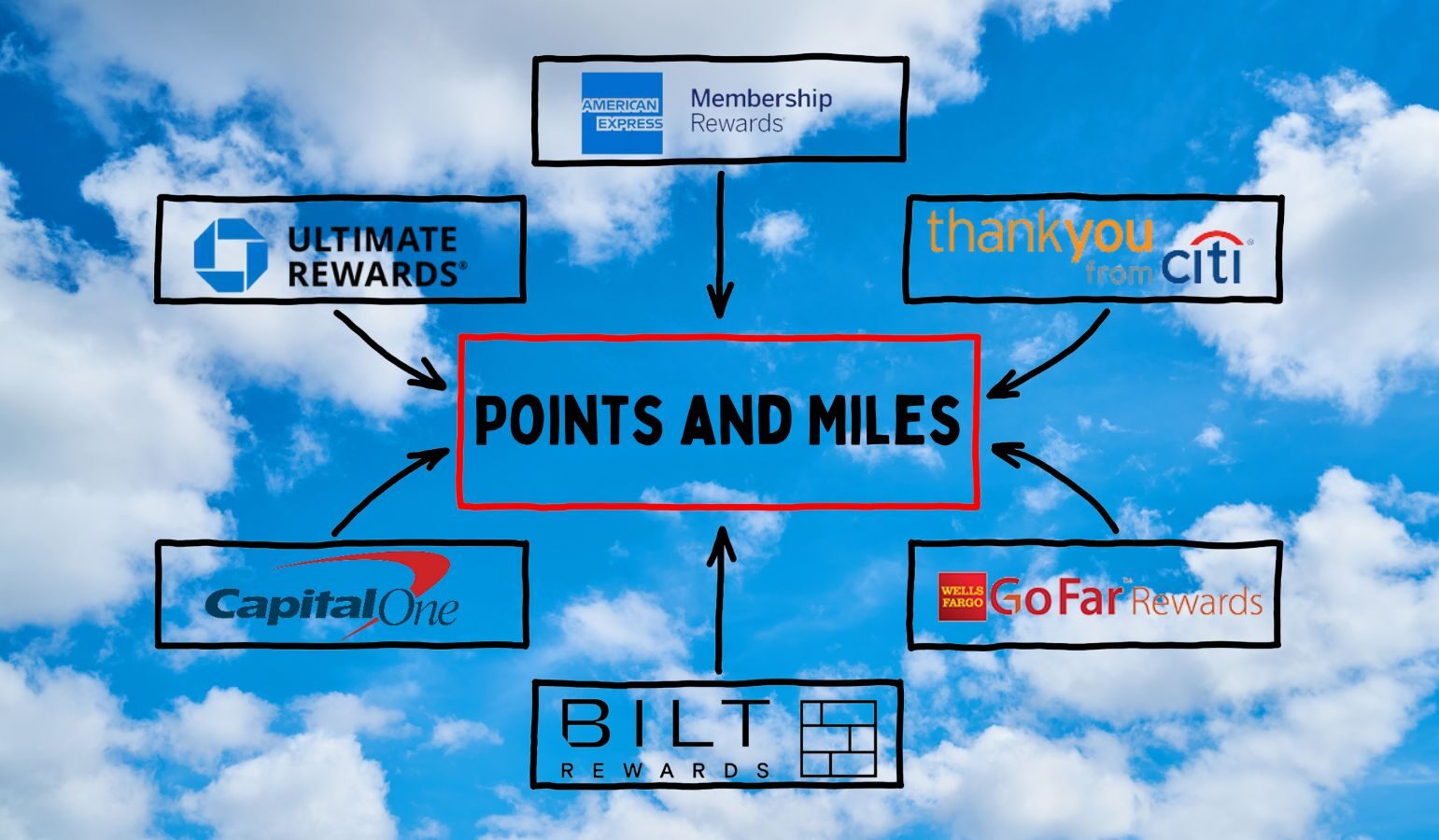

In our opinion, transferable points programs like Chase Ultimate Rewards and Amex Membership Rewards are the most valuable points (or “miles”) to accumulate. These points can often be used to book discounted travel and, even better, can be strategically transferred to airline and hotel programs when valuable awards are available.

