Marriott Bonvoy is a maddeningly complex program which promises the world, but often delivers disappointment. Want to sign up for a second Bonvoy card? Good luck figuring out if you’re eligible. Think your elite status guarantees free breakfast? Think again. Looking forward to a confirmed upgrade with your Nightly Upgrade Awards? LOL. This post is the “cheat sheet” that will may help you get past the obstacles that make Bonvoy so hard to love…

It rhymes with chariot

Most people pronounce Marriott with the first part sounding like “marry” and the second part rhyming with “got” or “lot”. But the correct pronunciation for “Marriott” rhymes with “chariot.” Sort of like “marry-et.” Huh.

The best Bonvoy card starts with R

Since Marriott adopted “Bonvoy” as their bodacious rewards program name, they’ve gone all-in and named all but one of their cards with the first letter “B”: Bevy, Bold, Boundless, Bountiful, Brilliant…

The one exception is also the very best Bonvoy card: The Ritz-Carlton Credit Card. You can’t get the card new, but you can get another Bonvoy consumer card from Chase (Bold, Boundless, or Bountiful) and, after a year, product change to the Ritz card. For details, see: Yes, the Ritz card is now the best value Marriott card.

Get it, but don’t spend it

Bonvoy cards (even those that start with B) can make sense to have for their perks and free night awards, but after earning the card’s welcome bonus, it rarely makes sense to use the card for spend outside of Marriott properties. Most Bonvoy cards earn 6 points per dollar at Marriott properties and 2 points per dollar everywhere else (with a few exceptions). Since Marriott Bonvoy points are usually worth less than 1 cent each, you’ll do better putting your spend on cards that earn 2% back in rewards, or more. For examples, see: Best cards for everyday spend. However, most Bonvoy cards also come with annual free nights (and sometimes other perks) which can be worth significantly more than the card’s annual fee. So, keep a Bonvoy card, but use other cards for your everyday spend. See also: Which Marriott Bonvoy card is best?

Bevy? Bountiful? Fuggetaboutit

Unlike every other current Bonvoy card that has an annual fee, neither the new Bonvoy Bevy Card nor the new Bonvoy Bountiful Card offers an automatic free night each year upon renewal. Instead, to earn the 50K free night with either card, you need to spend $15K per year. And since Bonvoy cards are usually a poor choice for your spend, I don’t recommend either card.

