NOTICE: This post references card features that have changed, expired, or are not currently available

May started with a bang, with announcements from Chase, Citi, and Amex on improvements made in light of the current state of travel (and the categories in which most of us are now spending). While Chase and Citi both made positive moves, Amex absolutely blew them out of the water. In this week’s Frequent Miler on the Air, Greg and I break it down card by card and decide which are suddenly must-haves; the answers surprised even us. Watch, listen, or read this week’s Frequent Miler week in review.

FM on the Air Podcast

For those who would rather listen than watch, the audio of our weekly broadcast is available on all popular podcast platforms, including:

| iTunes | Google Play | Spotify |

You can even listen right here in this browser:

If you can’t find the podcast on your favorite podcast platform, send us a message and let us know what you’d like us to add.

This week at Frequent Miler:

StayCay to Far Away Week 2: Bran-son, Stow away, breakfast for dinner: who wins?

Week 2 is in the books (sort of). Those following along will know that we’re calling the weekly winner based on total Youtube likes for the week. We will eventually crown category winners for each individual category as well with the same methodology — and then readers will have the opportunity to vote for a champ at the end. This week’s votes are in — though keep in mind that even if you missed the videos, you should click the link above this paragraph to see them since your likes can still count toward category winners at the end.

Week 2 of StayCay to Far Away had a tight race to the finish line between Greg and Carrie, with Greg ultimately victorious. Who would have thought that a burger between two halves of a donut would only be good for third place? Congrats to Greg for just barely edging out Carrie for Week 2.

Week 2 standings:

- Greg: 88

- Carrie: 85

- Stephen: 61

- Nick: 27

Current Category leaders:

- Destination Cooking: Nick (111)

- Travel-Themed Life Hack: Carrie (85)

- Imitation Travel: Greg (88)

- Improv Travel: Greg (70)

In the struggle to steal your spend:

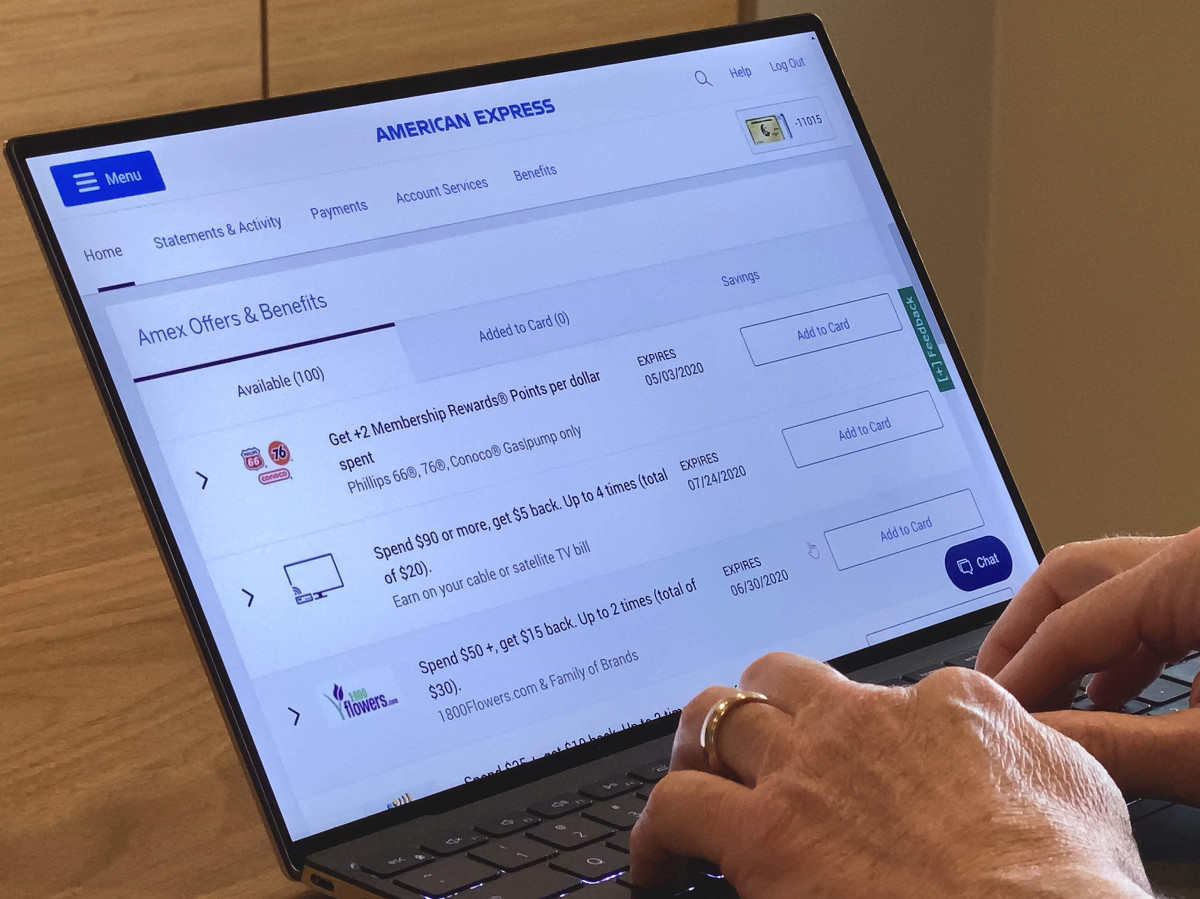

Amex adds great stay-at-home perks to ultra-premium travel cards (this year only)

In the battle to make your travel card rewarding on non-travel spend, Amex slaughtered the competition. While we gave them a little flak in Frequent Miler on the air for only adding 4x groceries on the Delta cards, they went to town on making the Platinum cards (both personal and business) outstanding values. In a time when we can’t travel, the fact that they made a card with a $550 annual fee seem like a must-have is remarkable. Read all about everything they’ve done — including putting together $920 in credits on the Business Platinum card this year.

Chase adds groceries on most $95 and up consumer cards

Chase made an effort to try to capture one corner of your spend and came up pretty short comparatively. Sure, 5x on groceries on the CSR sounds pretty nice, but it’s capped at $1500 in spend per month and only lasts for 2 months. I’m as happy as anyone to pick up 15,000 easy Ultimate Rewards points, but considering the ridiculous value that Amex added to the Platinum cards (that lasts well beyond June), this made it look like Chase is playing wiffle ball while Amex was swinging for the big league fences. Go back to the sandlot, Chase. You’re killing me, Smalls.

