NOTICE: This post references card features that have changed, expired, or are not currently available

I’m laying all my cards on the table. Tomorrow evening (June 22 9pm ET), the Frequent Miler team will be livesteaming our 3 Cards 3 Continents draft (details here). We’ll take turns picking 3 card bonuses from our Best Offers page and we’ll use the resulting bonuses as our budget to build the most amazing 3 continent trip we can dream up. The winner will be chosen by readers after our trips are done. In this post I’m going to lay out my full strategy… cards up.

Full details about our 3 Cards 3 Continents challenge can be found here.

Why reveal my plans?

Nick, the guy who gets to pick first in the draft, recently suggested that he might use his first pick to try to block Stephen’s and my plans. Surely, by revealing my strategy here, I’m just making his nefarious plans that much easier, right? Right. Nevertheless, there are multiple reasons I decided to go ahead and publish my full strategy…

- Despite what Nick wrote, I don’t believe for a second that Nick or Stephen will risk their own plans in order to block mine. With award availability at an all time low, this challenge is going to be hard enough even for the person that gets all 3 of their first choice cards.

- Before writing this post, my head (and spreadsheet) was spinning with ideas, strategies, contingencies, and back-up contingencies. Writing this post helped tremendously to clarify my thoughts.

- I believe that I have a plan that will work regardless of what Nick and Stephen do. Even though I am handicapped with the 3rd pick in the first round, I also get the 1st pick in the second round. This is very helpful! No matter what Nick and Stephen do with their first picks, I know that only two cards will then be off the table. I can then pick the next two best choices to meet my goals. My 3rd pick will be the last of the night, but I’m confident that I can make that work too, regardless of what goes before.

- Neither Nick nor Stephen can be sure that what I published here is really true. They’re probably reading this thinking “aha, Greg is really documenting what he won’t do in order to throw us off.” They’re wrong about that, but they can’t know for sure, can they?

My high level approach

I have two specific self-imposed goals in this challenge. The first is to make use of ANA’s Star Alliance Round the World award. This is one of the sweetest award sweet-spots in existence today and it’s high time I’ve booked it.

Second, I want to show the extremes of what is possible with Citi points transferred to Choice for high end hotel stays. Since Citi points transfer 1 to 2 to Choice, the current 80K Citi Premier offer would net 160K Choice points. I could do a lot with that! Choice has some excellent Ascend Collection hotels and Nordic Choice hotels to choose from, as well as the ability to book some really amazing Preferred Hotels & Resorts.

The problem with my Choice plan is that I get the 3rd pick in the first round of the draft and so I think I’ll be pretty lucky if the Premier card is still available for my turn. My backup plan for hotels is the Bonvoy Boundless offer for five 50K free night certificates. I would then do my best to stay in a different awesome Marriott hotel each night, perhaps on 5 different continents (that would be kind of cool, wouldn’t it?).

Why wouldn’t I pick Hyatt for my hotel plans? Hyatt would be easy. There are some amazing properties around the world that go for under 15K points per night. Plus, it’s often possible to stay in incredible suites for just a bit more. To me, Hyatt makes it too easy. I want to find Choice’s hidden gems (or Marriott’s hidden gems if I really have to). Plus, I’m hoping that Nick or Stephen will go for Hyatt stays.

