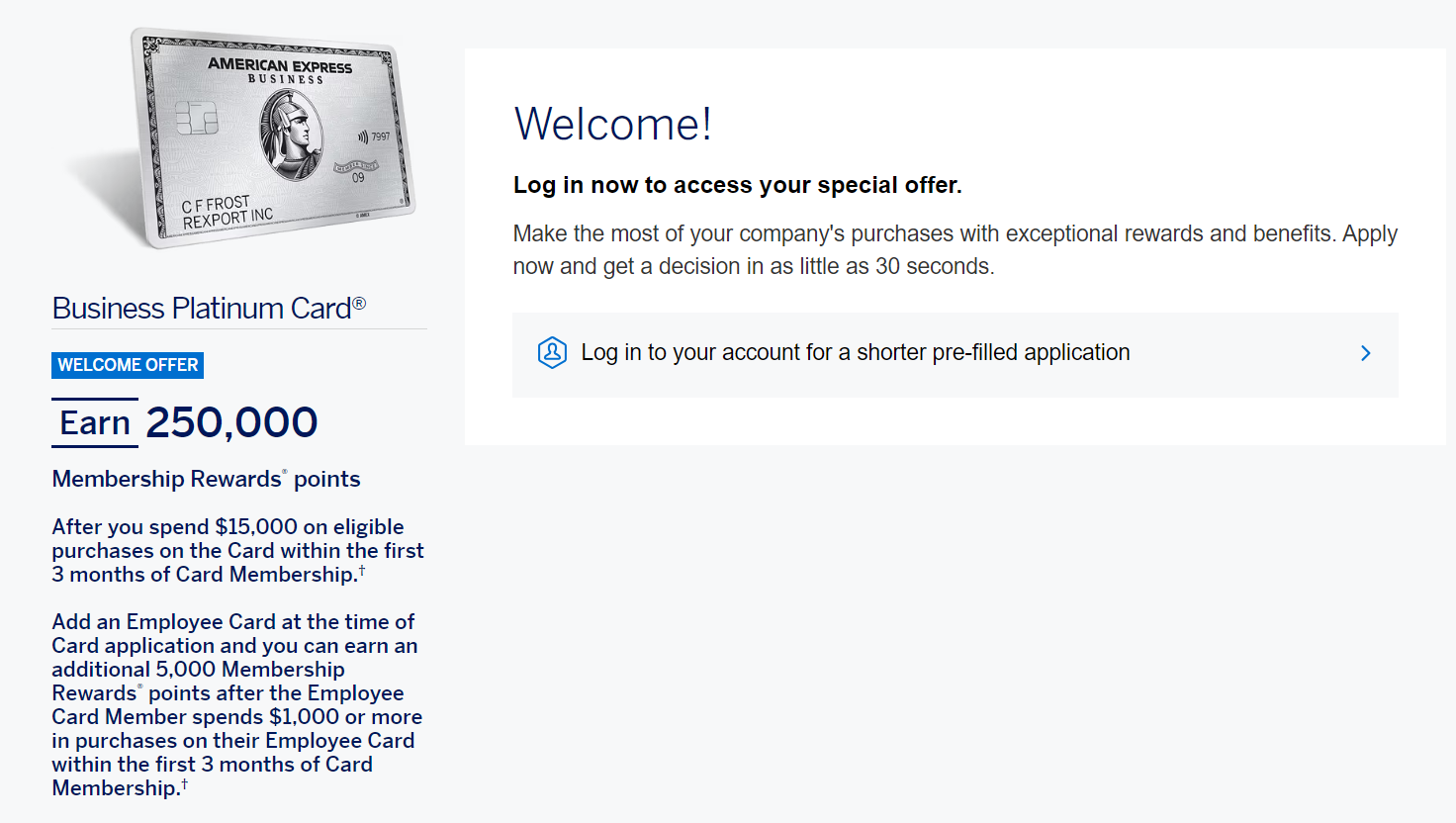

There’s another link available that allows you to check if you’re targeted for the 250K Membership Rewards offer on the Amex Business Platinum card that’s been floating around for a few months. This offer can be triggered several different ways (in fact, some folks have even found a 300K offer), but occasionally someone finds a direct link, like DDG did earlier this week.

