How much are airline miles worth? Surely almost anyone reading this likely knows that depends on how you use them. We recognize that there isn’t a single perfect answer here, but it is important for us to come up with a single “good enough” answer that is as objective as possible — and this week on Frequent Miler on the Air, we discuss the quest to find that answer and why it is important to us. This much is for sure: the values Greg came up with this week aren’t the best answers for our readers. More on why in the show and below — watch, listen, or read on for more of this week at Frequent Miler.

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen here in the browser:

This week at Frequent Miler

In the value of miles

Undervaluing airline miles (On my mind)

Beauty is in the eye of the beholder, right? The value of airline miles just depends on how you use them, right? Truthfully, the same could be said about any currency; send two people to the grocery store with $100 each and you’ll likely see entirely different results in terms of what they choose to buy, but yet we still have a general feeling as to the value of $100 and can compare two items with hundred-dollar price tags with a feeling as to which is worth it and which isn’t. We need to be able to make similar comparisons across loyalty currencies. If we pegged the value of American Airlines miles at 1c each, the casual reader would see a 60,000-mile American Airlines bonus as being equal in value to 60,000 Capital One miles. Is that right? If that casual reader wants to fly to Asia, he or she might choose the Venture bonus or worse yet they may choose to get a Delta card with a 70,000-mile bonus because it looks to be worth more — but readers “in the know” know that by choosing the Capital One or Delta bonus this casual reader may not have enough points to get one-way to Asia in economy class whereas they could have had enough AA miles to fly business class one way. In this post, Greg lays out why we need a new approach and what he thinks it should be — and the comments open some lively debate about the methodology.

What are Delta miles worth? (towards domestic economy flights)

What are American Airlines miles worth? (towards domestic economy flights)

What are United miles worth? (towards domestic economy flights)

The three posts above are the ones that touched off the big debate referenced above and the “Main Event” on this week’s FM on the Air show. Are AA miles really worth 1 cent each? I’m not at all surprised to hear that Delta miles are worth more towards domestic economy flights than competitors, nor am I surprised that three companies in such close competition came out so close in value. However, we quickly realized that this approach didn’t accurately reflect the value of bonus categories and welcome bonuses and might influence a casual reader to make poor decisions based on our claimed values. We want our best category bonuses page and our credit card displays to be as accurate and unbiased as possible, which is why we err on the side of being conservative, but these values took that a step too far. We’ll be revisiting the value of miles in the coming weeks and months.

In credit cards

Reader question reveals 9 things you ought to know about Amex cards

A reader asked what sounded like a simple question — they wanted to know which Amex card to cancel in order to get a new card they wanted. But in putting together an answer, Greg realized how many valuable pieces of information one needs to know to get the answer “right”. This post is worth a read if for nothing else as a reminder and appreciation of the complexity of the game — and you might even learn something you never knew.

Amex Removing Referral Ability For Some Cardholders Again

Amex giveth, Amex taketh away, Amex giveth back, and now Amex taketh away yet again. This mostly seems to be affecting people who were banned from referrals after self-referring a few years ago (which was totally possible for a stretch of time and then they mercilessly dropped the hammer on that activity). While I can understand the perspective of those who might say that if you play with fire you might get burnt, I really wish Amex would stop punishing consumers when their poorly-designed computer systems allow things that they later decide they don’t like. I wish they’d just design a system that doesn’t reward referral points for self-referral rather than these on-again off-again games for those caught up.

