NOTICE: This post references card features that have changed, expired, or are not currently available

This week, Greg and I continued our Facebook Live debate series and kept our streak alive of at least one of us not being home for the debate. This week, watch us disagree over speculatively transferring points and which card is the “best” single rewards card to have and to hold — then tell us your picks in the comments. See that video here:

On credit cards

On my mind (Venture only? edition)

Greg is wrong. We debated this in our Facebook Live discussion this week, but now I have to admit that I was wrong in that discussion, too. If Greg (or someone else) were going to use only one credit card, it shouldn’t be the Capital One Venture card or a cash back card. It should be the Amex Gold card. Hang on to your hats: I know you’re screaming that Amex isn’t widely accepted enough here or abroad to be the only option in your wallet. You’re right. And that’s why I’m going to be a miles and points heretic: Theoretical Greg should use the Gold card and pair it with a debit card from a bank that offers some sort of fraudulent charge protection or, ya know, use cash, for those times when Amex isn’t accepted. I say that because unless he spends something like $40K per year on travel, he would easily earn more points every year with the Amex Gold card with his regular dining and US Supermarket spend and some minimal supermarket MS sprinkled in for good measure. If Greg spends a few thousand every year on dining and maxes out the $25K cap on US Supermarket 4x, he’ll have well over 100K Membership Rewards points every year — probably enough for an ANA round-the-world business class ticket every stinkin’ year (or plenty of other business or first class options thanks to frequent transfer bonuses like those outlined below under the loyalty section of this post). Don’t get me wrong, it would be downright silly to have only one credit card, but if one insists on being archaic about the credit card scene, at least maximize your joy of free and earn a pile of points with the Amex Gold. You’d need that debit card backup for all the times when your credit card doesn’t work for some reason / gets lost / etc, so in hindsight I’d say to go Gold.

Should you combine ThankYou accounts?

Citi has the oddest system amongst the major issuers in that when you close a card that earns ThankYou points, you set yourself up to potentially lose points that were earned with that specific card. Combining your ThankYou points makes it complex to know which points came from which card. Still, Greg recommends you combine your Citi ThankYou points and I totally agree. Read about why and what you can do to keep points alive instead in this post.

The new 95K Sonesta credit card. My lazy review.

Sonesta? Spolestra? This card makes me want to take a siesta, which is an indication of how boring it is rather than reflecting its ability to earn points that put me in a hotel bed. This card is a snoozer in my opinion.

Is the new Bonvoy card good for anyone?

In loyalty

Amex transfer bonuses

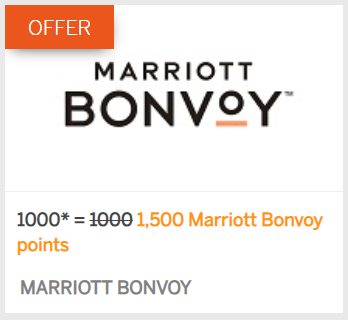

Amex is offering a ton of targeted (mostly targeted) transfer bonuses. See: 40% to 50% transfer bonus to British Airways Avios from Membership Rewards (targeted), 40% or 50% transfer bonus: Amex to Marriott (targeted), 40% Or 50% Transfer Bonus From Amex To JetBlue (Targeted), and 20% transfer bonus: Amex to Qantas, which might stack and be even better. While speculatively transfers rarely make sense, I made the case in this week’s debate as to why I think the Avios or Marriott bonuses might make sense speculatively in some scenarios. That said, you generally only want to transfer if you have a valuable use in mind rather than limiting the flexibility of your points in the hopes of someday getting good value.

Stay in a castle with Hyatt points (SLH is a nice win after all)

I wasn’t a fan of the Hyatt tie-in with Small Luxury Hotels of the World when it was announced. If my first SLH stay is any indication of what to expect at SLH properties (and I suspect it is), I can’t wait to stay at my next one. It surely doesn’t hurt that my first stay was in a castle built for the last German empress and where Dwight Eisenhower lived for 7 years during the occupation of Germany, meaning there was some interesting history at play. I think this place is cool enough to justify building an overnight stop in Frankfurt into your itinerary and renting a car to drive the 25ish minutes it takes from Frankfurt airport.

