NOTICE: This post references card features that have changed, expired, or are not currently available

If you have a large amount of spend to make in the near future, this is a great time to collect Amex Membership Rewards points! A combination of current promotions make it possible to earn an almost unbelievable number of points with big spend. In this post, I’ll lay out a number of options for how to amass your Amex point fortune. Wondering what to do with those points once you earn them? Hop on over to this post: How to use your Amex Point fortune.

Amex currently has a number of fantastic promotions happening at once. As you’ll see later in this post, it’s theoretically possible to combine all of these:

- Huge welcome bonuses for new cards: Amex has been on a roll lately with incredible bonuses for new signups. The most incredible offer (that I’ve ever seen) is the Platinum Resy offer which makes it possible to earn 500,000 points with a single welcome bonus!

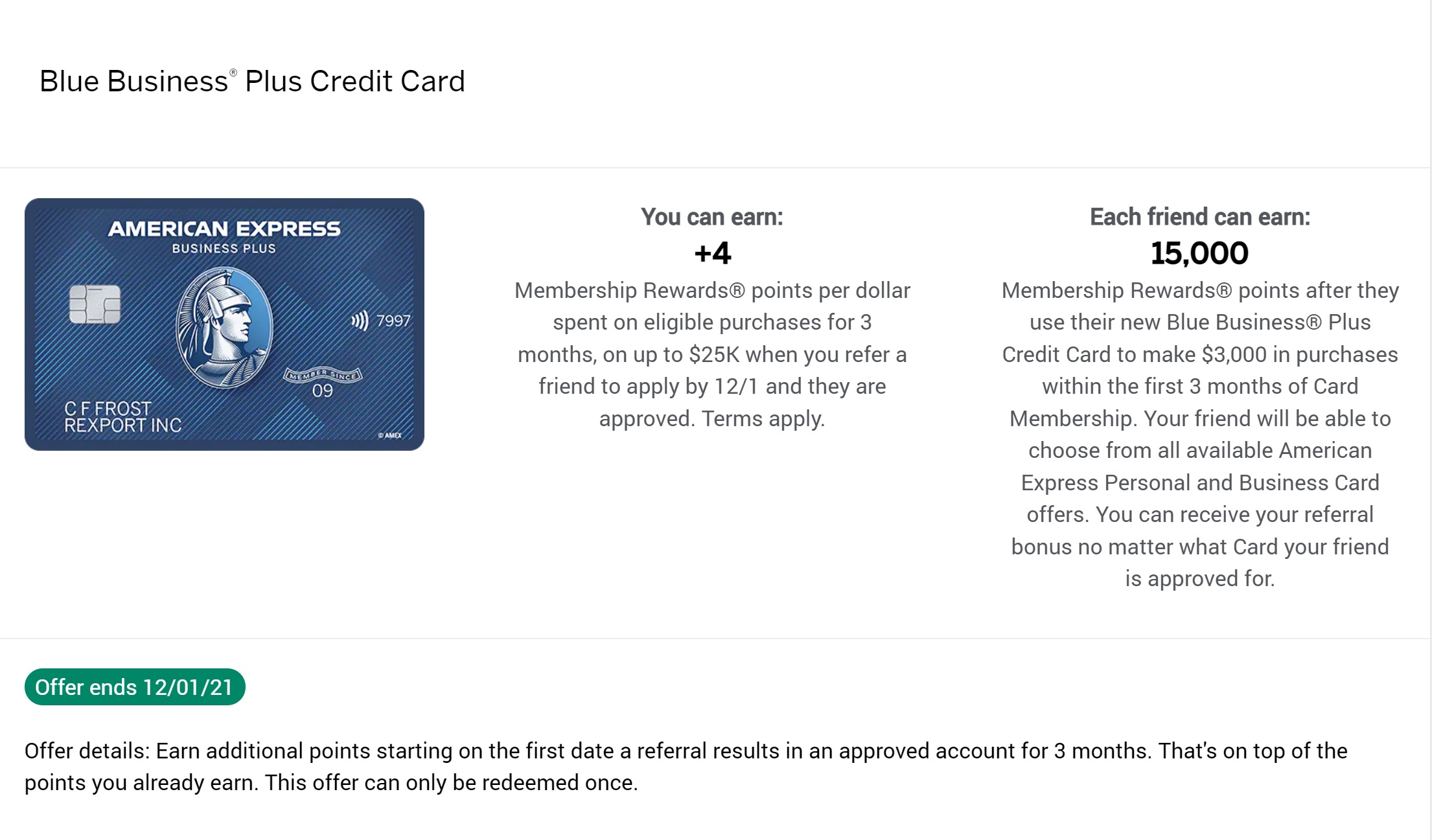

- Refer-A-Friend offer for +4 points per dollar: Through 12/1/21, most cards that earn Membership Rewards points have a compelling new referral bonus. Instead of getting a lump sum number of points for referring a friend, you get the ability to earn an additional 4 points per dollar on top of your card’s usual earnings, on up to $25K spend in 3 months. In other words, with a single referral, you can get up to 100,000 bonus points! Plus, unlike lump-sum referral bonuses, these rewards are not taxed. Note that Business Platinum cards get both a lump-sum bonus (15K) and the same +4 deal available to other cards. While we wrote about the +4 referral deal here, I recommend checking out Milenomics’ post on the topic, here: American Express ‘4-for-us’: The Best Promotion You’ve Never Heard of.

- Authorized user & employee card bonuses: Amex has been offering bonus points to many cardholders when they add an authorized user who then spends a targeted amount. For example, targeted Platinum cardholders can earn 20,000 points by adding an authorized user who then spends $2K in 6 months. And Business Platinum cardholders can earn 20,000 points with each of up to 5 new employee cards with $4K spend each within 6 months (find the offer here). See also: Authorized user bonuses via pre-qualification tool.

