NOTICE: This post references card features that have changed, expired, or are not currently available

This week on Frequent Miler on the Air, Greg and I talk about how Delta has roared back in a big way with major enhancements for top-tier elite members and huge new offers on their credit cards that are hard to ignore even if you assign relatively low value to SkyMiles. I still think Greg is kind of crazy to spend his way to Delta Diamond status, but now that I can find upgrade space online and use Greg’s global upgrade certificates to upgrade award tickets (and he offers to cover the miles!), maybe I’ll feel differently after he passes the GUC. Should you spend $90K on a shiny new Delta Reserve card to earn Platinum status and some (now even more) valuable regional upgrades? Watch or listen to this week’s show for our analysis on that and more.

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen here in the browser:

This week at Frequent Miler

Delta, Delta, Delta

Exciting enhancements for Delta’s top tier elites (On my mind)

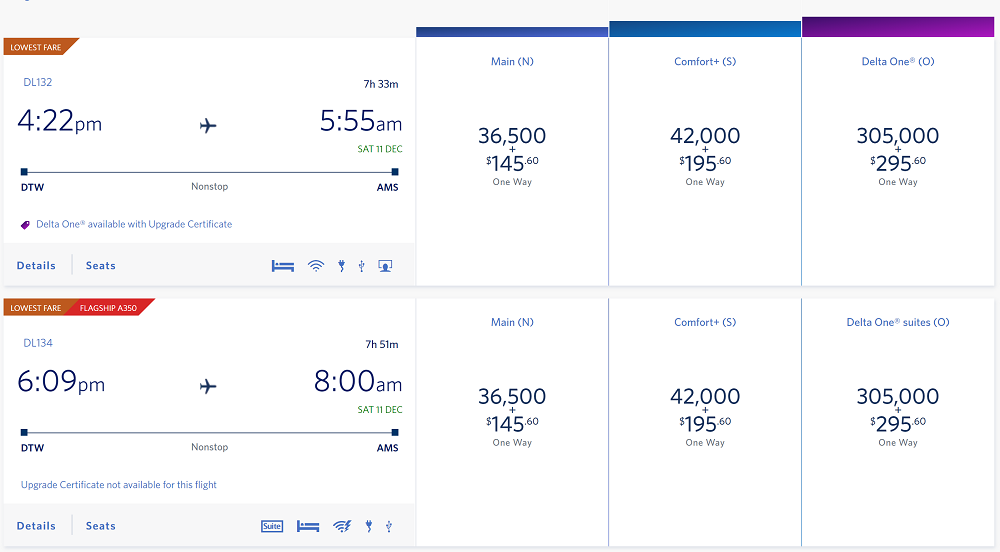

Delta made some downright exciting changes this week if you’re a Delta elite member. Upgrade certificates can now be used on award flights, which means that elite members with upgrade certificates can now book a cheap economy class award and then use an upgrade certificate to confirm a seat in first class, which could be a great deal (and is particularly awesome because of the flexibility of award tickets originating in the US). This definitely enhances the value of those upgrade certs and thereby the value of Delta elite status — possibly giving Greg the justification he needs to spend his way back to Diamond status next year.

Delta Upgrade Certificates can now be used for award & Miles + Cash flights

I teased Greg a bit about this on this week’s Frequent Miler on the Air, but the truth is that this is huge news for those with Delta elite status. This means that those with Delta upgrade certificates can now jump on an award flash sale and upgrade your award ticket to fly first class for few points. This combined with free cancellations for awards originating in the US only increases the value of SkyMiles and SkyMiles flash sales. That’s awesome.

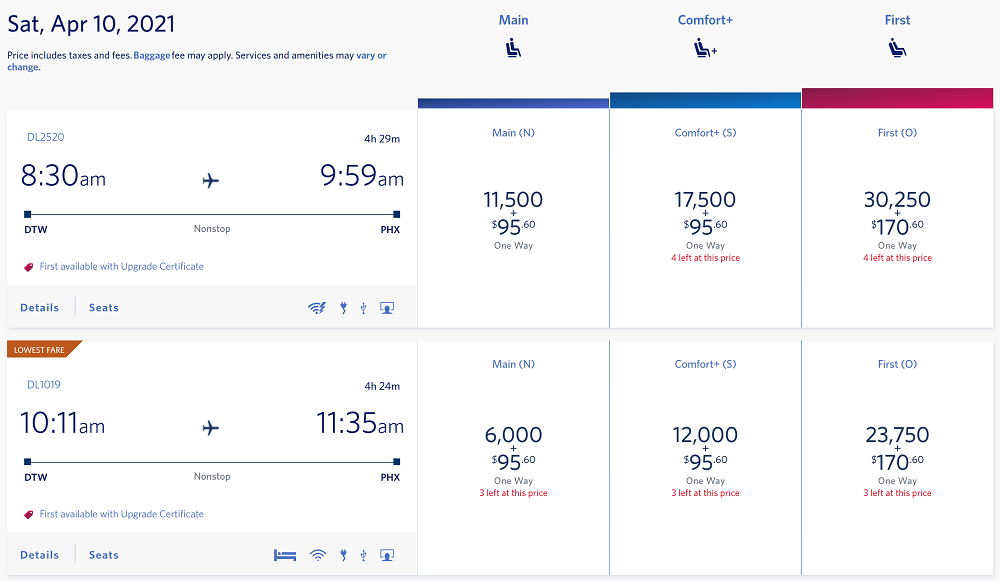

Delta now shows upgrade certificate availability in search results!

