NOTICE: This post references card features that have changed, expired, or are not currently available

Brex recently sent out account closure notices to many (most/all?) small business customers. Apparently intending to focus on large enterprise customers, Brex let me know that they intend to close my account as of August 15, 2022 (Greg received the same notice as did many other people). The good news is that Brex is giving us almost two months of notice to use our existing rewards balance before accounts are closed. That’s really nice. But now my wife has to figure out what to do with 100K Brex points. Should she cash out or make a speculative transfer? What should you do?

To speculatively transfer or cash out

At Frequent Miler, we typically advise firmly against transferring points speculatively. The strength of transferable points is that they are flexible. That flexibility enables you to cherry pick the best transfer partner at the time when you’re actually ready to redeem miles. Guessing at which partner will be best for you means trading away flexibility and being stuck with a narrower set of potential uses. You may also face unfavorable point expiration rules / cancellation policies, etc. Cash doesn’t expire and has unlimited uses. I therefore wouldn’t consider speculatively transferring my Brex points to an airline partner under normal circumstances. However, this impending account closure is obviously not a normal circumstance.

The first question then becomes whether to fly in the face of conventional wisdom and make a speculative transfer or to cash out points at a value of $0.01 per point.

My wife had originally intended to cash out her Brex points shortly after earning them, but she never got around to doing it and as such she still sat with just north of 100K points in her account when the closure notices went out last week.

I knew that readers would wonder what to do with existing points and indeed we were in the same position within my household. I glanced at the list of Brex transfer partners:

- Aeromexico Club Premier

- Air France/KLM Flying Blue

- Avianca Lifemiles

- Cathay Pacific Asia Miles

- Emirates Skywards

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

It immediately stood out that all of those partners overlap with other transferable currency programs. In fact, all of those airlines are also partners with Amex Membership Rewards points (and several also partner with Capital One, Chase, Bilt, and/or Citi). Just like many readers, my wife and I have been marching along to the beat of the Amex points parade these past couple of years and the points just keep flowing in. While I like several of the Brex transfer partners, I have easy access to miles in all of the above programs and will for the foreseeable future.

Therefore, my first thought was to cash out the Brex points. I don’t have an immediate need for miles in any of the Brex partner programs and I have enough access to those programs so as not to anticipate a need I can’t otherwise fill any time soon. Cashing out 100K Brex points at a value of $0.01 per point would mean $1,000 in cash, which certainly sounds nice given recent price increases on everything under the sun.

I think a cash-out strategy makes a lot of sense here and is probably the best choice for most people sitting on a pile of Brex points. That cash could be put to good use whether earning an excellent interest rate in I bonds or helping to trigger bank account bonus or just filling up our gas tanks for a few weeks. It wasn’t long ago that I wrote about how points sitting in a rewards account only devalue over time and since they keep flowing in faster than I’m using them, I cashed out some Membership Rewards points to put into bonds given the current 9.62% yield for the first 6 months (see this post for more on that).

However, thinking about that post about the bonds made me reconsider my cash out strategy thanks to the fact that my wife has the Schwab Platinum card. That card allows Amex Membership Rewards points to be redeemed for deposits in a Schwab brokerage account at a value of 1.1c per Membership Rewards point.

That matters here because as my travel schedule normalizes, I think there is a decent chance that I’ll make a redemption or two with one of the Brex partner programs in the next few months (even if for travel next year). On the one hand, I feel like it makes sense to cash out Brex points since I don’t yet know when or with which program I’ll redeem points. On the other hand, I realize that if I cash out Brex points today, it will mean later transferring even more valuable points that could have been cashed out for 1.1c per point (or used with other even more valuable partners).

Said another way, if I wanted $1,000 in cash today, I could either:

- Redeem 100,000 Brex points for $1,000

- Redeem the equivalent of 90,909 Membership Rewards points for a Schwab deposit of $1,000 (note that you can’t redeem in an odd amount like this in reality)

I would need fewer Membership Rewards points to produce the same amount of cash.

Put into an award-related example, imagine that I knew today that I needed 100,000 points for an Air France / Flying Blue award ticket and I also intended to redeem 100,000 points for cash and I had 100K points each in Brex and Amex Membership Rewards. In that case, I’d want to transfer the Brex points to Flying Blue and redeem the Membership Rewards points for cash.

- 100K Brex points = 100K Flying Blue miles

- 100K Amex points = $1,100 deposit into a Schwab brokerage account

Transferring the Brex points to Flying Blue makes me $100 richer if I am committed to redeeming some points for cash.

