NOTICE: This post references card features that have changed, expired, or are not currently available

Things have been changing in the ultra-premium card space! The new Prestige card was just released with it’s new 5X categories and $495 annual fee. And Amex is expected to unveil more details about their Business Platinum card any second now. What exactly are we getting now that the annual fee is $145 more than before (it jumped from $450 to $595)? And, back in October, the Amex Gold and Amex Business Gold cards too got new features and new fees.

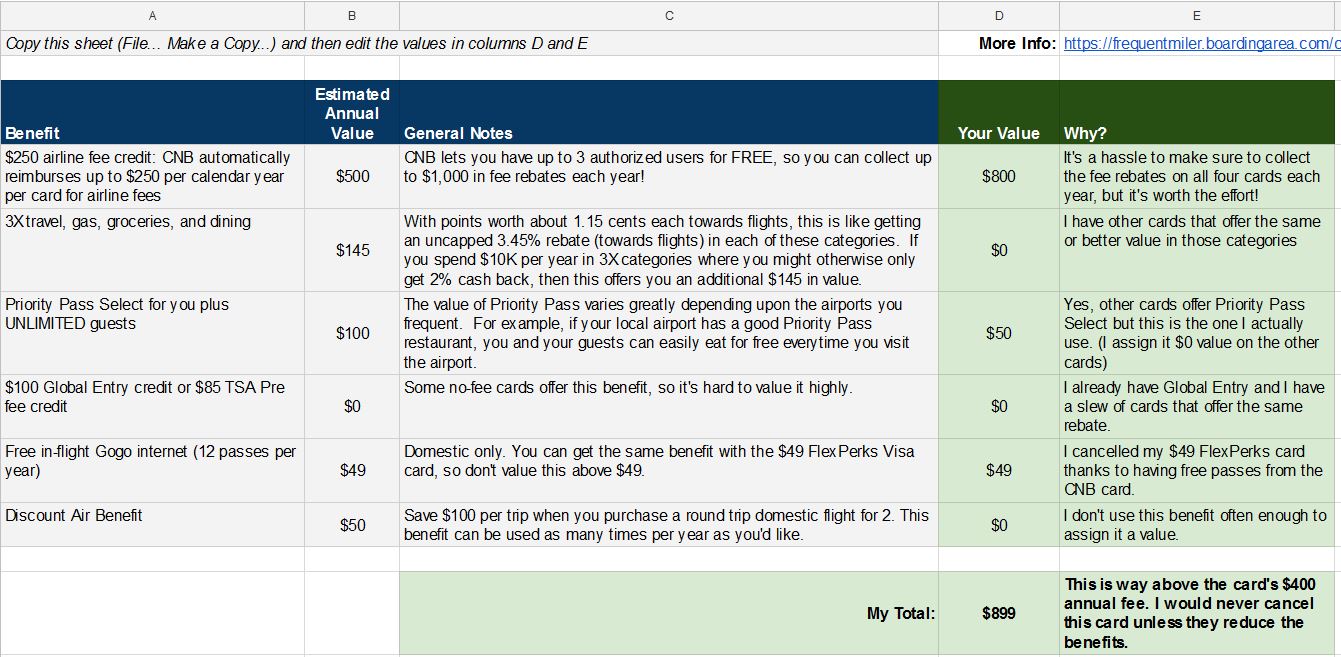

So, it was time for me to update the Ultra-Premium Credit Card Value Worksheet. I updated the sheet with new cards (Amex Gold and Amex Business Gold), new fees and features for the Prestige and Business Platinum cards, and new personal estimates. My big surprise was that my Prestige card didn’t fare as well as I had expected.

Introducing version 2.0…

Ultra-premium cards typically offer terrific benefits in exchange for terrifically high fees (typically around $450 per year). Often the value of the benefits far outweigh those fees, but not always.

Most ultra-premium cards are worth signing up for because they have good to excellent signup bonuses that are worth more than the first year’s annual fee. That’s not the question. The question is whether the cards are worth keeping past the first year. When the second year annual fee comes due, do you keep or cancel?

Do the card’s benefits outweigh the annual fee? Each person should conservatively estimate the value of each benefit to them to figure this out. In most cases, I recommend trying to estimate how much you’d be willing to pay for this feature if it was available stand-alone as a subscription. For example, if a card offers free checked bags, you could save hundreds of dollars if you use that benefit often enough. But how much would you pay for an annual subscription to get free checked bags? That answer should be substantially lower than the amount that you think you’ll save. Otherwise, why prepay for that benefit?

To help you come up with your own estimates, I created a Google Doc spreadsheet with tabs for each of the common ultra-premium cards. Click here to open the spreadsheet.

The spreadsheet currently includes general estimates of how much each major card benefit may be worth, along with my own personal valuation to give you an idea of how I think about each.

To use the spreadsheet, create a copy of it and then overwrite the values in columns D and E on each tab with your own value estimates.