ANA’s Round the World Award

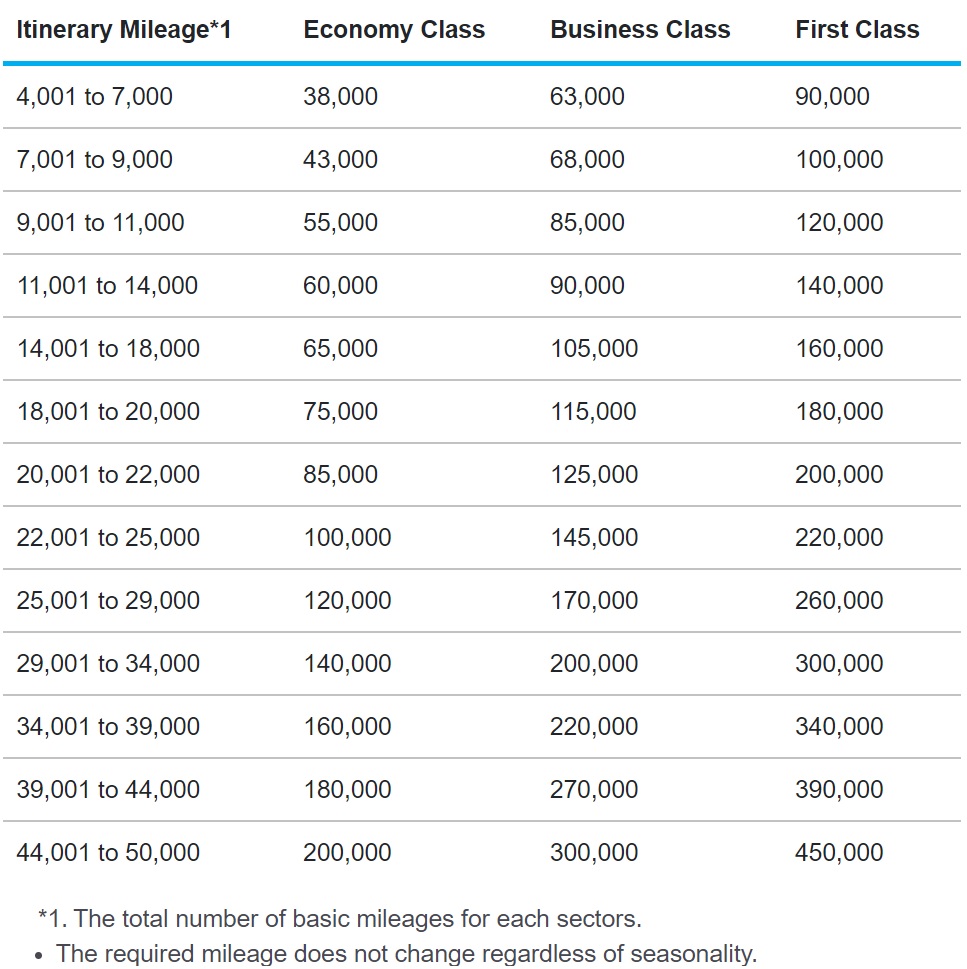

While most airline loyalty programs have increased award prices many times over the years, ANA’s Star Alliance Round the World award has remained intact for as long as I’ve known about it. This award offers extraordinary value, especially for business class. Award prices are based on distance bands. While distances flown can vary tremendously, common Round the World itineraries will cover between 20,000 and 29,000 miles flown. Given those distances, business class, around the world, would cost anywhere from 115,000 to 170,000 ANA miles:

Amex Required

ANA doesn’t offer any credit cards with significant bonuses. The only way that I can get enough ANA points to build a Round the World award is to sign up for Amex Membership Rewards cards. Amex Membership Rewards is the only transferable points program that supports 1 to 1 transfers to ANA.

Lots of Cash Needed

Flight awards are rarely free. In addition to exchanging airline miles for flights, you often have to also pay government taxes, airport fees, and fuel surcharges. Some loyalty programs do not pass along fuel surcharges on award tickets, but ANA does. And fuel surcharges can be huge. In order to have a chance of coming in under budget, I will have to find awards on airlines that don’t have high surcharges and/or on routes that limit surcharges. And I’ll have to avoid departing from airports that require huge fees. But award availability these days is at an all time low, so this will be a huge challenge. My guess is that I’ll need at least $1,000 available to book ANA’s Round the World award. But that’s not all. I’ll also have to account for airport transfers (e.g. getting from/to the airport and my hotel). My guess is that I can make that work with another $200.

