NOTICE: This post references card features that have changed, expired, or are not currently available

Many of us in this hobby share a common pet peeve: I can’t stand it when I realize that I spent more than I could have on something. It really doesn’t matter what it is — whether it’s a flight or hotel or a new pair of glasses, I want to stack that deal six ways to Sunday. On this week’s Frequent Miler on the Air, Greg and I discuss our techniques to slice and dice the (net) price.

Many of us in this hobby share a common pet peeve: I can’t stand it when I realize that I spent more than I could have on something. It really doesn’t matter what it is — whether it’s a flight or hotel or a new pair of glasses, I want to stack that deal six ways to Sunday. On this week’s Frequent Miler on the Air, Greg and I discuss our techniques to slice and dice the (net) price.

Elsewhere on the blog, we have the perfect list for you to check twice (and thrice and more!) to make sure you don’t miss those benefits you need to use up or earn by year’s end, a counterpoint that stands by the notion that travel is free, a really fun Marriott read and a bunch of thoroughly updated resource posts that can make for excellent bookmarks. Watch, listen, or read on for more from this week at Frequent Miler.

00:51 Giant Mailbag

5:46 What crazy thing double header First up: What crazy thing did Hyatt do this week?

11:43 What crazy thing did Marriott do this week?

17:05 Mattress running the numbers: Should we GoWild with Frontier?

22:39 Awards we booked this week

26:18 Main Event: Extreme stacking for extreme savings

27:01 How we find good deals 1st: Slickdeals & Slickdeals Live view

29:24 CamelCamelCamel.com

30:58 Shopping Basket Trick

38:19 Shopping Portals

38:45 How portals work

43:48 How do you find a good portal?

49:15 Best Practices for portaling & favorite portals

59:34 Portal referral bonuses

1:01:43 Capital One Shopping (no Capital One credit card required)

1:12:45 Capital One Offers (card required)

1:14:05 Credit Card rewards (welcome bonuses, category bonuses)

1:20:40 Card-linked offers

1:38:18 Question of the Week: In 2 player mode, is it possible to to gift hotel free night certificates so that Player 2’s certs can be given to Player 1 to enjoy their elite benefits?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Holiday Shopping Savings Tips & Tools