Each of the programs discussed here allows you to transfer points to multiple airline and hotel programs at a fair exchange rate (usually 1 to 1). This “transferability” then gives you the ability to book valuable travel awards opportunistically.

Suppose you’re finally ready to book that dream trip to Asia and you find (*gasp*) that Delta has the best award availability, but you don’t have a big stash of Delta miles. That’s not a problem if you do have a big stash of Amex Membership Rewards points since Amex points transfer 1 to 1 to Delta SkyMiles. Even better, you may be able to book the same flights for significantly fewer miles by booking through one of Delta’s partners, like Air France or Virgin Atlantic, whose miles are available through multiple transferable points programs.

It can be difficult to wrap your head around these transferable points programs, given the plethora of rewards programs and award charts that are involved, not to mention the varying rules for point transfers, pooling, and expiration.

This post is a brief, big-picture, “toe-dipping” guide to the primary transferable points currencies that exist today, and has been updated for 2025.

Earning transferable points

Transferable points are primarily earned through credit cards. Points can be earned through credit card welcome offers, credit card spend, promotions such as “refer a friend,” and shopping with various merchants.

Please see our complete guides to each program for full details about how to earn points.

Complete guides to transferable points programs

If you want to dive deeper into any of the individual programs discussed in this post, check out the guides below:

- Amex Membership Rewards Complete Guide

- Bilt Rewards Complete Guide

- Capital One “Miles” Complete Guide

- Chase Ultimate Rewards Complete Guide

- Citi ThankYou Rewards Complete Guide

- Wells Fargo Rewards (coming soon)

