Oh how the mighty have…mostly given up. At a time when Amex is completely doubling down in its efforts to dole out massive point bonuses through huge welcome offers, adding additional cardmembers, and retention bonuses, Citi and Chase have essentially conceded the ultra-premium card market. Citi dumped the Prestige and Chase has remained focused on its once-pioneering Sapphire Preferred while Amex has upped the ante in more ways than one. This week on Frequent Miler on the Air, Greg and I discuss our thoughts about the ultra-premium card race and what it all means. We also tackle an AT&T Access More dilemma, Marriott’s latest targeted promos, and just which Amex purchases have ever coded as cash advances.

Of course, for those more interested in reading our takes on these topics, read on for posts about the rumored changes coming to Sapphire cards, how to use your windfall of Amex points, how to decide which premium cards are worth it to you, Greg’s harrowing experience with Capital One, and more.

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen from your browser:

This week at Frequent Miler

In credit cards

Documents reveal changes coming to your favorite rewards cards

Word on the street indicates that the Sapphire Preferred is going to pick up some overdue updates. While I find the changes intriguing in comparison with the Sapphire Reserve, they hit me as weak in direct comparison to the Citi Premier card. Still, many prefer Chase’s transfer partners and as such I take the Sapphire Preferred changes as a clear win. It is more interesting though to see how Chase appears to be completely surrendering the ultra-premium card market to Amex with the only enhancements coming to the Sapphire Reserve being incentives to book through Chase. The Reserve has been weakened by the addition of 3x dining on fee-free Chase cards and now clearly only makes sense if you either book a lot of travel through Chase or use a lot of points at 1.5c per point. While I didn’t expect Chase to directly respond to Amex, I did expect to see something like an annual Peloton credit or other sponsored perk. Chase seems to be happier with the status quo.

Your Platinum card has new perks. Here’s what to do next…

Whether you are a newly-minted Platinum card holder or you’ve had the card for years, keeping all of the card’s various benefits in mind would occupy valuable mental real estate. Remembering which ones require enrollment and how to do so requires either a photographic mind or a bookmark of this post. Thankfully, Greg has laid out exactly what you need to do and how so that you can leverage all the value possible out of your Platinum perks – old and new.

