Hyatt exploring a new premium card, trying out Chase’s premium card rental insurance and did Delta go too far with their recent program changes? All that and more in this week’s Saturday Selection, our weekly round-up of interesting tidbits from around the interwebs (links to each article are embedded in the titles).

Is there a new Hyatt premium card on the way?

Here at Frequent Miler, we’re suckers for fancy new credit cards. Moreover, we might be even bigger suckers for Hyatt and the tasty benefits of Globalist status. Ultra-premium credits cards, with their $400+ in annual fees, are getting more and more popular these days. Several prominent hotel chains have blingy cards that we love: the Hilton Aspire could be one of the best values out there as a keeper card, while the Ritz Carlton card is something every member of the team has and holds for its travel protections, free authorized users, annual 85k free night certificate and $300 in airline credits. Hyatt, however, has stayed curiously out of the fray, content to rest its laurels on the fairly mediocre World of Hyatt personal and business cards. Hopefully, that’s about to change. Last week, there were intriguing posts on reddit and the app formerly known as Twitter about surveys that Hyatt sent out regarding potential perks for a card with an annual fee of $250, $350 or $450. There’s some fun options on the table, like 3x earning in your top two spending categories, the opportunity to combine two category 1-4 free night certificates into one category 1-8 certificate, buy-one-get-one-free at all-inclusive properties and 10 annual elite night credits. Mmm….yummy.

Did Delta finally go too far?