- Amex Spend Offers: Through Amex Offers, Amex has targeted some cardholders with spend bonuses like this on found on a Business Platinum card: Spend $23,500+, get 6,000 Membership Rewards® points, up to 3 times. It’s not huge, but its better than nothing! Note that while I’m pointing out these offers here, I haven’t listed these spend offers in the sections below because they are highly targeted.

About referring a friend…

When referring a friend from an Amex card that earns Membership Rewards points, they do not have to sign up for the card you are referring from. Your friend can sign up for any Amex card with your referral link and you’ll still get the bonus. For example, if you want to earn the referral bonus on a Blue Business Plus card, but your friend wants to sign up for the Hilton Aspire card, that’s fine. They can use your referral link to apply.

Also… don’t forget about relatives. While it’s a really bad idea to refer yourself to an Amex card, there’s no reason you can’t refer your spouse, child, parent, cousin, etc. And they can refer you to other cards. It’s not unusual for a couple to refer each other to new cards so that they’ll each earn a referral bonus and a welcome bonus.

Fortune building with any qualifying spend

If you have big spend coming up that doesn’t fit into a convenient category like small business, dining, or grocery then these options may work best for you:

Simple Plan: Up to 150K with $25K spend

The Blue Business Plus card earns 2 points per dollar on up to $50K spend per calendar year (then 1X). By referring a friend from the Blue Business Plus, you can then earn a total of 6 points per dollar on up to $25K spend. What if you’ve already maxed out your $50K 2X spend this calendar year? As long as you refer a friend by 12/1/21, you can wait until January to take advantage of your +4 earnings.

- Start with your Blue Business Plus Card which earns 2x everywhere on up to $50K spend per calendar year.

- Refer a friend to any Amex card to get +4 on up to $25K spend

- Spend $25K, earn 150,000 points:

- Regular card earnings: $25,000 x 2 = 50K points

- +4 earnings: $25,000 x 4 = 100K points

Back up plan if you don’t have the Blue Business Plus: Use the Everyday Preferred Card instead. The Everyday Preferred card earns at least 1.5 points per dollar on all spend when you make 30 or more purchases per billing cycle. With that combo and the above plan, you’ll earn a total of 137,500 points with $25K spend.

