The original Bilt Mastercard is no longer available for new applications. There are now three new Bilt credit cards issued by Cardless:

| Card Details and Application Link |

|---|

Bilt Blue Card  ⓘ $50 1st Yr Value Estimate$100 Bilt Cash valued at $50 Click to learn about first year value estimates $100 Bilt Cash Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler $100 Bilt Cash when you apply & are approvedNo Annual Fee Click here to learn how to apply This is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 1X points + 4% Bilt Cash on everyday purchases if you choose Bilt Cash rather than housing-only rewards ✦ 0.5X-1.25X points on rent & mortgage payments (if Housing-Only Earnings selected) ✦ 1X points on rent & mortgage payments when redeeming Bilt Cash (if Bilt Cash earning option selected) Base: 1X (1.55%) Card Info: Mastercard World Elite issued by Column NA. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline and hotel partners ✦ Earn miles on rent or mortgage payments |

| Card Details and Application Link |

|---|

Bilt Obsidian Card  ⓘ $30 1st Yr Value Estimate$200 Bilt Cash valued at $100, $100 Bilt Travel hotel credit ($50 per six months) valued at $25 Click to learn about first year value estimates $200 Bilt Cash Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler $200 Bilt Cash when you apply & are approved$95 Annual Fee Click here to learn how to apply This is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 4% Bilt Cash on everyday purchases if you choose Bilt Cash rather than housing-only rewards + 3X points on dining or grocery (Limit $25K per year for grocery) ✦ 2X points on travel ✦ 1X points on everyday purchases ✦ 0.5X-1.25X points on rent & mortgage payments (if Housing-Only Earnings selected) ✦ 1X points on rent & mortgage payments when redeeming Bilt Cash (if Bilt Cash earning option selected) Base: 1X (1.55%) Travel: 2X (3.1%) Flights: 2X (3.1%) Hotels: 2X (3.1%) Grocery: 3X (4.65%) Dine: 3X (4.65%) Card Info: Mastercard World Elite issued by Column NA. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline and hotel partners ✦ 2x $50 Bilt Travel portal hotel credit every six months (minimum two night stay) ✦ Earn miles on rent or mortgage payments |

| Card Details and Application Link |

|---|

Bilt Palladium Card  ⓘ $630 1st Yr Value Estimate$300 Bilt Cash valued at $150, $200 Bilt Cash valued at $100, $400 Bilt Travel hotel credit ($200 per six months) valued at $100 Click to learn about first year value estimates 50K points + $300 Bilt Cash Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 50K Bilt points + Gold elite status after $4K non-housing spend in the first 3 months, plus $300 Bilt Cash when you apply & are approved$495 Annual Fee Click here to learn how to apply This is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 2X points + 4% Bilt Cash on everyday purchases if you choose Bilt Cash rather than housing-only rewards ✦ 0.5X-1.25X points on rent & mortgage payments (if Housing-Only Earnings selected) ✦ 1X points on rent & mortgage payments when redeeming Bilt Cash (if Bilt Cash earning option selected) Base: 2X (3.1%) Card Info: Mastercard World Legend issued by Column NA. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline and hotel partners ✦ $200 Bilt Cash annually ✦ Up to $400 in Bilt Travel hotel credits ($200 per six months, two-night stay required) ✦ Earn miles on rent or mortgage payments ✦ Priority Pass (lounges only) |

~

The original Bilt Mastercard details can be found below.

| Card Details and Application Link |

|---|

Bilt is the core rewards program in which you can earn points by paying your rent and/or using the Bilt Mastercard. It’s a program that’s designed to enable those who rent their homes to earn points on the rent. This makes the program and associated card unique in offering an easy way to earn points on what is the probably the largest monthly expenditure for those living in many markets.

There are several ways to earn and redeem Bilt points as a Mastercard-holder, each is covered below.

How to earn Bilt points

Paying Rent: Pay by card, check, or ACH transfer.

