If you shop on Amazon as often as my family does, you likely have significant opportunity annually to earn great rewards. After one too many Amazon purchases at only 1x rewards, I recently decided that my family needed to implement a new solution to maximize our Amazon spend, but that led me to consider the many ways to maximize rewards on Amazon purchases and leverage rewards to get good deals on Amazon.

Earning rewards on Amazon purchases

There are many ways to earn excellent rewards for Amazon purchases. This post provides a high-level overview for maximizing rewards on Amazon purchases with links to more detail in most cases. Feel free to add additional tips in the comments and we will add them to the guide.

New card welcome bonuses

The fastest way to amass meaningful quantities of points will always be through earning new card welcome bonuses. Our Best Credit Card Offers page lists well over 100 different credit cards, many of which feature substantial introductory bonuses when opening a new card and meeting minimum spending requirements.

It therefore could be a good strategy to open a new card to maximize return on spend if your ordinary purchase activity could be helping you earn a welcome bonus. If you open a new card, it might help to temporarily make it your default card on Amazon if that will help you meet the spending requirements for the card. Most welcome bonuses average a least 10 or 20 points per dollar spent when comparing that large initial bonus to the spending requirement.

Just remember to switch that card out once you’ve completely the minimum spending requirement if that card does not offer a good bonus on Amazon purchases. For instance, your new card may have a bonus of 100,000 miles after $4,000 in purchases, yielding an average of 25 or 26 miles per dollar spent during that introductory period — but if it’s back down to 1 mile per dollar spent thereafter, you’ll want to switch that out to a more rewarding option after you’ve completed $4,000 in purchases.

Also keep in mind that returning purchases that you made during the minimum spending requirements could lead to a bonus being clawed back if you fall below the spending threshold. If I think there is a high chance that I’ll return a given purchase, I tend to shy away from putting it on a card where I am working on a new welcome bonus spending requirement.

Credit Cards that bonus Amazon purchases

Amazon Prime Visa

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: For Amazon Prime members, this is a great card for Amazon, AWS, and Whole Foods purchases. No Annual Fee Earning rate: Prime Members: 5% in Amazon rewards on US purchases at Amazon.com and Amazon physical stores ✦ 5% back at Whole Foods ✦ 5% back on Chase Travel℠ purchases ✦ 2% Back in Amazon rewards at gas stations; local transit and commuting (including rideshare); and restaurants ✦ 1% back on all other purchases Base: 1% Dine: 2% Gas: 2% Brand: 5% Card Info: Visa Credit Card issued by Chase. This card has no foreign currency conversion fees. |

The Amazon Prime Visa card offers an uncapped 5% back on Amazon purchases and access to offers of up to 20% back on certain products as found on this page (our affiliate link). This card is issued by Chase and as such I would expect that you’ll likely need to be under 5/24 to be approved.

Amazon Business Prime American Express card

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: For Amazon Prime members, this is a great card for Amazon, AWS, and Whole Foods purchases. Note though that Chase and Synchrony offer similar consumer cards. All information about the Amazon Business Prime American Express Card has been collected independently by Frequent Miler. No Annual Fee Earning rate: Prime Members: 5% in Amazon rewards on US purchases at Amazon Business, AWS, Amazon.com, Whole Foods on up to $120K in purchases per calendar year, then 1% ✦ 2% Back in Amazon rewards at US restaurants, US gas stations, and on US wireless telephone services (excludes Google Fi) ✦ 1% back on all other purchases Base: 1% Dine: 2% Gas: 2% Brand: 5% Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. |

I recently opened this card for 5% back on Amazon purchases on up to $120,000 in purchases per year (which is well over my annual Amazon spending threshold). As a business card, the Amazon Business Prime American Express card will not add to your 5/24 count. Upon approval, I was able to add this card to my existing Amex login alongside my other Amex cards.

Also noteworthy here is that we frequently see better targeted offers. For instance, while the current public offer on this card at the time of writing is for a $125 Amazon gift card upon approval, I had an offer in my Amazon account to earn a $200 Amazon gift card upon approval. Sweetening the pot, on the approval screen I had an option to create an Amazon Business account (which I did not previously have) and receive a free $50 Amazon gift card (which I did). I’ll note that the $50 Amazon gift card for opening that business account instantly posted to my new business account upon account creation. The $200 Amazon card that I received upon approval for the Business Prime Amex came through the same day I was approved, but quite a few hours after approval.

