NOTICE: This post references card features that have changed, expired, or are not currently available

If I told you that so far this year I have been in 16 countries over 3 continents and I’ve flown in flat bed business or first class on 8 different airlines and stayed in multiple 4 and 5-star hotels and resorts along the way *ALL FOR FREE*, you would (I hope) be incredibly skeptical at best and more likely you would think I was completely full of bologna (and rightfully so). There is indeed a “joy of free” when you sit down in a fancy seat and realize that at least some of the people around you paid a sticker price in the thousands when you used some airline miles and a few dollars in taxes, but don’t allow yourself to be fooled into thinking that it’s “free” lest you make poor choices. This concept of award travel not being “free” isn’t new, but it has come to mind a few times lately in specific instances and I think it’s worth a highlight to keep us all honest about what we do.

A common error in thought

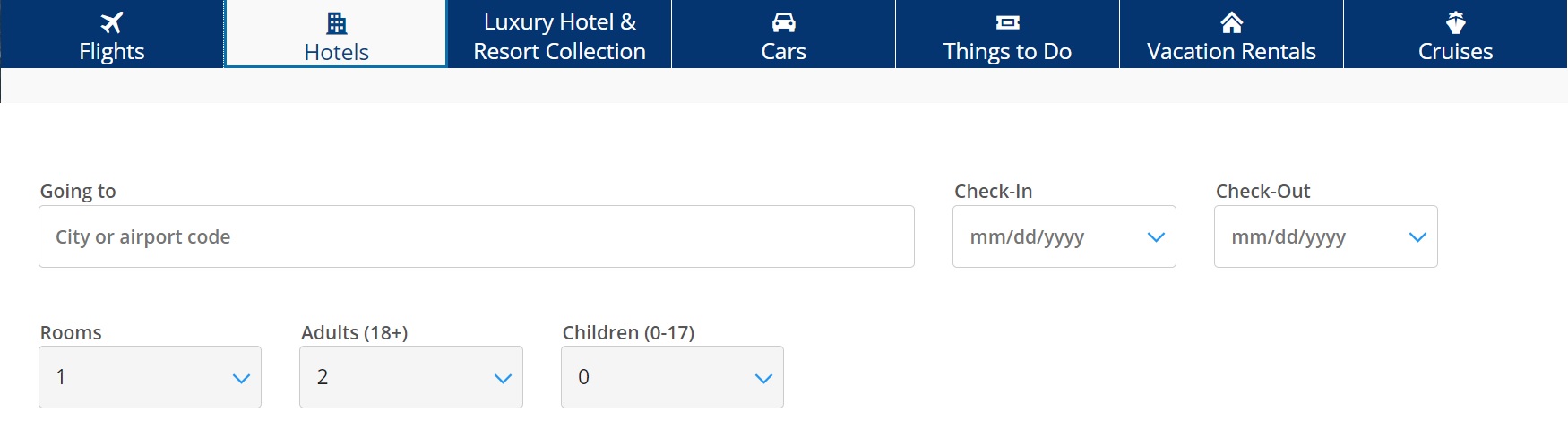

Let’s say you have the Chase Sapphire Reserve card and you used 100,000 Chase Ultimate Rewards points to book a hotel through Chase Travel℠ that would have cost $2,000. Your 100,000 points would have been worth $1500 (since you get 1.5c per point in value with the Sapphire Reserve), meaning that your out-of-pocket cost for the hotel would have been $500. Would you say that the hotel cost you $500 because you were able to cover the rest with your points?

I often see people think of it this way, but in my opinion it is an expensive mistake to fall into this trap.

At a base level, every Chase Ultimate Rewards point can be redeemed for $0.01 in cash. That means your 100,000 points could be cashed out for exactly $1,000 in cold hard cash – money in the bank. When you redeemed them for the hotel in this example scenario, you effectively paid $1,000, just in a different currency. Think of it like trading a stack of ten hundred dollar bills away for a $500 discount (since 100,000 points will cover $1500 of the bill, it’s like getting a $500 discount, not like getting a nearly “free” room).