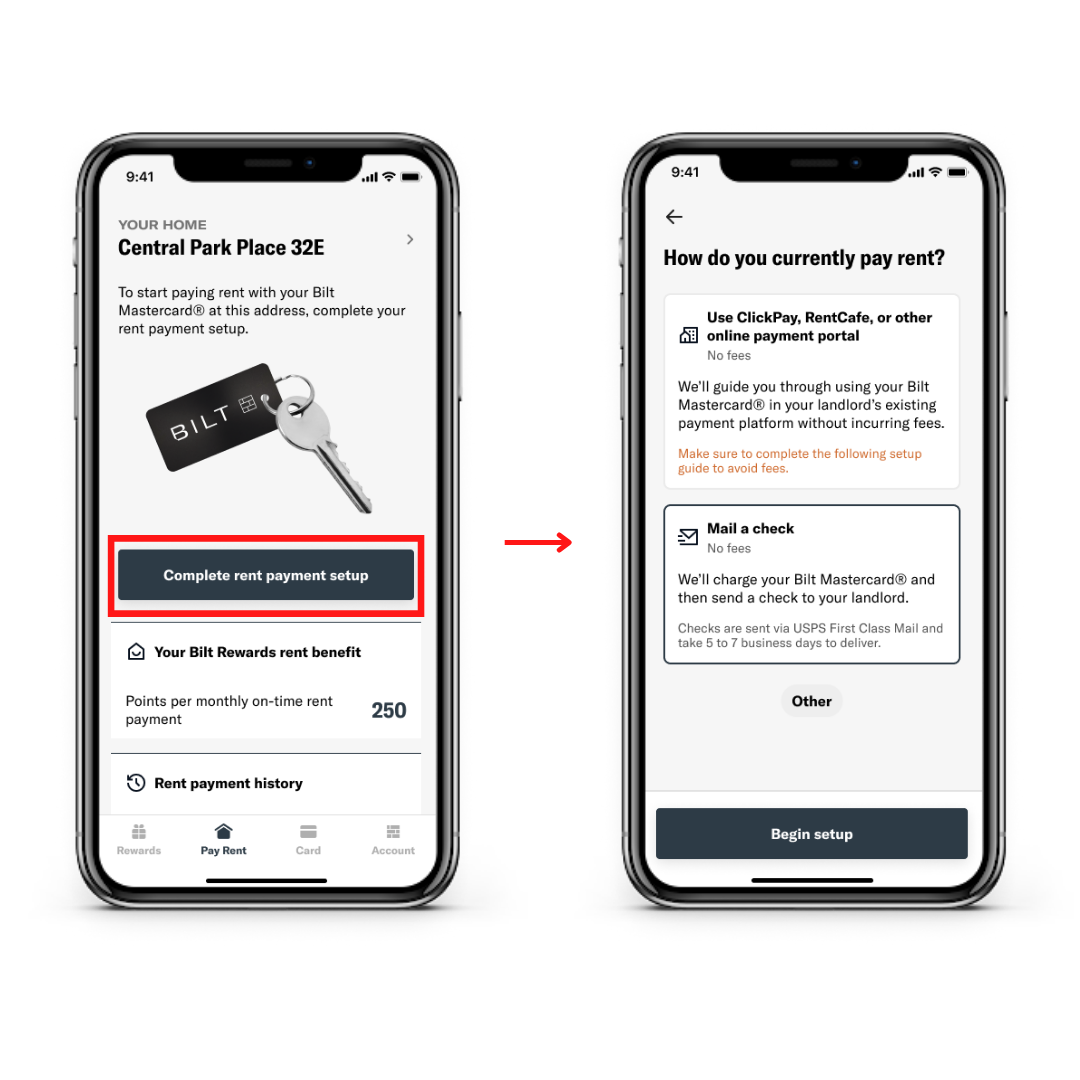

Even if your landlord doesn’t accept a credit card, Bilt Mastercard cardholders can pay rent via check or ACH and still earn 1x points on rent (1 rent payment per month, up to 100,000 points max per year). Whether you pay by check, ACH, or with your Bilt Mastercard, you’ll pay your rent through the Bilt app (or use the app to generate ACH account information that can be copied into your online rent payment portal). This makes it very easy for most people to earn 1 point per dollar spent on rent (up to 100,000 points per year). Keep in mind that you’ll need to make 5 total transactions per month with the Bilt Mastercard in order to earn points, so be sure to use it for more than just the rent.