Amazon Visa Card

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Not as compelling as the Prime Visa Card and, if you buy enough Amazon items to be interested in it, you should probably be a Prime member anyway. No Annual Fee Earning rate: 3% in Amazon rewards on US purchases at Amazon.com and Amazon physical stores ✦ 3% back at Whole Foods ✦ 3% back on Chase Travel℠ purchases ✦ 2% Back in Amazon rewards at US restaurants, local transit and commuting (including rideshare), US gas stations, and drugstores ✦ 1% back on all other purchases Base: 1% Dine: 2% Gas: 2% Brand: 3% Card Info: Visa Credit Card issued by Chase. This card has no foreign currency conversion fees. |

The non-Prime version of the Amazon Visa Card only offers 3% back on Amazon purchases. This post features a number of ways to earn better return.

Other Amazon cards

Note that there is also an Amazon Prime store card and an Amazon Prime Secured card (both issued by Synchrony Bank). While we don’t have card pages for those cards, you can find more information about them here.

U.S. Bank Shopper Cash Rewards Card

| Card Offer and Details |

|---|

ⓘ $218 1st Yr Value EstimateClick to learn about first year value estimates $250 cash back Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler $250 after $2K spend in the first 120 days$0 introductory annual fee for the first year, then $95 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This is a niche choice for 6% cash back at certain retailers that some may find rewarding. Otherwise this card is not particularly exciting. Earning rate: 6x on first $1,500 in purchases each quarter with two retailers you choose ✦ 3x on first $1,500 in purchases per quarter on one everyday category (like wholesale clubs, gas and EV charging stations, bills and utilities) Base: 1.5% Gas: 3% Card Info: Visa Signature issued by USB. This card imposes foreign transaction fees. |

The U.S. Bank Shopper Cash Rewards Card is actually a better choice than an Amazon co-branded card for someone who primarily values cash back and who spends $1,500 per quarter or less at Amazon. That’s because this card allows the cardholder to choose two retailers at which to earn 6% back on the first $1,500 in purchases every quarter — and one of the qualifying choices is Amazon.com. As long as you know you’re unlikely to exceed the quarterly cap, this could be an easy set-it-and-forget-it option for Amazon purchases. (H/T: David T in the comments for the reminder about this one!)

Affinity Federal Credit Union Card

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: The Affinity Cash Rewards Visa Signature card could be really interesting for its rotating categories since the fine print indicates that it stacks on top of ordinary earnings. No Annual Fee Earning rate: 5% back at all bookstores, including Amazon (note: this is capped at $1000 in purchases per month) ✦ 2% back at restaurants, gas stations, supermarkets, Netflix, Spotify, Uber and Lyft. Base: 1% Grocery: 2% Dine: 2% Gas: 2% Card Info: Visa Signature issued by AFCU. This card has no foreign currency conversion fees. Noteworthy perks: Cell phone protection |

The Affinity Cash Rewards Visa® Signature Credit Card mostly flies under the radar these days, but it could be another option for someone shopping for a good card to use on Amazon that isn’t issued by one of the major banks. This card offers 5% back on up to $1,000 in purchases per month at Amazon. I imagine that could be enough bandwidth for many households, which might make this card desirable, though I’ve heard that getting approved with Affinity can be difficult.

Quarterly bonus categories

Keep in mind that several cards offer rotating quarterly bonus categories. It is not uncommon for one or more cards to feature Amazon as a rotating 5% back category during at least one quarter per year, though this is often capped at around $1,500 in purchases (varies a bit by card).

Buy Amazon gift cards at category bonuses

Apart from getting a credit card that bonuses spend on Amazon’s website, another strategy could be leveraging your existing credit card portfolio to buy Amazon gift cards and earn category bonuses worth as much or more than the return on cards that bonus Amazon spend.

