After a couple of years as a miles-and-points blogger and a few more before that traveling in comfort that exceeded my occupation, you might assume that friends and family constantly pepper me with questions about how they can leverage credit card rewards and travel more or more cheaply or more comfortably. You’d be mistaken. I actually pretty rarely have a family member or friend reach out for help leveraging rewards. However, I did get one such email this week from a family member who is planning a special trip. He emailed me because Amex Travel wasn’t able to get the job done with his 1.25 million Membership Rewards points — they quoted him a trip of about $16,000 and told him that his points would only cover $9,000. Because of the huge gap, he initially decided to put the trip on hold and then figured he’d reach out to me to see if I could help him stretch his points any further. Yup, I’d say we can stretch them a bit beyond that . . .

Here’s the main guts of what my family member, who we’ll call Bob, sent me:

…..earlier in 2018, I spent a little time trying to plan a two week vacation with Amex Travel to Spain and Morocco. We have 1.25 million Amex points, which, at 141 travel (air/hotel) points per dollar, equals to almost $9000 in U.S. dollars. I thought that’d be enough to get us two business class flights and some luxury accommodations.Not quite.Here’s what I originally asked for:1. Fly from LAX into Madrid for a day – leave July 27th, arrive July 282. Fly to Marrakech for a week – arrive July 29th – Marrakech. (Essaouria) on coast (3hrs), (Ouarazate) inland (4 hrs) or High Atlas (4 hrs)3. Fly to Madrid on August 5th for 3 days4. Fly/drive to another Spanish city (Seville, Barcelona, Marbella, Granada?) until August 10-11 return to Madrid.5. Fly from Madrid to LAX on Aug 11-12.Alternative: Fly to Madrid and drive all the way thru Gibraltar to Marrakech and fly out of there. Problem is that is a LOT more driving than we want to do.I think we’d rather spend 3-4 days in two Spanish cities and 3-4 days in two Moroccan cities. There’s no direct flight from Marrakech which is why I was thinking of doing a loop and making Madrid our home base for the trip.Here’s what Amex came up with:Spain: total cost $8688Morocco: total cost $7577Long story short: we were trying to get two weeks paid in full at $9000 and Amex was like, yeah, that’ll cover about HALF of your trip. 🙂

It’s worth noting that the last sentence isn’t exactly saying that Bob was looking to pay $9,000 — that number is based on what Amex Travel told him the value of his 1.25 million points would be if applied to the trip. For those keeping score at home, that’s a value of 0.72 cents per point. Our Reasonable Redemption Value for Amex points, which it’s important to note is based on value you can reasonably expect to get without much effort at prime redemptions, is 1.82 cents per point — which means those 1.25 million points should reasonably be redeemed for around $22,700 worth of travel….or quite a bit more with maximization.

It’s also worth nothing that Greg wrote a post yesterday about the best cash back credit card options on the market (See: Super Combos Cash Back Credit Cards). It’s important to remember that the opportunity cost of collecting points over cash back is not zero. If Bob earned all of his Membership Rewards points at 1x, that same $1.25m in spend could have earned $32,750 in cash back with just one credit card and no effort at maximization (see Greg’s one card solution in that cash back post) – and one could have earned significantly more by maximizing a cash back strategy with multiple cards. Of course, the points likely weren’t all earned at 1x, so in reality the opportunity cost is likely less.

Bob sent me the sample itineraries that Amex had used to quote the trip. While I can’t quite recreate the whole thing on points, I thought it would be an interesting to think out how we might use his points better — and then to get reader feedback about what we could do to plan the trip for even fewer points as I’m sure that crowd-sourcing this will produce even better results. Here are my suggestions.

Easy road: cash in the points for a lot more

The first thing I told Bob was this: he has enough points to darn near cover the trip that Amex Travel planned, and I don’t mean by strategically transferring to partners. One of the many flavors of the Amex Platinum card is the Charles Schwab Platinum. A key benefit of the Schwab Platinum card is that one can cash out Membership Rewards points at a rate of 1.25 cents each when depositing them into an eligible Schwab brokerage account. From the brokerage account, one could obviously move the money to a checking account, etc. Doctor of Credit has a good write-up on the process for opening the brokerage account, and you can find out more about the Schwab Platinum card on our dedicated Schwab Platinum page. If you’re interested in comparison with other Platinum cards, see: Which is the best Amex Platinum card?

