With the hot holiday shopping season just around the corner, many of us will be hunting for great deals on everything from travel to gifts to home appliances and a lot more. The hype of “Black Friday Prices” keeps creeping earlier each year, but not every deal is a good one. On the other hand, some deals can get better-than-advertised with the right stacking techniques. This guide combines aspects from various deal-hunting guides we’ve written into an all-encompassing holiday shopping preparation guide to help you score the best deals and greatest return on holiday shopping spend.

Evaluating deals against historical Amazon prices using CamelCamelCamel

CamelCamelCamel.com is a tool I’ve been using for years to compare current pricing against historical pricing and I find it particularly useful at times like these when items are discounted across many retailers. Historical pricing information can help you quickly see whether a “deal” price is actually special or just a typical discount that repeats regularly. You can either type the name of an item or copy and paste the Amazon URL for the product into the search box at CamelCamelCamel:

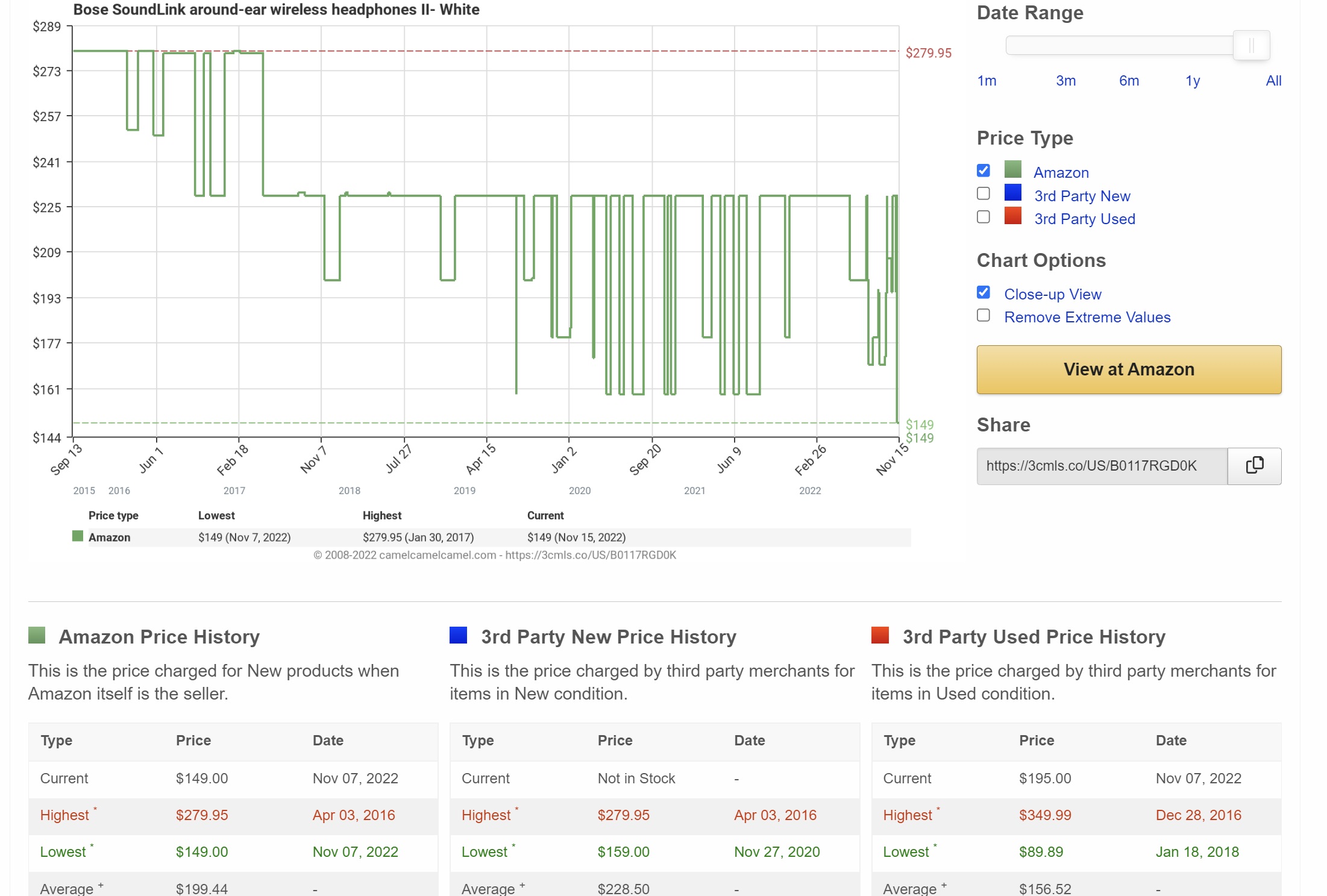

For instance, at the time of writing, this pair of Bose Soundlink around-ear wireless headphones II (our affiliate link) is on sale for $149 (with a list price of $229 crossed out).

When I copy and paste the URL into camelcamelcamel, it will show me a historical pricing graph where I can see Amazon’s pricing (I could also check 3rd party new and used prices as well if I were reselling and wanted to get an idea of the trends).

That data is incredibly useful for me. I can see the general trend in graph form as well as the highest / lowest prices and the last 5 price changes. That’s helpful on just about any product as I find the Amazon price to be a decent barometer of the marketplace as a whole. (in that specific instance, I can see that the current price is the lowest it has been — stack that with 40% off up to $40 off when using 1 Amex Membership Rewards point and you have yourself quite a deal on that specific pair of headphones!).

While there are some situations where camelcamelcamel might not tell the full story (e.g. there may have been a stacking coupon or Amex offer that made a past deal better-than-the-advertised-price), it’s a good start in determining if a price is so good that I need to make a move now or if the price regularly fluctuates.