In loyalty programs

A dream global upgrade trip around the world

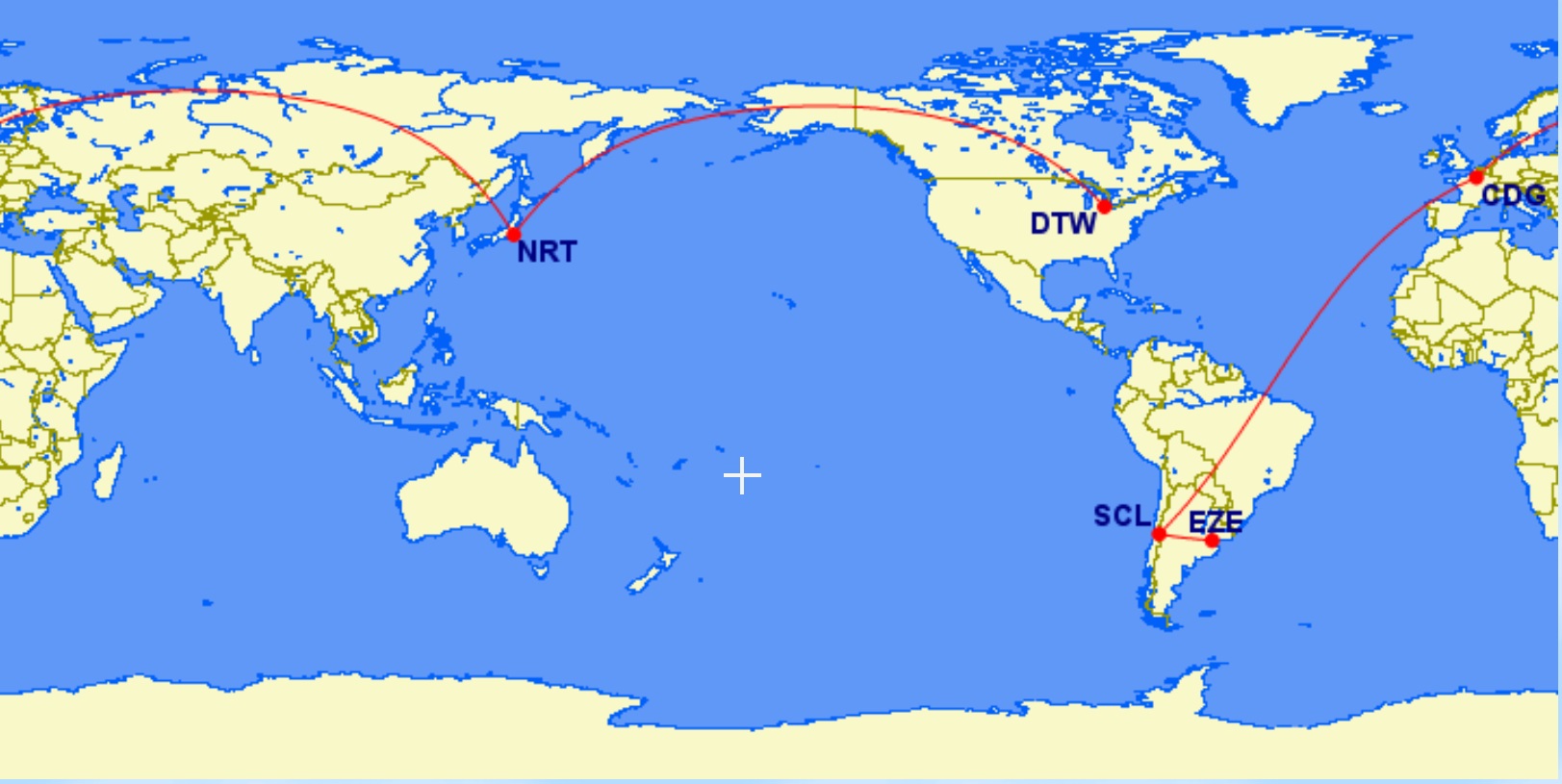

As the vaccine rollout rolls on and travel begins to pick back up, there’s no doubt that I am as excited as anyone to imagine a return to life as we knew it. Writing this post gave me at least a brief return to the joy of trip planning. I don’t think the dream trip I’ve laid out for our Passing the GUC adventure is likely to be realistic before they expire in January 2022, but this post lays out how I would use the global upgrade certificates if I could. The next step is going to be taking what inspired me – a couple of interesting routes – and seeing how I can twist them into a more realistic trip that meets more of the challenges than Greg expects.

Marriott on Twitter: Worth a try

Who woulda known? You might be able to get something done with the Marriott Twitter team. Truthfully, I’m a fan of Twitter for getting stuff done without having to sit on hold, but Marriott was the last company I expected to be able to do anything (like Greg, they told me to pound sand after my last request and took their sweet time doing it). But this week, Greg had success. I don’t know if Marriott hired someone from Hyatt who just hasn’t been Bonvoy-trained yet, but if you need something done and you aren’t in a hurry this might be worth a shot.

IHG Rewards Complete Guide

At Frequent Miler, we have comprehensive guides with everything you need to know about popular hotel loyalty programs like Marriott, Hyatt, and Hilton. It was time to add IHG to the mix, so I put together the most complete and current IHG Rewards Club guide possible. I have to admit that IHG Rewards Club doesn’t excite me, but I am happy to now have a one-stop reference the next time I’m wondering whether I can earn points for eight rooms booked on the same night (yup!) or what time of year to expect my invitation to Kimpton Inner Circle status (January).

