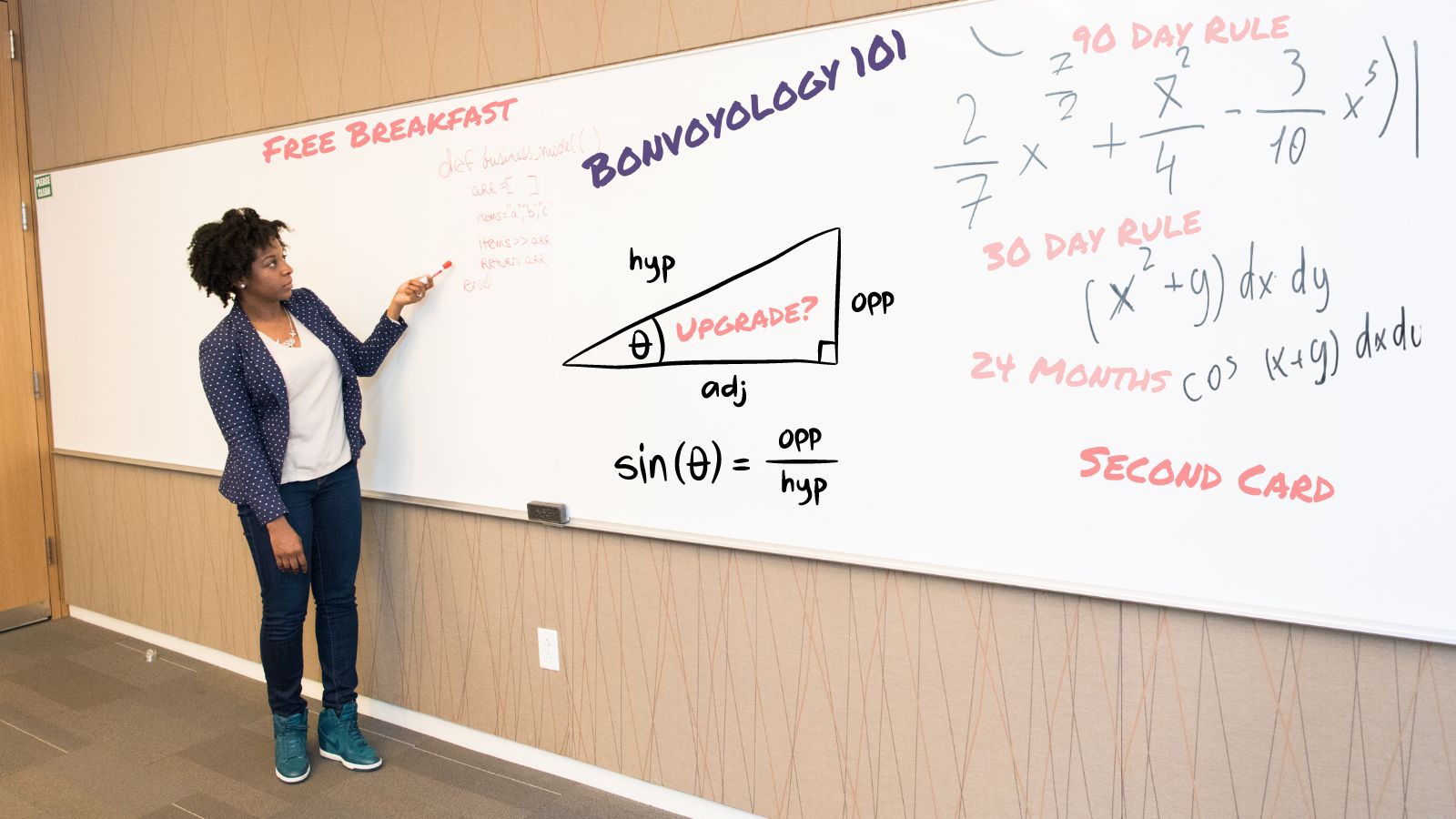

Bonvoyology: Mastering Marriott’s Mysteries

Greg has updated this post about Marriott’s many mysteries with the mystifying fact that you can’t use a Marriott free night certificate even when it would cover the cost of the room if the room available is an upgraded room rather than a standard room. This is really annoying: I sure wish Marriott would just make the certificates work in that scenario.

Would you return to Necker Island? | Ask Us Anything, Ep 50

We hosted our monthly Ask Us Anything live on YouTube last week. Check out Carrie’s recap and the replay if you’re interested in hearing us field questions that came from other readers live and in the moment.

What are Marriott points worth?

Greg recently updated his methodology for figuring the value of points for hotel programs, so this Marriott post is the latest update using the new tweaks. As he discussed on the podcast this week, Greg had expected that the value of Marriott points would decrease given the fact that he’s now considering resort fees (and the fact that Marriott still charges them on award stays), but hotel taxes are so high that the value of Marriott points increased just because of the new methodology. Read about the new method and our latest Reasonable Redemption Value for Marriott points in this post.

That’s it for this week at Frequent Miler. Don’t get lost in the holiday shuffle — keep your eye on our last chance deals post to make sure you don’t miss any of those deals ending this week.

![Viral marketing proves infectious for two more airlines, a new card lands with a thud and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/viral-airline-marketing-218x150.jpg)

Greg, I reflect on one person’s comment to another article some time back. If a person had every single credit card in existence and chose the value-maximizing card for every single purchase, that would establish a theoretical maximum attainable value (for any person). If the same person then selected only three of those cards based on the person’s specific spending pattern, the person would likely capture 90 to 95 percent of that theoretical maximum attainable value. Of course, each person’s three cards would be unique to oneself. Adding a fourth card might add another 2 to 4 percent. Adding cards after that provides diminishing returns.

So, I tried this concept in my own situation. In short, it came out to the 90 to 95 percent the person mentioned. As I considered each card, I focused on what its incremental value was to adding that specific card. What is this specific card giving me that I’m not receiving from any other card that I already have? Still, I’m tempted by this card or that card. So, I do the math. Invariably, I find that (given the spending level) if there is any incremental benefit, it might be (say) $100 or $200 per year. And, in the interest of a happy marriage, simplicity wins the day. Ha.

In the past, you’ve said that what you’re really after with Capital One is access to its platform. And, in spite of not being an authorized user, you do have access via your wife’s account. I’m not trying to afford you a sour grapes rationalization. I’m saying that Capital One likely provides no (meaningful) incremental value to your situation and, for reporting purposes, you have the access you need.

I hope this eases your frustration.

The thing is he mentioned that the main reason he wanted it was to access C1 lounges when traveling without his wife (neither of us has been to one yet and would want to go and take pictures / review it if we were in an airport with one). But he can’t do that unless his wife is with him. Obviously that’s not a huge deal, it’s just that his main reason for wanting it isn’t met with other cards. Your point makes sense otherwise.

So noted. Of course, you might crowd source images from your loyal base of readers. 🙂

Nick, small correction. The business platinum does not come with any Uber credit; only the personal platinum flavors do.

Whoops! You’re absolutelt right. Fixed.