Two words of caution about Amazon gift cards:

First, there have been reports from some folks of having their Amazon accounts frozen or shut down for pre-loading too much in gift cards. I don’t know how much will be too much, but my impression has been that an amount in the thousands of dollars worth of gift cards has drawn negative attention from Amazon in at least some instances. Personally, I try to avoid any type of behavior that may put my Amazon account at risk of shut down or freeze.

Second, remember that you will forgo credit card purchase protections when using gift cards. Many credit cards feature purchase protections like extended warranty, return protection, or protections against theft or damage. Purchases made with a gift card do not have those protections. The lack of credit card purchase protections is the primary reason why I don’t preload my Amazon account with a lot of gift card money (though keep in mind that during the checkout process you can choose whether or not to apply your gift card balance, so you do have the option to choose to use a credit card instead on any given purchase).

Buy Amazon Gift Cards at office supply stores

Office supply stores like Staples and Office Max usually sell a wide range of merchant gift cards, including Amazon gift cards. It can therefore make sense to use a card that earns one of the best category bonuses at Office Supply stores. For instance, the Chase Ink Cash card earns 5 Chase Ultimate Rewards points per dollar spent at office supply stores. Since we value those points more highly than 1c per point (since they can be combined with other Chase cards that offer transfers to partners), this could be considered an attractive return on Amazon spend.

Also keep in mind that the Amex Business Gold card now features a new benefit whereby you can get a statement credit for up to $20 in purchases at office supply stores each month, but you do need to make sure to enroll in the benefit prior to making a purchase.

Buy Amazon gift cards at gas stations

Most gas stations feature gift card racks. If you use a card that earns one of the best category bonuses at gas stations, you could potentially earn a valuable return on Amazon gift card purchases. For instance, the Wyndham Earner Business card offers 8 points per dollar spent at gas stations. If you value those points at 1c per point, that could be an excellent return on Amazon spend. See more options on our best category bonuses page.

You may also be able to stack with a gas station loyalty program. I haven’t tracked this for Amazon specifically, but I know that Speedway Speedy Rewards offers points on many types of third party gift card purchases. I would assume that you could earn Speedy Rewards on Amazon gift card purchases if Speedway cards offer Amazon gift cards.

Buy Amazon gift cards at U.S. Supermarkets

Depending on how you value points and spending action, you may prefer buying Amazon gift cards at U.S. Supermarkets. Again, some cards offer a good category bonus in this case. For instance, the Amex Gold card offers 4 Membership Rewards points per dollar spent at U.S. Supermarkets on the first $25,000 in purchases per year (then 1x) or the Amex Hilton Honors Surpass card offers 6 Hilton Honors points per dollar spent (and you could earn a free night certificate with $15,000 in eligible purchases per calendar year). In either case, you may also be able to double-dip with a grocery store fuel rewards program when buying your Amazon gift cards to make this a great way to make your Amazon spend more rewarding.

Also keep your eye on your local supermarket circulars as you can occasionally earn some sort of bonus when buying third party gift cards like this one for example.

Buy Amazon gift cards at pharmacies

Most major pharmacy chains like Walgreens and CVS sell Amazon Gift Cards. The Chase Freedom Unlimited card offers 3x at US pharmacies. Depending on how you value Ultimate Rewards points, this could be a good option for someone who does not qualify for a business credit card. It could also be very attractive for those in the first year of the current welcome offer given that those rewards would get double (given the offer at the time of writing this post).

Buy gift cards at Target with a RedCard?

I’m not positive whether Target sells Amazon gift cards, but if they do I expect that you’d get a 5% discount when paying with a Target RedCard — whether the credit card or the debit card (I’m more enthusiastic about the debit card than the credit card particularly when they offer a decent bonus on the debit card).

Redeem Discover cashback for Amazon Gift Cards

Discover offers a 5% discount when redeeming cash back for Amazon gift cards, so this can be a way of stretching the value of your Discover rewards a bit further.

Buy gift cards to utilize card-linked offers

Keep an eye out for card-linked offers like Amazon Offers, Chase Offers, Citi Merchant Offers, Bank AmeriDeals, US Bank offers, SimplyMiles Offer, and the sort for offers at merchants that may have a gift card rack in-store. You may be able to save 10-20% by purchasing an Amazon gift card at a store where you have a card-linked offer synced. Don’t forget potentially-stacking cash back apps.