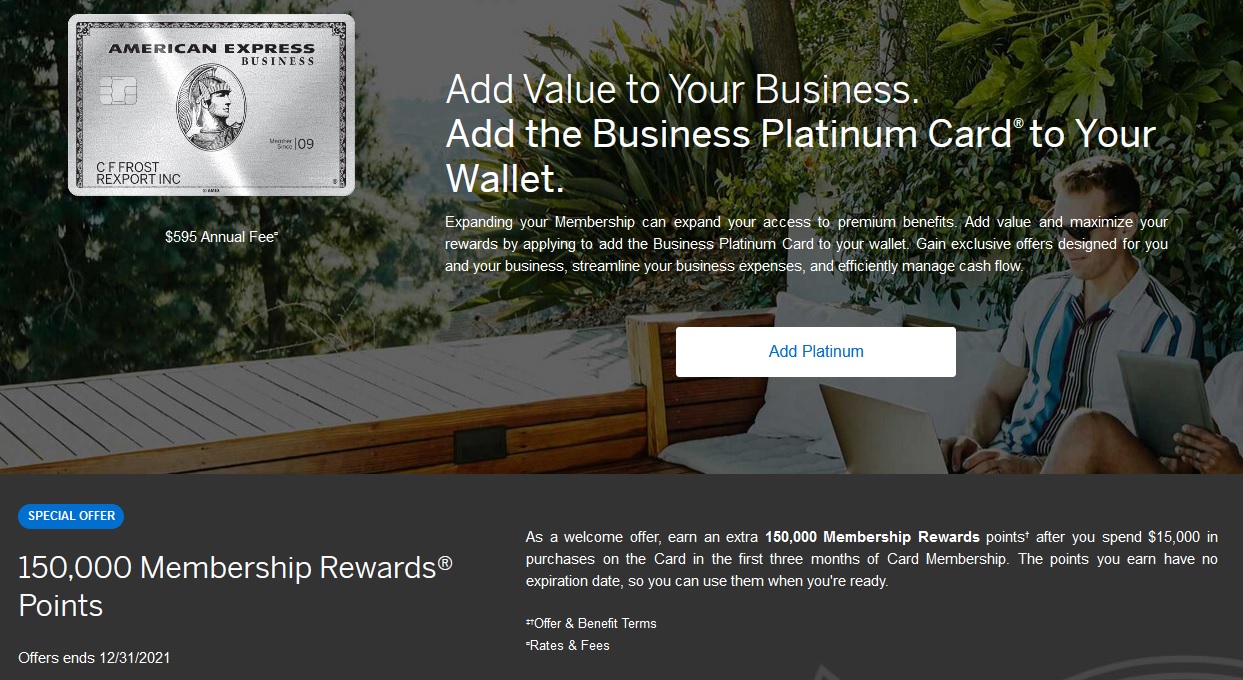

Stack a welcome bonus: Up to 290K with $25K spend

The Business Platinum card’s public offer at the time of this writing is for 120,000 points after $15K spend in 3 months (but please check this link for updates). That said, some have reported receiving targeted offers for 150,000 points after $15K spend. In fact, even if you currently have a Business Platinum card, you may be able to get 150,000 points after $15K spend by adding another card! See this post for details and then log into Amex after clicking to this link to see if you qualify.

- Sign up for the Business Platinum Card with the best welcome bonus you can find (Ideally 150K after $15K spend)

- Before spending towards the $15K requirement, refer a friend from your new Business Platinum Card. If they are approved, this will qualify you for 15K bonus points plus 4 additional points per dollar on up to $25K spend.

- Spend $25K, earn 290K points:

- Regular card earnings: 25K (or up to 37,500*)

- Earn up to 150K with welcome bonus (or 120K with public offer)

- Earn base 15K from referral

- +4 earnings: $25,000 x 4 = 100K

* The Business Platinum card earns 1.5 points per dollar for purchases of $5,000 or more.

Stack employee card bonuses for 100K more (up to 390K)

It should be possible to combine the above plan with the Business Platinum offer to earn 20,000 points with each new employee card you add in which they spend $4,000 in 6 months. Here’s how:

- Sign up for the Business Platinum Card with the best welcome bonus you can find (Ideally 150K after $15K spend)

- Before spending towards the $15K requirement, refer a friend from your new Business Platinum Card. If they are approved, this will qualify you for 15K bonus points plus 4 additional points per dollar on up to $25K spend.

- Before spending more than $5,000, add five employee cards to your Business Platinum account (hint: Green employee cards have no annual fee)

- Spend $25K total: Spend $5,000 on the Business Platinum card and spend $4,000 on each of the 5 employee cards.