In the Bilt app, cardholders have the option to send a rent payment by mailing a check or by ACH transfer using ClickPay, RentCafe, or other online payment portals.

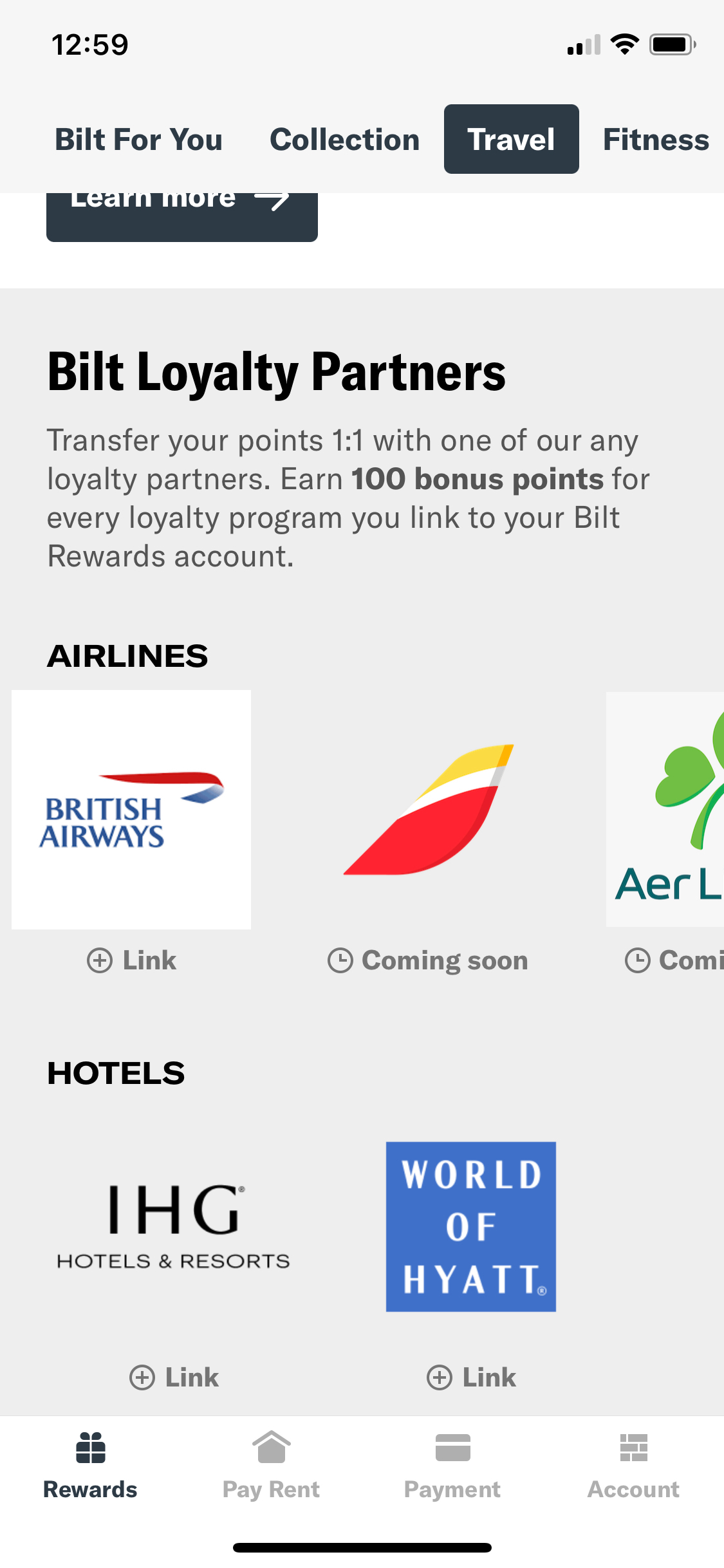

Linking Rewards Programs to Bilt

Note that Bilt has occasionally run promotions with increased incentives for linking specific programs. For instance, in April 2022, Bilt offered 500 points for linking an American Airlines AAdvantage account and in May 2022 Bilt offered 500 points for linking a World of Hyatt account. Both of those promotions have since expired, but it is worth keeping your eye out for future promotions if you have not yet linked all of your loyalty accounts.