So the simple math on the easy road is this: If Bob opens a Schwab brokerage account, he can cash out 1,250,000 points for $15,625. That’s awfully close to covering the cost of the trip as Amex quoted it. If he doesn’t want to spend a minute of his day transferring points from here to there and searching for award availability, he could simply cash out.

Savvy readers will also know that Bob’s timing couldn’t be better if this is the plan he selects. That’s because opening the Platinum card in December gives him a chance to triple dip the annual airline incidentals credit. That is to say that if he opens a Platinum card in December, he could spend $200 on airline incidentals before December 31, 2018 to get $200 in credits this calendar year. Then, between January and December 2019 he can receive another $200 in airline incidental credits. Then, he could pick up a third round of $200 in credits in January 2020. As long as he cancels within 30 days of the day his annual fee posts in December 2019, he won’t have to pay the second year’s fee. Since there are a lot of things that can trigger those credits, it’s pretty easy to get at least 85% of the face value for those credits (~$510). If he then uses some of the $200 in annual Uber credits (perhaps for UberEats since he has a car and doesn’t likely use Uber much), he should come out ahead of the $550 annual fee he’d pay in the first year — even if he never uses another benefit of the card.

So if all Bob wants to do is cash out and take his dream trip as Amex Travel planned it, that’s the easy solution. And if he wants to exercise the Joy of Free and use his points to totally cover the trip – taxes, fees, tours, etc – I think that cashing some out via the Schwab Platinum card makes sense.

Amex Travel’s total package

One significant advantage to booking with Amex Travel (or a travel agent in general) is that they really planned out much of the trip in detail — including airport transfers and several days of tours / private car and English-speaking driver. Add on to that the convenience of having a single contact point for the entire trip and I can see the appeal of booking through a travel agent. But the price still seemed outlandish to me.

Bob told me he was looking to book a luxury trip. I was therefore a little surprised when I looked at the itinerary Amex built — quoted at the prices above — and saw that the flights given from Los Angeles to Spain, Morocco, and back were all in economy class. I further looked up the hotels, and while all were well-reviewed and some looked quite unique, most were pretty reasonably-priced.

Still, I figured I’d try to approximate the itinerary Bob was given to see how many points and miles it would take to A) Book award flights and B) cash out points to pay for tours/transfers.

Award flights

Bob originally started planning last winter with the intention to take the trip this past summer, but decided not to move forward since his points wouldn’t cover as much of the trip as he’d hoped. He’s now looking to consider a trip in the spring. However, summer dates are traditionally the hardest for award tickets and most expensive for paid tickets since it is a peak travel period. For that reason, I decided to price out the trip (from an award travel standpoint) using approximately the same summertime dates he originally had. Spring dates will likely not be harder / more expensive.

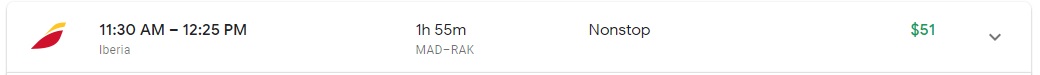

LAX-MAD

The trip as shown above started out with a flight on July 27th from Los Angeles to Madrid. The itinerary produced by Amex Travel had them in economy class on KLM via Amsterdam.

