NOTICE: This post references card features that have changed, expired, or are not currently available

One path to earning credit card rewards is to find ways to increase credit card spend and get most of your money back (see our guide here). Visa and Mastercard gift cards are often a key component to making these techniques work because they have PINs and can therefore be used in many places that only accept debit cards.

Without question, the biggest bang for your buck is to meet spend requirements on new credit cards in order to earn the best signup offers (found here). In that case, the best credit card to use for buying Visa or Mastercard gift cards is whichever one you recently signed up for. But what if you’re in-between new applications and are simply looking to earn rewards for spend? Below you’ll find my picks for the best credit cards to use when buying Visa or Mastercard gift cards…

Simon Mall

Simon Malls sell Visa gift cards either at the guest services booth in the middle of the mall or in a back office (you’ll have to ask at your local mall for details). You can find Simon Mall locations here. Simon Malls are welcoming to those who purchase gift cards for the purpose of manufacturing spend. You do need to fill out paperwork and provide identification for large gift card purchases. You are allowed to buy up to $10,000 in gift cards (inclusive of fees) per day or up to $25,000 once you are a known and trusted customer. Currently, Visa gift card fees are $3.95 per card. In the past, Visa gift cards were limited to $500 value per card, but recently Simon Malls have been offering card loads up to $1,000. Time will tell whether this option will continue past this year.

Since Simon Mall purchases do not usually earn credit card category bonuses, it’s best to use cards that offer the best rewards for uncategorized spend. The best of the best of these is arguably the Altitude Reserve card which earns 3X (equivalent to 4.5% back) on mobile wallet payments like Apple Pay and Samsung Pay. That said, US Bank is known to shut down accounts that take advantage of this option to buy gift cards.

You’d think that another great option would be the Amex Blue Business Plus card which earns 2X on all purchases up to $50K per year (then 1X). Unfortunately, Amex doesn’t like people using their cards at Simon Malls to buy gift cards. If you do use your card to buy gift cards at a Simon Mall, it won’t earn any rewards.

My pick for the best card to buy gift cards at Simon Mall is the Citi Double Cash card. This no-fee card earns 1% cash back when making a purchase and another 1% back when paying your credit card bill. In other words, it is a 2% cash back card. Better yet, Citi now allows cardholders to convert their cash back to ThankYou Rewards points. If you or a trusted friend or family member has either the Citi Premier or Citi Prestige card, it’s possible to move points from the Double Cash to one of those cards in order to then transfer those points to airline programs. This makes the Double Cash card far more rewarding than an ordinary 2% back card. See our Guide to Citi ThankYou Rewards for more details.

Cost per point earned with the Citi Double Cash (assuming $1,000 gift cards at $3.95 each): $3.95 / 2008 = $0.002 (e.g. 2/10th of a cent per point)

Online

You can buy $500 Visa cards online at either GiftCardMall.com or GiftCards.com. You’ll pay approximately $6 in fees per card (or more depending upon which shipping option you select). You can get most of the fee rebated back to you buy clicking through from a cash back portal to either GiftCardMall.com or GiftCards.com. When you do so, you’ll typically earn 1% cash back ($5 per card).

The best play, by far, when buying Visa gift cards online is to click through from the Rakuten (previously Ebates) portal and pay with a Rakuten (formerly Ebates) Visa credit card. By doing so, you’ll earn 1% back from the portal and another 3% back from the credit card. But it gets better…

If you have a special Membership Rewards Rakuten account, then you’ll earn Amex Membership Rewards rather than cash back. And if you sign up for the Rakuten credit card after establishing this Membership Rewards account, that credit card will also earn Membership Rewards. This means that you’ll earn 4X Membership Rewards when buying Visa gift cards online! Please see this post for full details before getting started: Ebates Visa with Membership Rewards. Everything you need to know.

Cost per point earned with the Rakuten portal + credit card (assuming $500 gift cards at $6 each): $6 / 2000 = $0.003 (e.g. 3/10th of a cent per point)

Grocery Stores

Many grocery stores sell $500 Visa and Mastercard gift cards, usually with a $5.95 fee. Credit cards that offer bonuses for grocery spend are great to use for these purchases.

My favorite of the cards that earn grocery store bonuses is the American Express Gold Card. The Gold card earns 4x points at US Supermarkets on up to $25K in purchases per calendar year (then 1X). Even though Amex states that rewards are not earned for gift card purchases, they do not appear to enforce this rule for grocery store spend.