Beyond credit cards, don’t forget that the Cash App debit card sometimes offers in-store boosts at retailers that sell Amazon gift cards.

Redeem Swagbucks for Amazon gift cards

If you have Swagbucks, you can save 12% on a $25 gift card once a month. You could therefore redeem $22 worth of Swagbucks for a $25 Amazon gift card once a month, stretching your rewards a bit further.

Shopping portals

Amazon typically only offers shopping portal rewards on Amazon devices, but if you intend to buy an Amazon Kindle Fire or Amazon Home Security type of device, it is worth checking for the best current shopping portal rates.

JetBlue may still offer 3x in-flight at Amazon

I don’t know for sure that this benefit still exists, but for years it was possible to earn 3x JetBlue TrueBlue points per dollar spent while on JetBlue in-flight Wi-Fi (I believe you have to click through a link on the in-flight Wi-Fi login page to earn 3x). Unfortunately, I can not find any current information about this benefit on the JetBlue website, though I see a number of other sites still report this benefit as being active in articles published or updated this year. If any readers have flown JetBlue recently, please let us know in the comments whether you still see this when connecting to the in-flight Wi-Fi.

If this partnership does still exist, it will be of limited value unless you fly JetBlue very frequently, but if you do this could be a way to stack additional rewards on Amazon purchases.

How to get good deals on Amazon purchases

Leverage rewards for a good deal

Amazon frequently offers opportunities to earn a discount when using at least 1 credit card rewards point to pay for your purchases. See this post and this post for examples. We often see opportunities for a significant discount when using at least 1 Amex Membership Rewards point, 1 Chase Ultimate Rewards point, 1 Citi ThankYou point, 1 U.S. Bank Rewards point and more.

Keep in mind that you only want to use 1 point to trigger those offers as you will otherwise get awful value for your points when using them toward Amazon purchases. Points are typically worth less than 1 cent each toward Amazon purchases, which means that it usually makes more sense to cash out your points for a statement credit if you want to use your rewards to buy stuff. Still, it can be well worth using 1 point to take advantage of a 50% or 60% discount.

Amazon Gold Box Deals

Amazon offers daily “Gold Box Deals”, which can sometimes feature attractive discounts. See today’s Gold Box Deals here (our affiliate link).

Subscribe & Save (but watch out)

Amazon often offers attractive discounts for singing up for “Subscribe & Save”, which offers automated re-ordering on your chosen interval (for example, you could set it to send coffee once a month or paper towels every 3 months, etc). The discount can often be worthwhile for the first delivery and you could cancel your subscription after that first delivery. That said, I’d recommend caution here for two reasons.

First, I have no idea how often you can sign up to subscribe & save for a big discount and cancel before Amazon decides that you’re abusing the system. As noted early in this post, I try to avoid behavior that might make my Amazon account fall out of favor.

More importantly, in the past, I often found that the price of a product would change between the time I set up Subscribe & Save and the time the product shipped. I don’t know if they ever fixed this problem and locked in the “order” price, but I stopped using Subscribe & Save years ago because I had several orders change in price after I ordered them and before the first delivery. Again, it’s possible that they fixed that — but if you’re going to keep Subscribe & Save turned on, it’s worth monitoring to make sure that prices remain reasonable.

