NOTICE: This post references card features that have changed, expired, or are not currently available

A question that we have seen repeated in our Frequent Miler Insiders Facebook group, on our Frequent Miler Ask Us Anything live Youtube broadcast, and in blog comments has been which temporary grocery bonus to use, specifically between the 12x offered by the Hilton cards at US Supermarkets and the 6x being offered by Marriott cards at grocery stores, both through the end of July. While I’ve noted that I’m not picking one over the other but rather using both, a question in Frequent Miler Insiders the other day prompted me to think about this more from the perspective of someone who is not engaging in advanced spending technqiues: if you aren’t going to do any MSing, which bonus should you be earning? I realize that at this point, the bonus period is about two-thirds over, but I still thought it was worth giving this some thought given that there are 5 weeks of grocery bonus time left.

My take thus far has been a mix

As noted on Frequent Miler on the Air a couple of weeks ago, I’ve been using cards in both families on grocery spend for these past couple of months as I could use more of each currency given a couple of years of heavy burn. I’ve also been happy to be able to spread spend over multiple cards within the household rather than having to focus it on one account. That has been particularly welcome for me given that I am not only buying my milk and bread at the grocery store, but also taking advantage of some gift card purchases. That has made a mixed spend solution more appealing.

MS Warning: Hilton points have been slow posting

For manufactured spenders, it likely won’t be news that Hilton points have been slow to post for those who have been suddenly spending much more on groceries than usual. We have received plenty of reports of points not posting (in some cases for two consecutive statement periods) and I heard of at least one shut down. The good news is that I’ve heard at least a handful of DPs of points finally posting to Hilton accounts, so there is hope that the points were simply delayed by the increased bonus. As I wrote the other day, there was a lag in my grocery bonus points on the Ritz card from May grocery spending (though grocery points from my June statement subsequently posted with the rest of my statement points). Nonetheless, it may be prudent to tread cautiously on the Hilton cards given the current economic environment and the way that so many were recently held up.

But manufactures spending isn’t the focus of this post, but rather this post is aimed at those who will not MS.

Based on Reasonable Redemption Values, neither makes sense

Before diving into my thoughts as to which card and why, it’s worth noting that neither card likely makes mathematical sense on the surface unless you have a particularly valuable near-term use of points in mind.

Based on our Reasonable Redemption Values, here is a comparison of cards that ordinarily earn the Best Category Bonus at Grocery Stores and the temporary offers:

- Amex Gold (4x Membership Rewards points on up to $25K per year at US Supermarkets, then 1x):

- 4 x 1.55c (RRV) = 6.2c per dollar

- Amex Blue Cash Preferred (6% back on $6K per year at US Supermarkets, then 1%)

- 6% back = 6.0c per dollar

- Amex Hilton cards (Surpass and Aspire) (12x Hilton points through July 31st)

- 12 x 0.45c (RRV) = 5.4c per dollar

- Citi Premier (3x on groceries now a permanent bonus category)

- 3x x 1.45 = 4.35c per dollar

- Marriott Bonvoy cards (6x through the end up July up to $5K in spend on Chase cards or up to $7.5K in spend on Amex cards)

- 6 x 0.72c (RRV) = 4.32c per dollar

The above leaves out some other options that are either more limited-time (Freedom quarterly bonus ending in a few days; Wells Fargo cards 5x for the first 6 months) or that involve more hassle (like the Amex Everyday Preferred, which requires 30 transactions per month to get a more valuable bonus).

As you can see above, neither the Hilton nor Marriott cards offer the most bang for your buck at the grocery store based on Reasonable Redemption Values. Keep in mind that our RRVs are meant to represent the value you can reasonably expect from your points without extensive effort at finding a top redemption. It is certainly possible to get more value from your Hilton or Marriott points than the RRV (and it is also possible to get less). That said, you would have to value Hilton points at more than half a cent each or Marriott points greater than 1c each just to break even with the value you can get on the Blue Cash Everyday or Amex Gold card (given that both Hilton and Marriott are selling points quite cheaply at the moment, either valuation would be questionable).

While some will make the argument that the Hilton earnings are uncapped, whereas both of the other Amex options have clear limits on annual spend, I bring this back to the viewpoint of the non-MSer, to whom the caps likely matter less. The key point here is that for average-value redemptions, the Hilton and Marriott bonuses don’t represent unprecedented value and may not be the best option in your wallet.