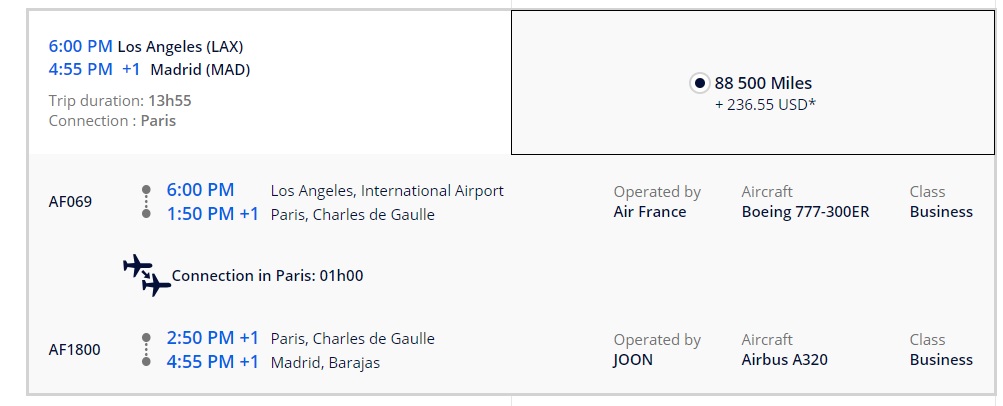

Of course, it should be possibly to get them to Europe and back comfortably within their points total. And sure enough, that’s pretty easily doable. For example, here is one-way pricing for Los Angeles to Madrid and in business class via Air France / KLM’s Flying Blue program. Flying Blue now offers variable pricing, but as you can see, some dates are available even in July from 70K miles and $254.85.

That said, I’d note that the 70K availability is on the Air France A380, which I believe features angled-flat seats. At 88.5K, you can fly on the 777 in what should be a flat-bed seat.

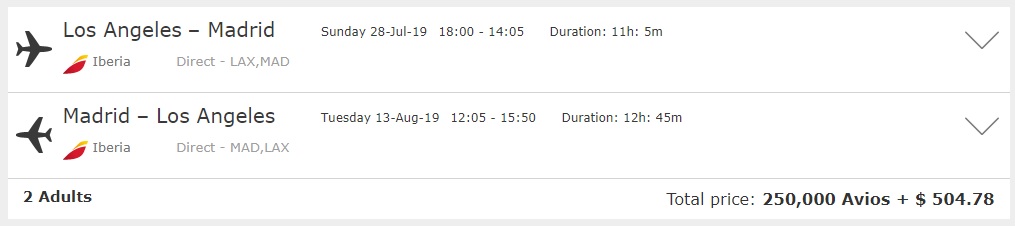

Of course, that’s not the only way to use Membership Rewards to get to Europe and back. The current point transfer bonus to Avios is offering a 40% bonus on Membership Rewards points transferred to Avios. Sure enough, Iberia has business class availability on some summertime dates on its Los Angeles to Madrid nonstop flight. Two passengers in business class on nonstop flights both ways comes to a total of 250,000 Avios and $504.78.

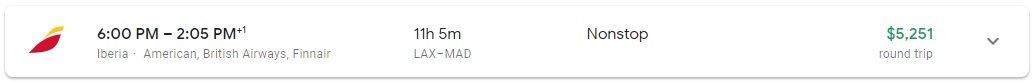

Thanks to the transfer bonus, it would only require 179K Membership Rewards points (plus $504) to book 2 people round trip in business class. Assuming Bob wants to cash out Membership Rewards points via the Schwab Platinum to cover the taxes & fees also, he would need to cash out 40,382.40 additional points. That’s 219,382.40 Membership Rewards points and the flights to and from LA are done. Those direct flights wouldn’t be cheap if paid cash — the same dates shown above would be more than $5,000 per person round trip.

Of course, if they’re looking for a more luxurious flight, there are some other good choices:

- Avianca charges 63K each way in business class or 87K each way in first class from the US to Europe on Star Alliance carriers with no fuel surcharges. I’m not sure if Lufthansa First Class is currently bookable with LifeMiles (and it would typically only be available within 2 weeks of departure if it is), but this would be a good way to fly in luxury and style if it is. That said, I probably wouldn’t stake an important trip on finding availability two weeks before departure.

- ANA charges 88K round trip in business class or 165K round trip in first class from the US to Europe on Star Alliance carriers, though surcharges can be high

- Aeroplan charges 55K one-way in business class to Spain or 70K in in first class from the US to Europe 1 (Spain) on Star Alliance carriers

I haven’t personally flown Iberia’s business class, but between Iberia and the options above, it’s possible to comfortably get 2 passengers to Spain for around 250K points total.