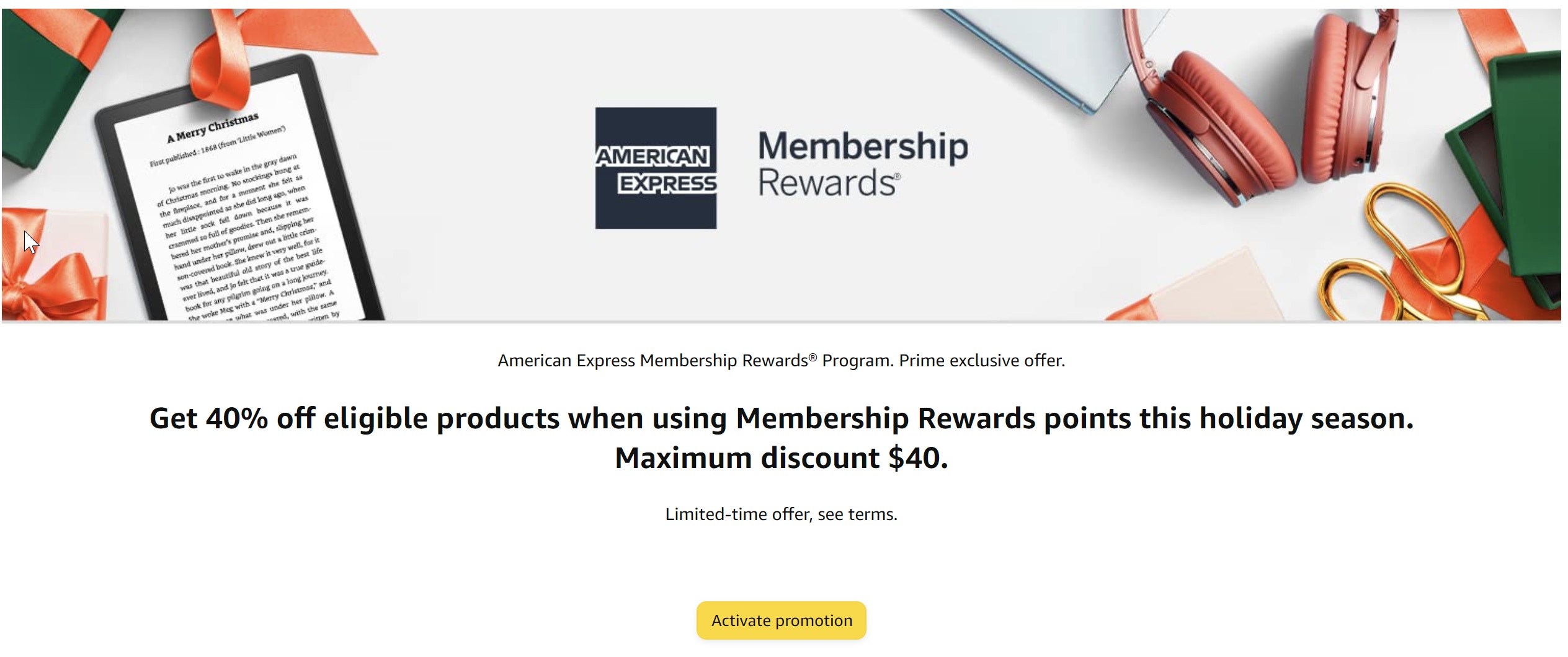

Use pay-with-points discounts

Amazon frequently offers a discount when you pay using at least 1 Amex Membership Rewards point, 1 Chase Ultimate Rewards point, or 1 Citi ThankYou point. Sometimes these discounts are relatively small, but other times they can be pretty significant (we’ve seen as high as 50% back on up to $120 or also occasionally seen 20% off on up to $500).

It usually makes no sense to use points to cover Amazon purchases since you’ll get less than a penny per point in value, but using one point to get a good discount can be worth it.

We have occasionally seen these discounts become even better-than-advertised. For instance, a few years ago we wrote about a deal where paying with one point was taking the discount as a percentage of the item’s price at full retail value and subtracting that amount from the sale price, which made for an outstanding deal. I wouldn’t expect to see that exact deal repeat, but it’s always good to keep in mind those things that have worked in the past when hunting for what works today.

Monitor shopping portals

During the Black Friday period, CashBackMonitor has been known to sometimes refresh their feed more than the usual once-per-day. Keep an eye out for mid-day changes in cash back as portals compete for your business over the coming weeks.

Don’t forget to compare portal payouts and leverage opportunities to Extreme Stack by combining current Amex Offers, gift cards, and opportunities to double and triple dip (see our Instant Gift Card Deals resource page for options to buy and receive gift cards instantly or near-instantly and save). Remember that in most cases, card-linked offers like Amex Offers or Chase Offers can be stacked with shopping portal rewards (often even in situations where terms suggest that you need to use a specific link, though when in doubt it’s worth asking in our Frequent Miler Insiders Facebook group about what has worked in the past).

