NOTICE: This post references card features that have changed, expired, or are not currently available

Hawaii vacation: when you hear those two words, what comes to mind? Palm trees, pineapples, coconuts, sandy beaches, waterfalls, mountains, luscious scenery and more I’m sure. For the majority of people, another word also comes to mind: expensive. But it doesn’t have to be that way thanks to award travel. In fact, one new credit card welcome bonus could cover four round trip tickets to Hawaii in economy class. One additional credit card could cover five nights of hotel in Waikiki Beach or three on Maui or Kauai. You could literally get away to paradise with two welcome bonuses and some cash in your pocket for food (which could be from a third welcome bonus if you so choose!). Learning how to use credit card rewards can make a dream trip an easy reality.

Get a Hawaii vacation with 2 credit card bonuses

Currently, there is a convergence of a couple of great opportunities to make a Hawaiian dream vacation a reality. This post offers a high-level overview of how it can be done with links throughout to resources for more. For those new to award travel and rewards credit cards, I highly recommend subscribing to our newsletter and weekly podcasts to begin building your knowledge in this realm. You can do that here:

thefrequentmiler.com/go/subscribe

Read on for an overview of how you could open 1 credit card to cover flights for multiple passengers to Hawaii and a second credit card to cover multiple nights of hotel and have a nearly-free Hawaiian vacation with just two new credit cards.

Economy class: 1 card for 4 round trip tickets to Hawaii

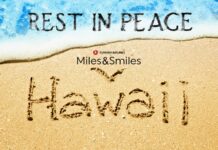

When it comes to booking award flights to Hawaii, there is a single runaway best value card to consider at the moment: the Citi Premier card. That’s because Citi’s ThankYou points can be transferred to United Airlines partner Turkish Airlines Miles & Smiles. Almost unbelievably, Turkish charges just 7,500 miles one-way in economy class for the same United flights that United offers for 22,500 United miles. That means you could take just 7,500 Citi ThankYou points and redeem them for a one-way ticket to Hawaii, paying just $5.60 in taxes. At 15K per passenger round trip, the Premier card’s welcome bonus is a runaway winner in terms of best value for tickets to Hawaii provided you can deal with the quirks of using Turkish miles to book flights on United (which are well worth the minor pain points in my opinion).

Here are the details of the Premier card:

| Card Offer |

|---|

ⓘ $741 1st Yr Value EstimateClick to learn about first year value estimates 60K Points 60,000 points after $4,000 spend in the first 3 months$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k after $6 spend in the first 3 months (ended 4/8/25) FM Mini Review: Very strong earnings for spend. Excellent bonus categories. Points transferable to select airlines. Recommend pairing this card with Citi Double Cash Click here for our complete card review |

How this card could cover your Hawaii flights:

- Fly United Airlines for 7,500 miles each way from anywhere in the US to/from Hawaii by transferring ThankYou points to Turkish Airlines Miles & Smiles (a 1:1 Citi transfer partner). Read more about how to book United flights with Turkish miles here.

Economy class: Other cards that offer enough points for at least 2 round trip tickets to Hawaii

While the Turkish Airlines sweet spot above is by far the best value for booking flights to Hawaii, there are some other cards on the market that offer enough points with a single welcome bonus to cover at least 2 passengers round trip. Some of the best options include:

| Card Offer |

|---|

ⓘ $651 1st Yr Value EstimateClick to learn about first year value estimates 80K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 80K points after $5K spend within first 3 months your account is open$299 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). |

How this card could cover your Hawaii flights:

- Southwest determines the cost of a flight in points based on the cash fare. Points are worth around 1.5c each toward paid fares. The interesting thing about this offer is that after meeting the spending requirement, you would have enough points to earn the Southwest Companion Pass. With the Companion Pass, a companion flies for free with you any time you fly Southwest, whether you book your flight with points or money. In other words, the welcome bonus will cover about $1500 in flights and you’ll be able to take a second passenger along on those flights and just pay the taxes ($5.60 each way). Learn more about the pass in our Southwest Companion Pass Complete Guide.

| Card Offer |

|---|

ⓘ $1277 1st Yr Value EstimateClick to learn about first year value estimates 100K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 100K after $8K spend in the first 3 months$95 Annual Fee Recent better offer: 120K after $8K spend (expired 9/4/24) FM Mini Review: Great card for welcome offer and 3X categories. Also consider the Ink Business Cash for its 5X categories, and the Ink Business Unlimited to earn 1.5X everywhere. |

First, it is worth noting that this is a business card.