That’s not to say it’s a bad deal. If you really wanted that $2,000 hotel room and I told you that you’d get a $500 discount if you paid in part with a stack of ten $100 bills, you’d probably be happy to make that trade. Just know that you’re making a trade — and it isn’t with monopoly money. In that case, Chase Ultimate Rewards are a made-up currency, but the points can be traded for real money.

Obviously if you got that 100,000 points via a new credit card welcome bonus, it probably feels especially “free” since you may have earned that bonus just by spending money on expenses you’d have paid whether or not you got that 100K bonus points — but at the end of the day, it doesn’t matter how you earned the points. Those points can be redeemed for one thousand dollars in cash and you are effectively using that cash when you redeem them. Think of the points as a coupon code — you’re paying $1,000 plus a coupon code to get [insert fancy travel]. That fancy travel might be “worth” a lot more than the thousand bucks you traded for it (and I’m not judging here – I make that trade all the time), but make no mistake: you traded a thousand bucks for it.

I know that thinking of it this way takes away some of the Joy of Free and that’s something I struggle with from time to time.

Soon I’ll be spending two nights in a room that otherwise would have cost more than $1,000 per night. But I won’t pay that sticker price. Instead, it’ll only cost me 29,000 points per night thanks to a Hyatt redemption and suite upgrade award. A family member will share the suite with us and I won’t charge them anything for it because I do earn a lot of points at relatively low effort. But saying that the hotel stay is free isn’t true. I transferred the points from Chase Ultimate Rewards to Hyatt to book the hotel. That 29,000 points per night could have alternatively been redeemed for $290 in cash in the bank — meaning that my hotel stay has a total cost of $580. It’s just like the old TV show Let’s Make a Deal: I had points and I could have traded my points for $580 or traded them for two nights at a fancy hotel. I took the hotel — which cost me the chance at $580 in my bank account. Thought about differently, Chase essentially gave me $580 and I gave $580 to Wayne Brady for my hotel this weekend (no, I didn’t go on Wayne Brady’s TV show, this is just a figurative example). Sure, that’s a huge discount over the $2,000 going rate, but it’s still almost six hundred real dollars that could have stayed in my pocket if I asked a friend to crash on their couch instead of booking a hotel.

If I had to take that $580 out of my bank account to pay for a hotel for this trip, I probably wouldn’t have done it. I’d have stayed somewhere cheaper or farther away or only gone for one night (or all of the above), etc. The banks and award programs know that people are more hesitant to part with cash than monopoly money — it’s no accident that they award made-up reward currencies. They want me to feel like it isn’t money out of my bank account that I’m using and to tell my friends and family about all of the “free” stuff my points got me. And to a certain extent, I’m happy to have them pull the wool over my eyes. I can close my eyes and cover my ears and say “but I get to stay in a fancy hotel in midtown Manhattan and park for free and eat breakfast for free and nah nah nah nah boo boo”, forgetting about that $580. And know this: I play my fair share of “nah nah nah nah boo boo”. I think it is natural in this game (and fun!) to focus on the quality of the redemption rather than the cost. I’m not judging those who do — I’m just admitting that we do it.

And again, it really doesn’t matter if I earned all of of my Ultimate Rewards points last week in a Staples fee-free gift card promotion or if I earned them back this week via another one. My acquisition cost is irrelevant — redeeming those points for a hotel cost me the chance to redeem them for $580 in cash. I’m happy to make that trade when it means that we’ll spend a weekend in a nice hotel in a perfect location and I’ll be very grateful for a spacious, comfortable room in a city of broom-closet-sized hotel rooms. But it isn’t free.

Framing travel as free does us no favors

I recently met up with a member of our Facebook group while I was at a Priority Pass restaurant at BWI and he mentioned how much he hates it when he sees people in the award travel community frame the type of travel we do as being “free” — in part because of the way this influences the perception of his friends and family.