Capital One Shopping toolbar and/or app for targeted offers?

Worth an honorable mention of its own is Capital One Shopping. Note that Capital One Shopping refers to the public shopping portal (and associated app), which does not require being a Capital One cardholder.

The Capital One Shopping portal offers “cash back” rewards like any other portal, but the catch is that you can only take rewards earned as gift cards to popular retailers. In other words, if you earn $100 in “cash back” through Capital One Shopping, you must redeem those rewards for gift cards to places like Amazon, Walmart, Best Buy, or many other retailers.

However, Capital One Shopping is notable for sometimes having targeted offers that are significantly higher than what you’d ordinarily find through other competitors.

Many who have installed the Capital One Shopping toolbar in their web browser have reported receiving great targeted offers. For instance, Greg reported receiving an offer for 30% back on an item at Sak’s Fifth Ave and 18% back at IHG hotels. I’ve heard of similarly-great offers at retailers like Dell.

The Capital One Shopping app also sometimes has targeted offers that are better than what you’ll find on the Capital One Shopping website. For instance, we’ve recently seen the app offer 6-8% back at GiftCards.com at times when the website only shows 4% back.

Stack card-linked offers with portals or other card-linked offers

Card-linked offers, particularly those that can be stacked with other card-linked offers and/or shopping portals, are where savings can get really juicy at times when items are also deeply discounted.

