With both the Amex Platinum and Sapphire Preferred welcome bonuses at all time highs, I decided that this would be a good time to update and re-publish this comparison of the Amex Platinum vs the Sapphire Reserve. Even though the Sapphire Reserve’s current bonus isn’t an all-time high, we often advise people to sign up for the Sapphire Preferred and later upgrade to the Reserve. For more about the current all-time-high bonuses, see these posts:

- Sapphire Bonuses up: 60K Reserve or 80K + $50 Preferred

- Sign up now for the Platinum 100K + 10X offer (here’s why)

For a comparison of the Amex Platinum vs the Sapphire Reserve, read on…

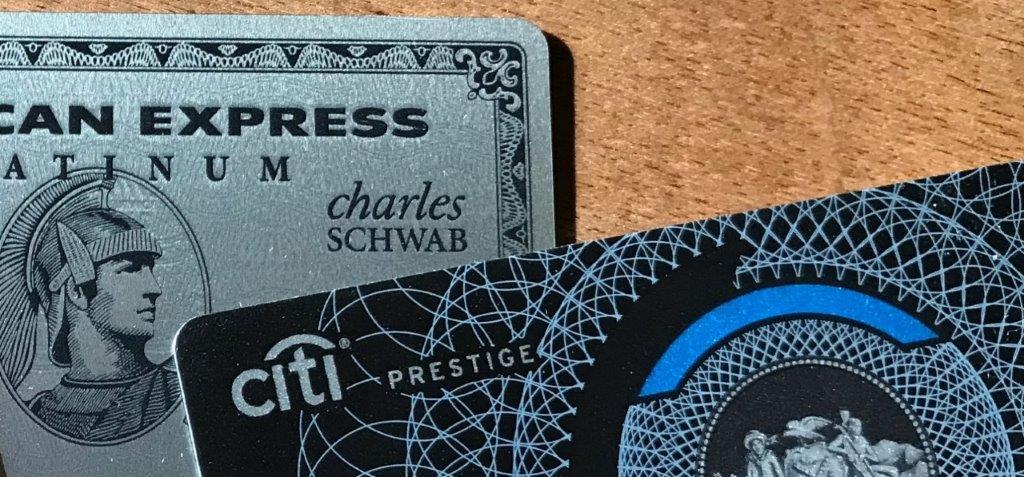

The Chase Sapphire Reserve card and the Amex Platinum card are probably the best known ultra-premium cards on the market. Both offer travel perks, including travel protections. Both cost $550 per year (since publication, the Amex Platinum card has increased its fee to $695). Which is better?

There’s no single answer to which card is better. They vary on a number of dimensions. For example, the Sapphire Reserve is arguably more rewarding for spend whereas the Platinum card offers better perks. On those dimensions and others, let’s compare head to head…

Before digging in, note that there are several “flavors” of Amex Platinum cards. For this post I’ve considered only the plain consumer Platinum card. For details about the others, see: Which is the best Amex Platinum card?

Fees: (Win: Chase)

Annual Fee: $695 Per Year Annual Fee: $695 Per YearAuthorized Users: $175 for 3 |

Annual Fee: $550 Per Year Annual Fee: $550 Per YearAuthorized Users: $75 Each |

Verdict: Since Amex increased its annual fee to $695, Chase has the obvious advantage here.

Statement Credits (Win: Amex)

|

|

Amex offers an almost unbelievable number of credits totaling over $1400 per year. In practice, though, few people are likely to use even half of these very specific rebates whereas Chase’s rebates are much easier to earn. That said, even if you only use half of Amex’s rebates, you’ll come out ahead of the card’s annual fee.

Another area where Amex shines compared to Chase is with Amex Offers. It’s hard to quantify these because they come and go, but Amex seems to be much more likely to have much more valuable offers.

Verdict: Amex for the win.

Rewards for Spend (Win: Chase)

|

|

Chase’s travel & dining categories are way broader than Amex’s 5X options. My bet is that most people will earn more points with the Chase Sapphire Reserve.

Verdict: Chase for the win.

Value of Rewards (Win: Chase*)

|

|

The Amex Platinum card earns Membership Rewards points and the Chase Sapphire Reserve card earns Ultimate Rewards points. Both are transferable points programs. Amex arguably has the edge by supporting more valuable airline transfer partners, but Chase supports a fantastic 1 to 1 hotel transfer partner: Hyatt. Further, Chase has the edge in making it easy to use points for 1.5 cents value towards any travel purchased through Ultimate Rewards and through Chase’s Pay Yourself Back feature. With Amex, you need to have additional cards in order to get better than 1 cent per point value when purchasing travel. For example, it’s possible to get approximately 1.5 cents per point value towards certain airfare with the Business Platinum card.