Special mention goes to the Chase Freedom Card and the Discover It Card (and the Discover It Student Card). Both cards offer 5X categories that change each quarter. Grocery Stores are a common 5X option.

Cost per point earned with the Amex Gold card (assuming $500 gift cards at $5.95 each): $5.95 / 2024 = $0.003 (e.g. 3/10th of a cent per point)

Gas Stations

Many gas station convenience stores sell Visa and Mastercard gift cards. Of these, some (but not many) allow you to buy the gift cards with a credit card. It’s also the case that some convenience stores that don’t sell gas code as gas stations when paying with a Visa or Mastercard credit card (but not usually when paying with an Amex card).

The best cards to use are those that offer bonuses at gas stations. Note that many cards offer bonuses only for “pay at the pump” purchases. Those are useless for this purpose. You have to find cards that bonus all gas station spend.

There are many great cards to use for gas station spend (you can find a list here — make sure to press “next” to see more than just the top 5). One of my favorites is the Citi Premier card which earns 3X at gas stations. I picked this one over some great Amex options because it is more likely to code stand-alone convenience stores as gas stations. It is also a good pick because it costs only $95 per year and it’s a great companion to the Citi Double Cash card (which earns 2X everywhere).

For those who prefer cash back, the Ducks Unlimited card (5% back) is a great choice.

Special mention goes to the Chase Freedom Card and the Discover It Card (and the Discover It Student Card). Both cards offer 5X categories that change each quarter. Gas stations are a common 5X option.

Cost per point earned with the Citi Premier (assuming $500 gift cards at $5.95 each): $5.95 / 1518 = $0.004 (e.g. 4/10th of a cent per point)

Staples.com

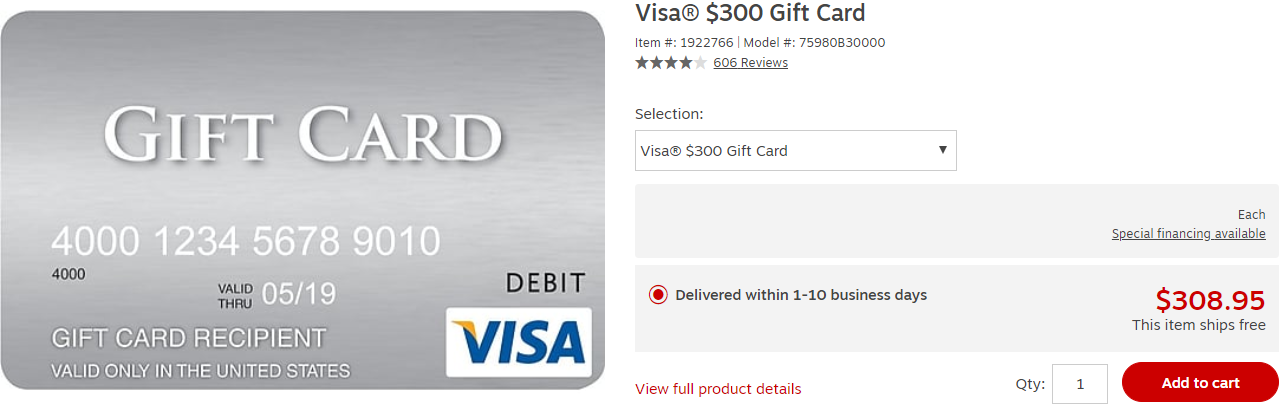

Staples.com sells $300 Visa gift cards online with a fee of $8.95 per card. Credit cards that offer bonuses for office supply purchases are great options to use when buying these gift cards.

My favorite of the cards that earn office supply bonuses is the fee-free Chase Ink Business Cash card (or the similar $95/year Ink Business Plus card which is no longer available to new cardholders). The Ink Cash earns 5X on Office Supply purchases, up to $25,000 per year. It’s possible to extend that limit by getting a second Ink Cash card. You can do so with a second business or by first signing up for a different Ink card (such as the Ink Business Preferred) and later product changing. If you or someone else in your household has a premium Ultimate Rewards card such as the Ink Business Preferred, Sapphire Preferred, or Sapphire Reserve, then you can move points from the Ink Business Cash card in order to make them more valuable. See our Ink Business Cash complete guide for details.