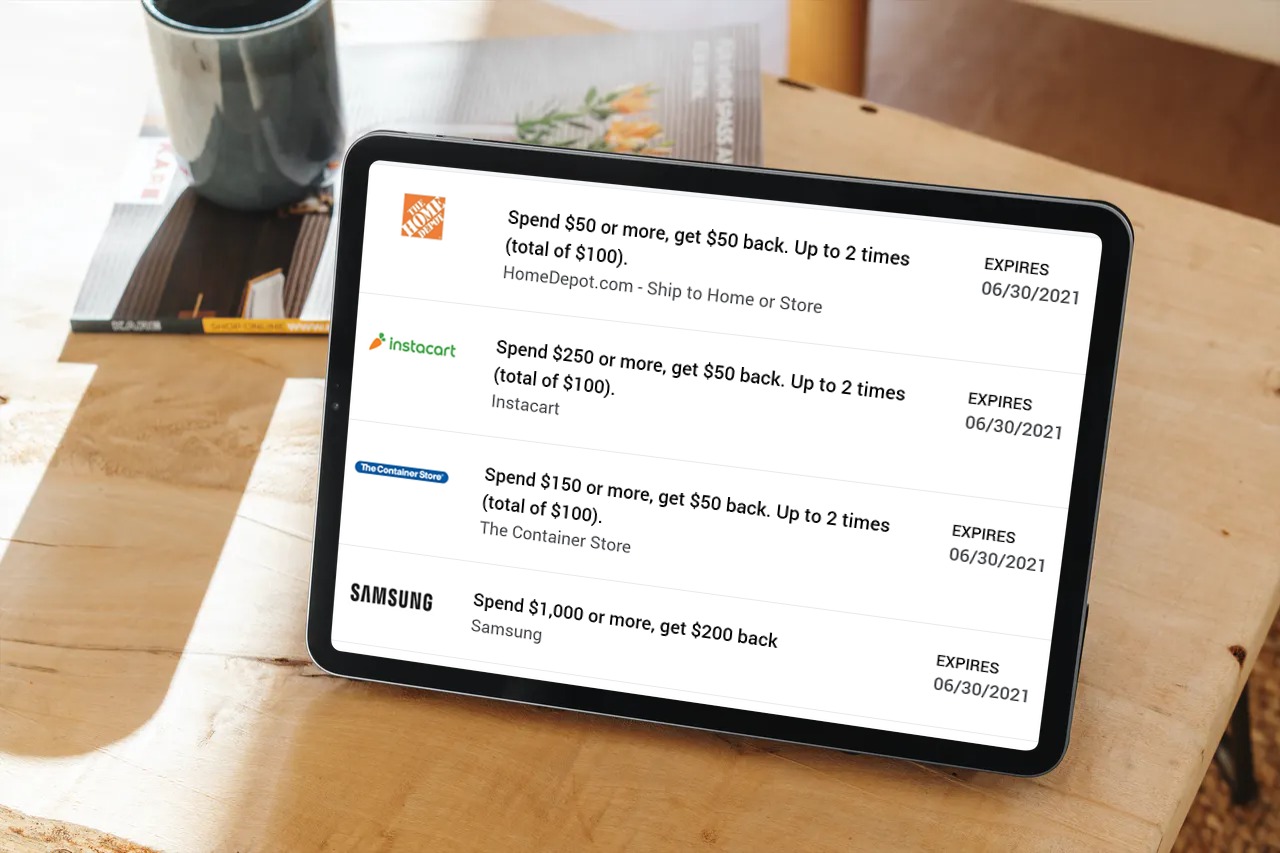

Ready to shop until you drop over the next week or two? Before you empty your wallet, check out this post for ways to fill up your rewards accounts in the process. The real gems at this time of the year are usually when the stars align to stack a shopping portal with multiple card-linked offers — and if you’re lucky enough to get targeted for one of the crazy Capital One Shopping offers, life can be really good.

Digging the Capital One Shopping Browser Extension

As noted in the previous section, the Capital One Shopping Browser Extension has been shooting out some targeted email offers sure to make you say, “Wowzer!”. Since anybody can sign up for Capital One Shopping and install the browser extension (no Capital One card required), it makes sense to do this provided that you follow our best shopping practices and do it in a “shopping” browser rather than a “buying” browser.

End of Year Checklist for 2022

As we near the end of the year, you want to make sure that you do not forget to use your various credits, choose your choice benefits, and meet the thresholds for any big spend bonuses or elite status levels before you run out of time. This post is a great checklist. A word to the wise: don’t wait until the last couple days of the year to use those Amex airline incidental credits. Wait a day after picking your airline and don’t do it on December 31st.