Take my trip upcoming hotel stay as an example: telling my family member that the room is free is totally inaccurate (since it did cost me the chance to put $580 in my pocket). It also gives the wrong impression — that I can just travel an unlimited number of nights this way and that it wouldn’t cost me anything to do the same for others in my circle. Again, I’m happy to cover the hotel with my points, but let’s not diminish the value of that to nothing. If I booked the same hotel for a friend or family member when I wasn’t going to also be traveling, it would feel to me a lot more like a $580 gift than a $0 gift, even if they would never consider paying $580 for it since I effectively did pay $580. The bottom line is it still costs me $580 even if I don’t plunk my card down to pay that price at check-out.

And this is where the reader’s frustration came in: if friends or family think it’s free, they think it is effortless and worthless and infinitely possible when in fact those points have very real value. Points often have cash value and their value also extends beyond the cash price into the value of the joy of free. That’s where things get murky.

The Joy of Free

Nearly a decade ago, Greg wrote an excellent post about the Joy of Free and the strange phenomenon where he actually derives more enjoyment from award currencies that are less flexible. The basic premise is that if Award Currency X can only be used for a free massage or a free yoga session, then it’s easier to enjoy that massage or yoga session without any guilt for having redeemed for that rather than something else. Read the full post here: Impossible point valuations and the joy of free.

In other words, if I have Hyatt points, the only realistic use of those points is for Hyatt stays. So, with this weekend’s stay as an example, let’s imagine that I had 58,000 World of Hyatt points sitting in my account and I therefore didn’t need to transfer anything from Chase Ultimate Rewards to Hyatt.

In that case, the “cost” of the redemption seems significantly less. After all, I can’t trade Hyatt points for $580. I can’t redeem them for cash at all (yes, there are mileage brokers who buy points, but I’m not interested in putting my loyalty accounts in jeopardy by selling points so that isn’t realistic for me). Other redemptions aren’t worth much. Practically speaking, the only good way to redeem Hyatt points is for a Hyatt stay.

So if I were in a situation where I had 58,000 Hyatt points, the stay I’ve booked for this weekend would feel significantly more “free”. I’d certainly feel less guilt about using my points. Sure, I might think about how those 58,000 points could alternatively get me 11 or 12 nights at a Category 1 Hyatt, but that feels more abstract. Points tied to a single airline or hotel awards currency are significantly easier for me to part with thanks to their limited range of use.

The Joy of Free is significant. I’ll check into my hotel and have breakfast in the restaurant knowing that some people around me are leaving many hundreds (or thousands) of dollars lighter than they arrived and there is some element of fun in feeling like an imposter in their world. And while yes, I could have redeemed my points for $580, the value of the cash is finite and can not realistically be leveraged into something more, whereas as points I am able to leverage that value into something I couldn’t or wouldn’t otherwise buy (in this case, the expensive room). It’s fun getting what sometimes feels like astronomical value out of points and I’m not going to stop loving that any time soon.

And my goodness have I enjoyed some jet-setter type travel this year that is far beyond anything I could afford. This year alone, I’ve been at Lake Como and on the shores of Malta and at Paris Disneyland and the Pyramids of Egypt and Turkey and the Greek Islands and snorkeling with whale sharks in Oman and visiting Santa in Finland and in Singapore and London and the Philippines and the list goes on. It is far more travel than I’d be able to afford to do if I were paying cash for it all even if I were doing it in the type of economy/backpacker style that I knew before miles and points. The reality for me has been quite the opposite, I’ve flown in business or first class and stayed at properties like the Grand Hotel Victoria, in a Grand Staircase Suite at the St. Pancras Renaissance London, and at the Waldorf-Astoria Dubai. I’m absolutely living the life and anyone who has done it knows that it is fun. And it is easy to get hooked.