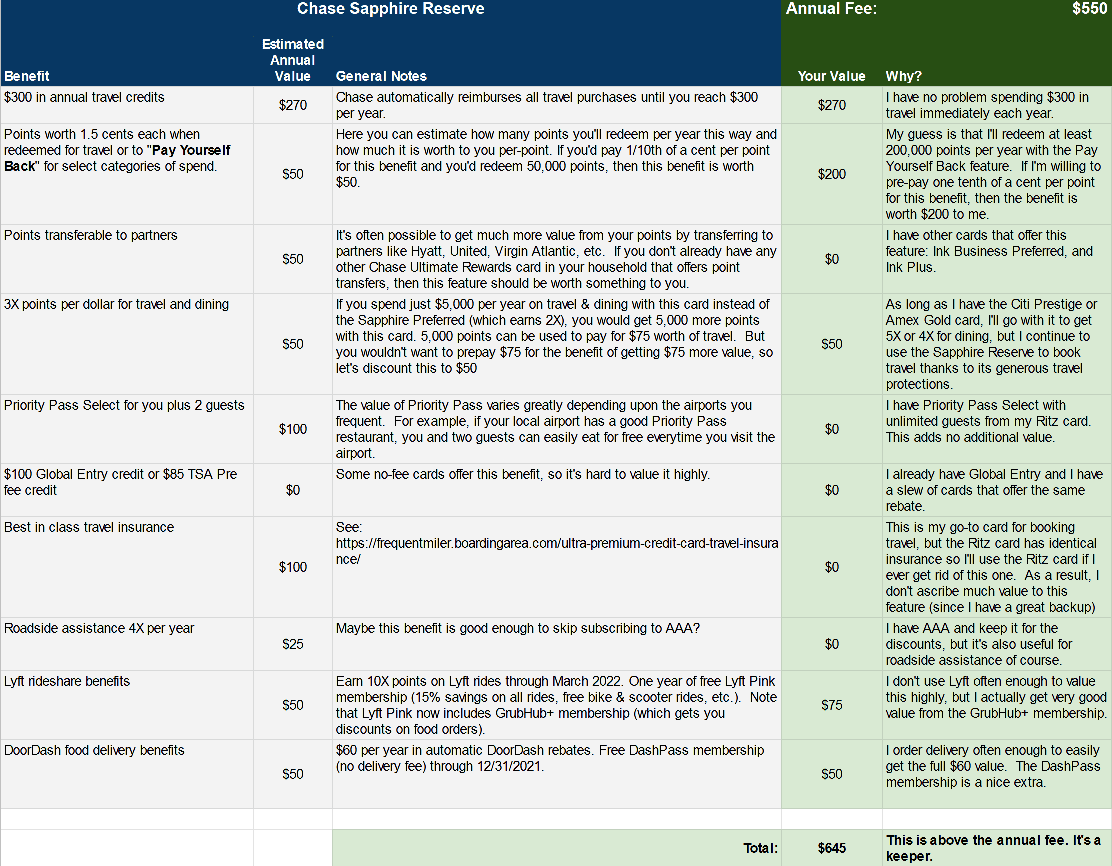

Which Premium Cards are Keepers? Version 4.0

I said on this week’s show that I found Greg’s valuation of the Amex Platinum’s Fine Hotels & Resorts credit to be too low, deciding that I would be happy to pay $125 a year to save $75 a year on an FHR booking. Maybe you don’t value that perk at all but you do already have an Equinox membership. Use this worksheet to decide which benefits to value and how much to value them in order to work out whether or not the Platinum card (and any others is your wallet) is a keeper for you.

Capital One shut down my account and gave me only a half cent per mile

This is awful. Capital One has long been dissed by rewards card enthusiasts, but as a long-time Capital One customer from a family of Capital One customers, I have been the closest thing Capital One has to a fanboy in the blogosphere, cheering on the positive changes we’ve seen over the past couple of years. But seeing what happened to Greg here certainly makes it hard to imagine recommending their products again. If it is possible to get approved, receive your card, spend, receive a bonus, and then get shut down without clear cause or explanation and no chance to use your rewards for better than half a cent per point value, how can you feel comfortable in the safety of your points balance…ever? With no standard system of appeal and no transparency at all, even if Greg is successful in getting a better resolution it won’t mean much for the average person. This situation certainly sours me on Capital One and moves my Venture card out of my wallet – because if they might take my points without warning, discussion or explanation and without giving me a chance to redeem them for rewards promised by their program, why do I want to keep earning them?

Citi Premier Card Complete Guide

The Citi Premier is out with a big new 80K offer this week – the highest we’ve ever seen on this card. This complete guide compiles everything you need to know about the Premier and its place atop the Citi Thank You Rewards ecosystem. If you have the card now and want to get the bonus again, should you cancel your current Premier? Nope. Find out why in the guide.

In award travel

Amex Membership Rewards sweet spots

If you are working your way toward a mountain of Membership Rewards points, here is some inspiration for your next vacation. With a collection of international premium cabin sweet spots that would make Willy Wonka jealous, Membership Rewards is by far my favorite transferable currency. Whether you want to fly to Europe, Africa, Asia, or Australia in style, there is a great way to do it with Membership Rewards points — or leverage one of two great round-the-world options and see them all in business class with a single card welcome bonus. Heck, with that new Resy offer, you could see them all and bring a friend.

That’s it for this week at Frequent Miler. Don’t forget to keep an eye on this week’s last chance deals Sunday updates for a list of what’s expiring this week.

Nick, you mentioned “3x dining on fee-free Chase cards”. Can you say which Chase cards those are?

Chase Freedom Unlimited (CFU) and Chase Freedom Flex (CFF) both have 3x on dining (as well as 3x at drug stores and 5x on travel booked through Chase Travel portal).

I have 270k amex points and every offer is some inflated price that bring the value of the points to .005 of a cent. Please help me with best way to redeem the points. I feel chase points are more valuable.