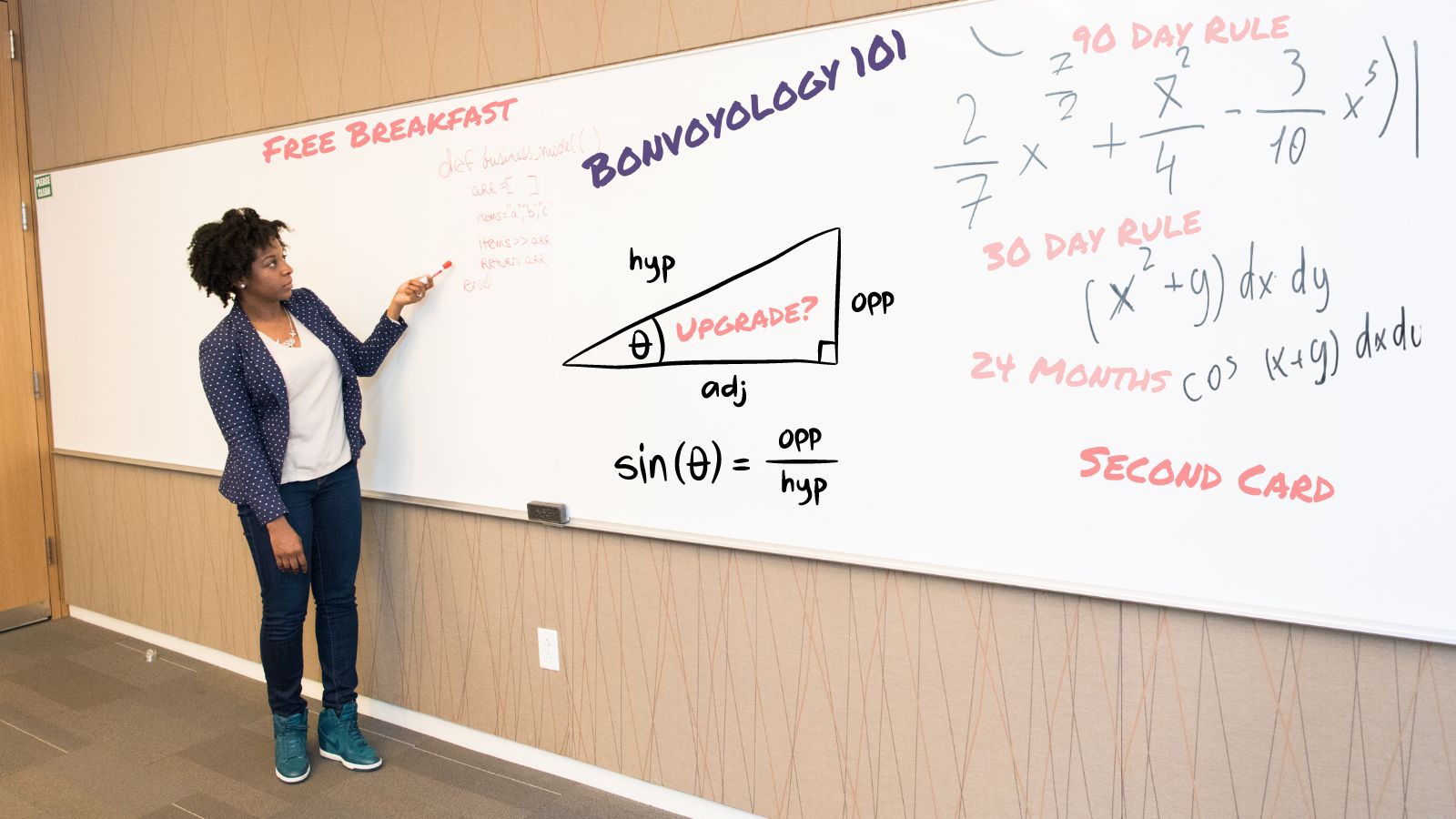

A second card requires a second degree

With both Amex and Chase issuing Marriott cards, someone at the helm decided that it would be wise to make the signup rules completely incomprehensible. Can you get the Chase Boundless card? Sure, as long as you haven’t had the Bonvoy Amex card in the past 30 days, and as long as you weren’t approved in the past 90 days or earned a welcome or upgrade bonus in the past 24 months on a bevy of Amex Bonvoy cards (not counting the card named only “Bonvoy” by Amex, which, as I already wrote, will prevent you from getting the Chase card if you’ve had it in the past 30 days). Learning and understanding these rules is way beyond this Marriott masterclass. Maybe we’ll develop a Phd program someday. In the meantime, suffice to say that the easiest path to two cards is to get both the Amex Bonvoy Business and Amex Bonvoy Brilliant. Boom.

What if you really want one of your cards to be a Chase card so that you can later upgrade to the Ritz card? Enjoy studying the treasure map here: Are you eligible for a new Marriott card?

Pick your perfect free night certificate

Many forms of Marriott free night certificates exist: 25K (from an old no-longer-available card), 35K, 40K (available as a Titanium Elite Choice Benefit), 50K, and 85K. Each can be used to book a night worth up to the face value of the certificate and you can top-off the certificate with up to 15,000 additional points. For example, if an award night costs 45,000 points, you could pay for it with a 35K certificate + 10K points, or a 40K certificate + 5K points, or a 50K certificate (and the extra 5K value of the cert will be lost), or a 85K certificate (and the extra 40K value of the cert will be lost).

When you go to use a certificate, Marriott.com will pick one out for you. I believe it chooses the cert that is closest to expiration. That’s a great choice when all of your certs are the same value, but it often makes sense to use a lower value cert instead. For example, it would be a waste to use a 85K cert for a 35K night. Luckily, Marriott has made it “easy” to pick the cert you want:

- Before booking the stay you want, book an additional stay to use up the certs that you don’t want Marriott to assign to your desired stay. We’ll call this the “dummy” stay.