Verdict: Chase for the win*

* This result requires an asterisk: If you primarily use points to transfer to airline programs to book international business or first class awards then Amex has a big edge over Chase thanks to supporting valuable programs like ANA, Air Canada, Avianca, Cathay Pacific, and Etihad.

Lounge Access (Win: Amex)

* Beginning 2/1/2023, Amex will charge for guests. |

|

The Platinum card has far superior airport lounge access privileges than the Sapphire Reserve. It’s unfortunate, though, that the Amex version of Priority Pass doesn’t include Priority Pass restaurants.

Verdict: Amex for the win

Elite Status & Memberships (Win: Amex)

|

|

Verdict: Amex for the win

Travel Protections (Win: Chase)

|

|

Amex offers better emergency evacuation coverage since there’s no stated limit. On all other protections, Chase is equal or better (at least on paper). See this post for more details: Ultra-Premium Credit Card Travel Insurance.

Verdict: Chase for the win

Purchase Protections (Tie)

|

|

Both cards offer decent purchase protections. On paper, the Sapphire Reserve looks slightly better because it offers 120 days of purchase protection vs. 90 with Amex, and it offers up to $500 per claim for return protection vs $300 with Amex. That said, I’ve heard great things about how easy Amex is to deal with for these things and so that alone could push Amex ahead. See, for example, this post from our own Nick Reyes: Amex Purchase Protection to the rescue. Even though Chase looks better on paper, I think that Amex’s known excellent customer support in this area makes Amex at least even…

See also: Best Credit Card Purchase Protections

Verdict: Tie

Summary: Platinum vs Sapphire Reserve

- Annual Fees: Chase

- Statement Credits: Amex

- Rewards for Spend: Chase

- Value of Rewards: Chase (but Amex wins for those who primarily book international premium cabin awards)

- Lounge Access Benefits: Amex

- Elite Status: Amex

- Travel Protections: Chase

- Purchase Protections: Tie

Overall, in my opinion, the better card depends upon what you value most….

- Pick the Amex Platinum card if you highly value airport lounge access, hotel and car rental elite status, and international premium cabin awards.

- Pick the Chase Sapphire Reserve card if you highly value rewards earned from spend and automatic travel protections.

To dig deeper into each of these cards, please see:

Comparing to other cards

This post was specifically designed to compare the Chase Sapphire Reserve and Amex Platinum cards. If you’re interested in looking more broadly at which cards are worth their annual fees, please see: Which Ultra Premium Cards are Keepers?

Amex Platinum gives many wonderful Amex offers throughout the year compared to chase offers

I break the main benefit of each down to airline tickets/AMEX or hotel/CSR. 5x v 3x earning on ticket purchases is a clear AMEX advantage, but transferring to Hyatt v AMEX hotel partners makes the CSR more valuable, per point.

Redemptions for hotels on the AMEX travel portal only nets 0.7 cents per point vs more than twice that with the CSR. Flight redemptions also only net .01 on AMEX vs .015 on Chase.

Left out can also earn 5x with AMEX by booking hotels on their travel portal. The only times I personally do that (with AMEX or Chase), though, are for indie, boutique properties since I can’t earn loyalty points/bonuses/upgrades/freebies by booking that way. And since it’s easier for me to accumulate points with Chase with 3x on ALL travel, I have more points to redeem on their travel portal than I even would with AMEX.

[…] shenanigans, when it comes down to which premium travel rewards you get, my advice is to go for the Chase Sapphire Reserve instead of the Amex Platinum in most cases. But of course your circumstances may be different. This is why there is never an […]

I think that the Elite status for rentals/hotels is negligible.

Marriott gold is marginally better than silver (SPG/Ritz SPG/Ritz pre-merger was a different story).

Hilton gold does offer breakfast and minor upgrade (but Hilton Aspire is a better bang for AF AF buck for premium card and offers Diamond status -yes the is a PT vs CSR shoot out).

Rentals

– Both also offer Avis Preferred plus (comp one class upgrade when available). I’ve found Avis a better deal over National/Emerald pricing and more global locations.

While I’ve recently shifted toward collecting MR over UR’s – both have sweet spots for transfer partners. But we did ditch the Plat card last renewal.

The simple fact that the $200 airline credit of Amex Platinum is so hard to spend (I often have free checked-in luggage thanks to my airline credit cards) makes me shun from it.