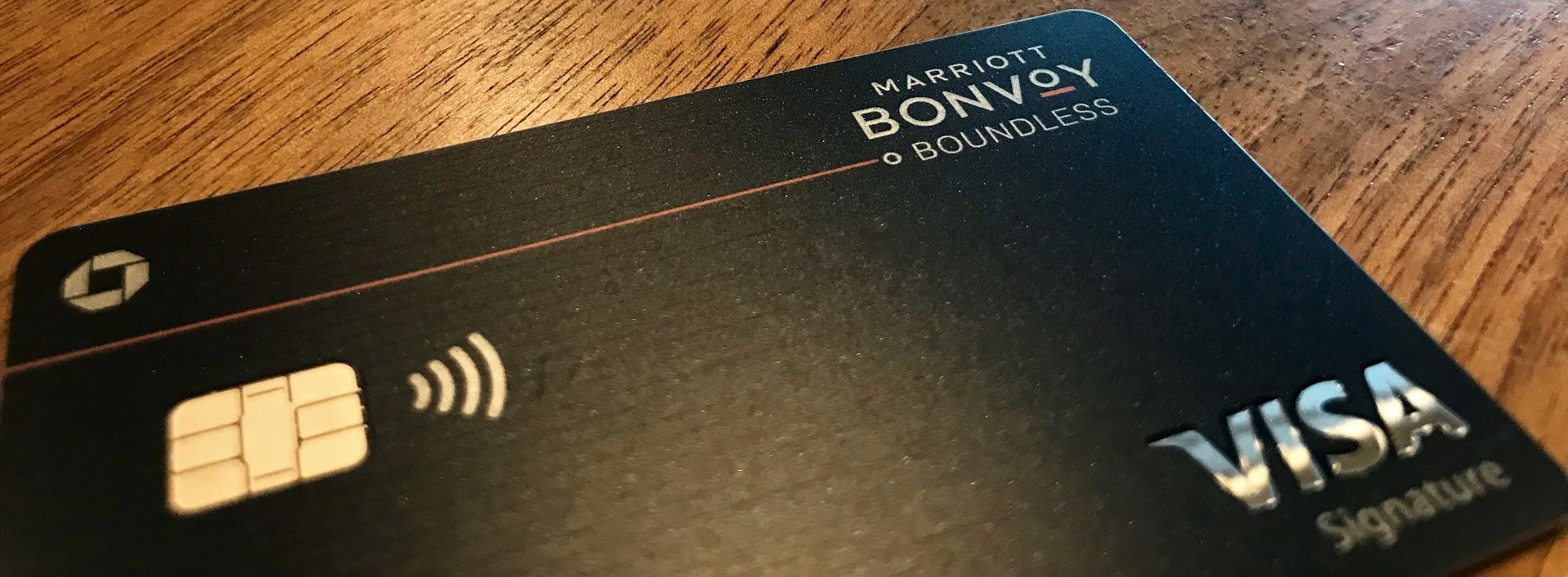

6x groceries on almost all US Marriott Bonvoy credit cards for a limited time

As we said in Frequent Miler on the Air, I kind of like this bonus if only because it makes me not feel too awful about earning Marriott points. This seems like a reasonable enough value for grocery store spend — though if you have a Freedom (Q2 bonus category) or a Chase Sapphire Reserve (5x on up to $1500 per month May/June), you probably want to work those out first. Then maybe a Marriott card could get a little bit of spend at least in July. Maybe.

Citi’s turn: Use Prestige credit at supermarkets / restaurants, more time to meet spend

This is basically Citi giving you $250 if you have a Prestige card. Since the Prestige earns 5x on dining, this is the card you should be using for all of your dining purchases if you have it (otherwise, you shouldn’t have it). If you won’t spend $250 between now and December 31st at restaurants, it was time to downgrade this card anyway. If Amex hadn’t stolen Citi’s lunch money with the enhancements to the Platinum cards, this might have seemed like a more exciting gesture.

In Earning Miles:

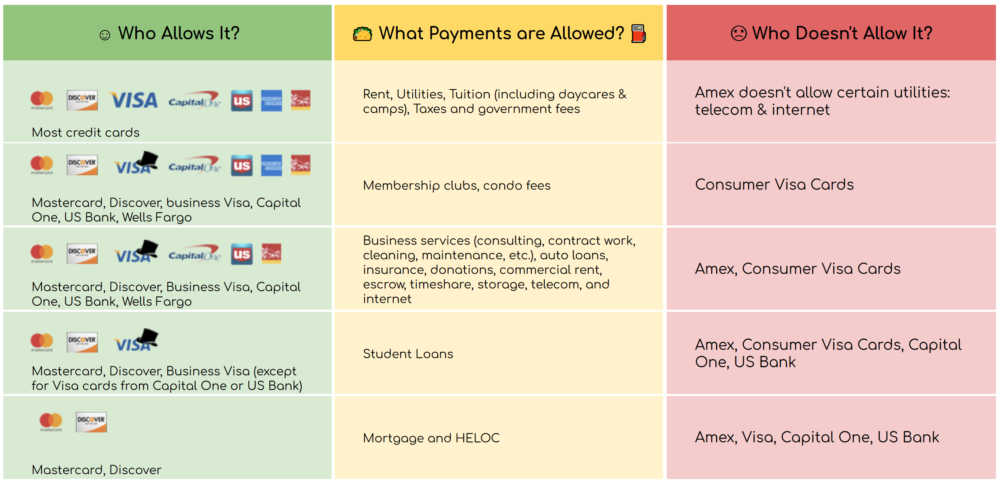

Best credit cards for Plastiq bill payments

For most people, Plastiq bill payments are merely a way to spend toward a new card welcome bonus and/or to take advantage of reduced-fee or fee-free opportunities. However, there are some cards that still make sense for Plastiq payments even outside of those scenarios. This post lists many of the best options.