Cost per point earned with the Ink Cash card ($300 gift cards at $8.95 each): $8.95 / 1545 = $0.006 (e.g. 6/10th of a cent per point)

Office Supply Stores

Staples and OfficeMax / Office Depot offer $200 Visa gift cards that can be purchased with a credit card, usually with a $6.95 fee. Fortunately, both stores frequently offer deals for discounted or fee-free Visa or Mastercard gift cards. For current deals, see: Current Visa and Mastercard Gift Card Deals.

Credit cards that offer bonuses for office supply purchases are great options to use when buying these gift cards.

My favorite of the cards that earn office supply bonuses is the fee-free Chase Ink Business Cash card (or the similar $95/year Ink Business Plus card which is no longer available to new cardholders). The Ink Cash earns 5X on Office Supply purchases, up to $25,000 per year. It’s possible to extend that limit by getting a second Ink Cash card. You can do so with a second business or by first signing up for a different Ink card (such as the Ink Business Preferred) and later product changing. If you or someone else in your household has a premium Ultimate Rewards card such as the Ink Business Preferred, Sapphire Preferred, or Sapphire Reserve, then you can move points from the Ink Business Cash card in order to make them more valuable. See our Ink Business Cash complete guide for details.

Cost per point earned with the Ink Cash card when no discount is available ($200 gift cards at $6.95 each): $6.95 / 1035 = $0.0067 (e.g. ~7/10th of a cent per point)

Everywhere Else

Many drugstores and warehouse stores sell $500 Visa and/or Mastercard gift cards, usually with a $5.95 fee. If you can’t earn credit card category bonuses for these purchases, it’s best to use cards that offer the best rewards for uncategorized spend. The best of the best of these is arguably the Altitude Reserve card which earns 3X (equivalent to 4.5% back) on mobile wallet payments like Apple Pay and Samsung Pay. That said, US Bank is known to shut down accounts that take advantage of this option to buy gift cards.

My pick for the best card to buy gift cards at miscellaneous stores is the Citi Double Cash card. This no-fee card earns 1% cash back when making a purchase and another 1% back when paying your credit card bill. In other words, it is a 2% cash back card. Better yet, Citi allows cardholders to convert their cash back to ThankYou Rewards points. If you or a trusted friend or family member has either the Citi Premier or Citi Prestige card, it’s possible to move points from the Double Cash to one of those cards in order to then transfer those points to airline programs. This makes the Double Cash rewards far more valuable than an ordinary 2% back card.

Special mention goes to the Chase Freedom Card and the Discover It Card (and the Discover It Student Card). Both cards offer 5X categories that change each quarter. Drug stores and warehouse stores are common 5X options.

Cost per point earned with the Citi Double Cash (assuming $500 gift cards at $5.95 each): $5.95 / 1012 = $0.006 (e.g. 6/10th of a cent per point)

[…] Buy Visa gift cards at Simon Mall: The Double Cash card is one of the most rewarding options for these purchases. […]

Interesting analysis. Cents per point is an important measure but it’s not everything – given that most people are also constrained by liquidation. For example, assuming I can only liquidate $10k/month, then I’d prefer to use Amex Gold or Ebates/MR route for 40k MR points instead of Simon/DCC which would only give me 20k TY points despite it being cheaper CPP to manufacture. Similarly, if goal is just cheaper CPP, then purchasing GCM on cash Ebates with BBP with free shipping would be even better than either Simon/DCC or Ebates/MR play.

That’s not cheaper than the Ebates/MR play. The BBP only earns 2x. Ebates/Rakuten earns 3x when you’re clicking through Rakuten,

Ebates/MR – as noted in the article is – $6 / 2000 = $0.003 for one $500 GC

Cash Ebates/BBP – ($6 fee minus $5 cash back)/1000 = $0.001 for one $500 GC.

So the amazing ability of Ebates/MR isn’t the low cost to generate points, but

the rate at which you can generate the points since it’s 4x (instead of 2x with BBP).

That’s a great point. I should update this with a metric that takes liquidation limits into account. Any suggestions for a good metric?

Hi! Thanks for the responses. Sorry I don’t know of any metric – I’m just a newb with liquidation issues… Your podcast discussion on this just got me thinking. Since I have liquidation limitations, I use GCM/Ebates instead of Simon and in my situation, I think it’s the right play. Keep up the great work!

Greg, thank you for the detailed information.

I wonder that if Simon Mall is coded as the department store for Chase credit card.

I can just google and find information for Citi dividend instead of Chase.

