NOTICE: This post references card features that have changed, expired, or are not currently available

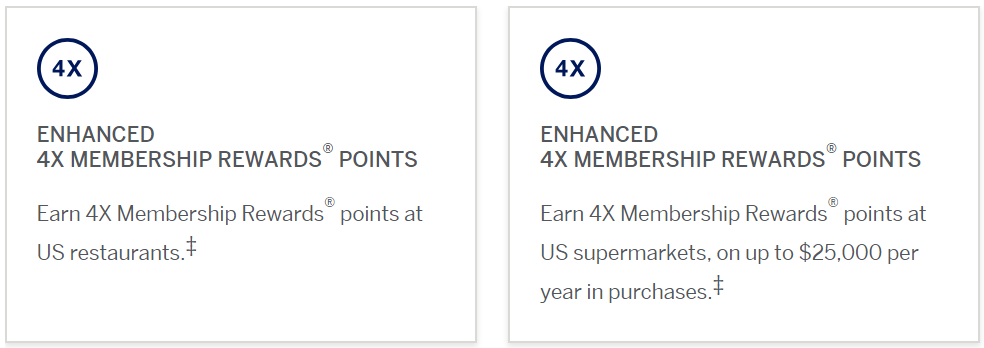

The new American Express® Gold Card offers an eye-popping 4 Membership Rewards points per dollar for spend at restaurants and grocery stores in the United States (grocery store 4X is limited to $25K spend per year). That’s great. Unfortunately, the card also offers a great big annual fee: $250. Is 4X worth that fee?

First, consider that the card offers other valuable benefits:

- $120 dining credit: $10 per month credit for spend at GrubHub, Seamless, The Cheesecake Factory, Ruth’s Chris Steakhouse, and Participating Shake Shack locations

- $100 Airline Fee Credit: Get reimbursed for airline fees charged by your selected airline, up to $100 each calendar year.

If you already spend at least $10 per month with one of the dining credit merchants, then the dining credits should be nearly as good as cash back to you. Otherwise, you will likely value this benefit far less than face value.

Similarly, the airline fee credit could be almost as good as cash if you know how to take full advantage of it (see: Amex Airline Fee Reimbursements. What still works?). Otherwise, you’ll probably value this benefit well below $100.

Personally, I’m sure that I’ll easily get the full $120 in dining credits each year. And, I’ve gotten good at getting full value from airline fee reimbursements. Still, it takes some effort to make sure to get all of those reimbursements, so I woudn’t value them at face value. My advice is to decide what price you would pay if you had the option to buy a membership to these benefits. For me, that would be maybe $80 for the dining credit and $80 for the airline fee reimbursement. That leaves me with $250 – $80 – $80 = $90 that I would have to justify to keep this card year after year. If the card’s 4X categories are worth significantly more to me than $90, then I should keep the card. Otherwise, I should cancel.

How much are 4X Membership Rewards points worth?

4X Membership Rewards points per dollar is exciting only to those who value Membership Rewards points at more than 1 cent per point. If you use your Membership Rewards points to buy gift cards, merchandise, or travel (with one exception) then you shouldn’t value Membership Rewards points highly at all.

Others will see 4X Membership Rewards as an awesome perk:

- American Express Platinum Card® for Schwab card holders can cash out points for 1.25 cents each. 4X value at 1.25 cents: 5% cash back.

- Amex Business Platinum card holders can get a 35% points rebate when they redeem points through Amex Travel for either a First or Business class flight on any airline, or for any flights with their selected airline. This makes points worth slightly over 1.5 cents each towards select airfare. 4X value at 1.5 cents: 6% back towards select airfare.

- All Amex Gold cardholders can transfer points to airline partners. The value of such transfers can range from very poor (less than 1 cent per point) to very high (e.g. 4 cents per point or higher). We think that it is reasonable to expect to get 1.82 cents per point value, or more (see: Reasonable Redemption Values). 4X value at 1.82 cents: 7.28% back, towards award flights booked with transfer partners.