There are many forms of card-linked offers that can make deals even better-than-advertised. Card-linked deals include both issuer-offered deals that you sync via your bank login (like Amex Offers, Chase Offers, Bank of America Deals, or Citi Merchant Offers) and also offers that you sync and/or trigger by linking a card number to a specific service (like Rakuten card-linked offers, Dosh, SimplyMiles, and Visa Savings Edge). See Card-Linked Programs & The Networks They Run On (AKA Which Programs Stack) for a full overview of such programs (and/or Beauty In The Eye Of The Cardholder: Stephen’s Top 6 Card-Linked Programs for just a few program highlights).

As shown in the full card-linked offer resource, it is possible (in some cases) to stack several card-linked offers on a single purchase. For instance, you may have a Chase Offer on your Chase Freedom Flex Mastercard for 15% back on IHG. Since that is a Mastercard, you may be able to link a SimplyMiles offer for American Airlines miles on an IHG purchase (I mean this as an example that we’ve seen in the past, though there is no such offer in my account at the time of writing). Click through a shopping portal like Rakuten when they offer an increased rate and you may be able to stack the Rakuten portal payout, the Chase Offer for a statement credit, and the American Airlines miles through SimplyMiles all on a single purchase. If you were able to stack all of those things with, for example, a special IHG Black Friday sale on hotels, you may come out nicely ahead of the advertised deal.

Keep in mind that in some cases you may be able to stack “in-store” rewards offers with shopping portal offers. For instance, if Rakuten offers in-store cash back at a particular retailer where you intend to shop, it may trigger even when shopping online since such offers are sometimes triggered by any purchase processed by that retailer. It is worth synching up the card(s) you intend to use with any card-linked in-store offers before shopping online and then clicking through a shopping portal to see if you can stack both (keeping in mind that bank-linked offers like Amex Offers or Chase Offers will likely also stack).

Stack card benefits with portals and card-linked offers

In some cases, you may be able to up the ante a notch further by stacking all of the above with card-specific benefits.

For instance, the Amex Business Platinum card offers a $200 credit for purchases at Dell twice per year (once between January and June and once between July and December). There are also sometimes Amex Offers for Dell, which may show up on an Amex Business Platinum card. You then may be able to stack the card benefit with the Amex Offer and a shopping portal payout on a single purchase.