- Spend $25K, earn 390K points:

- Regular card earnings: 25K (or up to 37,500*)

- Earn up to 150K with welcome bonus (or 120K with public offer)

- Earn base 15K from referral

- +4 earnings: $25,000 x 4 = 100K (yes, the +4 will be earned on employee card spend)

- Earn 100K points from the new employee card bonuses (5 cards x 20K points)

* The Business Platinum card earns 1.5 points per dollar for purchases of $5,000 or more.

Options that work with grocery & dining spend

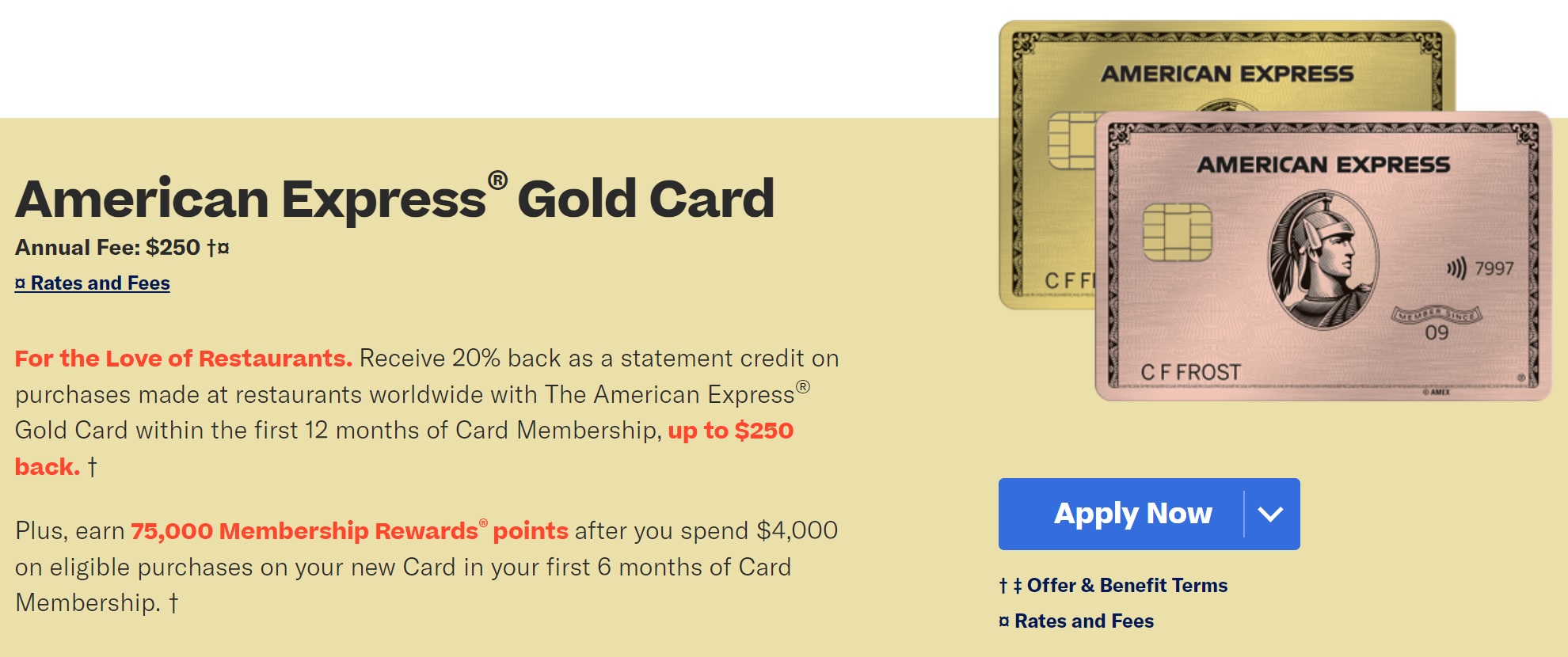

If you have a lot of grocery and/or dining spend in your future, you can do well with the Amex Gold card which earns 4x at U.S. grocery stores on up to $25K per year spend and 4x dining, uncapped.

Simple Plan: 200K with $25K grocery & dining spend

The Amex Gold Card earns 4x at U.S. grocery stores on up to $25K per year spend and 4x dining, uncapped. By referring a friend from the Gold Card, you can then earn a total of 8 points per dollar on up to $25K grocery & dining spend. What if you’ve already maxed out your $25K 4X spend this calendar year? As long as you refer a friend by 12/1/21, you can wait until January to take advantage of your +4 earnings on grocery spend.