Altogether, I think I need at least $1,200 to make this all work (this is just a very rough guestimate!). Since we start with only a $1,000 budget, and each card with an annual fee reduces that budget, I’ll need to sign up for at least one credit card that offers a big cash bonus or offers points that are redeemable for cash or for travel purchases. For example, the Capital One Venture and Spark Miles cards offer “Miles” which can be used to reimburse travel spend. Bonuses from those cards would work.

How I’ll get enough Amex points

The 150K Option

Initially, I thought my best option would be the Amex Platinum 150K offer. That would give me enough Amex points to fly up to 25,000 miles around the world in business class. This offer requires $6K spend which is a bit more than I’d like, but not too bad. It would still allow me to sign up for two more cards that have $4K spend requirements.

The problem with the Platinum card is its $695 annual fee. That would leave me with only $305 to cover the annual fees of two more cards. Worse, it would leave me with almost no cash cushion at all. I would have to earn a lot of cash with at least one of my next two credit card picks in order to cover the $1,200 that I think I’ll need for this trip. And guess what? There is no single card I can pick up within the rules of this contest that would give me that much cash. Well… the Schwab Platinum 100K offer would come close (since it allows points to be redeemed for cash at 1.1 cents each), but I wouldn’t be able to afford two Platinum card annual fees within the rules of this contest. If I got the cash from two welcome bonuses instead, I’d be stuck without an approach for lodging. From the Platinum card itself, all I’d have is its $200 hotel benefit (for Fine Hotels & Resorts or The Hotel Collection). That’s not enough.

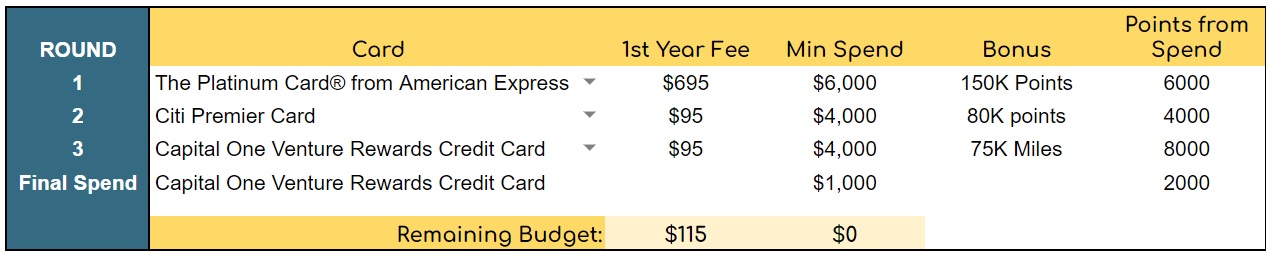

The one way I could make this work is if my three picks include the Platinum card, the Citi Premier card, and the Capital One Venture card. With all 3, I would have $115 left over from the original $1K budget. Plus, after spending a total of $5K on the Venture card, I’d have 85,000 “Miles” redeemable for $850 in travel. Then I’d only have to cash in around 20,000 Citi points to have a big enough budget overall.

The chance of me getting to pick all 3 of the above cards seems incredibly unlikely. What if I swapped in the Sapphire Preferred 60K offer instead of either the Premier or Venture? Would that work? If I used it to replace the Citi Premier, I would need all of the Chase points to cover hotel stays, so no that wouldn’t work. If I used it to replace the Venture, I would end up with $200 less to work with because I wouldn’t be able to use the Chase points at 1.25 cents value for things like award taxes and fees. It might be possible to make this work, but it would be a stretch.

