NOTICE: This post references card features that have changed, expired, or are not currently available

(Drumroll, please): Ladies and gentlemen, the moment you have been waiting for all year long has finally arrived. This week, we present to you the 2022 Bonvoyed Awards, where we discuss the nominees for which program Bonvoyed us (as in all of us) the worst in 2022. Yes, Marriott is among the nominees of the award borne of its namesake, but they are far from the only contender — and Greg and I did not agree on the “best” of the worst, so you’ll have to decide which of us is right (or neither) and crown your own champion. Before that discussion, we throw our regular segments to the wind in order to make sure that you’ve made a list and checked it twice so that you don’t miss out on any end-of-year goodies in miles, points, and credit cards.

(Drumroll, please): Ladies and gentlemen, the moment you have been waiting for all year long has finally arrived. This week, we present to you the 2022 Bonvoyed Awards, where we discuss the nominees for which program Bonvoyed us (as in all of us) the worst in 2022. Yes, Marriott is among the nominees of the award borne of its namesake, but they are far from the only contender — and Greg and I did not agree on the “best” of the worst, so you’ll have to decide which of us is right (or neither) and crown your own champion. Before that discussion, we throw our regular segments to the wind in order to make sure that you’ve made a list and checked it twice so that you don’t miss out on any end-of-year goodies in miles, points, and credit cards.