However, the reason I still find these bonuses exciting and am using Hilton and Marriott cards is precisely because these bonuses at least bring the earnings on those cards into the realm of “reasonable”, which represents a rare opportunity to earn hotel points from credit card spend at a rate that is at least competitive with the other cards in my wallet.

Estimated earn for “average” grocery spend

Again, the impetus behind this post was to give some thought to these bonuses in a context I hadn’t much considered: which earn rate makes sense for the non-manufactured spender? If you are only spending money at the grocery store on groceries (and maybe the occasional gift card for your personal use), which credit card should you be using?

Based on the Reasonable Redemption Values above, if you are set on using a Marriott or Hilton credit card, the clear choice looks like the Hilton card. At a return of about 5.4% based on our Reasonable Redemption Value, it clearly beats the 4.32% yield from the Marriott cards.

However, I think that it makes more sense to look at your total earn potential and consider its usefulness given your specific needs.

I gave it a Google to try to figure out the average monthly grocery expenditures for a family of four in the US, but every site I read seemed to have different figures that varied pretty wildly. For the sake of simplicity, I landed on the thought of spending $1,000 per month on groceries. That may be on the high end based on the figures I read, but given that many families have collectively spent much more time at home than usual over these past few months, slightly higher-than-average grocery bills seem reasonable.

Given that the grocery bonuses were to run May through July, our $1K/mo assumption would yield the following:

- Hilton ($3K x 12) = 36,000 points

- Marriottt ($3K x 6) = 18,000 points

While our Reasonable Redemption Values predictably tell us that the Hilton points are “worth” more, the redemption value only tells one part of a complicated story.

A couple of years ago, Greg and I talked about manufacturing free hotel nights and Greg wrote a post comparing the cost of manufacturing free nights via credit card (See: Manufacturing free nights (Hyatt, Hilton, Marriott)). In that post, he included the following chart showing the number of points required for a free night with each hotel chain.

| Hotel Type |

Marriott | Hyatt | Hilton |

| Bottom Category | 7,500 | 5,000 | 10,000 |

| “Average” | 18,272 | 7,561 | 29,236 |

| Top Category | 85,000 | 30,000 | 95,000 |

Interestingly, the total earn from my assumption above should get you a free “average” night in either chain. Given that the closest actual category prices to either of the averages above is 17,500 points (Marriott Category 3 standard) or 30,000 points (Hilton doesn’t have an award chart, but they usually charge in even increments), you should earn enough points from grocery spend to get that “average” sort of night either way.

That then brings me to two important points of comparison in terms of deciding which card to use:

- The type of stays you are looking to have

- Your best option for adding future points

I’ll consider each separately.

Like low-category stays?

Technically, Hilton’s awards start as low as 5,000 points per night, but to my knowledge there has not been a hotel charging that few Hilton points in the United States in quite a few years. A couple of years ago, Stephen posted about the Hilton hotels in the US that charge 10,000 points per night. Here was the map at the time:

That list is surely out of date now (indeed, the first property on the list in his post, the Hampton Inn Enterprise, a property at which Stephen had stayed for just 10K points per night a couple of years ago, is now double that cost at 20K points per night every night through the end of the booking calendar). Theoretically, the 12x at the above-assumed “average” grocery spend would comfortably give you enough points for 3 nights at one of those Hampton Inn properties that still cost 10K per night and very nearly give you enough for five nights since four nights would cost 40K points and the 5th night is free on award stays. If you can find that type of stay, it could be an excellent value.

The trouble of course is that Hilton has such variable pricing, so it may be hard to plan on a specific redemption depending on the area and season. Still, there is good value to be had here. Just $333.33 in additional spend would put you at the 40K points needed for five nights at a 10K property, so it would at least theoretically be pretty easy to grab a couple of gift cards to places where you frequently shop (perhaps Amazon, gas stations, etc) while you’re at the grocery store to top off for that 40K threshold.