That stuff just wouldn’t be possible if I didn’t make it my business to amass monopoly money en masse and study how to squeeze every last drop of value from it. I’m lucky that I can make a career out of helping others do the same. But these past few years, I have found myself thinking about the cost of some redemptions more carefully.

I find it far easier to part with free night certificates and airline or hotel-specific points than to transfer from Chase (where points are worth $0.01 per point in cash) or Amex (where points can be redeemed for Schwab deposits at a rate of $0.011 per point or into an Amex business checking account at $0.01 per point with the Business Platinum card).

For example, I recently wrote about how I booked my family of four a trip to Belgium next summer flying out in Air France business class and back on Brussels Airlines in business class (with flat bed seats in both directions). On that trip we spent:

- 197,750 Air France / KLM Flying Blue points + $780

- 102,000 Avianca LifeMiles + $393

In both cases, I had those points already sitting in those programs based on previous transfers for cancelled or changed trips (and I had taken advantage of a transfer bonus to Air France), but let’s imagine that I transferred all of those points from Amex Membership Rewards. .

Those 299,750 points could therefore be redeemed at 0.11c per point (with the Schwab Platinum card) for $3,297.25. That’s real dollars and cents, not an abstract concept of value. Add in the ~$1200 in taxes and fees and we’re at a cost of about $4,500 round trip for my family. Divided by four passengers, that’s only about $1125 per passenger all-in round trip — far below the cost of a round trip flat bed business class ticket to Europe on a normal day and in fact a price that some people pay for economy class airfare at peak times (and the trip is during peak summer dates). It is no doubt a great deal, but it’s not free.

And it’s important that I remember it’s not free. For every eight or nine of those types of trips I take, I could have bought a new car (and maybe earned a boatload of miles doing it) or saved more for this or that. I’m not saying that I’d rather cash in all my points and do something else with the money. I’m obviously happy to use them to travel more and more comfortably than I otherwise would. But I think it is important to keep yourself honest about the cost of redemption.

Why does it matter?

I think it’s important to consider redemption cost in order to avoid making bad choices. If you think of your points as being “free”, you are much more likely to redeem them poorly.

Let’s be clear: there’s nothing wrong with allowing yourself the Joy of Free and getting pumped up over a great redemption. Book that dream hotel or dream flight with your points and enjoy every minute of it, just be conscious of the value you’re trading so you make good choices.

In my mind, the problem with thinking of the points as being “free” is that this type of thinking makes it easy to make poor redemptions. If you don’t stop to consider the value you’re trading away, it can be easy to say “whatever, I’ll use some more points and it’ll be free”. It’s also easy for the allure of free travel to cloud our choices on the “earn” side.

One of the concepts I think it is important to consider is the cost of the points you earn. For instance, if you use a card that earns 2 transferable points per dollar, that’s a solid return on spend. But I’ve written in the past that this is akin to buying miles for 1 cent each since you could easily have a no-annual-fee card that earns 2% cash back. It’s that Let’s Make a Deal choice again: for every dollar you spend, you have the opportunity to get 2c and you’re instead choosing 2 monopoly money points. When you redeem well, that can be an excellent trade. But if you forget that those points cost you something, it can be easy to throw caution to the wind and redeem without thought.

At the cents level it can be easy to make that trade, but Capital One miles make it easier to feel the difference. For instance, if you redeem 63,000 Capital One miles for a business class flight to Europe with transfer partner Avianca LifeMiles, you’ll no doubt feel like you got a great deal while also realizing that the points could have otherwise been redeemed for $630 in travel expenses. Assuming you earned your points with a card like the Venture X or Venture Card, you earned 2 points per dollar spent — but remember that you could have earned 2% cash back, so that 63,000 points could have been $630 if you used a cash back credit card.

In that case, you’re probably saying that giving up the chance at $630 for a business class ticket to Europe is a very good trade. I don’t disagree — I’m happy to make that trade all day long. But if you forget that it’s a trade, it’s easy to start thinking “well, it’s only a few miles more” for this or that — or to throw away points on suboptimal redemptions.