This link has once-in-a-lifetime language and is targeted, meaning you’ll have to log-in to your account in order to see if you’re eligible. That said, for a welcome offer worth over $3,000, it’s worth taking a look-see.

The Deal

- Some Amex customers are seeing a targeted Business Platinum card offer for 250,000 points after $15,000 in purchases in the first 3 months in the “Offers” section of the Amex App.

Direct link to check if you’re targeted

You’ll be prompted to log in after clicking ‘Apply Now’ and then you’ll find out whether or not you’re eligible.

If you get a message stating “This offer is no longer available. If you’d still like to apply for a Business Card from American Express click here,” that means you’re not targeted:

Key Card Details

Note that if you click through the key card details, you’ll find more information about the current public offer for this card, which is different than the targeted offer we’re reporting here.

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Click here for our complete card review $895 Annual Fee Earning rate: Earn 5X flights & prepaid hotels booked at AmexTravel.com. ✦ 2X points per dollar (on up to $2 million of those purchases per year) for each eligible purchase of $5000 or more, US construction/hardware stores, US software & cloud system providers, US electronic goods, and US shipping ✦ 1X elsewhere ✦ Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Spend $250k+ on eligible purchases in a calendar year, get up to $1,200 in statement credits to use in the next calendar year on flights booked on AmexTravel.com, and up to $2,400 in statement credits for use in the next calendar year on monthly fees for American Express One AP®. Noteworthy perks: Select one qualifying airline and receive up to $200 in statement credits per calendar year for qualifying charges ✦ Up to $600 prepaid hotel credit semi-annually (Up to $300 Jan - June and July - Dec) valid on Fine Hotels + Resorts® and The Hotel Collection bookings ✦ Up to $1,150 a year in statement credits for Dell purchases ($150 + $1,000 when spending $5,000 in a calendar year) ✦ Up to $200 in Hilton credits (Up to $50 per quarter) ✦ Up to $120 in wireless services credits per year (Up to $10 per month) ✦ Global Entry statement credit every 4 years ($120) or TSA PreCheck statement credit every 4.5 years ✦ Global Lounge Access benefits: Priority Pass membership (Lounges only) with 2 guests, Centurion Lounge access. Also, Delta Sky Club® access (when flying an eligible Delta flight): 10 visits per year February 1 until January 31 of the next calendar year (after 10 visits have been used, additional visits can be purchased for $50 each or earn unlimited visits after spending $75K/calendar year on the card). Access limited to eligible card members ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Gold status. ✦ Leading Hotels of the World Sterling status ✦ Up to $209 CLEAR® fee reimbursement annually ✦ 35% Airline Bonus: Get 35% points back after you Pay With Points for flights with your selected airline. ✦ $250 statement credit when spending $600+ on U.S. purchases with Adobe per calendar year ✦ Enrollment required for select benefits See also: Amex Platinum Guide |

Quick Thoughts

It should go without saying that this is an incredible offer; almost double the current best public version. Even if you didn’t take advantage of any bonus categories, this works out to almost 18x MR on $15K spend…just a stellar deal. It does require a significant amount of spend within the three months, but for those who are targeted and can do the $5k/month, it’s a tasty invitation to join the Amex Points Parade.

This Business Platinum welcome offer DOES have “once-in-a-Lifetime” language. If you have had the card before (or within the last five to seven-ish years), you are not officially eligible for this offer. However, in those cases Amex will almost never do a hard pull and will let you know via a pop-up that you’re not eligible for the welcome offer before you submit the application. We’ve seen multiple reports of folks who shouldn’t be eligible successfully applying without getting the pop-up. YMMV and may the odds be ever in your favor!

Does anyone have a working referral link for the 250k offer? All the listed links I checked are expired. Thanks in advance!