Transfer ratios of each major points program

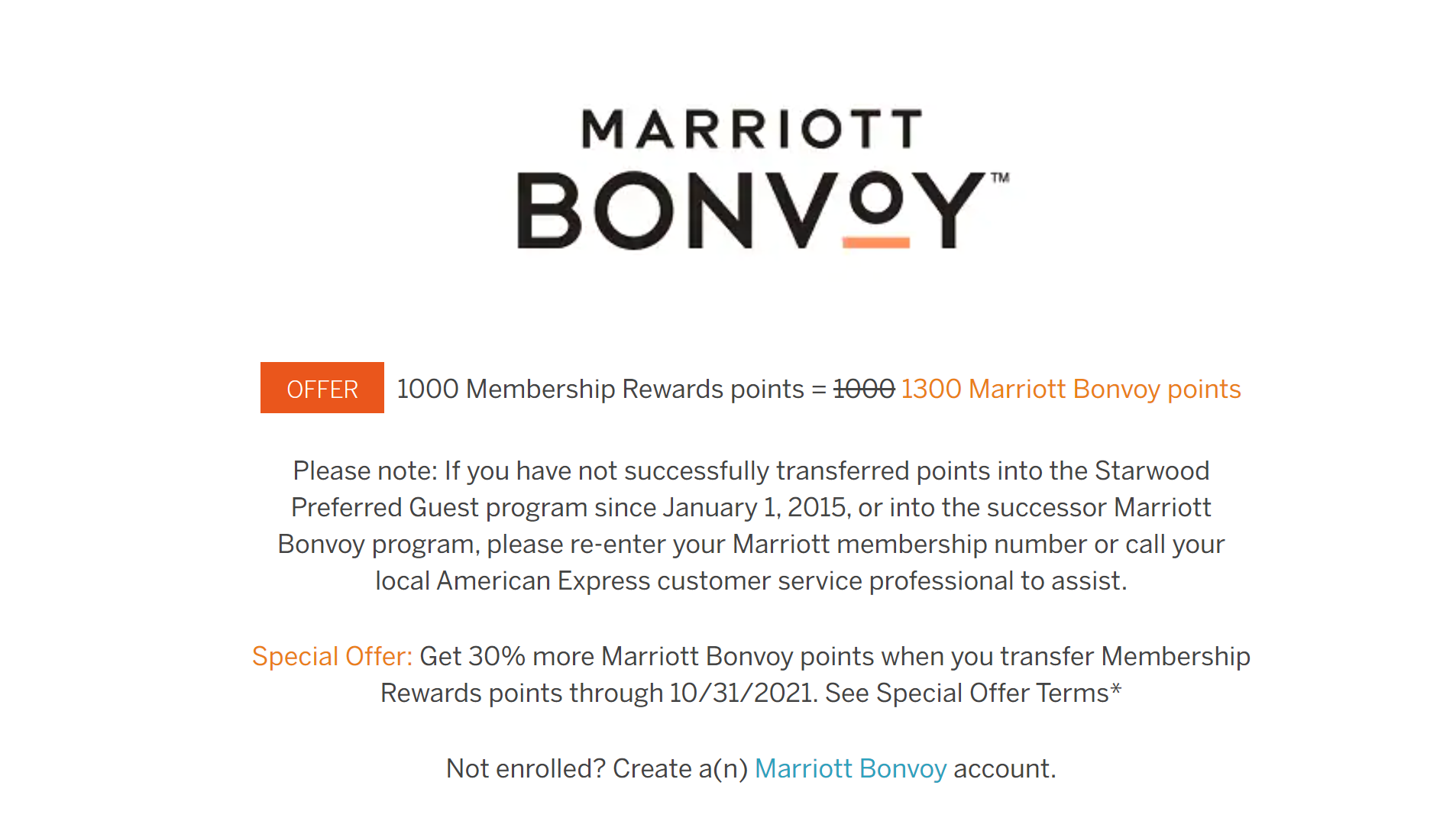

- Amex Membership Rewards: Points transfer to most partners 1 to 1. The exceptions are Aeromexico (1000:1600), Hilton Honors (1:2), and JetBlue (1000:800). Amex offers more frequent transfer bonuses than any other transferable program, averaging ~20 per year.

- Bilt Rewards: Points transfer to most partners 1 to 1, with two exceptions. Transfers to Accor are 3:2, and you can get a 5,000-point bonus to Marriott Bonvoy by making a 20,000-point transfer. Bilt offers around 5-6 transfer bonuses per year, often at excellent value.

- Capital One “Miles”: Points transfer to most partners is at a 1 to 1 ratio, with two exceptions: EVA Air (1000:750), JetBlue (1000:600), and Accor Live Limitless (2:1). Capital One averages around 7-8 transfer bonuses per year.

- Chase Ultimate Rewards: Points transfer to all airline and hotel partners at a 1 to 1 ratio. Chase averages 8-10 transfer bonuses per year, although Hyatt is never one of them.

- Citi ThankYou Rewards: Points transfer to most partners at a 1 to 1 ratio. Exceptions include: Accor Live Limitless (2:1), Choice Privileges (1:2), Preferred Hotels iPrefer (1:4), Leading Hotels of the World Leader’s Club (5:1), and Emirates Skywards (1000:800). Citi regularly offers transfer bonuses, averaging ~10/year.

- Wells Fargo Rewards: Points transfer to most partners at a 1 to 1 ratio, except for Choice Privileges (1:2). So far, Wells has never offered a transfer bonus to any of its partners.

Other points programs

- Mesa Rewards: Mesa is a tech platform that offers a mortgage marketplace and a credit card that earns up to 100,000 points per year for mortgage payments. Mesa Points can be transferred to Aeromexico, Air Canada, Cathay Pacific, Air India, Finnair, Hainan Airways, SAS Eurobonus, Thai Airways, and Vietnam Airlines at a 1:1 ratio. The only hotel partner is Accor, which also carries a 3:2 ratio. Accor points are worth 2 Euro cents each, so the transfer ratio essentially means that Mesa Points are worth ~1.5 cents each towards Accor Hotels.

- Rove Miles: Rove Miles is trying to be a standalone loyalty program for flight & hotel booking and shopping portal earnings. The idea is that you earn Rove Miles on paid travel and/or when shopping online, and then you have the flexibility to use them to book paid travel or to transfer Rove Miles to partner airline and hotel programs. Rove Miles can be transferred to Aeromexico, Air France/KLM Flying Blue, Air India, Cathay Pacific, Etihad, Finnair, Hainan Airways, Qatar, Thai Airways, Turkish, and Vietnam Airlines at a 1:1 ratio. The only hotel partner is Accor, which also carries a 3:2 ratio.

Transfer bonuses

Transferable points programs often run promotions where they’ll offer more airline miles or hotel points than usual when transferring your points. For example, it’s common to see 25% transfer bonuses to Flying Blue (the loyalty program shared by Air France & KLM). When a 25% transfer bonus promotion is available, it means that you’ll get an extra 25% Flying Blue miles when you transfer your points. For example, if you transfer 100,000 Amex Membership Rewards points during a 25% transfer bonus to Flying Blue, you’ll receive 125,000 Flying Blue miles.

