NOTICE: This post references card features that have changed, expired, or are not currently available

The Chase Ink Business Cash is one of my favorite cards. It has no annual fee, it offers awesome 5X category bonuses (and a couple decent 2X bonuses), and even though it is advertised as a cash back card it actually earns valuable Chase Ultimate Rewards points. Surprisingly this no-fee card offers a few valuable perks as well: auto rental coverage, 1 year extended warranty, and 120 day purchase protection.

Unfortunately, this card does charge foreign transaction fees, so it is not a good choice for spend outside of the US.

Chase Ink Business Cash Application Tips

Should you apply?

Even though this is a business card, I think that this is one of the first cards almost all point collectors should get. It offers a terrific combination of a great signup bonus, no annual fee, super-valuable points, and awesome 5X category bonuses. If you are eligible (see next section), you should get this card.

Are you eligible?

To get this card you must have a business, and you must be under 5/24:

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

How to apply

You can find the current best signup offer and application link here: Chase Ink Business Cash.

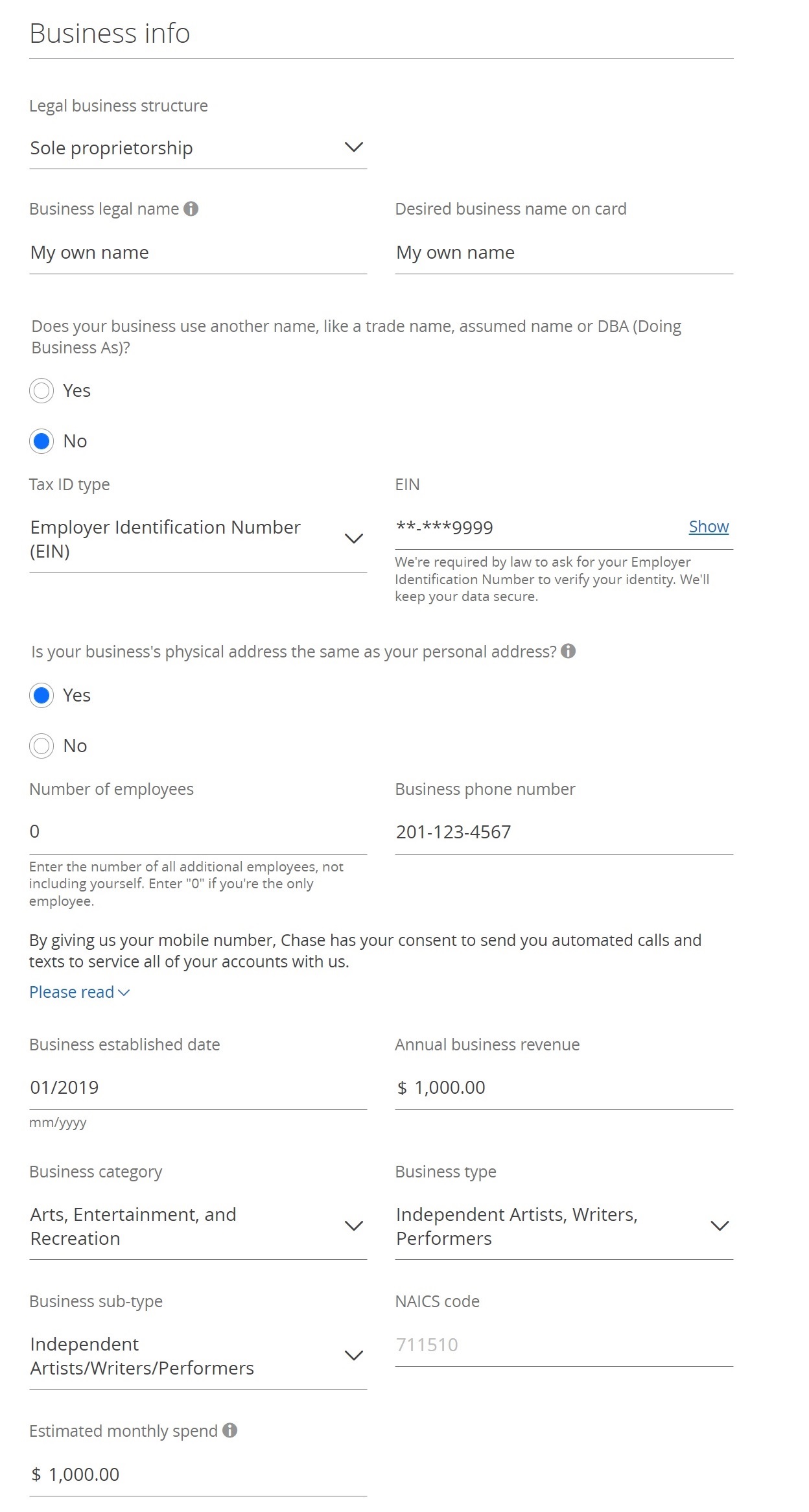

- Legal business structure: Sole Proprietor

- Business legal name: If you don’t already have a business name, I recommend using your own name as the business name.

- Desired business name on card: Again, this can be your own name if you don’t have a business name to use.

- Does your business use another name? No

- Tax ID type: EIN (you can get an EIN quickly and for free from the IRS here) If you'd prefer to use your social security number as your tax ID, select SSN rather than EIN.

- Is your business's physical address the same as your personal address? Yes

- Number of employees: 0 (the instructions say to enter the number of employees you have, not including yourself)

- Business phone number: Your phone number

- Business established date: When did your business start? If you've been doing your business for years (selling stuff at yard sales, for example), it's fine to estimate the starting date.

- Annual business revenue: $0 (or project an amount based on expected revenue)

