What’s the strongest transferable points wallet you can muster with just a $250 budget for annual fees? Will Greg or Nick come up with the killer combo — and can yours beat theirs? On this week’s Frequent Miler on the Air, we kind of shoot from the hip, each designing a wallet on a whim about 15 minutes before recording. See who came out ahead.

Elsewhere on the blog this week, I explore my real-life dilemma about whether or not to keep the Gold card and its $250 annual fee (and Greg’s no-brainer on the same question), Stephen and his wife get exiled to Mauritius, we get confirmation that some Marriott members got a lucky surprise and a lot more. Watch, listen, or read on for more from this week at Frequent Miler.

00:00 Intro

00:59 Giant Mailbag

03:32 What crazy thing . . . did Capital One do this week?

09:03 Mattress running the numbers: A potentially lucrative Wyndham promotion

14:06 Main Event: The single-best $250 wallet for point collectors

18:15 Nick’s gas station card

18:39 Greg’s gas station card

19:12 Greg’s grocery cards

20:20 Nick’s grocery cards

22:10 Nick’s dining card

22:43 Greg’s dining card

23:45 Greg’s travel card

24:10 Nick’s travel card

25:23 Nick’s phone and Internet

26:10 Greg’s phone and Internet card

27:14 Greg’s everywhere else card

28:00 Nick’s everywhere else card

28:56 All of the extra cards

33:55 Question of the Week: What’s the best card to pay for a $100K cruise? What about $150K in taxes?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Should I dump the Amex Gold card for the Capital One SavorOne Cash Rewards credit card? (On Nick’s mind)

On this week’s podcast, we discussed the ideal $250 wallet. That conversation was of course inspired at least in part by this post, where I contemplated whether it is worth keeping the Amex Gold card. Given that Capital One’s SavorOne card offers an effective uncapped 3x in the same bonus categories (and also on entertainment and select streaming services) for no annual fee, does it make sense to keep the Gold for an extra one point per dollar spent (that is also capped in one category)? It turns out that I spend enough in the bonus categories that yeah, it’s worth keeping the gold on paper — though I still walked away questioning it.

Why I’m keeping the Amex Gold another year

On the other hand, Greg made his Gold vs some other card debate very simple: a generous retention offer more than mitigates the annual fee for him for another year. This is a great point. It’s been a while since we’ve mentioned retention offers and it always makes sense to give the card issuer a chance to give you a compelling reason to keep your card. Amex has been especially good about retention offers over the past few years, typically extending one every other year. So even if Greg only gets an offer like this once every other year, that probably mitigates the fee when taken together with the monthly credits.

I had to go to Mauritius because Australia thought my wife was a criminal

I love this post that Stephen published this week about his ruined trip to Australia and how he (hopefully) saved the day with a quick pivot thanks to the power of miles and points. I am beyond jealous of course both because Mauritius was a stop I very much tried to incorporate in my 3 Cards 3 Continents trip, but simultaneously I had to step back and re-see just how amazing this hobby can be. How many people do I know who would be able to cancel their trip to Australia 90 minutes before their flight and book a trip to Mauritius that sets off 12 or 15 hours later without any major financial consequence?

Hilton Mauritius Resort & Spa: Bottom Line Review

If you’re curious about how Stephen and Shae are doing in Mauritius, you’ll want to check out this review of their first hotel stop on the island. Because I had only been researching budget accommodations during 3 Cards 3 Continents, I had only verified that I could sleep cheaply before trying to make flights work and I never got to the stage of researching rewards program hotels. It turns out Mauritius has several options and I’ll be very curious to hear how they all compare in the long run.