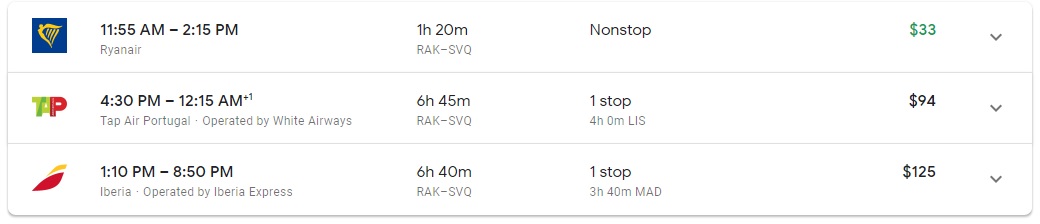

Flights within Spain and to/from Morocco

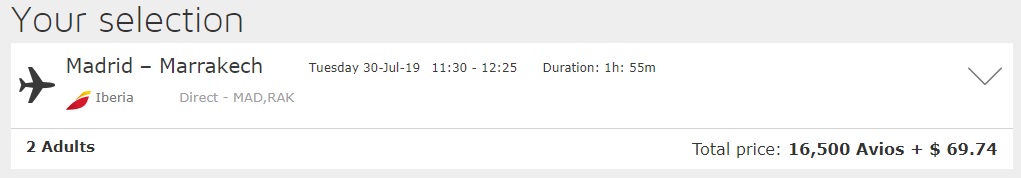

As one might expect, Avios initially look like they would be the best value for getting around Spain and to/from Morocco. That’s because Avios offers a distance-based chart, so Madrid to Marrakesh would cost under 17K for two passengers in economy class before the transfer bonus (under 12K considering the bonus) plus $70 in taxes for two people.

Of course, that only seems like a deal until you look up the cash price and realize that the flight only sells for $51 total per passenger.

At $102 for a party of two, Bob would only have to cash out 8,160 points at 1.25c each to cover two passengers. Flights from Marrakesh to Seville are a similarly story – a bit more to fly on TAP or Iberia (which probably make more sense than Ryanair when traveling with luggage).

While Iberia’s only nonstop flight from Marrakesh is to Madrid, it looks like Spanish discount carrier Vueling flies direct from Marrakesh to Barcelona. While discount carriers like Ryanair and Vueling may not be the stuff luxury vacation dreams are made of, I’d argue that even intra-European business class doesn’t fit that bill, so I tend to pick flights within Europe by the least amount of time from Point A to Point B.

While Iberia’s only nonstop flight from Marrakesh is to Madrid, it looks like Spanish discount carrier Vueling flies direct from Marrakesh to Barcelona. While discount carriers like Ryanair and Vueling may not be the stuff luxury vacation dreams are made of, I’d argue that even intra-European business class doesn’t fit that bill, so I tend to pick flights within Europe by the least amount of time from Point A to Point B.

Whether he chooses to buy the flights outright and cash out points or book them as award tickets, he shouldn’t be out be out more than 80,000 points to fly from Madrid->Marrakesh->Seville->Madrid for 2 people (and can probably do it for less).