- Business category, Business type, Business sub-type: Pick whichever categories are closest to your business. For example, an aspiring author, artist, or musician might choose: "Arts, Entertainment, and Recreation" and "Independent Artists, Writers, Performers."

- Estimated monthly spend: $3,000 (Use your judgement here. A higher number might lead to a larger credit line, but if it's too high it might negatively affect approval).

Reconsideration

If your application is denied, I recommend calling for reconsideration (1-888-270-2127). It’s surprising how often denials can be changed to approvals just by asking.

Chase Ink Business Cash Perks

Auto Rental Coverage

Chase offers primary auto rental CDW (collision damage waiver) when renting for business purposes. Here’s the description directly from Chase:

Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary when renting for business purposes and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most cars in the U.S. and abroad.

Purchase Protection

Extended Warranty: “Extends the time period of U.S. manufacturer’s warranty by an additional year, on eligible warranties of three years or less.”

Damage and Theft Protection: “Covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.”

Chase Ink Business Cash Earn Points

Signup Bonus

The signup bonus for this card is advertised as cash back, but the rewards are actually delivered as Ultimate Rewards points. Here’s the current signup offer:

| Card Offer |

|---|

ⓘ $1029 1st Yr Value EstimateClick to learn about first year value estimates $750 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $750(*awarded as 75,000 points) after $6k spend in the first 3 months.No Annual Fee Recent better offer: $900 (*awarded as 90,000 points) after $6k spend in the first 3 months. (Expired 11/13/25) FM Mini Review: This one should be in everyone's wallet. Incredible welcome offer for a no-annual-fee card. Great card for 5X categories. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review |

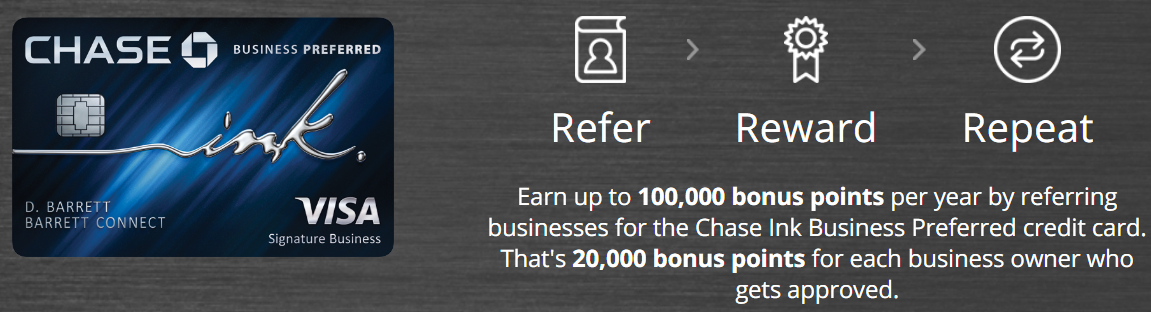

Refer Friends

Referring friends is often a good way to earn extra points with Chase products, but referral offers come and go over time. When referral offers are available, Chase sends emails to eligible cardholders with the offer details. Cardholders can also look for Chase friend referral offers here.