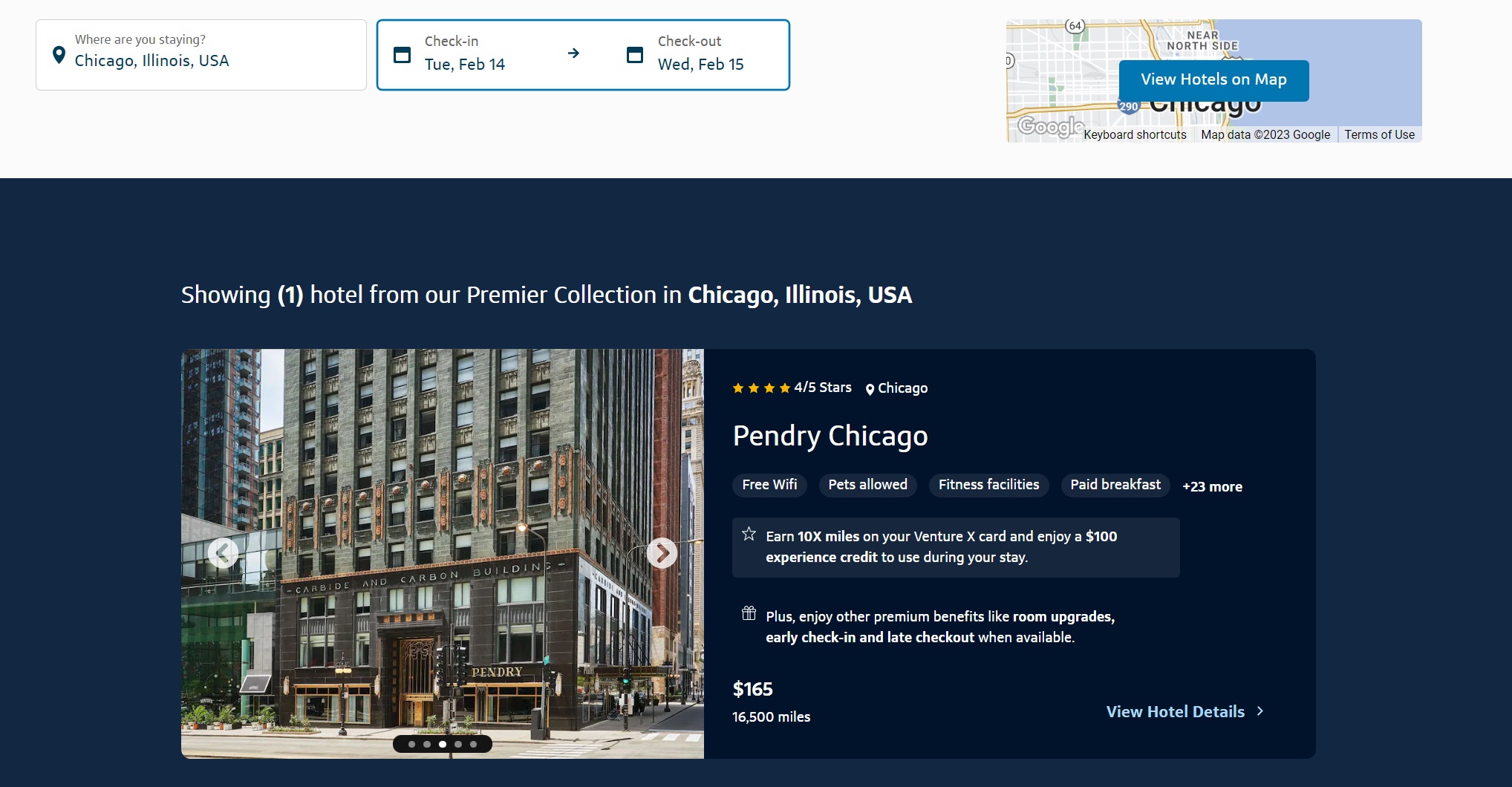

Can the Premier Collection really compete with Fine Hotels & Resorts and the sort?

Capital One’s Fine Hotels & Resorts competitor has finally been launched (sort of). I’m excited to see where Capital One goes with this as they clearly seem to be targeting their own unique set of hotels and resorts, but the fact is that it’s not yet ready for prime time. They aren’t yet in enough locations and the search functionality isn’t quite a smooth as I’d like, but I’ll be happy to take it for a spin and try out a new hotel with a Venture X credit. I should note that I made an update to the post because Capital One representatives reached out to confirm that the $100 experience credit definitely can be used on dining.

United vs. Qantas Business Class to Down Under

If you hadn’t listened to last week’s podcast, would you have thought Greg would have enjoyed United Polaris or Qantas business class more? I have to admit that I was suprised to hear his enthusiasm for United Polaris, though having flown the “real” Polaris seats a few months ago myself I can confirm that they are indeed quite good. That said, I am generally comfortable enough in most lie-flat business class seats, so for me what typically differentiates the experience is food and service and I would bet on Qantas to win that showdown more often than not.

[Update] Marriott gives 55 elite night credits to those with the right credit card combination

If you were so lucky as to wake up at the beginning of the year with 55 elite night credits, there’s good news: A Marriott Bonvoy rep on Facebook has seemingly confirmed that Marriott will not be clawing back any extra elite nights (while simultaneously confirming that the extra nights were issued in error). It turns out there is no perfect card combination, it was just a matter of luck. Nice deal for those who got lucky.

Park Hyatt Auckland: Bottom Line Review

I had been curious about this Park Hyatt for quite a while as often find my eye wandering Down Under when searching for speculative award trips. Greg’s review has me convinced that I’ll probably skip this one until reports roll in that things have turned around a bit. I completely understand his point that the hotel was very nice and that it probably would have been a different review were it not for the Park Hyatt label, but in my mind the entire purpose behind staying at chain hotels is for the predictability of experience that they offer. That is of utmost importance to me when a property separates me from my points because of the Park Hyatt brand and expecting the Park Hyatt experience. There are a lot of great hotels to consider — if I only want a very good hotel, I’ve got a lot more options for my points. When I book a Park Hyatt, I want a Park Hyatt…and this didn’t seem to tick the right boxes for that feel.

The George, Christchurch New Zealand (Bookable via Hyatt SLH). Bottom line review.

