NOTICE: This post references card features that have changed, expired, or are not currently available

When we kicked off the week after the big holiday sales, I wouldn’t have predicted the excitement to come. It’s been a big week here at Frequent Miler — from huge news (and a yuge deal) out of Google Fi to the best features of Marriott finally expanding to more SPG brands, there was good news galore. Balancing that out, we reported on frustrations over Amex’s failure to code restaurants as, well, restaurants. All that and more – read on for this week’s recap.

The games we play

Has anyone ever asked you why you’re buying Amazon gift cards at Staples with your Amex instead of just, ya know, buying stuff the traditional way? Or why you’re flying from New York to Africa via Hong Kong? This post is a terrific resource to bookmark and share the next time you’re trying to explain to someone how and why you do what you do.

Google’s Project Fi abroad. 6 surprises: 3 good and 3 bad.

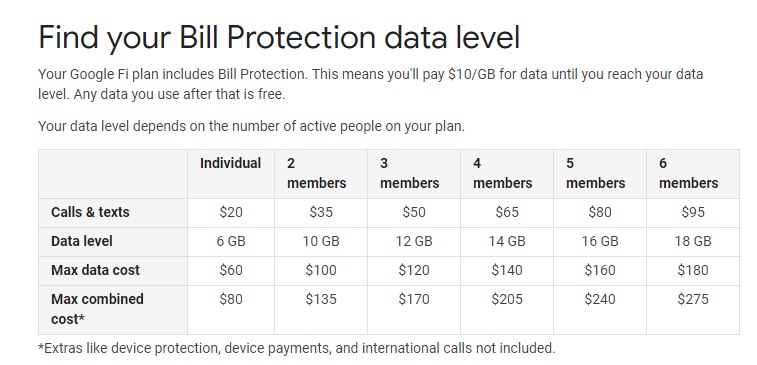

When Greg scheduled this post for Monday, I can’t imagine he could have foreseen the fantastic deal to come just two days later. In this post, written before we all got swept away by one of the hottest deals of 2018, Greg shares a bit about his real-world experience with Google Fi abroad. I always find it helpful to read stuff like this to get a feel for the good and the bad before I jump in head first. That said, I know many people probably jumped in with their eyes closed on Tuesday thinking they’d buy first and ask questions later. If that’s you, here’s the post that answers the questions you’d have normally asked before buying a thousand dollar phone.

Google Fi now officially supports new iPhones, Samsung, and more

In the second-biggest piece of news on Google Fi this week, it was announced that Google’s Project Fi is now just Google Fi and you can now bring your own device from many different manufacturers. That’s big news for those who want to stick with Samsung or HTC but longed for Google Fi’s high-speed international service. See this post for more on the announcement.

Despite a deal, not everyone should switch to Fi. Here’s why.

I still can’t really understand why Google decided to run the deal of the year two days after Cyber Monday; I can’t imagine those folks who bought over the Black Friday / Cyber Monday weekend felt as good about the crazy deal they ran on Wednesday as those of us who got in on it did. But despite what would be the deal of the year in a year that didn’t have that crazy Iberia Avios promo, I’m far from convinced that Google Fi makes sense as a primary phone service. That’s probably too strong a statement — Fi is probably great for those who spend most of their time on Wi-Fi. In this post, I explain why Fi won’t work for me. I feel like Google Fi is a teenage romance for me: I want to love Google Fi for the rest of my life, but Google’s mixed signals keep me confused about my next move: they want me to use Google photos and stream my entertainment and access my files via the cloud, but they don’t want to give me enough data access to do it all. In a world in which more and more people are embracing a digital nomad lifestyle (I haven’t been home in more than 2 weeks), I wish Google would make it easier for me to switch. We’ll see how it goes for the first couple of months.