Referring friends is often a good way to earn extra points with Chase products, but referral offers come and go over time. When referral offers are available, Chase sends emails to eligible cardholders with the offer details. Cardholders can also look for Chase friend referral offers here.

Bonus Spend

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 5X office supplies and cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually) ✦ 2X on the first $25K in combined purchases at gas stations and restaurants each cardmember year ✦ 5x Lyft through September 2027 |

This is where the action is… The Ink Cash card offers 5X on cell phone, cable, select streaming services, and internet on up to $25,000 in total purchases per account anniversary year.

Automated 5X

I recommend setting up autopay with your cell phone, cable, streaming services, and internet provider to charge to your Ink Business Cash card. This way you’ll automatically earn 5X on all of these bills. I suspect that many households pay $400 or more monthly on these services. $400/month in bills at 5X translates into 24,000 points per year.

Merchant gift cards. If you plan to buy things anyway from a nationwide business, it could be worth buying gift cards for that business first. By paying for those gift cards with your Ink Cash card at an office supply store (or at staples.com), you’ll earn 5X Ultimate Rewards points. In most cases that will be significantly more than you would have earned if you paid directly.

Bank gift cards (Visa, Mastercard, Amex). Many office supply stores sell Visa, Mastercard, and Amex gift cards in-store. So, theoretically, you can buy these gift cards at office supply stores and then use them for your everyday purchases as a way to earn 5X everywhere. The problem is that the gift card fee greatly reduces the benefit of earning 5X on the purchase. Fortunately, OfficeMax, Office Depot, and Staples frequently offer discounts or rebates on the purchase of these cards. For the latest deals, check our page: Current Visa and Mastercard Gift Card Deals.

Staples.com also usually sells Visa gift cards online. Unfortunately, at the time of this writing they’ve been out of stock online for the past week or so. In the past, the best option (other than during special deals) is the $300 Visa gift card for $308.95. By paying with your Ink Cash card, you’ll earn more than enough points to make up for that fee (309 x 5 = 1545 points which are worth at least $15.45).

Gift cards with PINs. Visa and Mastercard gift cards bought at office supply stores are debit PIN enabled. This is important because it is sometimes possible to buy things or pay bills with a debit card but not with a credit card.

2X Too

Don’t forget that the Ink Cash card also earns 2X at gas stations and restaurants. Unless you have a card that offers better rewards in those places, the Ink Cash is a good choice.

Chase Ink Business Cash Redeem Points

Cash Back

Cardholders can redeem points for 1 cent each either as statement credits or as cash back. Cash back can be taken as a statement credit or via check or ACH transfer.

Travel

Redeem points for travel: Up to 2 cents per point through Chase Travel℠

This option requires that someone in your household has the ultra-premium Chase Sapphire Reserve card. First move (combine) points from your no-fee card to the Sapphire Reserve account. Next, log into Chase under the Sapphire Reserve account, and go to the Chase portal to book through Chase Travel℠. Depending on when your Sapphire Reserve card was obtained, the value of your points may differ:- 1.5 cents per point: For cardmembers who applied or otherwise obtained their card prior to June 23, 2025, points earned prior to October 26, 2025 are eligible to be redeemed at 1.5x through Chase Travel℠ until October 26, 2027.

- Up to 2 cents per point: Cardmembers are eligible for Points Boost offers of up to 2x for travel booked through Chase Travel℠. All hotel bookings with The Edit by Chase Travel℠ should qualify for 2x (details here).