You can find current and past transfer bonuses here: Current point transfer bonuses.

Transfer partners for each points program

While there is a lot of overlap between them, each transferable points program has its own unique set of transfer partners.

A full list of all transfer options can be found in the Frequent Miler Transfer Partner Master List.

American Express Membership Rewards Transfer Partners

| Rewards Program | Best Uses | Amex Transfer Ratio (and transfer time) |

|---|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| AeroMexico ClubPremier | AeroMexico is a SkyTeam partner. Club Premier points can be used to book flights on AeroMexico, SkyTeam alliance members (such as Delta or Korean Air), or on select partner airlines. Unfortunately many have reported that awards are extremely difficult to book through AeroMexico so we do not recommend transferring points to this program. If you want to fly AeroMexico, look to transfer points to another SkyTeam partner (such as Air France) and then book AeroMexico with that program. | 1 to 1.6 (Instant) |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. | 1 to 1 (Instant) |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | 1 to 1 (Instant) |

| ANA Mileage Club | Redeem for Star Alliance flights. Multiple stopovers allowed. ANA offers many great sweet-spot awards, including flying around the world in business class for as few as 115K miles! See also: ANA - a terrific Membership Rewards gem. | 1 to 1 (~1 day) |

| Avianca LifeMiles | Avianca LifeMiles can be decent for Star Alliance awards. They offer reasonable-ish prices and no fuel surcharges on awards. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. | 1 to 1 (Instant) |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Cathay Pacific Asia Miles | Cathay Pacific has a decent distance based award chart, but they don't allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. | 1 to 1 (4 to 8 hours) |

| Choice | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. | 1 to 1 (Instant) |

| Delta SkyMiles | Delta no longer charges change or cancellation fees on awards originating in North America. Flash award sales and flights to/from locations other than the U.S. or Canada can offer great value. See: Best uses for Delta miles. | 1 to 1 plus excise tax (Instant) |

| Emirates Skywards | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be extremely steep. One workaround is to book select routes such as JFK to Milan or Newark to Athens. See: How to find and book Emirates first class awards. | 1000 to 800 (Instant) |

| Etihad Guest | Etihad offers a distance based award chart for flying Etihad and another for its partners. Points may offer good value for expensive but short-distance flights. | 1 to 1 (Instant) |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. | 1 to 1 via BA (Instant) |

| Hilton | 5th Night Free awards. Best value is usually found with very low end or very high end Hilton hotels. Bonus: award nights are not subject to resort fees. Note that Hilton points often go on sale for half a cent each and so its rare for point transfers to Hilton to be a good value. | 1 to 2 (Instant) |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (~12-24 hours (slower over weekend)) |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. | 250 to 200 plus excise tax (Instant) |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. | 1 to 1 (Instant) |

| Qantas Frequent Flyer | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. I recommend comparing award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) | 1 to 1 (Instant) |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. | 1 to 1 (12-24 hours) |

| Singapore Airlines KrisFlyer | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). | 1 to 1 (12-24 hours) |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). | 1 to 1 (Instant) |

Bilt Rewards Transfer Partners

| Rewards Program | Best Uses | Bilt Transfer Ratio (and transfer time) |

|---|---|---|

| Accor Live Limitless | Use to pay hotel bill with value of 2 Euro cents per point. In some cases (such as hotel to airline transfer bonuses) it may make sense to convert Accor points to the following airline miles at a 1 to 1 ratio: Finnair, Iberia, Qantas, or Virgin Australia | 3 to 2 (Unknown) |