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

How the Chase Ink Business Preferred card could cover your Hawaii flights:

- Chase transfer partner British Airways offers a distance-based award chart. Those who live on the west coast can book direct flights on American or Alaska Airlines for just 13K Avios (transferred from 13K Ultimate Rewards pionts) each way. At 26K points round trip per passenger, the welcome bonus alone could cover as many as 3 passengers round trip.

- Chase transfer partner Singapore Airlines charges 17.5K miles each way to fly on United between the continental US and Hawaii, but you’d be better off using ThankYou points to book the same flights since Turkish Airlines charges just 7.5K miles each way as shown above. However, Singapore is also partners with Alaska Airlines and charges as few as 11,500 miles one way to fly on Alaska Airlines from states like Arizona, Colorado, Nevada, and Utah (and more) or 12K miles each way from California, Oregon, or Washington. After meeting the minimum spending requirement, you would have enough points to fly 3 passengers round trip and a fourth passenger one way. Read more about this sweet spot here.

| Card Offer |

|---|

ⓘ $985 1st Yr Value Estimate$50 prepaid hotel credit valued at $35 Click to learn about first year value estimates 75K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 75,000 bonus points after spending $5,000 within the first three months from account opening.$95 Annual Fee Recent better offer: Expired 5/14/25: 100K after $5K spend FM Mini Review: Great welcome offer. Unlocks ability to transfer points to hotel & airline partners. Solid option to pair with no annual fee Ultimate Rewards cards such as the Freedom cards, Ink Business Cash, and Ink Business Unlimited. |

This card has the same sweet spots as the Chase Ink Business Preferred, but the Sapphire Preferred is not a business card.

How this card could cover your Hawaii flights:

- Chase transfer partner British Airways offers a distance-based award chart. Those who live on the west coast can book direct flights on American or Alaska Airlines for just 13K Avios (transferred from 13K Ultimate Rewards pionts) each way. At 26K points round trip per passenger, the welcome bonus could cover as many as 2 passengers round trip.

- Chase transfer partner Singapore Airlines charges 17.5K miles each way to fly on United between the continental US and Hawaii, but you’d be better off using ThankYou points to book the same flights since Turkish Airlines charges just 7.5K miles each way as shown above. However, Singapore is also partners with Alaska Airlines and charges as few as 11,500 miles one way to fly on Alaska Airlines from states like Arizona, Colorado, Nevada, and Utah (and more) or 12K miles each way from California, Oregon, or Washington. Read more about this sweet spot here.

| Card Offer |

|---|

ⓘ $885 1st Yr Value EstimateClick to learn about first year value estimates 75K Miles + 2,000 PQP ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 75K miles + 2,000 PQP after $5K spend in first 3 months. Plus, earn an extra 10,000 miles after you add an authorized user to your account in the first 3 months your account is open.$0 introductory annual fee for the first year, then $150 Recent better offer: 125K miles after $5K spend in first 3 months (expired 5/8/25) FM Mini Review: Decent perks such as enhanced access to United saver level economy awards makes this a keeper for some. |

How this card could cover your Hawaii flights:

- Since United starts at 22.5K miles each way for saver-level fares from the continental US to/from Hawaii, the welcome bonus could potentially cover 2 passengers round trip. However, note that those same flights that are available for 22.5K miles should be bookable with just 7.5K Turkish Airlines miles if you instead open the Citi Premier card and transfer ThankYou points to Turkish Airlines. I am including the United Business Card here because it meets my criteria of covering flights to Hawaii, but the better bet is the Premier card for those looking to fly United on the cheapest saver-level award tickets.