Using the Bilt Mastercard

| Card Name w Details & Review (no offer) |

|---|

The Bilt Mastercard offers rewards in the form of Bilt Rewards points as shown above so long as you use your card for at least 5 transactions per month. If you do not use your card for at least 5 transactions per month, you will not earn points based on your card activity.

2x travel, 3x dining

The Bilt Mastercard offers two bonus categories: 2x travel and 3x dining. While those multipliers do not put it at the top of our list of best category bonuses, they represent good return for a no annual fee card that earns points that can be directly transferred to partners.

Assuming you can meet the minimum transaction requirements, the return on dining and travel spend is respectable for a card with no annual fee given Bilt’s very strong set of transfer partners and even more so when you consider that points can be used not only to transfer to partners but also to book travel at a value of 1.25c per point through Bilt’s portal. While booking through a travel portal won’t always make sense (you need to shop rates), the added flexibility is nice for times when the portal is price-competitive.

1x everywhere else

Unfortunately, the Bilt mastercard does not offer a strong earning rate on everyday spend at just 1x for most purchases, nor does it offer a public introductory bonus. We recently saw a targeted offer where some were targeted for 10,000 points after $1,000 in purchases. In the first 90 days. Those targeted received an email with a personalized link.

Where the card really shines is in offering 1x on rent payments — even if your landlord does not accept a credit card. That’s because cardholders gain the ability to pay not only landlords in the Bilt alliance but any landlord by sending a check or by ACH transfer as outlined above in this guide.

Earning 1 point per dollar on most purchases is not a good return on spend. That said, if you would not otherwise earn points for paying your rent, the overall math may work out well for those looking for a single long-term card. For instance, if you generally have $1500 per month in expenses paid by credit card and you also pay $2,000 per month in rent, you would earn at least 3,500 points per month with the Bilt Mastercard and possibly more if any of those purchases are in bonus categories (assuming you make at least 5 transactions). If you would have alternatively put those $1500 in monthly purchases on a card that earns 2x everywhere and not earned points on rent, you would only earn 3,000 points per month. You could earn far more points by focusing your spend toward excellent credit card welcome bonuses, but the Bilt Mastercard can be a reasonable choice for someone who rents and is looking for a single no-annual-fee credit card.

Bilt has run some past spending promotions like 5x everywhere for Black Friday with Bilt card. It’s worth keeping an eye out for similar promotions.

Bilt “Rent Day”

For a 24-hour period on the 1st of each calendar month, Bilt offers a promotion called “Rent Day” where members with the Bilt Mastercard earn double points on all non-rent purchases. Not only does this make the base earning rate 2x, it also doubles existing bonus categories, meaning that cardholders earn 6x dining and 4x travel. (but for one day only). That makes the first of the month a great day to buy a gift card at your favorite restaurant or to book pending travel (though it would likely be harder to plan that specifically for the first of the month, given the fluidity of pricing).

Your earnings potential on Rent Day isn’t infinite: you can earn up to 1,000 maximum bonus points on rent day, a fairly modest ceiling given that it would take only $333.34 in dining purchases, $500 in travel or $1000 everywhere else to reach the 1K bonus point cap.

It’s also worth pointing out that you still only earn 1x on rent. The double rewards is for non-rent purchases only. In that regard, remember that you need to make 5 non-rent purchases per month in order to earn 1x on the rent. This double rewards deal on the first of the month should make it increasingly easy for cardholders to meet that threshold.

Bilt also runs additional promotions on Rent Day, in addition to the increased earnings. So far, offers that we’ve seen have included a transfer bonus to IHG One Rewards, a monthly rent giveaway, free SoulCycle classes and even a “Points Quest” trivia contest.

Referring friends to Bilt Mastercard

Bilt offers a referral program for the Mastercard, but the normal rates aren’t stellar. For each person you successfully refer, you get 2,500 points. Every 5th successful referral gets you an additional 10,000 points – up to 2 million bonus points. You can find your referral code by tapping the invite button in the app.