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. | 1 to 1 (Instant) |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | 1 to 1 (Instant) |

| Alaska Atmos Rewards | Alaska Airlines offers decent oneworld award pricing, excellent short-distant pricing, and uniquely allows free stop-overs one one-way awards. Additionally, Alaska allows free award changes and cancelations (although they do have a small non-refundable partner award booking fee) | 1 to 1 (Instant) |

| Avianca LifeMiles | Avianca LifeMiles can be decent for Star Alliance awards. They offer reasonable-ish prices and no fuel surcharges on awards. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. | 1 to 1 (Instant) |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Cathay Pacific Asia Miles | Cathay Pacific has a decent distance based award chart, but they don't allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. | 1 to 1 (Instant) |

| Emirates Skywards | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be extremely steep. One workaround is to book select routes such as JFK to Milan or Newark to Athens. See: How to find and book Emirates first class awards. | 1 to 1 (Instant) |

| Etihad Guest | Etihad offers a distance based award chart for flying Etihad and another for its partners. Points may offer good value for expensive but short-distance flights. | 1 to 1 (Unknown) |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. | 1 to 1 via BA (Instant) |

| Hilton | 5th Night Free awards. Best value is usually found with very low end or very high end Hilton hotels. Bonus: award nights are not subject to resort fees. Note that Hilton points often go on sale for half a cent each and so its rare for point transfers to Hilton to be a good value. | 1 to 1 (Unknown) |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth more than 2 cents each. Bonus: award nights are not subject to resort fees. | 1 to 1 (Instant) |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. | 1 to 1 (Instant) |

| JAL (Japan Airlines) Mileage Bank | JAL has a distance based partner award chart. Depending upon the length of the flights, this can lead to great award prices on partners such as Emirates and Korean Air. | 1 to 1 (Instant) |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. | 20K to 25K (Instant) |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. | 1 to 1 (Instant) |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary. Lower demand flights and those with higher taxes tend to offer better value. | 1 to 1 (~12 hours) |

| Spirit | 1 to 1 (Unknown) | |

| TAP Air Portugal | Surcharge-free Emirates redemptions. Increased availability on TAP flights between US and Europe. | 1 to 1 (Unknown) |

| Turkish Airlines Miles & Smiles | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. See: Turkish Miles & Smiles Complete Guide and Turkish business class sweet spots from the US. | 1 to 1 (Instant) |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. | 1 to 1 (Instant) |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). | 1 to 1 (Instant) |

Capital One Miles Transfer Partners

| Rewards Program | Best Uses | Capital One Transfer Ratio (and transfer time) |

|---|---|---|

| Accor Live Limitless | Use to pay hotel bill with value of 2 Euro cents per point. In some cases (such as hotel to airline transfer bonuses) it may make sense to convert Accor points to the following airline miles at a 1 to 1 ratio: Finnair, Iberia, Qantas, or Virgin Australia | 1000 to 500 (Instant) |

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 via BA (Instant) |

| AeroMexico ClubPremier | AeroMexico is a SkyTeam partner. Club Premier points can be used to book flights on AeroMexico, SkyTeam alliance members (such as Delta or Korean Air), or on select partner airlines. Unfortunately many have reported that awards are extremely difficult to book through AeroMexico so we do not recommend transferring points to this program. If you want to fly AeroMexico, look to transfer points to another SkyTeam partner (such as Air France) and then book AeroMexico with that program. | 1 to 1 (Instant) |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. | 1 to 1 (Instant) |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | 1 to 1 (Instant) |

| Avianca LifeMiles | Avianca LifeMiles can be decent for Star Alliance awards. They offer reasonable-ish prices and no fuel surcharges on awards. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. | 1 to 1 (Instant) |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Cathay Pacific Asia Miles | Cathay Pacific has a decent distance based award chart, but they don't allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. | 1 to 1 (1-2 days) |

| Choice | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. | 1 to 1 (Instant) |

| Emirates Skywards | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be extremely steep. One workaround is to book select routes such as JFK to Milan or Newark to Athens. See: How to find and book Emirates first class awards. | 1,000 to 750 (Instant) |

| Etihad Guest | Etihad offers a distance based award chart for flying Etihad and another for its partners. Points may offer good value for expensive but short-distance flights. | 1 to 1 (Instant) |

| EVA Air Infinity MileageLands | If you want to fly one of the best business class products in the sky, the best way to snag EVA flights is with their own miles since they release more award space to their own members. One-way business class flights from the US to Taipei cost 75K to 80K miles. Fuel surcharges are very low on these routes. | 1000 to 750 (~1 day) |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. | 1 to 1 (Instant) |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 via BA (Instant) |

| JAL (Japan Airlines) Mileage Bank | JAL has a distance based partner award chart. Depending upon the length of the flights, this can lead to great award prices on partners such as Emirates and Korean Air. | 2 to 1.5 (Instant) |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. | 1,000 to 600 (1-2 hours) |

