Elite status? Free airport restaurant meals? Guaranteed lounge access? Those things and more can be yours with the right cards. Ultra-premium cards carry ultra-premium perks, but those cards aren’t cheap. Thankfully, those ultra-premium cards often come with annual credits to help offset the annual fees. This week on Frequent Miler on the Air, we discuss how to utilize those credits to get your ultra-premium perks for a bargain-basement price.

Elite status? Free airport restaurant meals? Guaranteed lounge access? Those things and more can be yours with the right cards. Ultra-premium cards carry ultra-premium perks, but those cards aren’t cheap. Thankfully, those ultra-premium cards often come with annual credits to help offset the annual fees. This week on Frequent Miler on the Air, we discuss how to utilize those credits to get your ultra-premium perks for a bargain-basement price.

Elsewhere on the blog this week, Amex has lost their minds and released a dozen simultaneous transfer bonuses, learn how to leverage one of those to book Delta One flights at great prices, how to best book your positioning flights for those trips, and a lot more. Watch, listen, or read on for more from this week at Frequent Miler.

1:21 GIant Mailbag

5:47 3 Cards, 3 Continents, 3 Updates

19:45 What crazy thing….did Amex do this week?

30:00 Mattress Running the Numbers: Craftsy through SimplyMiles

37:34 Luxury Perks for Free (After Rebate)

38:46 Capital One Venture X card

46:50 Amex Platinum Card

1:24:22 Amex Business Platinum

1:38:55 Amex Hilton Aspire card

1:46:44 Question of the Week: Is it worth transferring speculatively (given the transfer bonuses available) if you know which programs you often use?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week at Frequent Miler

Gift lounge access, elite status, and more. Top cards offering great authorized user perks.

As we discuss on this week’s show, many ultra-premium credit cards have excellent perks. If you play the game right, you can get those perks for free (or nearly free). Even more fun is that in some cases you can then share those ultra-premium perks with others (possibly without additional cost). This post covers which perks can be shared and how to do it.

12 transfer bonuses from Amex Membership Rewards!

We don’t usually include transfer bonus posts in our week in review, but this was easily the big news of the week: Amex is offering transfer bonuses to a dozen different partner programs. Given all of these bonuses, September 2022 is looking like a great time to plan your vacations for spring and summer of 2023.

How to book Delta flights with Virgin Atlantic miles (2022 Edition)

If you are planning a trip or two thanks to those current point transfer bonuses, you may be on the hunt for Delta availability via Virgin Atlantic given that the transfer bonus means you can transfer just 39,000 Amex Membership Rewards points to get the 50,000 Virgin Atlantic points you need to fly Delta One from the US to Europe (paying just $5.60 in taxes departing the US!). Greg has republished this updated guide to help you figure out how to take a bite out of this sweet spot.

Best options for booking backup award flights

What if you want to take advantage of one of those Delta One options but you don’t happen to live at one of Delta’s international hubs? You’ll need a positioning flight. These days, when I need a positioning flight, I almost always book a backup flight just in case of a canceled or severely delayed trip on my intended positioning flight. However, not all programs make for good positioning flight options. See this post for some of your best options when you need to have a Plan B.

In defense of flexible hotel bookings (on Nick’s mind)