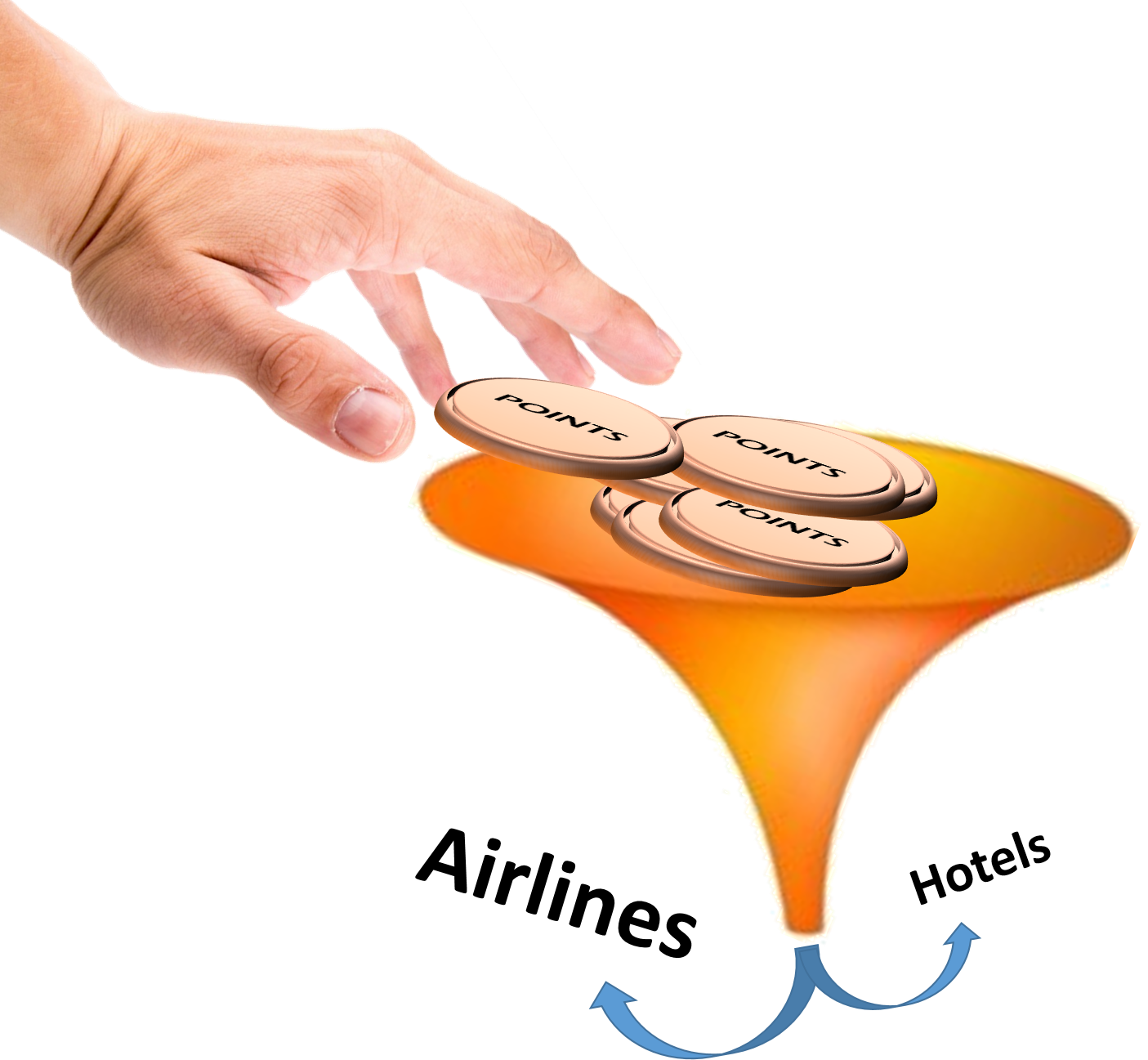

The most promiscuous airline programs

Part of the joy of diversifying the points you earn is the ability to cherry pick just the right awards from a variety of transfer partners. However, another key benefit is the ability to pick up multiple welcome bonuses from different issuers and pool them into a valuable award by combining forces. This post is about the airlines that partner with the most transferable currencies — which means it is particularly easy to amass the miles you need for an award.

In burning miles:

Best ways to get to Asia using miles (premium cabins)

We don’t know when travel will be safe / advisable / enjoyable again, but now might be a good time to plan which points to collect for the future trips you hope to make. If Asia is on your list, you’ll want to see this post for the best ways to get there, which might help you decide which card(s) to use now.

Virgin Atlantic in financial ruin. Should I burn my million miles? On my mind…

Many readers are concerned about the future of airline programs given the current state of travel. Personally, I agree with Greg’s take here: I think it’s extremely unlikely that Virgin will actually fold, so I wouldn’t burn miles already there — but neither would I transfer miles into any airline program right now to have a more confident view of the future before you move toward booking stuff.