[…] H/T Frequent Miler on this latest round […]

Data point: I have an AmEx Biz Plat already. I used an incognito browser to access the 250K offer but it said I wasn’t eligible when I logged in. So, I used another (incognito) browser to view the offer and applied without logging in. I did NOT receive a warning about not being eligible for the bonus. I was accepted and confirmed today that the 250K offer is on this new card. Hats off, per usual, to FM!

Any reason not to downgrade the first Biz Plat card to a Green (it’s up for renewal and has been a full year)?

How did you apply without logging in? I don’t see that option.

Re downgrade: seems like a good idea (or cancel outright)

I used Google to search for AmEx Business Platinum, then tried a few of those links in an incognito browser window to get a 250K offer. I just tried it now using https://creditcard.americanexpress.com/d/business-platinum-card/ and I got a 250K offer. Then, click “Apply Now” and it takes you to an application page where you are given the option to login, or you can complete the application on that page. That’s how I completed an application without logging in — that wasn’t possible with the direct link in your post.

The above link doesn’t always yield 250K – I tried it several more times and got 200K and 150K offers.

Aha. I see. I just tried that in different browsers and finally brought up the 250K offer in Edge. I applied without logging in, but I got a pop-up saying that I already have a Biz Plat card and wouldn’t qualify for the bonus.

OK, good. And I guess I got lucky, especially having been in AmEx jail for a while – I got no such pop-up, got approved, and then confirmed via chat that the bonus was active on the new card.

P2 received the offer yesterday in the mail. On the outside of the envelop, “Add the Premium Benefits of Business Platinum for your second Business.” Key word is second. We opened a LLC in February 2024. Shortly afterwards applied and much to my surprise, Amex business checking – approved! Also inside the words pre-approved are listed.

P2 has a Platinum business which was involved with 230K offer 12/2022 again with a business checking. This offer without combined checking account is 250K, $15K spend/3 months. In the recent past, pop-up even trying to get a Amex business blue for the second business. If no pop-up on the Platinum, talk about blowing past!

Can I pay federal taxes and have this count toward my required spend for the SUB?

can you have the business and the cunsumer platinum card open at the same time? I have had the consumer card for 5 years and still opened.

where do you find the NLL in the paperwork?

I got the “This Offer Is No Longer Available” response but it happened without me even logging in first. Interesting.

Go look at the other options on the “not available” screen. I found a 150k biz gold for $10k spend that is well worth it to me.

I also aquired that offer/card. Do you know if getting the biz Gold card prohibits one from getting the Platinum Biz bonus… say, in a year or two?

I have 3 plat biz and 2 gold biz at the moment

And you are saying you got bonuses for all 5 cards?

That’s how you do it

Do you log in before or during the application?

I’ve been targeted for this offer twice. Once in my app and once in a mailer. AND this is already having TWO Business Platinums. I got approved for my third and am a month into the spend and just received a 4th offer in the mail….

How many of these cards can I get???!!!

I recall you can have 4 or 5 AMEX credit card (both personal and business).

But there is no limit on charge cards.

There actually is a limit on charge cards, it’s just one most folks never hit – 10. 🙂

You’re right on, the limit on credit cards (for most people) is 5.

Tim, I just got another targeted mailer and I read the terms and conditions. I can’t find anything addressing NLL. Can you tell me where that language typically would be so I can make sure I’m not overlooking something. It would kill me to put 15k on it needlessly.

I don’t see a once-lifetime language on my link. Just this one. Already have a Buss Platinum but have several companies.

Suggestions?

If you have a history of cancelling or downgrading American Express Card accounts within your first year and you cancel or downgrade your new Card account within your first year, we may not credit, we may freeze, or we may take away Membership Rewards® points from your account. If we determine that you have engaged in abuse, misuse, or gaming in connection with this offer in any way or that you intend to do so, including if you return purchases you made to meet the Threshold Amount, we may not credit, we may freeze, or we may take away Membership Rewards® points from your account. We may also cancel any accounts you have with us.

I don’t particularly like what this says about me as a person, but is there a way to combine this with a referral bonus from your P2?