Redeem points for travel: Up to 1.75 cents per point through Chase Travel℠

This option requires that someone in your household has a premium card that earns Chase points: Chase Sapphire Preferred or Chase Ink Business Preferred. First move (combine) points from your no-fee card to one of these premium cards. Next, log into Chase under the account that now has the points, and go to the Chase portal to book through Chase Travel℠. Depending on when your card was obtained, the value of your points may differ:- 1.25 cents per point: For cardmembers who applied or otherwise obtained their card prior to June 23, 2025, points earned prior to October 26, 2025 are eligible to be redeemed at 1.25x through Chase Travel℠ until October 26, 2027.

- Up to 1.75 cents per point: Cardmembers are eligible for Points Boost offers of up to 1.75x for premium cabin flights and up to 1.5x for other travel booked through Chase Travel℠.

Details about booking travel through Chase

You can use the Chase portal to book airfare, hotels, cruises, activities, and car rentals. Airfare purchased through the portal still earns airline miles and elite qualifying miles. Hotels booked this way do not earn hotel rewards unless the portal specifically notes otherwise. Worse, hotels booked through the portal often won't offer you elite benefits even if you have status.Travel protections apply

When you pay with points for travel, Chase's automatic travel protections do apply. So, you can be covered for things like car rentals, trip delays, trip cancellation & interruption, lost luggage, etc. The coverage you receive will be based on which card's rewards were used to book the trip. For example, if you have both a Chase Sapphire Preferred and a Sapphire Reserve, you would want to move your points from the Preferred to the Reserve and then use the Reserve points to book your trip. You will get both better value and better travel protections. See: Sapphire Reserve Travel Insurance.Transfer points

Move points to premium or ultra-premium card first

You cannot transfer points directly from a no-annual-fee Chase card to airline or hotel partners, but you can move points first to a premium card (Sapphire Preferred or Ink Business Preferred, for example) or ultra-premium card (Sapphire Reserve) and then transfer the points to airline or hotel partners. Points can be transferred to the loyalty accounts of the primary cardholder or any authorized user on the account. Points can also be transferred to the loyalty account of a joint business owner, but they do need to be an authorized user on the associated business account.Transfer Partners

| Rewards Program | Best Uses |

|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth more than 2 cents each. Bonus: award nights are not subject to resort fees. |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Singapore Airlines KrisFlyer | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary. Lower demand flights and those with higher taxes tend to offer better value. |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

Other ways to redeem points

You can also use points to pay some merchants directly (Amazon.com, for example or via Chase Pay). Don't do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone hacks into your Amazon account, they might spend your points - causing you a headache in getting your points reinstated).

Chase Ink Business Cash Manage Points

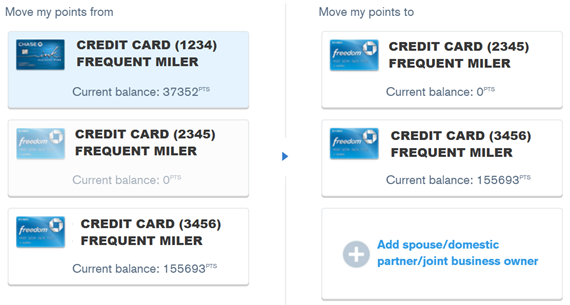

Combine Points Across Cards

If you intend to cancel a card that earns Chase points, you should first combine your points with a card you intend to keep active. Once you cancel, you will forfeit any unused points in that account. A product change should not affect your balance, but some people prefer moving points before a product change as well just to be safe.

Share Points Across Cardholders

Why this is valuable:

Why this is valuable:

- You earn points with the card offering the best return on purchases and then use points with the card offering the best redemption rate.

- Only one member of your household needs to maintain a premium card for transferring to partners or booking travel (though note that the primary cardholder can only transfer points to partner loyalty programs in the name of the primary cardholder or authorized users).