Note that you do not need to be a card holder in order to refer friends to the Bilt MasterCard, but that Bilt limits each customer to a maximum of 50 lifetime referrals.

Additional Bilt Mastercard perks

- Primary Rental Car Insurance

- Cellphone Protection – Applicable when paying you cellphone bill with the card. $25 deductable per claim, 2 claim max per year ($800 max per claim, $1600 max/year)

- Purchase Protection – 90 days from purchase date, $10,000 max per item, $50,000 max. See exclusions here.

- Trip Cancellation/Interruption Protection – $5,000 max per covered traveler per trip. See what’s covered here.

- Trip Delay Reimbursement – $200 per covered traveler per day for up to 3 days total, beginning upon 6 hour initial delay. See what’s covered here.

How to use Bilt points

Transfer Bilt points to airline and hotel partners

Bilt has a very unique set of transfer partner that make the program surprisingly strong. Points transfer 1:1 to partners, with most transfers occurring within 10 minutes or less. Partner programs can provide opportunities for far outsized value. See our Bilt points sweet spots post for full details on the best redemption opportunities.

Partners include:

Hotels

| Rewards Program | Best Uses | Bilt Transfer Ratio (and transfer time) |

|---|---|---|

| ALL Accor | Use to pay hotel bill with value of 2 Euro cents per point. In some cases (such as hotel to airline transfer bonuses) it may make sense to convert Accor points to the following airline miles at a 1 to 1 ratio: Finnair, Iberia, Qantas, or Virgin Australia | 3 to 2 (Unknown) |

| Hilton | 5th Night Free awards. Best value is usually found with very low end or very high end Hilton hotels. Bonus: award nights are not subject to resort fees. Note that Hilton points often go on sale for half a cent each and so its rare for point transfers to Hilton to be a good value. | 1 to 1 (Unknown) |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth more than 2 cents each. Bonus: award nights are not subject to resort fees. | 1 to 1 (Instant) |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. | 1 to 1 (Instant) |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. | 20K to 25K (Instant) |

Airlines

| Rewards Program | Best Uses | Bilt Transfer Ratio (and transfer time) |

|---|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. | 1 to 1 (Instant) |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | 1 to 1 (Instant) |

| Alaska Atmos Rewards | Alaska Airlines offers decent oneworld award pricing, excellent short-distant pricing, and uniquely allows free stop-overs one one-way awards. Additionally, Alaska allows free award changes and cancelations (although they do have a small non-refundable partner award booking fee) | 1 to 1 (Instant) |

| Avianca LifeMiles | Avianca LifeMiles can be decent for Star Alliance awards. They offer reasonable-ish prices and no fuel surcharges on awards. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. | 1 to 1 (Instant) |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Cathay Pacific Asia Miles | Cathay Pacific has a decent distance based award chart, but they don't allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. | 1 to 1 (Instant) |

| Emirates Skywards | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be extremely steep. One workaround is to book select routes such as JFK to Milan or Newark to Athens. See: How to find and book Emirates first class awards. | 1 to 1 (Instant) |

| Etihad Guest | Etihad offers a distance based award chart for flying Etihad and another for its partners. Points may offer good value for expensive but short-distance flights. | 1 to 1 (Unknown) |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. | 1 to 1 via BA (Instant) |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| JAL (Japan Airlines) Mileage Bank | JAL has a distance based partner award chart. Depending upon the length of the flights, this can lead to great award prices on partners such as Emirates and Korean Air. | 1 to 1 (Instant) |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. | 1 to 1 (Instant) |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary. Lower demand flights and those with higher taxes tend to offer better value. | 1 to 1 (~12 hours) |

| Spirit | 1 to 1 (Unknown) | |

| TAP Air Portugal | Surcharge-free Emirates redemptions. Increased availability on TAP flights between US and Europe. | 1 to 1 (Unknown) |

| Turkish Airlines Miles & Smiles | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. See: Turkish Miles & Smiles Complete Guide and Turkish business class sweet spots from the US. | 1 to 1 (Instant) |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. | 1 to 1 (Instant) |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). | 1 to 1 (Instant) |