Bottom line

None of the above is new or news to those who have been playing the game for years and it’s a topic that we’ve written about before. Still, recent conversations about the way we frame our “free” reduced price travel and how we think about our own redemptions remind me that it’s worth keeping ourselves honest now and then. Enjoy your Joy of Free and leverage those points to get outstanding value, just don’t fall into the trap of thinking that it’s really without cost. The juice is certainly worth the squeeze as long as you don’t forget about the trades you’re making.

Sorry to say but nothing is free. Even if I use a hotel or airline credit card, I’m choosing to use that instead of a 2% cash back card. Additionally, most merchants would price the goods and services with the consideration of credit card fees and so does airlines when they price the airfare with the consideration of miles they are giving. Think about it, if you’re the business owner, are you not going to take these costs into consideration? Do you really think that in the long run you’ll be smarter than the business owners (there are exceptions but those are rare)? The more realistic thinking is that you’re not getting free stuff by using a credit card and going through a portal but you’re recouping the extra fees from the goods and services you’re getting. The true value of the goods and services is really the net cost after credit card rewards.

I loved the podcast today–my girlfriend and I were pausing it and having animated discussions back and forth the whole time (and her first time ever listening to the podcast).

Here’s something I’ve been wondering along the same lines. I’ve taken advantage of several of the Amex Platinum Biz offers with a 150,000 welcom offer, and then using it to pay taxes to meet the $15,000 minimum spend. That means I’m out of pocket $1000 and have earned about 172,000 points. I then use my Schwab account to cash out 90,000 points and have 82,000 points (ignoring the other card benefits)–completely free.

I could pay $1000 and earn 172,000 which is arguably around .6 cents a point–a great deal. But the way I look at it, I’m actually paying the full $1000 only for those additional 90,000 points I cashed out–1.1 cpm . And I’d rather keep the money and have truly free points than spending real money to buy additional points. Does that strategy make sense–isn’t that earning truly free points?

I thought this discussion was very thought-provoking. Honestly I could see both sides of view. I kept waiting for you to discuss another aspect of being able to use miles and points for “free” travel which is the intangible value of being able to visit family (or fly them in) when there is a crisis or family event to celebrate. I’ve used miles/points several times over the years to visit a child studying abroad. I also used miles to fly a relative who was on hard times to a family wedding. Recently, in order to accommodate a back injury, I spent a ridiculous amount of miles on UAL at the last minute to fly business class to LHR due to the need to support a relative in need of comforting; I still am wincing at the amount of miles spent on that trip, but I am confident I made the right decision about doing what I could to shore up my health as best I could while taking care of family. I don’t think that one can reduce this “hobby” to a sheer numbers calculation when the reality is it provides me with some freedom to do things that normally would be out of reach. Thanks for your wonderful show.

Which season and episode was Nick on? Your fan base needs this.

:-). I have no idea. It was more than a decade ago. I used to have a copy of the video on my computer, but I lost it years ago. I tried at some point to see if I could find old episodes, but I couldn’t find it. Fun memories though!

Feels like a scavenger hunt for the fan base. If you remember the year, or range of years, maybe one of us will find a way to track it down for an FM mug, or something like that.

I think everyone is missing the real story here! Nick was on the Price Is Right! I’ve got to see that!

Ha! I was a sight to see :-). I got so excited when I heard my name and “Come on down!” that I flew out of my seat and down the aisle and ran right into the stage, taking out a few lights. Good times.

Did you make it out of contestants row? Was that with Bob Barker or Drew Carey?

Free is free. If I get 100,000 British Airway points as a credit card bonus from spending $5000 and fly a multi carrier flight that flight is free, plus the taxes.

I got those miles for free. Of course I could have got cash back $100 on a cash back card but that was a choice, not a cost.

In your example you could choose cash back, but in either case the cash back or the flight, what you get is free.