How to Keep Points Alive

Chase Ink Business Cash Summary Information

| Card Offer and Details |

|---|

ⓘ $1029 1st Yr Value EstimateClick to learn about first year value estimates $750 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $750(*awarded as 75,000 points) after $6k spend in the first 3 months.No Annual Fee Recent better offer: $900 (*awarded as 90,000 points) after $6k spend in the first 3 months. (Expired 11/13/25) FM Mini Review: This one should be in everyone's wallet. Incredible welcome offer for a no-annual-fee card. Great card for 5X categories. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review Earning rate: 5X office supplies and cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually) ✦ 2X on the first $25K in combined purchases at gas stations and restaurants each cardmember year ✦ 5x Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $20 monthly Instacart credit See also: Chase Ultimate Rewards Complete Guide |

[…] T-Mobile charge with an Amex Platinum card since wireless services are a 5x bonus category on the Chase Ink Cash (and my older Chase Ink Plus). In this case, I paid off the phone on our new Amex Platinum card […]

[…] x 5 points per dollar = 5,049 Ultimate Rewards points (if paying with a Chase Ink Cash card for […]

you mention purchasing gift cards at office supply stores with your business credit card. how do you account for that during tax season? is the purchase of the gift card (e.g. $100 Amazon) tax deductible? if not, how do you justify the purchase being on your credit card statement? also, some cards have an activation fee (e.g. Visa gift cards). how do you account for the extra fee? great blog btw. looking forward to your response!

Hi Adam,

There is no need to account for all of the transactions on your business card accounts. Simply report the spend that counts as legitimate business expenses and/or deductible expenses and ignore the rest.

When gift cards have fees I only buy them if the value of the awards earned far outweigh the fee. So, for example, I wouldn’t buy a $50 Visa gift card with a $4.95 fee since that fee is an exorbitant 10%. If you earn 5X rewards for buying it, you would be essentially buying points for 2 cents each. That’s not a particularly good deal at all. I do not report gift card purchases at all for tax purposes. Of course, if your business was about buying and selling gift cards then that would be a different matter.

[…] you get readers to get one. Nobody tells me these things. So, here is where you can learn all about this no annual fee card. Yep, we have it…after doing the rounds from the Ink Bold, Ink Plus, Ink Business Preferred. […]

Chase Ink Preferred Business is a great card. You can bypass the 5/24 rule by applying with a paper application through your local Chase bank business relationship manager (BRM).

People have also had good luck applying for multiple consecutive Chase Ink Preferred cards by using different variations of their name. For example, “John Doe”, “John Edward Doe”, “John E Doe”… Etc.

https://www.reddit.com/r/churning/comments/9vl7u1/_/ehop4hg

Actually, the “old” Business Cash Card is the best.

3X Gas

3X Restaurants

3X Office Supplies

3X Home Repair Stores

That is pretty good. I can’t imagine that too many readers have access to that one. Didn’t it disappear for new applicants about 8 years ago?

Correct. A real keeper at $0 fee and still my all time favorite.

I’ve been using your site and “playing the game” for about a year or so. I’ve gotten my wife and myself the best handful of credit cards, gathered the bonus points, and used them without any problem. However, lately I’ve been getting declined for Chase and Capital One cards because I’ve opened too many cards lately. Advice?

Many thanks

Yes, that’s pretty common with both of those issuers. Amex and Citi tend to be pretty easy on approvals. If you want to try again with Chase and Cap 1 in the future, then I recommend sticking mostly with Amex and Citi business cards for a while (those cards don’t appear on your personal credit report and so won’t hurt your chances of getting Chase and Cap 1 cards in the future)

Thank you Greg!

Do you think I can reapply for the Citi Premier card again having cancelled it at the end of February this year?

To apply for a card within the same brand, must wait 24 months after opening or closing account. So you can reapply but will not get the sign up bonus.

“Select streaming services”, what does that include?

It’s not a promised benefit, but people have found that a number of them work such as: Netflix, Hulu, Spotify, etc. You can search for streaming services here to see what has been reported to work: https://www.doctorofcredit.com/payments-workshop/

Greg, Is the $25k cap on 5x based on calendar or card-member anniversary? Thanks!

Good question. It’s based on anniversary year. I’ll add this to the post.

@Greg- Normally how low of a business revenue is sufficient for approval? Thanks

I don’t think there’s a minimum. I’ve known people to get approved for Ink cards with $0 business revenue to-date. My guess is that they’re more concerned with:

1) Your total income

2) The amount of credit Chase has already extended to you

3) Your credit score & related factors (e.g. how many recent inquiries, how many recent new accounts, etc)