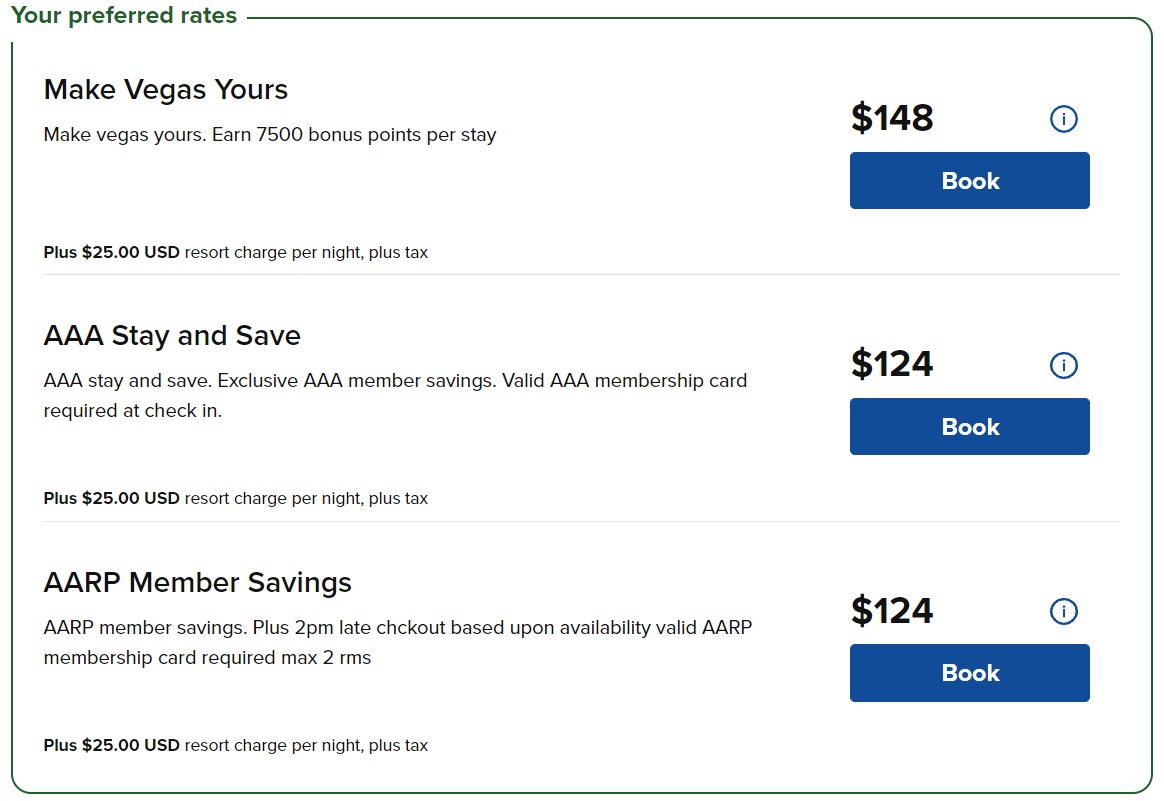

I hate making nonrefundable hotel bookings. Plans can change for so many reasons — sickness, scheduling conflicts, and a lot more. If a much better deal pops up on a better hotel or we find a crazy mistake fare to another destination altogether, I want to be flexible enough to jump on another deal. Of course, I don’t want to pay more than the cost of a nonrefundable booking, either. Thankfully, there are often easily accessible rates that are both flexible and about as cheap (or cheaper) than advance purchase rates.

Award spotlight: Marriott’s Torre de Palma Wine Hotel, Portugal

Greg spotlights a Marriott property in Portugal that looks pretty unique — and a couple of readers who have visited in the recent past add their two cents each in the comments. Marriott actually has (or at least had?) quite a few unique-looking properties in Portugal. I have only visited Lisbon and Porto, but my experiences have been that Portugal is underpriced compared to neighboring countries, so Greg has been smart to look here for the 3 Cards 3 Continents trip — I wonder whether he found something even better to highlight when he takes his trip.

St Mawes Hotel In Cornwall, England: Bottom Line Review (IHG/Mr & Mrs Smith)

I was very curious to read Stephen’s review of this property since I have never stayed at a Mr & Mrs Smith property. While Stephen’s photos looked cute and the little private theater sounded awesome, the truth is that he lost me at “$300+ per night hotel with no air conditioning”. And while, like Stephen, I am not bothered by street noise, neither do I expect to worry about it at this price point. Of course, Stephen said that neither of those things would prevent him from going back again, so don’t let my hang-ups stop you if those are non-issues for you.