In another great enhancement, Delta now shows upgrade certificate availability in online search results. That is huge because you previously had to call or message Delta to ask about availability each time you wanted to look at a flight. You will still need to contact Delta to actually apply the certificate, but this will make it much, much easier to find the opportunities to use them.

In credit cards and rewards

Beauty In The Eye Of The Cardholder: Stephen’s Top 6 Card-Linked Programs

Stephen Pepper has done some fantastic work lately in creating the most comprehensive and up-to-date post on card-linked programs that offer cash back or rewards for shopping with a linked credit card. That resource is huge, so in this post Stephen points out his top 6 programs and shows how to slice and dice prices by stacking offers and apps for max cash back. If you like getting stuff and then stuffing money back in your pocket, you’ll want to read this post.

Brex closed (and reopened) Nick’s account and there’s some cause for concern

Brex certainly may end up being the deal of the year for 2021, but the experience hasn’t been smooth for everyone. The hiccups thus far helped me realize that, counter to our usual strategy with transferable points, the safe bet here is to redeem rewards as they are earned because Brex is a new and young program. After publishing this post, some corrections came to light and I realized that some misunderstood my key points and takeaways, so I updated the post to fix what I got wrong and clarify key points. For a shortened / condensed version with just the key details, see: Clarifying that Brex post: what it boils down to is the rewards.

Amex adds cell phone protection to most ultra-premium cards

In an awesome development, Amex has added cell phone protection to several of its high-end cards. The good news is that the coverage looks particularly good: with just a $50 deductible and up to $800 in coverage per claim, it looks like a great option. Taken together with a temporary 5x on the Business Platinum or wireless credits on select other Amex cards, this will make it easy for many of us to switch our cell phone auto-pay over the next few months at least.

In award travel

My Round the World business class adventure (planning phase)

I always tell people that Greg is as good a guy behind the scenes as he seems. In the latest piece of proof, Greg has committed to helping relieve a reader’s insomnia by putting his ANA miles use to circle the world using ANA’s epic around-the-world award chart. In this post, Greg explores where he wants to go and routing ideas at a very high level that will help him narrow down how to accomplish the task of visiting all of the places he wants to go while maximizing his use of the round the world award.

Tips for booking ANA’s Round the World award

The ANA round-the-world award is the one thing in award travel that I feel like I’ve really missed out on. After spending some time building back balances, I’ve been itching to get with the program and put this ultimate sweet spot to use, so I’m loving Greg’s research here as I look forward to putting it to use at some point when the world is normal again. This post has all of the key considerations you need to know to get serious and get started if you want to do something crazy like fly around the world in business class topping in 8 cities for like 115K Membership Rewards points (give or take).

Gift hotel points, free night certificates, and award nights booked with points: Rules by program

Are you points-rich and/or free-night-certificate rich and looking to share the love with friends or family? You may have wondered whether you can give your Marriott free night certificates to a friend (you can’t) or use a Hyatt free night certificate to book a room for your spouse to take advantage of their elite benefits (you actually can if you “gift” it). This post has the rules for sharing your points, certificates, and awards in major hotel programs.

In updated resources

Delta Platinum complete guide

Delta Reserve complete guide

Credit card cell phone insurance compared

That’s it for this week at Frequent Miler. Don’t forget to check out this week’s last chance deals, updated every Sunday.

Thanks for the great content, as always!

After the whole brex things I don’t trust much of what Nick writes

Thanks for an interesting discussion. Of note, Greg wrote an article back in Dec which reviewed Delta elite benefits. He estimated platinum status to be worth only $750 but of course a lot of depends on how much you’ll be flying Delta. Since my home airport doesn’t have many Delta routes, it doesn’t seem worth it for myself. One question about tax payments, I just wanted to double check that I understand – one can make go online today and overpay your 2020 taxes. Then files your taxes, which include the overpayment, so that you would end up requesting a refund, which would mailed to you several weeks/months later?

Yes, that’s the idea. I did a ton of reading on this yesterday on reddit, flyertalk and elsewhere. I saw one person who said that he overpays by $15k every year and never has an issue, but I also saw people claiming that it will give extra scrutiny to your taxes and can hold up your refund for weeks or months. I thought $15k was crazy, but the fact that we are talking about doing $90k puts some perspective on the situation. I’d love to hear from more people who say that they overpay their taxes by these types of numbers every year without issue.