If I win a tv game show and have a choice of a free car or $15000, the prize is free. If I choose the car, it is free, it didn’t cost $15000.

Opportunity cost is just a business concept for comparing alternative strategies. Here everyone is using this “cost” incorrectly. There is no “opportunity cost” in any formal accounting.

I remember this same argument came up on the blog Travelisfree.com a few years ago.

Yes, I agree with the game show analogy. The car is free if you pick that. But if you pick the $15,000, that is more analogous to getting free miles. Once you have the $15K, whatever you spend it on isn’t free. Same with miles. You may have gotten the miles for free (or close to free if you consider the cost of a new card’s first year annual fee plus any cost to you to meet minimum spend), but once you have the miles, any trip you book with them isn’t free. A flight that costs 50,000 points isn’t free: it costs 50,000 points.

Greg

I Think Nick is laughing his Yacht Club backside off like I am. He has only been to 16 countries what a Slacker.Anything u do u have to Look at the Big Picture like FM does. No one on this planet would do what he did IF they had to pay cash..Who cares about a $99 AF if ur Traveling the World forget the 1.0 to 1.7 value rate Insane .

I just didn’t go on a ORD>HNL>ORD 11/7 so I lost $11 and some points their Singapore not United..

I see Nick didn’t post after posting this and ur covering his post so where is he at his Yacht Club ??

CHEERs

V Bernie

Except you aren’t using “opportunity cost” correctly. Even in accounting, there is such a thing as an “asset”. Regardless of how you come across it, a company has assets. The value of the asset may or may not be tied to the cost of obtaining it – that’s one way of doing it. So is valuing it for what you can sell it for or what you can do with it. If a company buys land at $10/acre and through development, it’s now worth $1000/acre, was the $990 free? Yes, but you no longer value it at the price you bought it at, you value at what you can sell it at – any good accountant can tell you that. If you hit it big in the stock market, do you have free money or a valuable asset? Both, but you certainly don’t give it away because most of it was “free”.

This is why I don’t advise giving cars to teenagers – they do value them as free. Make them work for it and it’s the same car with the same value, but they’ll value it properly.

I feel the need to rep my accounting bretheren here and state that ASC 820 (Fair Value) does not apply to all assets and I would hesitate to apply it to points given that points are explicitely not saleable per contract. I would recommend using the acquisition cost approach for valuing the asset (points) and then recognize a gain upon usage. Whether that gain would flow through revenue or other income would depend on the scope of the broader enterprise. For a full-time manufactured spender I expect to recognize it as revenue while a hobbyist would recognize as other income.

And that my point-fiend-friends is how you out-geek a points geek 🙂

TLDR: Money is fungible.

This is why I’ve never quite bought into the ” earn and burn ” philosophy. .

thanks for another great article.

Interesting article — except I think that the reasonable cash value of a Chase point is 1.5 cents (not 1 cent) because these points can so easily be cashed out for restaurant or travel spend at the 1.5 cent rate. So before I use Chase points for points redemptions, I figure out what those points would get me if I cashed them out at a 1.5 rate. E.g., if I need 5000 Hyatt points for a redemption, and need to transfer them from Chase, I peg the value of those points as $75. If the hotel I want to book is a good value at $75, I’ll transfer the points. And by good value, I’ll also compare what that Hyatt hotel gets me compared to other comparable hotels I could book with cash. So, I’d never say that using 5000 Hyatt points (transferred from Chase) is getting me a free room — I am paying $75 for that room, but it could be an excellent value. The same with IHG points — I just bought a slew of points in their recent sale and was able to use them to book hotel room at one half to two thirds the cost of paying case — so, not free, but definitely great value.

I do think that more mental math comes into play when considering luxury travel — something I rarely pay for with cash, but might be able to justify with points – especially points earned with sign up bonuses. Yes, when I do the calculation as to how much I could get in cash from points used for a luxury booking, it will likely be a number that I wouldn’t pay out of pocket — but I can also see justifying it as the bonus I get from playing the game, and paying attention to maximizing points. Which I guess is the point of your post — it is OK to do it, just don’t say it is “free”.