My new favorite city: Tbilisi, Georgia

I love reading Carrie’s off-beat and off-the-beaten path trip reports and this one does not disappoint. A leaning clocktower next to a puppet theater that was constructed by a renowned pupeteer out of pieces of abandoned buildings sounds quirky indeed. I don’t know when I’ll get to the coutnry of Georgia, but if I did then Tbilisi would certainly be on my list.

That’s it for this week at Fequent Miler. Keep an eye on this week’s last chance deals for deals set to expire soon.

![Viral marketing proves infectious for two more airlines, a new card lands with a thud and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/viral-airline-marketing-218x150.jpg)

![Prices rise, benefits cut: The new normal coming for ultra-premium cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/Increasing-fees-218x150.jpg)

![Juicy rumors, but how far will cardholders be squeezed? [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/Juicy-rumors-218x150.jpg)

Something I think you guys overlooked with your AMEX transfer bonuses by writing off Marriott as a good choice is the 5th night free in combination with the current transfer bonus. You guys simply said not worth it, however, I just transferred 57k AMEX to book a room in Bonaire (Current AA award sale) that was $1247.50 for my 5 nights.

I understand it’s a niche situation, but just providing it as a reason to not completely write off Marriott.

To answer a question from the podcast this week – yes you can stack those Citi offers on restaurants with AA dining. I live in NYC and a great place for this is Rosa Mexicano which has a few locations – AA dining points posted, 6% back Citi offer (which I’ve received a few times now) and almost always about 25% back on Seated (an incredible cash back app at certain restaurants available in NYC, Dallas, Boston, Atlanta, Chicago and Philadelphia). Basically free margaritas!

Audible from amazon has a few streaming options. Premium is $7.95/month and only includes a fluctuating selection to stream. Premium plus is all of premium plus 1 credit for any audiobook a month for $14.95, sales tax will depend on your state. You can store up to 12 audiobook credits before you start loosing them. There is another higher tier option that is > $20 a month that allows 2 credits a month, that’s probably where Greg’s 6 month idea comes from.

You definitely can also use the streaming credit for individual ala carte audiobooks that you own. When you buy audiobooks you can choose to either use one credit or pay the price for the book. If you pay the individual price that also triggers the amex streaming credits.

For the AMEX business platinum card – the $200 Dell credit can be used to buy printer ink and also SD memory cards. I just assume that most people have printers and maybe cameras that use the SD cards.

I was rejected for the Venture X card due to having too many accounts even with a mid 800 credit rating. Is it worth trying again or is there anything I can do to get approved?

guys, for paramount, it’s only temporary, but there’s an amex offer for 3 months for the ad-free option

Get a $9 statement credit by using your enrolled eligible Card to make a single purchase of $9 or more online at paramountplus.com by 11/15/2022. Limit of 3 statement credits (total of $27). See terms

For making Verizon payments with a credit card, you can setup autopay with a checking account and make manual one time payments with a card. As long as you make the credit card payment before the autopay date and don’t save the credit card to your account, you get the autopay discount and the credit card points/protection/etc.

Good to know! Thanks

Nick mentioned the Aspire resort credit can be used for a deposit. Then later if the plans don’t work out he doesn’t expect Amex to claw back. This worked for my May 2020 trip and there was no claw back after the property closed due to lockdowns. However, as of 2021 Amex will reverse the credit! Check the FT reports on this— I hope they are wrong.

Ugh. Thanks for letting us know

Sorry. Maybe it still works sometimes after all.

After looking again for recent posts, I saw a clawback for the Waldorf Vegas but none for Resorts World Vegas, and none for a Doubletree somewhere. Maybe the other clawbacks I saw were somewhere else like dansdeals or reddit. In 2020, clawbacks were added to the T&C.

Just a very small data point related to the Amex Plat Uber credit. I was able to use the credit in Panama, where Uber charges in USD. The credit terms say that the charge must be in the U.S. and in USD, but an Uber in Panama triggered the credit last month….

Lol…I paused the podcast and made this comment….and then literally 2 seconds later Nick made this very point. You were right…someone was going to make this comment, haha.