Greg trying to figure out understand your math on nlcost per point. If two Simon cards are 3.95 each, the coat per point would be $7.90/2008 for the two cards or $3.95/$1004 for 1 card. Can you explained n your calculation so I can make sure I am doing my ROI right on my side? Thanks

Citi Double Cash earns 2 points per dollar. So when you buy one $1003.95 card you earn 2,008 points.

Excellent post. Especially with the new citi double to thank you. I have ink cash and citi double cards. So I ran the comparison and it seems like ink beats it easily?

I don’t transfer to airlines (family of 4 so I rather more trips than few first class/business trips) so for me it’s all about portal

Please confirm my math –

Citi at gift card mall spend $1500 on cards, pay $18 in fees, then 3036 points – if transfer to citi premier card (forgot name? The one that gets you conversion of 1.5 cent) = 3036 * 0.015 = $45 value at portal. Minus the fees I paid: $45-18= $27. So I earn $27 by this move if I spend $1500.

Now ink at staples at $1500 spend (5x $300 cards) is $44.75 in fees and 7723 points.. With reserve transfer, like citi premier in portal, it’s 1.5 cent redpmtion so 7723 * 0.015 = $115 value at portal. Then minus the fees of 45 is $70 of value by spending the same $1500.

So more than twice the value of citi.

Any better deal there assuming only portal redemption?

Two errors:

1) Citi Premier and Ink Preferred give you 1.25 cents value via travel portal (not 1.5). You can get 1.5 with Chase, but only if you have the Sapphire Reserve.

2) If you want to buy online, you should go through a cash back portal to giftcardmall. This would give you 1% cash back, so subtract $15 from the fees in your Citi scenario.

Citi: Cost: $18 – $15 = $3. Earn 3036 points worth 30.36 x 1.25 = $37.95 – $3 = $34.95 in travel.

Ink Cash: 7723 points x 0.0125 = $96.54 – $44.75 = $51.79

With Citi you can think of it as paying net $3 for $38 in travel vs. with Chase paying $18 for $96 in travel. Both are good great deals which one is better depends on how you think about it.

Great Information but as someone who spends most of my time abroad what are my options?

Any of these single use or multi use prepaid cards I can use abroad and without the dreaded FTF?

Citi Double Cash CC like Chase Freedoms ( both cards ) have a FTF so that option is out.

8. CASH BACK EXCLUSIONS

“…Purchases of gift cards do not qualify for Cash Back.” for the Rakuten card. Therefore there’d be no cash back. I’ll just use my Citi Double card.

“…Purchases of gift cards do not qualify for Cash Back.” Section 8: https://www.rakuten.com/help/article/terms-conditions-360002101608

Darn…I guess I’ll stick with the Citi Double Cash

I think buying thru its own portal should be fine as you do earn 1% on giftcard purchase.

Do Visa and MC gift cards count as debit cards when paying estimated taxes or property taxes thus qualifying for the fixed fee rather than percentage of total payment?

Yes

This is interesting. I have never seen this mentioned in an article about paying taxes with credit card, or I didn’t catch its significance. I am betting you have pointed it out in one of your many detailed posts, can you point me to it?

Thanks for the unending information you provide!

Using the Southwest card at Simon Mall would appear to be a good way to top off for the Companion Pass. Compared to the Double cash you are giving up about .5% in redeemable value, but it will otherwise likely take you a while to gather CP=qualifying points. The faster the better. One free CP trip could be worth $600.

Simon Mall purchase doesn’t count as Department Store purchase at all ?

No

Ok, I don’t get the advantage to using TY points instead of just getting the cash and booking my own trip. The exchange on Citi is 1:1, basically I can take $100 cash or get $100 in travel. I can’t find anywhere on the TY page that gives a higher exchange.

What I see is I can use the $100 to pay my Chase UR at 1.5% the transfer the points to Sapphire and get more value without having my points with multiple rewards programs.

Someone please explain if I’m wrong.

Johnny

This is all Simple I transfer TY points to Singapore airlines then book flts @ the best total cost for me ..Now if ur flts are Cheaper,Safer,Easier to do that’s Great !!! Check 10 different ways like I do ..

Have Fun !!!

CHEERs

Seeing this, I’ll admit I haven’t looked 10 different ways, lol. Thank you for the reply and leading me into another direction. This hobby is getting interesting.

You’ll need to study the transfer partners. There are many ways to get much better than $100 in value out of the points when moved to ThankYou.