Current Transfer Bonuses

If Bilt is running any transfer bonuses, details will appear here:

| Transfer Bonus Details | Start Date | End Date |

|---|

Use Bilt Points to pay for travel at 1.25c per point

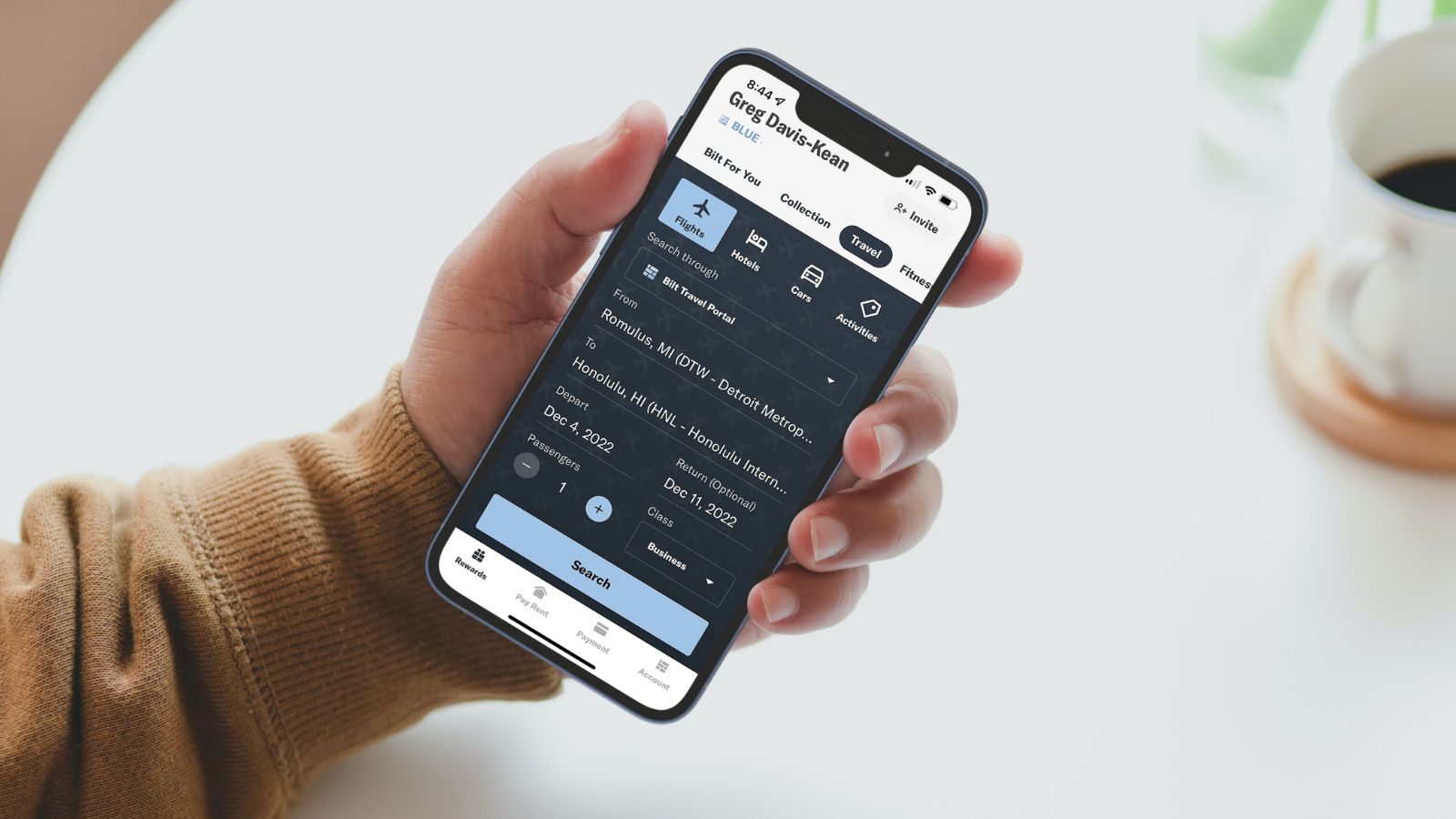

Bilt now offers the ability to use points at a value of 1.25 cents per point when booking travel through their new travel portal. The portal is baked into the Bilt app (simply select the “Travel” tab) or members can browse to: travel.biltrewards.com.