Slickdeals Live View: Watch the deals as they get posted

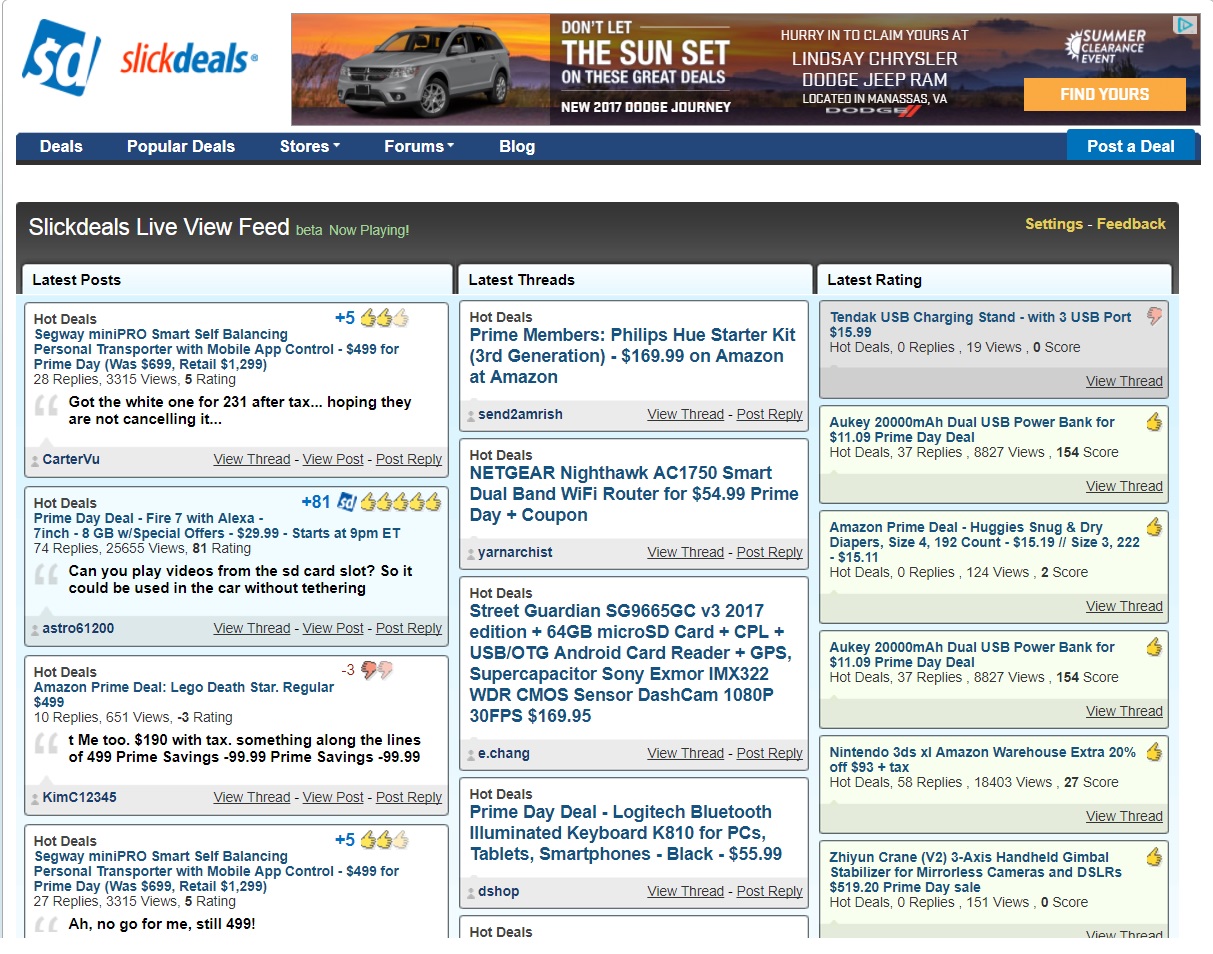

If you’re having trouble keeping up with which deals are going on and are looking to hop on the hottest deals before they’re gone, here’s a quick tip if you’ve got a fast eye: Slickdeals Live View.

Click the picture or go to slickdeals.net/live

As you can see in the picture above, there are 3 columns in the Live View — Latest Posts, Latest Threads, and Latest Rating. The Latest Posts column scrolls as people comment on deals. I find this super useful because you’re constantly seeing the latest comments. Sometimes, there is a price mistake or stacking coupon or related deal mentioned within a thread that I might never have seen if not for this column. That said, it moves fast at times. It can be hard to keep up with it, but if you’re a deal hunter it can be worth the challenge.

The middle column, Latest Posts, shows each deal that gets posted as it gets posted. This way, you’ll see each deal as it gets posted, increasing your chances of being able to take advantage of new deals before they are gone. This is great for catching limited-quantity or hot deals.

The third column, Latest Ratings, shows you which posts recently got a thumbs up or down. Truth be told, I don’t pay much attention to that column.

Keep in mind that it can be a little overwhelming on big shopping days. Sometimes, things fly by and when you blink you’ll literally miss things. However, I find this view great for times like Black Friday and Amazon Prime Day.

Best credit cards for online holiday shopping

Best Credit Card Offers

When it comes to credit card rewards, you will of course earn the highest rate of return when spending toward a large intro bonus on a new credit card. See our Best Credit Card offers page for links to the current best publicly-available offers.

Keep in mind that some issuers offer instant card numbers upon approval and/or the ability to add a new card to PayPal, Apple Pay, Google Pay, etc. Amex frequently (but not always) offers this capability. Other issuers will often expedite new cards upon request (Chase is usually willing to overnight a new card at no cost to the customer upon request).

For card-specific or issuer-specific questions, posting a question in our Frequent Miler Insiders Facebook group can often be a great way to get a fast response.

Stack with refer-a-friend bonus

If you intend to open a new credit card to earn a welcome bonus, consider whether your significant other may be able to earn a bonus for referring you. For instance, thanks to Amex multi-referrals, you may be able to have a spouse refer you to the best offer and earn both the welcome offer and a referral bonus for your spouse.