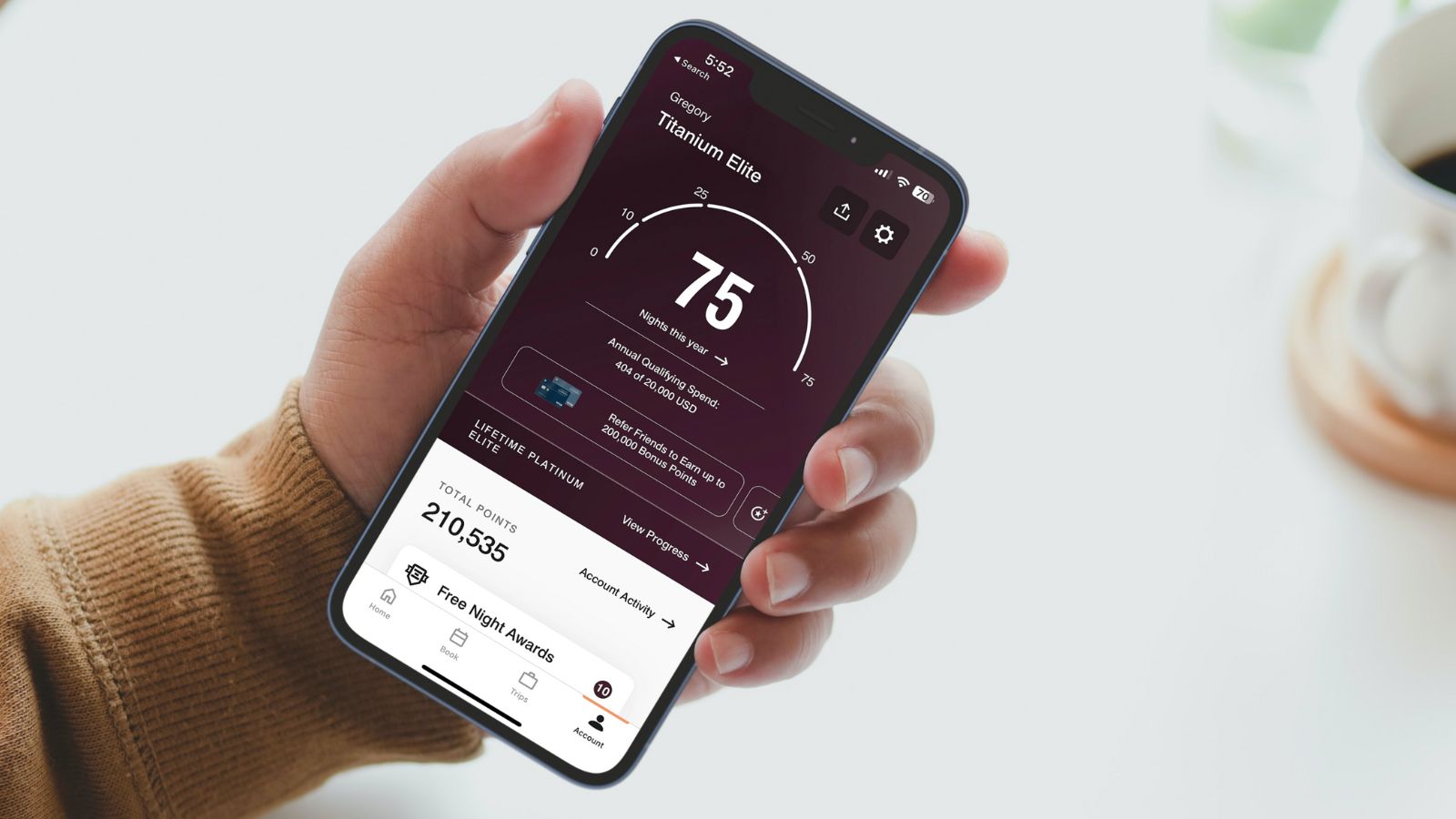

Elsewhere on the blog this week, Greg made extensive updates to his post about the “Must Have” Chase cards and you can read about his end-of-year push to Titanium status and the rumor regarding Pay Yourself Back. All that and more below.

01:37 Elite status

06:34 Expiring free night certs

13:41 Airline fee credits

18:36 Now is the time to apply for Amex Platinum cards 20:14 Saks credit

24:34 Fine Hotels & Resorts or The Hotel Collection

29:12 Dell credits

35:50 2022 Bonvoyed Awards

37:00 Radisson International

38:35 Hilton’s war on breakfast

43:17 Emirates

45:17 Delta’s Triple Threat

51:39 Capital One Venture X

54:08 American & United

57:18 Chase Pay Yourself Back

1:05:20 Question of the Week: Where is Aalborg?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

End of Year Checklist for 2022

He’s making a list, he’s checking it twice, he’s gonna find out which of those various calendar-year statement credit benefits has thus far gone unused and must be triggered by year end. That sentence may not quite have the same ring to it, but the point is to be sure that you get all of your “bling” out of your current crop of credits and benefits while there’s still time and make sure that you haven’t stopped short of the finish line on spending bonuses. Take it from this guy (me!) who waited until 12/31 to make a qualifying United charge one year: ya never know when the airline is going to actually put the finalized charge through the next calendar day — so don’t wait until you’re out of calendar days.

Marriott Titanium achieved. Here’s how I sprinted to the finish.

Greg sprinted across the finish line to Marriott Titanium status with credit card spend. He lays out the numbers and I’d agree that this is well worth it for someone in a similar position to him. Neither Titanium elite nor United Silver are hugely valuable statuses, but I’d pay the ~$60-$150 that he figures it cost in this scenario to keep both and goodness knows that his 40K free night certificate is worth a lot better than nothing. Unfortunately for me, I don’t have a Boundless card, so I’ll be checking in for a mattress run this week to pick up my final 3 nights to Platinum. In my case, a Chase Offer for 15% back at Fairfield Inn will make my cost to get to Platinum about $150 — while I’ll be sorry to lose my United Silver status, the jump from Marriott Gold (where I would land) to Marriott Platinum is significant given the benefits at Platinum.

“Must have” Chase cards

Chase offers some of the most highly prized cards in the game, but getting all of the best ones requires a little strategy thanks to Chase’s 5/24 rule. This post breaks down which of the many good Chase cards are the ones you really need to have and what you need to consider regarding the timing of your applications.

Uh-oh: Is Chase Pay Yourself Back adding grocery but dropping to 25% bonus in 2023 for CSR?

One popular feature of some Chase cards is the ability to “Pay Yourself Back” for certain categories of purchases. This popular redemption option appears to be changing for 2023. While we don’t yet have official word, it appears that the redemption categories will soon include grocery (indeed many are finding grocery purchases can already be reimbursed despite not being listed as an eligible category), but it looks like redemption rates may decrease in 2023. If you had it in mind to pay yourself back for any large charges, get those in sooner rather than later.