- Start with your Amex Gold Card which earns 4x at U.S. grocery stores on up to $25K per year spend and 4x dining, uncapped.

- Refer a friend to any Amex card to get +4 on up to $25K spend

- Spend $25K on grocery & dining, earn 200,000 points:

- Regular card earnings: $25,000 x 4 = 100K points

- +4 earnings: $25,000 x 4 = 100K points

Stack a welcome bonus: 275K with $25K grocery & dining spend

If you don’t already have the Gold card, then you can do well to get one. The best public offer for the Gold Card at the time of this writing is for 75,000 points after $4K spend in 6 months plus 20% back as a statement credit on restaurant purchases worldwide for the first 12 months, up to $250 back (but please check this link for updates).

- Sign up for the Amex Gold Card.

- Before spending towards the $4K requirement, refer a friend from your new Gold Card. If they are approved, this will qualify you for 4 additional points per dollar on up to $25K spend.

- Spend $25K on grocery & dining, earn 275K points:

- Regular card earnings: 4 x $25K = 100K

- Earn 75K with welcome bonus (plus up to $250 back on dining)

- +4 earnings: $25,000 x 4 = 100K

Options that work with small business & dining spend

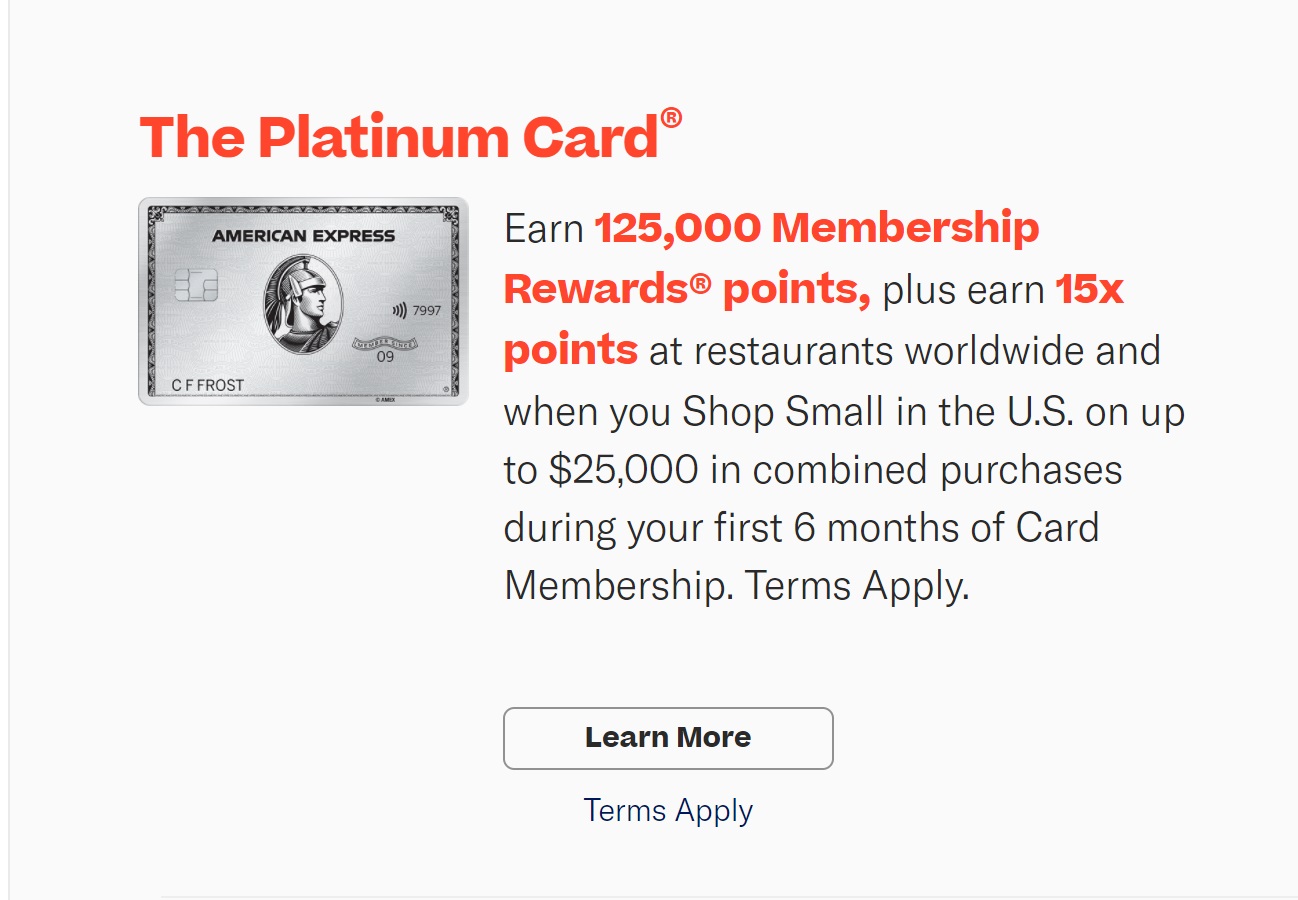

If you have a lot of small business and/or dining spend in your future, you can do unbelievably well with the Amex Platinum offer from Resy.

600K to 620K with $25K small business & dining spend

At the time of this writing, the Resy website has an unbelievably generous offer for the Amex Platinum card: 125K points after $6K spend plus earn 15 points per dollar on qualifying small businesses and on dining on up to $25K in purchases in the first 6 months.

- Sign up for Platinum Resy Offer

- Before spending towards the $6K requirement, refer a friend from your new Platinum Card. If they are approved, this will qualify you for 4 additional points per dollar on up to $25K spend.

- Check to see if you’re targeted to earn 20K after adding an authorized user who then spends $2K. If so, enroll and make sure the $2K is spent on small business & dining.

- Spend $25K at small business and dining, earn 600K to 620K points:

- Regular card earnings: 25K

- Welcome bonus:

- Lump sum after $6K spend: 125K

- +14 points per dollar on eligible $25K spend: 350K

- +4 earnings: $25,000 x 4 = 100K

- Optional 20K for authorized user

Conclusion