Accommodation

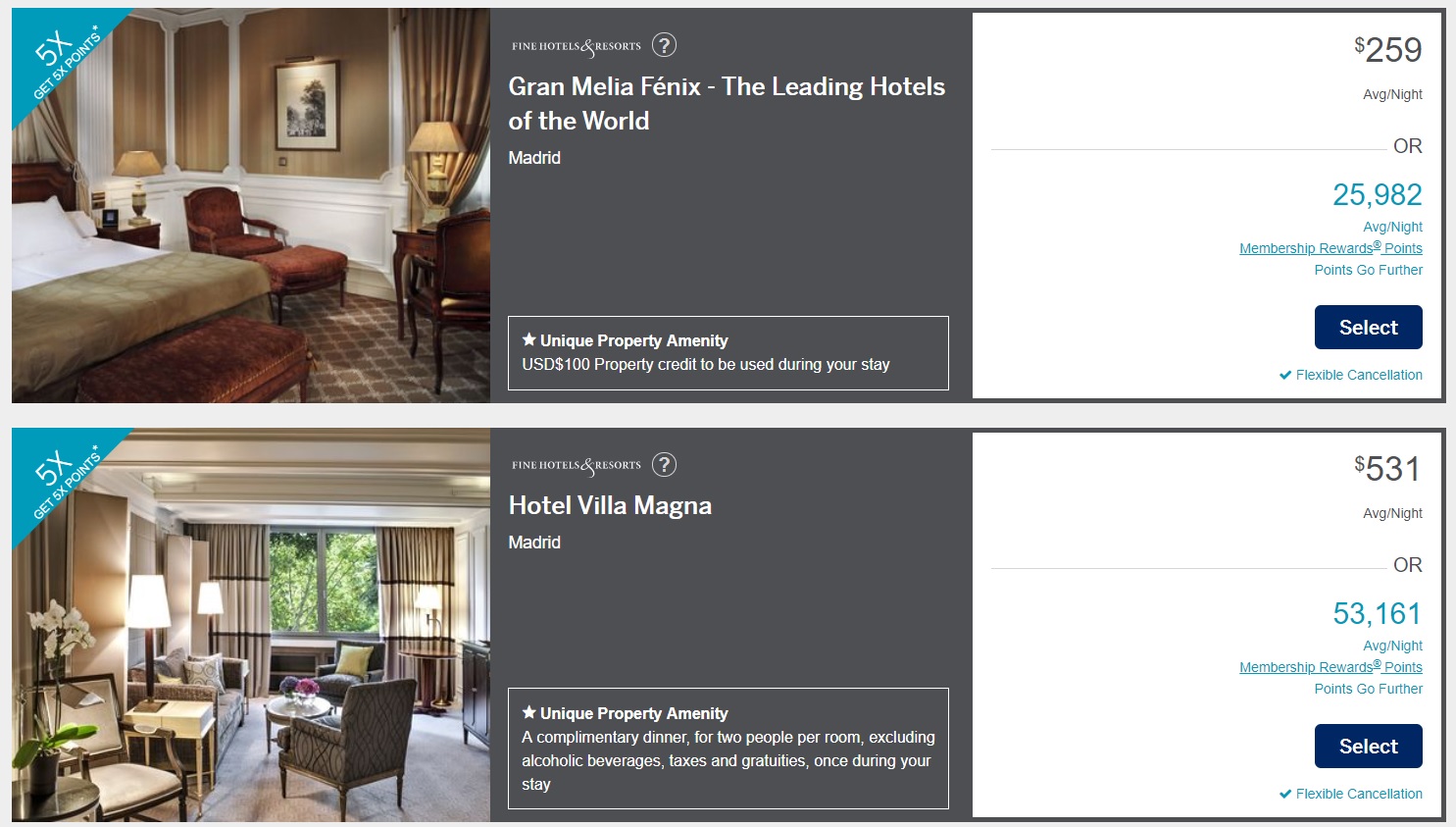

This is where Amex is typically thought to be pretty weak as hotel partners are pretty limited: Marriott (1:1 transfer), Choice (1:1 transfer), and Hilton (1:2 transfer, though some people have been targeted for better lately).

That said, if Bob opens the Platinum card as mentioned before, he should be able to book hotels through Amex Travel at a value of $0.01 per point. For example, one of the hotels Amex Travel had set him up with is the Gran Melia Fenix in Madrid. That hotel is part of Amex Fine Hotels & Resorts and costs $259 per night on the date on the dates I checked — or just shy of 26,000 points per night.

Booking through Amex FHR means he would receive a $100 property credit during the stay, breakfast for 2 daily, guaranteed 4pm late checkout, and a room upgrade and early check-in (based on availability). Spending three nights at the Gran Melia Fenix would cost about 78,000 points.

Of course, if he cashed those points out via the Schwab card, he’d only need 62,160 points to pay the $777 bill for 3 nights.