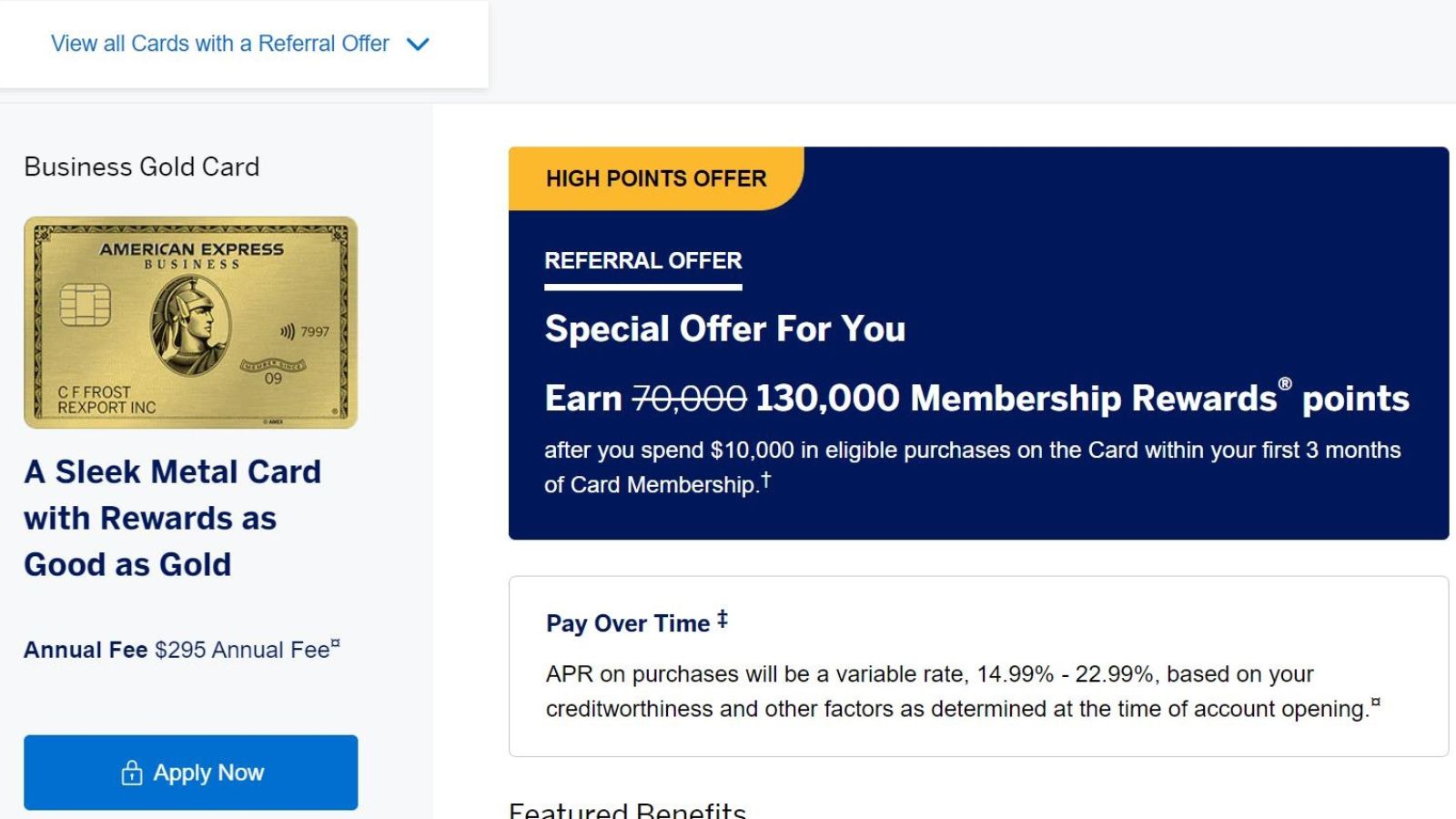

The 130K Option

The next possibility I considered is the targeted 130K Business Gold offer. By opening a referral link in a clean browser, it is sometimes possible to get targeted for this one. As a team, we agreed that offers like this would be fair game as long as the offer is listed on our blog’s card page as an alternate offer AND as long as we can show that we can get the offer to appear during the livestream draft. That last part proved to be difficult for me. I had no luck with private browsing Chrome, Firefox, or Edge on my laptop; nor with Chrome or Safari on my phone. Finally, thanks to reader comments, I tried out the Brave Browser (which was new to me!) on my laptop and was able to pull up the offer. That doesn’t guarantee I’ll be able to pull it up during the draft, but it makes it much more likely.