The Deal of the Week

T-Mobile is doing it again: Another free line promo starts tomorrow (3/17)

This week’s deal is only applicable to those on T-Mobile with 2 or more paid voice lines, but as I think the deal is slated to end on Monday I thought it was worth a highlight for those T-Mobile customers who may have missed it. There are some ineligible plans, but for those with a qualifying plan (which covers most regular T-Mobile plans, even those older no-longer-existing plans), you can add a free line to your account. If your plan is tax-inclusive, it won’t cost you anything at all (others pay a few bucks in tax each month for the free line). T-Mobile on Twitter or via chat in the app can tell you whether you qualify and whether it will cost anything in taxes. I have now gifted free cell phone service to four family members (I have now added 4 “free” lines to the 3-line paid plan I’ve long had without increasing my cost and while decreasing their costs by hundreds of dollars each year) and I picked up a nice phone for one my mother-in-law for $99 by adding a free line (there are phones you can get for free with your free line also!). If you’re a T-Mobile customer, check this out.

In updated resources

Ultra-Premium Credit Card Travel Insurance Benefits

(Updated) Card-Linked Programs & The Networks They Run On (AKA Which Programs Stack)

That’s it for this week at Frequent Miler. Don’t forget to check out this week’s last chance deals.

![Viral marketing proves infectious for two more airlines, a new card lands with a thud and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/viral-airline-marketing-218x150.jpg)

![Prices rise, benefits cut: The new normal coming for ultra-premium cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/Increasing-fees-218x150.jpg)

![Juicy rumors, but how far will cardholders be squeezed? [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/Juicy-rumors-218x150.jpg)

I have written Delta off. I live in a little feeder town for Delta and to find any use of their points is mostly worthless and much pricier than than AA and UA. I am about 40-50K short of being a million miler for Delta and seriously doubt I will get there or want to get there. I no longer collect Delta miles and a one time was top of the heap with them. They have just gotten too expensive and poor use of points.

You guys actually make it to your destination flying AA? The rare times I actually “try” to fly AA, the flight is usually canceled and always delayed.

Good for you! Glad to see that they actually have productive flights.

PREFER American Airlines.

AMERICAN HAS THE YOUNGEST FLEET!

777,787,A321,ETC.

DELTAS FLEET STILL IS MADE UO OF OLD AIRTRAN 717’S,757,767.

LIKE PUTTING LIPSTICK ON A PIG!

AA has many hubs accross American offering me more convenient choices.

I think Greg owes Nick a post toast next week, did him dirty. 🙁

The content has been amazing lately, guys.

Sorry no time stamp but did I hear Greg saying that good is better than great and good is better than perfect? Great is actually better than good! Maybe it is the idea of not letting the quest for unattainable perfection keep you from doing something good? I think that was the point but maybe I was actually missing what you were trying to convey?

LOL. I was reaching for one of those quotes that basically mean that pursuit of perfection gets in the way of “good enough”. My reach wasn’t so good.

I imagine that if I had to record myself talking for an hour straight that the mumbo jumbo word salad would be unrecognizable. Yeah, the fact that so many factors make the value of miles relative in so many different cases makes perfect totally unattainable. Two factors that have really impacted my desire to have AA miles are the difficulty in obtaining them and the ease of immediate redeposits on cancelled awards, even web specials.

Off topic but quick question if anyone can help. 2/5 initial credit card application denied. Request for reconsideration finally approved 3/19. When does the clock stat ticking if using the 91 day interval between credit card applications? 2/5 or 3/19?

Hi, Guys,

I just listened to the podcast (while baking a cake. Too chilly yet to garden this morning). Great again.

You two wondered if your reader/listeners use miles to fly domestically or internationally. Yes for this reader/listener and my P2. In normal times, we’ll fly domestic economy 2 – 3 times a year. Internationally, we care about front of the plane seats for overnight or long flights like to Asia, but are fine with economy for daytime flights from Europe.

My husband and I rarely get a card for the bonus for a specific trip anymore. We used to and might again if makes sense. Right now, we prefer to keep a stash of points and miles on hand.

Miles we can’t transfer from a bank: We make sure we have AA miles because our home airport is a previous USAirways hub. We take turns, so one of us is always eligible for a Citi AA card when our stash is low. One son moved to Seattle. Alaska is the only direct flight there from our home airport. So we’ll keep some Alaska miles to see him.

Miles we can top off from a bank: If there’s a great United, Southwest, or Delta card offer and we’re under the Amex or Chase threshold, we’ll jump on it. I know I’ll be able to use them one day. Even if they aren’t the BEST redemption, one of them or AA will usually get us where we want to go for a pretty good value. For other times, there’s…

Transferrable points: We concentrate on Amex MRs and Chase URs and like to have 200,000 of each on hand. Given Covid days, we’re beyond that, even after cashing out 200,000 URs last fall. Even before Covid, it didn’t take us long to replenish if we depleted our balances since we concentrate our spend mostly on two banks.