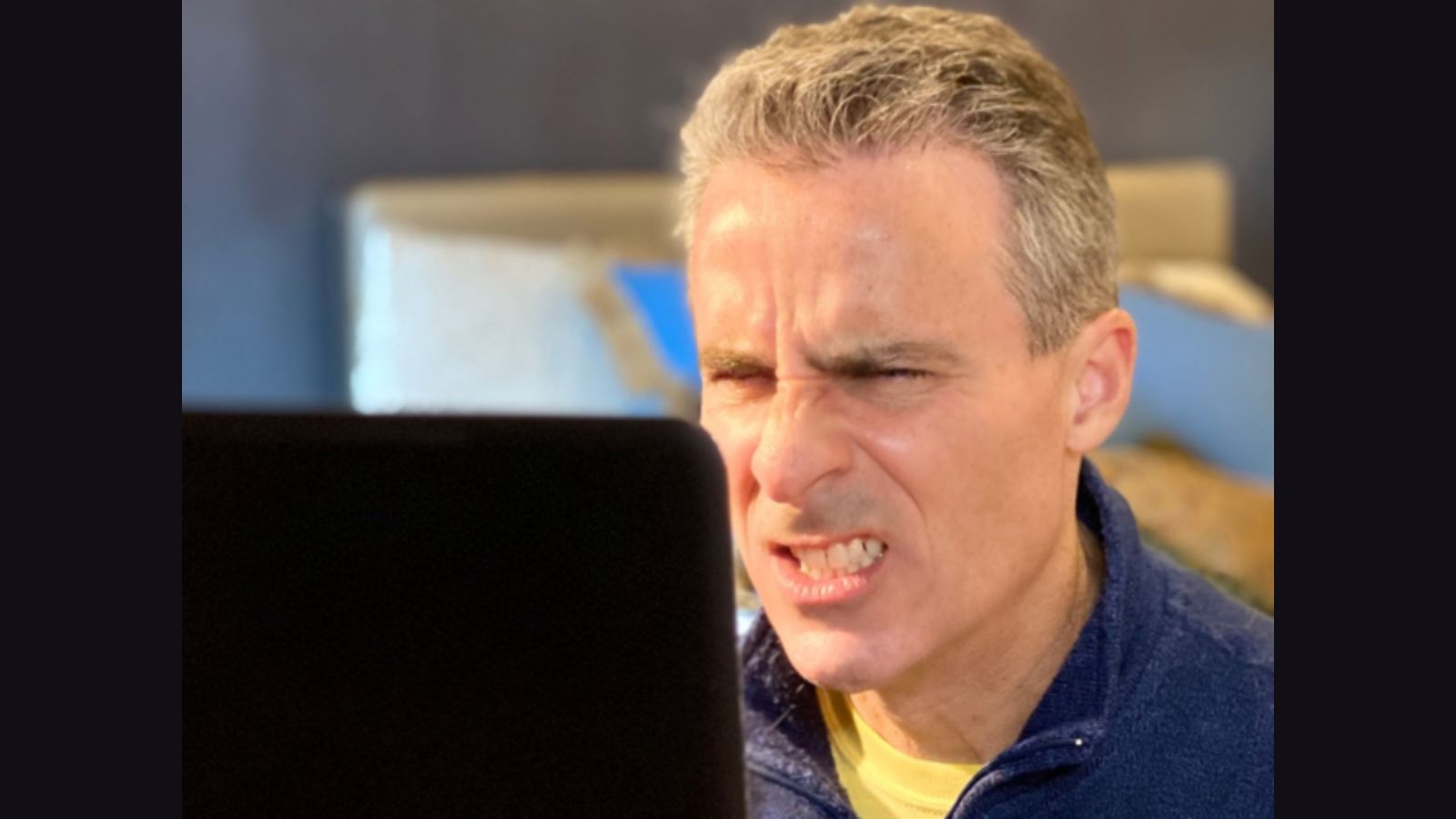

If you’re even casually following the world of points and miles, you may have noticed that Delta was in the news this week, doing their best to try and disprove the adage that “any publicity is good publicity.” Delta was the sensei of creative destruction, blowing up their elite program, making their credits cards more difficult to get and less useful when you actually do get them. Even a million-miler, Delta-hub-captive, 6-figure manufactured-spender (and long-time DL loyalist) like Greg the Frequent Miler has had enough. On the most recent FM on the Air, Greg publicly announced that he was “done with spending for Delta status.” Based on what we’re hearing from other Delta elite members, he’s not alone. Dave Grossman over at Miles Talk puts keyboard to paper to explain why he thinks that, this time, Delta has gone too far in its disregard for moderate-spending, brand-loyal customers.

Taking Chase Sapphire Reserve car rental insurance out for a crash

First off, let me say that, while I’m somewhat notorious for the broad geographical reach of my automotive “incidents,” I like to think that’s primarily due to how long and how often I’ve been renting cars (that “BS” cough you heard was my wife). Regardless, paying out of pocket for an engine overhaul in South Africa during my honeymoon impressed upon me the value of having primary rental car insurance that wasn’t my own. While there’s a handful of credit cards that provide it, for me the gold standard is what Chase gives cardholders of the Chase Sapphire Reserve and Ritz Carlton cards. It’s not just that it’s primary coverage, meaning it kicks in before your personal insurance, but the ease with which reimbursements work is extraordinary, given the sums of money involved. I’ve been able to use it three times so far, most recently when my rental car was stolen in Columbus, Ohio last year as a casualty of the “Kia Challenge.” The credit card insurance paid for the whole thing, with about 25-30 minutes of work on my side. Matt from Miles Earn and Burn describes a similarly smooth experience when he took the CSR insurance out for a crash spin.

Skipping TSA Precheck to finally get some quiet time

Nick Reyes, that infamous, globetrotting, fedora-wearing, father-of-two, has made no secret of his staunch opposition to TSA Precheck. My guess is he’s fairly unique among points and miles bloggers in never letting his (numerous) Precheck/Global Entry credits see the light of day. When asked, he usually gives an answer that’s some sort of mix of “it’s unnecessary,” “I don’t want my biometric data at every airport in the US,” and “those kids better get off my lawn!” Now, though, I think I might finally understand the real reason by behind his perennial passing on Precheck. In an extremely cute Instagram video that I first saw on Your Mileage May Vary, a mother of four explains that, because all four kids are able to go with her husband through Precheck, going through regular security by herself means that she gets 1/2 hour of peace and quiet to herself in the middle of an otherwise stressful trip. Something tells me that, if Nick’s wife sees this, she’ll be strongly encouraging him to get TSA Precheck in the near-future.

TSA precheck is just a way for the government to know who you are by screening you for a criminal background check and then surveilling you wherever you go. And Especially Global Entry. Also taking your money for these memberships.

The Elite Globalist Bourgeois Business by Hyatt? In for one.

Convicted people cannot enroll in global entry. Good question to ask on a second date.

Which question, “do you have Global Entry” or “are you a convict?”

Either should be a solid method of maintaining one’s chastity.

Is the CSP insurance the same as the CSR one? Or does Chase meaningfully distinguish between them.

https://upgradedpoints.com/credit-cards/chase-sapphire-preferred-vs-chase-sapphire-reserve/

Look for Travel Benefits and Protections

Thanks! That’s a useful distinction to be aware of.

I’m curious about this too and hope someone will answer this.

WILL the new Hyatt card give us access to admiral club? ?? Will love it

Yes . . . and a pony.

Nick, your passport is biometric. The rectangular symbol on the bottom of its front cover indicates that it is. When you enter most developed countries, they use your biometric passport to verify your identity. They digitize an image of your face. And, once its interior ministry has your face digitized, those police surveillance cameras along the street know where you are and who you are with. It’s too late, baby.

Separately, not everyone is angry at Delta. Some people are actually benefiting from the announced changes.