After meeting the required spend, I’d have 140K points from this offer. 140K points is more than enough to fly up to 22,000 miles around the world in business class. I could make that work, no problem. Plus, I may find a good use for the 15K points I’d have leftover. The Business Gold card’s annual fee is only $375, so I’d have an extra $400 in cash to work with compared to if I signed up for the Platinum card. That’s almost a sign-up bonus worth of cash right there.

The problem with the Business Gold card is its $10K spend requirement. That would leave me with only $5K to spend on other cards because each contestant has a maximum of $15K they can spend towards meeting offer spend requirements. Most of the best offers that I’d be likely to pick in round 2 (including the 80K Citi Premier offer) require $4K spend and so I’d only have $1K left for round 3 to try to get more money to cover award taxes & fees and airport transfers. That would be really tough because most of the good cash and cash-like offers require at least $4K spend. The best current cash back option I can find with $1K or less spend required is for the Disney Premier Card which would get me $251 back after paying the $49 annual fee. That’s not enough.

If I went with the Business Gold option, the Citi Premier would be my second pick, but I would have to use a significant portion (around 60K) of the Citi Premier 80K bonus as cash back. If the Citi Premier isn’t available, my next best second pick is the Capital One Venture 75K offer. After the card’s $95 annual fee, this would give me $655 of travel spend. Either way, I’d then sign up for a hotel card with a $1K spend requirement (maybe the no-fee Hilton card, for example). My hotel budget then would be super tight, so I don’t at all love this option. That said, I would have some Amex points left over that can transfer to Hilton 1 to 2 (and hopefully better if a transfer bonus returns). Still, finding great Hilton properties for few points is not a game stacked in my favor.

Overall, I’m not too enthused by the Business Gold option!

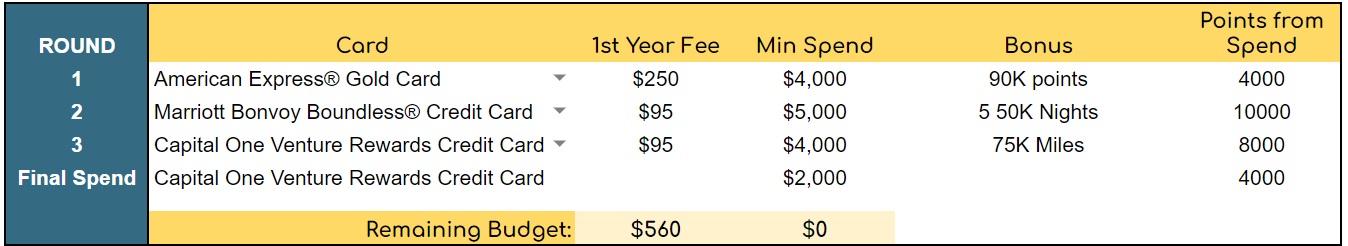

The 90K Option

One of my favorite options is to go with the consumer Amex Gold 90K offer. This one requires only $4K spend and has a modest $250 annual fee. At first I dismissed this since I didn’t think 90K would be enough for a Round the World award (and I don’t think I can afford to pick up two Amex Membership Rewards cards), but then I did some research and found that it is actually possible to do the around the world award for 90K by keeping the total miles flown to under 14,000. This is possible because ANA doesn’t count open-jaw segments in their distance calculations. So, for example, I could fly to western Europe from the U.S. east coast, find an inexpensive way to get to eastern Europe or perhaps the Middle East, then continue around the world to Hawaii to complete the award. Finally, If I had 7,500 Citi ThankYou points or Capital One Miles, I could transfer to Turkish to book a United flight home. Since the Gold card only requires $4K spend, I could still pick up a good hotel card option (such as the Citi Premier or Bonvoy Boundless) and a good cash-like option (such as the Capital One Venture) and I should be good to go!