Like many other travel portals, Bilt’s portal is powered by Expedia. This means that most flights will probably be the same price that you can find elsewhere, but rental cars, hotels, and activities may cost a bit more. Still, this can be a good way to get decent value for points when booking hotels or certain experiences (like tickets for Disney World).

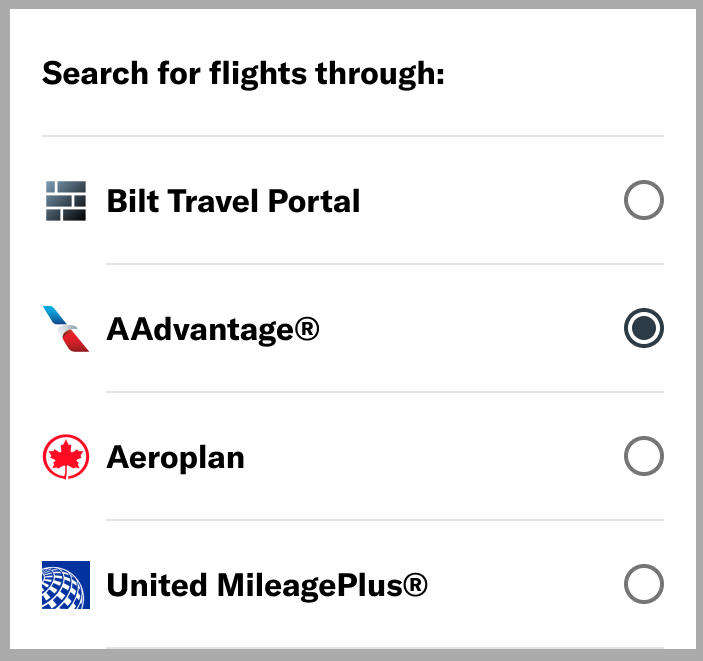

One really cool feature is only available through the Bilt app. When searching for flights, you can choose to search through the Bilt Portal for cash rates or through a selection of their airline partners to see award rates for the same dates and destination. This should make it easier for people to decide whether to use their points through the portal or by transferring to partners. At the moment, only American Airlines AAdvantage, Air Canada Aeroplan, and United MileagePlus are supported, but I’m guessing that Bilt will add more partners soon.

If you don’t have enough points to cover an entire charge, you can pay in part with points and the remainder in cash.

While you can often get far more value by transferring points to airline and hotel programs, the ability to alternatively get decent value when redeeming for travel directly is a strength for those who don’t intend to learn the intricacies of booking award flights using airline miles.

Redeem points for rent

Bilt allows you to redeem points for rent. The value here is very poor as you will get less than 1c per point. If you intend to use credit card rewards to pay for rent, you would likely be better off with a credit card that earns 2% cash back everywhere and using that cash back toward your rent.

Redeem points for fitness classes

Bilt has partnerships with several popular exercise class brands, so you can redeem your points for popular classes like Soul Cycle, Rumble boxing, Solidcore, and Y7. These redemptions generally don’t provide maximum value.

Redeem points for art, home décor and more

Bilt offers the Bilt Collection, a curated selection of limited-edition art and home décor. Redemptions start at 5,000 points. Whether or not these redemptions make sense is a matter of personal taste.

Use points to cover Amazon purchases

You can use Bilt Rewards points at checkout to cover purchases at Amazon.com. This yields very poor value for points at 0.7c per point and should be avoided.

Bilt Rewards elite status

Bilt Rewards offers an elite status program that offers the chance to earn interest on rewards points among other benefits.