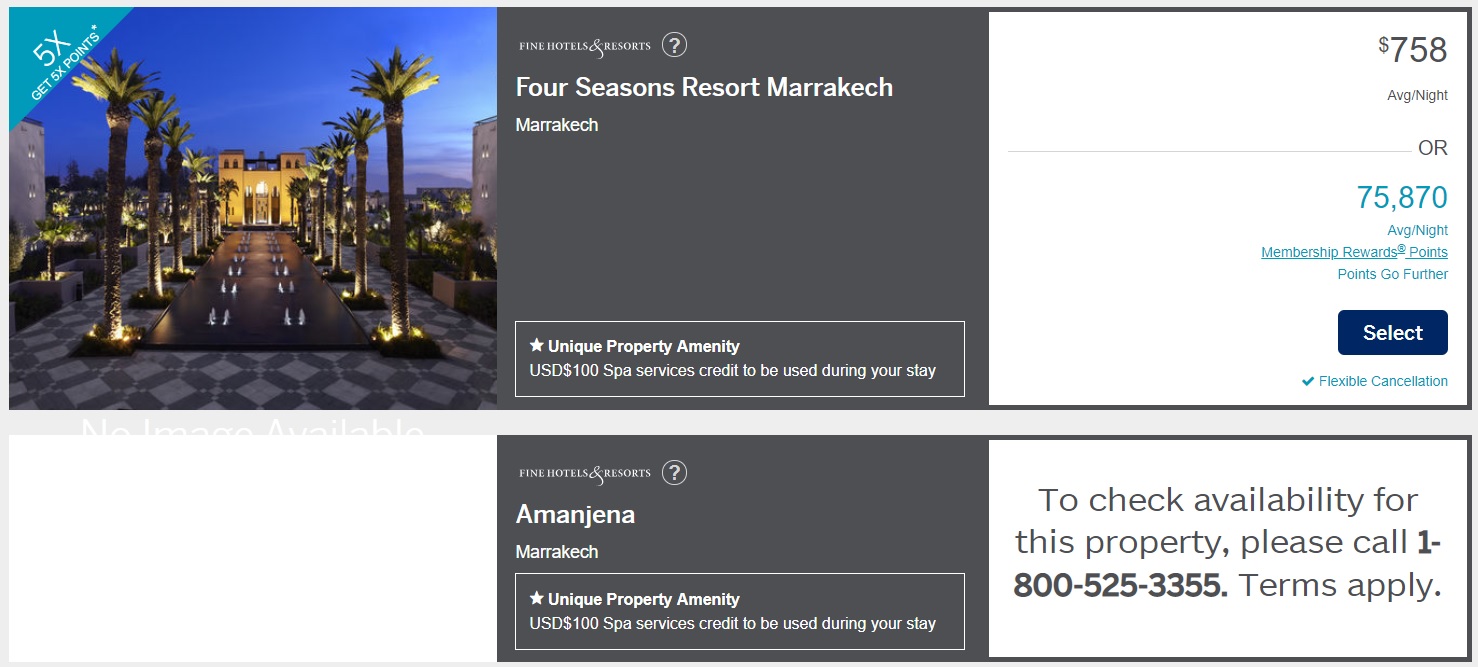

If Bob really wants to go luxury, there are plenty of options for that in Marrakesh also. According to Bob’s original itinerary, he planned six days in Marrakesh. If he were to pay 75,870 points per night to stay at the Four Seasons (again, with daily breakfast for two, late checkout, etc), it would cost him a hefty chunk at 455,220 points.

Of course, I’d suggest he do that differently. I’d suggest he consider opening the Citi Prestige card when it re-launches and booking through the Prestige concierge. After the Citi Prestige 4th night free, he’d be looking at a bill of about $3,790 for six nights at the Four Seasons. That would only require him to cash in around 303,000 points at 1.25 each to pay for it. Of course, there are plenty of other luxury properties in Marrakesh that likely cost less than $758 per night, so this isn’t a “best” example by any stretch.

Because of the fact that FHR is making the update to offer 5x points (and likely because it is the end of the year, when Amex renews the list of FHR properties), many properties aren’t currently bookable online. Some hotels offer a 3rd or 4th night free through FHR, so I wouldn’t be surprised if one of the other FHR options in Marrakesh offers a better value.