| Card Offer |

|---|

ⓘ $795 1st Yr Value EstimateClick to learn about first year value estimates 90K Avios Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler Earn 90K Avios after $5K spend in the first 3 months$95 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 7/4/22: 100K after $5K spend FM Mini Review: Good choice for a nice intro bonus. Award rebate makes the card a keeper if you frequently book awards from the US to Europe. |

How this card could cover your Hawaii flights:

- British Airways offers a distance-based award chart. Those who live on the west coast can book direct flights on American or Alaska Airlines for just 13K Avios (transferred from 13K Ultimate Rewards pionts) each way. At 26K points round trip per passenger, the points earned from the welcome bonus and the minimum spend would be more than enough for four passengers round trip if you live on the west coast and can fly direct.

First class: 1 card for 2 round trip first class tickets to Hawaii

Domestic carriers like United, American, and Delta refer to their highest cabin as first class (though many award travelers consider this to be more like business class compared to foreign carriers). First class awards to Hawaii are notoriously card to find, and most flights to Hawaii only feature domestic recliner seats in first class. The few routes with true lie-flat business class seats are not known for releasing many seats in business class, but your best option if you can find them is:

| Card Offer |

|---|

ⓘ $741 1st Yr Value EstimateClick to learn about first year value estimates 60K Points 60,000 points after $4,000 spend in the first 3 months$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k after $6 spend in the first 3 months (ended 4/8/25) FM Mini Review: Very strong earnings for spend. Excellent bonus categories. Points transferable to select airlines. Recommend pairing this card with Citi Double Cash Click here for our complete card review |

How this card could cover your Hawaii flights:

- Fly United Airlines first class for 12,500 miles each way from anywhere in the US to/from Hawaii by transferring ThankYou points to Turkish Airlines Miles & Smiles (a 1:1 Citi transfer partner). Read more about how to book United flights with Turkish miles here. Note that Turkish Airlines can not book mixed-cabin awards (where you fly a segment in economy class and a segment in first class), you will need first class available on all segments. Note also that Turkish can not book segments operated by Hawaiian airlines, nor expanded availability that is only available to Chase United cardholders or United elite status holders.

Hotels for your Hawaii vacation: covering multiple nights with a single welcome bonus

When it comes to hotels, one ecosystem is the clear stand-out for Hawaii: Chase Ultimate Rewards. That is because Chase partners will Hyatt and Hyatt has a range of properties in Hawaii that can be booked with points. From the Hyatt Place Waikiki Beach (12K points per night) to the Grand Hyatt Kauai (25K points per night) or the Andaz Maui (30K points per night), Hyatt has a nice range of options and since Chase points transfer to Hyatt 1:1, you’ll have enough for multiple nights from a single welcome bonus. Better still, Hyatt does not charge resort fees on award stays, so you can easily save yourself $30-$40 per night by booking an award stay with Hyatt.

Additionally, if you happen to know someone with top-tier Hyatt Globalist elite status (achieved by spending earning 60 elite night credits in a calendar year), you can enjoy a really good stay: transfer your Hyatt points to a Globalist member and ask them to book your stay as a Guest of Honor and you will receive their Globalist elite benefits (See: How to get top-tier Hyatt elite benefits without status). This means lounge access for free food and drinks in the lounge if your chosen hotel has a lounge (like the Grand Hyatt Kauai or Hyatt Regency Maui) or free breakfast for 2 in the restaurant if there is no lounge (which can be great at properties like the Andaz Maui where breakfast comes to nearly $50 per person), free parking (an easy $50 per day savings at some Hawaii properties), a 4pm late checkout, and a nice room upgrade that could even be to a suite. I got an amazing suite upgrade at the Grand Hyatt Kauai last year on a guest of honor stay.