Note that Nick is probably not reading this article or comments section.

But, to further your point, imagine if everyone born in this country were trackable by a nine digit identifier. Or if I were to post details of my personal experiences on a public forum, including pictures of myself. Impossible to track this anonymous dude!

Which cards is one able to change over to the Ritz Carlton Chase card?

Chase Brilliant, Amex Bevillium

Brilliant is an AMEX card.

Any Chase personal Marriott card that you have held for at least one year.

Need to convert Bold to another Chase personal Marriott card first. Just did myself last month.

Unfortunately, I only hold the AMEX Marriott cards. I do not currently have any Chase cards for Marriott.

Chase Bonvoy Boundless

Chase Boundless. Just did the product change. Easy peasy.

I REEEALLY hope significant barriers to Globalist remain. When everybody is a VIP, nobody is a VIP.

If a premium Hyatt card gave auto-Explorist status, along with 30 nights of qualifying nights, I think that would be a max sweet spot. People should have to earn Globalist in some way to prevent a deluge of Globalist-Lites. A deluge will just mean the benefits (legit free breakfast for 4, concierge, free parking, etc.) will eventually go away (see: Hilton Diamond).

If Globalist becomes diluted, I see myself becoming FAAAR more of a free agent.

LOL. I figured I’d see a downvote. Truth is, a Globalist for the masses will simply mean the death of the attractive Globalist benefits as you know them today. You may get a “Globalist” status, but the benefits won’t be there bc it won’t be financially viable for Hyatt to maintain.

There is already a way to spend your way to Globalist. If you really want it but can’t do it now, then you probably wouldn’t travel enough to actually enjoy Globalist benefits.

Folks in the points and and miles world don’t want to hear about oaths that make it harder.

I’m a folk in the points and miles game, for decades now. Do I count? I participated with Hilton, SPG, Marriott… I’ve seen a thing or two. Auto-“top tier” status with a premium card is a death knell to benefits.

I have been in the game myself for a while. You are obviously not the folks I am speaking of.

It is practically impossible to be literal, and state every single detail online. Every comment would be a book.

It was not a blanket comment, it was a generally speaking comment.

You are correct in that the more people for whom the programs must provide benefits, the more likely they are to provide fewer. Then people will complain about that. It is a loose loose proposition.

Oaths should have been paths by the way. Absolutely not sure what you thought I was trying to say, but I was in a loose agreement with you.

I did misread you. You’re correct. People don’t want to hear it, yet they’ll complain with indignation when the “free” wine they finally receive is diluted.

Other than the points-per-dollar multiplier, I gave up on tier benefits years ago. Property owners don’t care about a person’s loyalty to a network. Property owners care about a person’s loyalty to their own property. If you’re not a regular at a specific property, don’t be surprised if the property is tightfisted with benefits. I know some people have had great success. I’m just relating my experience.

I became a free agent and now predominantly use non-network hotels. I’m a regular at a few specific properties. Those specific properties know that I’m loyal to them. And, they overwhelmingly respond. At one of these properties two weeks ago, I received an insane signature suite upgrade that I would never have expected in my life. At another property, two months before a stay, I’m confirmed for an upgrade. While YMMV, free agency has been very positive for me.

Smart move on your part. I’m glad you have a system that works well for your travel habits. I travel worldwide, rarely repeating the same places with routine so your system isn’t relevant to my habits.

Globalist is the only hotel status worth anything to me personally. Anything Hilton and Bonvoy, even lifetime, have become nothingburgers, mainly due to dilution through “premium” credit cards. I do love the game, but when an ostensible short term gain begets a monumental negative program shift, I don’t want the short term “gain”.

I do hope any “premium” Hyatt card comes with accelerated nights but not auto-Globalist. If it does, so be it. I’ll adjust accordingly and stay at Hyatts far less. Change…that’s one thing that’s a constant.

Same here. I upvoted you so you now have a flat rating.

From a customer experience perspective, I think you are spot on about how the other programs have been diluted by giving away top tier status.

Thanks, Andrew. I appreciate the support.

Delta didn’t make everyone angry. Next time I pony up for a Delta One ticket I’ll be more than happy to see fewer of these “moderate-spending” whiners in the lounge. Good riddance, and good job, Delta.

Participating in Greyhound’s Road Rewards program now offers better value than participating in Delta’s Skymiles program. While Delta is kicking customers out of lounges, Greyhound is offering customer ways to get free food.

Agreed.

Are you posting from the future? Otherwise the post makes no sense since the lounge clearing changes don’t come until 2025.

Nick most likely uses iPhone or face login but worries about his biometric data and at the same time gives all his data to multiple

Cc companies that sell it