| Preferred Hotels & Resorts I Prefer | Redeeming points for hotel stays offers the best value but availability can be hard to find. Next best option is to look for good value points+cash opportunities. Redeeming for certificates is always poor value. | 1 to 2 (Unknown) |

| Qantas Frequent Flyer | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. I recommend comparing award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) | 1 to 1 (~1 day) |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. | 1 to 1 (Instant) |

| Singapore Airlines KrisFlyer | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). | 1 to 1 (12-24 hrs) |

| TAP Air Portugal | Surcharge-free Emirates redemptions. Increased availability on TAP flights between US and Europe. | 1 to 1 (Unknown) |

| Turkish Airlines Miles & Smiles | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. See: Turkish Miles & Smiles Complete Guide and Turkish business class sweet spots from the US. | 1 to 1 (Instant) |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). | 1 to 1 (Instant) |

| Wyndham | Wyndham often allows booking multi-room suites for the same price as a standard room. It's sometimes possible to get great value from points in that way. Bonus: award nights are not subject to resort fees. Wyndham Earner cards offer automatic 10% discount on award stays. | 1 to 1 (12-24 hrs) |

Chase Ultimate Rewards Transfer Partners

| Rewards Program | Best Uses | Chase Transfer Ratio (and transfer time) |

|---|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. | 1 to 1 (Instant) |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | 1 to 1 (Instant) |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. | 1 to 1 via BA (Instant) |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth more than 2 cents each. Bonus: award nights are not subject to resort fees. | 1 to 1 (Instant) |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. | 1 to 1 (4-8 hours) |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. | 1 to 1 (Instant) |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. | 1 to 1 (1-2 days) |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. | 1 to 1 via BA (Instant) |

| Singapore Airlines KrisFlyer | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). | 1 to 1 (~1 day) |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary. Lower demand flights and those with higher taxes tend to offer better value. | 1 to 1 (Instant) |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. | 1 to 1 (Instant) |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). | 1 to 1 (Instant) |

Citi ThankYou Rewards Transfer Partners

| Rewards Program | Best Uses | Citi Transfer Ratio (and transfer time) |

|---|---|---|

| Accor Live Limitless | Use to pay hotel bill with value of 2 Euro cents per point. In some cases (such as hotel to airline transfer bonuses) it may make sense to convert Accor points to the following airline miles at a 1 to 1 ratio: Finnair, Iberia, Qantas, or Virgin Australia | 1000 to 500 (Instant) |

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 via Qatar (~1 day) |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | 1 to 1 (Instant) |

| American AAdvantage | Best for AA's web special awards or for partner awards such as Cathay Pacific business class, Qatar business class, Etihad first class, etc. AA no longer charges change or cancellation fees on awards. | 1 to 1 (Instant) |

| Avianca LifeMiles | Avianca LifeMiles can be decent for Star Alliance awards. They offer reasonable-ish prices and no fuel surcharges on awards. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. | 1 to 1 (Instant) |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 via Qatar (~1 day) |

| Cathay Pacific Asia Miles | Cathay Pacific has a decent distance based award chart, but they don't allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. | 1 to 1 (Instant) |

| Choice | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. | 1 to 2 (Instant) |

| Emirates Skywards | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be extremely steep. One workaround is to book select routes such as JFK to Milan or Newark to Athens. See: How to find and book Emirates first class awards. | 1000 to 800 (Instant) |

| Etihad Guest | Etihad offers a distance based award chart for flying Etihad and another for its partners. Points may offer good value for expensive but short-distance flights. | 1 to 1 (~1 hour) |

| EVA Air Infinity MileageLands | If you want to fly one of the best business class products in the sky, the best way to snag EVA flights is with their own miles since they release more award space to their own members. One-way business class flights from the US to Taipei cost 75K to 80K miles. Fuel surcharges are very low on these routes. | 1 to 1 (1-2 days) |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. | 1 to 1 via Qatar (~1 day) |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 via Qatar (~1 day) |

| Jet Airways Inter Miles | JetAirways JetPrivilege miles are useful only for a few very specific cases such as certain flights to Hawaii for as low as 15K (30K business) one-way, or to the Caribbean or Central America for as low as 10K (20K business) one-way. Details can be found here. | 1 to 1 (Instant) |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. | 1 to 1 (Instant) |