Best category bonus: online shopping

See our Best Category Bonuses page for a complete list of the cards offering the best return in various spending categories. Very few currently-available credit cards offer a bonus category for online shopping, but there are a few that currently do:

Amex Blue Cash Everyday

| Card Name w Details No Review (no offer) |

|---|

No Annual Fee Earning rate: ✦ 3% cash back as a statement credit at US supermarkets up to $6,000 per year in purchases (then 1%) ✦ 3% cash back as a statement credit at US gas stations on up to $6,000 per year, then 1%. ✦ 3% cash back as a statement credit on U.S. online retail purchases on up to $6,000 per year, then 1% ✦ 1% cash back as a statement credit on other purchases ✦ Terms apply. Base: 1% Gas: 3% Grocery: 3% Shop: 3% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: Get $7 back each month after using your Blue Cash Every Day card to spend $12.99 or more each month on an eligible subscription to The Disney Bundle. Terms Apply. (Rates & Fees) |

The Amex Blue Cash Everyday offers a better-than-average return of 3% back for online retail purchases on up to $6,000 in purchases per year, then 1%.

Bank of America Customized Cash Rewards

| Card Name w Details No Review (no offer) |

|---|

No Annual Fee Earning rate: 3% back on your choice of the following: gas and EV charging, online shopping, cable, streaming, internet & phone plans, dining, travel, drugstores, home improvement & furnishings (can choose a new category monthly). ✦ 2% back at grocery stores & wholesale clubs ✦ 1% back everywhere else. 2% and 3% rewards are capped at $2500 in combined purchases per quarter Base: 1% Travel: 3% Dine: 3% Gas: 3% Grocery: 2% Shop: 3% Phone: 3% Other: 3% Card Info: Visa Signature issued by BOA. This card imposes foreign transaction fees. Noteworthy perks: Up to 75% bonus for Preferred Rewards banking customers |

The Bank of America Customized Cash Rewards card allows you to select your own bonus category: Choose a category in which to earn 3% cash back on up to $2500 in purchases per quarter. One of the category options is online shopping. This is particularly interesting because of the fact that those with Bank of America’s top-tier Platinum Honors status can get a 75% bonus — making for a return of up to 5.25% back in the category of your choice. That is an excellent return for holiday shopping, particularly when stacked with other things in this post.

M1 Owners card*

| Card Name w Details No Review (no offer) |

|---|

$0 introductory annual fee for the first year, then $95 Earning rate: 2.5%, 5%, or 10% back at select retailers ✦ 1.5% everywhere else ✦ Note a monthly limit of $200 in earned rewards. Base: 1.5% Card Info: Visa Signature issued by M1. This card has no foreign currency conversion fees. Noteworthy perks: As much as 10% back in rewards at select retailers. Note that cash back rewards are limited to $200 back per calendar month. |

I’m including the M1 Owners card here for completeness since it advertises as much as 10% back at select retailers. I don’t have this card and am not familiar with its cash back structure, but my educated guess is that this works with a service like Dosh facilitating card-linked cash back at select retailers — meaning that you can probably earn a similar return on other cards by linking to a service like Dosh (and then stack that return with the rewards earned on your credit card). If any readers have the M1 card and can comment as to the rewards earning and ability to link the card to other card-linked programs, let us know in the comments.

Best cards for everyday spend

Outside of credit card welcome bonuses and the online shopping category bonus, your best bet for holiday purchases will likely be the best card in your wallet for everyday spend. The top cards in the table below offer great rewards regardless of where they’re used. Our entire database of credit cards is contained below, shown 10 cards at a time, and sorted with the best everyday everywhere-else rewards on top. For more on this list and how it is created, see Best Cards for Everyday Spend.

Best purchase protections

Finally, consider purchase protections that may be particularly important for the purposes of your purchases. For instance, some cards offer extended warranty, others cover purchases against damage or theft within 90 days of purchase, and a few still offer price protection if you make a purchase and the price later drops. See our Best Credit Card Purchase Protections post for a guide as to which protections are available and which cards may be your best choices for those protections.