Of course, the trouble is that I don’t need 100K Flying Blue miles today and I don’t want to try to wait until August 15th to decide where to send my Brex points. Is it worth gambling on a speculative transfer for what amounts to a $100 “win”? That’s certainly questionable and I think it would still be reasonable to cash out the Brex points and be done with it. That said, I can see the argument for trying to preserve Amex points since they have both higher cash value and far more potential value in terms of transferability to even more partners of high value.

I’m still not sure that speculatively transferring makes sense, but we moved some points to Avianca LifeMiles yesterday in part because I know I pretty frequently look to LifeMiles in normal times and in part to test whether my wife could transfer her Brex points to my LifeMiles account. LifeMiles made (some) sense for me, but it certainly may not be the best choice for everyone.

Picking a speculative transfer partner

When I wrote about the impending account closures, I summarized what I considered to be the couple of “best” options in terms of where to send points if you don’t have an immediate need in mind but also don’t want to redeem for cash.

However, I recognize that even more of the Brex partners could be good in the right circumstances, though some are better than others. Here are my quick thoughts on each Brex transfer partner:

- Aeromexico Club Premier has access to expanded Delta award availability which could make them useful for those who like to redeem for Delta flights. That said, a 1:1 transfer ratio from Brex is poor considering the fact that Amex points transfer 1:1.6. I wouldn’t choose to move points to Aeromexico. Don’t be tempted by that around-the-world award chart — nobody seems to know anybody who has ever successfully booked it with Aeromexico.

- Air France / KLM Flying Blue: This could be an appealing option since award rates to/from Europe are reasonable, particularly during their Promo Rewards sales, and miles are easily combined with points from your other transferable currencies. As long as you never credit a flight to Flying Blue, your miles can be extended by transferring from Amex, Chase, Citi, Capital One, or Bilt at least once every 24 months. Read about Flying Blue sweet spots here.

- Avianca LifeMiles can be a good choice for excellent Star Alliance sweet spots and points that you can easily top off with Amex Membership Rewards or Citi ThankYou points, but only transfer to Avianca if you know you won’t let your miles expire. The mileage expiration policy is among the shortest out there with miles expiring after just 12 months of inactivity. If you speculatively transfer to Avianca, do yourself a favor and set an annual reminder to do something to keep your Avianca LifeMiles alive.

- Cathay Pacific Asia Miles: This can be a good option since miles you transfer today won’t expire as long as you earn or redeem at least 1 mile every 18 months and Asia Miles can also be topped off with either Membership Rewards, Citi ThankYou points, or Bilt Rewards. AsiaMiles can be useful for oneworld flights since they have a competitive award chart for longer itineraries (sometimes with lower surcharges) and expanded availability on their own flights.

- Emirates Skywards miles are useful if you want to fly extra fancy. Emirates has basically stopped releasing premium cabin award space to partners, so if you want to fly in blingy Emirates first class, you’ll need Skywards miles. However, keep in mind the quirkiest mileage expiration policy in the business: miles expire 3 years after you earn them at the end of your birthday month. In other words, if your birthday is in January and you transferred miles to Emirates in June 2022, three years would be up in June of 2025 — but miles won’t expire until the end of your next birthday month, so a January baby would have those miles until the end of January 2026 (whereas someone born in July would see miles expire at the end of July 2025). That’s weird. Separately, another good use of Emirates miles could be flying JetBlue Mint class to London.

- Qantas Frequent Flyer used to be a dark horse favorite program of mine for cheap short-distance redemptions on American Airlines, but now that American Airlines has dynamic pricing and no longer charges close-in booking fees or award change fees (and now that they release such little space to partners), Qantas is much less interesting to me. There are still a few Qantas sweet spots, but this would probably be my next-to-last choice for a speculative transfer after Aeromexico.

- Singapore Airlines Krisflyer is your best option (and in many cases your only option) for booking premium cabins on Singapore Airlines flights. With their “new” First Class looking pretty amazing, I can see the appeal of Singapore miles. Singapore also offers good pricing on flights to Hawaii on either United or Alaska. However, Singapore has a hard expiration policy of 3 years with no way to extend miles. That makes a speculative transfer to Singapore a gamble.

Can you transfer to an authorized user’s loyalty account? Yes!

I had wondered whether it would be possible to transfer points to an authorized user’s loyalty account. In our case, my wife had Brex points but I tend to make most of the household award bookings.