- Book your real stay with the cert you want.

- Cancel your dummy stay.

- Check your account to make sure that the cert(s) applied to your dummy stay have come back

- Call Marriott to ask them to find the certs that failed to get put back into your account.

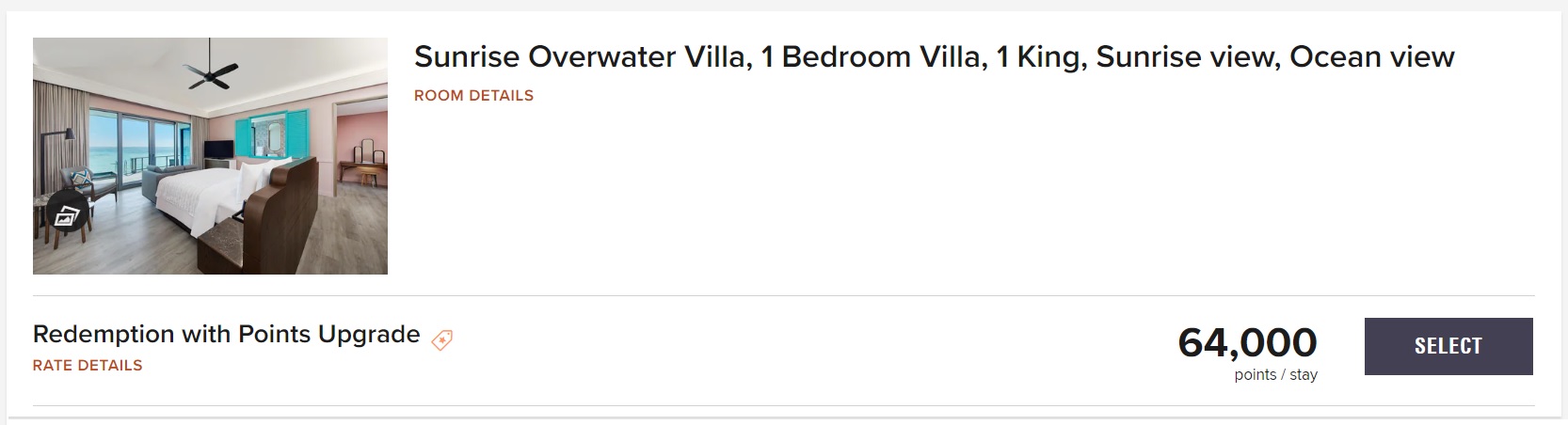

Your free night certificate isn’t on the path to Redemption (with Points upgrade)

Here’s the scenario: You found the perfect room at the perfect resort. The point price is 64,000 points per night and you have a 50K free night certificate. You think: perfect, I’ll book this with my free night certificate plus 14,000 points! Not so fast. If the rate is listed as “Redemption with Points Upgrade” or “Redemption with Cash Upgrade” or “Cash & Points Redemption” you can’t use your free night certificate. If your heart is set on using your free night certificate, you need to look for a room where the rate is described as simply “Redemption.” If that’s not the type of room you want, it may be worth booking it anyway and then contacting the hotel directly to ask about paying for an upgrade to the room you really want.

Enjoy your Platinum Elite Bonvoy breakfast (or not)

If you have Platinum Elite status or higher with Marriott, you are eligible for free breakfast except when you’re not. Platinum Elite status offers free breakfast in the lounge (when available) or in the hotel restaurant except under the following conditions… (roll out giant scroll…)

- No breakfast for you if you booked your stay at a Design Hotel, EDITION, Gaylord, Vacation Club, Marriott Executive Apartment, or Ritz-Carlton.

- No breakfast for you if you visit one of these properties when their lounge is closed (which is typical on weekends and after pandemics): Chicago Marriott Downtown Magnificent Mile, JW Marriott San Francisco Union Square, Renaissance Chicago Downtown Hotel, Marriott Marquis San Diego Marina.

- Partial breakfast for you (i.e. you’ll get $10 towards breakfast) at AC Hotels; Courtyard (except those with a lounge); and Moxy Hotels.