Good review but a couple of other points. I have the Bus. Plat. and CSR, called the ABS and CSR. I travel with my wife 95% of the time. Each time I get to the Delta lounge, oh, I have to pay for her. Ever centurion lounge is over crowded, poor food, and hard to get a drink, much less a place to sit and drink it. The CSR gives me the Priority Pass with restaurants which is a big winner in my book, plus many PP lounges have showers, which is very nice after those all night flights. It is easier to earn the Amex points due to more cards and no 5/24, but the Hyatt transfer is just awesome. With the ABS you have to pick your airline for your bonus, but with the CSR you just travel and bingo they knock off $300 without me doing a thing. I plan to dump my CSR when payments comes due next time. Besides, spending 10K just to get 50K points is out of line in my opinion. I may drop the CSR to the Preferred since I have the very nice Ritz card.

Why not have your wife apply for one of the many Amex Plat flavors, get a signup bonus, and no more paying her way in? Alternatively, you could apply for Morgan Stanley plat (open MS Access acct), which comes with free authorized user.

You must not have a Amex platinum because it does have emergency medical @ $20,000 and emergency dental @ $1,000.

I’m guessing that you have a version from a country other than the United States? I don’t think the Platinum card issued in the US has those features. If I’m wrong, please point me to some documentation. Thanks!

The thing about CSR is it’s easy to get another card to also cover the areas where CSR is strong, like 3x(or more) travel/dining, roadside assistance, etc. But there’s no non Amex card that will get you Centurion access and skyclub access. By itself sure maybe CSR is more well rounded, but as part of a portfolio I’d say the plat is more valuable.

If you were making a portfolio to get the same benefits as the CSR what cards would you choose to replicate it with a annual fee less than the CSR?

I said CSR might be well rounded, implying if you want only one card then it might be better. Sounds like that’s you. Those of us with many cards have no problem getting 3x or better on dining and travel without CSR.

I’m not advocating paying AFs in perpetuity on a portfolio of cards either, as I’m going after signup bonuses. The great thing about Amex Plat is that there are so many versions and NLL offers that you could go a long time getting a signup bonus every year and always hold a Plat.

There’s only one $450+ AF card that I’ll pay a second year AF on, and that’s Amex Hilton Aspire.

Gotcha, I slightly misunderstood your original post. I agree there’s very few high annual fee cards that are hard to keep after the first year.

Right. That’s why I wrote that the Platinum card offers far superior lounge access benefits.

What about shopping protections? eg: Return Protection, Extended Warranty, etc. Would be good to add that to the comparison.

Good idea. I’ll try to remember to add that next time I refresh this post.

WhatEver

On FBN a travel pro said 1 in 8 already canceled their Spring and Summer trips ..

Deals coming ..

CHEERs

I had both cards; however, I cut SR since it was boring. I would pick SR later to redeem UR points.

If someone is using the AMEX Uber credit, they could just as easily use the $199 off Chase Lyft Pink membership/15% off Lyft rides. I think the Chase travel credit are both more valuable & easier to use than AMEX.

not true. you can use uber credit on ubereats pickup orders from many local restaurants (no delivery fee, no service fee). So you can get close to face value from the uber credit.

Saks credit is close to face value on cosmetics which are priced the same across different vendors.

The airline credit is another story.

Throw in there Too a Dead Dog can get a AMEX and the sign up once . I’m 10/24.

CHEERs

AMEX statement credits top out at $600. The $460 Chase credits s/b increased at a minimum by $199 for a total of $659 due to the $199 Lyft Pink credit (not listed). Chase is $59 more credit than AMEX even without the addtl 15% off Lyft ride discounts (also not listed or evaluated).

Unfortunately many dont use/need lyft pink that much. So lyft benefit could worth little.

My value of Amex credit: $170 Uber, $80 Saks, $80 Airline, total is $330

and CSR credit: $285 Travel, $50 doordash, $20 Lyft, total is $355

And many say Uber is overpriced & pick Lyft on that basis alone for ridesharing.

The lady on FBN (NYC) said she uses both a lot . After about a week of non use she will get a coupon off on that one so Switch .

CHEERs

Interesting, I did not know it worked with uber eats pickups too.

Sounds like I can use it the same way I use the Gold’s grubhub pickups for the dining credit.

I might have to rethink my strategy of holding a CSR+Freedom and Gold+BBP and move to a fully Amex lineup of Platinum+Gold+Green+BBP to keep it simpler in terms of earning.

With a delivery fee, service fee, and a small order fee, much of the $15/mth AMEX credit can go towards paying for them on an Uber Eats order. I appreciate how the Door Dash Chase benefit waives those fees on DashPash orders. The savings add up quickly!