You can qualify for elite status by total points earned or through spending via five different channels:

- Bilt Mastercard (excluding rent)

- Bilt dining with a card that’s linked to your Bilt wallet

- SoulCycle classes booked via the Bilt app

- Bilt Travel Portal

- Lyft rides

Elite status thresholds are as follows:

- Blue – anyone enrolled in Bilt Rewards with under 25,000 points

- Silver – 50,000 points earned or $10K in non-rent spend

- Gold – 125,000 points earned or $25K in non-rent spend

- Platinum – 200,000 points earned or $50K in non-rent spend

Benefits as you move up status tiers include:

- Silver and higher

- Earn interest in the form of points to a member’s Bilt Rewards account every month based on average daily points balance for each 30-day period (rate is based on the FDIC published national savings rate)

- Bilt will deposit up to 50% bonus points on top of points issued by landlords to

members for signing for new tenant leases and lease renewal., depending on

member status.

- Gold and higher

- Bilt Homeownership Concierge: Members who redeem Bilt Points toward a home down payment can get help from a dedicated concierge who will walk the member through the home buying process.

- Platinum

- Members will receive a complimentary gift from the Bilt Collection (apparently some type of home decor / art).

- One free BLADE helicopter ride each time you qualify (or re-qualify) for status.

I just read through this “BILT REWARDS COMPLETE GUIDE” and there are a few questions I was hoping to find answers to. Did I just miss them, as that happens…

1) HOW do I connect other loyalty programs and why would I want to? Do I have to choose the loyalty program I want to use for each transaction?

2) HOW do I connect other credit cards and why would I want to? Do I have to choose BILT REWARDS when using the credit card?

It’s all confusing to me. I read your guide and then went to try and find the answers on the BILTREWARDS web site and couldn’t find what I was looking for. Bilt suggested I connect my BILT card to my ‘favorite’ vendors but that wasn’t really working (broken API?)

Thanks for any help you can give…

Shouldn’t this be 1000 maximum bonus points on rent day?

“Your earnings potential on Rent Day isn’t infinite: you can earn up to 10,000 maximum bonus points on rent day.”

Limit of 1,000 bonus points is right. Huge downgrade from what it used to be

Yup, hugh downgrade from what used to be with unlimited bonus points (or a bigger cap as I remembered) on rent day. 1,000 bonus points didn’t mean much now, as I used to rack up tons of bonus points during rent day to achieve Platinum. The card is not very attractive as it used to be.

Yes, you’re absolutely right. We’ve published that in numerous other places, but we missed changing it here. I appreciate you highlighting that — I’ve fixed it.

can you use Bilt to pay your income tax? If so is there a fee? If you do it quarterly on the first you can get the 5X? I notice one guy said he got 50K but it says the limit is 10K on rent day.

Can you apply for the Bilt Mastercard more than once ?

I hate to be the pedant in the comments, but I just signed up for this card, and my terms say 5 transactions per statement period to qualify for points, not per month. If trying to make 5 tx per month, there could be a situation where you make your 5 tx on the first of one month, and then 5 tx on the last day of the next month; and unfortunately would not earn points for a statement period that ran from the 10th to the 9th.

Again, hate to be the pedant, but just so people don’t miss out …

Good catch! Updated, thanks.

How does rent day stack with the 5x for 5 days? Eg rent day you get 6x dining (3+3), so would you maybe get 8x? (3+3+2)?

They don’t stack. My understanding is that you’re only eligible for the Rent Day benefits if you got your card more than 5 days beforehand.

[…] 【2023.8更新】根据FM的信息,Bilt开卡奖励依然存在(这个奖励没有正式公开过,YMMV): […]

Did I hear Nick & Greg talk about paying condo HOA fees with Bilt on the podcast a while back?

Yes, many people have reported success with this despite it not being an officially sanctioned way of “paying rent”

Just got the Bilt card 1 hour ago and paid $10K tax bill to earn the 50K points for the first 5 days…what a deal

I guess that counts as their sign up bonus – but only have 5 days and not 90 days.

does $1 amazon gift card reload count as a transaction for the 5 min. transactions per month?

Does bilt have a refferal program for the account without a credit card?

Yes. You can find the referral link in the app when logged in. You don’t need the card to refer others to Bilt Rewards and earn points.