Good show, but I thought the discussion of CSR was a bit premature. I’ll be very surprised if it doesn’t get any additional non-UR benefits (like DD credit extension). That’s because the leaked doc only addressed UR, so there’s room for surprised on other benefits.

Personally, I’m guessing CSP annual fee will end up somewhere between $99 and $125.

With regard to discussion about people picking CSR over CSP, I think the main pull is probably the Priority Pass, together with the enhanced earnings and portal redemptions. I don’t think having the CSR implies the holder knows more about quality redemptions and loyalty programs. I have quite a few friends that have CSR, and the PP and higher earnings/portal redemptions are their main considerations for justifying the higher fee (with the underlying assumption being that the majority of people are sharp enough to realize that the net fee is only $250 after the travel credit). They literally have no clue about the loyalty programs.

And they have been applying the travel credit to grocery store and gas .

Regarding the discussion of downgrading the ATTAM to the no AF ATTA–I think the ATTA is one of those secret, under appreciated cards. Those same great retention offers that Nick was talking about are often available on the no fee card. This card has been my primary TYP generating card for the past couple years. And while the extra points on online purchases is hit or miss, there are some reliable places (like Costco.com, including for gift cards). One of the biggest advantages is the best in class extending warranty. Since most electronics I buy are online, I usually get the multiplier and great warranty coverage.

With the discussion of NY Times, I just want to point out that print subscriptions due count for the new Amex credit. Per the T&C, “digital or print news, NYT Cooking, and New York Times Games” are covered. While Nick may not want the print edition if it comes 3 days later, for those of us that can get it same day, this new credit should cover it.

Great info.

Questions: what is the no AF ATTA?

How does one get a retention bonus? And what is considered a good retention bonus for the AF and no AF cards?

Thanks!

ATTAM=AT&T Access More card ($95 annual fee version that is no longer available, earns 3x TYP on online purchases, 1x everywhere else, and gets a 10K TYP bonus if you spend $10k in a calendar year).

ATTA=AT&T Access card (no annual fee, still available, earns 2x TYP on online purchases, 1x everywhere else).

I call at least once a year and ask for a retention offer. The offers between the no annual fee & annual fee version are often similar. The one most people want is the 2 extra TYP per $ on up to $17500 spend in 6 months. This turns it into a 3x minimum on everyday spend. I received this last year. This year I received “spend $3K, get an extra 10K TYP.” Basically meant more than 4x TYP per $ for that spend. Given that this is a no AF card, either one is a great deal.

Amex seems to have gone off the deep end … in a positive sense for us:

My wife: Amex Plat personal: 100K points

Me: Two additional targeted Amex Plat Biz offers

(I now have 3 Amex Biz Plat cards!!),

one 100K points offer and one 150K points offer.

Together we now have something like 600K rewards points.

It’s a mystery to me how that works for Amex …

They are losing thousands of $$

Can you apply for biz plat card if you already have one? so you can have more than one of a certain card?

I didn’t know that was possible…

thanks.

Yes – Amex has been targeting existing Business Platinum cardholders to open another one for the past couple of years. They have been particularly agressive in that offering over the past 8 or 9 months. Here are just a couple recent posts about it:

https://frequentmiler.com/amex-business-platinum-150k-offer-no-lifetime-language-sort-of/

https://frequentmiler.com/targeted-amex-business-platinum-150k-offer-with-no-lifetime-language/

I bet Sapphire Preferred becomes $150 annual fee (cover hotel credit). The rest is just to stay competitive.

On a side note it would be pretty funny after the amex massive points binges we see if they decide to some how subtle devalue them. Point inflation.

Re: devaluing, that part is easy. I talked about that on a recent episode. I used the example of the Foo Fighters — there had been a news article about how they had handled the travel for a tour/documentary thing they were doing by using up all the Amex points from the single Amex card they had been using for years and years. They said they had something like 50 million points and used it all on travel around the US, leading me to believe that they likely booked hotels and flights at far suboptimal value.

I bet a lot of people do the same — they just look up a flight or hotel and use however many Amex points Amex tells them they need to use to book that travel for “freeeee”. Amex can easily devalue that at any time and nobody would notice — including most of us.