My Draft Decision Tree

Most of my decisions hinge on what Nick and Stephen pick in the first round of the draft. I will then get to do my round 1 and round 2 picks back to back. So, this decision tree is organized around which cards may be available for me to pick in the 1st and 2nd round…

First preference: If both the Citi Premier & Venture are available, then:

If both the Citi Premier & Venture are available for my round 1 and 2 picks, then I can make my plans work with whichever of these is still available for my 3rd pick: the Amex Gold 90K offer, Amex Platinum 150K offer, or either of the Schwab or Morgan Stanley Platinum 100K offers. So my picks would be:

- Round 1: Citi Premier 80K

- Round 2: Capital One Venture 75K

- Round 3: Amex Gold 90K, or Amex Platinum 150K, or Alternative Platinum 100K [Note: It’s impossible for all 3 Platinum cards to be gone because the annual fees are too high for someone to take more than 1]

Second preference: If Amex Gold 90K is available, then:

- Round 1: Amex Gold 90K

- Round 2: Citi Premier 80K, Capital One Venture 75K, or Chase Sapphire Preferred 60K

- Round 3: Marriott Bonvoy Boundless 5 Free Nights, or IHG Premier 140K, or IHG Premier Business 140K

Third preference: Business Gold 130K

If I get down to this option it can only be because the consumer Gold card has been taken, and one of either the Citi Premier or Venture cards has been taken, but not both. I can make the Business Gold option work with either one of them. So…

- Round 1: Amex Business Gold 130K

- Round 2: Citi Premier 80K or Capital One Venture 75K

- Round 3: Any $1K spend hotel card (Hilton, Wyndham, Sonesta)

Back up plan: if I can’t get the Business Gold 130K offer to appear…

If I get down to this last-resort option it can only be because the consumer Gold card has been taken, I can’t get the Business Gold 130K offer to appear, and one of either the Citi Premier or Venture cards has been taken, but not both.

- Round 1: Chase Sapphire Preferred 60K [If we get this far, this option will be available because Nick and Stephen took the Gold card and either the Premier or Venture card in round 1 picks 1 and 2]

- Round 2: Citi Premier 80K or Capital One Venture 75K

- Round 3: Amex Platinum 150K, or Alternative Platinum 100K [Note: It’s impossible for all 3 Platinum cards to be gone because the annual fees are too high for someone to take more than 1]

This is my backup plan because it doesn’t leave much room for a hotel budget. It will help that I’ll have $200 to spend on Fine Hotels & Resorts or The Hotel Collection, but I’d have to be in a very cheap hotel market to stretch that to more than 1 or 2 nights. I’ll have to also be creative with the Sapphire Preferred points transferrable to Hyatt. That wouldn’t be hard except that I think I’ll need most of those points to cover award fees and airport transfers.

Thoughts? Suggestions?

Do you see any holes in my plans? Do you have suggestions for better options? Please comment below!

I would recommend looking at countries (such as Brazil) that limit fuel surcharges for starting your ana RTW trip. You might find that the flight there will be less then the surcharges you will save, plus it will really open up your options for who and where to fly.

Can you choose which category the spend counts toward? If so any 5x back card or cards that give increase multipliers for certain categories would be really valuable. For instance, the resy plat offer is still 10x for restaurant spend. If you allocate $6k of spend toward restaurants that will get you 120k+60k mr points. 30k better than the 150k Plat offer. It may be so good that you can allocate $10k of spend toward the 10x category. The return of 10x may be better than a lot of still available cards when you pick

No we decided that we would count all spend as base, non-bonused spend

I wonder if anyone is thinking about using aeroplan with their stopover that only costs 5,000 points. Might be a decent choice since Aeroplan doesn’t pass on any fuel surcharges.