Road-Trip from Monterrey to Mexico City – so many waterfalls

Considering how far I’ve traveled around the world, I know embarrassingly little about Mexico beyond the major all-inclusive resort towns (and even then I’ve only been to Los Cabos!). The pictures and description of Carrie’s road trip from Monterrey to Mexico have me really intrigued! I love waterfalls and Las Pozas looks amazing. A post like this really makes me want to get to Mexico and do some exploring.

Amex Airline Fee Reimbursements. What still works?

Speaking of things you should do sooner rather than later, you’ll want to be sure to use up all of those Amex Airline fee reimbursements before the end of the year. With reimbursements going slower than usual, you may be out of time to make a qualifying charge and see the statement credit before the end of the year (and try again if something goes wrong), so you’ll want to reference this guide to see what is highly likely to work.

PSA: You Can Redeem Albertsons/Safeway Just For U Rewards For Alaska Mileage Plan Miles

This post from Stephen highlights a cool opportunity for those who live within the Just for U footprint as you have a very interesting redemption opportunity hiding beneath the surface. While we don’t know how valuable Alaska miles will be in the future, I’d certainly be happy to pick up some easy miles through this partnership.

IHG One Rewards Complete Guide

Tim makes an update to our IHG One Rewards complete guide to note that unused food & beverage awards from 2022 will be extended to the end of 2023. There have been mixed reports about how well this benefit has been rolled out, but if you have them it is worth knowing that time is on your side.

That’s it for this week at Frequent Miler. Keep an eye on this week’s year-ending last chance deals to make sure you don’t miss the good stuff before it’s gone.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

Another great podcast with useful info. I’m particularly interested in Greg’s notes about the xbox gift cards because I’ve been in Dell cancellation purgatory since October. I don’t know how five gift card purchases in a year was determined, but I managed to do 9 separate xbox gift card purchases in a span of about a month from September to October (varying in total from $22.50 to $200). Then the 10th one was canceled and all my purchase attempts after that. I even tried purchasing normal items, like smart bulbs, and my orders were canceled. I decided to not do anything for 2 months, but I needed to try again now to finish using credits. Interestingly, I found a comment on reddit or flyertalk that said that dell tracked your IP address and you needed to use a different device entirely to get around this. So I logged into my account from an old laptop and placed an ordered a non-gift card product (a smart home item) and it worked. I don’t know if it was the new laptop, the 2 month break or the fact that I ordered a non-gift card, but I thought it was a useful to mention trying to order at dell on another device. I might still try to place a gift card order (more credits to use!), and I’ll update this post with the results if I do.

Delta (fourth nomination) – It lowered boarding priority of Diamonds. Insult to injury.

American Airlines – It virtually never opens award space to partners on transcon routes

British Airways – It virtually never opens up first class award space on trans-Atlantic routes TO ITS OWN MEMBERS.

I wonder how Marriott feels about this.

Nick giving it to AA bc of web specials? I don’t see how a discounted option is such a bad thing. I guess I just never had domestic redemptions with partner miles high on my list, Id rather use partner miles on intl F/J.

I think it’s between Delta and Bonvoy. You also forgot another Delta nerf: lounge access restrictions. But still, I will side with Greg. The inaugural bonvoyed awards should after all go to bonvoy.

For me it’s bc their elimination of award charts while pimping so many credit cards with fixed point free night certs was so dishonest. Suddenly what got you a free night at a nice(35k), and sometimes luxurious(50k) place can’t get you anything but a roadside dump that you might have to top off another 15k for the privilege. And of course now every hotel is setting their award prices to make cert usage as undesirable as possible, or impossible.

I finally dumped all my Marriott CCs, and am going with Hyatt as primary with Hilton as backup now.

Merry Christmas!

See my comment about no partner redemption on AA transcon.

For some on us, it is a particular hardship.

+1. Nick is probably affected by the AA issue the most — unable to book with partner miles to get an AA flight.

However Delta eliminated their last remaining high value award, so their awards are now the worst in the US. Maybe no one sees this due to DLs long slow frog boil.

He also said that other programs follow DLs lead, so this action could ripple through other programs. In the future I think Delta should get a Lifetime Bonvoyed Achievement award, maybe a plane statue with a lump of coal on top.

In 2023, Marriott is a shoo-in with the coming changes. Don’t see how they can lose without holding back on some of it.