As a quick example, $75 in “cash back” becomes 7,500 ThankYou points. That’s enough for a one-way ticket within the US, including to Hawaii, transferring to Turkish Miles & Smiles. You definitely couldn’t book that for $75 cash. See this post:

https://frequentmiler.com/7-5k-each-way-to-hawaii-with-turkish-miles-and-smiles/

And then check out this post about the ThankYou rewards program for more sweet spots:

https://frequentmiler.com/citi-thank-you-points-sweet-spots/

As another quick example, $600 in cash back could become 60,000 ThankYou points. That’s enough for a Delta One suite between Tokyo and the US — a flight you couldn’t buy for anywhere near $600 — if you transfer to Virgin Atlantic and use the miles to book Delta.

In a nutshell, your points can be a LOT more valuable when transferred to partners. It’ll take some time to study the transfer partners and learn how to find availability / learn how to find good value, but it’s well worth it. That’s not to say that cash is bad — obviously cash enjoys the ultimate flexibility. But in terms of hang for your buck, you’ll get a lot more return out of transfer partners if you have any interest in flying in premium cabins on international routes.

” The Tools We Use ” to the RIGHT (I’m Left) on the home page is the Best link for Newbie’s..

CHEERs

Love your examples highlighting the use of transfer partners. Is there a comprehensive resource that you could recommend that explains how to find availability and book flights?

In my experience, Simon doesn’t allow mobile payments. Must use physical card.

To that point, has anybody actually used AR at a Simon? I without thinking tried to use my AR at grocery to but just a guft card at 505.95 and the purchase wouldn’t go through, even with physical card in the reader. I also tried using it on raise to catch a deal and the payment would not process

Keep posting Jed if u don’t answer my questions that’s fine but sounds like u Ben Around .

CHEERs

Greg do you not MS with BofA @ 2.625%? They agreed to expedite my 3 month window to a week so I’m eager to check out this option.

I do. In this post I listed my favorite cards that I think are more accessible to most people.

How much? I’m worried about a shutdown.

Simple Do Nun like they do and no worry’s too. How could he know the number ???

CHEERs

That’s what I thought, thanks. Just wanted to also comment on the Ebates card — my CL is paltry and i still can’t get approved for a high line. Any tips on that? I’d love to buy more than 2 gift cards a months, lol.

Von

I don’t know if that post is to me but who cares .PAY ur card off every Monday like I do ($5K CL) . I get many offers of CL increases BUT u DON”T WANT THAT u want more cards to get the sign up BONUS as in $$$$$$$$ .

CHEERs

Same issue here with a paltry CL on Ebates card – I tried for an increase after 4 months – auto denied – they didn’t even pull credit. I called for an explanation, was told they don’t do CL increases until there is a 6 month account history. So I’ll try again then. I started cycling the line this month at 2X, cycle just closed, no issues, and I’m paying weekly 2 weeks in arrears (long enough for GCM to get the order to me before payment).

Mike

Always think LONG TERM that’s nice u get free points whatever . But u need a high FICO score to get lower Ins,Car loans,student loans and House loans which is the only one u may or may not make $$$ on.

Learn all u can bankers are very unforgiving people and they have a line for every thing.

CHEERs

CaveDWeller I don’t think you understand what I mean when I say paltry. It’s EXTREMELY low. It limits me to only a few cards per month which makes it a worthless card unless I can get an increase.

Citi closed all my cc accounts for Simon spend on the Double Cash. 8 year history with Citi, always paid on time, no bill pay, no bounced payments.

James

Honest Person which is few today .

I had 2 cards in 10 years which I DIDN’T get the bonus Citi and AMEX !!!! But I got Got Them HaHa !!!!

Thank You !!

CHEERs

James

What’s ur FICO mine is 820 and C1 turned me DOWN 3x over 2 years for a Hotel.com card !!!

CHEERs

What kind of volume were you doing?

@Greg 1-4x CL

Accounts were closed and rewards confiscated 1-2 days before statements cut/rewards posted. No fraud alerts on purchases or any warnings.

Did they specifically say it was due to GC purchases? Cycling CL is a risky proposition as well.

no reason given in the letter.

If they give u Data u can sue or many ph calls ect.. ” Just Say No ” ..

CHEERs

Unfortunately, cycling is a common trigger for Citi shutdown

I mean, come on! what do you expect would happen if you cycle the CL that much