Tell me if my thinking is wrong, but with Aeroplan, could you say decide you ultimately wanted to end up in Lima, Peru (Machu Picchu seems like an excellent destination), but wanted a stopover in Istanbul. The total this would cost is 65,000 Aeroplan miles because any distance over 4,501 is only 60,000 points in business class plus the 5,000 for the stopover. I’m not sure when this game starts, but I found business class from JFK to IST, via CAI, with an 24 hour layover in CAI, which would allow you to get a hotel and go see the pyramids for Africa, then head onto IST for your stopover, which would be both Europe and Africa. Then take the business class flight from IST to LIM via PEY or BOG. Then you could leave LIM and do a stopover in Tokyo and come back to JFK, again for 65,000 Aeroplan miles. So you would hit 4 continents and have no fuel surcharges passed on…plus Aeroplan is a transfer partner to Amex, Chase, & Capital One. The Business Gold 130K card would give you all of the points you need and with two other $95 annual fee cards, the $560 leftover would probably cover the award fees.

I’ve thought this over and played with different combos, and I’ve come to a few conclusions:

-Each player really needs amex points, a hotel plan and a way to produce cash. As Greg writes here, the Amex points are for ANA. You really get the best bang for your buck with ANA miles and I wouldn’t be surprised if (or even expect) all 3 to book their flights via ANA.

-The $1k AF and $15k spend totals are very limiting. IMO, this makes the Premier and Gold cards the most valuable, and why I don’t think the 150k Platinum will go until the 6th/7th pick. If Nick starts with the 150k Platinum, it makes it very hard for him to find a way to produce cash with his final 2 cards. Same goes for Stephen with the second pick. And Greg just wrote that he won’t take the Platinum with pick 3/4 (and, despite point 4 above, I think we all know that he’s too honest to go against this post). Even Stephen grabbing it at the 5th spot wouldn’t be good for him because he’d be without good hotel/cash options, and he’d only have the cash for a $55 AF card with his last pick.

So, here are my guesses:

1) Premier (Nick)

2) Gold (Stephen)

3) Biz Gold @ 130k (Greg)

4) Venture (Greg)

5) Marriott Boundless (Stephen)

6) Platinum (Nick)

7) Sapphire Preferred (Nick)

8) Venture X (Stephen)

9) Wyndham Biz Earner (Greg)

One wildcard here is the Brex card. 110k points with $0 AF, but it takes $9k spend. I’m guessing it doesn’t go, but I think it would’ve if the spend was just $1k less ($8k). If it does go, I think Stephen grabs it with the 5th pick then needs to take a hotel card with a SUB spend of $2k or less with pick #8 (like the 130k surpass offer).

We’ll see what happens. These guys are the experts, so it wouldn’t surprise me if Nick takes the platinum with his first pick and then has some crafty way to make it all work with his last two picks, but I couldn’t figure out a worthwhile way to do it!

It will be very interesting to see how well your predictions pan out. I’m hoping not well because I really want to do either the Premier or Bonvoy for hotels.

If you really want one of those for your hotels, are you saying you might go against your plan and take the boundless card if it’s available at picks 3/4?

At least I’m prognosticating that you can make the 130k biz gold appear!

No I’m sticking to my plan.

I don’t want to give away too much, but ANA isn’t part of my plans. Of the three cards you picked for me, only one of them is one that’s on my radar – I’ll let you (and Greg & Nick) try to work out which one that is 😉

Awesome! I was thinking that the place to start was with the airline sweet spot you want to use, and then build your draft strategy around that (even if you don’t draft your airline card in the first round). ANA seems to be the easiest to use all-around, but there are obviously other sweet spots. For the sake of keeping things easy in my guessing, I decided that everyone would need an Amex card for flights (and maybe you still do), but it makes me excited to see your strategy. T-minus 13 hours until the draft!

I think a decent Amex bonus is almost a necessity if you’re looking to tap 3 continents.

I know you thought about the possibility of a Hilton transfer, but if you end up with the Boundless, you’d have the flexibility to top off those 50k certificates as well. In terms of bang for the buck, the Boundless at $95 AF is pretty hard to beat. Great ROI!

However this goes down, it’s most assuredly going to be both entertaining and educational. Good luck to all, and enjoy the ride!

PS. Anyone who visits Antarctica in this competition should automatically win. He will certainly win my vote.