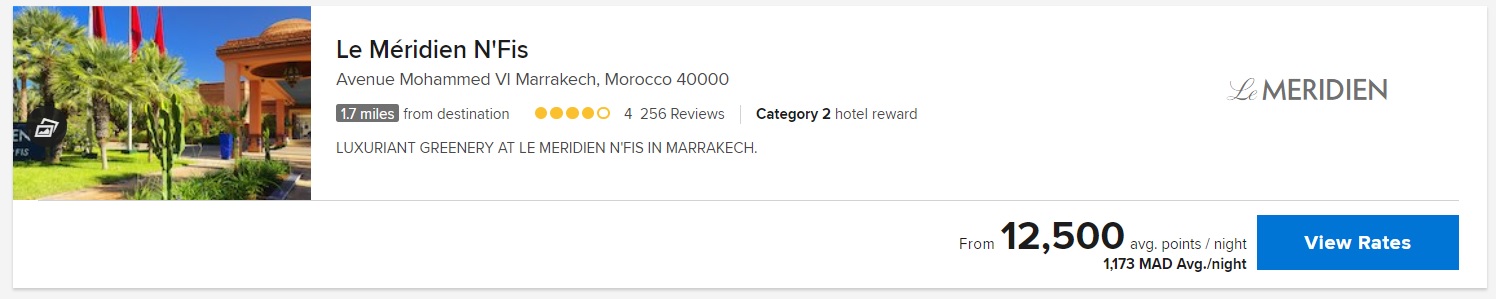

Speaking of value, at the other end of the spectrum the Le Meridien would only cost 12,500 points per night. While I’m sure it’s a vastly different experience than the Four Seasons, it would only run 62,600 total points (after Marriott’s 5th night free).

Putting it all together

Let’s make some assumptions about how many points Bob will need based on what I’ve laid out above:

- 219,000 points [RT business class from LAX to Madrid + cashed in points for taxes / fees]

- 80,000 points [Flights from Madrid->Marrakesh->Seville->Madrid

- 62,160 points [Hotel in Madrid]

- 303,000 points [Four Seasons in Marrakesh]

664,160 points

Now he’s still missing a hotel for 3 nights in Seville and tours. Guestimating that Seville won’t cost much more than Madrid, he’ll be at around 725,000 points used. All that’s missing from what Amex Travel planned is airport transfers and the private guided tours for Bob’s days in Morocco. He’d still have more than 500,000 Amex points (with a cashout value of $6,250), so I’d say those could be arranged pretty easily.

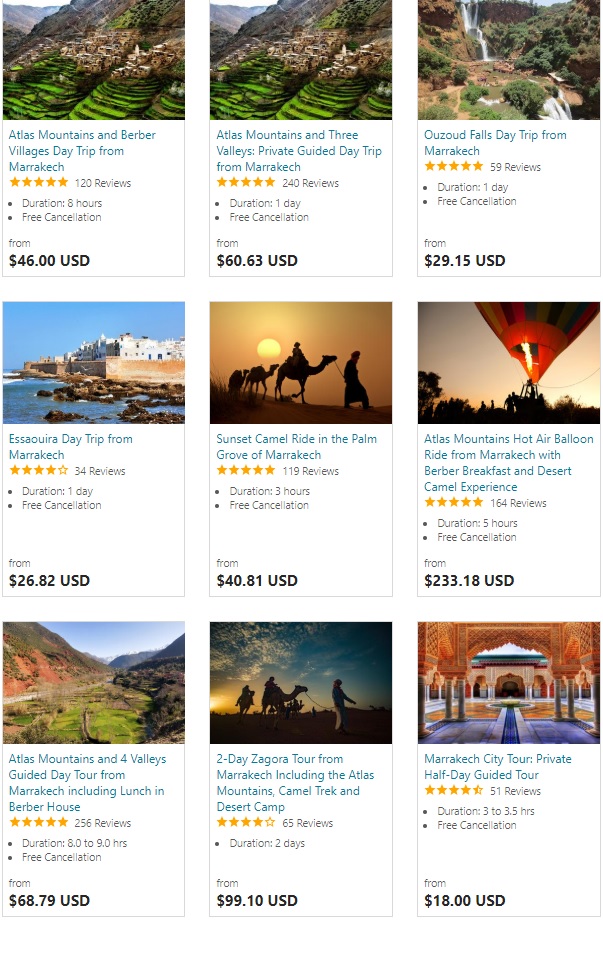

In fact, there is no shortage of similar tours that can be booked via Viator.com and many of which can be private or custom.

Alternatively, he could just keep his leftover half-a-million points and fly 2 people round trip in business class to Europe again in the future. Twice.

Bottom line

While many readers strategically plan and collect points with maximum value uses plotted out in advance, many other people do not collect with the same laser-focus on redeeming. When this family member reached out this week, it made me wonder how many people must redeem points at low value annually. Of course, they likely get the aforementioned joy of free — a “free” $9,000 trip can certainly sound attractive — but this is a great meta example of how largely it pays to educate yourself about redemption options, learn about foreign programs, and do some of the leg work yourself. I am definitely not an award booking specialist, but I’ll be happy to help this family member figure out some flights and hotels and how to cash out for much better value than what he’d been told.