Tips for using the spreadsheet effectively

- Be conservative with your estimates. Enter values that you would pay for a subscription for that benefit rather than the amount you expect to save.

- Once you identify cards that you know that you’ll keep year after year (like my CNB card pictured above), make sure to consider that when evaluating overlapping benefits on other cards. For example, I get 12 Gogo internet passes from my CNB card each year (really 48 passes since I get 12 from each CNB card), so I don’t value the same benefit on the Altitude Reserve card.

- You’re allowed to make irrational decisions if you can afford it. My personal valuation of the Altitude Reserve card comes out higher than the card’s annual fee. But, even if it came out lower, I would consider keeping the card simply because I like it. I love knowing that I get good value from mobile wallet purchases (Samsung Pay, Apple Pay). And I love getting 1.5 cents value per point through Real Time Mobile Rewards (and no, I do not earn an affiliate commission for this card).

The Card Roundup

At the time of this writing, the spreadsheet includes the following cards…

Bank Cards

Card Name w Details & Review (no offer)

Airline Cards

Card Name w Details & Review (no offer)

Hotel Cards

Card Name w Details & Review (no offer)

My Personal Keepers

Here’s where I landed after analyzing each card:

To understand the above results, keep in mind the following dependencies:

- The CNB card is an obvious no-brainer since it offers up to $1,000 per year in airline fee credits for $400. As a result, other cards that offering duplicative benefits were not valued as highly. For example, I don’t value getting Priority Pass from any of the other cards since this one gives me Priority Pass with unlimited guests.

- After analyzing both the consumer and business versions of the Amex Platinum card, I realized that the business card was closer to a keeper, so I zeroed out the duplicate benefits on the consumer spreadsheet. For example, there’s no advantage to having two cards that offer Emergency medical evacuation.

- Similarly, the values I assigned to the Delta Reserve business card assume one already has the consumer card, so some of the card’s benefits were zeroed out.

Also keep in mind:

- I live near a Delta hub (Detroit) and like to use Delta credit cards to manufacture high level elite status for both me and my wife.

- I rarely fly AA or United

- I’ve gotten very good at getting full value from credit card travel credits, so my net cost on many of these cards is far less than it appears.

Based on the analysis, I should do the following:

- Cancel my Schwab Platinum card when the next annual fee comes due

- My wife should cancel her Business Platinum card when she gets charged the new $595 annual fee.

- I should consider getting the Hilton Aspire if I can ever free up credit card slots in my Amex portfolio.

- I should re-evaluate the Prestige card when the next annual fee comes due.

The big surprise for me was that the Prestige card didn’t do better in my estimates. My valuation barely edged out the card’s new $495 annual fee. If I really get charged that much next October, I might drop the card then. We’ll see.

Where can I get the SPG Luxury Card?

Oops. I thought I had fixed that

I see now that I did fix it in the spreadsheet but forgot to update the image in this post.

[…] I last published version 2.0 of the ultra-premium card analysis spreadsheet in February, but things have already changed enough to warrant an update. One critical change was Citi dropping their purchase and travel protections. If you thought the Citi Prestige was worth keeping before, you might want to take a second look. Personally, I’ve retreated back to my Sapphire Reserve card for most travel purchases. […]

Spreadsheet is missing earning rates for Hilton Aspire! 14x, 7x, 3x! This is a big changer in the math!

Can you remind me the rules on Thank You Points? If you cancel the prestige, you lose the points earned on that card, right? Even if you have other Thank You Point earning cards? If that’s the case, and you plan on cancelling, what do you think is the best/easiest way to liquidate the value of your unused Thank You Points? FWIW, I have like 30,000 earned from Prestige right now.

Jared

I’m sure Greg will answer this BUT I combined them and got Rid of them (Singapore AL) .So there would be no playing Games by Citi.. I always error on the side of caution I Flip not Spend .

CHEERs

Yes, that’s true that if you cancel the Prestige you’ll lose the points earned on that card. A better solution is to convert to a no-fee ThankYou card in order to keep the points alive. Then, you can convert to airlines as needed in a few ways:

1. combine accounts with your Premier card (if you have one)

2. move points to a friend or family member who can then move points to an airline program and book for you.

3. Upgrade your Preferred card to the Premier or Prestige when you’re ready to use the points.

If you’d rather just cash out your points, that’s a tough call. If you fly Delta non-stop a lot, you might want to go with Virgin Atlantic. If you fly United or other Star Alliance airlines a lot, consider Avianca Lifemiles. Some of the other good choices are problematic since they make it very difficult to keep points alive (Air France, for example), or impossible after 3 years or so (Singapore, for example)

It took 10hrs to transfer my Thank You points to Singapore Airlines now I can cancel my Citi Primer card and Keep the Prestige card .

Game On !!

