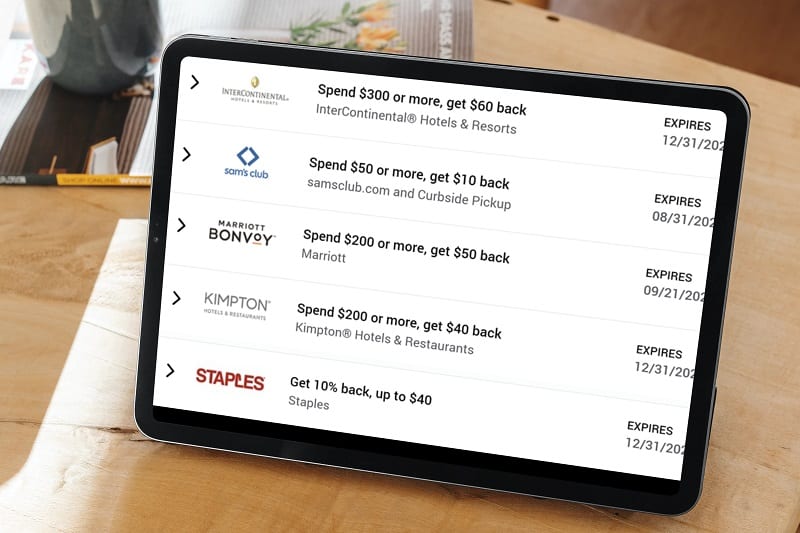

Amex has been killing it lately with fantastic Amex Offers. Here are a few recent examples:

- Amazon: Spend $50 or $100 (offer varies), Get $10 Back, 2 Times: This one was so easy. Simply reload your Amazon gift card balance with $50 or $100 (depending upon which offer you got) and you get 20% or 10% back. Then repeat!

- Amazon: 5 additional points per dollar: This one isn’t huge, but getting 5 extra points per dollar at Amazon is certainly welcome.

- 10% back at AT&T Business: This one isn’t supposed to work on consumer plans, but I wouldn’t fight it if credited 10% back anyway for paying my AT&T phone bill.

- Marriott: Spend $250, Get $75 Back: This works out to 30% back if you spend exactly $250. In the past, similar offers have amounted to 20% back so this is a nice improvement!

- Delta: Spend $300+ & Get $120 Back. This one works out to 40% back if you spend exactly $300! That’s awesome. Unfortunately, this one was very highly targeted. I didn’t find it on any of my family’s cards.

To see a full list of current offers, click here: Current Amex Offers.

How to get targeted

Every time we publish details about a great Amex Offer, people ask why they weren’t targeted. Or, they ask, “How can I get targeted in the future?”

We don’t know the secret sauce Amex uses to target people or cards, but there are several things you can do to greatly increase your chances.

1. Get every type of Amex card

Amex treats consumer cards and small business cards very differently. They also treat cards that earn Membership Rewards points differently from those that earn other types of rewards. Often, offers are available for one type, but not another.

Frequently, offers are targeted only to Amex business cards. And some of these are targeted only to business Membership Rewards cards. Conversely, many offers are available only to consumer cards, and sometimes only to consumer Membership Rewards cards.

One way to increase your odds of getting targeted Amex Offers, is to make sure you have at least one of each type of card (consumer vs. business; and Membership Rewards vs other rewards). Here are my favorite fee-free Amex cards within each category:

Consumer Membership Rewards cards

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Great choice for keeping Membership Rewards points alive if you choose to cancel other Membership Rewards earning cards. Click here for our complete card review No Annual Fee Earning rate: ✦ 2x points at US supermarkets, on up to $6,000 per year in purchases (then 1x) ✦ 1x on other purchases Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: ✦ Make 20 or more purchases in a billing period and get 20% more points, less returns and credits ✦ Points transferrable to many airline programs (unusual feature for no annual fee card) ✦ Low intro APR: 0% for 15 months on purchases and balance transfers, then a variable rate, currently 13.24% to 24.24% ✦ $0 balance transfer fee. Balance transfers must be requested within 60 days from account opening. Terms apply. See Rates & Fees |

Consumer Non-Membership-Rewards cards

| Card Name w Details & Review (no offer) |

|---|

No Annual Fee Earning rate: ✦ 3% cash back as a statement credit at US supermarkets up to $6,000 per year in purchases (then 1%) ✦ 3% cash back as a statement credit at US gas stations on up to $6,000 per year, then 1%. ✦ 3% cash back as a statement credit on U.S. online retail purchases on up to $6,000 per year, then 1% ✦ 1% cash back as a statement credit on other purchases ✦ Terms apply. Base: 1% Gas: 3% Grocery: 3% Shop: 3% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: Get $7 back each month after using your Blue Cash Every Day card to spend $12.99 or more each month on an eligible subscription to The Disney Bundle. Terms Apply. |