Ah the joys of elite status! For more, see: Marriott Platinum Elite Free Breakfast Simplified.

Naughty Nightly Upgrade Awards

When you earn 50 elite qualifying nights in a calendar year, and again at 75 nights, you get to pick a Choice Benefit. One of those choices is to select “5 Nightly Upgrade Awards.” The idea is that you can book a standard room and apply these awards to upgrade to a higher level room or suite. That sounds great, but the reality is worse than Marriott’s Platinum breakfast benefit. Like the breakfast benefit, some brands simply don’t participate. Staying at a Design Hotel? Yeah, you’ll be staying in a base room because you can’t apply a Nightly Upgrade Award. Worse, many (or maybe most) individual hotels simply opt out. Worse than worse, there’s no way to know whether a hotel participates until you’ve booked a room. Worse than worse than worse, the system may tell you that the hotel doesn’t participate even when it does (see: Marriott Suite Night Awards Shenanigans). And, finally, even if you succeed in applying your Nightly Upgrade Awards to a stay, that doesn’t come close to guaranteeing your upgrade. They won’t even check for upgrade availability until 3 days before your stay and then there seems to be a mysterious lottery system where you have a chance of an upgrade each day until your stay. Still, despite all of that, these things sometimes work. Do you like your chances?

[…] in the news cycle and draw vital attention to them. View From The Wing, One Mile At A Time and Frequent Miler have each highlighted at least 100 instances of individual properties not delivering on the […]

Ugh, I’m so confused. What is the best route for me? I want to plan a Marriott stay in January 2026.

Can someone explain to me why anyone chooses Bonvoy? As someone relatively new to points & miles, I don’t see a scenario to choose it. Hilton seems to have better credit card perks and Amex to Hilton and Chase to Hyatt seem like better transfer values. They also charge tax/fees on award stays where Hilton and Hyatt do not.

I currently have the AMEX Marriott Business card (got it last year when I got 5 FNCs for the SUB, which I’ve been able to put to good use this year). I’m looking at the AMEX Marriott Brilliant – I like the 185K point SUB, the annual 85K FNC after anniversary and the automatic Platinum status. Question – do I still need to reach 50 elite night credits each year to get the 5 nightly suite upgrade awards? Or is that automatically applied to my Marriott account once I have Platinum status? Also, would it be wiser to get the Bevy (155K SUB) this year, hold for a year, cancel, then sign up for the Brilliant (hope for a 185K sub in a little over a year) because do these cards have family language and I can only go up the ladder, not down? I don’t have a problem with the annual fee because I see value in the $300 dining credit and 85K cert.

So two separate questions –

do I need to earn 50 elite nights (25 Brilliant, 15, Biz, 10 from actual hotel nights) to get the nightly suite upgrades if I have the Brilliant card? Or does just holding the Brilliant card automatically grant me the 5 nightly suite upgrades?should I go Bevy this year, then Brilliant next year? Or just skip the Bevy and head straight to Brilliant? I want to execute a plan for P1 and P2 to either have 2 or 4 of the 85K certs annually (would eventually be working in a Chase Marriott card that I would product change to Ritz – yes, I understand that I can’t start on this for a minimum of 2 years because I plan on earning Marriott personal SUBs now). Right now, P1 and P2 both just have AMEX Marriott Biz.Thanks for the advice and help. I love Frequent Miler!

You’d need to earn the 50 nights to get the nightly upgrade choice.

You can get the Bevy followed by the Brilliant (at least 3 months apart) but not the other way around. It comes down to preference- it’s what my P2 is doing (got the 155K Bevy early this year, planning on Brilliant application next week, RC in the future).

I think it’s worth mentioning that due to Amex family rules combined with the heightened sign up bonus of 155k bonvoy points means that Bonvoy Bevy for someone who wants to go down the AMEX Bonvoy path (especially if at lol/24) the Bevy is the right choice before getting the Brilliant (and the sign up bonus for Bevy is better than the current bonvoy business offer which is limited to the 3 awkward hard to use 50K free night certificates).