CHEERs

Now that my Prestige 4NF and $350 AF are going away, that’s an easy cancel. I also wouldn’t consider the Amex Golds as ultra premium, based on your own criteria of $450+ AF, but still not a keeper. No Amex plat is a keeper because you’re always better off recycling the Ameriprise. That leaves for me the only keeper: Hilton Aspire. $250 resort credit + $250 airline credit + free night + Diamond status is a clear win, and allows you to stop wasting time and money chasing status.

UBS Visa Infinite for all the perks: Mandarin Oriental, the Peninsula, Park Hyatt, Waldorf Astoria, Conrad, St Regis, W Hotels. VIP Treatment, free breakfast, upgrades, credits, etc without bothering with gaining elite status with individual hotel chains.

That benefit sounds very similar to the Amex FHR one, or Visa Infinite hotels, though I think the latter has fewer properties. It’s probably nice on the high end, but not super useful when you aren’t at a place with luxury hotels. The airport lounge membership thing is kind of interesting, but not much better than Skyguide Executive Club. If you really like that hotel benefit, maybe it’s better than the Crystal Infinite Visa, but otherwise not all that interesting.

I’m taking a trip to France and Italy this spring and I will save $991.10 with the Citi 4th night free. I expect to save that much next year also as I plan to book some stays before the phase out this fall.

The Ritz Carlton card has to be the biggest sham in the history of cards……….you won’t be able to use the Club certificates or $100 credit UNLESS you are bilking your company at a standard rate way above any rate you find online………

The AMEX Platinum actually does rebate you without calling or jumping thru your ass…………

But I spend a LOT of money at restaurants and that makes the Citi card the hands down winner AND I spend a LOT of money on wine and believe it or not there are quite a few Napa wineries that code as entertainment! Until later this year those dollars are also 2X……….and sporting event tickets 2X…………I’ll be happy to revisit the argument this fall but right now Citi is the beast in the wallet!

Prestige is a keeper only if my AF stays at $350, I’m still CitiGold.

Amex Platinum (Personal/Business)both going down the toilet

Altitude Reserve, CSR, Hilton Aspire and CNB Crystal are keepers.

I don’t have any other premium cards so far.

Yuri, I would love to see the numbers you use to justify how all those cards are keepers. Only one among them is a keeper. Rest aren’t. So would to see your justification.

Just want to point out that your valuations make sense separately (i.e. if you only had one premium card), but the marginal value of these cards gets lower the more cards you have. For example, Delta Reserve gives you skyclub access but so does Amex Platinum. Similarly, Prestige’s 5x on dining is great, but if the alternative is 3x from Sapphire Reserve, then the additional benefit is so much smaller.

True. See the section titled “Tips for using the spreadsheet effectively” where I wrote the following:

“Once you identify cards that you know that you’ll keep year after year (like my CNB card pictured above), make sure to consider that when evaluating overlapping benefits on other cards. For example, I get 12 Gogo internet passes from my CNB card each year (really 48 passes since I get 12 from each CNB card), so I don’t value the same benefit on the Altitude Reserve card.”

The intent is that you should make multiple passes through the sheet to lower your valuations based on the keeper cards that already have overlapping benefits.

Deleted – wrong message

Don’t forget the 12 Gogo passes per year on the CNB is per AU so you actually get 48 per year!

I actually mentioned that in the section titled “Tips for using the spreadsheet effectively” but didn’t spell it out in the spreadsheet. I probably should

Great information! I’m new in the game of collecting travel awards with credit cards, so I read this comprehensive review with great interest. It’s all a little overwhelming, but seeing all this information in one place makes it a bit easier to do the comparisons I’ve been looking for. Thank you.

Glad it was helpful!

You forgot to put best in class travel insurance on the Ritz page. The Ritz is a keeper for me so that zero’s out the value of that on the CSR. Although if the CSR was also a keeper I would put the spend on that card for 3x UR vs 2x Marriot obviously.

To add to this as well, all premium Amex cards come with the same medical and roadside assistance benefits. Since SPG Lux and Hilton Aspire both have out sized value, that diminishes the personal and biz platinum’s in everything except the credits and Centurion/SkyClub/Escape lounge access for me.

Good point. I need to expand the details regarding travel protection and purchase protection. Maybe V3..

Hi Greg. I am Citi Gold and have had the Prestige card for 3+ years. Do you know if Citi Gold clients are grandfathered into the $350 annual fee? If so, I think that it’s definitely a keeper for me.

Yes, we’ve been told that the card costs $350 for Citi Gold clients.

Dr.McFrugal

I looked @ ur hoard of points on another post worth $28,000 unreal !!!

CHEERs

If I keep only one it’s the CSR–3x travel, best in class travel insurance, and 1.5x on portal buys (MUCH better now that Expedia is the vendor; even got a national park lodge!) for a total of $150/year is killer value.

Amex Gold for restaurants/groceries and my old Biz Gold Rewards for gas and that’s most of my cats covered.