If you have the need/opportunity to spend big in the near future, there’s never been a more rewarding time for it. You will need to twist a friend’s arm to sign up for a new Amex card to make it work, but if you manage that, the potential rewards are huge!

I’m pretty sure the gold business card also is eligible for employee card bonus from the same link you have provided above. I was looking at the AMEX offers page and both my AMEX Gold Business card and AMEX Business Platinum card both brought me to the same link you have provided here so I think your link works for either card. I’ll try it out and report back.

A couple questions about authorized users on the business platinum:

1) Can you use the annual credits on the AU cards? Like, if an employee makes a purchase at dell using their card, will it count toward my annual dell credit?

2) Do I need to sign up for the 5 employee cards all at once, or can I do them one at a time for the 20k bonus each?

Thank you for the advice!

thank you for all the stacking suggestions, very helpful

Greg, I am referring from Player1 to Player2. Is there a trick to get the Platinum 125k, 15x Restaurant offer to come up for Player 2? Instead, Player 2 is receiving the 100k, 10x offer.

If not, Isn’t is just better for Player 2 to bypass the whole referral effort and take the 125k, 15x (assuming of course that Player 2 plans on maximizing the 15x).

Thank you in advance

There is no way to refer someone to the Resy offer (125K/15X). I think the best option is to sign up for the Resy offer, and then immediately refer the other player for some other Amex card (it doesn’t matter which one) to bump up the 15x to 19x.

Thanks for pointing out the this Page 3 Resy Plat option.

P2 was at $500 spend on her new Resy 15x when AMEX released the +4X referral. Now closing in on those 600k MRs in disbelief. That’s almost seven RT Business flights to Europe, Asia or South America.

Do you need to have 5 people willing to give you their SSN for the employee cards? Or can I get a card for my favorite houseplant, Bob? Or can I get an employee card for myself?

I think you’re better off using real friends/family. The good news is that employee cards won’t show up on their credit reports

Thanks for the reply Greg. Now that we’re such great friends, please email me your SSN so I can order that employee card for you 😉

One other question that just occurred to me. I’ve signed up for all my business cards as a Sole Proprietor. I’m assuming Amex isn’t going to find it weird that I suddenly have 5 “employees”?

A sole prop can have employees.