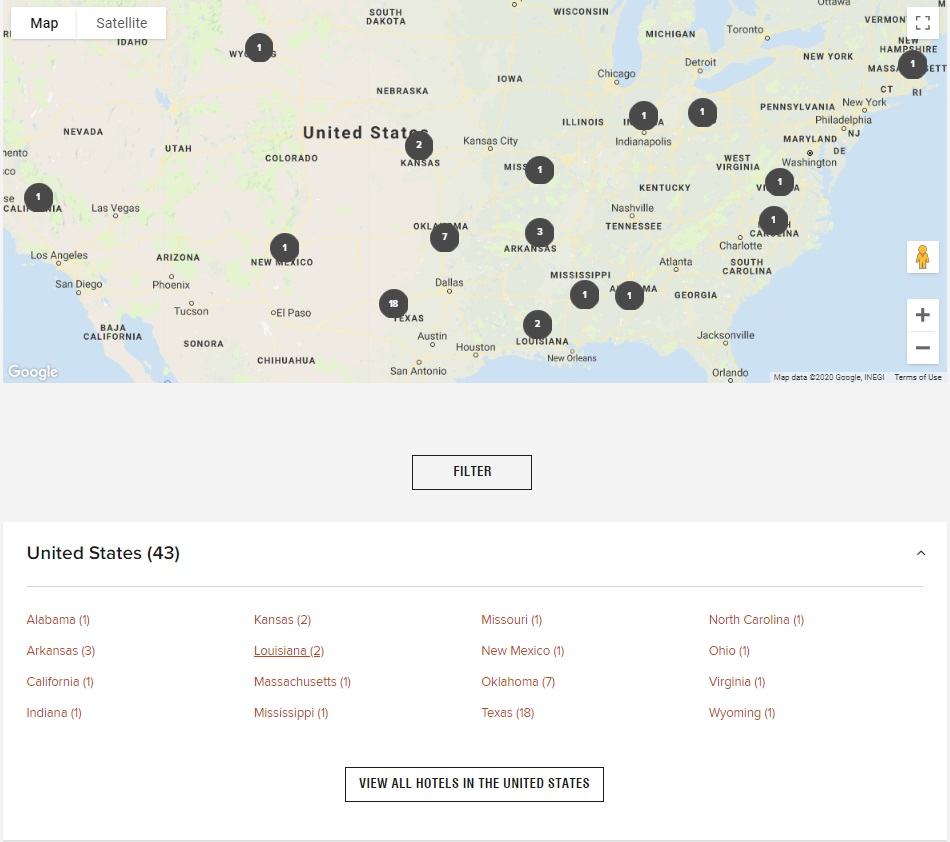

On the flip side, Marriott’s Category 1 starts at 7500 points per night standard. Off-peak awards cost just 5,000 points per night at Category 1 properties. There are precisely 43 Marriott Category 1 properties in the US, so whether or not this redemption makes sense or matters to you is fairly location-dependent. You can search and filter Marriott properties by category here.

With just one property in all of California and only one property in the entire northeast, it certainly may be hard for many readers to come by an opportunity for an off-peak Category 1 property. Those in or traveling to Texas or Oklahoma may find more value in an off-peak Category 1 redemption.

With just one property in all of California and only one property in the entire northeast, it certainly may be hard for many readers to come by an opportunity for an off-peak Category 1 property. Those in or traveling to Texas or Oklahoma may find more value in an off-peak Category 1 redemption.

Much like with Hilton, average monthly grocery spend will get you quite close to enough points to get a 5-night stay at the bottom-tier property (during off-peak dates with Marriott) given that a 5-night stay at 5K points per night would cost 20K Marriott points after the 5th night free. If you wanted to generate the additional 2K points needed for that 5-night off-peak stay, you would coincidentally need to spend the same additional $333.33 during the grocery bonus period.

Given the relatively low concentration of low-category properties, both chains would look relatively even if your primary goal is to generate points for low-category stays. Which card you use will likely be a function of which chain has low-category properties in the area you’d like to visit.

I will note that one group who may want to more heavily consider Marriott than Hilton would be those chasing Marriott elite status. Given the status boost Marriott is giving to members who earned any level of elite status in 2019, many members will find themselves within reach of qualifying for a higher tier and/or elite choice benefits. For example, someone who earned Marriott Gold status in 2019 (including from having an Amex Platinum card) will receive 13 nights toward earning elite status in 2020. If that person had both a Marriott personal credit card and a Marriott business credit card, they would get an additional 30 nights of elite credit from holding those credit cards. That would put them at 43 nights toward elite status without having spent a night in Marriott hotels. It certainly may be worth a 5-night Category 1 mattress run to bump up to Marriott Platinum status through February 2022 given that it carries much more meaningful benefits than Gold (including free breakfast and/or lounge access at most Bonvoy properties, 4pm checkout, and a 50-night choice benefit like 5 suite night awards).