How much you value 4X Membership Rewards points depends on how you would use the points (see above). Conservatively, I think it is fair to say that Membership Rewards points are worth at least 1.25 cents each. After all, even if you don’t have a Schwab Platinum card, you can sign up for one and collect the 60K welcome bonus to more than offset the $550 annual fee, and then cash in all of your Membership Rewards points (across cards) at 1.25 cents per point.

So, if we agree that Membership Rewards points are conservatively worth at least 1.25 cents each, then we can say that earning 4X Membership Rewards is like earning at least 5% cash back. How does 5% back compare to other alternatives for restaurant and grocery spend? Let’s take a look…

4X Restaurants (US only)

Our Best Category Bonuses page shows cards that earn more than 2% back at restaurants. The best of these, at the time of writing, and aside from the Amex Gold card are:

- Chase Sapphire Reserve: Earn 3X on all travel & dining purchases. With points worth 1.5 cents each towards travel, this is like a 4.5% rebate.

- US Bank FlexPerks Gold Amex: Earn 3X at restaurants (and 2X at gas stations and airlines). With points worth 1.5 cents each towards travel, 3X is like a 4.5% rebate.

- Barclaycard Uber Visa Card or Capital One® Savor® Cash Rewards Credit Card: Both cards offer 4% cash back for dining.

With 4X Membership Rewards being valued conservatively at 5% back, you can see that the Amex Gold card offers .5% to 1% more rewards for dining than its best competitors. Since the Uber card has no annual fee, it arguably makes the best comparison to see what 4X Membership Rewards are worth, otherwise we’d have to factor in each alternative card’s annual fee in the comparison. Paragraph summary: The 4X Membership Rewards points at restaurants benefit is worth 1 cent per dollar above the best fee-free alternative (the Uber Visa).

How much is this benefit worth to you? Estimate your annual restaurant spend within the US and multiply by 1%.

Example:

- You spend $150 per week at US restaurants

- = $7,800 per year

- x 1%

- = $78 per year more in rewards than you would earn with the Uber Visa

4X Grocery (US only, $25K per year max)

Our Best Category Bonuses page shows cards that earn more than 2% back at grocery stores. The best of these that are still available at the time of writing, and aside from the Amex Gold card are as follows…

Best cards with low bonus category annual limits:

- Amex EveryDay Preferred: 3X to 4.5X, $6K cap, US only

- Amex Blue Cash Preferred: 6%, $6K cap, US only

- Amex EveryDay: 2X to 2.4X, $6K cap, US only

Best cards with no annual limits (or very high limits):

- CNB Crystal Visa Infinite: 3X

- US Bank FlexPerks Travel Rewards: 2X in category used most each billing cycle

- Golden 1 Platinum Rewards Visa: 3% back

- Platinum Rewards Visa: 3% back

- Bellco VISA Platinum Rewards: 3% back

- UMB Simply Rewards VISA: 3% back

- Amex Hilton Ascend: 6X

- Asiana Airlines Visa: 2X (200K cap)

As we did with the 4X dining analysis, let’s use the best no-fee card for comparison. That would be any one of the uncapped 3% cash back cards listed above. When we value 4X Membership Rewards at 5%, we can see that the 4X Membership Rewards points at US grocery stores benefit is worth 2 cents per dollar above the best fee-free alternative. This is true as long as your US grocery spend stays under $25K per year. Once you go over $25K, you’ll only earn 1 Membership Rewards point per dollar.

How much is this benefit worth to you? Estimate your annual grocery spend within the US and multiply by 2%, as long as the total is less than $25K. If the total is over $25K you may want to do the first $25K with the Gold card and then use another card for spend above that threshold.

Example:

- You spend $250 per week at US grocery stores

- = $13,000 per year

- x 2%

- = $260 per year more in rewards than you would earn with a fee-free 3% cash back card.