For this reason, your best options from Chase would include:

| Card Offer |

|---|

ⓘ $1277 1st Yr Value EstimateClick to learn about first year value estimates 100K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 100K after $8K spend in the first 3 months$95 Annual Fee Recent better offer: 120K after $8K spend (expired 9/4/24) FM Mini Review: Great card for welcome offer and 3X categories. Also consider the Ink Business Cash for its 5X categories, and the Ink Business Unlimited to earn 1.5X everywhere. |

| Card Offer |

|---|

ⓘ $985 1st Yr Value Estimate$50 prepaid hotel credit valued at $35 Click to learn about first year value estimates 75K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 75,000 bonus points after spending $5,000 within the first three months from account opening.$95 Annual Fee Recent better offer: Expired 5/14/25: 100K after $5K spend FM Mini Review: Great welcome offer. Unlocks ability to transfer points to hotel & airline partners. Solid option to pair with no annual fee Ultimate Rewards cards such as the Freedom cards, Ink Business Cash, and Ink Business Unlimited. |

| Card Offer |

|---|

ⓘ $1029 1st Yr Value EstimateClick to learn about first year value estimates $750 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $750(*awarded as 75,000 points) after $6k spend in the first 3 months.No Annual Fee Recent better offer: $900 (*awarded as 90,000 points) after $6k spend in the first 3 months. (Expired 11/13/25) FM Mini Review: This one should be in everyone's wallet. Incredible welcome offer for a no-annual-fee card. Great card for 5X categories. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review |

Some may also consider the World of Hyatt credit card given the fact that in addition to a nice welcome bonus, it offers a free Category 1-4 night each year plus an additional free Category 1-4 night when you spend $15,000 in your cardmember year.

| Card Offer |

|---|

ⓘ $790 1st Yr Value Estimate5 Hyatt Category 1-4 free night certificates valued at $1080 Click to learn about first year value estimates Up to 5 Free Night Certificates ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 3 Hyatt Category 1-4 free night certificates after you spend $5,000 on purchases in the first 3 months of account opening, plus 2 additional 1-4 certs after you spend $15,000 on purchases in the first 6 months.$95 Annual Fee This card is subject to Chase's 5/24 rule. FM Mini Review: Great card for welcome offer and annual free night. Might be worth using regularly for additional free night and as a path to status. |

However, those interested in non-Hyatt options might consider the Hilton Aspire card. While this card carries a high annual fee, the benefits can far outpace the fee. You’ll get 1 free weekend night at nearly any Hilton property in the world each year and a $250 Hilton resort credit each cardmember year in addition to $250 in airline fee credits. You’ll also get Hilton Diamond status, which gets you free breakfast for 2 each day and lounge access at properties that have a lounge (though note that a few properties, like the Hilton Waikoloa Village near Kona on The Big Island, offer dollar-based vouchers you can use at different outlets and may not cover breakfast — while uncommon, it does apply at some Hawaiian properties). After meeting the welcome bonus and the free weekend night certificate, you may be able to score 3 free nights at some Hawaiian properties and have a $250 resort credit to go with it.

| Card Offer |

|---|

ⓘ $811 1st Yr Value Estimate$400 Hilton resort credit ($200 per six months) valued at $280, Hilton Free Night valued at $418, $200 airline credit ($50 per quarter) valued at $160 Click to learn about first year value estimates 150K Points + free night certificate ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 150K after $6K spend in first 6 months of card membership. Free night certificate every year - first certificate is awarded 8-12 weeks after approval. Terms apply. Rates & Fees$550 Annual Fee Recent better offer: 175K point after $6k spend in first 6 months (Expired 1/14/26) FM Mini Review: This card is loaded with valuable perks that are more than worth the card's annual fee if you stay in Hilton resorts at least twice per year. |

Hawaii vacation with 2 credit cards: Bottom line

A Hawaii vacation is a dream that many people think will require a major financial commitment, but it could be much easier: opening one new credit card could easily cover round trip flights for at least two people and opening a second new credit card could easily cover 3-5 free nights in a hotel in Hawaii. If you’re playing in 2-player mode (where both you and a partner are willing to open a new card or two), you could stack points together to get yourself a week’s vacation to Hawaii and just pay for your food and drinks. It doesn’t need to be expensive to get to paradise, you just need to prepare. Earn miles without flying and learn to leverage them by subscribing to our newsletters and get ready to enjoy an outsized vacation.

[…] Build your own Hawaii vacation package with 2 credit cards […]