However, those who are not in need of five nights for that purpose will likely find the earn here relatively even.

Topping off for future redemptions

With many of us pausing travel plans for the time being, it is likely that many of us are collecting points now to put toward an undefined future trip. In that case, your best options for topping off your points balance for future stays matters.

Going back to Greg’s post comparing manufacturing nights via credit cards, which is worth reading in its entirety, the Hilton cards (particularly the Hilton Surpass card given its bonus categories) beat out the Marriott cards in terms of the amount of spend required to earn nights at the bottom and top tiers in almost every scenario and are fairly comparable at the middle “average” stay level.

The only situation where manufacturing Marriott nights via credit card spend came out comfortably on top of Hilton was when using an Ink Cash card at office supply stores. Marriott came out on top there because Hilton doesn’t offer a card with an office supply store bonus (neither does Marriott, the assumption here was transferring points from Chase Ultimate Rewards). Transferring Chase Ultimate Rewards to Marriott would be a questionable value proposition at best. Given that Marriott is selling points for 0.78c per point right now, you would be better off cashing out Chase points for a statement credit for 1c each and then buying the Marriott points (or better yet, cashing out at grocery stores for 1.5c and then using the cash saved to buy points). If you’re considering either of those cash-out-to-buy options, you then also have to consider that you could cash out and buy Hilton points for even less.

In other words, if your aim is to combine the points earned during these limited-time bonuses with those earned on future spend, it would in most cases be hard to justify going with Marriott. That’s because the Marriott credit cards earn a base rate of 2x and don’t offer particularly generous bonus categories. On the flip side, the Hilton Surpass card offers 6x at US Supermarkets, US restaurants, and US gas stations. While none of those are category bonus bests, the return is at least not unreasonable if you will continue to spend down the road to earn free nights. Combine that with the fact that the Surpass earns a free weekend night at $15K calendar year spend (and that “weekend” night will be valid any night of the week if earned by the end of 2020) and the return on the Surpass card becomes more compelling.

In fact, assuming $1K per month in grocery spend on the Surpass that you maintain monthly during 2020, you would earn the following total of points:

- $1k/mo at 12x during May-June-July = 36,000 total points

- $1K/mo at 6x for the other 9 months = 54,000 total points

At the end of 2020, someone spending $1K per month on groceries on the Hilton Surpass card will have earned 90,000 Hilton points plus 1 free night at nearly any Hilton hotel in the world. You would be just a few thousand points shy of being able to spend 2 nights at a top-tier Hilton property.

Comparatively, the Marriott cards can’t really hold up for non-MSers. The only key bonus categories on any of the Marriott credit cards are 4x on gas stations and restaurants (on different cards). Most readers likely aren’t spending $1,000 per month in those categories, but assuming you are, here would be the comparable Marriott earnings:

- $1K/mo at 6x during May-June-July = 18,000 total points

- $1K/mo at 4x for the other 9 months = 36,000 total points

That would total at 54,000 Marriott points at the end of a year. That’s enough for a night at a pretty nice Marriott property, but won’t get you anywhere near a top-tier property for even a single night during off-peak dates. Whether your aim is to stay at top-tier properties or just top off for future redemptions, it will be a grind with Marriott.

Bottom line

When Greg and I discussed this on the podcast and live broadcast, I know I said that I was using both card families but I believe that I said I would likely pick Marriott if I had to choose one over the other. That’s because I’ve gotten excellent value out of Marriott points over the past few years. However, I think my perspective would be entirely different absent any manufactured spending. As you can see in this post, those who are not MSing will find it hard to put together a meaningful number of Marriott points. Not only are the Hilton points worth more according to our RRVs, it will be easier to put together the points for a meaningful award stay with Hilton when combined with your regular spend the rest of the year. While the chance to earn 6x Marriott points per dollar spent for a limited time might look appealing given the difficult nature of earning Marriott points at a reasonable rate of return for most spend during most of the year, I think you would likely be better off with a Hilton strategy for hotel points in general and certainly given this bonus situation if you are not a manufactured spender.