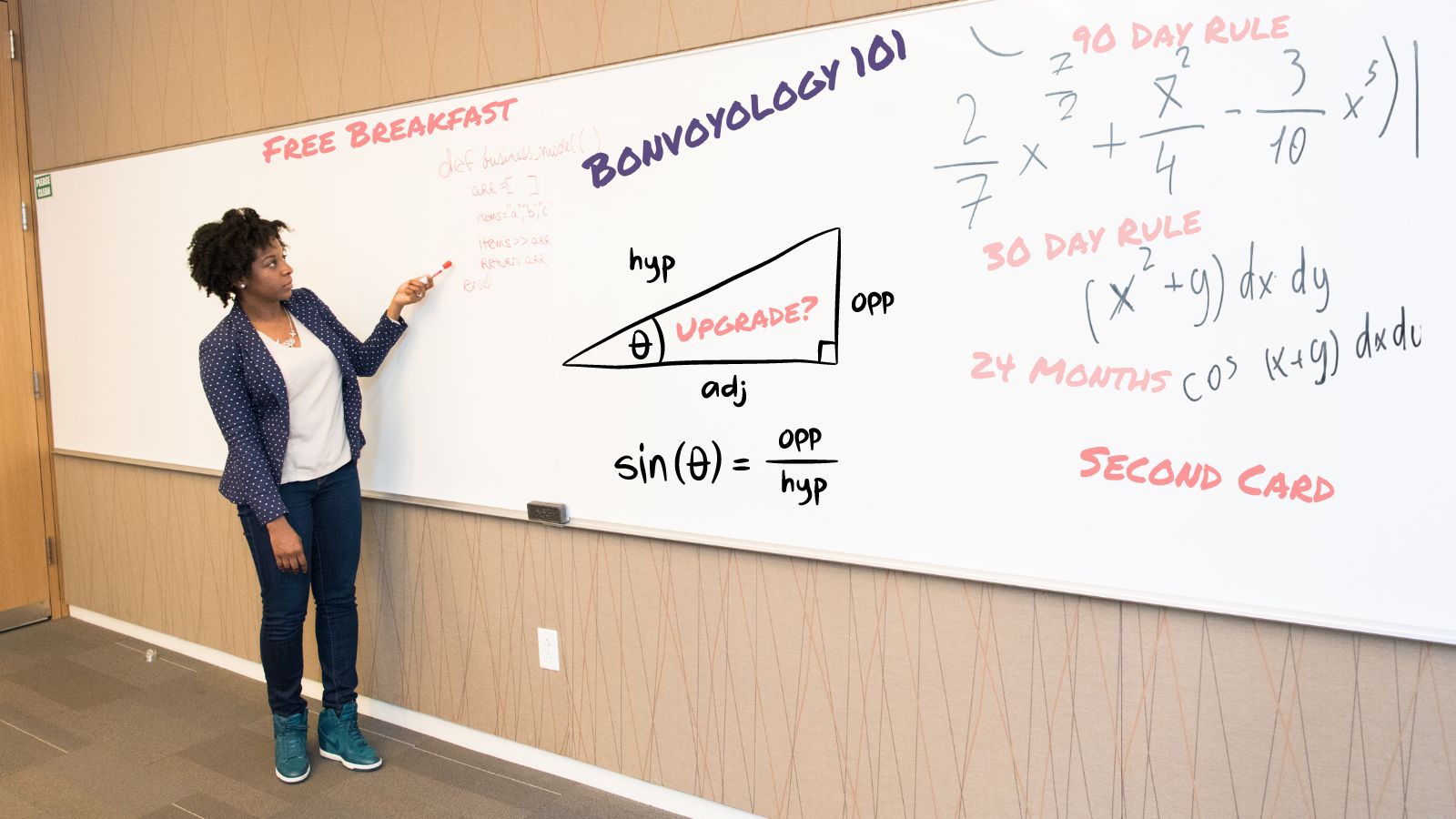

Bonvoyology: Mastering Marriott’s Mysteries

If you know Marriott well and struggle with the all-too-familiar love/hate relationship, you will surely find this post to be a top notch work of art. How true it all is — and yet we will continue on with Marriott because they are everywhere we need to be. But for all of the reasons that Greg so eloquently expresses in this post, I just can’t get excited about being loyal to Marriott.

Current Amex Offers

Our Current Amex Offers page is a really useful Frequent Miler resource. We collect all of the current Amex Offers from our cards and maintain a database of which offers are currently available and which have expired over the last year or two. I use this page all the time when I can’t recall whether or not an offer is available for a particular merchant because I find it faster to load than logging in to Amex and going through one card at a time when I simply can’t remember whether an offer has already expired or might be available on one of my cards. This is definitely a good one to bookmark.

Air Canada Aeroplan Complete Guide

When Air Canada launched the new Aeroplan program a couple of years ago, Greg wrote a comprehensive guide. Since then, there have been numerous changes and we have learned a significant number of things about the strengths of Aeroplan. This newly-updated guide consolidates what we’ve learned about this really cool and unique airline loyalty program.

Travel feels free when you’re broke and platinum…

Carrie offers a counterpoint to my post last week about the joy and myth of “free” travel. This post gave me a big smile remembering the days of much simpler travel that my wife and I enjoyed 10 or 15 years ago. And just as Carrie notes about her travels with Drew, my wife and I would easily say that many of our most memorable travel experiences came in the days before we even knew that flat bed seats and lounges in airports and hotels existed. While I can’t argue that the hitchhiking and couch surfing cost Carrie any money, I would argue that the choice to earn a boatload of miles instead of a boatload of cash back did cost them a potentially significant amount of money (and yes, I know that Greg will argue that I shouldn’t count the opportunity cost of earning their miles as a cash cost, but I think the idea of collecting a bunch of miles when you’re cash poor is exactly the type of irrational decision that the myth of “free travel” encourages). That’s not to say I think they made the wrong choice. The funny thing is that Carrie and Drew and my wife and I have uncanny similarities and I wouldn’t have done things differently, either (FYI Carrie, my book title was going to be “How to live like you’re rich on thirty grand”) so I’m sure I wouldn’t have taken the money over the flights either. But I think that dismissing the flights as being “free” because they were just miles is the idea I dispute and caution against. I’m not saying that going after money instead of those flights would be better but rather that I think we should all consider the money we’re giving up to get those flights and decide whether or not it’s a good trade. Lest you think I’m a grinch trying to talk everyone out of free travel, let me say that this comment was my favorite on Carrie’s post.