Mark, I am so glad you commented. I was just thinking of grabbing the Bevy for the sign-up bonus only (as I have never had a Brilliant). Bonvoy cards are going for the free nights welcome offers lately, so it makes sense to get a Bevy for the points but toss after 1 year.

Great article, Greg – nails my own frustrations!

I read on a blog (maybe here?) a handy reader tip for quickly repricing rooms. Ever so often I reshop my bookings. Used to be if points were cheaper, I would cancel & rebook. That often causes any NUA attached to “disappear” (& for the property to think I’m crazy since they can view all my res changes).

Anyways, if you go to Marriott’s website/not app, click on “View/Modify” on the reservation under My Trips then “Modify Room” (1st horizontal blk tab on right) and you can see what the new points requirement is. Click “Update” and your needed points will auto adjust.

Nice, too, cos the res number stays the same, less to keep up with. And any original NUA used to book also stays the same without redeposit & more confusion. I am a lot more prone to reshopping, too, with this easy tip & have saved 10s of 1000s of MRs.

As a practical matter, the Ritz Carlton card club lounge upgrades can be difficult to use. And, if a person has comparable travel coverages and Priority Pass via another card, there’s little reason to get the card.

Greg please explain again that dummy stay using certificate, canceling it and calling bonvoy to find it. Please I did not get how it works thank you for great article!

This is only necessary when Marriott tries to make you use a cert that you don’t want to use. In that case, the trick is to book another stay (dummy booking) using that certificate and then book the regular stay that you really want, and then cancel the dummy booking. Usually the cert will automatically go back into your account when you cancel the dummy booking, but if it doesn’t, then you have to call about it.

According to leaked Marriott brand standards available through a Google search and also on Scrib, Marriott auditors are instructed to add or deduct more points to properties that offer a late check-out to eligible elites at the time of check-in than properties that comply with the breakfast benefit. Moreover, Marriott’s own internal standards for auditors do NOT actually define what constitutes a breakfast. So, it’s no wonder that so many properties cheat.

Literally, Marriott’s standards provided to auditors define breakfast as, “Complimentary breakfast for 2 in the restaurant.”

But the same standards go to great lengths to define what must be provided in a lounge and even on a (non-complimentary) breakfast buffet based on regions.

Failing to offer a late check-out results in a 4-point penalty on audits. Failing to offer a breakfast benefit is only a 2-point reduction.

Very interesting, thanks for sharing. This definitely gives more insight into the breakfast games they play.

Marriott’s brand standards are very specific about minimums for club lounge, for example. They’re also very specific for what must be on the buffet, if there’s a buffet. But they’re silent internationally or out of ignorance as to what constitutes an elite restaurant breakfast.

[…] hotel program is equivalent to Delta Skymiles from the major programs? Marriott Bonvoy! Bonvoyology: Mastering Marriott’s Mysteries. If you are a road warrior and your company makes you stick with this program, please go ahead and […]

Working towards lifetime platinum status but last few years have been at gold. If I get the Brilliant, do I need to have it before Jan 1 for that year to count as a lifetime platinum-qualifying year?

I appreciate the information. Crossing out “will” and replacing with “may” was a good choice in the first paragraph. Between myself and P2 we do have quite a few Marriott cards. After hours of pouring over the application rules, I determined that she was qualified for the Amex Bevy card and no others (no way I qualify). The Bevy may not be the most attractive card, but I’ll take another 125k points. Anyway, the popup said she did not qualify despite me quadruple checking all the various card languages. So either I am missing something or Marriott’s language is not 100% correct. Just be aware that even when you figure it all out, you still may not have it figured out…

I’m not surprised at all. Bonvoy’s motto should be what you wrote: “even when you figure it all out, you still may not have it figured out…”

You forgot to mention in your list of No Breakfast For You If … if you think breakfast means more than a bottle of water OR a 2 day-old muffin if you’re just a Platinum.

1 Marriott Point = 1 Italian Lira

I miss SPG (sob). Given the present situation, we got off of the hamster wheel and just signed up for the Brilliant-we’ll see if it is worth it. If not, it gets canceled next year. BTW, I love the sarcasm in the article!

What sarcasm?