[…] 12x Hilton vs 6x Marriott for non-manufactured spenders […]

The Hilton spend (bonus or non bonus category) through end of year also count as base points for those chasing lifetime diamond status. Not sure if that is same for Marriot. If not, another reason I would go Hilton over Marriot here

[…] current hotel credit card promotions and answered the question of whether it was better to earn 12X Hilton points or 6X Marriott. In this post, I stepped back to look at normal non-promotional card earnings. Specifically, I […]

“At the end of 2020, someone spending $1K per month on groceries on the Hilton Surpass card will have earned 90,000 Hilton points plus 1 free night at nearly any Hilton hotel in the world.” $1K per month for a year is only $12K, $3K short of the free night.

Hilton Aspire all the way for me simply because I’m accumulating as many free nights as possible for a Maldives trip. The Conrad Maldives at 76K Hilton/night is a fantastic value. Looks like we need 14 nights now based on their new restrictions….what a shame!

They flip flopped on their requirements and now they don’t require anything. It could change again but for now there’s no 14 day minimum.

Glad you agree with the 83K HH points I accumulated last month.

SURPASS is the winner for the first $15k. Worst case you would easily get an extra $150 of value from the free night, thus adding an extra 1c to the valuation and bringing it to 6.4c

With any bit of effort at all, you should be getting at least $300 from the free night, bringing the return to 7.4c

My wife easily spends $1500 a month at the grocery store. I gave her my Aspire card. I’m Diamond with Hilton and Gold with Marriott so I’ll accumulate Honors points. If I’m at the grocery store I’m currently using my Sapphire Reserve although I believe the Chase promotion ends this month.

First, thanks for the clarification about MS, because I was trying to figure out from an earlier column why you (or anyone else) would be putting grocery spend on the Ritz Carlton card with Freedom and Chase Sapphire Reserve options available this quarter. Having said that, I think your valuation of Hilton is low particularly if used at high end properties, and unfortunately, your valuation of Marriott is pretty spot on if staying for five nights (a bit too high if not). The big story to me (as a lifetime Titanium) is what has happened to the value of Marriott points during the past three years. I used to regularly be able to get more than 1.25 cents per point pre-Bonvoy days (the price at which Marriott used to sell points). The constant series of devaluations has significantly changed the value proposition of the program. One of the more amusing things to note that it is very hard to use the free night certificates from the Ritz Carlton card at a Ritz Carlton anymore since the cost of Ritz Carltons in points have increased so much. Essentially, it seems like the change in earning on the Marriott credit card from 1 point per dollar to 2 points per dollar was matched with a corresponding doubling or tripling of the cost of many or most Marriott hotels in points. I’ll take 12x Hilton over 6x Marriott for groceries in the current environment any day. In the absence of a promotion (last year I received 3 points per dollar on both the AMEX and the Ritz cards), my three Marriott credit cards remain in the sock drawer–this from a former die-hard Marriott loyalist.

I’m going with Hilton because of the current non-restricted free night on the surpass. Plus, even though I have high level status at both, I’d choose Hilton over Marriott (all other things being equal) because of the fact you know that you’re getting breakfast and you don’t have to look at some convoluted chart to see what your “free breakfast” entails.

Having maxed out the Freedom quarterly 5x and the monthly 5x on Sapphire Reserve, and not holding either of the better-return Amex cards, and not doing MS, I have went with the Hilton Aspire for regular grocery spend over the Marriott. I gave some thought to using the limit-$1K-per-month 5x on the CNB Crystal that just came out, but I am trying to work away from that card … and the RRV of Hilton return is good enough to essentially make it moot. CNB is technically more flexible than Hilton, but more annoying to use the points. And Embassy Suites are typically a good redemption for us when we travel as a family-of-6 to get standard reward prices with 2 queen beds plus a pull-out couch in two separate rooms and full, hot breakfast for everyone. I have not found a different hotel brand that reliably gives sleeping space for 6 and full breakfast at “standard” award pricing.

We have two surpass cards in the house and are taking advantage of the 12x supermarket bonus. Both of our cards’ cycles closed last week and we got the bonus spend within 24 hours. I was surprised to see people were having an issue with this.

As a contrary example. I got my points in May within 24 hours of statement closing (with ~$5K in grocery spend). My June statement closed June 19th (~$10K in grocery) and I have yet to get any points transferred to Hilton. I suspect I will be in limbo for a while.

I did automatically get the Free Night though. It triggered before the statement closed, so I don’t think it got caught up in the “review”.