SLH properties continue to impress me. My major hesitation with boutique hotels is always that I do value that consistent “Park Hyatt experience” (or Hyatt Place or whatever the case may be). But SLH is lowly making me a believer that the right boutique hotels can provide a consistently positive experience. Breakfast at The George looked great and exterior photos of the property made it look lovely to me. You could certainly do a lot worse with a Hyatt free night certificate.

Hyatt Centric Old Town Alexandria: Bottom Line Review

Tim’s review of the Hyatt Centric Old Town Alexandria made me realize that I’ve never actually visited Alexandria. That seems kind of crazy to me because I’ve been to Washington, DC plenty of times and mostly driven there since it is only a 5-6hr drive. While it sounds like the Hyatt Centric likely won’t be my best option for a place to stay whenever I get there, Tim’s review at least made me realize that I’ll have to put this on the short list for a summer weekend getaway.

That’s it for this week at Frequent Miler. Keep your eye on the upcoming last chance deals to make sure you catch them before they’re gone.

Regarding the 100k cruise travel protection on Sapphire Reserve:

Firstly:

“Trips that exceed 60 days in duration are not covered”

Secondly:

“Up to $10,000 per covered trip and a maximum limit of $20,000 per occurrence and a maximum benefit amount per 12-month period of $40,000

Examples:

A family of four charges a covered trip to their Chase card or pays with rewards earned on a Chase card for a covered trip that costs $6,000/person. If the family experiences a loss of $24,000 for the entire trip, the reimbursement would be $20,000, as that is the maximum limit per occurrence.”

So a family is covered only up to $20000 per occurrence. The amount that Nick mentioned of $40000 is over 1 year.

I have a hard time listening to podcasts, but love the topic. Can you make a post about the $250 wallet? Or summarize here?

Yes, would like to see this laid out.

I second that suggestion

Wyndham could potentially count as indirectly transferrable – they transfer at 5:1 to a number of airlines (including AA, LifeMiles, Turkish, and United.) This probably wouldn’t be a good use of Wyndham points, but IMO it’d qualify as indirectly transferrable.

I would love to have Stephen join the weekly broadcast

Great podcast as usual. However, the Question of the Week discussion about the $100K cruise payment gave me second-hand anxiety about the thought of using one-time large payments to satisfy multiple sign-up bonuses. My first thought was: What happens if the cruise plan falls through? You don’t want anything to be refunded to the cards b/c then you’d be worrying about multiple sign-up bonuses being clawed back. I understand that someone planning to take a year-long $100K cruise would probably just make other cruise plans to replace anything that gets cancelled, and so would therefore be perfectly happy getting a future cruise credit rather than a refund. But I’d still be worried about some sort of automatic refund that happens before you could tell the cruise company that you want a future credit or that you just want to book something else.

Of course, I have no cruise experience, so perhaps the possibility of a cruise company actually automatically refunding money is practically zero.

That’s an interesting thought. I’d have never considered that!

Question: Regarding the Blue Business Plus for your “everywhere else” card, has Amex ever hammered a person for using it for non-business purchases? Within the Amex ecosystem, I wonder if the risk of a shutdown is worth the extra 0.5X the BBP offers over the Everyday Preferred.

I’ve never heard of a bank cracking down on someone for using a business card for personal use. That’s not something I worry about at all.

Thanks

If you have any Amex business, take a look at the Amex Offers associated with it. A large number will be for stores and services that would never be considered “business” expenses. They just want you to spend on it.

If you have any Amex business card…

Check out this post. Amex is unlikely to shut you down for using a business card for personal purchases. However, the process around resolving disputes/fraud is much less consumer friendly.

https://www.reddit.com/r/amex/comments/tvj6p3/comment/i3akg8y/

Guys, great Photoshop images. Keep ’em coming.

OK Stephen behind bars is awesome, but honestly the other stuff is getting played out. Once in a while sure, but it has gotten to the point where readers are comparing it to the running joke of “pictures of Emily” at Million Mile Secrets. IMHO

And yet Frequent Miler as a business is at record revenues.

This is probably cheating, and I haven’t listened to the podcast yet, but really the best option here is to get 4 custom cash cards (via product change) for the equivalent of 5.5x (with rewards+) for gas, grocery, travel and restaurants and then pair them with the premier card to transfer the points and get 3.3x in all those categories once you go over $500 each month on the custom cash cards. Pair this with the double cash for 2.2x everywhere else. Finally, do the ink cash for 5x for phone/utilities with an ink preferred (to transfer points) for 3x on travel if you want URs instead of TYs from the premier card. Toss in a freedom flex for 3x at drug stores and 5x in rotating categories. Total annual cost: $190.

Has anyone done that? Seems like they would have shut it down a long time ago.

I’ve read about a bunch of people who have done that. I can’t say what’s the most # of custom cash’s I’ve seen someone post about, but I know Greg the frequent miler has at least 2.