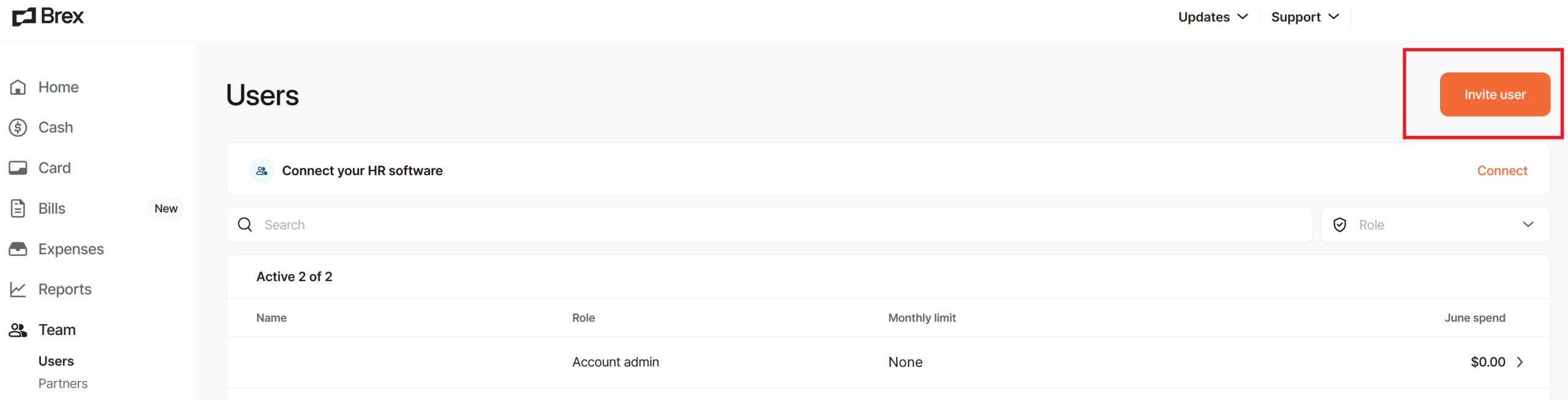

We were pleasantly surprised to find the process for adding an authorized user with admin-level access to the account was pretty easy. Simply log in to your Brex account and click “Team” on the left side bar and then “Invite User”.

You will be prompted to enter the new user’s name and email and choose their level of access (whether employee / admin / something else). My wife added me as a full admin of the account.

That ultimately sent me an email prompting me to create a Brex login to manage the account. I needed to provide my social security number and contact information and Brex informed me that they would ship me my employee card by July 6th. More importantly, once I finished the account creation process, I had full access to help manage the rewards and transfer to either my wife’s loyalty accounts or mine.

All-in, it took less than 10 minutes for my wife to add me, then for me to create an account, and finally to transfer some of the rewards to my loyalty account.

That certainly may be useful for those in a multi-player household where a specific player already has existing miles in one of the transfer partner programs and/or has relevant elite status, etc.

I’ll note that while the LifeMiles showed up in my Avianca account activity within just a few minutes, they weren’t actually added to my account balance / usable until sometime during the overnight hours. They were not instantly available for use. That likely varies by transfer partner. Last fall, I transferred points to Emirates and while the points didn’t immediately show up in the web interface, they were available to use in the Emirates ap within a few minutes.

Bottom line

If you’re sitting on Brex points without an immediate need to use them, your best option is probably to cash those points out, particularly if you have been marching in the Amex points parade (and thus already have plenty of access to the included transfer partners). However, those who might consider a Schwab cash out of Amex points at 1.1c per point might rather move points to a frequently-used transfer partner (retaining the ability to cash out an equivalent number of Amex points for more cash either now or in the future). Just be sure to choose a partner with which you can keep your miles alive or where you know you’ll use points before they expire.

Has anyone successfully transferred to KrisFlyer? I’ve transferred points to partners 4 or 5 times before, and for some reason I’m on day 5 of waiting for KrisFlyer to post. Still says pending. Wondering if anyone else has had this issue? Brex says to wait another 4 days, which doesn’t seem accurate.

Thank you!

Got an email from LifeMiles today saying there’s a 25% transfer bonus for Brex to LifeMiles July 1-31.

Brex has now clarified their position and many companies are qualified to stay with the company. One of the qualifications is over 1 million in gross sales. There are several other qualifiers and any one of them is fine. Bad communication from them. I like them for free outgoing US and International wires.