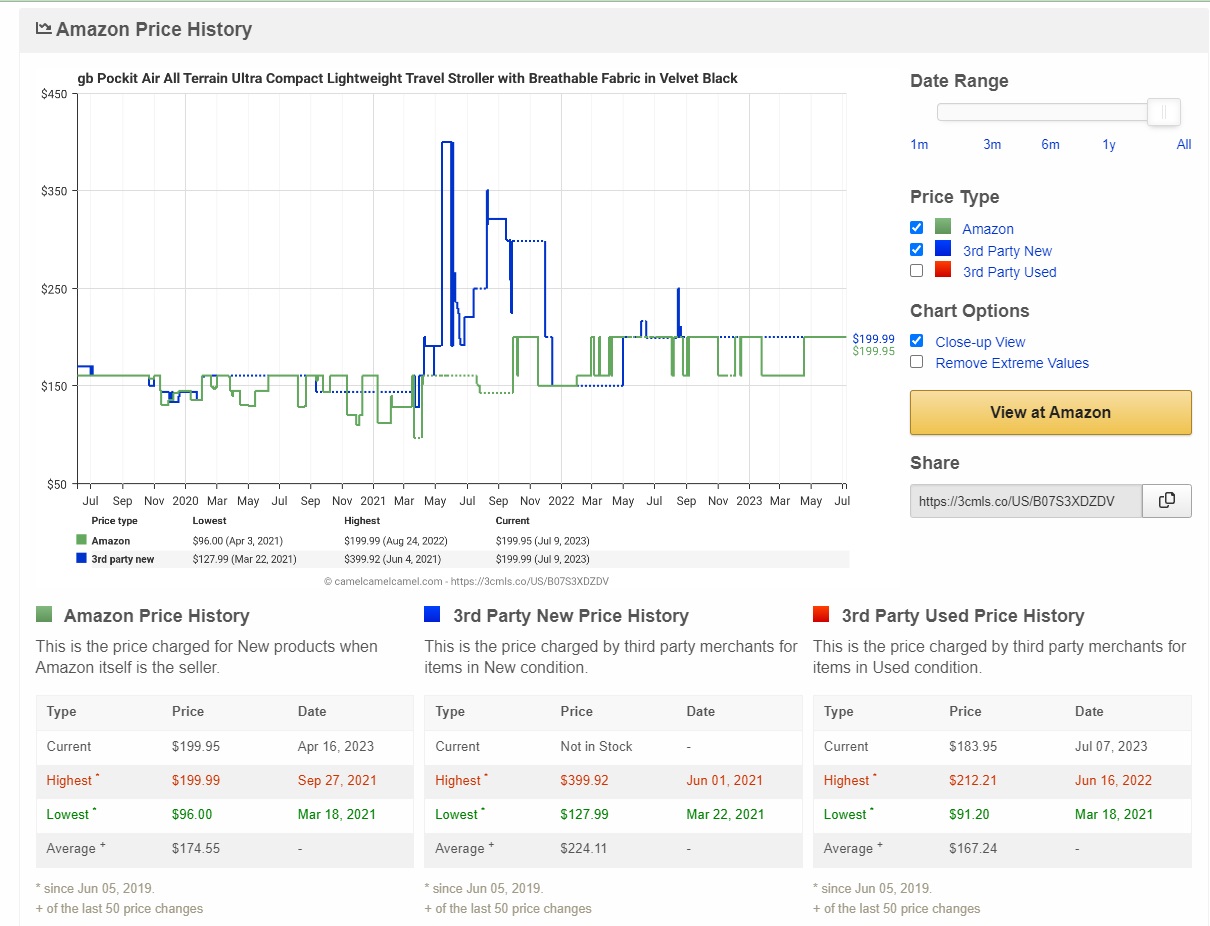

Check historical pricing

Products are advertised as “deals” so frequently that it can be hard to know whether a “deal” is really a deal.

I have long used Amazon price comparison site camelcamelcamel.com to check historical pricing on items before I buy them. Simply paste a product link into the search box and see useful price history data.

Bottom line

There are a plethora of ways to score a good deal at Amazon, whether in terms of rewards earned on purchases or shopping for a good price. Many of the best ways to save at Amazon involve buying Amazon gift cards from third parties. Personally, I recently opted to open the Amazon Business Prime American Express card since it won’t add to my 5/24 count and gives me a “set it and forget it” option to earn 5% on all Amazon purchases, but I know that many people prefer to stack the right category bonuses and card-linked offers to save even more with Amazon gift cards.

What’s your preferred method to stack the best deal at Amazon? Let us know how you do it and add any additional options you see in the comments.

Another deal option related to leveraging points – keep an eye out for offers for adding a credit card to your payment options or setting it as default. These pop up from time to time as a “get $10 off a purchase of $10.01+” or “get $20 off a purchase of $20.01+” for paying with that card and entering a promo code. DoC tends to update their posts pretty quickly each time these come around. I’ve had the best success with Citi and Discover cards, I never seem to get targeted for cards from other banks. Buying a few low dollar items you can practically get your order for free!