Your worksheet

Fill out these values to determine how much the Amex Gold card is worth to you:

- $120 Dining Credit. If I could buy this as a membership, I’d pay: ____________

- $100 Airline Fee Credit. If I could buy this as a membership, I’d pay: ____________

- 4X at US Restaurants:

- Weekly restaurant spend: ____________

- X 52 = ____________

- X .01 = ____________

- 4X at US Grocery Stores (up to $25K):

- Weekly grocery spend: ____________

- X 52 = ____________

- X .02 = ____________

- Total annual value: ____________

If the total annual value is significantly more than the annual fee, then keeping the card each year makes sense.

My worksheet (example)

Here are my values:

- $120 Dining Credit. If I could buy this as a membership, I’d pay: $80

- $100 Airline Fee Credit. If I could buy this as a membership, I’d pay: $80

- 4X at US Restaurants:

- Weekly restaurant spend: $150 (it’s probably much more than that actually)

- X 52 = $7,800

- X .01 = $78

- 4X at US Grocery Stores (up to $25K):

- Weekly grocery spend: $200

- X 52 = $10,400

- X .02 = $208

- Total annual value: $80 + $80 + $78 + 208 = $446

$446 is significantly higher than the card’s $250 annual fee, so it’s definitely a keeper for me.

![Which Premium Cards are Keepers? [Updated w/ Strata Elite, Atmos Summit, and refreshed Platinum] Pile of credit cards with calculator on top](https://frequentmiler.com/wp-content/uploads/2025/06/Calculator-with-Credit-Cards-218x150.jpg)

[…] the annual fee is $145 more than before (it jumped from $450 to $595)? And, back in October, the Amex Gold and Amex Business Gold cards too got new features and new […]

Does anyone know if you use the American Express Gold credit card that earns 4X at grocery stores, if the grocery store has a gas station like Kroger or Hi-Vey, will that gas purchase court towards the 4X since you are filling up at a grocery store?

As others have mentioned, I don’t get 4x when the restaurant uses Square. I reached out to Amex and told them it’s a really bad idea on their part. I really don’t feel like asking each coffee shop or restaurant I visit if they use square or not and I’m not going to go through my membership rewards statement each month to memorize which places use what. Therefore, if I’m at all unsure, the Amex gold is staying in my pocket. I’m usually unsure. So my Amex gold is basically groceries, $100 airline incidentals, and once a month cheesecake factory card until they fix that.

I told them the square exclusion is common enough for people to notice and be irritated but rare enough that if they got rid of the exclusion it would cost them almost nothing. Why spend all the money and effort marketing the gold card as a restaurant card only to have this exclusion that no other card has. I warned them that there are people, possibly me, who are going to be annoyed enough to bank the 50k rewards points and cancel after a year instead of keeping it for a decade. I’ll probably keep it for the groceries though. I have 4 kids…

[…] past few days and weeks, there is no doubt that the newly revamped Citi Prestige Card and Amex Gold Card and their effect or lack thereof on the Chase Sapphire Reserve have been top-of-mind and […]

Why settle for 25,000 bonus points when you can get 50,000 bonus points for the same $2k spend?

[Editor’s note: We do not allow referrals to be posted unless we’ve specifically invited people to do so, so this referral was removed. Please note that the offer displayed on our site is the same 50K w/ $2K spend that Mike mentions: https://frequentmiler.com/amxgoldcard/%5D

Great analysis–thanks Greg. Here’s my data point–I thought I gave up my Premier Rewards Gold Card in 2010. AMEX says it was 2012. In any case, it doesn’t matter since no sign up bonus for me.

It may be worth it at some point anyway for the supermarket and dining out bonuses, but I think I’ll wait to see if it ever comes around without the once per lifetime language.

Another approach to consider in your situation is to get another card that can be later upgraded or downgraded to the Gold card. For example, if you’ve never had the Amex Plat card, you could sign up for that to get the welcome bonus and then later downgrade to the Gold card (after taking advantage of the Platinum $200 airline fee credits)

If the downgrade is done within the first 12 months, wouldn’t it invite a RAT attack (per the new T&C definition of benefit abuse)?