A sure way to know that cashing out for $ is the way to go is if you’ve spent a fair amount of time trying to figure where to credit the points, and you still can’t decide because nothing jumps out at you. Cash out and pat yourself on the back for jumping in. Toss the money in an index fund like VTSAX and in five years you’ll be smiling.

You make a good point. And I’ve certainly put more of a focus on investing these last few years, so I am far from arguing that you’re wrong, but I thought it was worth making a point: if I put that $1,000 in an investment today that earns 10% annually (an intentionally higher-than-is-likely rate), I’d have $1,610 in five years. That’s certainly a nice boost on money that didn’t really “cost” me anything to product, but it’s not a clear win if I might have used those points to travel. 100K transferred to the right partner and used in the right situation could get me round trip to Europe in business class — $1610 is unlikely to do that (and I’m unlikely to end up with that much). Again, I’m not arguing against investing — if I were to cash out the points I would absolutely either be putting the cash in index funds or I bonds right now — just saying that the benefit isn’t clear until you reach a longer haul. I know that you picked an arbitrary number there, you weren’t actually recommending five years specifically, I just used that to illustrate that the choice may not be so clear.

Of course, since I earn enough points each year to cover my travels, cashing the points out and putting them in an index fund isn’t likely to prevent me from taking any trips, so that certainly may be the smarter play. In this case, I’m mostly trying to decide if it makes more sense to speculatively transfer them to a program I’m likely to use a bunch (like LifeMiles) and cash out Membership Rewards points for a 10% boost in value (and then put that cash into investments as you suggest).

All good food for thought.

So you’re now an employee of your wife’s “business”? Guess she’s gonna give you a “hard” time being your “boss” 😉

Fortunately, this is one issue I don’t need to stress about. I was worried Brex wouldn’t make it, so I transferred my points to Flying Blue within the first month. I enjoyed a fabulous biz RT flight on AF to Paris with them last fall. But, being from ATL, I get a lot of use from FB. Whatever you do will be fine and fun!

can i transfer amex point to lifemiles to keep the miles from expiring or only citi thank you points?

Yes, you can transfer from Amex to keep LifeMiles alive.

Just like at a casino, cash in your chips for $1,000 cash and feel good about the decision. Crazy good sign up bonus for minimal spend. RIP Brex.

Yep one card move on with the $$$$…

I transferred to Avianca as well.

@ Nick — You are overthinking this. Pick a transfer partner and be done with it. I never transfer to LM because I can always just buy their miles for ~1.3 cpm. I like SQ because the only way to book SQ premium cabins is generally with SQ miles. AF can offer excellent deals as well, so that is a decent option. I would never transfer to the rest of the choices unless it was a use it or lose it situation with no other options.

What program do you use to keep track of all your various passwords?

Straight up brainpower.

I really like Dashlane. Been using it for many years. I lack Nick’s brainpower.

I’m curious whether Brex will send a 1099 if you redeem for $600+ in cash. Have you heard any reports of this one way or the other?

I’ve never received a 1099 for a credit card bonus. Historically, credit card bonuses have been considered rebates on spend, not income. I can understand where the line is a little gray here because there’s a bank account component of Brex and you do typically receive a 1099 for a bank account bonus. However, I don’t think that’s applicable here because the bonus was tied to using the credit card, which makes it pretty clearly a rebate for spend I think (note that I’m not a financial advisor or tax expert, so consult your own expert).

If they were going to send a 1099, I wouldn’t think it would matter how you redeemed the points. For instance, Amex sends a 1099 for referral bonuses because those are not rebates. Doesn’t matter whether the bonus comes to you in the form of points, they estimate cash value – in other words, they don’t wait to see if you redeem membership rewards points for a Schwab deposit, they just send you a 1099 for the points. Again, that’s only for points earned from referrals, not points earned from spend. Since these Brex points came from spending on the credit card, I would be very surprised if redeeming them caused a 1099 to be generated. That said, I don’t know for sure.

That makes sense. I was concerned about the 1099 because I’d been thinking of Brex more like a bank account than a credit card, but you make a great point about the redemption method not mattering even for bank account bonuses. When thinking about it that way, it seems like they would’ve sent a 1099 last year when the points were initially awarded if they ever intended to send one. Thanks for the reply!

I tink under $600 they don’t send one..

The US Tax Court and Federal Appellate Courts agree with you.