| Leading Hotels of the World | It is often possible to get 8 cents per point value, or more from LHW points. | 1K to 200 (Instant) |

| Malaysia Enrich | Given Malaysia's award chart devaluation in June 2017, We're not aware of any good uses for these miles. | 1 to 1 (1 to 2 days) |

| Preferred Hotels & Resorts I Prefer | Redeeming points for hotel stays offers the best value but availability can be hard to find. Next best option is to look for good value points+cash opportunities. Redeeming for certificates is always poor value. | 1 to 4 (Instant) |

| Qantas Frequent Flyer | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. I recommend comparing award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) | 1 to 1 (~1 day) |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. | 1 to 1 (~1 day) |

| Shop Your Way Rewards | Don't do it. Shop Your Way points can be redeemed for a variety of gift cards. That said, unless Shop Your Way starts offering discounted gift cards, there's no point in converting transferrable points to Shop Your Way. | 1 to 10 (Instant) |

| Singapore Airlines KrisFlyer | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). | 1 to 1 (~1 day) |

| Thai Airways Royal Orchid Plus | I'm not aware of any good uses for these miles | 1 to 1 (3-7 days) |

| Turkish Airlines Miles & Smiles | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. See: Turkish Miles & Smiles Complete Guide and Turkish business class sweet spots from the US. | 1 to 1 (12-24 hours) |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). | 1 to 1 (Instant) |

| Wyndham | Wyndham often allows booking multi-room suites for the same price as a standard room. It's sometimes possible to get great value from points in that way. Bonus: award nights are not subject to resort fees. Wyndham Earner cards offer automatic 10% discount on award stays. | 1 to 1 (Instant) |

Wells Fargo Rewards Transfer Partners

| Rewards Program | Best Uses | Wells Fargo Transfer Ratio (and transfer time) |

|---|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Unknown) |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | 1 to 1 (Unknown) |

| Avianca LifeMiles | Avianca LifeMiles can be decent for Star Alliance awards. They offer reasonable-ish prices and no fuel surcharges on awards. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. | 1 to 1 (Unknown) |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Unknown) |

| Choice | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. | 1 to 2 (Unknown) |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. | 1 to 1 via BA (Unknown) |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Unknown) |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. | 1 to 1 (Unknown) |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. | 1 to 1 (Unknown) |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). | 1 to 1 (Unknown) |

How to redeem points for paid travel at better than 1 cent per point value

- Amex Membership Rewards: Business Platinum cardholders get ~1.5 cents per point value for eligible flights: “Get 35% of your points back when you redeem points through Amex Travel for either a First or Business class flight on any airline, or for any flights with your selected airline.” Starting September 18th, 2025, this will change to only being good towards flights with your selected airline, regardless of service class.

- Bilt Rewards: Bilt offers the ability to use points at a value of 1.25 cents per point when booking travel through their travel portal.

- Capital One “Miles”: N/A

- Chase Ultimate Rewards: Using Points Boosts for up to 2 cents per point value by redeeming points through Chase Travel℠ with the Sapphire Reserve card. Sapphire Preferred and Ink Business Preferred cardholders can redeem at up to 1.75 cents per point.

- Citi ThankYou Rewards: N/A

- Wells Fargo: N/A

Other not-too-terrible uses for transferable points

-

- Amex Membership Rewards: Cash out points at 1.1 cents each with the Schwab Platinum Card (1,000,000 points/year max).

- Bilt Rewards: Bilt Rewards members can use points toward their down payment at a value of 1.5c per point when redeemed through participating lenders for eligible home purchases.

- Capital One “Miles”: Capital One Entertainment can be an incredible deal for terrific seats to Major League Baseball games. “Cardholder Exclusive” seats are often within a few rows of the field and sometimes include club access – for only 5,000 miles per ticket.

Moving points to another person’s account

- Amex Membership Rewards: United States cardholders cannot move their Membership Rewards points to other accounts. However, you can transfer points to a friend’s loyalty account as long as you add them as an authorized user or employee to one of your Membership Rewards accounts. Once your friend has been an authorized user for 90 days, you can transfer points to their loyalty accounts.