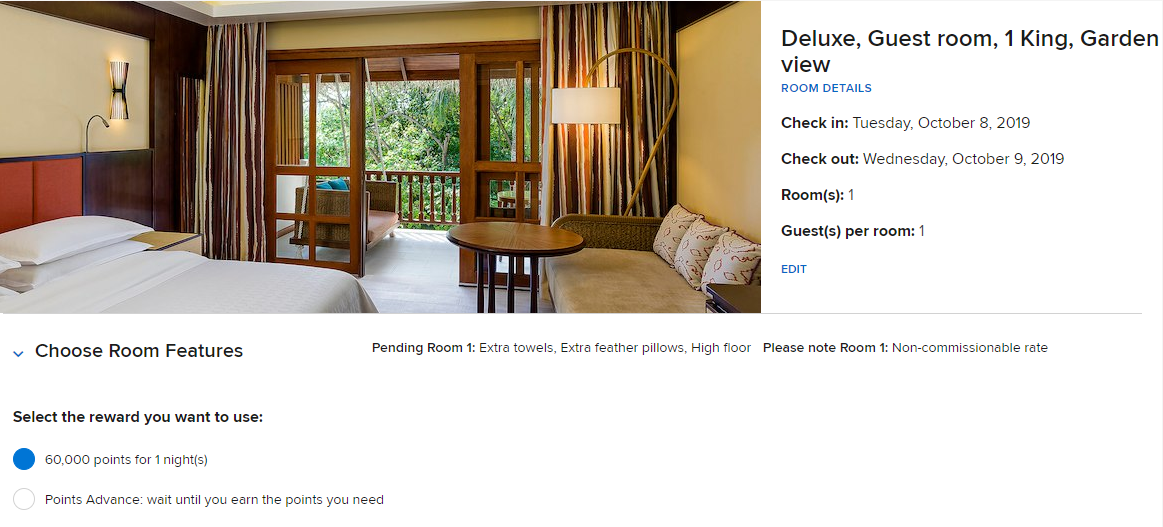

Sheraton and Four Points fully Marriott.com enabled. Eligible for points advance and online certificates

I want to like Marriott, but they sure haven’t made it easy since the merger back in August. However, good news is here: You can now use your free night certificates online at many more brands and even book awards without enough points in your account. All brands should be coming on board soon.

More SPG properties fully Marriott.com enabled. Eligible for points advance and online certificates

Speaking of all brands coming soon, several more came on board just after that previous post.

Amex Gold not always 4X at US restaurants

An old adage says you can count on two things: death and taxes. Nobody ever said anything about 4x at restaurants in that list, so it’s no surprise that spend at some many US restaurants isn’t earning 4x as expected on an Amex Gold card…right? Truth be told, this is no big deal for two groups of people: 1) Those who haven’t been affected and 2) Those who have the Citi Prestige card and intend to keep it. For the rest of us, this is frustrating. Read about what’s happening and Greg’s take in this post.

Yes, Greg, Amex 4X failure is a big deal

Greg made good points in that previous post about why Amex failing to code many restaurants properly at 4x isn’t a big deal. However, I don’t agree with them. At least, not completely. It’s not that I don’t intend to use my Citi Prestige for dining starting next month, but I think Amex failing to code at 4x is still a huge deal for anyone who opened the card expecting this. At this time of year more than any other, I’d bet some people are paying for large group meals and plan to use a card that offers a great return on dining. The Amex Gold card should be it, but it isn’t. No way I could justify putting a big restaurant bill on the card that might only end up earning 1x. See this post for more on what’s happening, why it’s a problem, and there 4x actually works.

How to view Amex category bonus success

But then, maybe this isn’t a big deal for you — maybe all of your restaurants are coding properly for 4x. If you would like to see whether or not your spend is triggering a category bonus on a Membership Rewards card, it’s pretty easy: all you have to do is go to “statements and activity” and select any date range other than “current activity” (that’s the default setting). See this post for how to do it.

Use your 2018 travel fee credits before it’s too late

![]()

Do you have a credit card that offers some sort of free travel credits — airline incidentals, airfare, travel, resort credits, etc? You’re reading Frequent Miler. Of course you do. Does that benefit reset with your cardmember year? On January 1st? As soon as your December statement closes? Knowing whether you’ve got a month yo use your credit or you need to use it by, like, tomorrow since your December statement is about to cut is important. See this post so you don’t mess that up.

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)