This is well said, but also where I would push back a bit. How is this consistent with what you wrote above?

Here’s how I think about this, FWIW.

I boarder on being cheap by nature (not a humble-brag—I’m generally this way to a fault.) Specifically, I know from experience that I’m very reluctant to spend on “champaign quality experiences”, even if I can afford them–and even if my loved ones would really value them (and I would get real joy about the joy THEY would get to experience.)

So what “maximizing points” often does is let me pay beer prices for champaign experiences. My cheap, value-engineering side can take real joy in that–call it my “joy of free”. Moreover, I realize these opportunities are often “limited time only” on experiences I I may not have tried before–and therefore I, and especially my loved ones–might value more than I think.

When these factors appear together in a particular opportunity, they lead me to feel warranted spending the points. FWIW.

.

The 1.5 cents cash out really changed things, with the pandemic and a very nervous wife for travel during it along with a now 4 year old and 6 month old, we’ve done only a few minor domestic trips since December 2019. I’ve cashed out probably $3-4k with at 1.5 cents and still have nearly 800k UR points. It’s hard to justify keeping if not earning and burning, with interest rates up I may cash out even more.

Excellent article that deals with something that bugs the crap out of me – travel with points is not “free”, those points have value. Even people with points don’t seem to understand this and I see people blowing enormous amounts of points because they think they’re getting something for nothing. No, everything has a value. In economics, that value is called Opportunity Cost. In easy to understand terms, your points can do more than one thing – and if they do one thing, they then can’t do something else. That something else is the Opportunity Cost, you did X, you can no longer do Y. Hopefully you value X more than Y.

Other things that have Value/Opportunity Cost are time and money. If you think of points, time, and money as interchangeable currencies, each with an Opportunity Cost, then nothing is free, you are just extracting more Value by exchanging them efficiently. We all value things differently, yes, and those values are dynamic, but if you don’t put a price on them, you wind up making inefficient transactions, and thus wasting time, money, and/or points.

Example, and I see this a lot. People are very reluctant to spend money, very free with their time, undervalue their points, and overvalue their purchase. They’ll spend an additional 10-20 hours searching for a deal with rather high points that has low taxes & fees when they could have spent gotten the same deal (or better) in an hour for cash or higher fees with less points. But it’s “free” or cost me only $6. No, it didn’t. And that first class cabin on one flight – that could have bought you several RT J tickets, for you or family or friends. Opportunity costs! But you do you, you clearly value things I don’t. (Yes, I’m judgy. But I’ve also got experience. So do the writers and audience at FM. Pay attention and learn something. I do, and I already know things. And sometimes I have to unlearn them.)

Develop a shorthand system, know what things generally cost or how much you value them. (Experience!) I tend to value transatlantic J flights on legacy airlines at $700-$800 each way because I know that with a little effort (time), and flexibility (an undervalued input) I can buy them for that in cash. If I have specific dates to hits, they can be more valuable, but not much more, maybe $100-200. Very specific dates and a can’t miss event – price goes higher. And know that buying for cash generates more points and status if I’m chasing that, so that actually lowers the cash costs. If a flight is short, I may lower how much I perceive the value, as I won’t be able to sleep, so JFK-LHR is less valuable than DFW-LHR going east. Etc. This makes is very fast to search for flights. Search for flights in cash first, that takes 10 minutes, know that if I hit that threshold, finding a point flight is unlikely, but do a quick search, and use the most efficient currency, in this case cash.

Keep an eye on deals in the email. Have a stash of points on-hand for incredible deals and know they’re incredible. (STL-CUR 20K miles round trip in winter. That sounds cheap, but a few clicks, you discover it’s a $900 ticket, and you’re on it after checking with P2. We can worry about hotels later, it’s refundable.)