- Bilt Rewards: Bilt doesn’t allow points transfers to other members’ accounts.

- Capital One “Miles”: Capital One allows members to freely move “miles” to anyone else’s account without limits.

- Chase Ultimate Rewards: Chase allows cardholders to freely move points from/to a household member. The recipient must also have a Chase credit card that earns Ultimate Rewards points.

- Citi ThankYou Rewards: Citi allows ThankYou members to move points to anyone’s ThankYou account, but transferred points then expire 90 days after transfer. Citi only allows you to transfer or receive a maximum of 100,000 points per calendar year.

- Wells Fargo Rewards: Wells Fargo Rewards allows you to transfer between member accounts free of charge. You can also transfer between cashback-earning cards and points-earning cards.

How to keep transferable points alive

- Amex Membership Rewards: Points do not expire as long as you have an open credit card that earns Membership Rewards points.

- Bilt Rewards: Points do not expire as long as your account remains open and is active. An account becomes “inactive” when there has been no activity for 18 months.

- Capital One “Miles”: If you cancel a card account that has Capital One “miles”, you will lose those points. Move points first to another account held by you or someone in your household. Alternatively, product change to a no-fee Capital One Miles card, such as the VentureOne Rewards Credit Card.

- Chase Ultimate Rewards: Points in an open account will not expire. If you close a card that earns Chase points, you will lose any points associated with that card. You should first combine points and move them away from the card you intend to close and to another card that will remain open before canceling.

- Citi ThankYou Rewards: There are several situations in which you may have Citi ThankYou Rewards points that will expire: 60 days after cancelling an account, 90 days after a point transfer, and after 18 months of inactivity for some credit cards.

- Wells Fargo Rewards: Points do not expire as long as you have an open credit card that earns Wells Fargo Rewards points.

My personal rank as to overall value:

1- chase UR

2- Citi TY

3- Amex MR

YmmV

Great overview. One issue. Amex to emirates wiill soon be 5:4 transfer ratio. I believe on 9/16

“not-toO-terrible” (not “not-to-terrible”)

😉

The entire article is a great resource that newbies ought to bookmark. As newbies might not be familiar with the term “transfer bonus,” it might be worth adding some sort of introductory language (even though there’s a link to the other article). Just trying to help.

“A transfer bonus is a powerful tool that amplifies points and occurs when a bank affords a higher transfer rate than it normally does to a given loyalty program. Between a specific bank and a specific loyalty program, transfer bonuses range from never occurring to one/twice per year and typically in the amount of 10 percent to 30 percent extra points. Larger transfer bonuses have occurred but are unusual.”

Great suggestion. I added a section explaining transfer bonuses

Newbies to the hobby thank you. 🙂

I think (but have not done it myself) that you can cash out TYP for effectively 1.1 cpp if you have the Rewards+, 100k annual cap. Lower cap than Amex, same rate of return, and no AF card required. Also makes the DC effectively a 2.2% everywhere card.

[…] Ultimate Rewards is a transferable points program available through a number of Chase cards. In my comparison of transferable points programs, […]

[…] I bet that food and fuel are big portions of most American’s spend. We now (or soon) have a transferable points-earning card which offers 3X uncapped in these critical categories for only $95 per […]

[…] A quick guide to transferable points programs […]

[…] its game with those enhancements: Chase Ultimate Rewards. Chase has everything you could want in a transferable currency: 1) A plethora of useful airline transfer partners; 2) Both high-quality and wide-footprint hotel […]

It would be good if you could update this article to reflect cards now available and cards no longer available . May I specifically suggest mentioning Marriott . Only so many hours in the day right ?

Thanks for your efforts .

Thanks for the suggestion! I’ve corrected the obvious out of date stuff and threw in a few Marriott mentions. Hopefully I’ll find time to redo this guide altogether!

[…] account holder transfer points to their choice of a number of airline and hotel programs. See: A quick guide to transferable points programs. My favorite transferable points program is Chase Ultimate […]

[…] plenty of great uses of Alaska Mileage Plan miles, but the sudden change underscores the value of transferable points programs over airline specific programs. Transferable points depreciate less than airline specific miles […]

[…] offer for 100,000 valuable transferable points which requires only $3K spend doesn’t come along often. I finally decided to double check my […]

[…] Points […]

[…] Points […]