I think the bottom line is that you can do this, but if you’re going to grossly overpay you should be sure your taxes are accurate and be ready to float the expense for months. I guess the IRS does pay you back with interest if they hold you up for more than a few weeks though.

What that male lion is about to do is a very good metaphor for how Delta treats Skymiles members.

Is there a minimum credit limit on reserve? What if you get hit with the big annual fee but then get a credit limit that makes $90k in taxes impossible or infeasible before the payment period unless you want to cycle your credit limit?

I’m not aware of a minimum, but you can ask Amex for credit limit increases at 90 and 180 days (it’s been a long time since I’ve done this, but for many years the standard was that you could get a ~3x CLI on a low-ish CL at 90 days). Also, Amex has been known to allow charging well above one’s limit (which obviously needs to be paid right away – can’t carry the balance over your limit). I don’t recommend making a habit of that especially if it means a sudden huge increase in your spending level and it might be a worse idea yet in pandemic times, but I say this to say that it may yet be possible even if it looks impossible. All that said, it may not be readily feasible and/or you may not be comfortable cycling or charging above your limit, which would very likely make $90K in taxes impractical. Definitely not a solution for everyone.

Delta should never be trusted.

What’s wrong with spending your way to elite status if you were already going to spend that money anyway?

Because DL miles are worth 0.9 cpm.

This somewhat depends on how you use them, but behind the scenes we’ve been running searches. Greg very consistently found about 1.3cpm (and with flash sales you can often get 2cpm or more) and you can use the miles to pay for fares at a value of 1cpm as a worst-case.

1.3 cpm minus values not earned?

Eearnings are too highly variable depending on your status, fare class, where you credit your flights, etc, to meaningfully adjust for that in my opinion. Still, we long ago adjusted the value of airline miles down 7% across the board as the best possible approximation:

https://frequentmiler.com/targeted-chase-earn-500-bonus-points-5-when-using-tap-to-pay-3-times/

I don’t know whether he had adjusted down the 1.3cpm already before we discussed it, but even if he hadn’t that’s 1.21cpm and he said that he found many cases where it was more and very few where it was less for domestic economy. Of course that might vary depending on your starting airport, route, time of year, flight selection the direction that the wind is blowing, and whether or not the groundhog has seen his shadow, but after a respectable number of searches he was finding a pretty consistent 1.3 he said. I use 1cpm as the floor comparison point because you can buy flights with that and I figure.

When I look at these offers, I think of someone like me who has never earned or burned a Delta SkyMile before. I typically fly Southwest because of the companion pass. I will probably spend $900 on flights over the next few years in situations where I could fly Delta. I’d (at least theoretically) be plenty happy to get enough points here to keep that $900 in my pocket on flights I’d have otherwise bought and I’m not terribly concerned with the 4500 Delta miles I’d have earned on those paid flights since I probably wouldn’t have chosen Delta if not for the “free” flights and I probably won’t use Delta SkyMiles again after burning through the bonus. You’re not wrong that there is some value there, but I’m more concerned with the $900 I get to keep by using the miles than the $45 I could have earned if I instead spent that $900.

I personally won’t go for these offers because Delta just isn’t a fit from my airport, but if I had a P2 who didn’t mind a small Delta plane I’d probably be happy to take this offer.

Also, 1 cpm for PW is worth less than 1 cpm since you do not earn MQD.

That only matters if you’re chasing Delta elite status. What percentage of Delta’s customers do you figure have elite status? What percentage of the population who flies do you anticipate that represents? I suspect the answer to both is an awfully small slice. You might be in that slice, so this might not make sense for you. But that doesn’t make the offers objectively bad.

I replied to someone on Twitter this morning basically saying this: you can’t complain that a Phillips head screwdriver won’t work to turn a flat head screw or something that requires an Allen wrench. The Phillips head is not a bad tool, it’s just not the right tool for the situation you face. That’s fine.

I do think that $900 worth of flights on $3K spend would pop the eyes of most of the friends in my social circle who don’t chase elite status or travel internationally (which is most of the people I’ve ever known). On the other hand, I expect that people who are looking to fly in luxury to Europe or who are regularly spending their own money on flights for the purpose of earning elite status should get themselves a flathead screwdriver instead. For the record, I’m personally more interested in flying in international premium cabins, and I have a lot of Southwest points (and a Companion Pass) and I’m not afraid to email a bunch of Turkish ticket offices to book a United flight, and Delta only flies small planes out of my airport that my wife typically won’t take, so I’m not going after this. It’s not the right tool for the things I need. But it’s still going to work to turn a lot of screws for a lot of people. Does that make sense?

@Sea Pea. Opportunity cost. $90k in spend could yield a shit ton of points if put towards new card sign up bonuses. Would you rather 2M points across many programs to fly anywhere for free in F/J, or would you like Delta top tier status and 100k skypesos?

Glad I won’t see you on the flights