Andaz San Diego: Bottom Line Review

I almost booked a night or two at this property at some point. Tim’s review makes me glad I didn’t as it doesn’t sound like there was a lot going for this place. I’ll be glad to use my points on a different property thanks to having read this review.

Citi ThankYou Rewards Review and Guide

Citi ThankYou points don’t get nearly the attention of transferable currencies like Amex Membership Rewards and Chase Ultimate Rewards points in large part because there just aren’t as many ways to earn them. However, they can be quite valuable as this thoroughly updated guide demonstrates.

That’s it for this week at Frequent Miler. Keep a close eye on this week’s last chance deals to make sure you know what’s scheduled to end in the coming days.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

Great episode!

Nick, to be clear, your wife upgraded to the ritz card one week before the annual fee on her boundless card was due? If so, I was thinking that could result in no certificate of any kind since you didn’t pay the Boundless AF and you might have to wait 12 months before the Ritz card renews to get the 85k cert. Am I wrong about either of those?

Great stacking podcast! Thank you.

You mentioned Max Rewards adding all your AMEX offers for you. I worry that it’ll add offers to a card that I wouldn’t use for the multipliers. Say, it’s a restaurant offer and it was added to my Platinum card instead of my Gold card which would earn me 4X instead of 1X on the platinum card. How do you get around this when using Max rewards?

If you pay for the Gold version of MaxRewards, it add the same offers to all of your cards so it won’t matter if it gets loaded to cards that you don’t use.

A couple shopping portal tricks that I have found:

Be on the lookout for companies where you can place in a shopping cart and checkout across different brands. Sometimes the brands will have different portal rates. For example, I had to purchase something from buybuy Baby for a colleague’s shower. Portal rate was terrible (1x). However, I could add it to my cart and checkout through Bed Bath and Beyond, which had a higher rate (5x). It did track and payout at the higher rate. I found a similar thing with Onitsuka Tiger, where I buy a lot of shoes. Basically on no portals, but I can add it to my cart and check out through Asics for the portal rewards (plus SimplyMiles & Citi Merchant deals). Anyone else encounter something like this with other stores?

For those still with points from Expedia, using their rewards are considered almost a cash equivalent. Even if your entire stay is covered with points, you can earn through portals (has worked multiple times with Rakuten).

Personally I like to have at least the Rakuten extension installed, because there are so many times where I am shopping at a place where I would not even think of checking for a portal, and it pops up.

Great point that we didn’t think to mention! The same is true with 1800Flowers brands (Harry & David, Sherri’s Berries, etc). You can just click through the one with the highest rate and it tracks (or at least it always did when I used to buy stuff through them – I guess it’s been a while). Actually, with 1800Flowers, what always used to work was clicking through the rate for 1800Flowers and then searching for something that, for example, was sold by Harry & David. It would show up branded under 1800Flowers and you’d still check out via 1800Flowers. I had orders for lots of Harry & David stuff track via portal and card-linked offers for some really good deals years ago (money makers). Everybody got chutneys and dips and crackers for Christmas one year :-).

Should also work with all of the IHG brands (and I assume also Marriott). Every once in a great while you’ll see a different rate for like Holiday Inn or something and you can click through and then search the city you want and still book a Crowne Plaza or whatever.

Others don’t immediately come to mind, but any time I see several brands in the header of a store, I assume it’ll probably work that way.

The Gap brands are another one that often have different rates depending on who you click through (Banana Republic, Old Navy, Gap, Athleta). When I’ve checked out with a mixed cart of items from multiple brands it seems like it defaults to Old Navy which typically has a lower cashback rate than the others – now I am going to want to go check to see what it coded as for tracking.

I heard you say you click through the portal one more time on the checkout page to be extra sure.

I purposely always start with an empty cart before clicking. It was or is a requirement for some stores to pay out. Maybe that’s gone now?

That’s certainly a good way to do it — but I always figure that if I do it that way and also click through again before paying it will only steal the click from itself. But you’re definitely not doing it wrong.

In my experience, Hyatt applies the certificate that expires the soonest. Category 1-7 certificates for the 60 night milestone reward is only good for 6 months rather than a year. Most category 1-4 certificates are good for 1 year rather than 6 months. If Hyatt can’t easily change the technology, as a “fix” it would be great if Hyatt would make the category 1-7 certificates good for a year like the category 1-4.

Great podcast! Thank you

You mentioned a good post by Stephen Pepper about Card-Linked offers, e.g,, DOSH, by Stephen Pepper. Would you please post a link? Again thanks!