Is the AU offer public or targeted?

https://www.americanexpress.com/en-us/business/campaigns/employee-cards/business-platinum/index.html

Would like to take advantage on that but it’s super annoying that they didn’t mention anything on the page while adding employee card 🙁

I don’t know. I’ve seen the offer when logged into my Biz Plat account in two different places. Sometimes it shows up at the top of the Amex Offers section and sometimes it shows up at the top of the page. I’d recommend refreshing page several times to try to get it to show up. If it doesn’t show up for you, maybe you’re not eligible.

Do payments via plastiq still code as small business for Amex?

Unfortunately no.

what counts towards “qualifying small businesses and on dining” purchases for Resy Plantium card? Are groceries considered small businesses? I need to make sure that I can spend the $25k on the card. Thanks.

Depends on the grocery… Others can weigh in here on whether the big national and regional chains are posting as small businesses, but we have been pleased to see that our local MOM’s store, which is part of a chain (even if a homey, folksy one: https://momsorganicmarket.com/# ) has been paying out 15x.

Go to Americanexpress.com/shopsmallonline. By default will go to Online businesses. In upper left corner click on Map. That will allow you to put in your city and/or county, state. Below that you will see Filters click and then click on Shop Small (box) and scroll down to Shopping, click that box and that gives you categories one of which is groceries click on that box and then hit Apply. If any in your area should show. Remember always look for that Shop Small logo on any business.

If, say, a new employee on an Amex Business card (we’ll call him P4) wanted to make a $5,000 estimated tax payment for P1, does that work with the credit card tax-paying portals (not to mention IRS)? I know that P2 has paid through P1’s portal, but then P1 and P2 file jointly, and P4 has aged off of their return.

Fill out the tax payment info exactly as you would normally do for P1, but then when it asks for the credit card info, put in the employee card info.

Wow, I see on my account the 4X referral, the downside of it is.

Its the standard offer, not the 125K offer, so if using player 1and2 not sure if its better then just the resi offer

100,000

Membership Rewards points after they use their new Card to make $6,000 in purchases within the first 6 months of Card Membership. Plus, they can earn 10x points

Yep, I think the best option is for both P1 and P2 to do the Resy offer, and then immediately refer each other for some other Amex card.

When I log in the “Refer A Friend Limited Time Offer” shows the platinum card, how does one refer a Green card?

You can give your friend the link to the Platinum card and they can they can finding on the landing page an option to look for other cards. Or, you can use your own link and do that for them, find the Green card and then copy the URL to give to your friend.

The link you posted for the Amex Biz Plat employee addition (4K in 6 months for 20K). How long is this link valid (12/01?) I am just finishing spend on my consumer add on cards, so want to time this just before this promotion ends

Hmmm, I’m not sure about how long that one is available for. I’ll have to check the fine print to see if it says. Stay tuned.

Does the Schwab Platinum typically support referrals? It seems the current referral offer is available on all my other Amex cards except for this one. Great article as always.

Unfortunately, that card only earns cash back when doing referrals and so it doesn’t qualify for offers like the +4 thing

I only see 15k referral bonus for Bus Platinum. I can’t find it has 4x bonus points in addition to 15K. Where is it? Thanks!

If you click through to the 15K offer, you’ll see the +4 stuff below.

Got it. Thanks!

Click on Refer and then it will show 4X + 15K

Did you click on the terms and conditions after clicking on the 15K link? I am able to see terms for both the 15K and the +4x on that page.

Off the offer page, you’re looking at 15K but no 4X (repeat of above). Then click and you should see 15K + 4X. Click again on the Referral page & Offer terms and again you should see 15K + 4K. Slight catch with Amex referrals. Sometimes you open a referral FYI, then stop. Later you go back and the referral might not be there. I had to scroll way down the offers to it but no mention of the 15K or 4X until I opened it. Sometimes I have had to wait a few days for one to show again my account or P2.

Thanks for the info.

Having finished the Resy Platinum for 500K, now working on 4X referring P2 with my Green card. Yes, to me the most underrated almost never ever mentioned Green (travel) card. I have a cruise to pay for, so 3X + 4X = a whooping 7X! Hoping to reach 140K to 160K early January 2022 to go with my 500K. It’s been a great year for Amex points.

good job man! how do you intend to spend lol

Taxes?!

The only rewards listed here that should be taxed is the 15K points for referring a friend from the Business Platinum card.