@ Nick — Great podcast! Does spreading your cell phone payments across multiple AMEX Plat Biz cards via $10 pay now charges invalidate the AMEX cell phone coverage? I thought your entire bill had to be paid with one card to receive the insurance coverage from that card.

It doesn’t exactly say that. It says that your bill needs to be paid with an “eligible amex card”. Other issuers do say you need to pay the bill in full with your card, but Amex’s wording leaves it open to the interpretation that you just need to use an Amex card. If I were placing a bet, I’d guess that they mean you need to pay the full bill on the card providing coverage….but if I were making an argument, I’d argue that it doesn’t exactly say that. Anyway, that’s neither here nor there for me. I have explained before what I do:

I autopay my full bill on a BizPlat (let’s say for example that my bill is $100 and payment happens on the 23rd of every month). Then, a couple of days later, I make the additional $10 payment (I do a few, but I’ll keep the math simple here). My T-Mobile balance is now -$10. Then, my bill generates on (for example) the 2nd of the next month. I get billed $90 (the usual $100 minus a “balance forward” of $10 from the previous month’s overpayment). So my bill shows a total due of $90. On the 23rd of the month, the auto-pay charges my BizPlat $90. You could argue that I’ve paid the “full bill” on that card since the full amount it showed due ($90) was charged to the BizPlat. I figured that even if what they really meant is that the entire bill has to go on a single card, most likely, anyone examining the claim would be looking at the large number in bold at the top of the page for the amount due and matching it up with what I paid on the Biz Plat.

I don’t know whether it’s because my interpretation (that paying with any Amex works) is correct or because (more likely) someone did as I suspected and just matched up the amount due with the amount charged to my card, but I had a phone screen break and the claim was approved. That doesn’t mean yours will also get approved, but that’s my method and experience for what it’s worth.

That is helpful, plus I suppose you card argue that since the charges would all be paid on AMEX Plat Biz cards cards offering the exact same insurance that you full bill has indeed been paid with eligible AMEX cards.

I wonder how this works out if you bill is $110 per month and you have 9 AMEX Biz Plat cards in your household? 😉

I mean, after a year of mostly not paying your bill, you could probably afford to self-insure. 🙂

Great minds think alike… 🙂

I think in the discussion of WoH and the milestone rewards earning is good, but the use of the term “points” versus “base points” could be quite misleading. Points are earned with credit card spend, transfer from URs, and bonuses in addition to stays whereas “base points” upon which milestone rewards are based are earned through actual money spent at Hyatt (or as pointed out, with Lindblad booked through Hyatt). It might sound like splitting hairs but the distinction is important (eg, I earned Globalist this year by July and have 250K WoH points but still have only 18K base points despite several actual head in bed stays).

“Basically” a good point :-). That’s definitely a distinction we should have made clearer in hindsight.

Nick…when you use the pay with points ( 35%) with business plat.Do you earn frequent flyer points with your airline of choice

Yes, absolutely! As far as the airline is concerned, you’re flying on a paid ticket.

I’m also a speculative transferer. I think it comes down to your travel style. I am one who (at least pre covid) would often take advantage of <2 weeks out award availability, so more options to get where I need to go in a short time is very valuable. So I also sprinkle points across programs, maybe just enough points in each program for one typical J/F redemption.

Yes there is deval risk, but there is also risk of Amex shutdown, so keeping all the points in flexible currencies isn't always the risk free option.

Lesser known Amex perk – if you have a corporate card through work (I had green) you should be able to call them and ask about “Corporate Advantage Program”. Provide your corporate card number and they’ll give you $150/yr for platinum and $100/yr for gold. I think also $75 for green, $50 for blue

For using Amex plat $200 flight credit you can usually book Southwest flights (<$70 ideally) and cancel for credit immediately. Has worked for me in 2021 and 2022

Also true. In the past, I wouldn’t have preferred that option because the credit expires, but now that flight credits don’t expire, you’re absolutely right. That option is indeed a really good one, particularly because there’s no risk of clawback.

Assuming you fly Southwest at all, I think this is the best option at present. Better than United with its five year expiration.