Bonvoy Success: Marriott Free Night Certificate Extended Another Year

Stephen brings us a post this week with a hot tip: it is possible to extend the expiration of a Marriott free night cert. I wouldn’t hang on to a cert counting on this as it’s a favor any time someone helps you do something that’s not strictly within the rules. But overall, this is great news and a nice customer-friendly piece coming out of Marriott Bonvoy. Is Greg right? Is it time to give Marriott a break?

In cool tools you can use

Google Maps AR walking directions: a useful tool, only available for some so far

Have you ever gotten off the subway in a major city and not known which direction you’re facing vs which direction you need to go? You know that feeling when you don’t see a street sign anywhere and you just have to wait to see where Google maps puts your dot after you’ve moved a bit? Speed up that process of self-discovery with Google Maps AR walking directions if you are invited to test it out (or if you buy a new Pixel 3a, this is a feature out of the box). This feature saved me a bunch of time in those initial moments of getting my bearings this week and I’m sure that Google will make it better (and more widely available) over time. See this post to find out more about how it works and might be helpful.

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

I enjoyed the banter but I’m confused about how Greg can admit that points cost money and then turn around and talk about the “joy of free”. There is no free. I don’t think it makes sense to be comforted by the irrational. Also the continued discussion on optimal one card is pointless IMO. No one in our hobby is limited to one credit card and if they are limiting themselves to one card, then the discussion should focus on convenience because they’re clearly sacrificing optimal return for convenience by staying with just one card.

The whole point about the “joy of free” is that it is illogical, but that doesn’t mean it isn’t valuable. If you enjoy redeeming points because it feels free (even if you logically know that it isn’t free), then you are getting something more from your points than the redemption itself. It’s like choosing a top shelf drink because you enjoy it more. You’re willing to pay more for the more pleasurable experience.

Conversely, if you don’t experience the joy of free then it shouldn’t be a factor in your decision making.

Hi! Thanks for the reply. But I’d argue it’s just an illusion or a fallacy. If you can’t tell the difference in your top shelf drink than the cheaper version, then I’d argue, you’re wasting your money. You should enjoy something for it’s actual value not because you’ve made a miscalculation. Suppose you went to the store and found a 50% off sale tag on an item. You’re excited that it’s a huge discount. When you pay for it at the register, you get distracted with a phone call and don’t realize the sale tag was a mistake and the store charged you the full amount. But for the rest of week, you’re still excited that you got such an awesome deal. Would you want to be in that situation? Not me. Sorry but this is a pet peeve of mine – I’m tired of all the blogs and youtube videos talking about how “you too can fly first class around the world for free!” It’s not free and people should figure out the actual costs. It’s still likely a great deal and allowing them to do something they couldn’t otherwise afford. But for some people the misunderstanding of “free” is going to lead them to make worse decisions with their money because they don’t see the real costs.

I’m not talking about miscalculating. We dedicate many posts to making sure that people understand the true costs involved in acquiring points. In this case, I’m talking about a situation where you fully understand the costs involved but you prefer one outcome over another and are willing to pay more for it. People who choose a top shelf drink know (or hopefully know) that they’re paying more for it. They may do so because they prefer the taste or they want to look like a high roller or whatever. Their motivation doesn’t matter to me. The point is that for whatever reason, they knowingly value the top shelf drink above the house drink. Maybe a better example would be choosing to eat at an elegant restaurant instead of a cheap diner. You knowingly pay for an experience that is more desirable to you. People do this all the time in countless ways. And I’m not saying that you should pay more for the joy of free. I’m simply acknowledging that I personally value the joy of free and I’m willing to “pay” more for it… Not a lot more, but a little more.

Maybe I’m misunderstanding you because I’m not following your dining example and the joy of free. My point was simply, there is no “free” in the points/miles game and when people get giddy about getting a “free” night at Tokyo Andaz, then they’re clearly mistaken if they think it’s “free” (as in, it costs no money). If they’re spending 30k UR points to pay for it, then they’re spending a minimum of $300 for that room (which is the cash out rate for those points, plus any time/energy/money needed to get those points to begin with). Now $300 is great price for a room that runs $800, but $300 is not $0. So people can feel good about getting a big discount on the room, but they’re very mistaken if they think it’s “free”. If they are the type of person that would never pay for a $300 a night room, then maybe they should book elsewhere. These points are a type of currency and people would be better off treating them as such. Imagine if I told you that I got that hotel night for “free” because I paid in Yen instead of US dollars. You’d think I was confused. But change “Yen” to “UR” and people instead get all excited because it was “free”.