![(EXPIRED) Amazon: Save up to 40% when redeeming at least 1 Membership Rewards point [Targeted] a laptop on a table](https://frequentmiler.com/wp-content/uploads/2022/07/Amazon-Laptop-Featured-Image-218x150.png)

Interesting, but I noticed that Iberia has only 1 seat available on the return date of 8/13 and no other non-stop return available at all within a week.

Basically, getting your desired flight dates with award points for a non-stop flight is rare. Hope he jumped on it.

Could he then just have amex travel book his airport transfers and tours using the points? That obviously skips the schwab option, but i wasn’t sure if they would book those things if you aren’t booking air and hotel through them.

I wondered that to myself, but threw that option out mentally since they are offering such a poor value-per-point. Every $100 will require almost 14,000 points if using them through Amex Travel vs 8,000 points if you cash them in at 1.25c each. If he were only spending a hundred bucks on transfers and tours, maybe he wouldn’t care about throwing away the 6K points — but if he’s spending a thousand on them, that’s a 60,000 point difference.

Good point. I just like the idea of having Amex book the tedious stuff and get nice transfers and such. I guess you could just cash them out with the schwab and then have your platinum concierge book some of that stuff for you…

Very enjoyable read. It is like a journey and a road map.

yeah, but if everyone was “smart” about redemption, etc…the availability would plummet (if not already so on certain routes/classes) and value of miles / points would fall. so don’t pray for that.

that is one hairy armed super hero

This post scratches that itch I get sometimes wondering how I could best spend my points. Great work!

Hah – I have to laugh that people are gushing over how brilliant your advice is here.

It’s not really the actual advice that was so impressive, but the walk through of the thought process. It is a situation a lot of us have found ourselves in, and watching how he went about knocking down each problem let us compare to what we have done ourselves in the past and either confirm, yup I’m doing it right, or dang, I never thought of that.

It’s also a useful post because you can send it to friends/family that are not in the game to give them a real life example of how much more value you can extract from your rewards if you know what you’re doing

Great analysis and good writeup!

Great article. Loved the process on building this itinerary.

Uh, where is he getting the 303000 Citi TYPs to pay for the Four Seasons? Or is he supposed to be somehow booking the 4th Night Free through the Citi Concierge and then paying for the stay with MR points? How does that work?

He would ideally like to pay for the entire trip on points. For that reason, throughout the post, I refer to the value of Membership Rewards points if he opens a Schwab Platinum card and cashes out points at 1.25c each (possible with the Scwhab Platinum card) to pay for cash costs (like the taxes on the Iberia flight for example).

In the case of the Four Seasons, he’d pay 455K if he booked it through FHR using Membership Rewards points. Alternatively, he could cash out 303K Membership Rewards points at 1.25c each and have the $3700 needed to outright pay cash for the stay if he books a 4th night free stay through the Citi Prestige Concierge (since he’d stay for 6 nights but pay for 5). That would save him more than 150,000 points over booking it directly with Membership Rewards points. Again, assuming he had his heart set on the Four Seasons. It’s just an example to illustrate that you’re better off thinking outside the box a little bit now and then.

Oh, I didn’t realize that you could outright convert MR points to cash at 1.25 cents. I wouldn’t do that, but I get how that works in the context of the post now. Thanks.

Great article. May if he has a platinum card and selects that airline as the preferred, he can get 35% points back too!

First, and most important, this article is a masterpiece of the genre.

Second, a small endorsement: At $259/night all-in, and especially for someone without status, Gran Melia Fenix via FHR is a very good deal, especially for someone with no status at hotel chains. They have a very appealing breakfast (our favorite buffet scrambled eggs — butter is harmed in the making of those eggs — and even at 15 euros a pop (martinis), the martini bar and some tapas is a nice way to blow the 85 euro credit. FWIW, the in-house hair salon is not expensive, but can’t be used for the credit.

great work!

goes to show how incapable those guys are and how hard they try to mill you for their commission.

One of the very best articles. Ever.

Great content, Nick. This is the type of stuff that gets people interested in learning how best to redeem their points for maximum value. Ahh the possibilities of 1,250,000 MR points…