Maybe if you did that often, but I don’t think a one time downgrade is going to draw any attention

[…] Is 4X worth $250 per year? How much are those Amex Gold 4X categories (grocery & dining) worth? […]

I love my Amex Hilton Ascend. I get 6x points on restaurants, grocery stores & gas stations.

At least it’s not as worthless as their business card with $250 annual fee (Plum Card), but it not being waived the first year is kind of a bummer for new card members. The higher annual fee is a downer for me. I was initially fine with the $120 restaurant credit being useless to me personally. I can probably take advantage of $10 of it because of my geographical location and the places I visit. I only visit a US area with those services once a year. The rest are staycations and international vacation. But, the higher annual fee even with the higher earning bonus if a big disappointment. I’ll figure it out in October, 2019 when the next annual fee is due how much I’ve earned and paid for the card.

Would have been nice if Plat card holders could get the card at a reduced fee.

Quick question. Regarding the $120 dining credit, terms state.

To receive this benefit, Card Members must enroll. Only the Basic Card Member or Authorized Account Manager(s) on a U.S. Consumer Gold Card Account can enroll in the benefit. Traditional Gold, Senior Gold, Classic Gold and Ameriprise Gold Cards are not eligible. Eligible purchases must be charged to a Card Member on the enrolled Card Account for the benefit to apply. Purchases by both the Basic Card Member and Additional Card Members on the eligible Card Account are eligible for statement credits. However, each Card Account is eligible for up to a $10 statement credit per month, for a total of $120 per calendar year in statement credits across all Cards on the Account.

I am reading this as $10 max per month, charged to any card, whether main card or authorized card.

Vs. only getting $10 if the charge is to the main card.

Is this correct?

Thank you!

Yes, you’re correct – shouldn’t matter whether it’s the primary cardholder or an AU who makes the charge.

Love the analysis. The bummer for me specifically is we do most of our grocery spend at Costco and only go to the grocery store for a small number of things that’s why I didn’t apply for it ahead of the changes. I may consider it near the end of this year for the triple dip though!

And as someone else mentioned the gift card perspective, having a few Ink Cash’s pretty much has me covered in that department..

Thanks for an excellent analysis, Greg! You do a great service to your readers.

Beyond the 50K sign up bonus, the referral offer has a sweetener that includes “Receive 20% back as a statement credit, up to $100 per Card account,” from restaurant spend in the first 3 months for approved applicants by 1/9/2019. AMEX might be putting my CSP in the sock drawer.

Keep up the good work gents and have a great Columbus Day weekend.

Yeah, for the first year getting the 50k bonus, 100 back for restaurants, 100 credit from airline and some portion of the $10 per month from grubhub made this an easy call. My CSR is going to get as much use.

It’s going to get harder after year 1 – that’s where I think decisions get tough. I’m not sold on using this when Chase Freedom has 5% on grocery or restaurants, tho I respect the ability for MR to be worth more than UR if one works hard enough to time the transfers. At some point that energy isn’t worth the effort for me and UR becomes easier to maximize. That’s what make all these calcs so helpful – year two is the decision point for me on CSR vs AMEX Gold – they won’t both survive for me.

Thanks for the great analysis.

Regardless of the additional benefits, I think Amex raising the annual fee from $195 to $250 is good old-fashioned “highway robbery.” That’s a 28% increase!

I’ve had a Gold Card for 40 years! (No old fart jokes please.)

I live in a small town with no Grub Hub service or any of the other restaurants. So the $10 credit is worth almost zero to me.

I really don’t want to pay $250 annually for ANY credit card. I will have to call Amex and see what they can do.

If you can’t get good value @$250 with the increased returns then that means you weren’t getting good value @$195.

I was getting enough value out of the basic points along with the special promotions. Now it will be marginal at best. My objection is based on the size of the fee increase 28%! That’s just greed IMHO.