Notable new deals:

30% or 40% off at Amazon with 1 Membership Rewards point! [Targeted]

Many people are targeted to save either $30 off $100 or $50 off $125 at Amazon. It only takes a second to see if you’re targeted and it’s well worthwhile if you do have the offer — just be sure to use only 1 Membership Rewards point at checkout to avoid burning points at poor value.

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

[…] this week’s Frequent Miler on the Air, Greg and I agreed that the Platinum cards have suddenly become compelling thanks to the recent […]

Emails are starting to go out from Amex to business platinum cardholders informing them they’ll get a one-time $200 statement credit following account renewal. In the email, Amex specifically uses the term “$200 appreciation credit”.

Yep, my son got that email for his Biz Plat card. Sweet deal.

Do you need to do anything to get the streaming and cellphone benefits on the Amex personal plat? I went to website and did not see anything about adding the benefit to your card or anything about these new benefits

No, I believe it’s automatic

What about upgrading biz green/ biz gold to a biz plat? That’d seem like a good deal right now, especially if you can get an upgrade offer.

Definitely

Greg/Nick, Here’s a suggestion for a post that I think would be very interesting. Assume you didn’t have any of these AMEX cards with elevated benefits, … how would each of you rank the cards from most attractive to least attractive (taking into account the elevated benefits).

One thing that you would need to consider that wasn’t discussed on the podcast, was what the current SUB is for each card versus the all-time high. Also, worth considering is the extended 6-month period to achieve SUB for cards like the Biz Platinum’s high spend threshold. I know the value of each card is subjective to what each person values (e.g. Uber credit vs Dell, etc.), … but I’d be interested to hear how each of you would rank these AMEX cards from your own perspective, assuming you didn’t have any.

Ok… so I asked this question before listening to the last 15 minutes of the pod :). I appreciate the discussion on the Aspire/Biz Plat/Pers Plat, … but the one thing I think you all failed to consider was current SUB relative to all-time highs.

Thanks. Yes, this is worth a post or two

It is disappointing that Amex didn’t offer anything for the Gold cardholders who can’t use the $100 travel credit.

Thanks for the podcast; I enjoyed listening to it. But I would caution you all against talking about complex topics like MS so cavalierly. Casually mentioning that someone could buy GC at their grocery store and then take it to Customer Service to buy a MO is recipe for disaster. And not only for that person but for other people who might be MSing there. Similarly using Amex airline credits in a grey area has gotten recent claw backs and likely added to recent shutdowns. Similar issues with Simon Mall GC which you often talk about. Not that I don’t want you to talk about these topics because I do MS, but please give some disclaimers since these activities are fraught with risks.

With all these Grocery bonus’s im sure people will be buying a lot of gift cards. There’s an issue with the US Bank Visa/MC issued gift cards which are sold at Kroger and other stores. They do not allow you to change pin, it says the 3 digit code is wrong and it locks the card for 24 hours. I’ve had this happen on 5 cards since Wednesday the 29th.

https://www.flyertalk.com/forum/manufactured-spending/1953215-kroger-master-thread-2019-a-17.html

Do you give a more detailed explanation or example anywhere on how to use airline credits? You mention booking a flight now, then an example is to add seat upgrade (I believe it must be a separate, second transaction), then cancel the booking. This is based upon being able to cancel/ rebook these days due to travel uncertainty. But could you also do it under the pre-existing policy of cancel within 24 hours of booking with no penalty?

It was also mentioned that Southwest is the easiest since they allow no-penalty cancellation anyway.

Are you saying that when you book with a separate qualifying item such as seat upgrade, or anything on Southwest, you get the credit at that point; then turn around and cancel, the credit is not reversed?

On all of these, when you cancel, are you getting a refund and not any sort of voucher?

I’m afraid I will do something not quite right and end up with even more credit to monitor!

I am sitting on an AX Gold UA credit and a partial UA on AX Plat and a DL Gold credit.

Any news(incentives) from CNB for Crystal card owners ?

Checked my account – no news there, called them – no info given.

Maybe you know more from your end ?

Thanks.

Is the 5x on CSR for ALL holders of the card, or do you need to see if on the Chase website as an offer available to you. I have not gotten an email or other communications making the offer.

It’s for all cardholders

Thanks!