I have held a Chase Amazon Prime Visa for a long time and easily earn about $900 in cash rewards per year. Too bad they don’t feed into Chase Ultimate Rewards though.

I never new that Amex offered an Amazon Business card or that U.S. bank offered a shopping card. Very interesting. Great summary.

Deleted

The Bank of America Customized Cash rewards has an online shopping category, and this includes Amazon. Ifs 3% cash back normally, but if you have Preferred rewards status with BOA, you get as much as 5.25 % back on up to $2,500 purchases per quarter. And is a no annual fee card.

And The mastercard version of that card (No longer offered I think) comes with price protection. I claimed a lot of cash back when amazon lowered the price within 90 days of purchase

I’m pretty sure the Amazon on JetBlue no longer exists. Looked for it on a recent B6 transcon and it was nowhere to be found. Heck, the internet was barely anywhere to be found 😉

I don’t go overboard, but pretty much always reload my Amazon balance with gift cards purchased from Staples using my Ink. I usually load $300-500 and then reload when it runs down. I can see if you loaded $1000+ regularly it would raise flags.

I can confirm that you do earn Speedy Rewards points while purchasing Amazon gift cards from Speedway. I’ve done this several times over the last 2 years or so to take advantage of various gas bonuses on cards. I’ve racked up enough Speedy rewards to redeem for a decent amount of free gas.

Doing 15 reloads per day with the Fidelity Bloom debit card (10 cents back per transaction) was great when you could do 50 cent reloads, but it’s still a decent option at the new minimum $1.

Beware of using Amazon gift cards for gift purchases. I had an Amazon account shut down and all gift card money stolen from them as this is against their Terms & Conditions.

Hi Steve, how much were you purchasing gift purchases with Amazon GCs? Over what time period? How much did you lose in gift card funds?

It was five or so years ago, but the account got shut down within a month of making gift purchases using gift cards. I probably purchased ~$1,000 in gift cards and was able to use less than $500 before they closed the account and took the gift card money. There was no warning either.

When you say “gift purchase”, do you mean merchandise purchased as gifts (and presumably shipped to various addresses other than your home address) or do you mean gift CARD purchases?

You can no longer buy third party gift cards with Amazon gift cards.

Anyway, I did note in the post that I personally don’t pursue the avenue of loading up on gift cards because I have heard other similar data points of account shut downs on people with large gift card purchases (most of the DPs I’ve heard have been amounts more in the $2K and up range, but nonetheless it seems risky to load too much). I think a couple/few hundred bucks is probably fine, but large quantities of gift cards seem to be risky.

It was merchandise purchased as gifts and shipped to other addresses.

Interesting points about not using gift cards because of (1) lack of purchase protections and (2) risk of account closure. Even though I have the Amz Prime (5% return), I’ve been routinely using Ink Cash at office supply stores for the 5x and preloading my account. Rethinking best path moving forward….

See above. I think it kind of depends on the volume. It’s probably also more likely to be an issue if you’re loading up on gift cards and shipping stuff to unusual addresses.

Bottom line, 5% is close to the best you can get regardless of effort and better savings are probably found on ebay or walmart.com

Recently got the Amex Gold Biz which comes with Walmart+ free so foreseeing some future purchase that would have gone to AMZ now to Walmart. Have loved how easy to drop off at UPS my AMZ purchases that needed to be returned but if Walmart+ picks up returns at my home for no charge, could be equally or better option. Looking forward to trying out. But don’t get 5x+ on Walmart purchases if pricing is same at both retailers. Hummm

5x UR is more like 7.5%, depending how you use the points

Does the AT&T card offer 3% for online when using Amazon?

Yes, this is my go-to Amazon card. Despite online 3x purchases being a bit hit and miss, Amazon consistently earns 3x. Has to be the AT&T Access More version, and it’s no longer open to new applicants or product change.

Have you looked into the US bank Shoppers Visa? It offers 6% back on up to $1500 every quarter on Amazon, Walmart, Target and several other big box retailers. Between that and the US Bank Cash+ with 5% for Utilities and cable, you can build up a little cash!

Thanks for the reminder on that card! I just added it. Great option for someone who won’t exceed the quarterly cap.