That, my friends, is efficient use of points. Protect them as if they’re cash. Because the sort of are.

I agree about efficient use of points. A friendly amendment:

My salary is pretty much spoken for (by P2, P3, and P4) when it pops up in my bank account. For many of us, it’s easier to generate 100K MR than to generate an extra 1K in cash earnings.

Same with use of time. I’m prohibited from “moonlighting” – I can work more hours but I won’t earn more if I do so. Even if I didn’t enjoy the game, “working” on free travel / credit cards makes economic sense for people like me.

Of course this is true – if working an additional hour produces no cash income, either because of salary structure or legal prohibition, then it makes sense to have a side-gig that produces cash (e.g. selling on eBay) or produces an alternate currency (e.g. points). Effort (time) can also be put into increasing efficiency on spending what you do have, e.g. searching for deals, couponing, growing your own vegetables, etc.

We all have our own mix of what is possible or most efficient. (Trust me, Elon Musk isn’t looking for the cheapest point deal, his time is too valuable.) When you generate lots of cash with your time, cash is the most efficient vehicle to spend. If generating more cash isn’t possible, look for a different angle. The basic principle is the same, greatest return for the least effort, it’s just that we all have a different set of tools and constraints.

But, while I COULD gross another $405 for an hour of representing a client, I PREFER to spend 2x that figuring out how to book the best hotel suite for points. It’s a hobby and I love it much more than my job. (Besides that $280 I’d net pales in comparison to the $1500/night hotel suite I found.)

Nick– The flaw in your logic here is that this isn’t how most people budget their travel. For me, the starting point is, “I have $X for my vacation this summer. What is the best vacation I can make out of $X?” It’s not a question of whether the points you pay are “free”, it’s a question of maximizing value.

Viewed from that standpoint, spending the points and miles (vs. cashing out) is a no-brainer.

good thing I don’t have an AmexPlat card that allows MR cash out at higher level then. (Like Schwab, etc…) So I can still feel good about using them by xfr’ing to the right airline rather then getting 0.6 for covering card charges. Or the 0.7 at Amazon. 🙂 And I don’t have a Chase Sapphjire at the moment…so can’t convert my measly 20k UR stash to any travel rewards.

So folks — cancel your AmexPlat Schwab and Morgan Stanley? and feel better about your redemptions! Cancel the Sapphire Reserve!

I’ll feel extra good on my recent Amex MR redemption for a business r/t to Asia/Australia where I’m really gonna use the 70 lbs weight limit on luggage! 🙂

No CapOne here….and not too much Citi TYP at the moment.

this is exactly why i never redeem chase UR for travel and instead cash out @ 1.5 cents pp.

amex MR is my second least redeemed points bec of its cash out value as well.

instead, i use other hotel/airlines points and miles that dont allow me to cash out. i do realize i am losing out on travel, but unless i am willing to spend that much in cash i dont do it.

Trust me, you’re losing out on some awesome travel. ; )

i realize. but for me i treat most airline/hotel points like real money (assuming i can be cashed it out) – so if i wouldnt spend $600 in cash for a room, i wont use 40,000 hyatt points transferred from chase UR.

Nick, I have said in comments to other articles — if only to be criticized by one particular reader — that airlines are NOT just giving us award flights and that we have PAID for them. In support of my assertion, I would recommend readers go to the Securities & Exchange Commission website and access (say) American Airlines’ annual 10-K report. Go to the financial tables. Where AA states revenue, it expressly segregates flight revenue received into 1) that which is attributable to the revenue flight taken and 2) that which is attributable to future award flights TO BE taken. So, AA is expressly acknowledging that award flights are in fact paid flights and is NOT just giving them away. I understand and agree that airlines have flexibility to time and allocate award inventory. But, it is offensive to suggest that award seats are simply being given away by the grace of Revenue Management and the Almighty.

This is incredibly insightful. Thanks for putting this together, Nick.