Absolutely!

You’ve addressed award availability in these posts, but what about the availability of acquiring the cards in the first place? In general, the drafts are being done assuming everyone will be able to acquire every card they want. What happens if the bank foils your plans? Some glaring pitfalls:

They’re not actually opening the cards. They’re just using the points as if I did open them and met the spend.

Wow, tough crowd with all the downvotes. I re-read the original post and yup, I missed the note about not actually signing up for the cards. Fair enough, although in the spirit of educating readers, I do think it’s worth a mention of the reality of actually attaining these cards IRL.

How will you draft the Capital One Venture card if Capital One has shut down your account? Even though you arent actually opening the card in this challenge, wouldn’t you still need an equivalent number of points already in your account to spend on the challenge? Would Nick or Stephen just loan you the points if you draft the Capital One card?

Greg’s wife has cap1 account.

It seems like he’d be mostly using the Capital One card for cashback, so he could just pay for those costs with cash, rather than needing Venture miles in order to book anything on his trip.

I think the idea is to create a challenge that has applicability to us.

If this really were just a competition to see who “wins,” then maybe those kind of limits would be relevant. But most people can get a cap 1 card and can use the points and so I think the competition should not really take into account this bizarre C1 ban that Greg has. Just my two cents.

I will have to account for travel expenses as if I used Capital One Miles, but I wouldn’t really have to. As Stephen said, for things where I’d redeem Capital One Miles for cash back, I’ll just pay with whatever approach is most convenient to me, but in our accounting spreadsheets I’ll “deduct” the correct number of Capital One Miles. Similarly, if I want to transfer the Miles to an airline program, I could get the same miles from elsewhere (or I may already have them) or I could even book the same flights with some other currency as long as I account for the costs that would have been charged if I started with Capital One Miles

If ANA round the world doesn’t work out, consider the following: With fuel surcharges and high hotel prices, I’d avoid Western Europe. I’d similarly avoid East Asia due to Covid restrictions. The best bang for your buck would be Southeast Asia, South America, India, Northern Africa, Eastern Europe and Middle East. Asia is so huge so unless you do go around the world it’s impractical to try to hit East or SE Asia.

I’d try to route through Brazil to Northern Africa to Istanbul which would get you 4 continents (SA, Africa, Europe, Asia) with would require relatively less distance flown. These countries should be cheap enough that you can pay cash or really stretch Marriott or Hilton points.

I’ve been thinking along similar lines even if RTW does work out

Good strategies, although most likely none of 3 options will go by this plan with other players being picky as well.

There is also Alaska 60,000+$100 offer that can produce a nice award ticket with a stopover(s) if saver-level tickets can be found for the route. For 65k one can go anywhere in Asia in business, or for 40k+ in economy from/to USA.

For hotels: Wyndham Business card can be an option with 75,000 bonus and nights start at only 7,500 or 15,000 points at nice properties around the globe.

Also with any Amex MR card, one can use MRs for hotels or cover cash airfare, plus cover some food expenses with Uber benefit.

All players probably need to consider getting an airport lounge benefit with the card picks – as it can cover some food during their travel. Also some countries/airlines offer free city tours to ticket holders with long layovers, like Singapore or Istanbul – that can save significant money on transfers. Some even provide free hotel nights.

Excited to see fresh ideas flowing and possibilities for award travel on a budget!

Good luck to all players!

I don’t think food/activities count towards the budget this time around.

Correct. Food & activities will be a separate budget

Greg, I like the plan, but my gut feel is the current ANA fuel surcharges are going to put you over budget. Excited for this challenge though!

There are enough airlines without fuel surcharges for him to get around the world, but whether limiting his destinations based on those airlines and their availability will make for the best trip remains to be seen :-D.

Who says you’re not planning to go that route yourself tricky Nicky?!?!

He has to be — aiming for the ANA around the world is the natural first choice — 1 card and (nearly) all the flights are done. And in doing so it would be hard to make it a trip not potentially worthy of a win.