FM Mini Review: This card isn't particularly rewarding, but it's good to keep primarily for targeted Amex upgrade offers to the Surpass card. No Annual Fee Earning rate: ✦ 7X Hilton eligible Hilton purchases ✦ 5X US restaurants, US Supermarkets, and US gas stations ✦ 3X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Gold elite status with $20K in eligible purchases in calendar year Noteworthy perks: ✦ Free Silver status; Gold status with $20K in eligible purchases. ✦ Terms Apply. |

Business Membership Rewards cards

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: 2X rewards for all spend (up to $50K per year) with no annual fee makes this card a winner. Click here for our complete card review No Annual Fee Earning rate: 2X Membership Rewards points on all purchases, up to $50K spend per calendar year (then 1X thereafter). Terms apply. (Rates & Fees) Base: 2X (3.1%) Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

Business Non-Membership-Rewards cards

| Card Name w Details & Review (no offer) |

|---|

No Annual Fee Earning rate: 2% cash back as a statement credit on all eligible purchases, up to $50K spend per calendar year (then 1% thereafter). Terms apply. Base: 2% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

FM Mini Review: For Amazon Prime members, this is a great card for Amazon, AWS, and Whole Foods purchases. Note though that Chase and Synchrony offer similar consumer cards. No Annual Fee Earning rate: Prime Members: 5% in Amazon rewards on US purchases at Amazon Business, AWS, Amazon.com, Whole Foods on up to $120K in purchases per calendar year, then 1% ✦ 2% Back in Amazon rewards at US restaurants, US gas stations, and on US wireless telephone services (excludes Google Fi) ✦ 1% back on all other purchases Base: 1% Dine: 2% Gas: 2% Grocery: 5% Shop: 5% Phone: 2% Brand: 5% Other: 2% Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. |

Above, I listed only Amex cards with no annual fees, but there are many excellent cards with fees too. See our Best Offers page for details. Note too that Amex limits cardholders to 4 primary credit card accounts. Charge cards (such as Amex Platinum cards, Amex Gold Card, Amex Green Card, etc.) are not similarly restricted, but they all have annual fees.

2. Get additional (free) Amex cards

You don’t have to sign up for new Amex accounts in order to get additional Amex cards. With Amex, every authorized user card has its own card number and is independently eligible for Amex Offers. With most Amex card accounts you can add authorized user cards for free. Even Platinum cardholders can request up to 99 authorized user Gold Cards for no additional fee.

Within a family, each Amex accountholder can easily add other family members as authorized users. In fact, sometimes Amex will offer bonus points for doing so.

3. Enroll quickly

The best Amex Offers have limited enrollment. If you don’t add the offers to your account in time, you may lose out. Keep an eye out for our posts about the latest Amex Offers. If a new one seems exciting, then load it to your account ASAP!

Summary

Amex Offers can be amazingly lucrative. To maximize your chances of getting in on all of the best offers, you could:

- Get every type of Amex card

- Get extra Amex cards (via authorized user and employee cards)

- Enroll quickly

My new Platinum card has only 40 offers. I did add 40 crappy offers looking for the Amazon offer.

PS I have checked in Chrome/Firefox on Android, Amex android app and a windows desktop.

Disappointing that the hotel offers such as Marriott are only valid for properties in the US. Why should it matter to them?

I don’t know, but Amex also often limits bonus point earnings to the US as well. My guess is that they can’t earn as much in credit card transaction fees outside of the US so they don’t want to encourage that.

Authorized users can create their own log ins and can avail all the Amex offers ?

Yes

Any DP on whether AMEX truly only rewards for room rate and charges to room? In other words can you include the taxes when determining if you hit the minimum spend? Thanks!

Taxes are included. For example, if you have a Marriott offer that requires $250 spend and the room rate is $200 plus you pay $50 in taxes or other services at the hotel, the total would trigger the offer. Really any charges at all at the hotel desk will trigger the offer.

My best AMEX offer ever was for $1,000 this past March. “Spend $5,000 on Tampa Bay Buccaneers season tickets, get $1,000 back.” I had already paid for my tickets with a different card, so I called the ticket office and had them refund that card and charge my tickets to my AMEX. In May, my season tickets were canceled and I worried about AMEX clawing back the $1,000. Fortunately, the Bucs let me roll over my season ticket money to next year.

Cool!

Thank you, Greg!

Curiously, I seem to very rarely get ANY of the Amazon offers, either on Amazon or AMEX. I believe we literally have almost every AMEX card out there. (Please do not attempt to fathom my credit card strategy.)

[…] Amex offers are over rated. But if you want to get more of them… […]

Perhaps I’m the only one experiencing an odd process with the Sam’s Club offer. There’s an immediate hit to my amex as a “pending charge”. After 1-2 days, this disappears. So there’s no “pending” nor “posted”. A couple days later, the purchase (in my case, a $50 GC) comes via UPS. A couple days later, acknowledgement from Sam’s. A few days after that, it’s at amex as “posted”. A few days after that, the $15 rebate posts. It’s quite bizarre and very different from the old days when an email acknowledgement came indicating “the offer has been achieved” moments after the transaction at other stores.

I don’t think you’re alone. This seems to vary from offer to offer